Introduction

Navigating the complexities of taxes can feel overwhelming, especially for those receiving Social Security Disability Insurance (SSDI) benefits. We understand that the potential for significant tax implications based on various income thresholds can add to your stress. That’s why it’s crucial to know whether these benefits are taxable as you plan your finances.

This article offers a comprehensive checklist to help SSDI recipients assess their tax obligations. We’ll explore state-specific regulations and share proactive management strategies to ease your concerns. As tax laws continue to evolve, you might wonder: how can you ensure you’re prepared for any potential tax liabilities tied to your disability benefits?

You are not alone in this journey. Together, we can navigate these challenges and find the best path forward.

Determine Taxability of SSDI Benefits

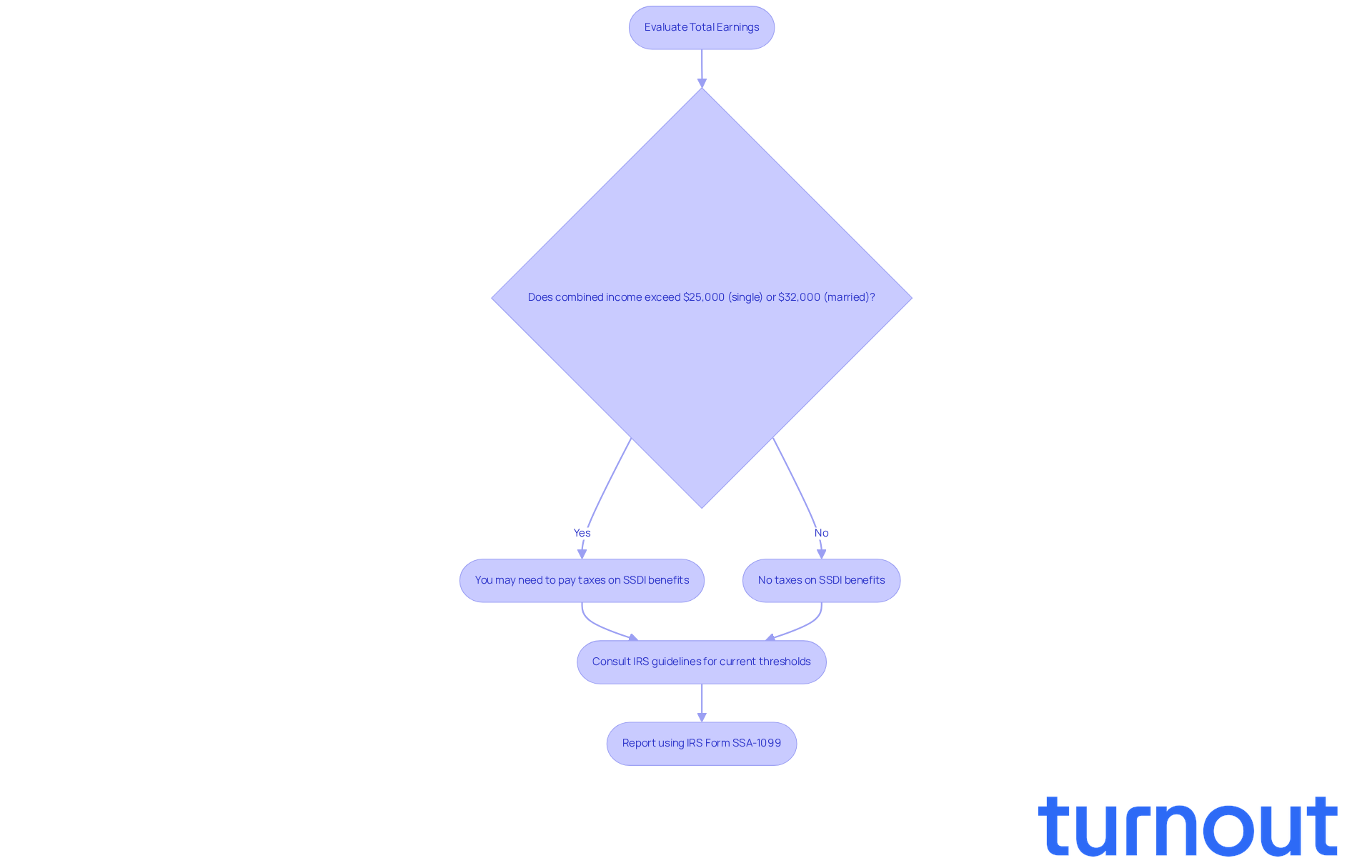

Evaluating your overall earnings can feel overwhelming, especially when it comes to understanding disability payments and any extra sources like dividends or interest. We understand that navigating these financial waters can be challenging. Start by determining your total earnings: take half of your Social Security Disability Insurance benefits and add it to your additional revenue.

