Overview

The article thoughtfully explores the question of whether long-term disability insurance is necessary, focusing on its vital role in providing income replacement for those unable to work due to debilitating conditions. We understand that navigating this decision can be overwhelming, and it’s important to evaluate your personal financial situation, potential payouts, and the duration of benefits available.

By taking the time to understand these factors, you can make informed decisions about your coverage needs. It’s common to feel uncertain about what to choose, but remember that you are not alone in this journey. We’re here to help you find the best solutions for your unique circumstances.

In conclusion, considering long-term disability insurance can be a crucial step in securing your financial future. Take a moment to reflect on your situation and the peace of mind that comes with being prepared.

Introduction

Navigating the complexities of long-term disability insurance can feel overwhelming. We understand that understanding its significance is crucial for safeguarding your financial stability during unforeseen health challenges. This type of insurance serves as a vital safety net, replacing a portion of your income when debilitating conditions prevent you from working.

As many grapple with the question of whether they truly need this coverage, it's essential to evaluate not just the policies available, but also the potential benefits and implications of being unprotected. What factors should you consider to make an informed decision about long-term disability insurance? How can it ultimately shape your financial future?

You are not alone in this journey. Together, we can explore the options and find the right path for you.

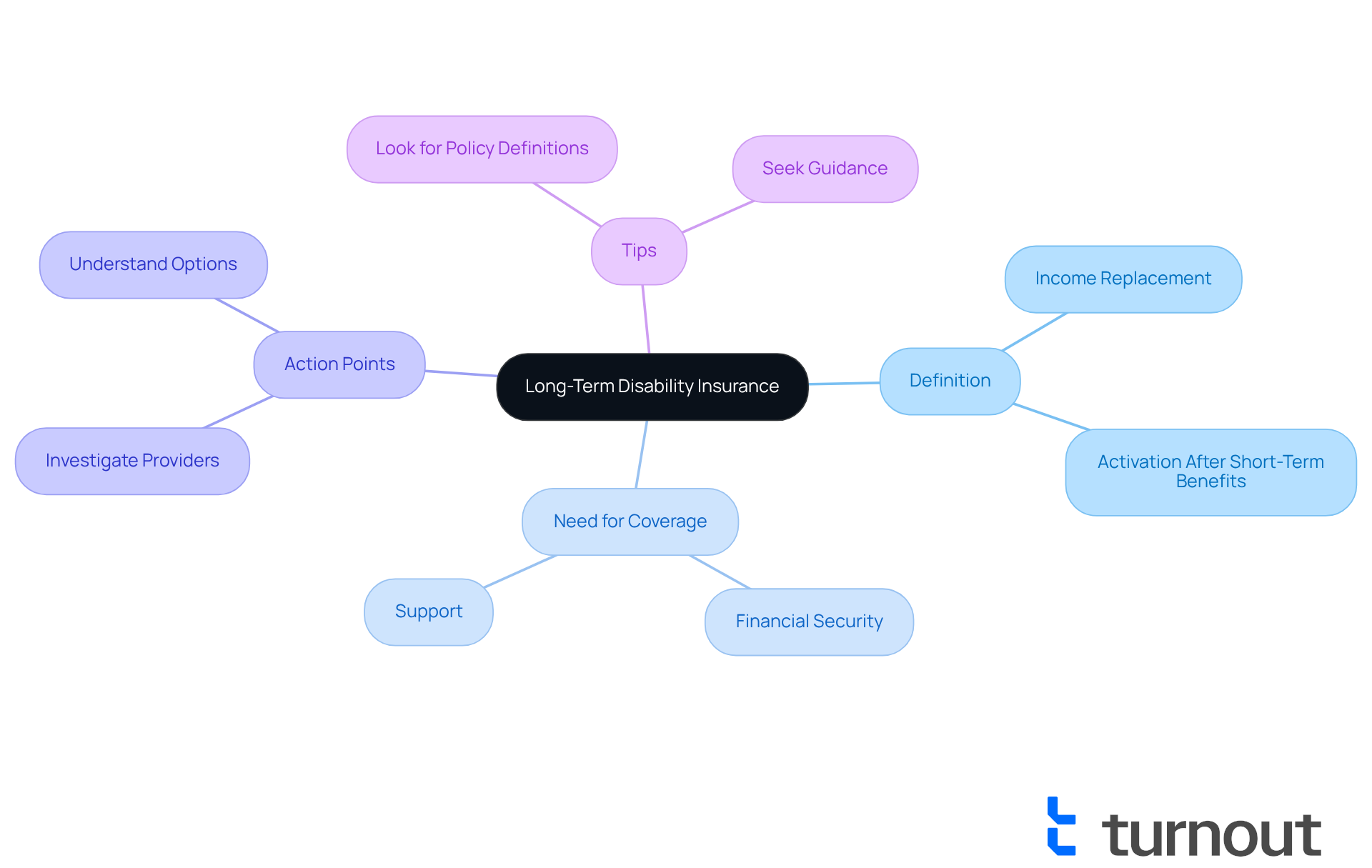

Define Long-Term Disability Insurance

When considering protection options, one might ask, do I need long term disability insurance, as it provides income replacement for individuals who cannot work due to a debilitating condition. We understand that facing such challenges can be overwhelming. When considering financial security, one may ask, do I need long term disability insurance, as this type of coverage typically activates after short-term benefits end, providing financial assistance for a prolonged duration—often until retirement age or until you are able to resume work.

Action Point: Investigate various coverage providers to comprehend their definitions and options for long-term income protection. It’s crucial to find a plan that suits your needs.

Tip: Look for policies that clearly outline what defines a condition under their terms. Remember, you are not alone in this journey; we’re here to help you navigate your options.

