Introduction

Navigating the complexities of Social Security survivor benefits can feel overwhelming, especially for those who have recently lost a loved one. We understand that for many widows, figuring out if they qualify for financial assistance is crucial for rebuilding their lives after such a profound loss. With millions of Americans relying on these benefits, a pressing question arises: how can widows ensure they receive the support they need?

This article aims to shed light on the intricacies of survivor benefits. We’ll explore:

- Eligibility criteria

- The types of assistance available

- The application process

Our goal is to empower you to secure your financial future during one of life’s most challenging transitions. Remember, you are not alone in this journey; we’re here to help.

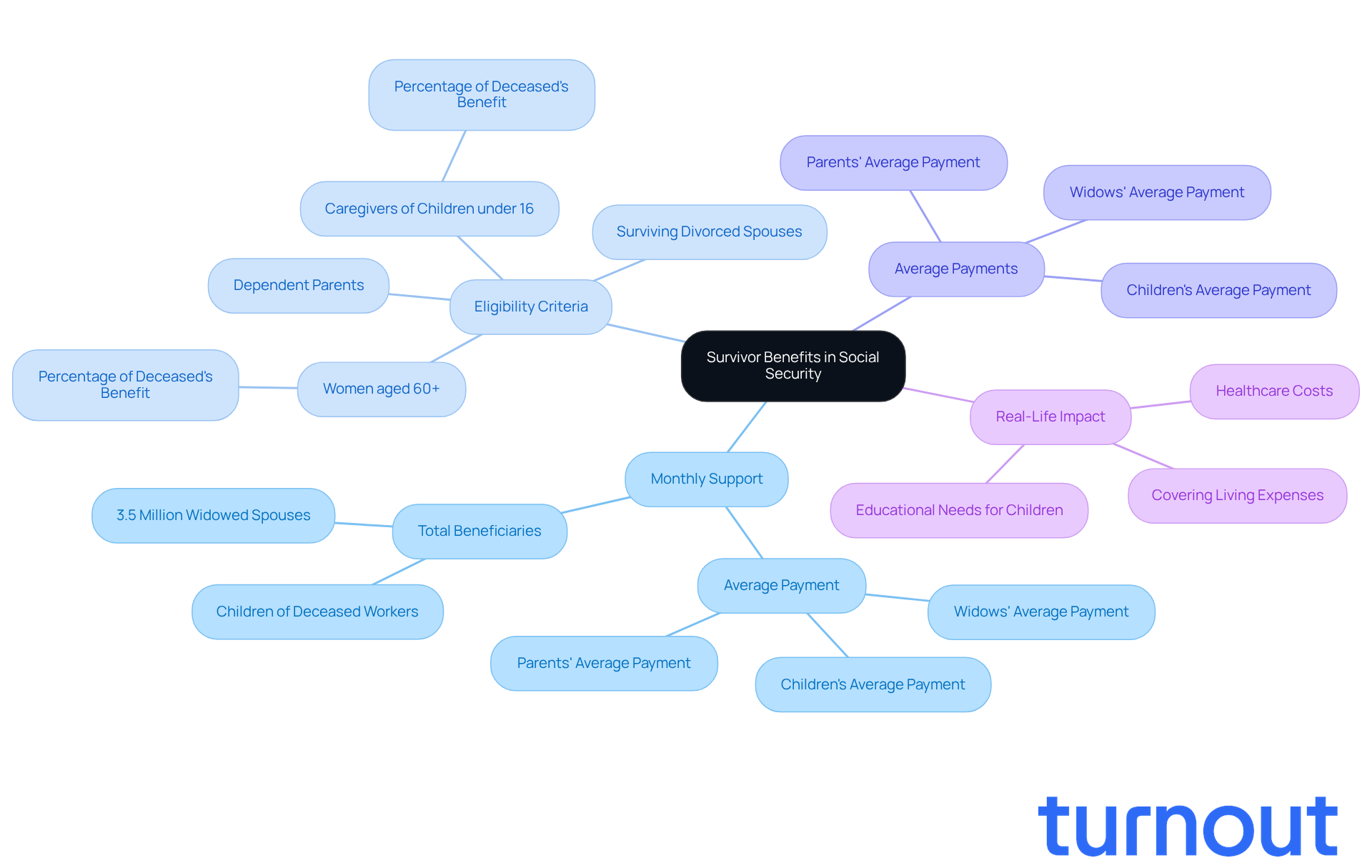

Define Survivor Benefits in Social Security

Survivor payments under Social Security provide vital monthly support for family members of those who contributed to Social Security before their passing, which leads to the inquiry: do widows get social security? We understand how challenging it can be to navigate life after losing a primary earner. These payments are essential for helping surviving spouses, children, and sometimes parents maintain financial stability during such difficult times. In 2026, around 3.5 million bereaved partners will receive this assistance, averaging about $1,864 each month. This highlights just how crucial the program is in supporting families through their toughest moments.

The amount of assistance largely depends on the deceased worker's earnings history. Spouses typically receive the highest average monthly payment, which stands at $1,835.32. Eligibility can vary based on several factors, including age and relationship to the deceased. For instance:

- Women aged 60 or older may receive between 71.5% to 99% of the deceased's payout.

- Those caring for a child under 16 can receive 75% of the deceased's payment.

Real-life stories illustrate the impact of these benefits. Many bereaved spouses have shared how these payments have been crucial in covering everyday living expenses, healthcare costs, and even educational needs for their children. Experts emphasize the importance of these benefits, highlighting that they serve as a vital safety net for families facing the economic challenges that arise after losing a loved one.

In conclusion, a common question is do widows get social security death assistance, which offers essential financial support to bereaved spouses, ensuring they receive the help they need to rebuild their lives after the loss of their partner. Understanding the eligibility requirements and the potential benefits available is key for women looking to secure their financial future. Remember, you are not alone in this journey; we're here to help.

