Introduction

Navigating the complexities of tax season can feel overwhelming, especially for those seeking benefits and assistance. We understand that the Form 1040 is a crucial document for U.S. taxpayers, playing a pivotal role in determining tax liabilities and potential refunds. This guide aims to demystify the process of completing Form 1040 en Español, empowering you with essential tips and resources to maximize your benefits.

How can you ensure that you are accurately reporting your earnings and claiming all available deductions? It’s common to feel uncertain about this process, but we’re here to help. Avoiding common pitfalls can make a significant difference in ensuring your refunds aren’t delayed. Let’s explore how you can navigate this journey with confidence.

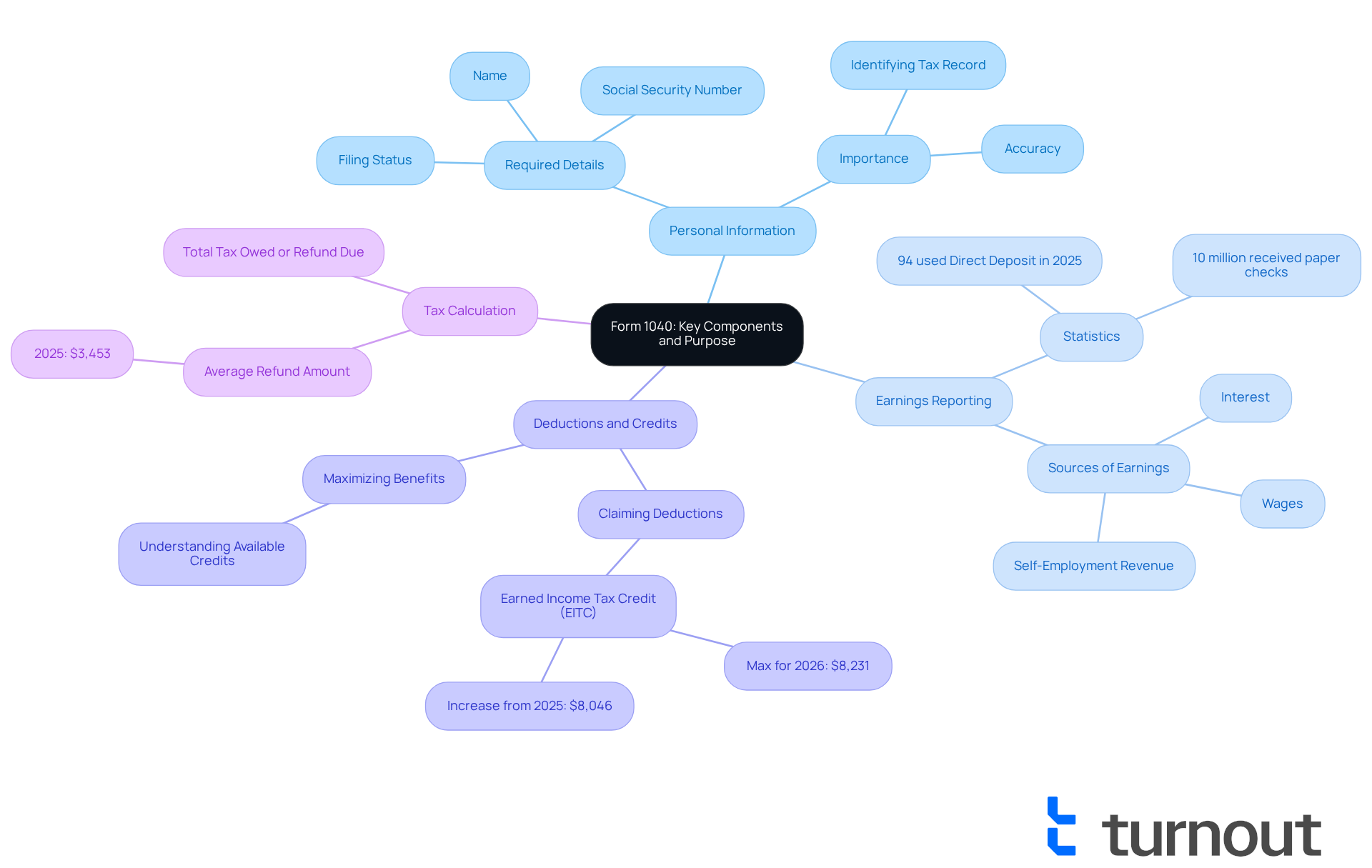

Understand Form 1040: Key Components and Purpose

The form 1040 español serves as the standard IRS document for U.S. taxpayers to submit their yearly tax returns. It plays a crucial role in assessing tax liability or refunds, and we understand that navigating this process can feel overwhelming. This form collects essential information about your earnings, deductions, and credits, and knowing how to fill it out can make a significant difference.

