Introduction

Navigating the complexities of short-term disability insurance for maternity leave can feel overwhelming for expectant mothers. We understand that this essential safety net is crucial, providing financial support during a vital recovery period. However, the options available can vary significantly from one plan to another.

With so many choices out there, how can new parents ensure they select the best coverage for their needs? By exploring the key features, benefits, and costs associated with short-term disability plans, mothers can empower themselves to make informed decisions.

Ultimately, this knowledge can help secure the financial stability you deserve during this transformative time. Remember, you are not alone in this journey; we're here to help.

Understanding Short-Term Disability Insurance for Maternity Leave

Short-term disability insurance (STD) is here to help you when you need it most. If you’re temporarily unable to work due to medical conditions, including pregnancy and childbirth, this insurance is considered the best short-term disability for maternity leave as it provides crucial income replacement. For parental absence, it typically covers a portion of your salary - often between 50% to 70% - for a designated period, which can range from six to twelve weeks, depending on your policy.

We understand that new mothers may face financial strain during their recovery after childbirth. Understanding the best short-term disability for maternity leave policies, including waiting times and compensation amounts, is essential for expectant mothers preparing for their time off.

At Turnout, we’re here to support you through the complexities of government assistance, including Social Security Disability (SSD) claims. It’s common to feel overwhelmed, but you’re not alone in this journey. Our trained nonlawyer advocates are dedicated to helping you understand the processes involved, ensuring you’re informed about your options for financial aid during this critical time. Let us guide you through this process with care and compassion.

