Introduction

Navigating the complexities of health insurance and tax obligations can feel overwhelming. We understand that the regulations set by the Affordable Care Act (ACA) can add to your worries. It’s crucial to know whether health insurance is a requirement for filing taxes, as this impacts not just compliance but also potential penalties and tax credits.

Many individuals find themselves asking: what happens if you don’t have health insurance when tax season arrives? It’s common to feel uncertain about this. This article aims to provide you with the essential information you need to feel prepared and informed. Remember, you’re not alone in this journey, and we’re here to help.

Clarify Health Insurance Requirements Under the Affordable Care Act

We understand that navigating health insurance can be overwhelming. Under the Affordable Care Act (ACA), it raises the question of do you have to have health insurance to file taxes, as all taxpayers must have qualifying medical coverage every month of the year. This requirement can feel daunting, but let’s break it down together.

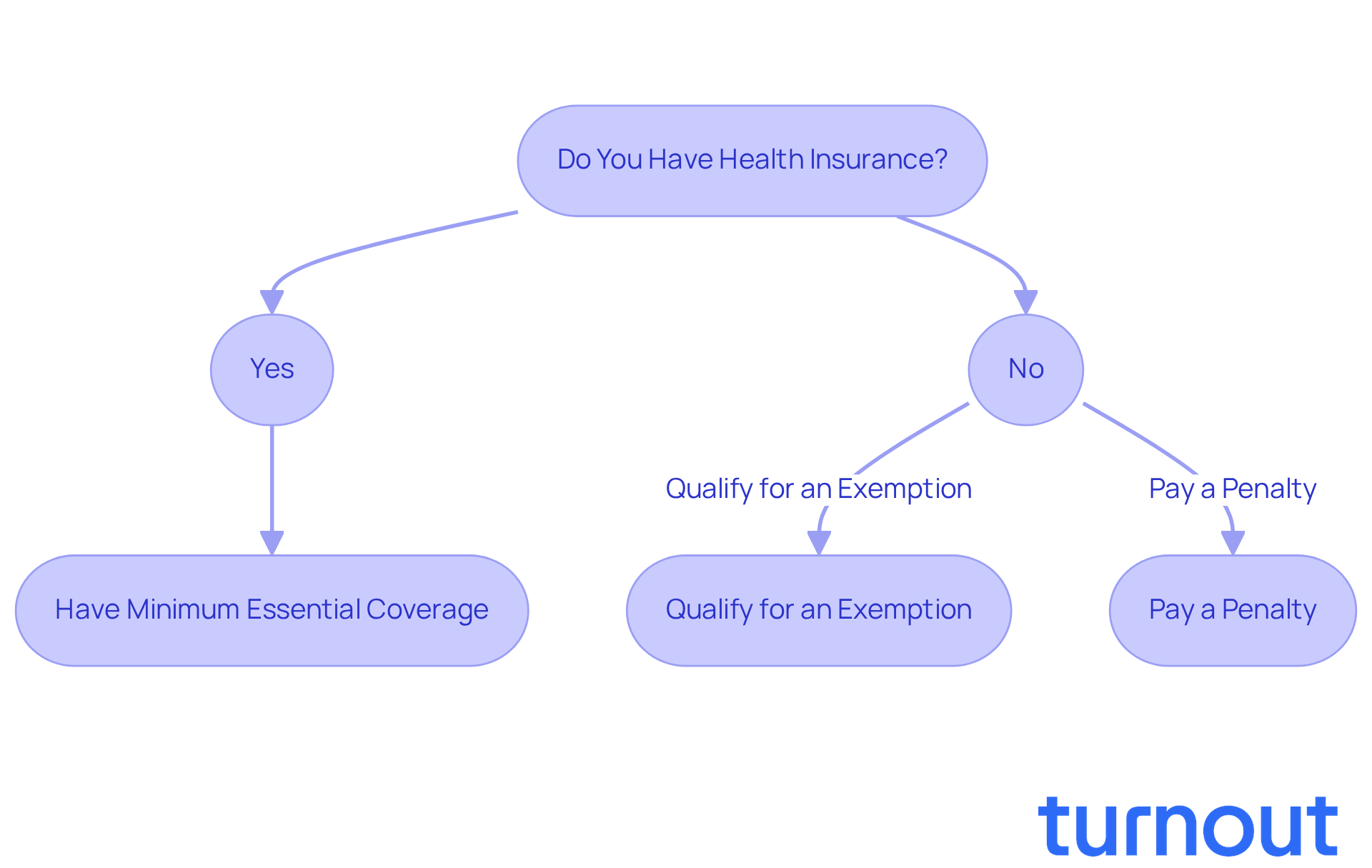

You have a few options:

- Have Minimum Essential Coverage: This includes plans from your employer, government programs like Medicare and Medicaid, or plans you purchase through the Health Insurance Marketplace.

