Introduction

Navigating the complexities of Social Security Disability (SSD) benefits can feel overwhelming. We understand that many recipients may be surprised to learn that their SSD payments can be subject to federal taxation under certain conditions. This realization can add another layer of financial stress, especially as tax season approaches.

It’s common to wonder whether you need to file taxes on these benefits and how your total earnings might impact your obligations. What happens if your income exceeds the thresholds set by the IRS? We’re here to help clarify these concerns and ensure you feel confident in managing your financial resources.

Understanding your tax obligations is crucial. By staying informed, you can navigate this process with greater ease and peace of mind. Remember, you are not alone in this journey.

Understand Social Security Disability and Tax Obligations

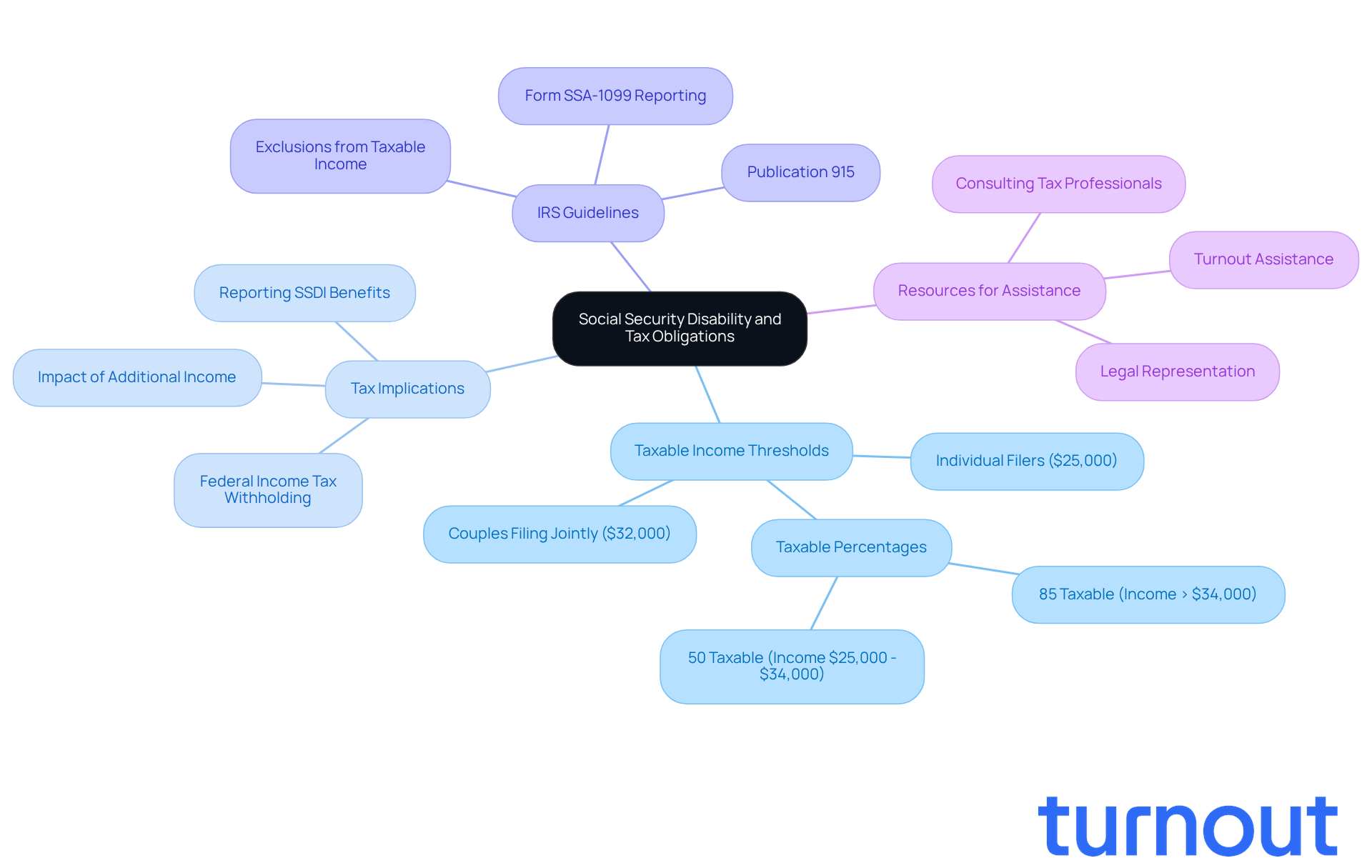

Social Security Disability assistance serves as a crucial financial lifeline for those unable to work due to disabilities. Yet, many recipients might not realize that do you have to file taxes on social security disability benefits can be subject to federal taxation under certain circumstances. We understand that navigating these complexities can be overwhelming. The Internal Revenue Service (IRS) states that if your total earnings exceed specific limits, a portion of your SSD payments may indeed be taxable. This makes it essential to grasp these responsibilities for effective financial planning and to understand do you have to file taxes on social security disability.

To help you navigate this landscape, it’s important to understand the IRS guidelines regarding SSD assistance. Your total earnings are calculated by adding your adjusted gross income (AGI), any tax-exempt interest, and half of your SSD payments. If this total exceeds $25,000 for individual filers or $32,000 for couples filing jointly, do you have to file taxes on social security disability