Introduction

Navigating the labyrinth of tax obligations can feel overwhelming, especially when financial strain weighs heavily on your shoulders. We understand that this journey can be daunting, but tax relief programs are here to offer you essential support. Options like:

- Installment Agreements

- Offers in Compromise

- Penalty Abatement

provide tailored solutions designed to ease your burden.

With so many choices available, how can you determine which program is the right fit for your unique situation? It’s common to feel uncertain, but exploring these tax relief initiatives can empower you to regain control over your financial future. Remember, you are not alone in this journey. As you seek assistance, stay vigilant against potential scams that may arise along the way.

We're here to help you navigate these options and find the relief you deserve.

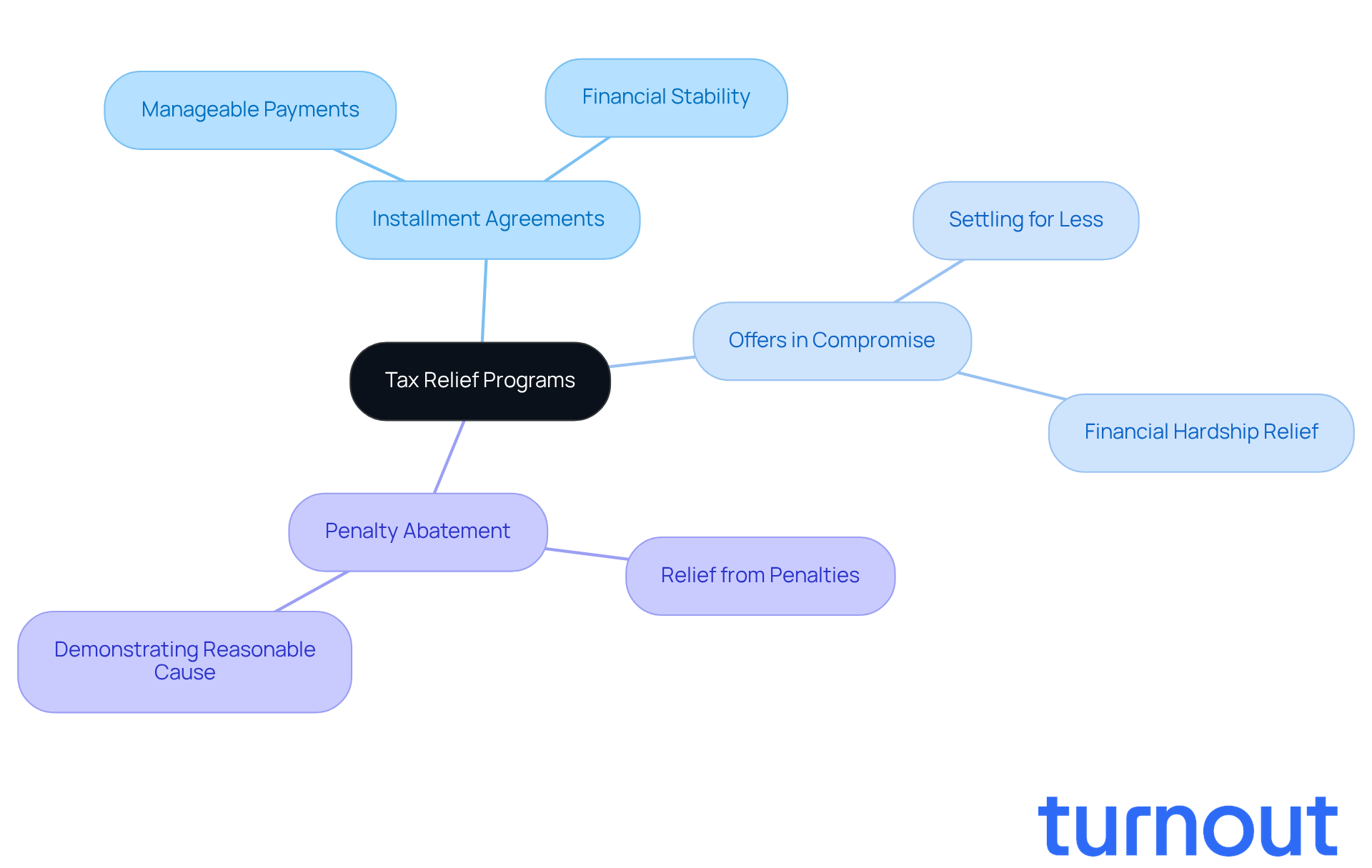

Overview of Tax Relief Programs

The best tax relief programs are vital tools for individuals and businesses striving to manage their tax obligations effectively. We understand that navigating these options can feel overwhelming, especially for those facing financial difficulties. These initiatives offer various solutions tailored to different situations, including Installment Agreements, Offers in Compromise, and Penalty Abatement.

-

Installment Agreements allow taxpayers to pay their tax debt in manageable installments. This option eases the burden of large sums due at once, helping individuals maintain their financial stability while addressing their tax obligations.

-

Offers in Compromise provide a way for taxpayers to settle their debts for less than the total amount owed, as long as they meet specific criteria. This initiative is particularly beneficial for those experiencing significant financial hardship, allowing them to tackle their tax problems without the pressure of full repayment.

-

Penalty Abatement offers relief from penalties associated with late payments or filings, provided the taxpayer can demonstrate reasonable cause for their delay. This can significantly lessen the financial strain on individuals struggling to meet their obligations.

At Turnout, we're here to help. Our skilled nonlawyer advocates are dedicated to assisting you in understanding and accessing these tax assistance options without the need for legal representation. We also collaborate closely with IRS-licensed enrolled agents who can support you in managing your tax obligations effectively. Remember, you are not alone in this journey. Understanding the best tax relief programs is crucial for taxpayers who feel overwhelmed by their financial responsibilities, and we're here to guide you toward regaining control over your tax situation.

