Overview

This article highlights essential steps for effectively managing tax debt relief, recognizing the challenges taxpayers face in addressing their obligations. We understand that navigating tax liabilities can be overwhelming, but there are relief options available, such as Offer in Compromise and Installment Agreements, that can help. By following a structured application process, you can avoid common pitfalls and move towards financial stability.

It's important to explore these relief options thoroughly. Each option has its own benefits, and understanding them can empower you to make informed decisions. Remember, you are not alone in this journey; we’re here to help you every step of the way.

As you consider your options, take the time to reflect on your situation. What challenges are you currently facing? By acknowledging your struggles, you can better identify the solutions that resonate with you. With the right support and information, achieving financial relief is possible.

In conclusion, we encourage you to take action. Explore the available strategies, seek assistance if needed, and remember that financial stability is within your reach. You're taking a positive step towards a brighter future.

Introduction

Tax obligations can often feel overwhelming, creating a sense of dread for many individuals. We understand that with unpaid tax obligations in the U.S. exceeding £44 billion, the burden can feel heavy. It’s crucial to recognize that understanding and addressing these debts is more important than ever. This article explores effective strategies for managing tax debt, offering you valuable insights on relief options, application processes, and common pitfalls to avoid.

But what happens when the weight of tax debt becomes unbearable? It’s common to feel lost in the complexities of relief programs. How can you navigate these challenges to regain financial stability? We’re here to help you on this journey.