- Qualify for an Exemption: Life can throw challenges our way. If you face financial hardship or have brief gaps in your insurance, you might qualify for an exemption from this requirement.

- Pay a Penalty: While the federal fine for not having coverage was removed in 2019, some states, like California and Massachusetts, have their own rules and penalties for those without coverage.

It is crucial to understand if you do have to have health insurance to file taxes. It helps you stay compliant and avoid unexpected tax liabilities. Remember, you’re not alone in this journey. We’re here to help you navigate these complexities.

Understand Consequences of Not Having Health Insurance for Tax Filing

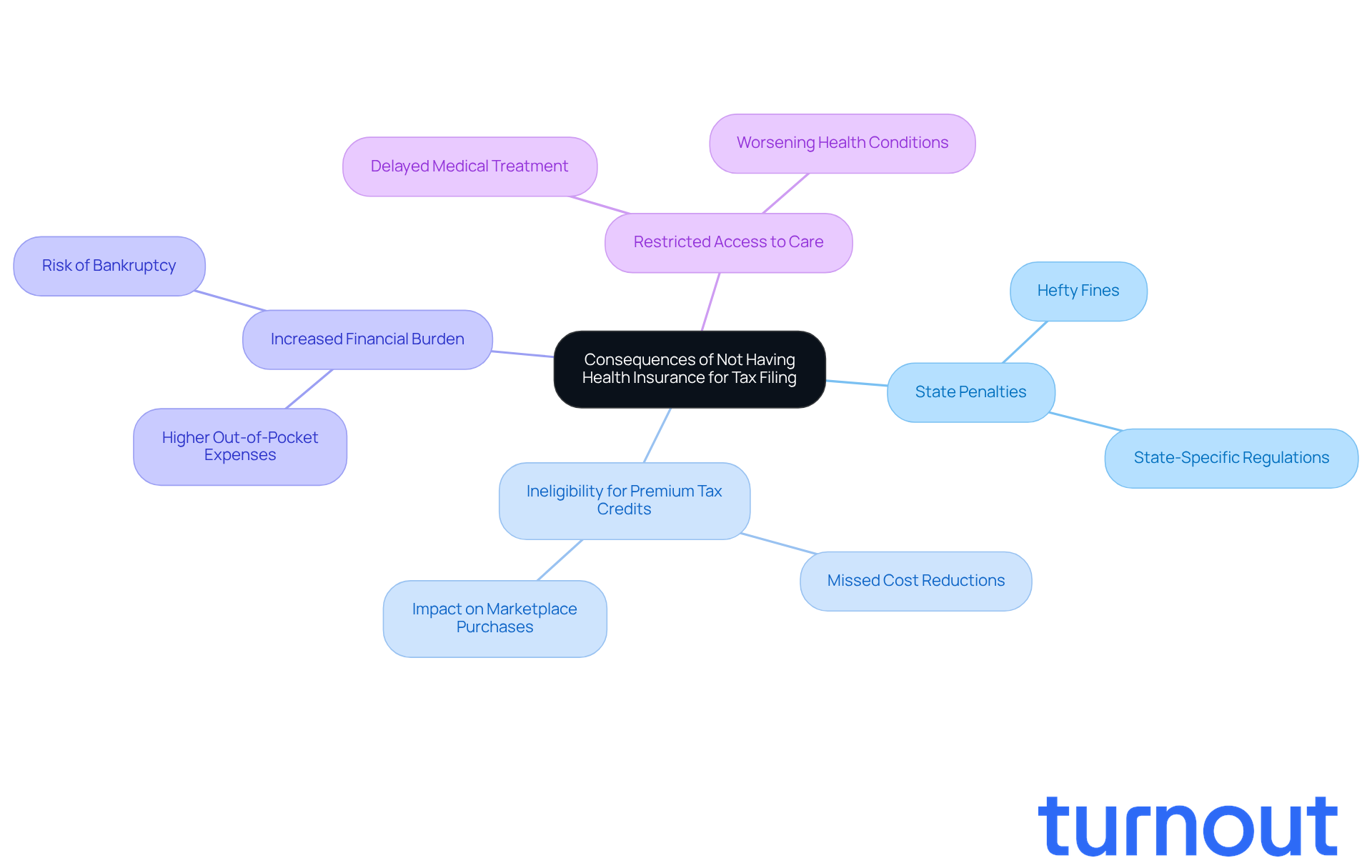

Some tough situations during tax filing can arise from not having health insurance, leading to the question: do you have to have health insurance to file taxes?

