Introduction

Navigating the world of taxes can feel like a daunting puzzle, can’t it? Many people find themselves unsure about whether state or federal obligations should take precedence. We understand that this confusion can lead to stress and uncertainty.

Understanding the distinct roles these taxes play is crucial for effective financial management. It offers you the chance to maximize deductions and avoid costly penalties. However, it’s common to feel overwhelmed, especially when a staggering 60% of individuals struggle to grasp the differences between these tax systems.

So, how can you confidently prioritize tax payments to ensure compliance and financial stability? We’re here to help you through this journey.

Differentiate Between State and Federal Taxes

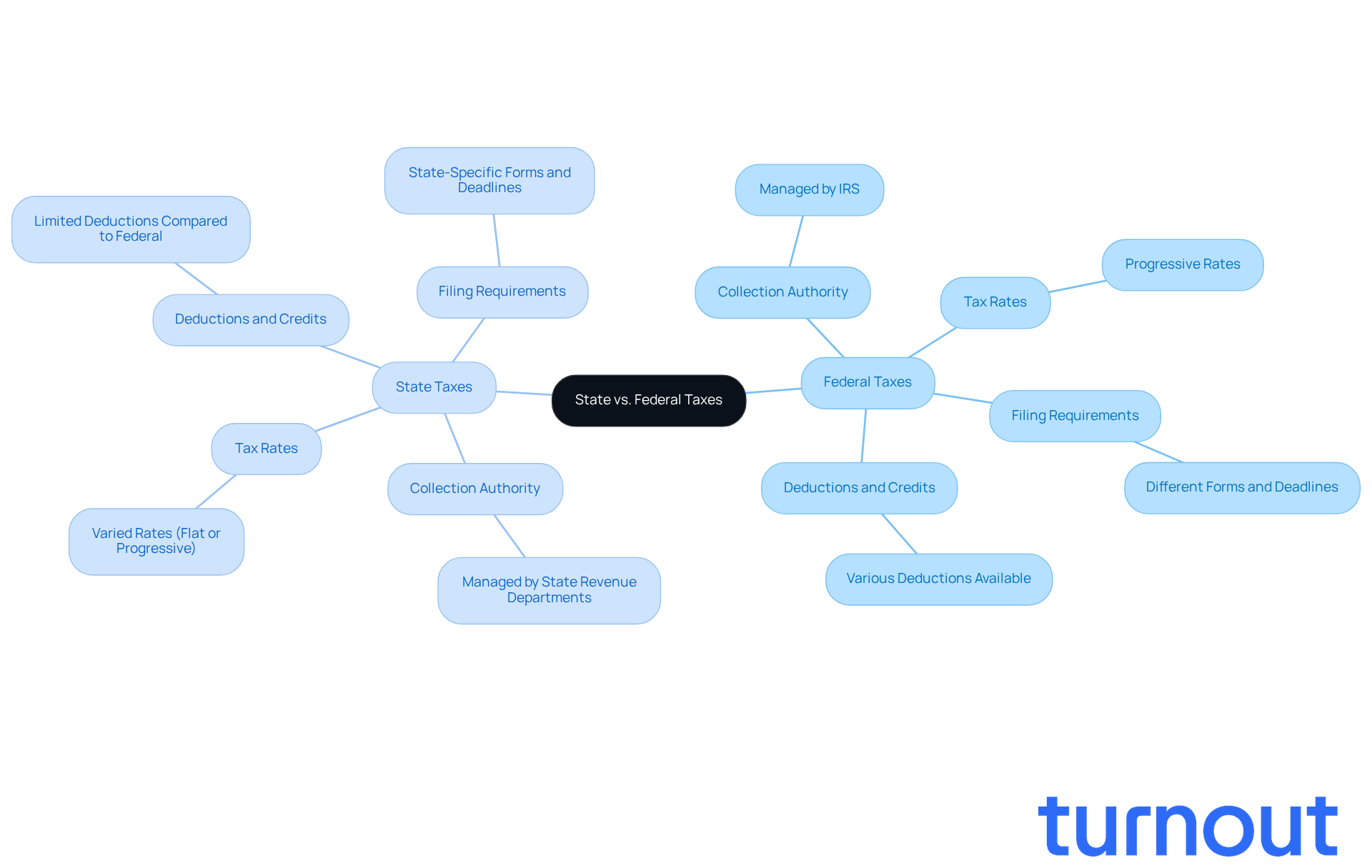

When considering the distinct purposes and separate regulations of taxes, one might ask, do state or federal taxes come first? We understand that navigating these can be overwhelming. Federal levies, gathered by the IRS, finance national initiatives, while regional assessments, overseen by individual regional revenue departments, back local services. Here are some key differences to consider:

- Collection Authority: Federal taxes are managed by the IRS, whereas state taxes are overseen by state revenue departments.

- Tax Rates: Federal income tax rates are typically progressive, rising with earnings. In contrast, regional tax rates can differ greatly - some regions apply flat rates, while others utilize progressive systems.

- Deductions and Credits: Federal tax regulations provide several deductions and credits that might not be accessible at the regional level. For instance, many regions do not allow deductions for national levies paid.

- Filing Requirements: Taxpayers must submit both national and local returns, often using different forms and following varying deadlines. It's common to feel confused about these differences, especially regarding do state or federal taxes come first, but understanding them is crucial for compliance and effective tax planning.

Despite the significance of these distinctions, research shows that around 60% of taxpayers find it challenging to grasp the differences between regional and national levies. You're not alone in this journey. Tax professionals, like Kelley R. Taylor, emphasize that awareness of these regulations is essential for maximizing deductions and ensuring compliance. As we approach the 2026 filing period, being knowledgeable about how do state or federal taxes come first will empower you to manage your responsibilities more efficiently. Remember, we're here to help!