Explain How Long-Term Disability Insurance Works

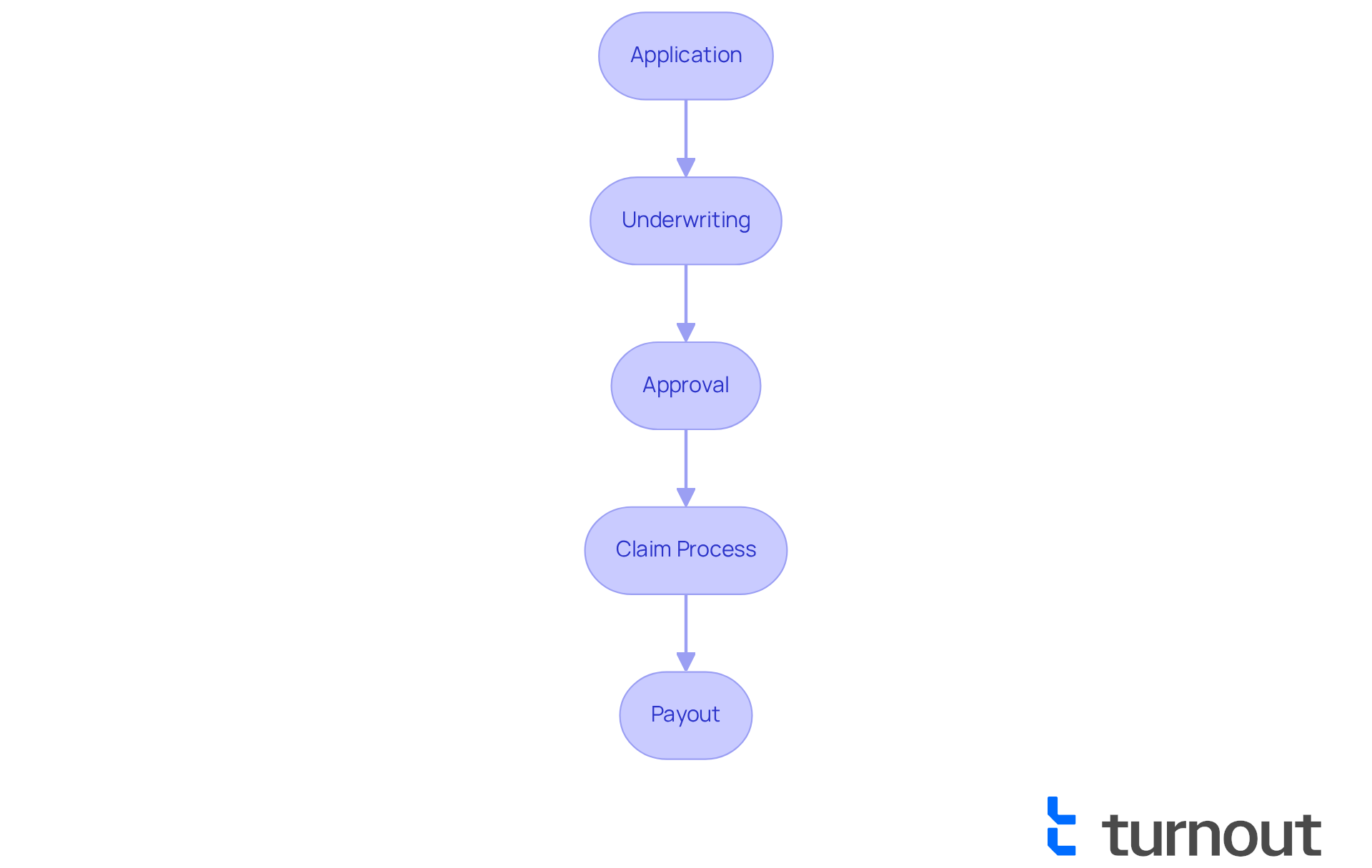

Navigating long-term disability insurance can feel overwhelming, leading to the question, do I need long term disability insurance, but understanding the process is the first step toward securing the support you need. Here’s a compassionate breakdown of what to expect:

- Application: Begin by submitting an application to your insurance provider. This should include details about your medical history and current health status, allowing them to understand your situation better.

- Underwriting: The insurer will review your application, assessing risk and determining your eligibility based on your health conditions and occupation. We understand that this can be a stressful time.

- Approval: If your application is accepted, you will receive a document outlining your coverage details, including waiting periods and payout amounts. This clarity can bring peace of mind.

- Claim Process: Should you face a medical condition, it’s essential to file a claim. You will need to provide documentation to prove your situation. Remember, Turnout can assist you in navigating the complexities of the SSD claims process, ensuring you receive the right support from trained nonlawyer advocates who are here to help.

- Payout: Once your claim is sanctioned, you will begin receiving monthly payments as detailed in your agreement, helping to ease your financial burdens.

- Action Point: Familiarize yourself with the claim processes of potential insurers. Understanding what documentation will be required can alleviate some of the stress related to the question of do I need long term disability insurance. Turnout's trained nonlawyer advocates are available to clarify these requirements and guide you through the process.

- Tip: Keep a record of all communications with your insurer for future reference. Additionally, consider leveraging Turnout's resources for assistance with tax debt relief, which can further alleviate financial burdens during this challenging time.