In places like California and Massachusetts, where state penalties apply, many wonder, do you have to have health insurance to file taxes? These fines can be quite hefty, sometimes even more than the cost of getting insurance itself.

-

Ineligibility for Premium Tax Credits: It’s common to feel overwhelmed, and you may wonder, do you have to have health insurance to file taxes, since without qualifying medical coverage, you might miss out on premium tax credits. These credits can significantly reduce your costs when purchasing insurance through the Marketplace.

-

Increased Financial Burden: If you’re uninsured, you may face higher out-of-pocket expenses for medical care. This can lead to financial strain and, in severe cases, even bankruptcy.

-

Restricted Access to Care: Without coverage, many people delay medical treatment. This can worsen health conditions and lead to even greater expenses down the line.

Understanding these consequences can motivate you to seek medical coverage. Remember, you’re not alone in this journey, and taking action now can help prevent unnecessary financial difficulties.

Gather Necessary Documentation for Health Insurance Reporting on Taxes

When it comes to reporting your health insurance coverage on your tax return, do you have to have health insurance to file taxes? We understand that it can feel overwhelming. But don’t worry! Gathering the right documentation can make this process smoother for you. Here’s what you’ll need:

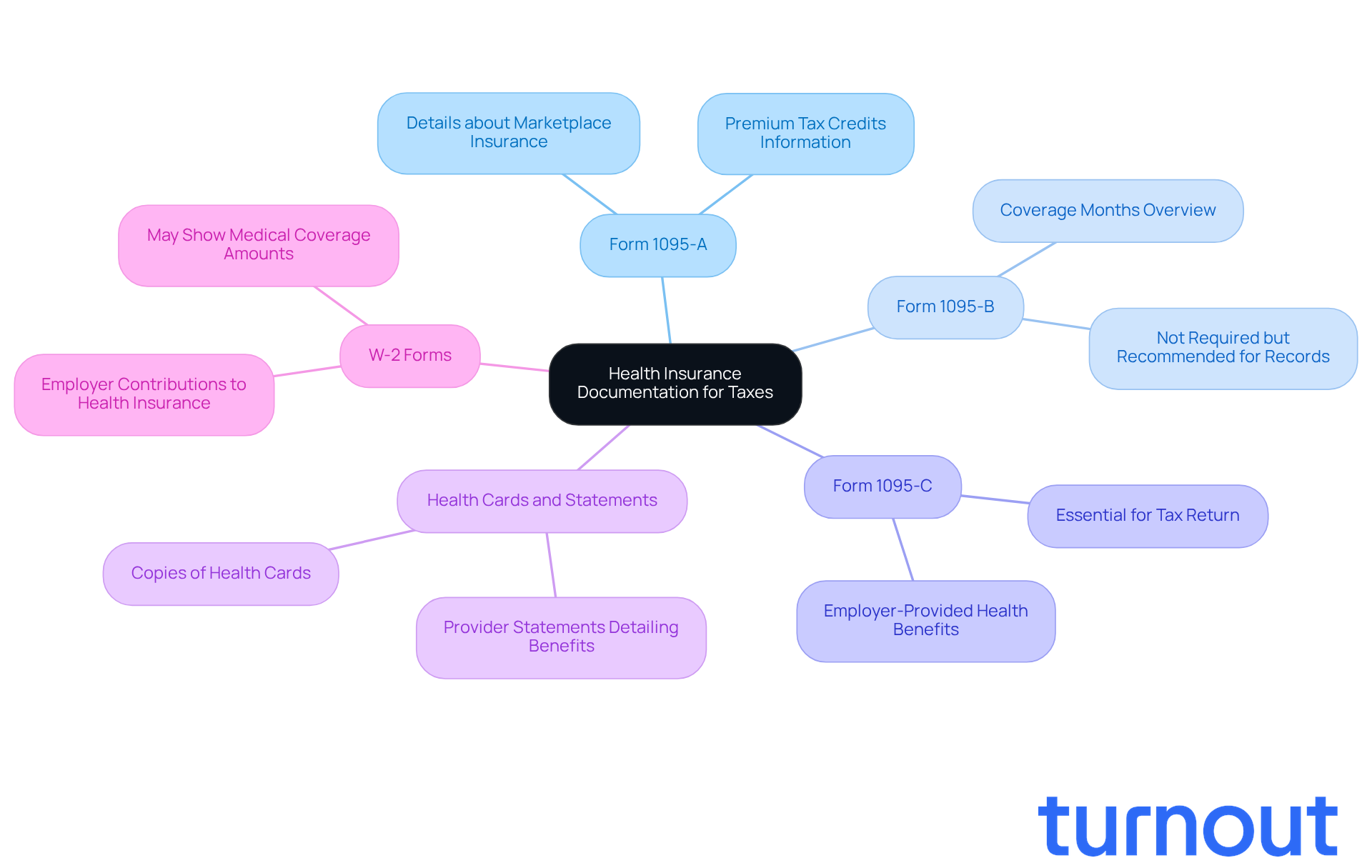

- Form 1095-A: If you got your insurance through the Health Insurance Marketplace, this form is crucial. It provides details about your plan and any premium tax credits you may have received.

- Form 1095-B: This document comes from your medical plan provider and shows the months you were covered. While it’s not required for filing, it’s a good idea to keep it for your records.

- Form 1095-C: If you’re employed by a larger company, your employer will provide this form. It outlines the health benefits offered to you and is essential for your tax return.

- Health Cards and Statements: Make sure to keep copies of your health cards and any statements from your provider that detail your benefits. These can be helpful references.

- W-2 Forms: If your employer provides your medical coverage, your W-2 may also show the amounts contributed towards your health insurance.

Having these documents ready will not only streamline your tax filing process but also clarify whether you have to have health insurance to file taxes, helping you stay compliant with ACA requirements. Remember, you’re not alone in this journey; we’re here to help you every step of the way!

Report Health Insurance Coverage Accurately on Your Tax Return

When it comes to reporting your health insurance coverage on your tax return, many wonder, do you have to have health insurance to file taxes, and we understand it can feel overwhelming. But don’t worry; we’re here to help you through it. Just follow these simple steps:

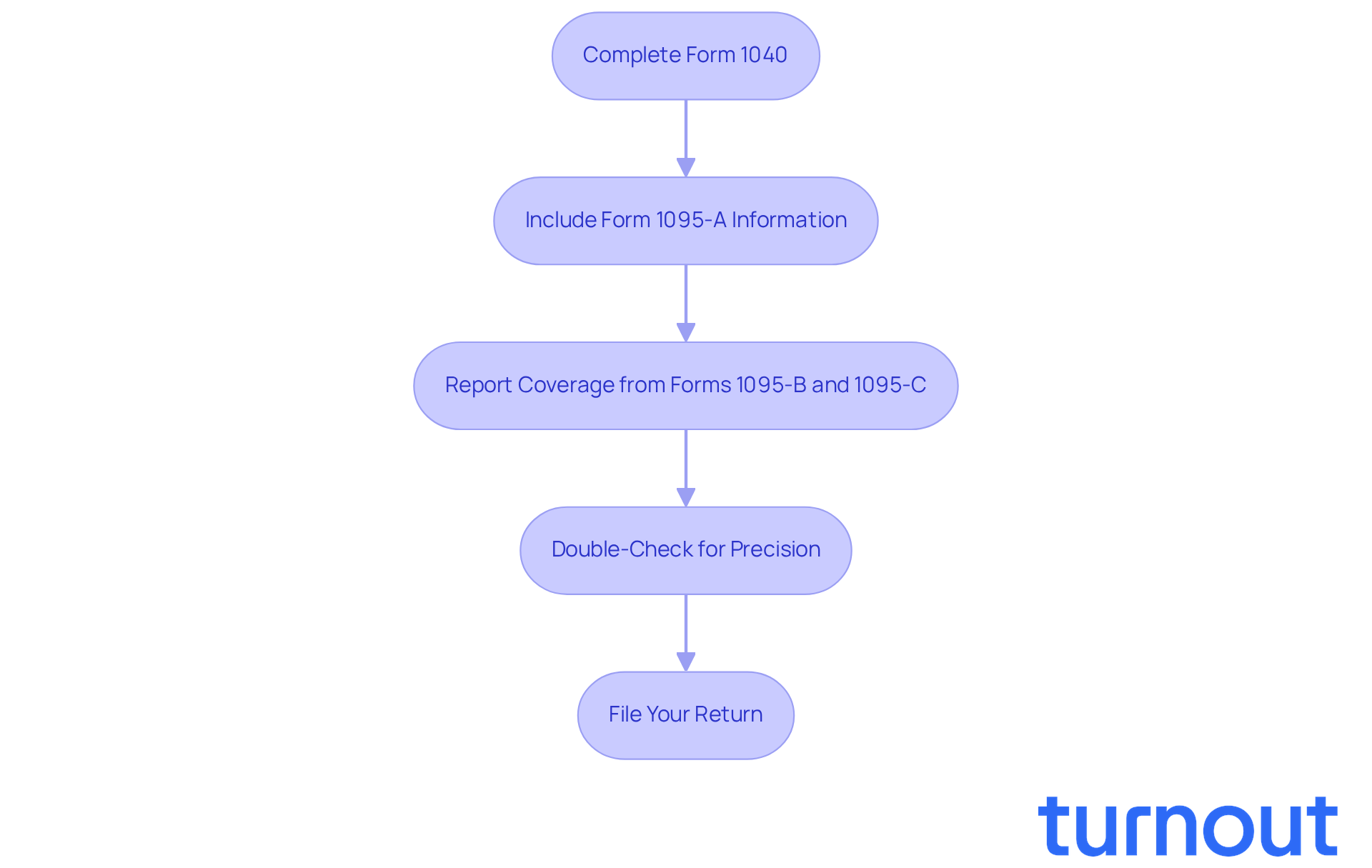

- Complete Form 1040: Start by filling out your Form 1040, which is the standard individual income tax return. This is your first step toward ensuring everything is in order.

- Include Form 1095-A Information: If you received Form 1095-A, use that information to complete Form 8962. This form calculates your premium tax credit, and it’s important to attach it to your 1040.

- Report Coverage from Forms 1095-B and 1095-C: While you don’t need to submit Forms 1095-B or 1095-C with your tax return, make sure the information aligns with what you report on your 1040. Keep these forms handy for your records.

- Double-Check for Precision: It’s common to feel anxious about accuracy, so take a moment to review all entries for correctness, especially the months of coverage. Any discrepancies can lead to issues with the IRS, and we want to help you avoid that.

- File Your Return: Finally, submit your completed tax return by the deadline. Make sure you’ve included all necessary forms and documentation.

By following these steps, you can confidently determine if you have to have health insurance to file taxes. This minimizes the risk of complications with your tax filing, allowing you to focus on what truly matters.

Conclusion

Understanding the requirements for health insurance in relation to tax filing is essential for every taxpayer. We understand that navigating this landscape can feel overwhelming. The Affordable Care Act mandates that individuals maintain qualifying health coverage throughout the year to avoid complications during tax season. This obligation not only ensures compliance but also helps prevent unexpected financial burdens that can arise from being uninsured.

Having Minimum Essential Coverage is crucial. It’s important to know that you might qualify for exemptions, and being without health insurance can lead to state penalties and missed premium tax credits. Gathering necessary documentation like Forms 1095-A, 1095-B, and 1095-C is vital for accurate reporting on tax returns. This preparation can help you navigate this process smoothly and confidently.