Evaluating Key Features and Benefits of Short-Term Disability Plans

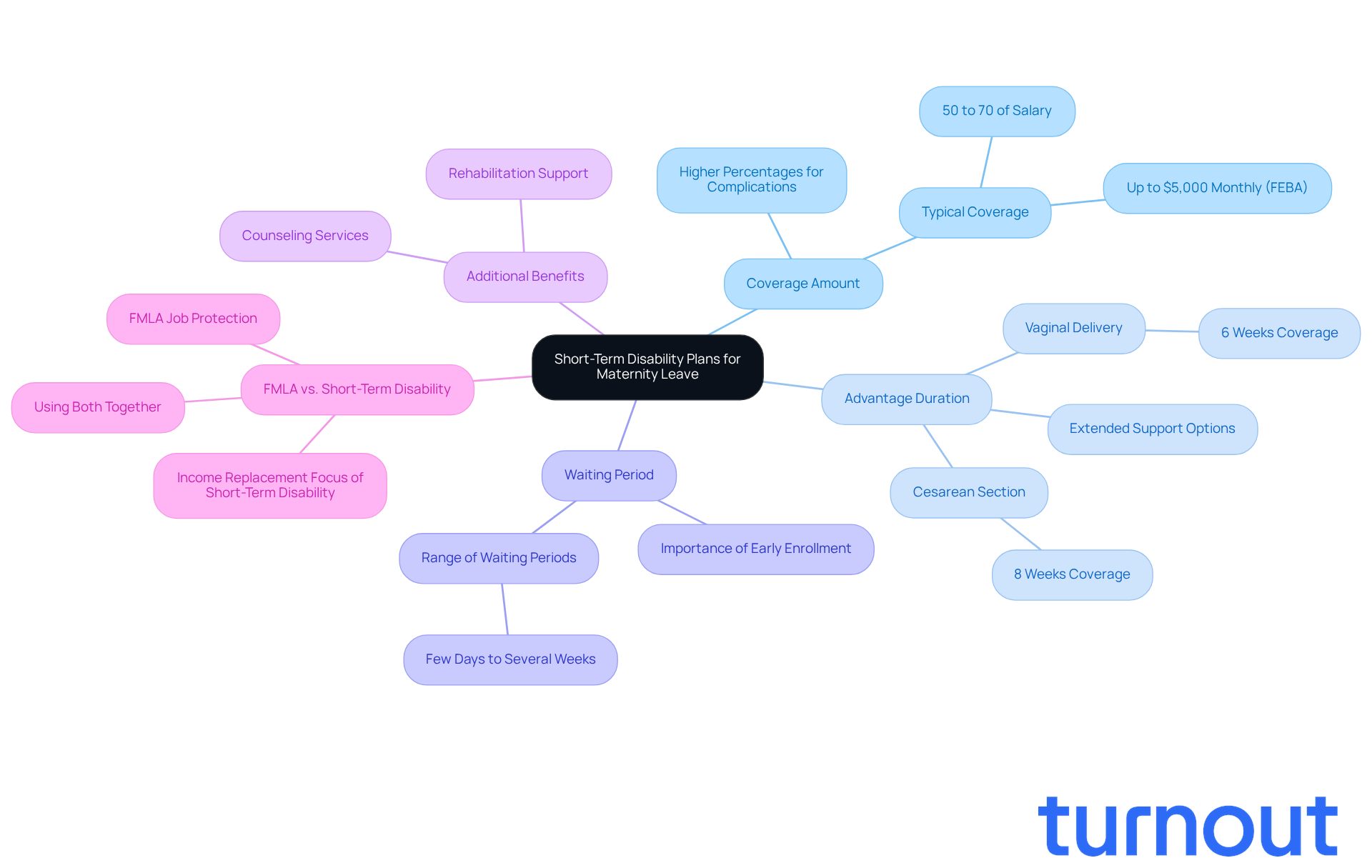

When evaluating the best short-term disability for maternity leave, it’s essential to consider several key features that can make a significant difference in your experience.

-

Coverage Amount: Most plans typically offer between 50% to 70% of your salary. However, some options, like those from Aflac and Guardian, may provide higher percentages or additional benefits for complications during pregnancy. For instance, FEBA's plans can offer flexible monthly allowances of up to $5,000, which can really help ease financial stress during your maternity leave.

-

Advantage Duration: The duration of benefits can vary widely. Many plans cover six weeks after vaginal delivery and eight weeks for cesarean sections. Yet, some plans extend support for longer periods, ensuring you have the time you need to recover fully.

-

Waiting Period: This is the time you must wait after filing a claim before benefits kick in. Waiting periods can range from just a few days to several weeks, which can impact when you receive financial assistance. If you’re planning to start or grow your family, early enrollment in the best short-term disability for maternity leave is crucial to prevent any gaps in protection.

-

Additional Benefits: Some plans may offer extra services, like counseling or rehabilitation, which can be incredibly helpful for new mothers navigating postpartum recovery.

-

Understanding FMLA vs. Short-Term Disability: It’s important to remember that while the Family and Medical Leave Act (FMLA) provides job protection during unpaid leave, it doesn’t offer paid parental leave. In contrast, the best short-term disability for maternity leave focuses on replacing your income, which helps to ensure your financial stability during this important time.

By understanding these features, you can choose a plan that aligns with your needs during parental leave, ensuring you feel secure and supported during this crucial period. Remember, you’re not alone in this journey, and we’re here to help you find the right solution.