payments? Individuals earning between $25,000 and $34,000 may wonder, do you have to file taxes on social security disability, as up to 50 percent of SSD payments could be taxable. Many wonder, do you have to file taxes on social security disability if you exceed $34,000, as this may result in taxation on up to 85 percent of your payments?

As we approach tax season in 2026, these thresholds remain vital for determining your tax obligations. It’s common to feel uncertain about these matters, so we encourage SSD recipients to consult IRS Publication 915 for detailed guidance on whether you have to file taxes on social security disability benefits. Additionally, seeking advice from tax experts can provide valuable insights into the question of do you have to file taxes on social security disability when receiving disability support alongside other earnings and how it may impact your overall tax responsibilities. Turnout offers assistance through trained nonlawyer advocates who can help you navigate these complexities without the need for legal representation. Remember, Turnout is not a law firm and does not provide legal advice.

It’s also worth noting that individuals receiving Supplemental Security Income (SSI) do not receive a 1099, as SSI payments are not taxable. Real-world examples highlight the importance of compliance. For instance, a recipient with SSD assistance and a modest pension might unexpectedly face a tax bill if their combined earnings exceed the limit. Conversely, individuals without additional income streams typically do not owe taxes on their SSD payments, leading to the question, do you have to file taxes on social security disability, which underscores the importance of understanding your financial situation.

By familiarizing yourself with these guidelines and seeking professional assistance when needed, you can ensure compliance with tax laws while maximizing your financial resources. Remember, you are not alone in this journey; we’re here to help.