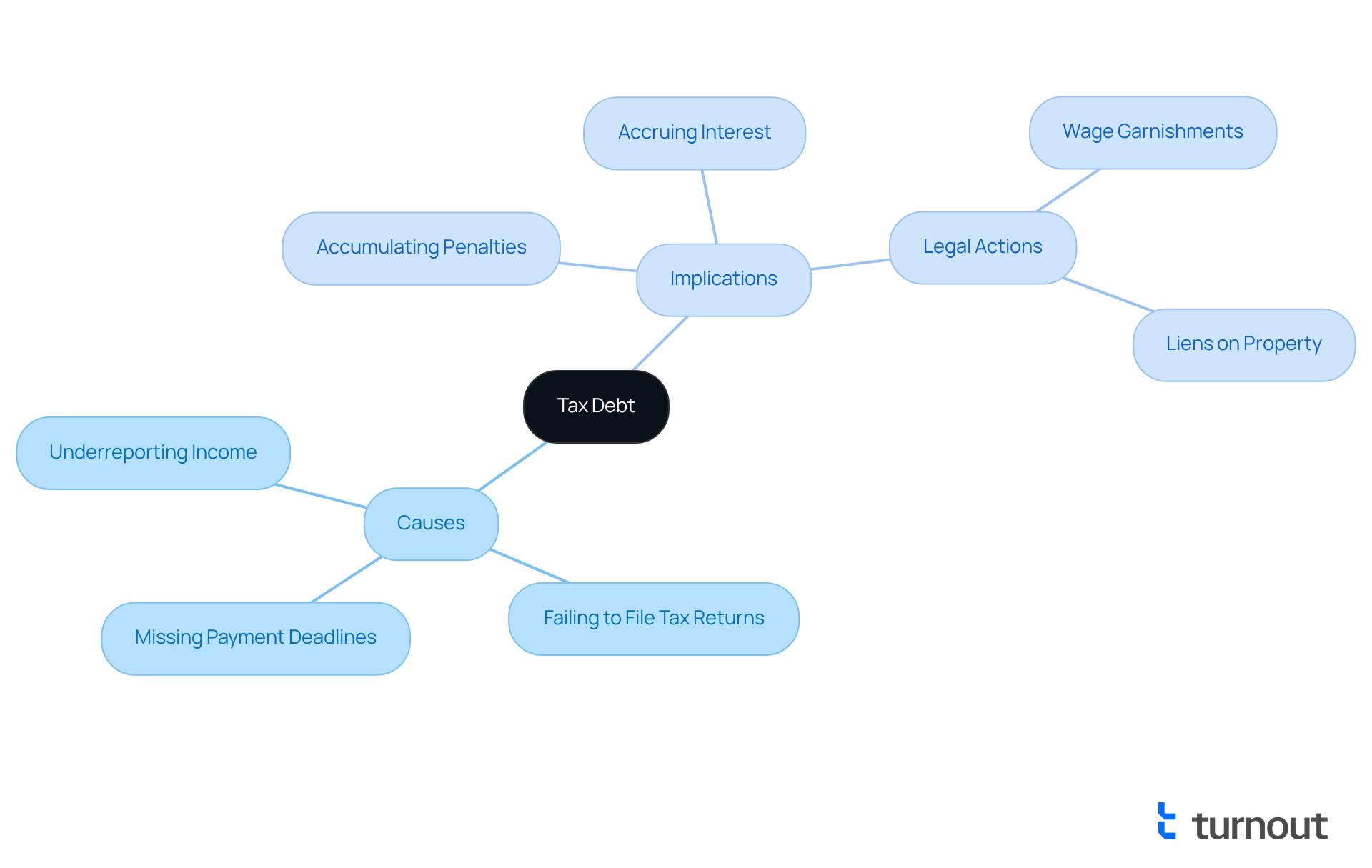

Define Tax Debt: Understanding Its Implications

Tax obligations can feel overwhelming, as they represent the balance owed to the IRS or state tax authorities due to unpaid taxes. This situation often arises from various challenges, such as:

- Underreporting income

- Failing to file tax returns

- Missing payment deadlines

We understand that navigating these issues can be stressful, but comprehending your tax obligations is essential. Ignoring them can lead to serious consequences, including:

- Accumulating penalties

- Accruing interest

- Legal actions

For instance, if left unresolved, taxpayers may face wage garnishments or liens on their property. As of December 2024, unpaid tax obligations in the U.S. exceeded £44 billion, highlighting the urgency of addressing these matters. Recent government measures are in place to help reduce tax liabilities through debt relief tax and close the tax gap, with expectations to generate over £1 billion in additional tax revenue per year by 2029/30.

It's common to feel anxious about tax obligations, but handling them promptly can prevent further complications. We’re here to help you restore your economic stability. Remember, you are not alone in this journey; taking action now can lead to a brighter financial future.