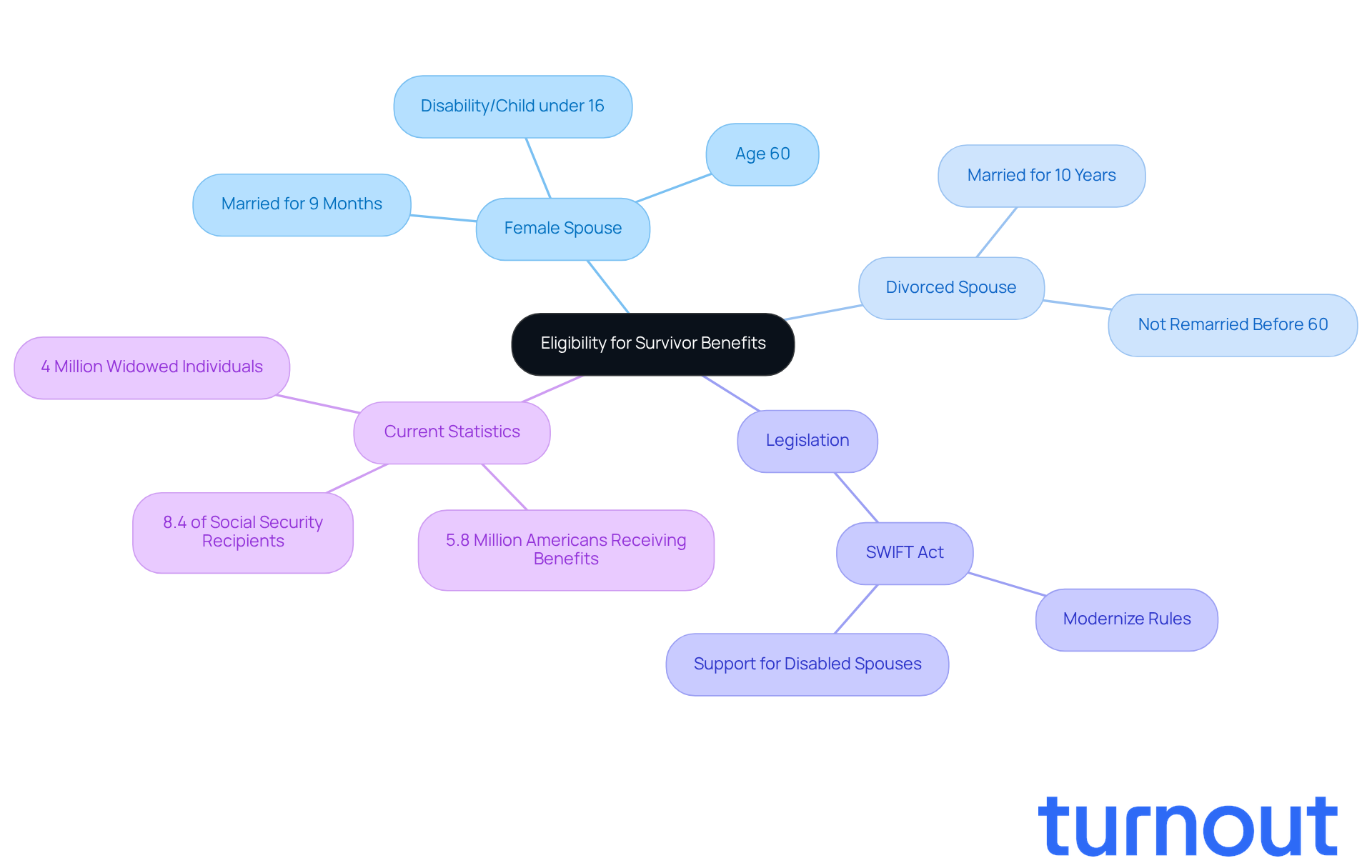

Contextualize Eligibility for Survivor Benefits

Navigating survivor assistance can feel overwhelming, especially during such a difficult time. Understanding eligibility is crucial for you or your loved ones to access the support you deserve.

Typically, if you are a female spouse, you may qualify for assistance if you were married to the deceased for at least nine months before their passing. Age plays a significant role too. Many wonder do widows get social security, as women who have lost their spouses can start receiving assistance as early as age 60. If you’re under 60 but have a disability or are raising a child of the deceased who is under 16 or has a disability, you might qualify at age 50.

If you’re divorced, there’s still hope. You may qualify if you were married to the deceased for at least ten years and haven’t remarried before turning 60. Remember, remarrying before this age can disqualify you from receiving assistance from your previous spouse.

Recent proposals, like the Surviving Widow(er) Income Fair Treatment (SWIFT) Act, aim to modernize these rules. This legislation, introduced by compassionate leaders like Senators Kirsten Gillibrand and Bernie Sanders, seeks to ensure that widowed and surviving divorced spouses with disabilities can access full support at any age.

It’s important to know that around 5.8 million Americans currently receive death benefits, which raises the question of do widows get social security, and this represents 8.4 percent of Social Security recipients. Almost 4 million of these individuals are widowed, which leads to the inquiry: do widows get social security?. You are not alone in this journey.

Additionally, notifying Social Security about a death can activate a one-time $255 death allowance for the surviving spouse, providing further assistance during this challenging time. We understand that seeking help can be daunting, but comprehending these eligibility criteria is the first step toward obtaining the support you need.