Identify Criteria for Taxability of SSD Benefits

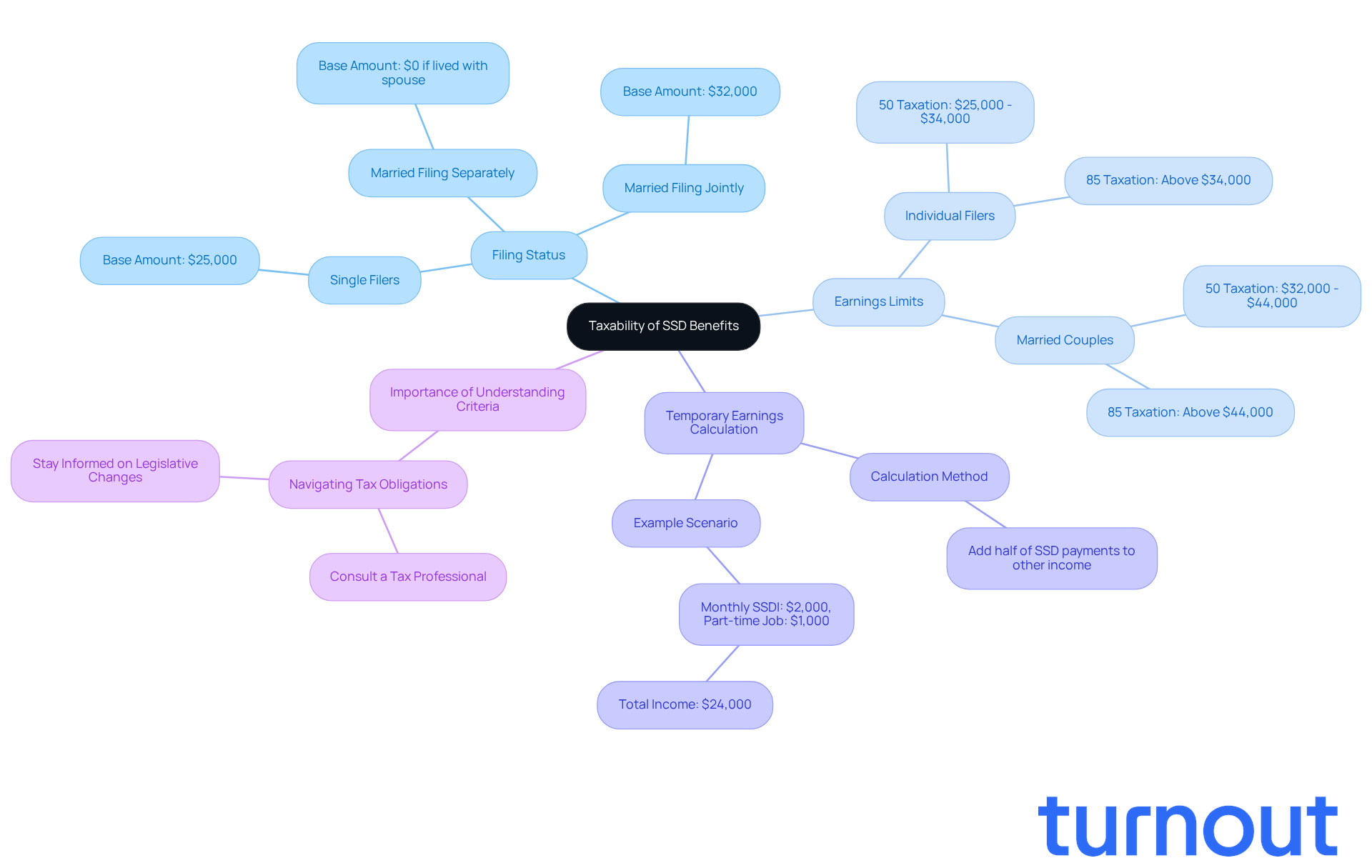

Are you wondering if you do have to file taxes on social security disability payments? It’s a common concern, and we’re here to help you navigate the important issue of whether do you have to file taxes on social security disability. To determine if you have to file taxes on social security disability, you should evaluate your total earnings against IRS limits. Let’s break it down together:

-

Filing Status: Your tax filing status-whether you’re single, married filing jointly, or something else-plays a significant role in your tax responsibilities. As tax expert Mary Johnson wisely notes, 'Income and filing status, not age, determine whether you have to file taxes on social security disability payments.'

-

Earnings Limits: If you’re an individual filer and your total earnings exceed $25,000, you might have to pay taxes on your SSD payments. For married couples filing jointly, the threshold is $32,000. According to the IRS, up to 50% of SSD payments may be taxed if your total earnings fall between $25,000 and $34,000 for individuals, and up to 85% if they exceed $34,000. For married couples, the thresholds are $32,000 to $44,000 for 50% taxation and above $44,000 for 85% taxation.

-

Temporary Earnings Calculation: To find your temporary earnings, simply add half of your SSD payments to any additional income you have. If this total exceeds the thresholds mentioned, do you have to file taxes on social security disability allowances that may become taxable?

