Introduction

Navigating the W-7 form can feel overwhelming, especially for those seeking an Individual Taxpayer Identification Number (ITIN) in the United States without a Social Security Number. We understand that this process can be daunting, and that’s why we’re here to help. This guide aims to clarify the purpose and significance of the W-7 form while providing a step-by-step approach to completing it successfully.

It’s common to feel uncertain about eligibility criteria and the potential pitfalls that can complicate the process. But don’t worry; you’re not alone in this journey. By following our guidance, you can navigate this crucial task with confidence, avoiding unnecessary delays or complications. Let’s take this step together.

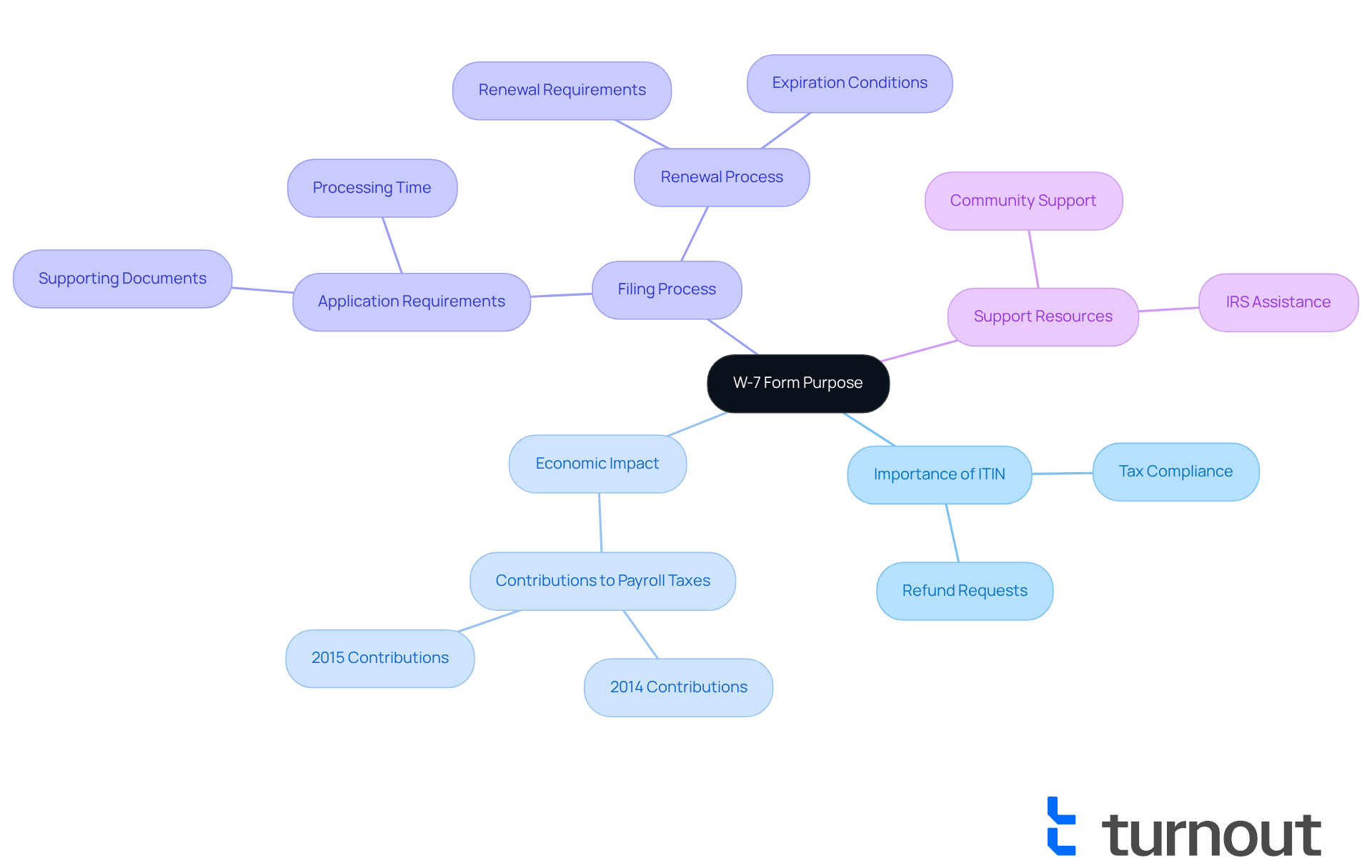

Understand the Purpose of the W-7 Form

The W-7 form Spanish is crucial for anyone applying for an Individual Taxpayer Identification Number (ITIN) from the IRS. If you can’t obtain a Social Security Number but need to meet your tax obligations in the United States, this number is vital. It allows you to submit tax returns and access various tax benefits, helping you stay compliant with U.S. tax regulations.

For many non-resident aliens, the ITIN isn’t just a number; it represents your ability to participate in the tax system and request refunds, which can be an important source of income. We understand that navigating this process can feel overwhelming. From 2012 to 2015, an average of 4.4 million to 4.6 million individuals submitted returns using an ITIN each year, underscoring its significance.

In 2014 alone, ITIN filers contributed over $9 billion in payroll taxes, highlighting their economic impact. Understanding the purpose of the W-7 form Spanish is the first step toward successfully completing the W-7 form and effectively managing the complexities of the tax system. Remember, your taxpayer identification number remains valid as long as you continue to file taxes.

It’s also important to note that obtaining an ITIN requires supporting documents, and processing can take around 7 to 11 weeks. So, it’s essential to prepare appropriately. You are not alone in this journey; we’re here to help you every step of the way.

