Introduction

Navigating the complexities of tax obligations can feel like an uphill battle for many. We understand that this often leaves individuals wondering if professional tax relief companies truly deliver on their promises. In this article, we’ll explore the effectiveness of these firms compared to DIY solutions, highlighting the potential benefits and drawbacks of each approach.

As tax regulations evolve, it’s common to feel overwhelmed. The stakes are high, and you might be asking yourself: can expert assistance help you save money and reduce stress? Or is tackling tax issues independently the smarter choice? We’re here to help you find clarity in this journey.

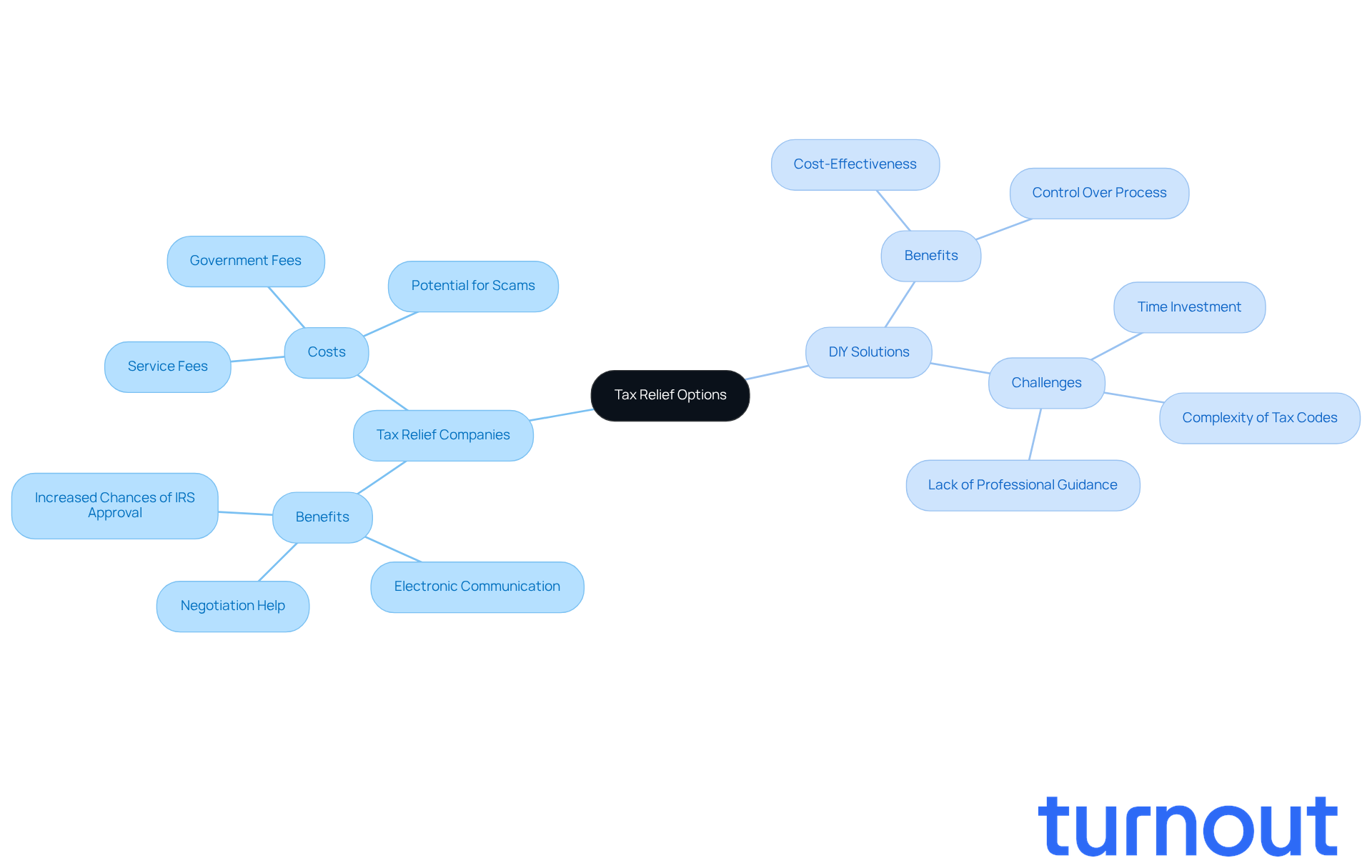

Understanding Tax Relief Companies and DIY Solutions

Tax assistance firms, like Turnout, are here to help you navigate the often overwhelming world of tax obligations. We understand that dealing with the IRS can be daunting, and these specialized organizations can negotiate on your behalf to potentially lower what you owe. While they do charge fees that can vary based on your situation and the firm's reputation, Turnout offers a blend of free services and those that come with Service Fees, which leads one to wonder, do tax relief companies really work? It's important to note that any Government Fees charged by agencies are separate and need to be settled before Turnout can submit any paperwork for you. Plus, you’ll receive all communications electronically, which can make the process smoother and more efficient for you.

On the other hand, some individuals choose to tackle their tax issues on their own. This DIY approach involves researching tax laws, filling out forms, and negotiating directly with the IRS. While it might seem like a cost-effective option, it often requires a significant investment of time and a solid grasp of tax regulations. If you’re considering this route, be prepared to navigate the complexities of tax codes and IRS procedures without professional guidance.

When weighing your options, it's essential to consider whether tax relief companies really work in relation to the costs involved. Turnout's fees can vary widely based on the services you need, while DIY solutions might look more economical at first glance. However, the time and effort required for DIY approaches can lead to hidden costs. It’s crucial to reflect on your personal circumstances, including how complex your tax situation is and how comfortable you feel managing tax regulations on your own.

Ultimately, whether you choose tax assistance services or a DIY approach, remember that you’re not alone in this journey. We’re here to help you find the best solution for your needs.