Navigating Eligibility and Application Processes for Disability Insurance

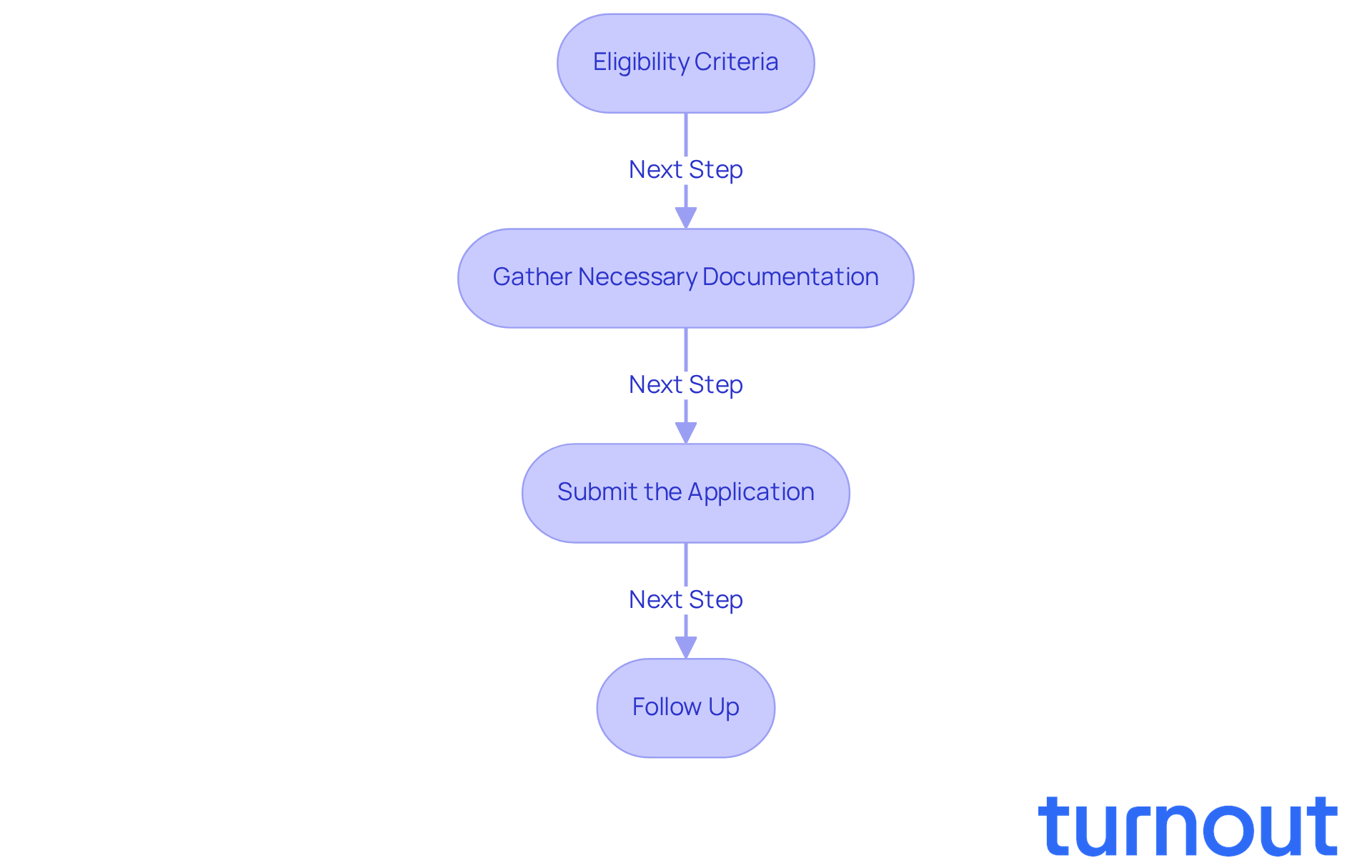

Navigating the eligibility and application processes for the best short-term disability for maternity leave can feel overwhelming. But don’t worry; we’re here to help you through it. Here are some important steps to consider:

-

Eligibility Criteria: Most plans require that you’ve been employed for a certain period - often around 12 months - and have worked a minimum number of hours. You’ll also need to provide medical documentation confirming your inability to work due to pregnancy or childbirth. As Travis Christy from White Coat Insurance wisely notes, "Obtaining coverage prior to an impairment is crucial, as insurance providers may enforce exclusions or reject coverage for pre-existing conditions, including pregnancy-related complications."

-

Gather Necessary Documentation: It’s essential to prepare various documents, such as proof of pregnancy, medical records, and any required forms from your employer. This documentation is vital for validating your claim. John Robert Peace, founder of Peace Law Firm, emphasizes, "Medical documentation is usually necessary when applying for short-term assistance."

-

Submit the Application: You can typically submit your application online or through your HR department. Make sure to follow the specific instructions provided by the insurance company to avoid any delays. Generally, the processing time for claims related to the best short-term disability for maternity leave is about 14 days, though this can vary.