-

Personal Information: In this section, you’ll need to provide your name, Social Security number, and filing status. These details are vital for identifying your tax record, and we’re here to help you ensure everything is accurate.

-

Earnings Reporting: Here, you report various sources of earnings, such as wages, self-employment revenue, and interest. Accurate reporting is crucial. Did you know that about 94 percent of individual taxpayers provided their direct deposit information on their Form 1040 during the 2025 filing season? This shows a strong trend in compliance. However, it’s important to note that 10 million individual taxpayers received their tax refunds by paper check last year. Providing your direct deposit information can help prevent potential delays.

-

Deductions and Credits: This part allows you to claim deductions and credits that can significantly reduce your taxable income. For example, the maximum Earned Income Tax Credit (EITC) for tax year 2026 is $8,231 for qualifying taxpayers with three or more children, up from $8,046 in 2025. Understanding the available credits is essential for maximizing your tax benefits, and we want to ensure you’re aware of all your options.

-

Tax Calculation: The document computes the total tax owed or the refund due based on the information you provide. This ensures that you receive the correct amount. In the 2025 tax season, the average refund amount was $3,453, highlighting the financial impact of precise submissions.

Understanding these components is essential for completing the form accurately and maximizing your potential benefits. As tax professionals often say, navigating the complexities of form 1040 español can unlock significant financial advantages for taxpayers. It’s imperative to grasp its key elements. Additionally, being aware of changes, such as the SALT deduction cap increase from $10,000 to $40,000 effective for tax year 2025, can further enhance your understanding of the deductions available. Remember, you are not alone in this journey; we’re here to help you every step of the way.