Establish the Order of Tax Payments

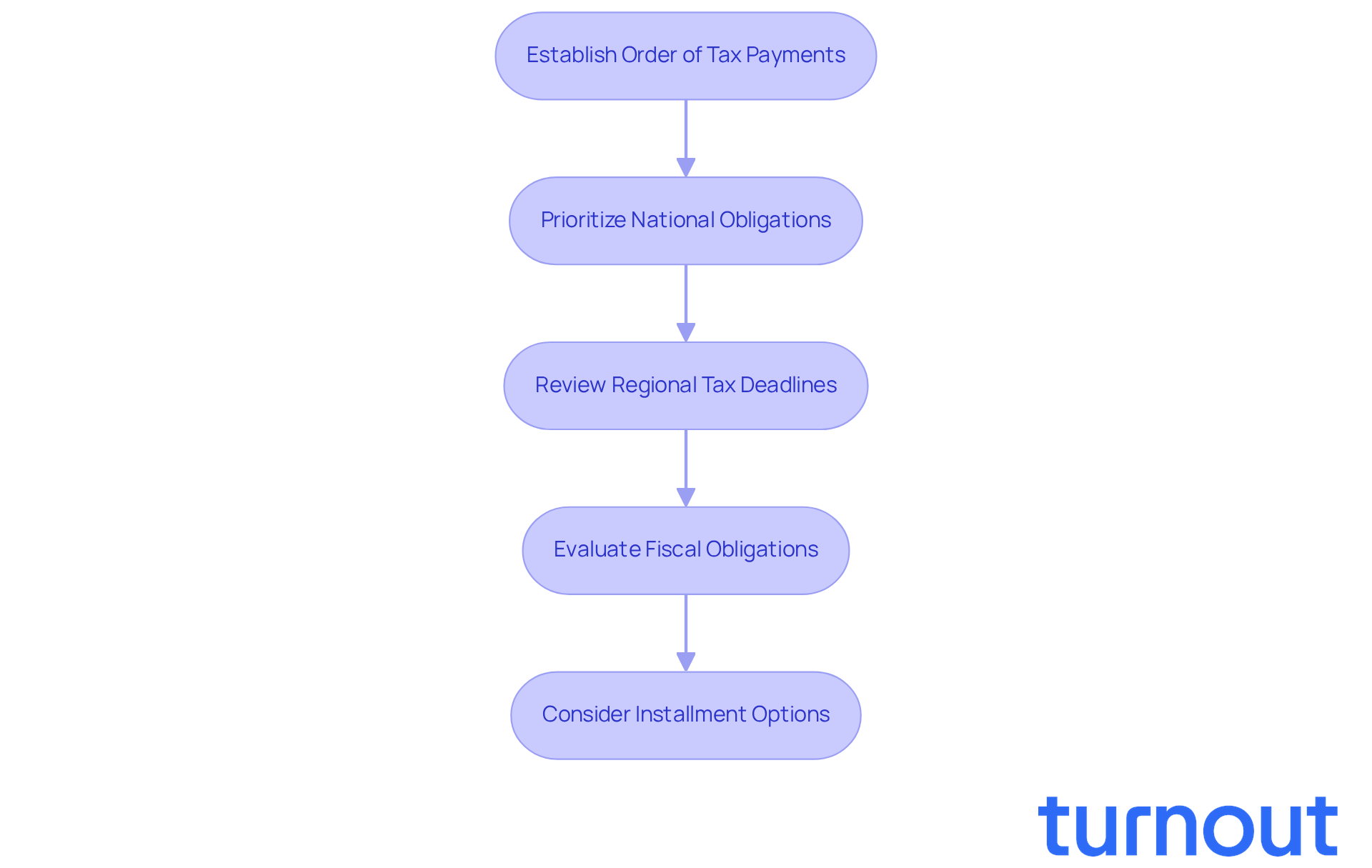

Managing tax payments can feel overwhelming, but establishing a clear order is crucial to avoid penalties. Let’s explore how to prioritize your obligations with care:

-

It’s essential to prioritize national financial obligations over state duties, especially when considering if do state or federal taxes come first. The IRS has strict collection practices, and neglecting national taxes can lead to severe penalties, including daily compounding interest until the debt is settled. Remember, the federal tax filing deadline is April 15, which highlights the urgency of addressing these obligations promptly.

-

Review Regional Tax Deadlines: Each region has its own deadlines for tax submissions, and these can vary significantly. Familiarizing yourself with these dates can help you avoid late fees, as many regions impose penalties for overdue payments. For instance, states like Iowa and Nebraska have distinct tax deadlines that may not align with national timelines.

-

Evaluate Your Fiscal Obligations: If you owe both national and local dues, take a moment to assess the total amounts owed. In situations where state levies are significantly lower, it might be wise to evaluate do state or federal taxes come first by prioritizing national obligations. Keep in mind that the failure-to-file penalty is generally five percent of the tax owed for each month, up to a maximum of 25%. This makes timely submissions essential.

-

Installment Options: If settling your national taxes completely feels daunting, consider setting up an installment arrangement with the IRS. This option allows you to manage your national tax debt while still addressing local obligations, providing a structured approach to your financial responsibilities. As tax expert Rocky Mengle wisely notes, "If you’re trying to plump up your nest egg or stretch your retirement savings, every dollar you can keep in your pocket counts."

By following these guidelines, you can navigate the complexities of tax obligations more effectively and minimize the risk of penalties. Remember, you’re not alone in this journey, and we’re here to help.