Evaluating the Pros and Cons of Tax Relief Companies

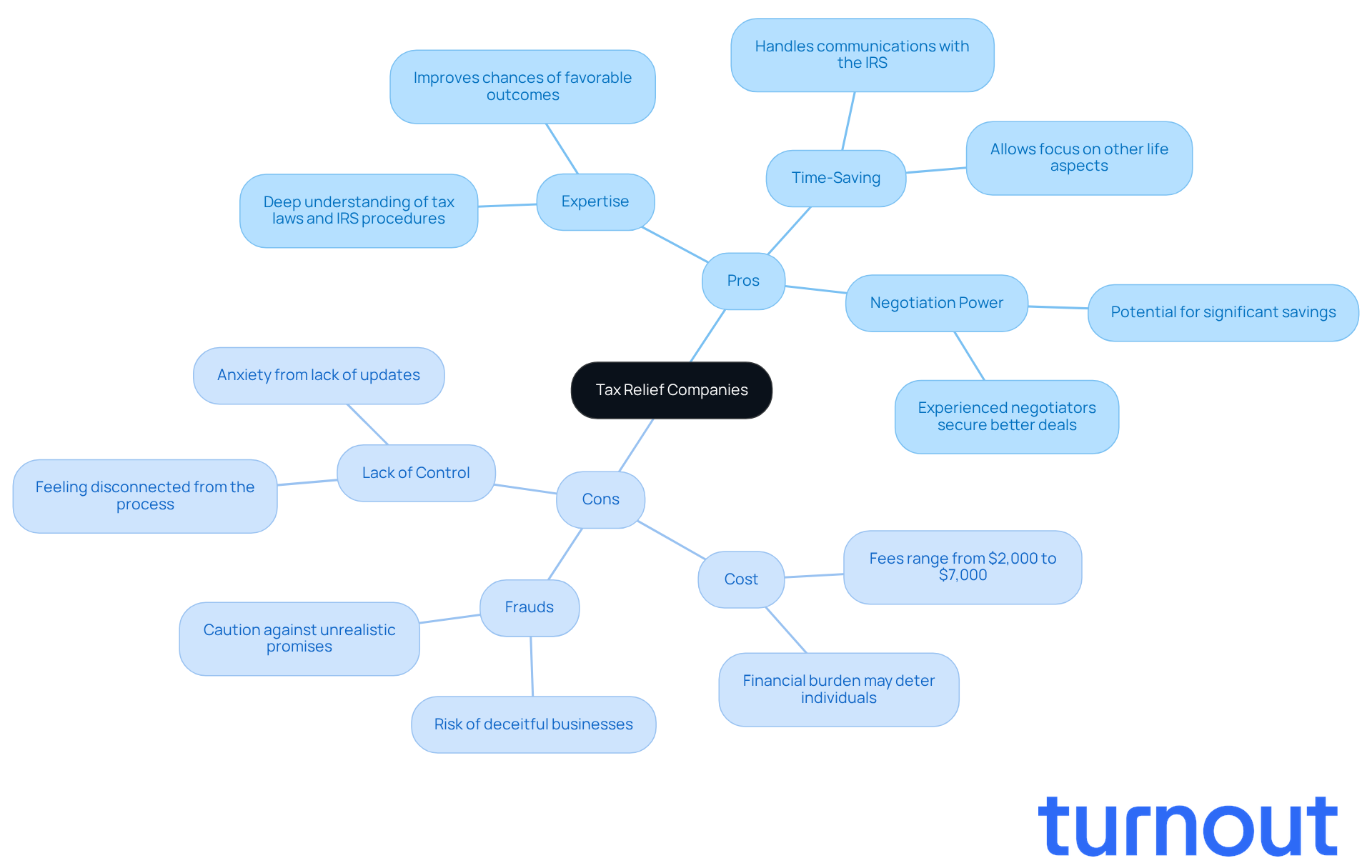

If you're facing tax issues, you might feel overwhelmed and unsure of where to turn. Tax relief companies can offer several advantages that may help you navigate these challenges:

- Expertise: These firms employ professionals who have a deep understanding of tax laws and IRS procedures. This expertise can significantly improve your chances of achieving a favorable outcome. For instance, Precision Tax Relief has been recognized for its exceptional customer service and effective negotiation strategies, helping clients resolve over $58 million in tax obligations.

- Time-Saving: Handling all communications and negotiations with the IRS can be a huge relief. Tax assistance firms take on this burden, allowing you to focus on other important aspects of your life. This support can be especially valuable if you're feeling overwhelmed by the complexities of tax issues.

- Negotiation Power: Experienced negotiators within these firms often secure better deals than you might achieve on your own. For example, Anthem Tax Services has been noted for its ability to negotiate favorable payment plans and settlements, leading to significant savings for clients.

However, it's important to consider some potential drawbacks:

- Cost: The fees for tax relief services can be substantial, often ranging from $2,000 to $7,000. This financial burden may not be feasible for everyone, which can deter individuals from seeking the help they need.

- Frauds: Unfortunately, the tax assistance sector has its share of deceitful businesses that make unrealistic promises. It's crucial to be cautious of firms that guarantee specific outcomes or demand high upfront payments, as these practices can lead to financial loss.

- Lack of Control: You might feel disconnected from the process, relying entirely on the organization to manage your case. This can create anxiety, especially if you're not kept informed about the progress of your negotiations.

As we look ahead to 2026, tax regulations are expected to become more complex due to changes brought by the One Big Beautiful Bill Act. If you're considering involving a tax assistance firm, take the time to thoughtfully evaluate both the potential benefits and the associated risks to see if tax relief companies really work. Remember, you're not alone in this journey, and we're here to help.