Evaluate Potential Payouts from Long-Term Disability Insurance

Evaluate Potential Payouts from Long-Term Disability Insurance

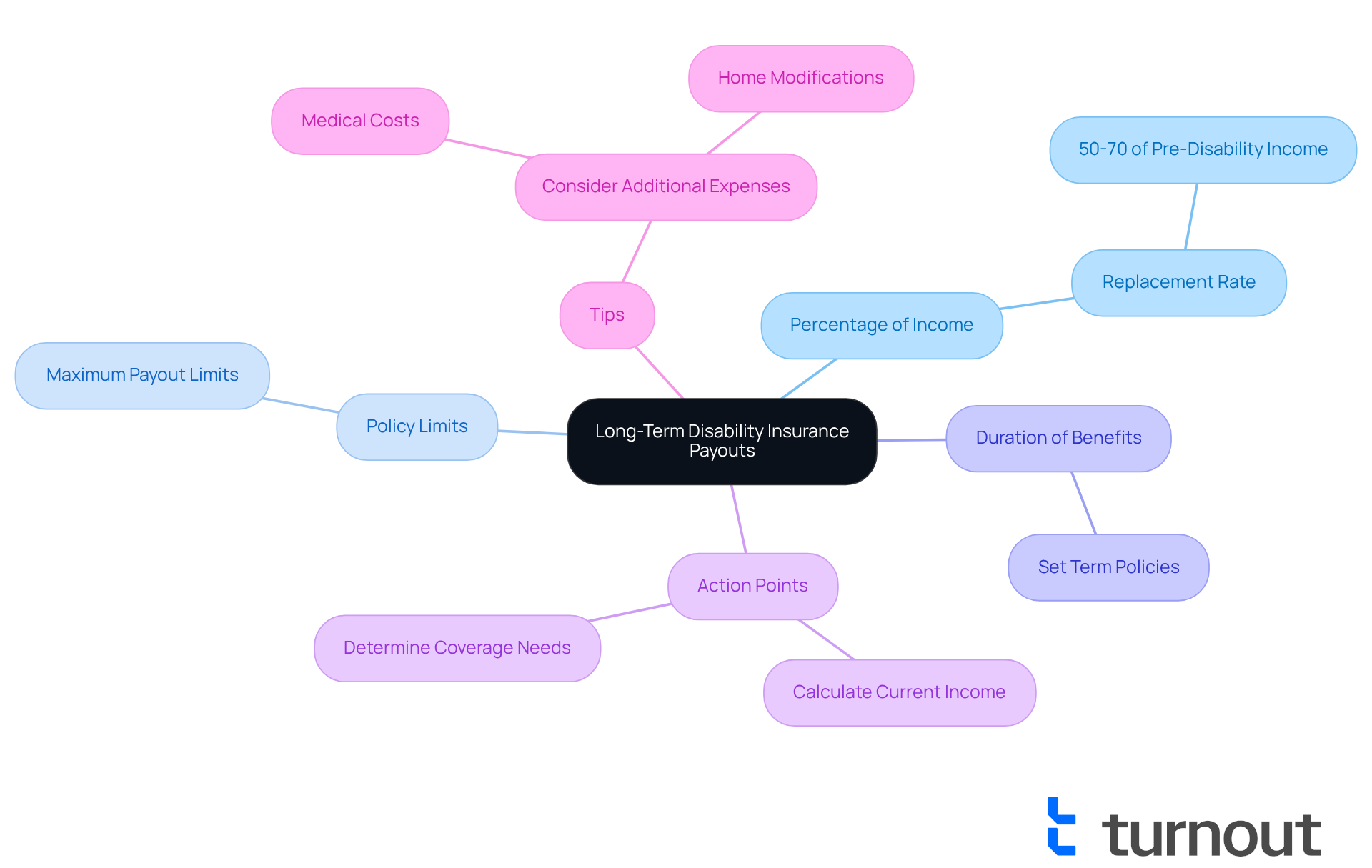

Navigating the world of long-term disability insurance can feel overwhelming. We understand that considering your financial future during a challenging time is not easy. Payouts from long-term disability insurance can vary based on several factors that are important to keep in mind:

- Percentage of Income: Most policies replace 50-70% of your pre-disability income, which can provide a crucial safety net.

- Policy Limits: It’s essential to check if there are maximum payout limits that could impact your advantages.

- Duration of Benefits: Understanding how long you will receive payments is vital, as some policies have a set term.

As you explore long-term coverage options, you should ask yourself, do I need long term disability insurance, while also considering how these benefits might affect your Social Security claims. It’s common to feel uncertain about whether do I need long term disability insurance and how these elements interact. Turnout can assist you in navigating the complexities of both long-term impairment insurance and SSD claims, which can help you determine if do I need long term disability insurance for financial support.

- Action Point: Take a moment to calculate your current income and determine how much coverage you would need to maintain your standard of living. This step can provide clarity and peace of mind.

- Tip: Don’t forget to consider additional expenses that may arise during a disability, such as medical costs or necessary home modifications. Planning for these can make a significant difference in your overall well-being.

Remember, you are not alone in this journey; we’re here to help you every step of the way.