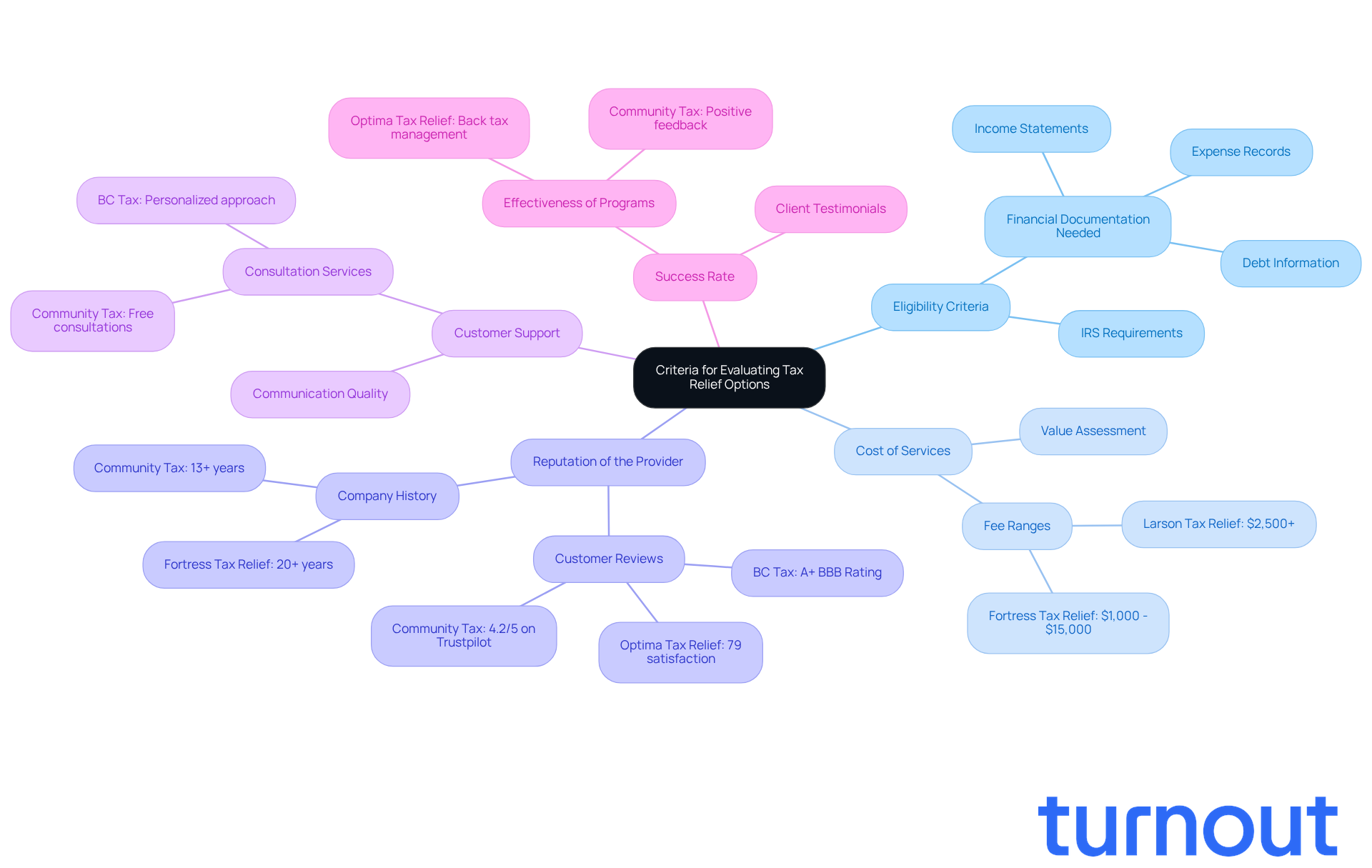

Criteria for Evaluating Tax Relief Options

When evaluating tax relief options, it’s important to consider several key criteria that can make a difference in your journey:

-

Eligibility Criteria: We understand that navigating the requirements can be overwhelming. Each program has specific qualifications that must be met. For instance, the IRS requires precise financial records to assess eligibility for the best tax relief programs, which include considerations of income, expenses, and debts. Knowing these requirements can save you time and effort during the application process.

-

Cost of Services: It’s common to feel concerned about costs. Fees can vary significantly between providers, ranging from a few hundred to several thousand dollars, depending on the complexity of your case. For example, Larson Tax Relief starts at about $2,500, while Fortress Tax Relief can charge between $1,000 and $15,000. It’s crucial to evaluate whether these costs align with the potential benefits you might receive.

-

Reputation of the Provider: Protecting yourself from fraud is essential. Investigating the history of tax assistance firms can help ensure you receive quality support. Look for companies with positive customer reviews and a clean background, like BC Tax, which boasts an A+ rating from the Better Business Bureau. This can provide peace of mind as you make your choice.

-

Customer Support: Effective communication can significantly enhance your experience. Firms such as Community Tax offer complimentary consultations and emphasize understanding clients' tax situations before engaging with the IRS. This approach can lead to a smoother process and a better overall experience.

-

Success Rate: Understanding the success rates of the best tax relief programs can provide insight into their effectiveness. For instance, Optima Tax Relief is known for its successful management of back tax issues, while Community Tax has built a solid reputation based on customer feedback. Assessing these success rates can empower you to make informed choices about which option to pursue.

Remember, you’re not alone in this journey. We’re here to help you navigate these options with care and support.