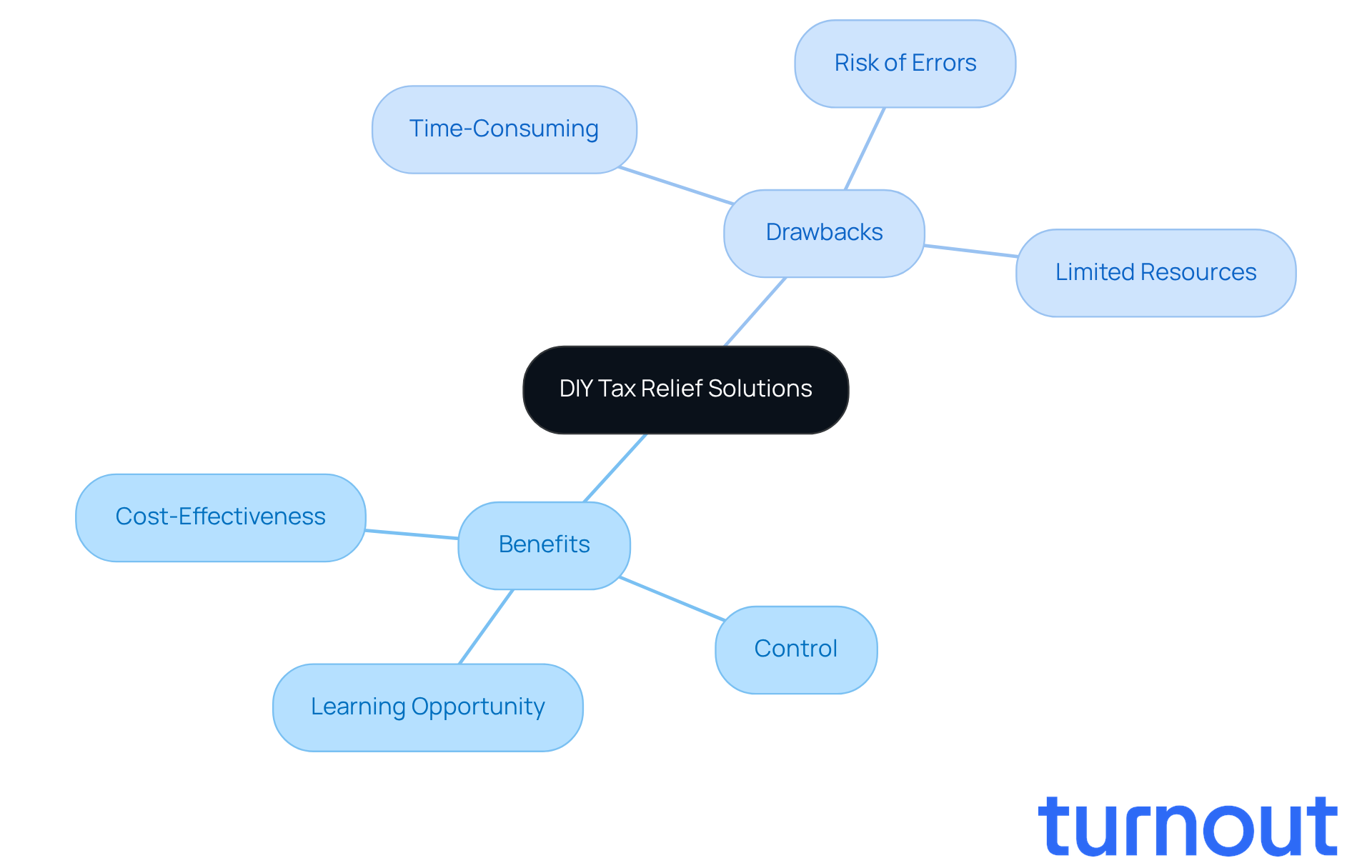

Assessing the Benefits and Drawbacks of DIY Tax Relief Solutions

The appeal of DIY tax relief solutions lies in several key benefits that many individuals can appreciate:

- Cost-Effectiveness: Managing your own tax issues can help you avoid professional fees. This approach is especially attractive if your tax situation is straightforward.

- Control: DIY solutions empower you to maintain full control over your tax matters. You can make decisions that are tailored to your unique circumstances.

- Learning Opportunity: Navigating tax issues independently can provide valuable insights into personal finance and tax regulations. This journey can enhance your financial literacy.

However, it’s important to consider some notable drawbacks:

- Time-Consuming: Researching tax laws and completing forms can be labor-intensive, especially for more complex situations. In 2024, Americans are expected to spend over 7.9 billion hours on IRS tax compliance. That’s a significant time commitment!

- Risk of Errors: Without professional guidance, it’s easy to make mistakes that could lead to penalties or increased tax liabilities. The IRS estimates that taxpayer compliance accounts for 66% of the total 12 billion hours spent on federal paperwork, highlighting the complexity and potential for error in the process.

- Limited Resources: DIY solutions often lack the negotiation power and assistance that tax reduction firms can provide. For instance, clients represented by tax professionals have seen substantial savings. One client reduced a $1.2 million debt to just $60,300 through expert negotiation.