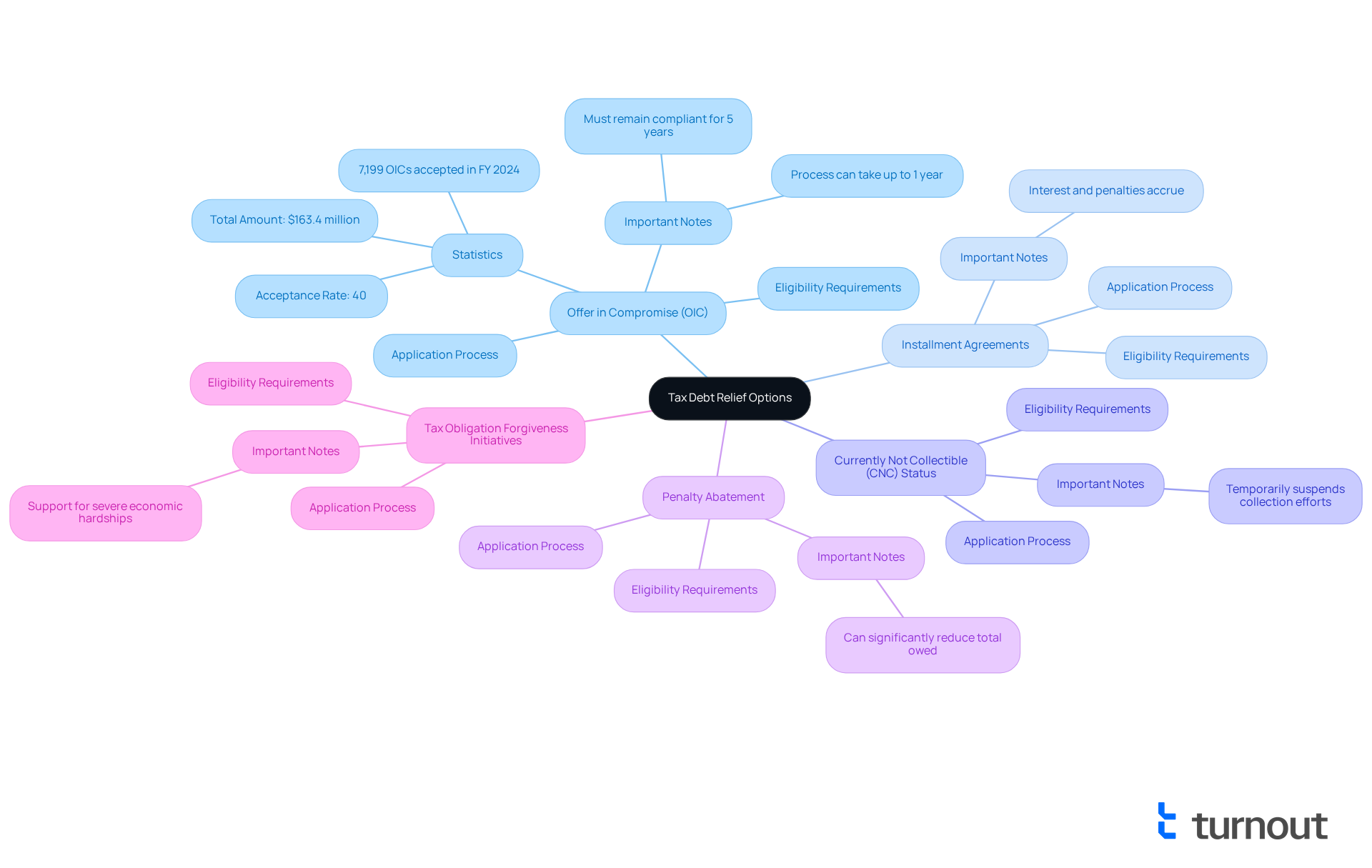

Explore Tax Debt Relief Options: Strategies for Management

Taxpayers encountering monetary difficulties often feel overwhelmed, but there are various tax relief options tailored to your specific circumstances. Let's explore the most common strategies available in 2025:

-

Offer in Compromise (OIC): This program allows you to resolve your tax obligations for less than the total amount owed. To qualify, you must demonstrate financial hardship and meet specific eligibility criteria, including proving that paying the full amount would cause undue economic strain. Recent data shows that about 40% of OIC applications are accepted, with the IRS accepting 7,199 offers in compromise during fiscal year 2024, totaling $163.4 million. This underscores the importance of thorough documentation and a well-prepared case. The process can take up to one year; however, if your OIC is rejected, you can resubmit an offer with a letter increasing the amount without needing a new Form 656 if done within a month.

-

Installment Agreements: You can create a payment plan with the IRS, allowing you to settle your obligations over time. This option is ideal for those unable to pay their tax bill in full but capable of managing smaller monthly payments. As of 2025, many taxpayers are utilizing installment agreements, reflecting a growing trend towards manageable debt repayment solutions. While this option allows for gradual repayment, it’s important to note that it does not stop interest and penalties from accruing.

-

Currently Not Collectible (CNC) Status: If you are facing significant hardship, you may qualify for CNC status, which temporarily suspends IRS collection efforts. This status provides assistance for individuals who cannot afford to make payments due to their economic circumstances.

-

Penalty Abatement: You can request a reduction or elimination of penalties related to your tax obligations, especially if you have valid reasons for late payments. This option can considerably decrease the total sum owed, alleviating some of the economic burdens you may be facing.

-

Tax Obligation Forgiveness Initiatives: Several initiatives may absolve a portion of tax obligations for eligible individuals, particularly those experiencing severe economic hardships. These programs can offer essential support for taxpayers striving to restore their economic stability.

Key Points:

- Diverse Options: Understanding the range of relief options is essential for effective debt management.

- Eligibility: Each program has specific eligibility requirements that must be met to qualify for relief.

By exploring these options, including debt relief tax, you can better navigate your monetary challenges and work towards a more stable economic future. Remember, you are not alone in this journey, and we’re here to help.