-

Understanding these criteria is crucial for accurately determining whether do you have to file taxes on social security disability. For example, if you receive $2,000 in monthly SSDI and earn $1,000 from a part-time job, you may not owe taxes if your total income stays below the threshold. This highlights the importance of careful calculation in understanding your tax obligations.

We understand that navigating these complexities can be overwhelming. That’s why Turnout offers tools and services to assist you, ensuring you comprehend your rights and obligations regarding SSD entitlements and tax relief. Staying informed about legislative changes, like the new senior deduction set to begin in 2025, is also vital, as it may impact your tax situation in 2026. Remember, you are not alone in this journey.

Calculate Your Taxable SSD Benefits

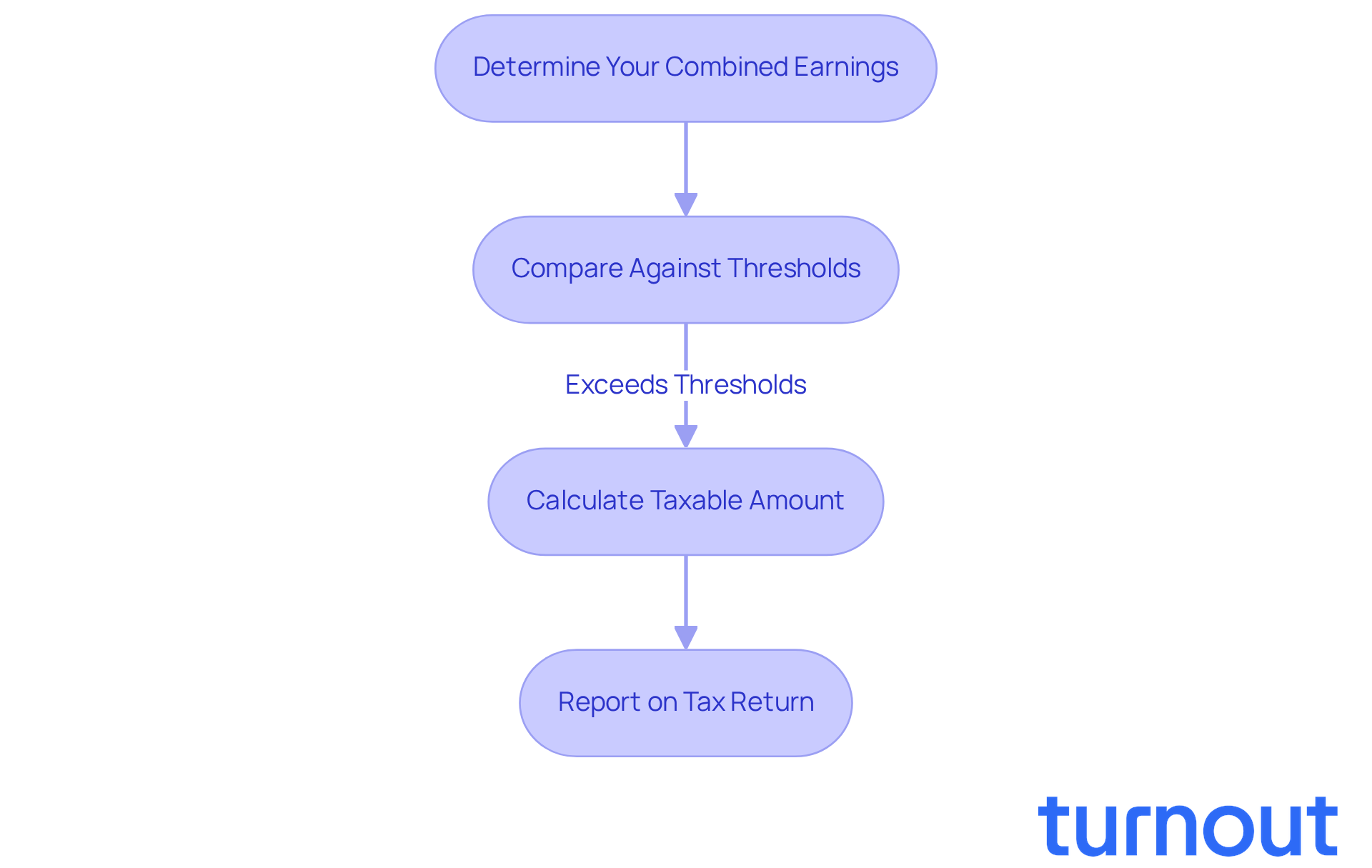

Navigating the world of Social Security Disability benefits can feel overwhelming, but we're here to help you understand if you do have to file taxes on social security disability. Follow these simple steps to make the process easier:

-

Determine Your Combined Earnings: Start by calculating your adjusted gross income (AGI). Add any tax-exempt interest and include half of your SSD benefits. This total will give you your combined earnings.

-

Compare Against Thresholds: Next, check if your combined earnings exceed the thresholds of $25,000 for single filers or $32,000 for married couples filing jointly. It's common to feel uncertain about where you stand, especially when considering do you have to file taxes on social security disability, but knowing these numbers is crucial.

-

Calculate Taxable Amount: If your combined income is above the threshold, here's what to expect:

- For single filers: If your combined income falls between $25,000 and $34,000, up to 50% of your SSD benefits may be taxable. If it exceeds $34,000, up to 85% may be taxable.

- For married couples filing jointly: The same percentages apply, with thresholds set at $32,000 and $44,000, respectively.

-

Report on Tax Return: Finally, make sure to report the taxable portion of your SSD payments on line 6b of Form 1040 or Form 1040-SR. This step is essential for staying compliant with tax laws and ensuring you receive the correct refund amount.

Understanding these steps is vital, as around 50% of SSD recipients may wonder, do you have to file taxes on social security disability based on their income levels. Remember, accurately reporting these benefits is key to avoiding potential penalties and ensuring you get the support you deserve. You're not alone in this journey, and taking these steps can help you feel more secure in your financial situation.