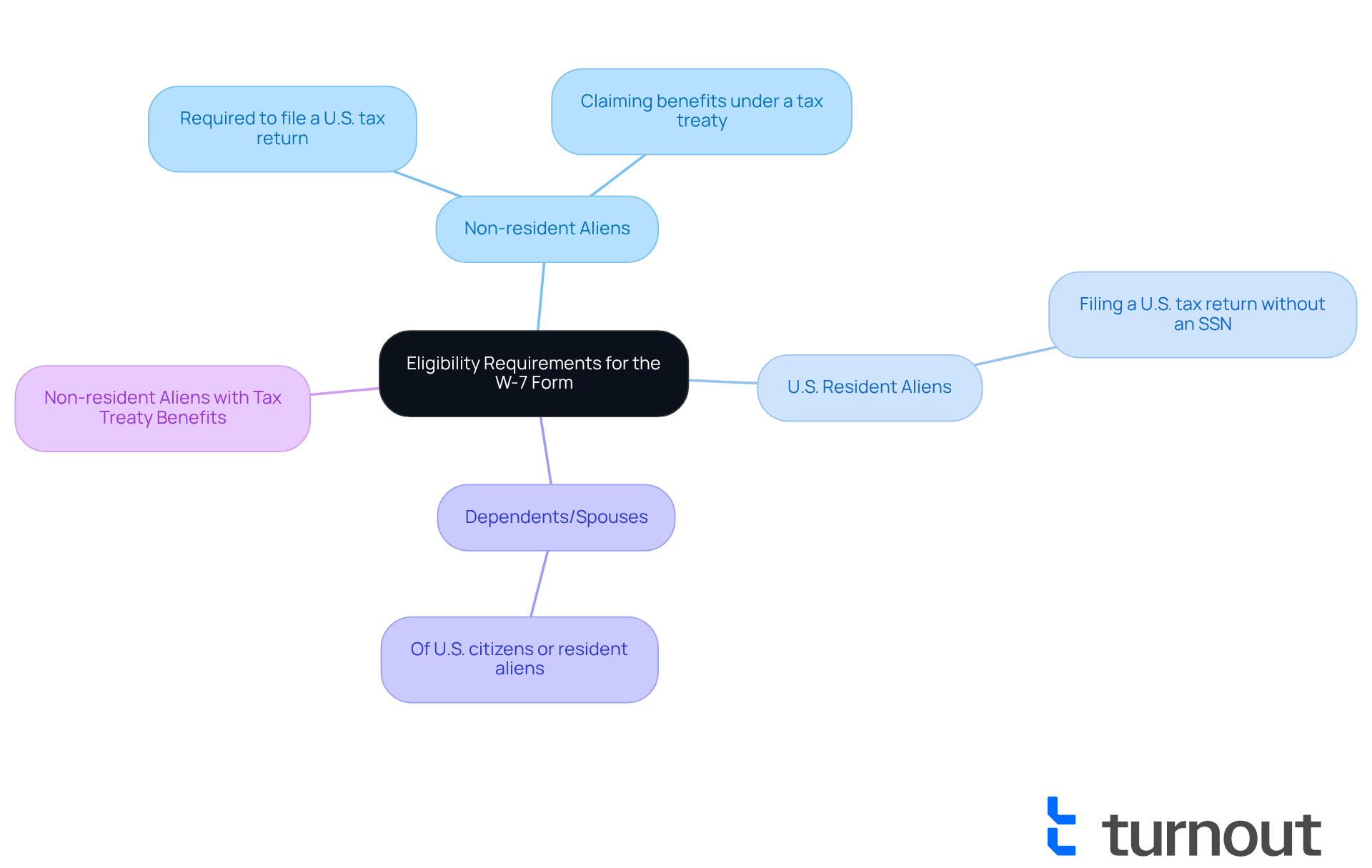

Identify Eligibility Requirements for the W-7 Form

We understand that navigating the w 7 form spanish can be challenging. To qualify, applicants must meet at least one of the following criteria:

- Non-resident aliens required to file a U.S. tax return.

- U.S. resident aliens filing a U.S. tax return without a Social Security Number (SSN).

- Dependents or spouses of U.S. citizens or resident aliens.

- Non-resident aliens claiming benefits under a tax treaty.

Comprehending these eligibility criteria is crucial. It ensures that you can successfully apply for an Individual Taxpayer Identification Number (ITIN). Recent research highlights that eligibility rates for tax identification number requests vary significantly across different demographics. Some groups face greater obstacles to approval.

It's common to feel overwhelmed by the process. Tax consultants often point out misunderstandings about ITIN eligibility. For instance, many believe that applying for an ITIN could affect their immigration status. In reality, the IRS does not share this information with immigration authorities.

Furthermore, the IRS typically processes tax identification number requests within 7 to 11 weeks. However, delays can occur during the busy tax season. Precise information is essential in the w 7 form spanish submission process to avoid unnecessary complications. Remember, you are not alone in this journey; we're here to help.