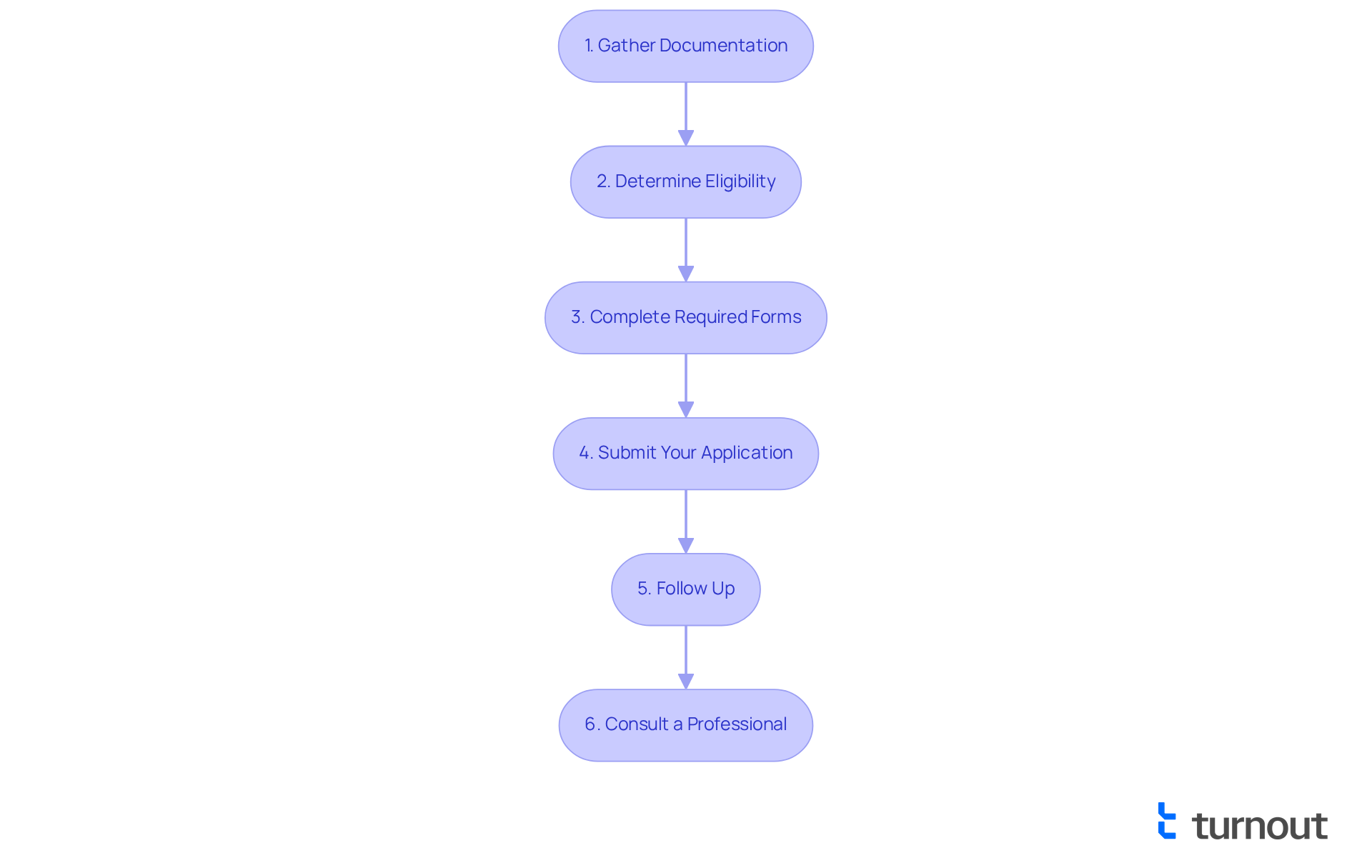

Navigate the Application Process: Steps to Secure Relief

Navigating the application process for tax relief can feel overwhelming, but we're here to help simplify your experience. By following these steps, you can approach the process with confidence:

-

Gather Documentation: Start by collecting all necessary monetary documents, such as tax returns, income statements, and any correspondence from the IRS. Common documentation includes proof of income, bank statements, and records of expenses. It's also important to review the latest version of the Offer in Compromise (OIC) Booklet to avoid any processing delays.

-

Determine Eligibility: Take a moment to review the eligibility criteria for the relief option you’re interested in, like the Offer in Compromise (OIC) or Installment Agreement. Remember, to qualify for an OIC, you must be current with all filing and payment requirements.

-

Complete Required Forms: Fill out the appropriate forms for your chosen relief option. For instance, Form 656 is required for an Offer in Compromise. Be sure to review the instructions for Form 656-B to see if you qualify for a waiver of initial costs. If you're a low-income taxpayer, you may have the $205 application fee waived.

-

Submit Your Application: Once you've completed your application and gathered your supporting documents, send them to the IRS. Don’t forget to keep copies for your records. The application for an OIC requires a fee of $205, but this can be waived for low-income taxpayers.

-

Follow Up: After submission, it's common to feel anxious about the status of your application. Monitor it closely, and be prepared to respond to any requests for additional information from the IRS. Staying proactive can truly help expedite the relief process.