Determine How Long Benefits Last

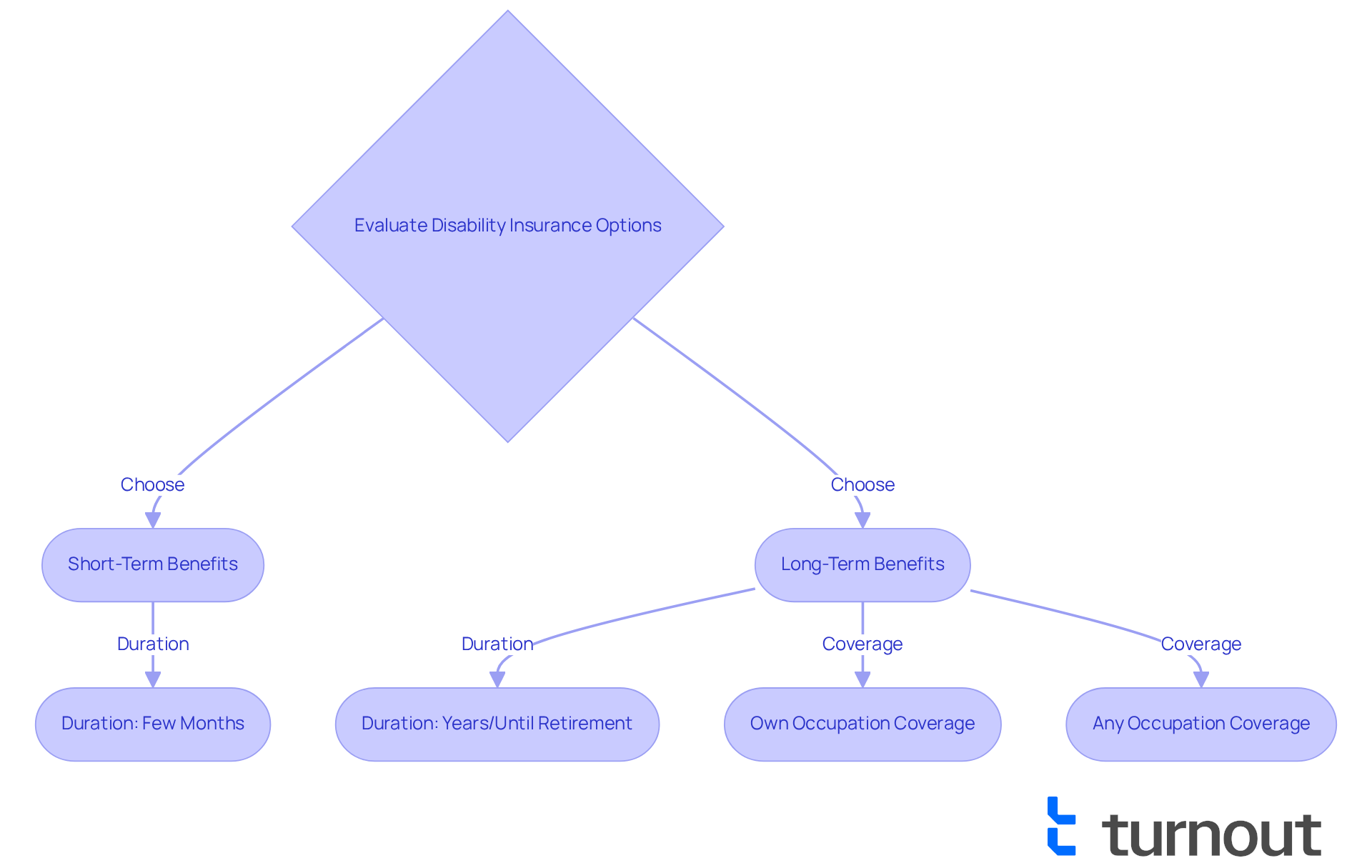

Navigating the world of benefits can feel overwhelming, and we understand that. As you make decisions, it's crucial to consider the duration of benefits between policies to determine if I need long term disability insurance.

-

Short-Term vs. Long-Term: Short-term plans may last for a few months, while long-term arrangements can provide support for years or even until retirement. This distinction is vital for your planning.

-

Own Occupation vs. Any Occupation: Policies that cover 'own occupation' may offer assistance for a longer duration than those that only cover 'any occupation'. Knowing this can help you choose a policy that aligns with your needs.