It's important to check if your combined income exceeds $25,000 for single filers or $32,000 for those married filing jointly, especially when asking do you pay taxes on disability social security. This threshold will determine your tax liability, and we want to ensure you're prepared for questions like do you pay taxes on disability social security. Remember, consulting IRS guidelines will clarify if you do you pay taxes on disability social security and provide you with the most current thresholds and calculations regarding the taxability of your disability benefits.

To accurately report your disability payments on your tax return, utilize IRS Form SSA-1099. This step is crucial for adhering to tax regulations. You are not alone in this journey; Turnout is here to assist you in understanding these processes without the need for legal representation. We're here to help you every step of the way.

Review Federal Tax Rules for SSDI Recipients

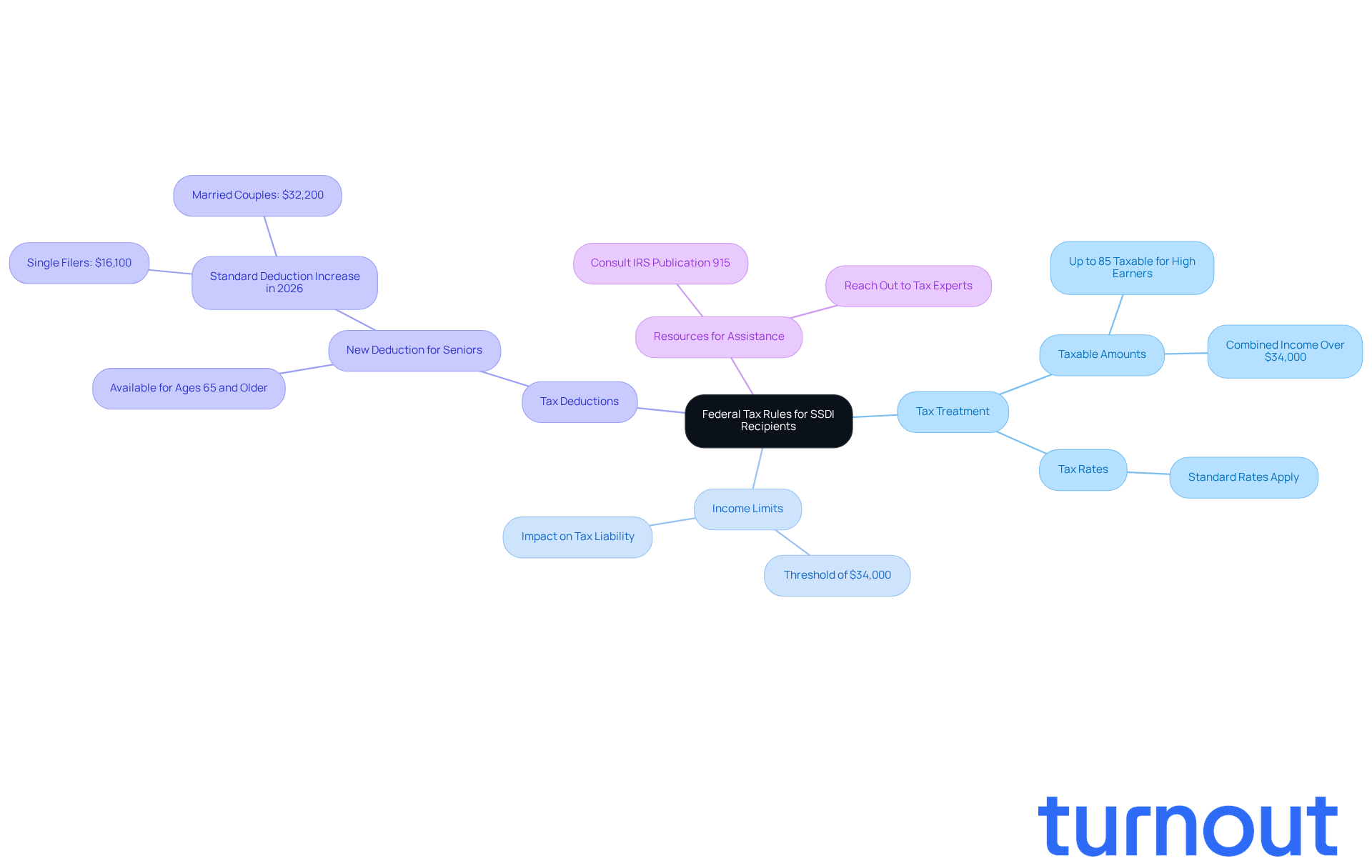

It can feel overwhelming to understand the tax treatment of Social Security payments, especially when considering do you pay taxes on disability social security. We know that navigating these waters is not easy, especially when it comes to your hard-earned benefits. That’s why it’s essential to familiarize yourself with IRS Publication 915.