Ultimately, staying informed about health insurance requirements and their implications for tax filing is vital. Taking proactive steps to secure coverage, understand available options, and gather the right documentation can significantly ease the tax filing process. You are not alone in this journey; embracing these responsibilities fosters compliance and promotes better health outcomes and financial stability in the long run. Remember, we're here to help you every step of the way.

Frequently Asked Questions

Do I have to have health insurance to file taxes under the Affordable Care Act?

Yes, all taxpayers must have qualifying medical coverage every month of the year to comply with the Affordable Care Act (ACA).

What are my options for meeting health insurance requirements?

You have a few options: 1. Have Minimum Essential Coverage, which includes plans from your employer, government programs like Medicare and Medicaid, or plans purchased through the Health Insurance Marketplace. 2. Qualify for an exemption due to financial hardship or brief gaps in insurance. 3. Pay a penalty if you live in a state with its own rules, such as California or Massachusetts.

What is Minimum Essential Coverage?

Minimum Essential Coverage includes health insurance plans provided by employers, government programs like Medicare and Medicaid, or plans purchased through the Health Insurance Marketplace.

What if I face financial hardship or have gaps in my insurance?

If you experience financial hardship or have brief gaps in your insurance, you might qualify for an exemption from the health insurance requirement.

Is there a penalty for not having health insurance?

While the federal fine for not having coverage was removed in 2019, some states, such as California and Massachusetts, have their own rules and penalties for individuals without coverage.