Comparative Analysis of Leading Tax Relief Programs

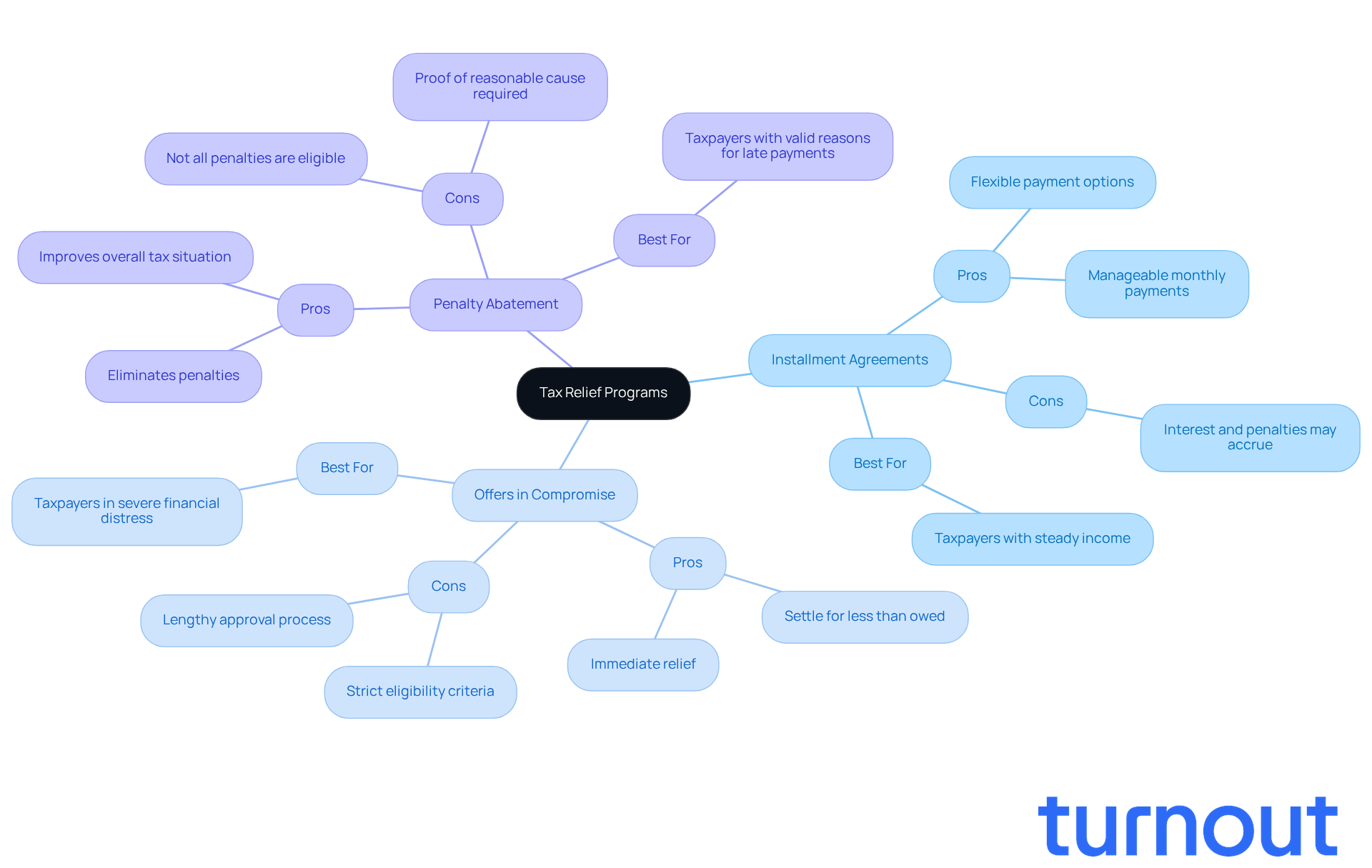

Understanding Your Tax Relief Options

Navigating tax issues can be overwhelming, and it’s common to feel uncertain about your options. Here’s a closer look at some programs that might help you find relief:

-

Installment Agreements

Pros: Flexible payment options and manageable monthly payments can ease your burden.

Cons: Keep in mind that interest and penalties may still accrue.

Best For: This option is ideal for taxpayers with steady income who can commit to the best tax relief programs. -

Offers in Compromise

Pros: You might be able to settle for less than what you owe, providing immediate relief.

Cons: However, there are strict eligibility criteria and a lengthy approval process to consider.

Best For: This is best suited for taxpayers in severe financial distress who are looking for the best tax relief programs. -

Penalty Abatement

Pros: This can eliminate penalties and may improve your overall tax situation.

Cons: Not all penalties are eligible, and you’ll need to provide proof of reasonable cause.