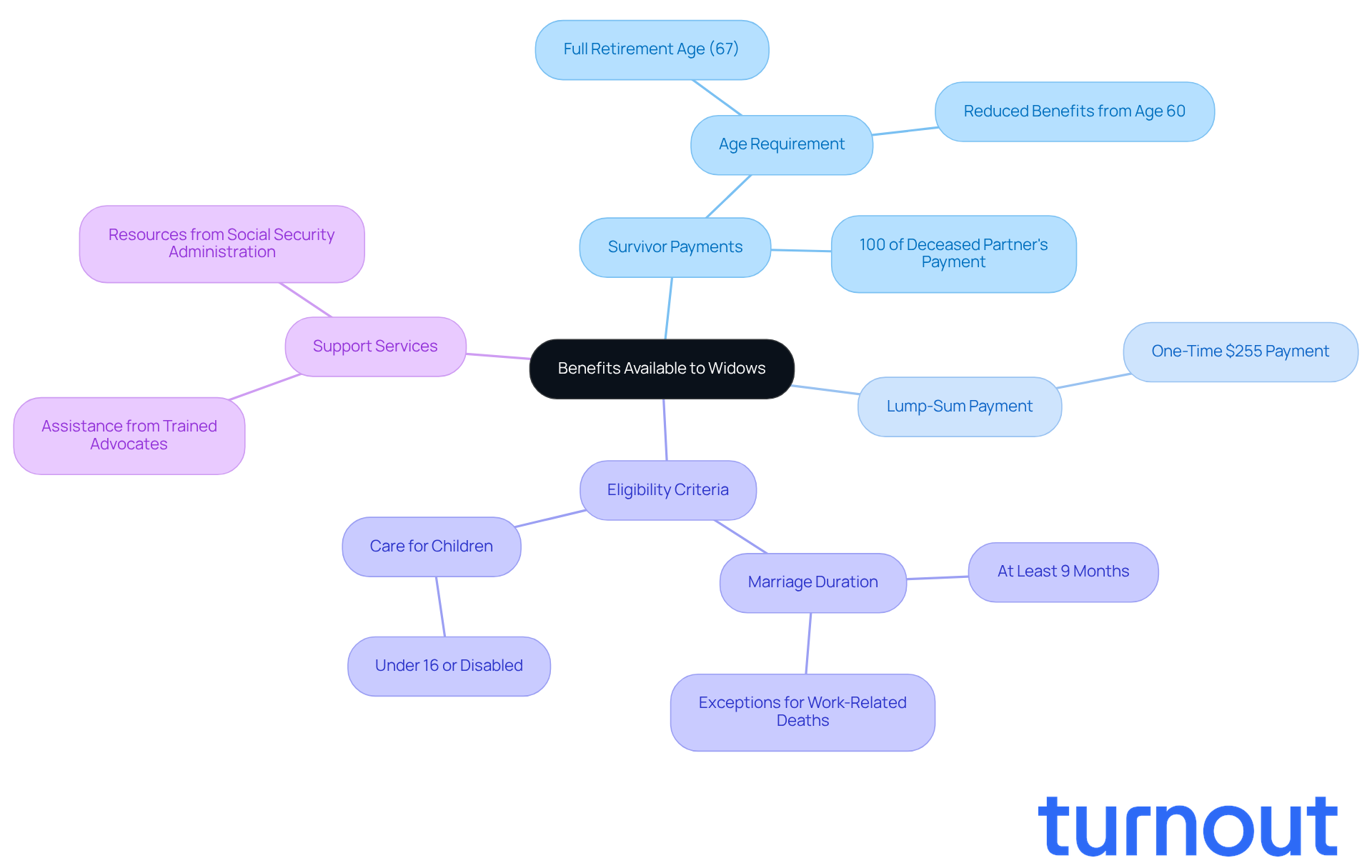

Detail Types of Benefits Available to Widows

Widows may find themselves facing significant challenges, but there’s hope. Social Security offers various support programs that can greatly assist in achieving economic stability. One of the main advantages is the basic survivor payment, which allows spouses to receive up to 100% of the deceased partner's payment amount if claimed at full retirement age, typically around 67. Additionally, a single lump-sum payment of $255 is available to spouses who were living with the deceased at the time of passing, providing immediate financial relief during a difficult time.