-

Consult a Professional: If you encounter any difficulties, consider seeking assistance from a tax professional or advocate who can guide you through the process. Tax professionals understand the importance of thorough documentation and can help maximize your chances of approval. Additionally, be cautious of offer in compromise mills that may mislead you about your qualifications, leading to unnecessary financial strain.

Remember, proper documentation is crucial for a successful application, and staying proactive can help expedite the relief process. You are not alone in this journey; support is available every step of the way.

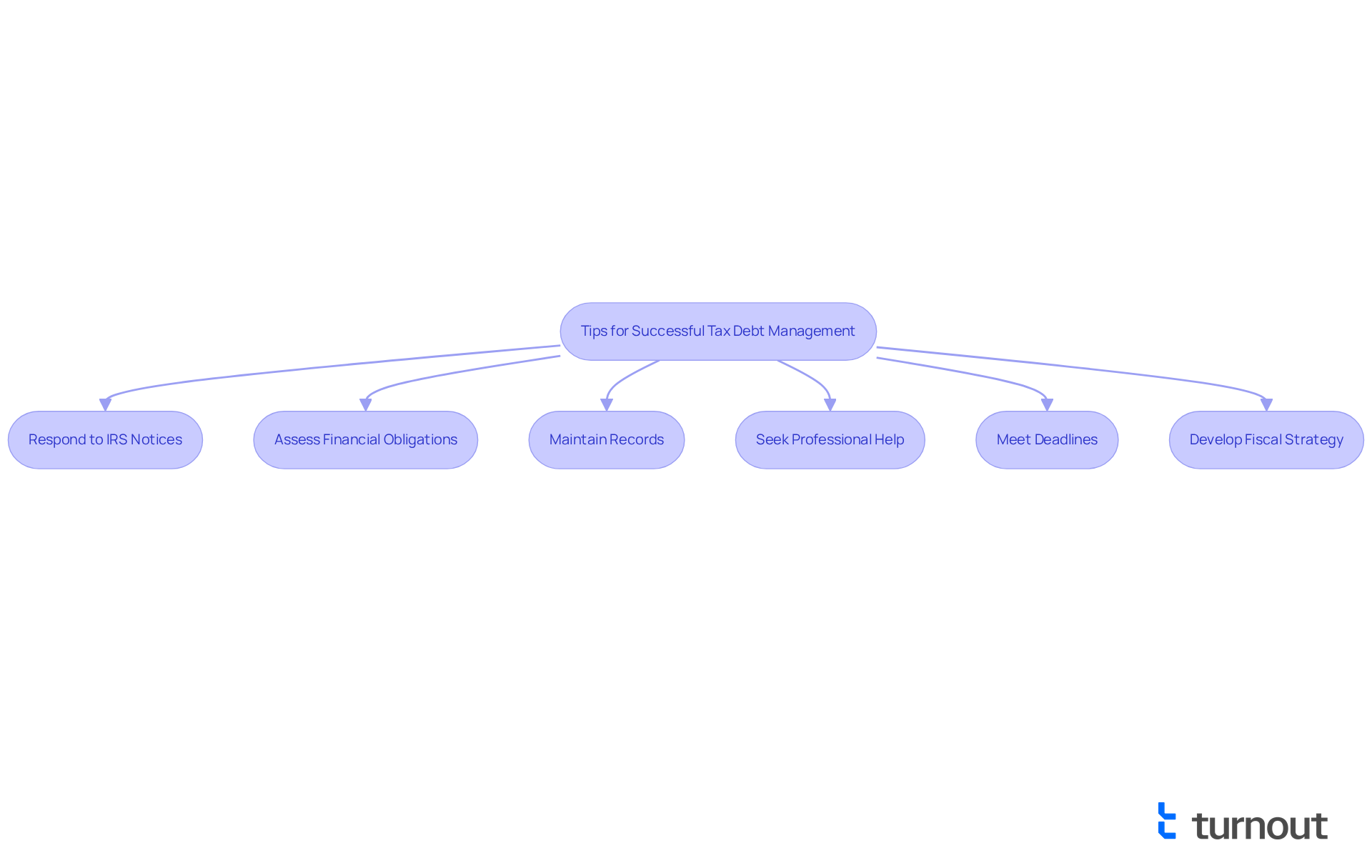

Avoid Common Pitfalls: Tips for Successful Tax Debt Management

Managing tax obligations effectively can be challenging, and it’s important to be aware of common pitfalls that may derail your efforts. We understand that navigating tax issues can feel overwhelming, so here are some supportive tips to help you avoid these mistakes:

-

Ignoring IRS Notices: It's crucial to respond to IRS communications promptly. Ignoring notices can lead to escalated collection actions, including wage garnishments and tax liens. Tax professionals emphasize that addressing IRS concerns immediately can prevent minor issues from escalating into major financial problems. As one expert wisely advises, "If you get a letter from the IRS, deal with it promptly."