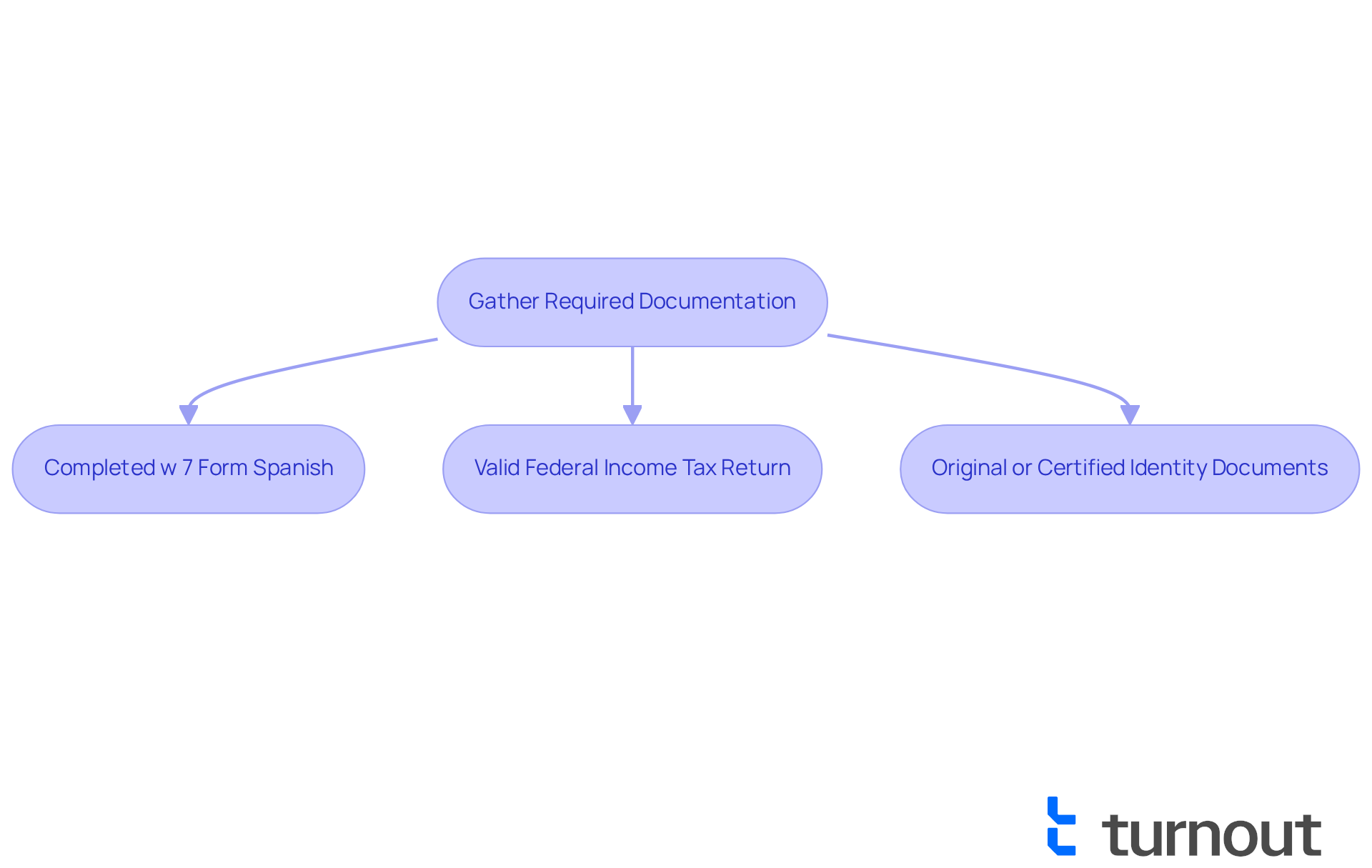

Gather Required Documentation for Submission

Before you submit the w 7 form Spanish, we understand that gathering the necessary documentation can feel overwhelming. Here’s a simple checklist to help you through the process:

- A completed w 7 form Spanish is required.

- A valid federal income tax return (unless you qualify for an exception).

- Original documents or certified copies that prove your identity and foreign status, such as a passport, national identification card, or birth certificate.

Make sure all your documents are current and meet the IRS requirements. This will help you avoid any issues during processing. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