Explore Filing Statuses and Their Impact on SSD Taxes

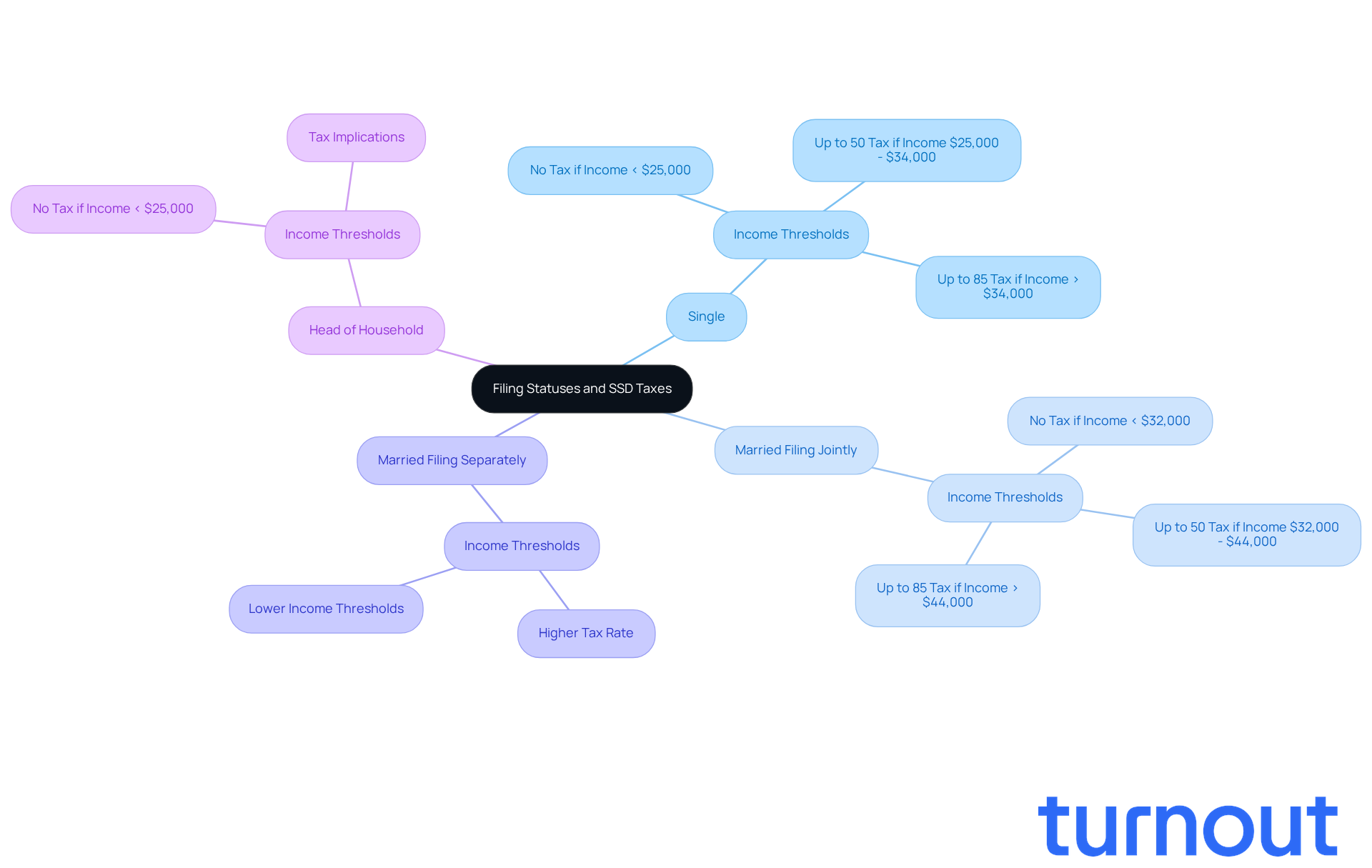

Your tax filing status can significantly influence whether you do you have to file taxes on social security disability payments. Understanding this can feel overwhelming, but we’re here to help you navigate it. Here’s a breakdown of how each status affects your tax obligations:

-

Single: If you’re filing as an individual, the combined earnings thresholds are set at $25,000 and $34,000. Exceeding these limits means you could be taxed on up to 85% of your SSD assistance. It’s common to feel concerned about this, but knowing the thresholds can help you plan better.

-

Married Filing Jointly: Couples who file jointly benefit from higher thresholds of $32,000 and $44,000. This status often allows for a greater total income before taxes kick in, which can ease your overall tax burden. It’s reassuring to know that you might have more leeway here.

-

Married Filing Separately: If you’re married but decide to file separately, different rules apply. Unfortunately, this often results in a higher tax rate on your SSD payments, as the earnings threshold is lower compared to other statuses. We understand that this can be frustrating, but being aware of these rules is the first step.

-

Head of Household: This status can provide a more favorable tax situation, with a threshold of $25,000 for combined income. Understanding your filing status is crucial for optimizing your tax situation, particularly when you consider do you have to file taxes on social security disability to ensure you retain as much of your benefits as possible.

In 2026, around 74 million Americans will receive Social Security assistance. This highlights the importance of being informed about how these tax rules apply to your unique situation. Additionally, a new tax deduction for individuals aged 65 and older will reduce taxable earnings by up to $6,000, which could significantly impact the tax responsibilities of senior SSD recipients.

We encourage you to consult with a tax advisor who can provide personalized strategies to help you navigate these complexities effectively. Remember, you’re not alone in this journey.