-

Underestimating Your Financial Obligations: Be realistic about your tax liabilities and their implications. Many taxpayers mistakenly believe their financial obligations will settle on their own over time, which can lead to additional complications. In 2025, the IRS anticipates processing over 140 million individual tax returns, highlighting the importance of understanding your financial responsibilities. Notably, over 90% of IRS refunds were issued in less than 21 days last tax year, underscoring the efficiency of the IRS in processing returns.

-

Failing to Keep Records: Maintaining thorough records of all correspondence and documentation related to your tax obligations is essential. This practice can be crucial if disputes arise. Keeping detailed records helps ensure accurate tax returns and can protect you in case of audits.

-

Not Seeking Help: Don’t hesitate to consult a tax professional if you feel overwhelmed. Their expertise can provide clarity and direction, especially when navigating complex tax regulations. Many individuals fall victim to bad tax advice, leading to costly mistakes, so verifying information with reputable sources is essential.

-

Missing Deadlines: Be aware of all deadlines related to your tax relief applications and payments. Missing these can result in penalties or denial of debt relief tax benefits. The IRS typically sends a series of notices for unpaid balances, and responding promptly can help avoid further enforcement actions. Furthermore, taxpayers with an obligation of $50,000 or less can establish a long-term payment arrangement online, which can alleviate the strain of tax liability.

-

Neglecting Fiscal Strategy: Creating a long-term monetary plan can help you avoid future tax liabilities. This includes budgeting for taxes and adjusting withholdings as necessary. Keeping organized and submitting documents promptly can prevent tax obligations from turning into a serious financial strain.

Key Points:

- Awareness: Understanding common pitfalls can save you time and money.

- Proactivity: Taking proactive steps can lead to more favorable outcomes in managing debt relief tax.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges with confidence.

Conclusion

Understanding tax debt and its implications is crucial for anyone navigating financial challenges. We understand that facing tax obligations can be overwhelming, and it's important to address them promptly to avoid severe consequences like penalties and legal actions. By recognizing the various relief options available, you can take proactive steps towards regaining economic stability.

Key strategies include:

- Offer in Compromise (OIC)

- Installment Agreements

- Currently Not Collectible (CNC) status

- Penalty Abatement

Each option provides unique pathways for managing tax debt, and it’s essential to maintain thorough documentation and understand eligibility requirements. It's common to feel uncertain, but avoiding common pitfalls—such as ignoring IRS notices and failing to keep accurate records—can prevent exacerbating financial difficulties.

Ultimately, the journey towards effective tax debt management is a collaborative effort. Seeking assistance from professionals, staying informed about deadlines, and maintaining organized records can significantly ease the burden of tax obligations. Remember, you are not alone in this journey. By taking these steps, you can navigate your financial challenges with confidence and work towards a more stable economic future.

Frequently Asked Questions

What is tax debt?

Tax debt refers to the balance owed to the IRS or state tax authorities due to unpaid taxes, which can arise from issues like underreporting income, failing to file tax returns, or missing payment deadlines.

What are the consequences of ignoring tax obligations?

Ignoring tax obligations can lead to serious consequences, including accumulating penalties, accruing interest, and potential legal actions such as wage garnishments or liens on property.

What is the current state of unpaid tax obligations in the U.S.?

As of December 2024, unpaid tax obligations in the U.S. exceeded £44 billion, indicating the importance of addressing these issues promptly.

What measures are being taken to help reduce tax liabilities?

Recent government measures aim to reduce tax liabilities through debt relief tax initiatives and to close the tax gap, with expectations to generate over £1 billion in additional tax revenue per year by 2029/30.

How can taxpayers manage their tax obligations effectively?

Taxpayers can manage their tax obligations by taking action promptly to address unpaid taxes, which can help prevent further complications and restore economic stability.