In summary, while DIY tax assistance solutions can offer cost savings and control, they also come with significant time demands and risks. It’s essential to weigh these factors carefully. Remember, you’re not alone in this journey, and we’re here to help you navigate your options.

Comparative Analysis: Tax Relief Companies vs. DIY Solutions

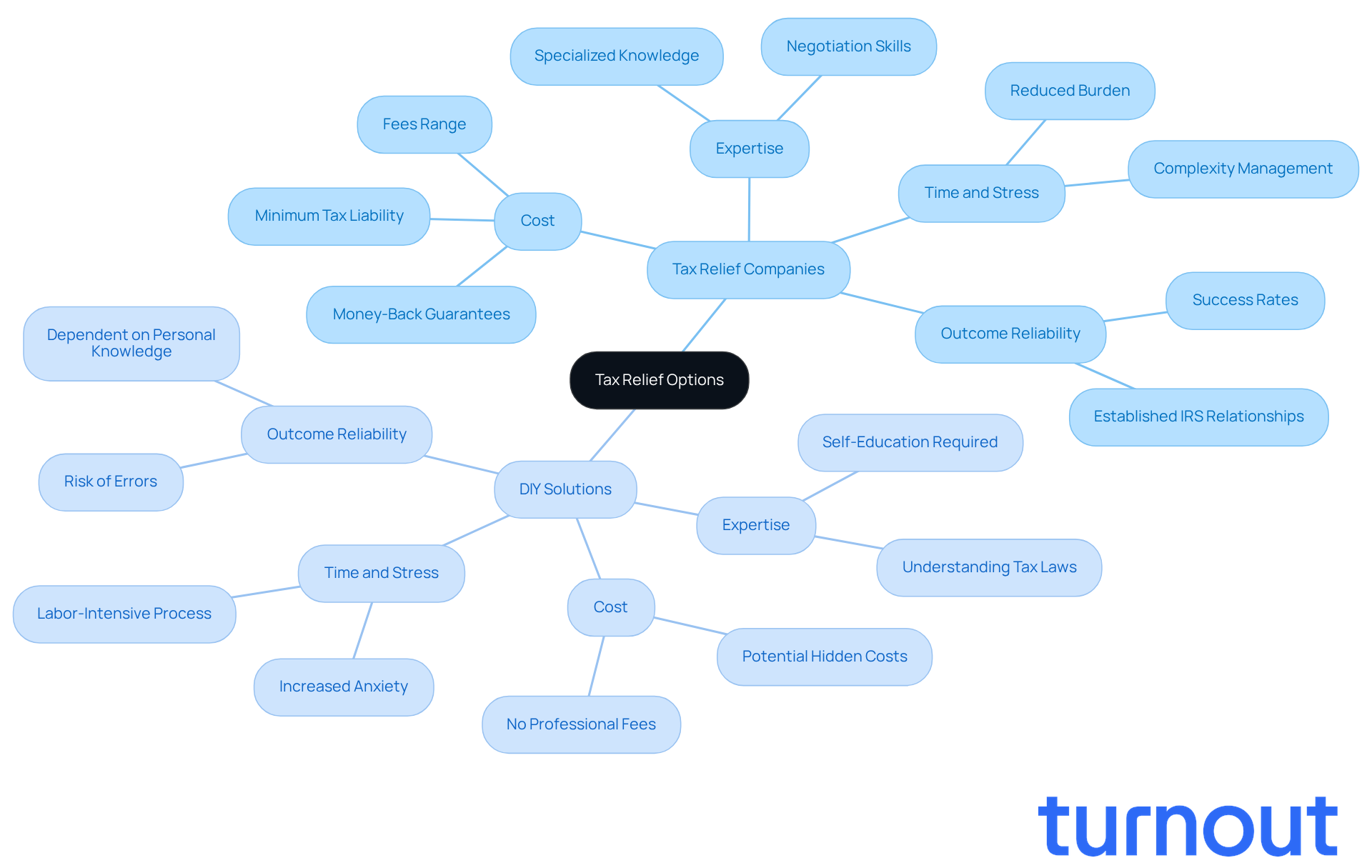

When it comes to tax relief, we understand that deciding if tax relief companies really work or opting for DIY solutions can feel overwhelming. Let’s explore some important factors that can guide your decision.