Did you know that when receiving Social Security Disability Insurance payments, you might ask, do you pay taxes on disability social security? If your total earnings exceed certain limits, you may wonder, do you pay taxes on disability social security benefits, which could be taxed up to 85%? For instance, individuals with a combined income over $34,000 may face this situation. It is crucial to stay informed about recent tax law changes, especially concerning do you pay taxes on disability social security benefits.

There’s some good news! A new tax deduction for individuals aged 65 and older could provide some relief. However, it’s important to note that this doesn’t apply to many disability benefit recipients who are under retirement age. Looking ahead to the tax year 2026, the standard deduction will increase to $16,100 for single filers and $32,200 for married couples. This change may impact your overall tax liability, so it’s worth considering.

We encourage you to consult the IRS website or reach out to a qualified tax expert. They can help you navigate the complexities of disability benefits taxation and clarify whether do you pay taxes on disability social security, ensuring you have the most current information. Remember, you’re not alone in this journey.

At Turnout, we want to clarify that we are not a law firm and do not provide legal advice. However, we do employ trained nonlawyer advocates and IRS-licensed enrolled agents. Our goal is to help you understand these processes and navigate your disability claims and tax relief options without needing legal representation. We're here to help!

Assess State Tax Obligations on SSDI Benefits

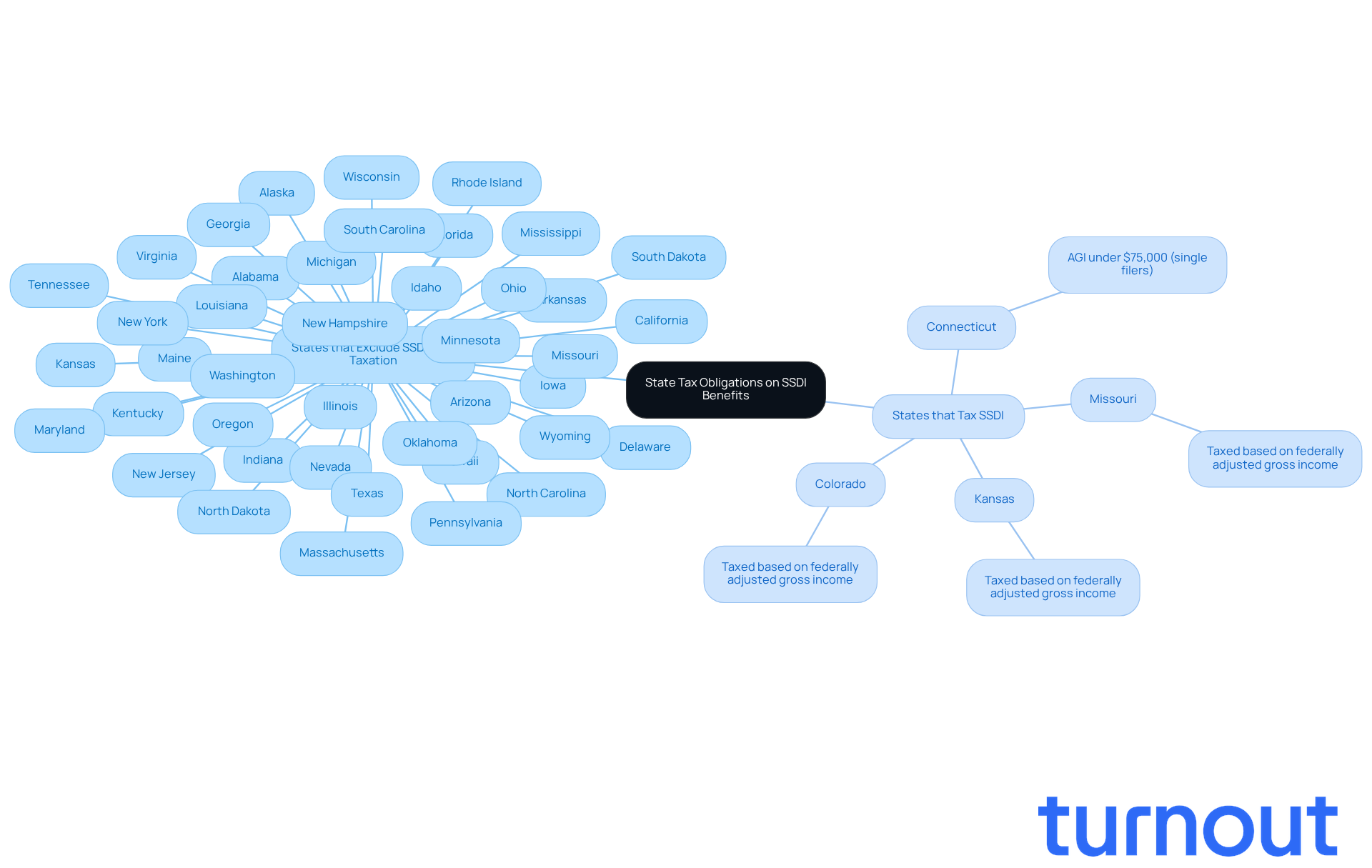

Navigating tax regulations can be overwhelming, particularly when trying to determine do you pay taxes on disability social security. We understand that many states offer relief by addressing the question of do you pay taxes on disability social security payments. In fact, 38 states currently exclude disability payments from state taxation, which can provide significant support for recipients.

It's important to understand the specific financial limits in your state to determine if do you pay taxes on disability social security payments. For example, in Connecticut, if you're a single filer with an adjusted gross income (AGI) under $75,000, you won’t owe state taxes on Social Security payments.

Stay informed about any recent changes in state tax laws that could impact disability benefit recipients. Starting January 1, 2026, several states will implement tax changes that may affect how disability assistance is taxed.

When it comes to reporting your disability benefits, accuracy is key. Make sure to use the appropriate state tax forms, as this is crucial for compliance and can help you avoid potential penalties. For instance, recipients in states like Colorado and Missouri should be aware that their assistance might be taxed based on federally adjusted gross income.

If you're feeling uncertain about your state tax responsibilities, especially regarding do you pay taxes on disability social security, consider reaching out to a tax expert. They can help you navigate the complexities, especially with the current legislative changes. Remember, you’re not alone in this journey, and we're here to help.