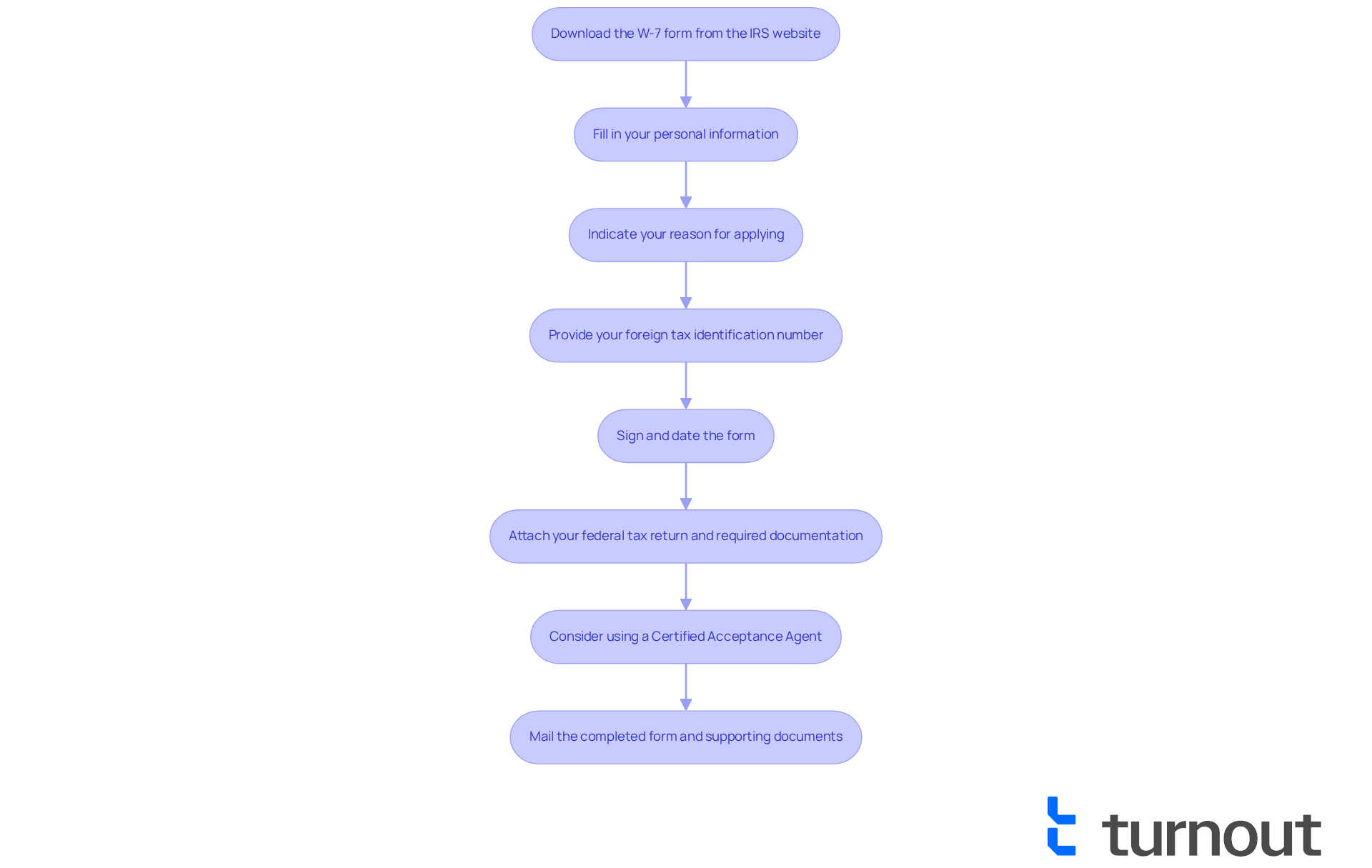

Complete the W-7 Form: Step-by-Step Instructions

Completing the W-7 form Spanish for your Individual Taxpayer Identification Number (ITIN) can feel overwhelming, but we're here to help you through the process. Follow these simple steps to make the process smoother:

- Download the W-7 form from the IRS website.

- Fill in your personal information, including your full name, mailing address, and foreign address if applicable.

- Indicate your reason for applying by checking the appropriate box on the form.

- Provide your foreign tax identification number, if you have one.

- Sign and date the form to confirm your request.

- Attach your federal tax return and any required documentation, such as proof of identity and foreign status.

- If you prefer, consider using a Certified Acceptance Agent (CAA) to verify your identification documents. This can save you the hassle of mailing originals to the IRS.

- Mail the completed form and supporting documents to the address specified in the W-7 instructions.

It's common to feel anxious about making mistakes, so take a moment to double-check all entries for accuracy before you submit. Errors can lead to delays, and we want to ensure your application is processed as quickly as possible. Also, submitting your W-7 form Spanish request during off-peak times can help avoid unnecessary wait times.