Take Action If You Owe Taxes on SSD Benefits

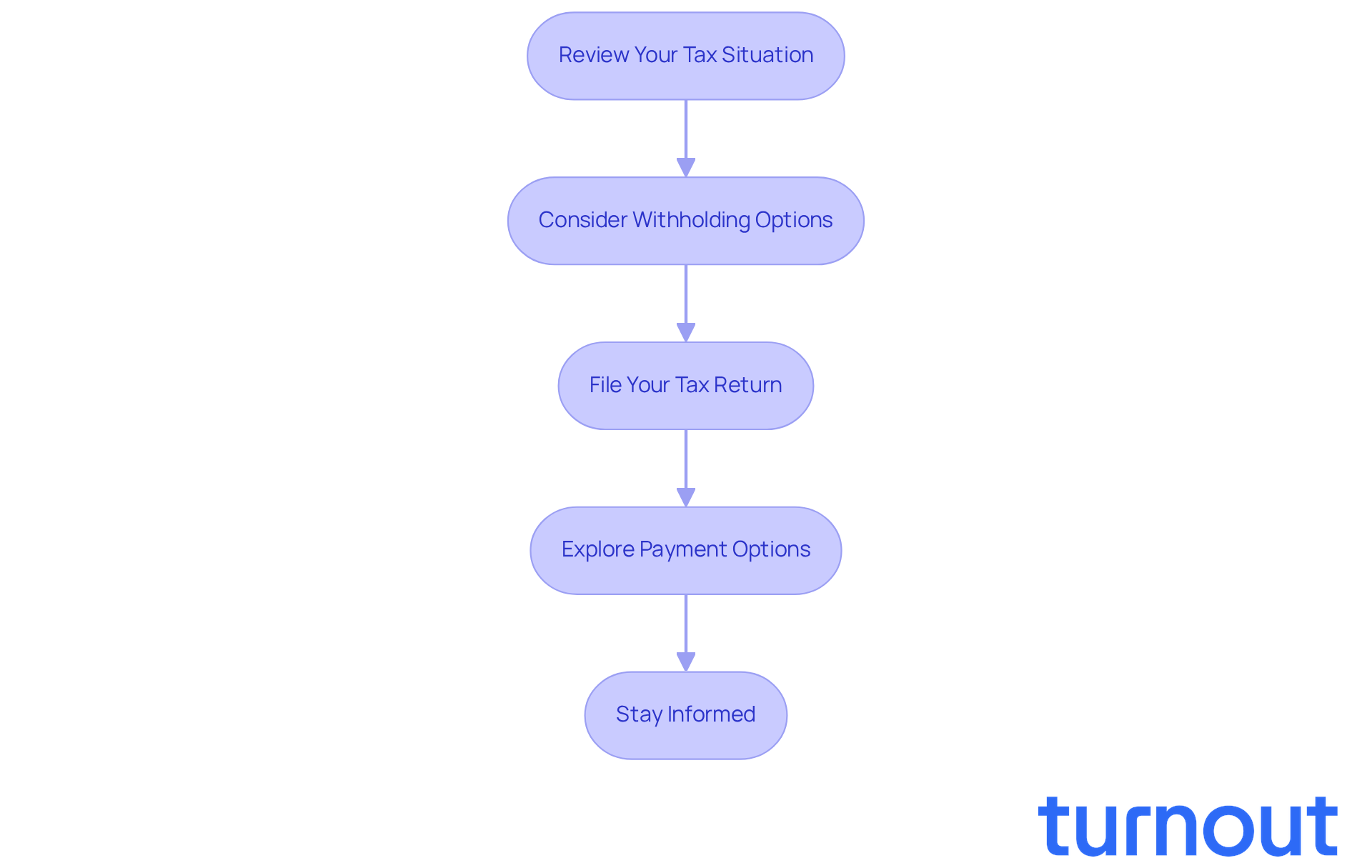

If you find yourself in a situation where you owe taxes on your Social Security Disability benefits, you might be wondering, do you have to file taxes on social security disability? Don’t worry. We’re here to help you navigate this process with ease. Here are some steps to effectively manage your tax obligations:

-

Review Your Tax Situation: Start by double-checking your calculations to ensure everything is accurate. Gather all necessary documents, like your SSD payment statements and any other income sources, to get a clear picture of your total tax liability.