Best For: Taxpayers who have a valid reason for late payments can benefit from the best tax relief programs available.

We understand that evaluating these options can feel daunting. However, this analysis empowers you to assess your choices based on your personal circumstances and financial capabilities. With more than 90% of individual taxpayers qualifying for streamlined payment plans introduced in 2025, understanding these programs is crucial for effective tax management. Remember, you are not alone in this journey, and we’re here to help you navigate through it.

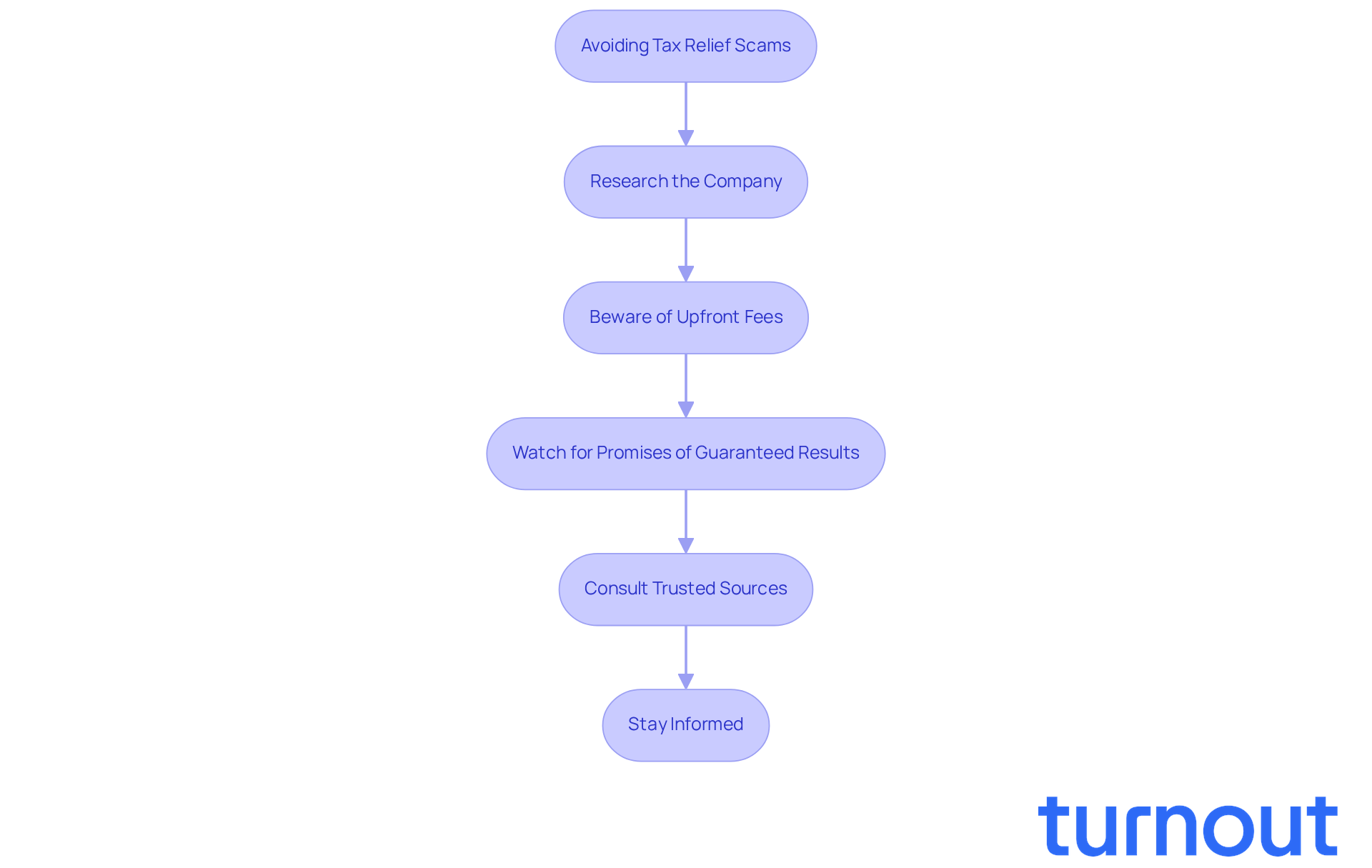

Avoiding Tax Relief Scams and Pitfalls

To avoid falling victim to tax relief scams, it’s crucial to stay vigilant. We understand that navigating tax issues can be overwhelming, but following these guidelines can help you protect yourself:

- Research the Company: Always verify the credentials of tax relief companies. Look for reviews from previous clients to gauge their reliability and effectiveness. You deserve to work with someone trustworthy.

- Beware of Upfront Fees: Legitimate tax assistance companies usually don’t require large charges before providing their support. Be cautious of any company that asks for significant payment upfront. Remember, you should feel comfortable with the financial commitment.

- Watch for Promises of Guaranteed Results: No tax assistance organization can guarantee specific outcomes, especially when dealing with the IRS. It’s common to feel skeptical about claims that suggest otherwise. Trust your instincts.

- Consult Trusted Sources: Before interacting with a tax assistance organization, seek advice from reputable financial advisors or consumer protection agencies. They can offer insights into the validity of the offering. You’re not alone in this journey; there are people who can help.

- Stay Informed: Regularly check IRS warnings about known scams and fraudulent practices. The IRS's annual Dirty Dozen list highlights various scams, including those related to tax assistance, emphasizing the importance of consumer awareness. In 2024, the IRS received nearly 300,000 reports of identity theft, underscoring the prevalence of scams and the need for vigilance.

As Michael Scheumack, chief innovation officer at IdentityIQ, wisely advises, "If you don't know who it is, it's probably a scam." By following these guidelines, you can better protect yourself from fraudulent tax relief services and make informed decisions about the best tax relief programs for your tax situation. Remember, we’re here to help you navigate these challenges.

Conclusion

Navigating the landscape of tax relief programs can feel overwhelming, but it’s essential for individuals and businesses looking to ease their financial burdens. We understand that understanding your options - like Installment Agreements, Offers in Compromise, and Penalty Abatement - can empower you to make informed decisions that fit your unique situation. These programs are designed to provide tailored solutions, helping to alleviate the stress that often accompanies tax obligations.

In this article, we’ve shared key insights about various tax relief programs and how to evaluate them. It’s important to consider:

- Eligibility requirements

- Cost factors

- Provider reputation

- Customer support

- Success rates

By carefully assessing these elements, you can find the most suitable options to manage your tax situation effectively.

Remember, you don’t have to navigate this journey alone. With the right information and support, you can regain control over your financial responsibilities. Staying informed and vigilant against potential scams is crucial. By leveraging the best tax relief programs available, you can work towards a more secure financial future, ensuring that you not only meet your obligations but also pave the way for long-term stability. We're here to help you every step of the way.

Frequently Asked Questions

What are tax relief programs?

Tax relief programs are initiatives designed to help individuals and businesses manage their tax obligations effectively, especially during financial difficulties.

What types of tax relief programs are available?

The main types of tax relief programs include Installment Agreements, Offers in Compromise, and Penalty Abatement.

What is an Installment Agreement?

An Installment Agreement allows taxpayers to pay their tax debt in manageable installments, easing the burden of large sums due at once.

How does an Offer in Compromise work?

An Offer in Compromise allows taxpayers to settle their debts for less than the total amount owed, provided they meet specific criteria, making it beneficial for those facing significant financial hardship.

What is Penalty Abatement?

Penalty Abatement offers relief from penalties associated with late payments or filings, as long as the taxpayer can demonstrate reasonable cause for their delay.

Who can assist with understanding and accessing tax relief options?

Skilled nonlawyer advocates at Turnout can assist individuals in understanding and accessing tax relief options, and they collaborate with IRS-licensed enrolled agents for additional support.

Why is it important to understand tax relief programs?

Understanding tax relief programs is crucial for taxpayers feeling overwhelmed by their financial responsibilities, as these programs can provide necessary support in managing tax obligations.