Implement Proactive SSDI Tax Management Strategies

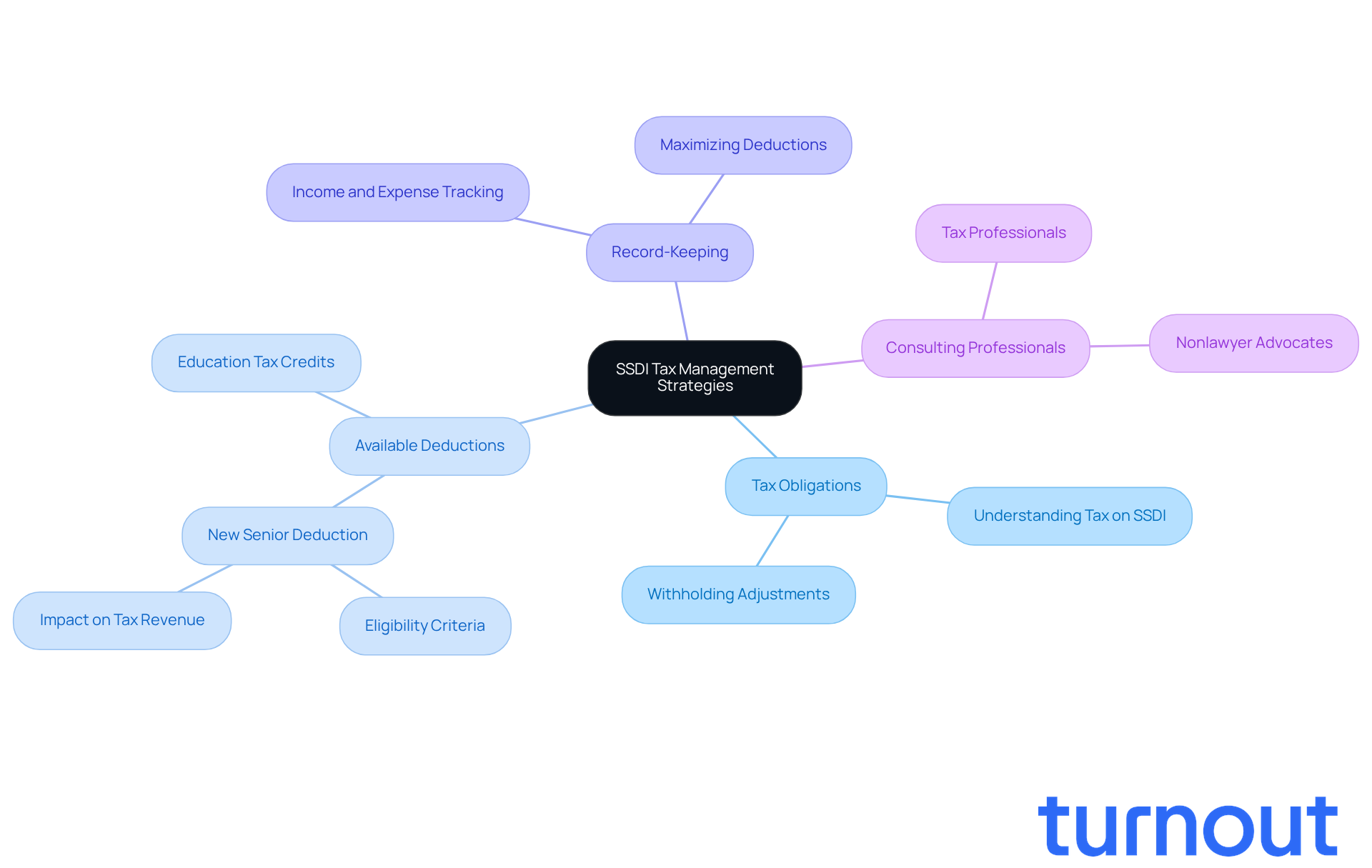

When managing your disability benefits, it’s crucial to consider do you pay taxes on disability social security and adjust your withholding accordingly to account for potential tax obligations. We understand that tax season can be overwhelming, and we want to help you avoid any surprises. Turnout offers valuable tools and services to guide you through these complexities. Our trained nonlawyer advocates are here to assist with SSD claims, while our IRS-licensed enrolled agents can help with tax debt relief. Just a reminder: Turnout is not a law firm and does not provide legal advice.

Have you looked into the tax reductions and credits available for disability benefit recipients? For instance, starting in 2026, there’s a new senior deduction for those aged 65 and above, which can reduce taxable earnings by up to $6,000. This deduction is expected to cost Social Security $168.6 billion in lost tax revenue over the next decade, which could impact the trust funds.

Keeping meticulous records of all your income and expenses throughout the year can simplify tax reporting and maximize your deductions. We’re here to help you understand how to maintain these records effectively. Plus, in 2026, the disability insurance earnings limit will increase to $1,690 monthly. Knowing this is essential for understanding how your income might affect your benefits.

We encourage you to consult with a tax professional to develop a personalized tax strategy that fits your unique financial situation. Navigating the complexities of SSDI taxation can be challenging, especially when considering do you pay taxes on disability social security, but effective tax planning can provide emotional relief. This way, you can focus on your goals without the stress of tax-related issues. Remember, you’re not alone in this journey; we’re here to help.

Conclusion

Navigating the complexities of tax obligations on Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that grasping these responsibilities is vital for your financial well-being. It’s important to assess your total income, including SSDI benefits and other earnings, to determine your tax liability. By familiarizing yourself with federal and state tax rules, you can ensure compliance and avoid unexpected tax burdens.