-

Action Point: We encourage you to examine the conditions of potential agreements closely. Understanding if I need long term disability insurance and the duration of benefits under various circumstances is essential for your peace of mind.

-

Tip: Don’t hesitate to ask insurers about the specific conditions that could lead to the termination of benefits. Remember, you are not alone in this journey, and we’re here to help you navigate these choices.

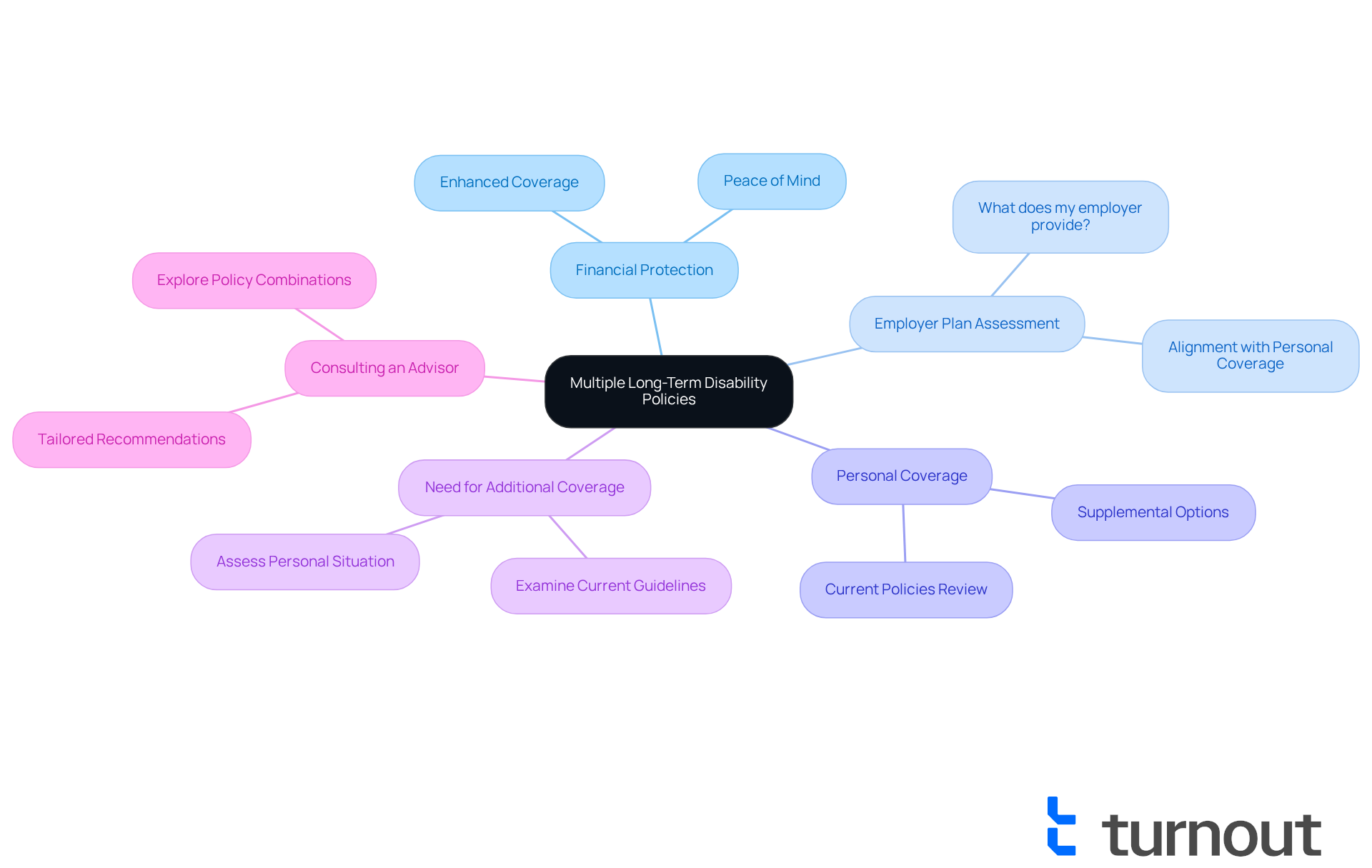

Assess the Possibility of Multiple Policies

Having multiple long-term disability policies can significantly enhance your financial protection.