Looking ahead, in 2025, you can expect an average processing duration of 7 to 11 weeks for your W-7 form Spanish submissions. This timeframe can vary based on factors like submission volume and timing. After a few weeks, if you're feeling uncertain, you can track the status of your request by calling the IRS hotline dedicated to ITIN inquiries. Remember, you are not alone in this journey, and we're here to support you every step of the way.

Troubleshoot Common Issues When Filling Out the W-7 Form

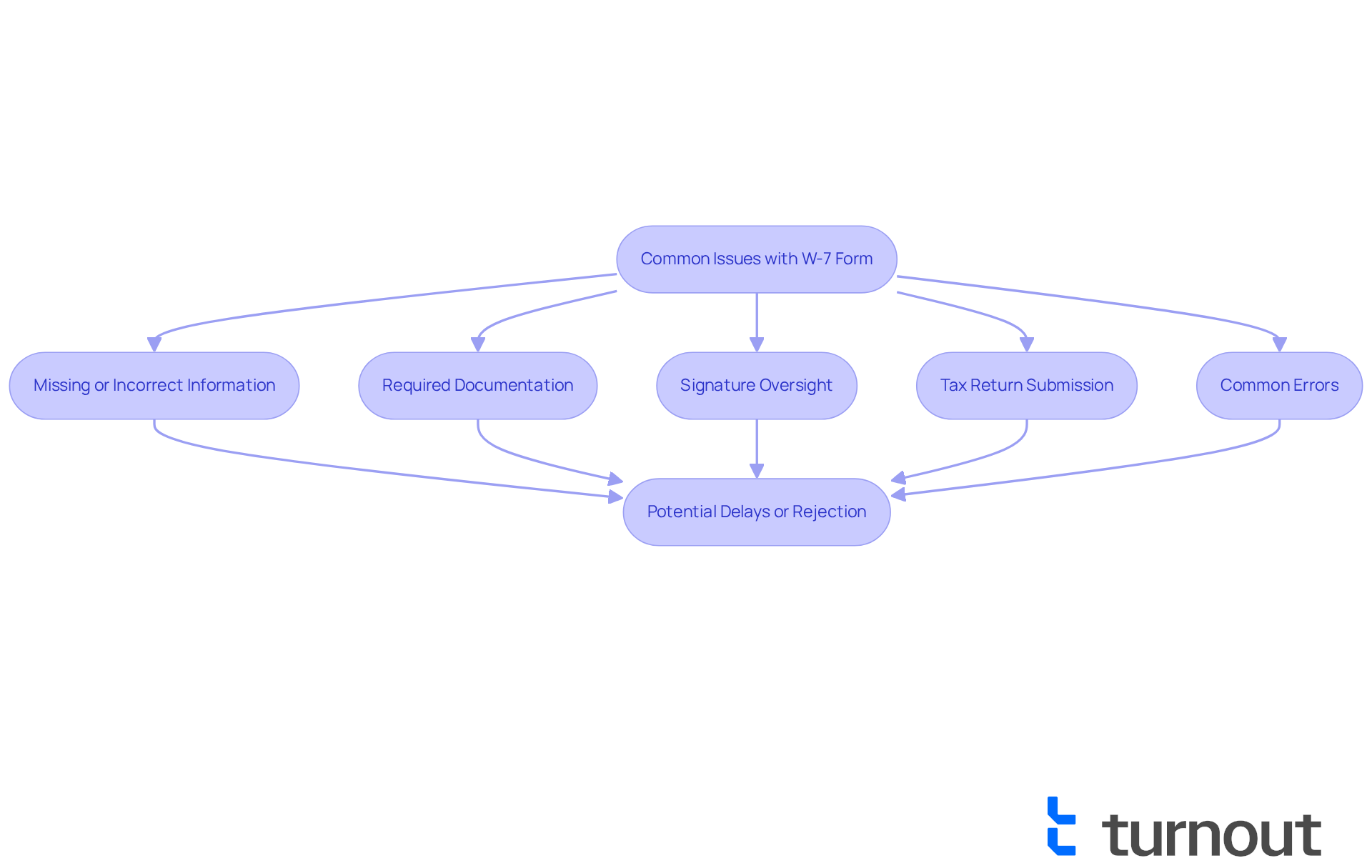

When completing the W-7 form Spanish, we understand that it can be a bit overwhelming. It's crucial to be mindful of several common pitfalls that can hinder your application process:

-

Missing or Incorrect Information: Incomplete or inaccurate entries can lead to significant delays. Make sure every field is filled out correctly, including your full legal name, date of birth, and addresses.