Understand the Consequences of Payment Mismanagement

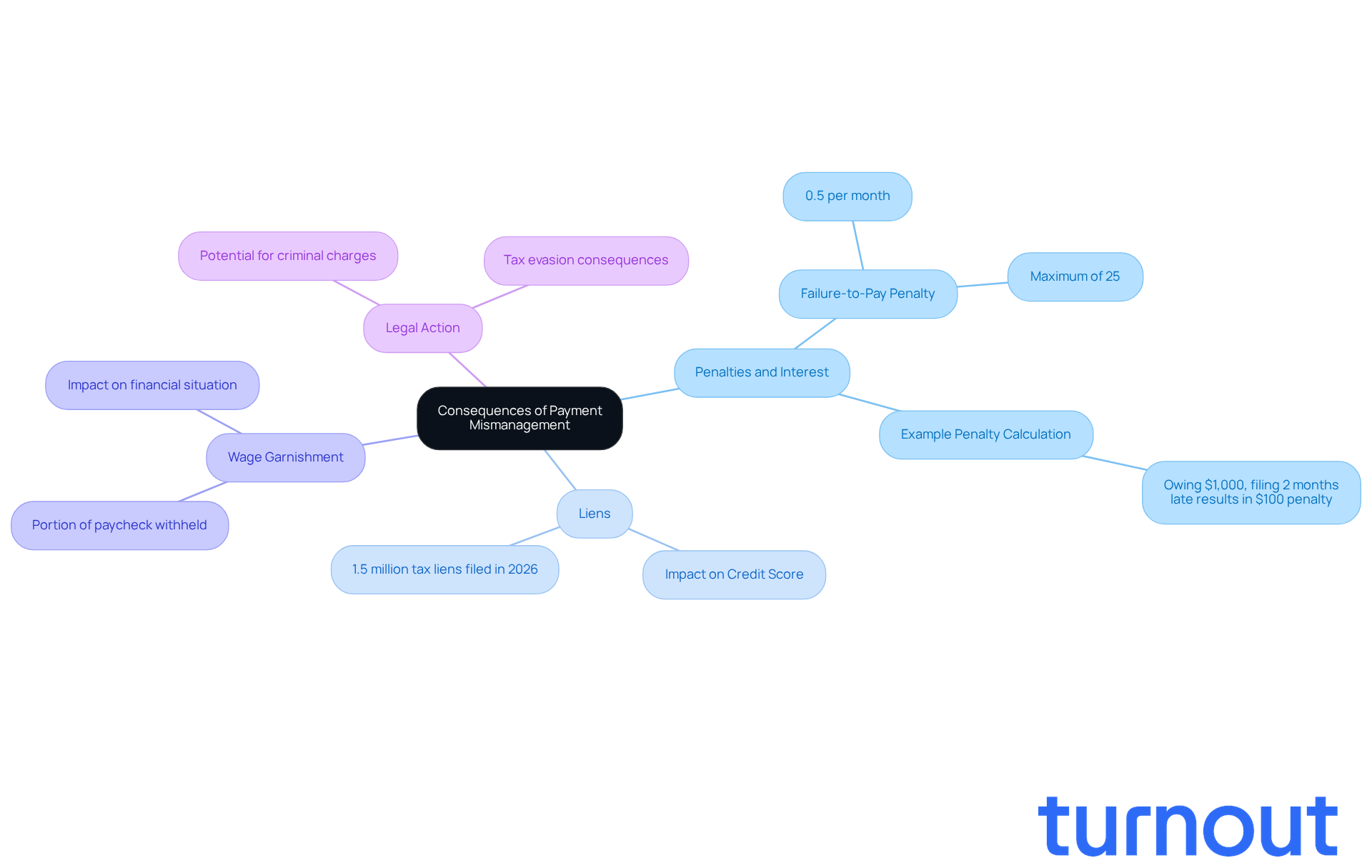

Mismanaging tax payments can lead to serious consequences, and we understand how overwhelming that can feel. Here are some important points to consider:

-

Penalties and Interest: Both federal and state governments impose penalties for late payments. The IRS imposes a failure-to-pay fine of 0.5% per month on overdue payments, which can accumulate rapidly, reaching a maximum of 25%. For instance, if you owe $1,000 and file two months late, the penalty could amount to $100, plus interest that accrues daily.

-

Liens: Failing to pay obligations can result in liens against your property. This not only jeopardizes your credit score but also hinders your ability to secure loans. In 2026, the IRS filed approximately 1.5 million tax liens, highlighting the severity of this issue.

-

Wage Garnishment: The IRS has the authority to garnish wages to collect unpaid dues. This can severely impact your financial situation, meaning a portion of your paycheck could be withheld until your tax debt is settled.