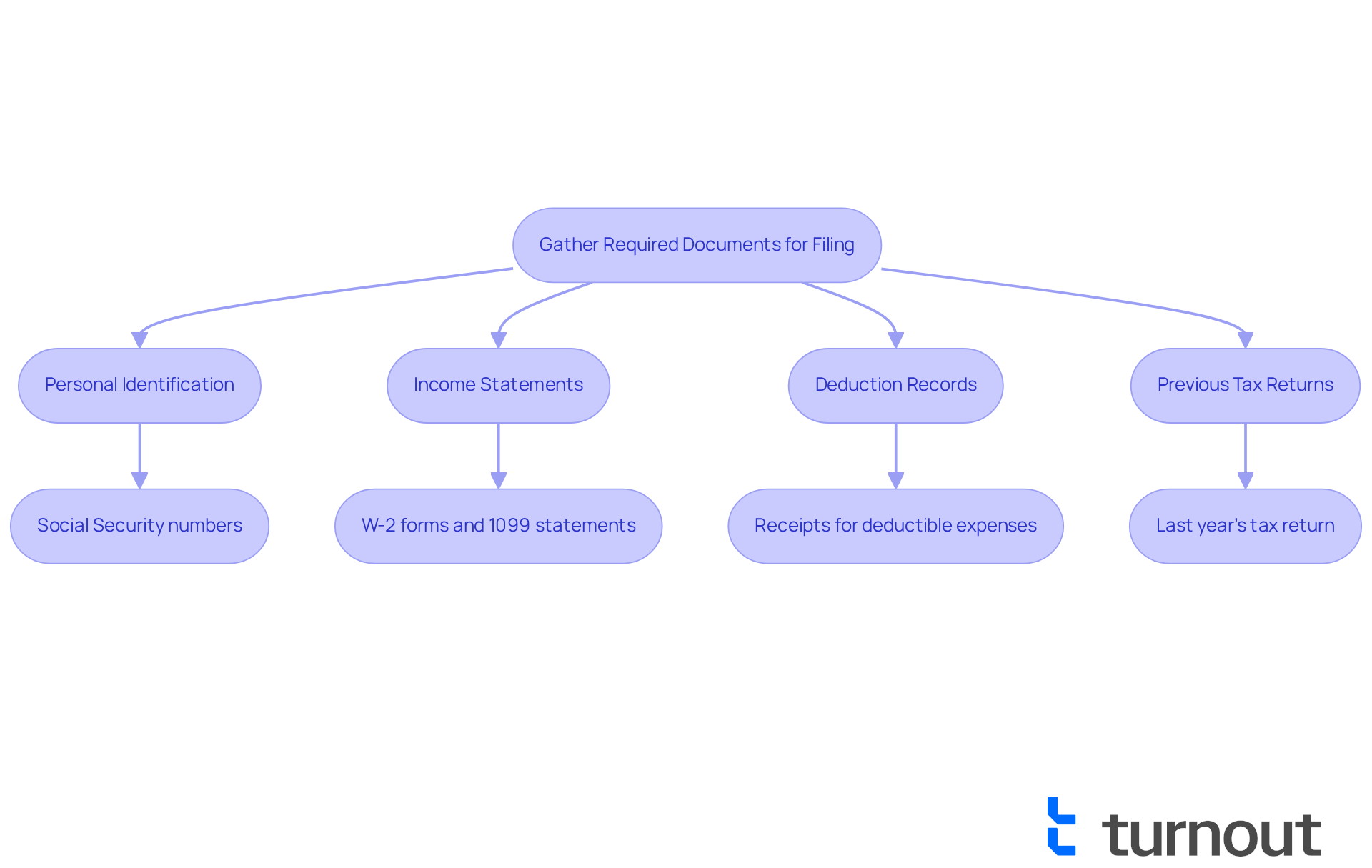

Gather Required Documents and Information for Filing

Before you tackle the form 1040 español, it’s important to gather the necessary documents to ensure a smooth submission process. We understand that this can feel overwhelming, but we’re here to help. Here’s what you need:

- Personal Identification: Make sure to collect Social Security numbers for yourself, your spouse, and any dependents. This step is crucial for accurate filing and can help avoid delays.

- Income Statements: Gather all relevant income records, including W-2 forms from your employers and 1099 statements for any freelance or contract work. These documents are essential as they report your earnings and are necessary for accurate tax calculations.

- Deduction Records: Compile receipts or statements for any deductible expenses, such as medical costs, mortgage interest, and charitable contributions. Keeping these organized can significantly lower your tax liability.

- Previous Tax Returns: Having last year’s tax return handy can serve as a useful reference for consistency and help you identify any carryover deductions or credits.

It’s common to feel stressed about collecting these documents. Statistics show that around 30% of taxpayers face challenges in this area, often leading to delays in submission. This can be especially true for individuals with disabilities, who may encounter additional hurdles in organizing their paperwork. Experts emphasize that having all income statements readily accessible is vital. Not only does it aid in creating a comprehensive and accurate return, but it also reduces the chances of audits, which the IRS can initiate up to three years after submission. Remember, the IRS advises, "Taxpayers should always carefully review documents for inaccuracies or missing information."

To make your document management easier, ensure all papers are organized and within reach. Keep in mind that the deadline for submitting the form 1040 español is April 15, 2025. This preparation will help you navigate the complexities of tax submission with confidence. Additionally, consider creating a spreadsheet dedicated to tracking your tax records throughout the year; this can make the process even smoother.

Once your documents are submitted correctly, take comfort in knowing that the IRS issued more than 9 out of 10 refunds in less than 21 days last tax year. This highlights the efficiency of the process, and you’re not alone in this journey.

Follow Step-by-Step Instructions to Complete Form 1040

Completing the form 1040 español can feel overwhelming, but you’re not alone in this journey. Here’s a step-by-step guide to help you navigate the process with confidence:

-

Fill in Personal Information: Start by entering your name, Social Security number, and address at the top of the form. Don’t forget to indicate your filing status (single, married, etc.). It’s crucial that your name matches exactly as printed on your Social Security card to avoid any processing delays.

-

Report Your Earnings: In the earnings section, list all sources of revenue. Use your W-2 and 1099 forms to ensure accuracy. It’s common to misreport earnings or overlook sources, which can lead to discrepancies in your tax return. Remember, the IRS states, "Many mistakes can be avoided by filing electronically," which can help reduce errors.

-

Claim Deductions: Decide whether to take the standard deduction or itemize your deductions. Fill in the appropriate lines based on your choice. Many taxpayers miss out on potential deductions, which can significantly affect their tax liability. Statistics show that math errors are among the most common mistakes in tax returns, so take your time with those calculations.