We understand that navigating financial security can be challenging. Consider a supplemental policy to increase your payout, offering you greater peace of mind. If your employer provides a plan, take a moment to assess how it aligns with any personal coverage you may possess.

It's common to feel uncertain about whether do I need long term disability insurance to ensure you have enough coverage. Examine current guidelines to determine if extra coverage is required or if asking yourself 'do I need long term disability insurance' is advantageous for your situation.

We recommend consulting with a coverage advisor who can help you explore the best combinations of policies tailored to your needs. Remember, you are not alone in this journey—support is available.

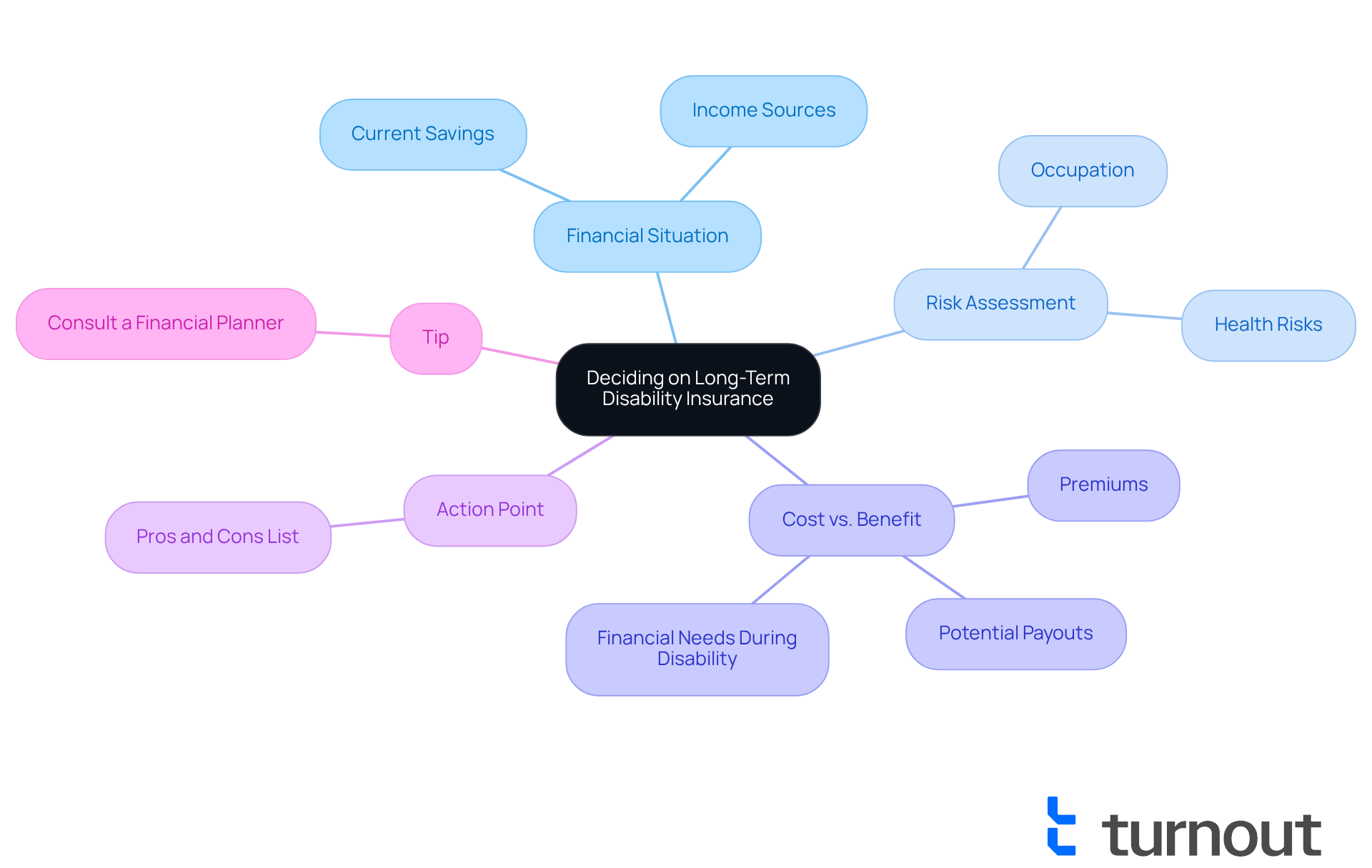

Decide If Long-Term Disability Insurance Is Worth It

To determine if long-term disability insurance is worth it, it’s important to reflect on a few key aspects:

-

Financial Situation: Take a moment to assess your current savings and income sources. This step is crucial in understanding your financial landscape.

-

Risk Assessment: Consider your occupation and any health risks that may lead you to ask, do I need long term disability insurance benefits?. It's common to feel uncertain about these factors, but acknowledging them is a vital part of the process.

-

Cost vs. Benefit: Compare the cost of premiums against potential payouts and your financial needs during a disability to help answer the question, do I need long term disability insurance?. This comparison can help clarify your options.

-

Action Point: Creating a pros and cons list can be a helpful way to visualize your decision-making process. It allows you to weigh the benefits against the costs thoughtfully.

-

Tip: Seeking advice from a financial planner can provide you with tailored insights and help evaluate your options. Remember, you are not alone in this journey; support is available.

Conclusion

Long-term disability insurance serves as a vital safety net for individuals who may find themselves unable to work due to serious health conditions. We understand that facing such challenges can be overwhelming, and this type of coverage not only offers peace of mind but also ensures financial stability during difficult times. It’s a crucial consideration for anyone evaluating their insurance options.

Throughout this article, we have explored key aspects of long-term disability insurance, including:

- Its definition

- The application and approval process

- Potential payout structures

- The importance of assessing the duration of benefits

It’s common to feel uncertain about these elements, but knowing the advantages of having multiple policies can empower you. We hope the actionable insights provided help you navigate your options effectively. Each of these elements plays a significant role in determining whether long-term disability insurance is a necessary investment for your financial future.

Ultimately, the decision to secure long-term disability insurance should be approached with careful consideration of your personal financial circumstances, potential risks, and the overall benefits versus costs. Engaging with knowledgeable advisors and utilizing available resources can help you make an informed choice. Remember, taking proactive steps today can lead to greater security and peace of mind in the face of unforeseen challenges. You are not alone in this journey; we’re here to help you safeguard your financial well-being.

Frequently Asked Questions

What is long-term disability insurance?

Long-term disability insurance provides income replacement for individuals who cannot work due to a debilitating condition. It typically activates after short-term benefits end and offers financial assistance for an extended period, often until retirement age or until the individual can resume work.

Why might someone need long-term disability insurance?

Individuals may need long-term disability insurance to ensure financial security in case they become unable to work due to a serious medical condition. It helps replace lost income during prolonged periods of disability.

How does the application process for long-term disability insurance work?

The application process involves submitting an application to the insurance provider, which includes details about your medical history and current health status. The insurer will then review the application during the underwriting phase to assess risk and determine eligibility.

What happens after the application for long-term disability insurance is approved?

Once your application is approved, you will receive a document outlining your coverage details, including waiting periods and payout amounts. This document provides clarity about your insurance coverage.

What is the claim process for long-term disability insurance?

To file a claim, you must provide documentation to prove your medical condition. Once your claim is sanctioned, you will begin receiving monthly payments as specified in your insurance agreement.

How can Turnout assist with long-term disability insurance claims?

Turnout can help navigate the complexities of the Social Security Disability (SSD) claims process by providing support from trained nonlawyer advocates, ensuring you receive the appropriate assistance with your claim.

What should I keep in mind regarding documentation and communication with my insurer?

It's important to keep a record of all communications with your insurer and familiarize yourself with the documentation required for claims. This can help alleviate stress and ensure a smoother claims process.

Are there additional resources available for financial relief during disability?

Yes, in addition to long-term disability insurance, Turnout offers resources for assistance with tax debt relief, which can further help alleviate financial burdens during challenging times.