-

Consider Withholding Options: Many SSD recipients choose to have taxes withheld to make financial planning simpler. You can request the Social Security Administration to withhold a portion of your monthly SSD payments for federal taxes. This proactive step can help you manage your tax liability throughout the year, reducing the chance of a hefty tax bill when it’s time to file. As tax professional Olsen Thielen wisely points out, "By having a predetermined percentage withheld automatically, you can remove the guesswork and variability associated with manual, lump-sum tax payments."

-

File Your Tax Return: Make sure to submit your federal tax return by the deadline, accurately reporting the taxable portion of your SSD payments. Use Form 1040 or Form 1040-SR, and don’t hesitate to consult a tax professional if you encounter any complexities.

-

Explore Payment Options: If you owe money and can’t pay it all at once, the IRS offers various payment plans to help you manage your debts. If you owe under $50,000, you may have up to 72 months to pay your balance, which can ease immediate financial pressure.

-

Stay Informed: It’s important to keep an eye on changes in tax laws that could impact your SSD benefits. Regularly checking IRS updates and consulting with a tax professional can help ensure you stay compliant and optimize your tax situation. For instance, nearly 90% of Social Security recipients won’t pay federal income taxes on their payments in 2026, but understanding your specific situation is crucial. Also, remember that the IRS can garnish up to 15% of your SSDI payments under the Federal Payment Levy Program for unpaid taxes, so managing your obligations is key.

By following these steps, you can effectively manage your tax obligations related to Social Security Disability benefits and determine if you do have to file taxes on social security disability to avoid potential complications. Remember, you’re not alone in this journey, and there are resources available to support you.

Conclusion

Understanding the tax implications of Social Security Disability (SSD) benefits is crucial for recipients who want to manage their financial obligations effectively. We recognize that while SSD payments provide essential support, these benefits can be subject to taxation based on total earnings and filing status. By familiarizing yourself with IRS guidelines and thresholds, you can navigate your tax responsibilities with confidence.

It's important to accurately calculate your combined earnings and recognize the specific income limits that determine taxability. Different filing statuses can also impact your tax obligations. Consulting resources like IRS Publication 915 and seeking guidance from tax professionals can provide clarity and ensure compliance, helping you avoid unexpected tax bills.

Staying informed and proactive about your tax responsibilities related to SSD benefits is vital. As tax laws evolve, especially with changes expected in 2026, it’s common to feel uncertain about your unique situation. Taking the necessary steps now can lead to better financial management and peace of mind. Remember, SSD benefits are meant to support you, and being aware of potential tax complications can help you make the most of them.

Frequently Asked Questions

What is Social Security Disability (SSD) assistance?

Social Security Disability assistance is a financial support program for individuals who are unable to work due to disabilities.

Are SSD payments subject to federal taxation?

Yes, SSD payments can be subject to federal taxation depending on your total earnings.

How is total earnings calculated for SSD recipients?

Total earnings are calculated by adding your adjusted gross income (AGI), any tax-exempt interest, and half of your SSD payments.

What are the income thresholds for SSD taxation?

For individual filers, if total earnings exceed $25,000, a portion of SSD payments may be taxable. For couples filing jointly, the threshold is $32,000. Up to 50% of SSD payments may be taxable if earnings are between $25,000 and $34,000 for individuals and $32,000 and $44,000 for couples. If earnings exceed $34,000 for individuals or $44,000 for couples, up to 85% of SSD payments may be taxable.

Do individuals receiving Supplemental Security Income (SSI) have to pay taxes on their benefits?

No, individuals receiving Supplemental Security Income (SSI) do not receive a 1099 form, as SSI payments are not taxable.

What should SSD recipients do if they are unsure about their tax obligations?

SSD recipients are encouraged to consult IRS Publication 915 for detailed guidance and seek advice from tax experts to understand their tax responsibilities.

Can Turnout assist SSD recipients with tax-related questions?

Yes, Turnout offers assistance through trained nonlawyer advocates to help navigate tax complexities related to SSD without providing legal representation.

What is the importance of understanding SSD tax obligations?

Understanding SSD tax obligations is crucial for effective financial planning and ensuring compliance with tax laws, as failing to do so may result in unexpected tax bills.