-

Calculate Your Tax: Use the tax tables included in the instructions to determine your tax obligation based on your taxable earnings. Mistakes in calculations happen often; double-check your math to avoid errors that could lead to penalties. The IRS emphasizes that "tax laws are complicated but the most common tax return errors are surprisingly simple."

-

Complete Additional Schedules: If applicable, fill out any additional schedules (like Schedule C for business income) and attach them to your Form 1040. Ensure that all required documents are included to prevent processing delays.

-

Review and Sign: Before submitting, double-check all entries for accuracy. An unsigned tax return is invalid, so remember to sign and date the document.

By following these steps, you can minimize common mistakes and enhance the likelihood of a successful submission. For instance, disabled taxpayers have successfully navigated the process by ensuring all income sources were accurately reported and deductions were maximized. Tax professionals often emphasize the importance of reviewing your return for accuracy, as many errors are surprisingly simple yet can lead to significant issues. Taking the time to carefully complete your form 1040 español can truly make a substantial difference in your tax experience.

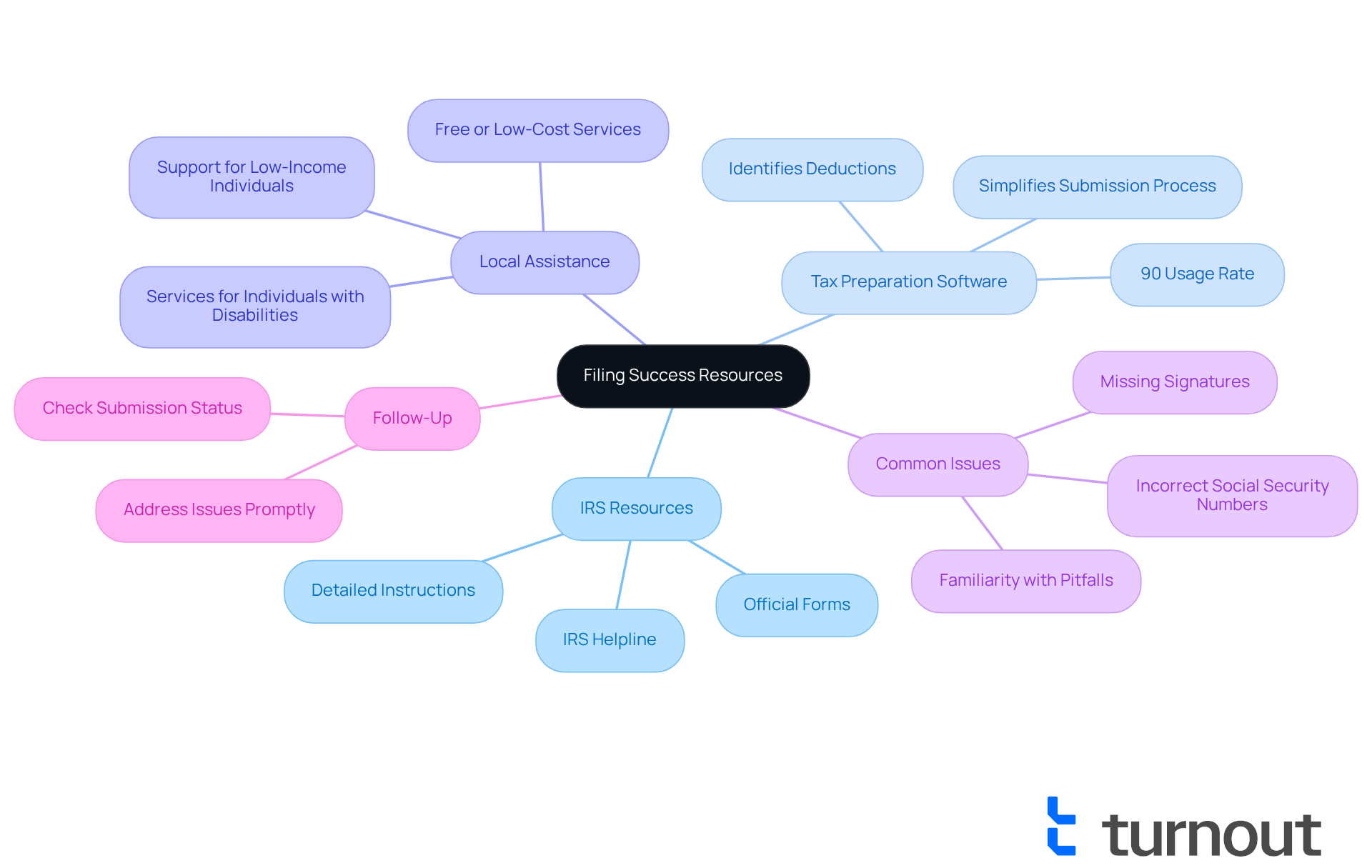

Access Resources and Troubleshooting Tips for Filing Success

To make your filing experience smoother, we understand that having the right resources can make all the difference. Here are some essential tips to guide you:

- IRS Resources: The IRS website serves as a valuable hub for accessing official forms, detailed instructions, and answers to frequently asked questions. If you have specific inquiries, don’t hesitate to reach out to the IRS helpline for personalized assistance.

- Tax Preparation Software: Consider using tax preparation software designed to simplify the submission process. These tools not only guide you through form 1040 español but also help identify potential deductions, making it easier to maximize your refund. Did you know that roughly 90% of taxpayers now rely on such software? It’s a testament to how effective these tools can be in improving submission accuracy.

- Local Assistance: If you’re feeling overwhelmed, seek out local tax assistance programs that support low-income individuals and those with disabilities. Many of these programs offer free or low-cost services, ensuring you get the help you need without added stress.

- Common Issues: It’s common to encounter submission mistakes, like incorrect Social Security numbers or missing signatures, which can lead to frustrating processing delays. Familiarizing yourself with these pitfalls can save you time and help you avoid unnecessary headaches.

- Follow-Up: After you submit your return, keep an eye on its status through the IRS website. This proactive approach allows you to address any issues promptly, paving the way for a smoother resolution.

By utilizing these resources and being aware of common challenges, remember that you’re not alone in this journey. We’re here to help you navigate the filing process more effectively and tackle any issues that may arise.

Conclusion

Completing Form 1040 en español is a crucial step for taxpayers who want to accurately report their income and maximize their benefits. We understand that tax season can be overwhelming, but this guide offers a comprehensive overview of the form's key components, the necessary documents for filing, and a detailed step-by-step approach to ensure a smooth submission process. By grasping these elements, you not only simplify tax filing but also empower yourself to take full advantage of available deductions and credits.

Throughout this article, we’ve emphasized the importance of meticulous preparation. From gathering personal identification and income statements to accurately reporting earnings and claiming deductions, every step matters. It’s common to feel uncertain about the process, but the insights shared here reveal how you can avoid common mistakes by following the outlined steps and utilizing available resources, such as IRS tools and local assistance programs. This knowledge is vital for enhancing your overall tax experience and ensuring timely refunds.

Ultimately, navigating the complexities of Form 1040 en español isn’t just about compliance; it’s about unlocking potential financial benefits and reducing stress during tax season. By approaching this task with the right information and support, you can confidently take charge of your financial well-being. Remember, you are not alone in this journey. Embrace the resources available, stay organized, and know that thorough preparation can lead to a more rewarding tax filing experience.

Frequently Asked Questions

What is Form 1040 and its purpose?

Form 1040 is the standard IRS document used by U.S. taxpayers to submit their yearly tax returns. It is essential for assessing tax liability or refunds.

What personal information do I need to provide on Form 1040?

You need to provide your name, Social Security number, and filing status. This information is vital for identifying your tax record.

What types of earnings need to be reported on Form 1040?

You must report various sources of earnings, including wages, self-employment revenue, and interest.

Why is it important to provide direct deposit information on Form 1040?

Providing direct deposit information can help prevent potential delays in receiving your tax refund. In the 2025 filing season, 94 percent of individual taxpayers provided this information.

How can deductions and credits affect my taxable income?

Deductions and credits can significantly reduce your taxable income. For instance, the maximum Earned Income Tax Credit (EITC) for tax year 2026 is $8,231 for qualifying taxpayers with three or more children.

How is the total tax owed or refund due calculated on Form 1040?

The total tax owed or refund due is computed based on the information you provide on the form, ensuring you receive the correct amount.

What was the average tax refund during the 2025 tax season?

The average tax refund during the 2025 tax season was $3,453.

What is the SALT deduction cap, and how has it changed?

The SALT deduction cap increased from $10,000 to $40,000 effective for tax year 2025, which can enhance your understanding of available deductions.

How can I maximize my benefits when filling out Form 1040?

Understanding the key components of the form, such as available deductions and credits, is essential for maximizing your potential tax benefits.