To qualify for these benefits, the marriage must have lasted at least nine months before the spouse's death. For women caring for a child under 16 or a disabled child, assistance is accessible regardless of the woman's age. This ensures that families receive the essential support they need. Many widows have shared their experiences of obtaining significant monetary support through these programs, which raises the question of do widows get social security and highlights how they help secure a brighter economic future.

Understanding whether do widows get social security is crucial for maximizing financial support. We understand that navigating these options can be overwhelming. Experts emphasize the importance of knowing eligibility criteria, as factors like the duration of marriage and the age of the surviving partner play a vital role in determining payout amounts. Moreover, it’s important for women who have lost their spouses to understand that, in relation to do widows get social security, government pensions may affect the amount of Social Security survivor payments they receive.

By effectively navigating these options, widows can ensure they receive the full support they are entitled to during these challenging times. Remember, you are not alone in this journey. Turnout offers tools and services, including trained nonlawyer advocates and IRS-licensed enrolled agents, to help individuals understand these processes. We're here to help you navigate the complexities of government assistance without the need for legal representation.

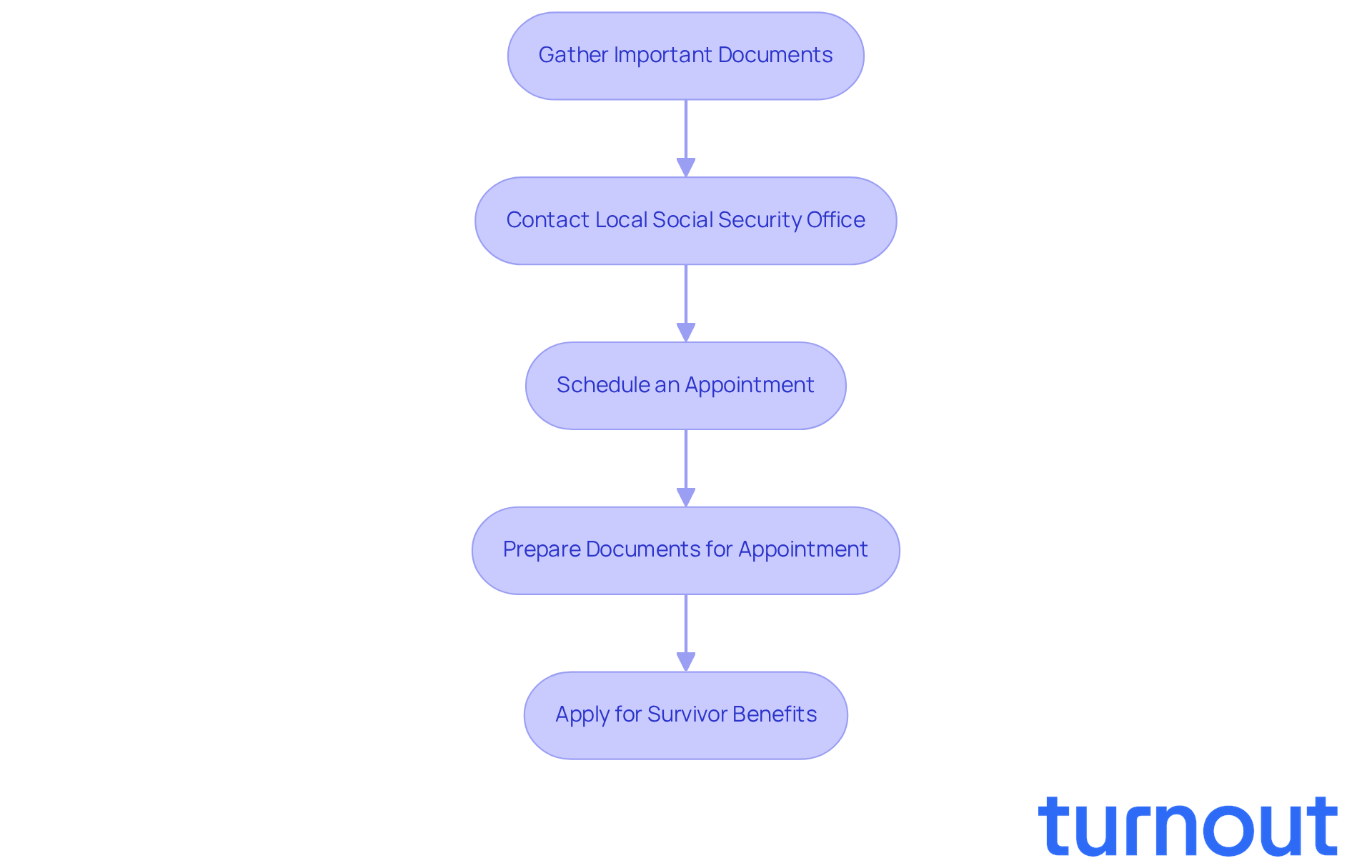

Explain the Application Process for Survivor Benefits

Requesting assistance can feel overwhelming, especially during such a difficult time. We understand that as a widow, you must first gather important documents, like the deceased's work history, marriage certificate, and proof of death, such as a death certificate, to determine how do widows get social security. Unlike many other applications, the process for assistance related to deceased individuals can't be completed online. You'll need to apply either by phone or in person at your local Social Security office. It's a good idea to call ahead to schedule an appointment and ensure you have all the necessary documents ready.

Navigating this process can be daunting. Studies show that nearly 60% of bereaved spouses face significant challenges when applying for survivor assistance, leading many to question do widows get social security. Real-life stories highlight the importance of being well-prepared. One widow shared how having her documents organized helped speed up her application, while another experienced delays due to missing paperwork. By understanding these steps and common pitfalls, you can feel empowered to navigate the system effectively and secure the benefits you deserve. Remember, you're not alone in this journey; we're here to help.