Key insights to consider include:

- The income thresholds that dictate whether SSDI benefits are taxable.

- The potential impact of upcoming changes in tax laws.

- Consulting tax experts for personalized guidance can be invaluable.

- Proactive tax management strategies, like keeping accurate records and adjusting withholdings, can help ease the stress that often accompanies tax season.

Ultimately, being informed and prepared is essential for SSDI recipients. By taking the time to understand tax implications and leveraging available resources, you can navigate this intricate landscape with confidence. Embracing these proactive strategies not only alleviates financial anxiety but also empowers you to focus on your well-being and future goals. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

How do I determine the taxability of my SSDI benefits?

To determine the taxability of your SSDI benefits, calculate your total earnings by taking half of your Social Security Disability Insurance benefits and adding it to any additional revenue.

What income thresholds should I be aware of for SSDI benefits taxability?

The income thresholds to consider are $25,000 for single filers and $32,000 for those married filing jointly. If your combined income exceeds these amounts, it may affect your tax liability.

Do I need to consult any guidelines for SSDI taxability?

Yes, consulting IRS guidelines is important to clarify whether you need to pay taxes on your disability social security benefits and to obtain the most current thresholds and calculations.

What form do I need to report my disability payments on my tax return?

You should use IRS Form SSA-1099 to accurately report your disability payments on your tax return.

Can I get assistance in understanding the taxability of my SSDI benefits?

Yes, organizations like Turnout can assist you in understanding the processes related to the taxability of SSDI benefits without the need for legal representation.