- Cost: DIY solutions often seem like the more budget-friendly choice since they save you from professional fees. However, tax assistance firms can provide results that justify their costs, especially in complex situations where expertise is essential. For instance, many firms require a minimum tax liability of $10,000 to offer their services, with fees ranging from $2,000 to over $10,000 depending on the complexity of your case.

- Expertise: Tax assistance firms bring specialized knowledge and experience to the table, which can be invaluable when navigating tricky tax issues. On the other hand, DIY solutions demand a solid grasp of tax laws, which can be daunting for many. As tax expert Christin Perry wisely points out, "A credible tax assistance organization will be open with information regarding their pricing and what factors might lead to price alterations."

- Time and Stress: Engaging a tax assistance firm can lift the weight of negotiations and communications off your shoulders, allowing you to focus on what truly matters. DIY approaches can be labor-intensive and stressful, especially if you’re not familiar with tax processes. Did you know that the IRS reports 17% of federal taxes go unpaid each year? This highlights the importance of taking timely action in tax matters.

- Outcome Reliability: Tax assistance firms often have established relationships with the IRS, which can lead to more favorable outcomes. For example, companies like Anthem Tax Services offer a money-back guarantee if they don’t save you money or adjust your payment schedule. In contrast, DIY solutions depend heavily on your ability to navigate the system effectively.

Ultimately, the choice between DIY solutions and whether tax relief companies really work depends on your unique circumstances. Consider your budget, the complexity of your tax issue, and how comfortable you feel managing these matters. Remember, you’re not alone in this journey, and we’re here to help you find the best path forward.

Conclusion

Navigating the complexities of tax obligations can feel overwhelming. Whether you’re considering the help of tax relief companies or thinking about tackling these challenges on your own, it’s important to know you’re not alone. This article has explored both approaches, highlighting that while tax relief firms bring expertise and negotiation skills to the table, DIY solutions can save you money and give you more control over your situation. The key is understanding your personal circumstances and weighing the potential benefits against the costs involved.

Tax relief companies like Turnout and Anthem Tax Services offer significant advantages, including professional guidance and the ability to save you time. However, it’s crucial to be aware of the financial implications and the risk of running into fraudulent firms. On the other hand, DIY solutions can be a more budget-friendly option, but they often demand a lot of your time and come with the risk of costly mistakes. Each choice has its own set of pros and cons, making it essential to carefully assess your specific situation.

Ultimately, deciding between tax relief companies and DIY solutions should be based on your financial landscape and comfort level with tax regulations. Seeking professional help can lead to better outcomes, especially in more complex cases. Meanwhile, self-management might be a good fit for those with simpler tax issues. By understanding the nuances of each approach, you can make informed choices that best suit your needs. Remember, you are not alone in your journey toward tax resolution; we’re here to help.

Frequently Asked Questions

What are tax relief companies and how do they assist individuals?

Tax relief companies, like Turnout, help individuals navigate tax obligations and negotiate with the IRS to potentially lower what they owe.

Are there fees associated with using tax relief companies?

Yes, tax relief companies charge fees that can vary based on your situation and the firm's reputation. Turnout offers a mix of free services and those that come with service fees.

What is the process for working with a tax relief company?

When working with a tax relief company, you will receive all communications electronically, and any government fees charged by agencies must be settled before the company can submit any paperwork on your behalf.

Can individuals handle their tax issues on their own?

Yes, individuals can choose a DIY approach, which involves researching tax laws, filling out forms, and negotiating directly with the IRS. However, this requires significant time and a good understanding of tax regulations.

What are the potential drawbacks of a DIY approach to tax issues?

The DIY approach may seem cost-effective initially, but it often requires a substantial investment of time and effort, and individuals may encounter complexities in tax codes and IRS procedures without professional guidance.

How should one decide between using a tax relief company and a DIY solution?

When deciding, consider the complexity of your tax situation, your comfort level with managing tax regulations, and the potential hidden costs associated with the time and effort required for a DIY approach.

What should individuals keep in mind when seeking tax assistance?

Remember that you are not alone in this journey, and it’s important to find the best solution for your needs, whether through tax assistance services or a DIY approach.