Conclusion

Understanding the complexities of Social Security survivor benefits is essential for widows seeking financial support after losing a partner. These benefits can be a vital lifeline, offering monthly payments that help maintain stability during such a challenging time. By understanding the eligibility criteria and the types of assistance available, widows can secure the support they need to rebuild their lives.

It's important to recognize that eligibility for survivor benefits often depends on factors like:

- The duration of marriage

- The age of the surviving spouse

For many, these benefits can significantly ease financial burdens, covering everyday expenses, healthcare, and educational needs for children. Moreover, knowing the application process and preparing the necessary documentation can make accessing these vital resources smoother.

We understand that this journey can feel overwhelming. But remember, you are not alone. Millions are currently receiving support, highlighting the importance of being informed about available benefits and the steps to access them. By taking proactive measures and seeking assistance, you can navigate this complex system and ensure you receive the financial help you deserve. We're here to help you every step of the way.

Frequently Asked Questions

What are survivor benefits in Social Security?

Survivor benefits in Social Security provide monthly financial support to family members of individuals who contributed to Social Security before their passing, helping them maintain financial stability during difficult times.

Who is eligible to receive survivor benefits?

Eligibility for survivor benefits can vary based on several factors, including age and relationship to the deceased. Typically, widows or widowers aged 60 or older may receive between 71.5% to 99% of the deceased's payout, and those caring for a child under 16 can receive 75% of the deceased's payment.

How much assistance do survivors typically receive?

In 2026, around 3.5 million bereaved partners are expected to receive an average monthly payment of about $1,864. Spouses usually receive the highest average monthly payment, which is approximately $1,835.32.

What impact do survivor benefits have on families?

Survivor benefits are crucial for covering everyday living expenses, healthcare costs, and educational needs for children, serving as a vital safety net for families facing economic challenges after losing a loved one.

Do widows get Social Security death assistance?

Yes, widows can receive Social Security death assistance, which provides essential financial support to help them rebuild their lives after the loss of their partner.

Why is it important to understand survivor benefits?

Understanding the eligibility requirements and potential benefits available is key for those seeking to secure their financial future after the loss of a loved one.