-

Legal Action: In extreme cases, failure to pay taxes can lead to legal action, including criminal charges for tax evasion. Tax attorneys emphasize that understanding how do state or federal taxes come first is crucial for avoiding the most common and costly mistakes. As one noted, "IRS tax penalties can turn a simple oversight into a financial nightmare."

Comprehending these repercussions highlights the significance of prompt tax management. We’re here to help you stay compliant and evade the drawbacks related to delayed submissions. Remember, you are not alone in this journey.

Implement Strategies for Effective Tax Payment Management

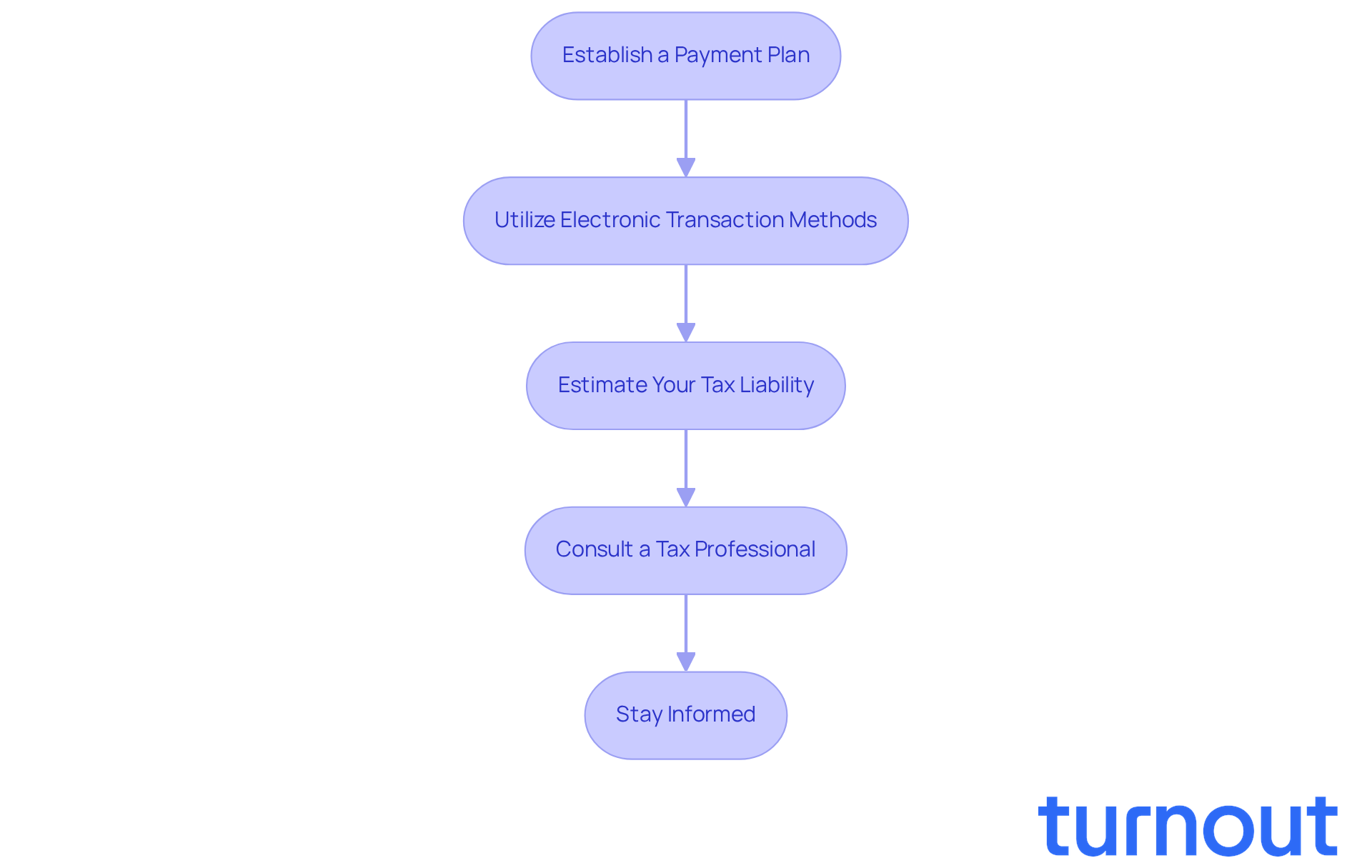

Managing tax payments can feel overwhelming, but you’re not alone in this journey. Here are some strategies to help you navigate this process with confidence:

-

Establish a Payment Plan: Mark important tax deadlines on your calendar, like the April 15, 2026, cutoff for submitting 2025 tax returns. Setting alerts can ensure you submit on time. Tax experts emphasize that having a clear billing schedule can significantly reduce stress and help you avoid penalties.

-

Utilize Electronic Transaction Methods: Electronic transfers are not only quicker but also more secure. The IRS offers various electronic options that simplify the process, making it easier for you to meet those deadlines.

-

Estimate Your Tax Liability: Regularly reviewing your income and expenses can help you estimate your tax liability. This proactive approach allows you to plan for payments throughout the year, minimizing the chance of unexpected tax bills.

-

Consult a Tax Professional: If your tax situation feels complex, reaching out to a tax professional can provide you with personalized advice. Did you know that over half of taxpayers seek help from professionals? This highlights the value of expert guidance in managing your tax obligations. As Kristin McKenna, a senior contributor, points out, "Taxpayers and investors have many new tax rules to navigate in 2026."

-

Stay Informed: Tax laws are constantly changing. Staying updated on any changes that could affect your situation is crucial for compliance and optimizing your tax strategy. Engaging with resources and expert insights can empower you to adapt to new regulations effectively.

Remember, we’re here to help you through this process. By taking these steps, you can approach your tax payments with greater ease and confidence.

Conclusion

Understanding the hierarchy of tax payments is essential for effective financial management. We know that navigating the world of taxes can feel overwhelming. The distinction between state and federal taxes isn’t just about compliance; it’s about ensuring that your obligations are met on time and in the right order. Prioritizing federal taxes over state taxes is crucial, given the stringent collection practices enforced by the IRS. Neglecting these can lead to severe penalties, and we want to help you avoid that.

Throughout this article, we’ve shared key insights about the differences between state and federal taxes, the importance of adhering to deadlines, and the consequences of mismanagement. From varying tax rates and collection authorities to potential penalties and legal actions that can arise from late payments, it’s clear that a well-structured approach to tax obligations is necessary. Implementing strategies like:

- Establishing a payment plan

- Utilizing electronic methods

- Seeking professional advice

can significantly ease the burden of tax management.

Ultimately, staying informed and proactive about your tax responsibilities not only helps you avoid penalties but also empowers you to make informed financial decisions. By mastering the order of tax payments and understanding the implications of each, you can navigate the complexities of your financial obligations with confidence and clarity. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Frequently Asked Questions

What is the primary difference between state and federal taxes?

Federal taxes are managed by the IRS and finance national initiatives, while state taxes are overseen by individual state revenue departments and support local services.

How are federal and state tax rates structured?

Federal income tax rates are typically progressive, increasing with earnings, while state tax rates can vary significantly; some states use flat rates, while others have progressive systems.

Are there differences in deductions and credits between federal and state taxes?

Yes, federal tax regulations offer various deductions and credits that may not be available at the state level. For example, many states do not allow deductions for federal taxes paid.

What are the filing requirements for state and federal taxes?

Taxpayers must file both federal and state tax returns, often using different forms and adhering to different deadlines.

Why do many taxpayers struggle to understand the differences between state and federal taxes?

Research indicates that approximately 60% of taxpayers find it challenging to grasp the distinctions between state and federal taxes, which can lead to confusion regarding compliance and tax planning.

How can taxpayers prepare for the 2026 filing period regarding state and federal taxes?

Being knowledgeable about the differences between state and federal taxes can empower taxpayers to manage their responsibilities more efficiently and maximize deductions.