-

Follow Up: After you submit your application, it’s a good idea to follow up with the insurance provider. This ensures your claim is being processed and allows you to address any additional requests for information promptly. As Corrida Legal points out, "Employees must recognize their entitlement and take the initiative in claiming parental absence privileges."

Understanding these steps can empower new mothers to secure the best short-term disability for maternity leave during this important time away from work. Remember, short-term health benefits typically cover 60-70% of your regular salary during your inability to work, providing essential financial support. You are not alone in this journey; we’re here to guide you every step of the way.

Comparing Costs of Short-Term Disability Plans for Maternity Leave

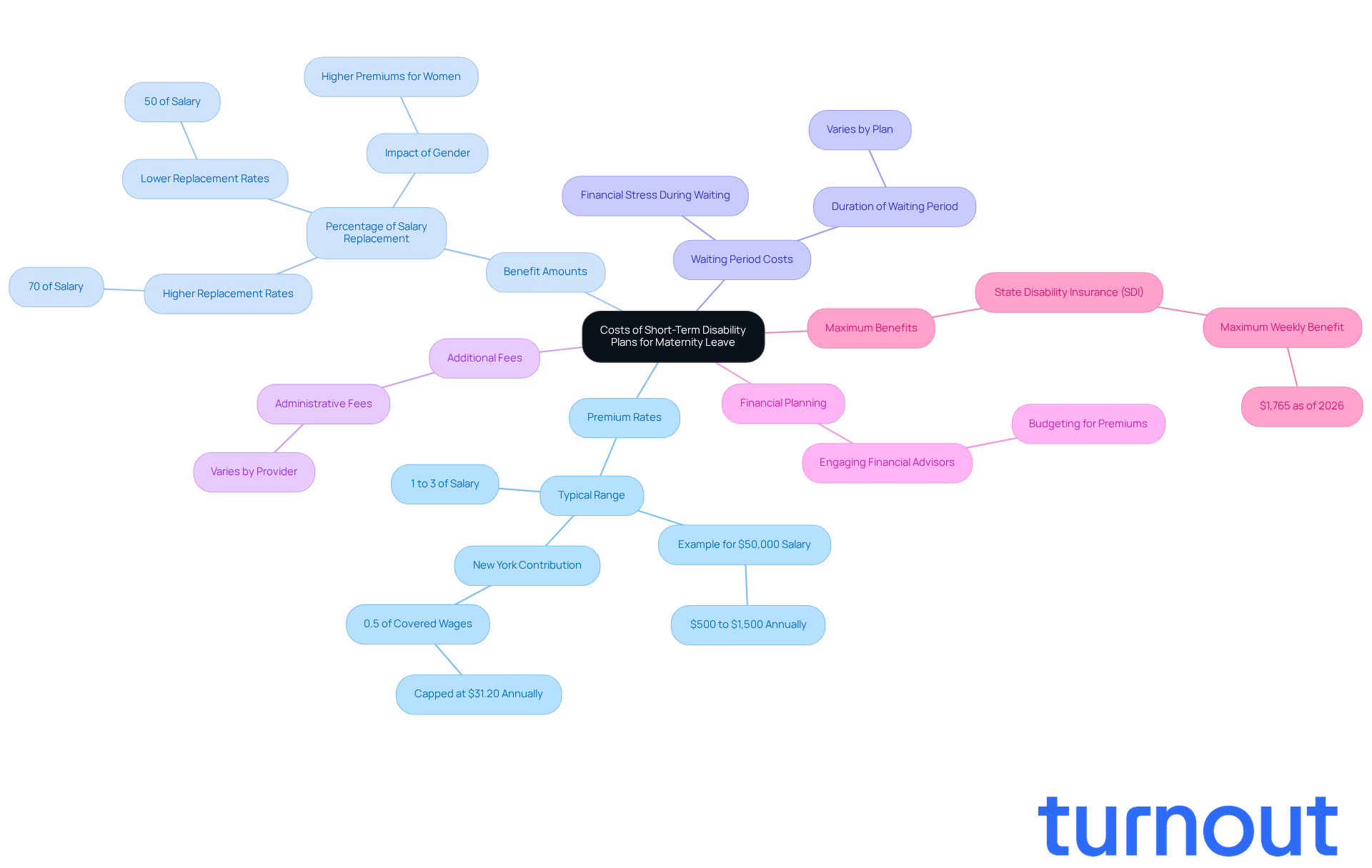

When evaluating the costs of the best short-term disability for maternity leave, it’s essential to consider several key factors that can impact your financial well-being.