-

Required Documentation: Failing to include necessary documents can lead to outright rejection of your submission. Always double-check that you have attached all required identification, such as a passport or certified copies of alternative documents. Missing documentation can extend processing times, which typically range from 6 to 11 weeks.

-

Signature Oversight: It’s common to forget to sign the form. Always remember to sign and date your form to validate it.

-

Tax Return Submission: Submitting the W-7 form without a valid tax return can cause processing delays. If you are a first-time applicant, ensure that your tax return is included, as it is typically required.

-

Common Errors: Tax professionals frequently note that errors such as misspelled names, incorrect addresses, and missing reasons for applying are prevalent. These mistakes can lead to complications or even denial of your request. As highlighted in a case study on completing the W-7 form Spanish, providing accurate personal information is essential to avoid these common pitfalls.

If you encounter issues, remember that you’re not alone in this journey. Refer to the IRS instructions for guidance or consult a tax professional for personalized assistance. By being thorough and attentive to detail, you can navigate the W-7 form Spanish application process more smoothly. We're here to help!

Conclusion

Completing the W-7 form in Spanish is an important step for those seeking an Individual Taxpayer Identification Number (ITIN) from the IRS. We understand that this process can feel overwhelming, especially for non-resident aliens and others without a Social Security Number. However, it’s a crucial way to meet your tax responsibilities and access various tax benefits while complying with U.S. tax regulations. Recognizing the significance of the W-7 form is essential for anyone looking to navigate the complexities of the tax system effectively.

In this guide, we’ve addressed key elements that can help you along the way. We’ve outlined the eligibility requirements for the W-7 form, the necessary documentation for submission, and provided detailed step-by-step instructions for completing the form. We’ve also highlighted common pitfalls that applicants may encounter, emphasizing the importance of accuracy and thoroughness in the application process. By following these guidelines and being aware of potential challenges, you can enhance your chances of a smooth submission and timely processing.

The journey to obtaining an ITIN through the W-7 form may seem daunting, but it’s a significant step toward ensuring compliance and accessing vital tax benefits. We encourage you to approach this process with diligence and seek assistance when needed. Remember, you are not alone on this path to fulfilling your tax obligations. Resources and support are available to help you navigate this important task, reinforcing the message that we’re here to help.

Frequently Asked Questions

What is the purpose of the W-7 form?

The W-7 form is used to apply for an Individual Taxpayer Identification Number (ITIN) from the IRS, which is essential for individuals who cannot obtain a Social Security Number but need to fulfill their tax obligations in the United States.

Who needs to apply for an ITIN using the W-7 form?

Individuals who need to apply for an ITIN include non-resident aliens required to file a U.S. tax return, U.S. resident aliens filing a tax return without a Social Security Number, dependents or spouses of U.S. citizens or resident aliens, and non-resident aliens claiming benefits under a tax treaty.

How does having an ITIN benefit individuals?

An ITIN allows individuals to submit tax returns, access various tax benefits, participate in the tax system, and request refunds, which can be an important source of income.

How long does it take to process a W-7 form?

The IRS typically processes W-7 forms within 7 to 11 weeks, although delays may occur during the busy tax season.

What documents are required to obtain an ITIN?

Obtaining an ITIN requires supporting documents, although the specific documents needed are not detailed in the article.

Will applying for an ITIN affect my immigration status?

No, applying for an ITIN does not affect your immigration status, as the IRS does not share this information with immigration authorities.

What should I do if I feel overwhelmed by the W-7 form process?

It is common to feel overwhelmed, but there is support available. Seeking help from tax consultants or other resources can assist you in navigating the process.