-

Premium Rates: We understand that budgeting can be challenging. Typically, premiums for short-term incapacity insurance range from 1% to 3% of an employee's salary. For example, if you earn $50,000 annually, you might pay between $500 and $1,500 per year for coverage. In New York, employee premium contributions are set at 0.5% of covered wages, capped at $31.20 per year.

-

Benefit Amounts: The percentage of salary replacement offered by a plan can significantly influence its premium. Plans that provide higher replacement rates, like 70% of salary, often come with higher premiums compared to those offering 50%. It’s important to note that women may face higher premiums due to more claims related to pregnancy and mental health.

-

Waiting Period Costs: Many plans impose a waiting period before benefits commence. This delay can be stressful, especially if you need to manage expenses without financial support during this time. The cost of short-term income protection insurance can vary greatly depending on personal situations, so it’s crucial to evaluate your individual needs.

-

Additional Fees: Don’t forget to consider any administrative fees or costs associated with enrolling in the plan. These can vary by provider and add to your overall expenses.

-

Financial Planning: Engaging with financial advisors can provide valuable insights into budgeting for short-term disability premiums. They can help ensure you’re financially prepared for parental absence, giving you peace of mind.

-

Maximum Benefits: As of 2026, the highest weekly benefit for State Disability Insurance (SDI) has increased to $1,765. This can be a significant help in managing your financial obligations during parental leave.

By carefully comparing these factors, you can make informed decisions about the best short-term disability for maternity leave that align with your financial situation. Remember, you’re not alone in this journey, and we’re here to help you find the coverage that best supports you during maternity leave.

Conclusion

Understanding the best short-term disability insurance for maternity leave is essential for new mothers seeking financial support during this pivotal time. This coverage not only provides a crucial safety net by replacing a portion of income but also allows mothers to focus on recovery and bonding with their newborns without the added stress of financial instability.

We understand that navigating this process can feel overwhelming. Key features of short-term disability plans include:

- Coverage amounts

- Duration of benefits

- Waiting periods

- Additional services that can greatly enhance your experience

Evaluating these aspects helps expectant mothers make informed decisions that align with their unique needs. Furthermore, understanding the eligibility and application processes ensures that new mothers can secure the financial assistance they deserve. Awareness of costs associated with various plans aids in effective budgeting.

Ultimately, the significance of short-term disability insurance for maternity leave cannot be overstated. It empowers mothers to take the necessary time to heal and bond with their child while alleviating financial burdens. By exploring the best options available, new mothers can confidently navigate this journey, ensuring both their well-being and that of their families.

Taking proactive steps now can lead to a more secure and supportive maternity leave experience. Remember, you are not alone in this journey, and we're here to help you every step of the way.

Frequently Asked Questions

What is short-term disability insurance (STD) for maternity leave?

Short-term disability insurance (STD) provides income replacement for individuals temporarily unable to work due to medical conditions, including pregnancy and childbirth.

How much of my salary does short-term disability insurance cover during maternity leave?

STD typically covers a portion of your salary, often between 50% to 70%, for a designated period during maternity leave.

How long does short-term disability insurance provide coverage for maternity leave?

The coverage period for short-term disability insurance can range from six to twelve weeks, depending on your specific policy.

Why is understanding short-term disability insurance important for new mothers?

Understanding short-term disability insurance is essential for expectant mothers as it helps them prepare for potential financial strain during their recovery after childbirth.

What support does Turnout offer regarding short-term disability and maternity leave?

Turnout provides support for navigating the complexities of government assistance, including Social Security Disability (SSD) claims, and offers guidance through the processes involved in obtaining financial aid during maternity leave.