Introduction

Disability insurance is more than just a policy; it’s a vital safety net for those facing unexpected health challenges. Yet, many individuals may not fully grasp its importance. Did you know that nearly 30% of adults in the U.S. live with some form of impairment? Understanding the nuances of disability coverage is essential for your financial security.

This article will explore the intricacies of disability insurance, guiding you through key criteria for evaluating providers. We’ll compare leading companies to help you find the best policy tailored to your needs. We understand that navigating this market can feel overwhelming. How can you ensure adequate protection against unforeseen circumstances?

You are not alone in this journey. Together, we can uncover the support you need to secure your future.

Understanding Disability Insurance: Key Concepts and Importance

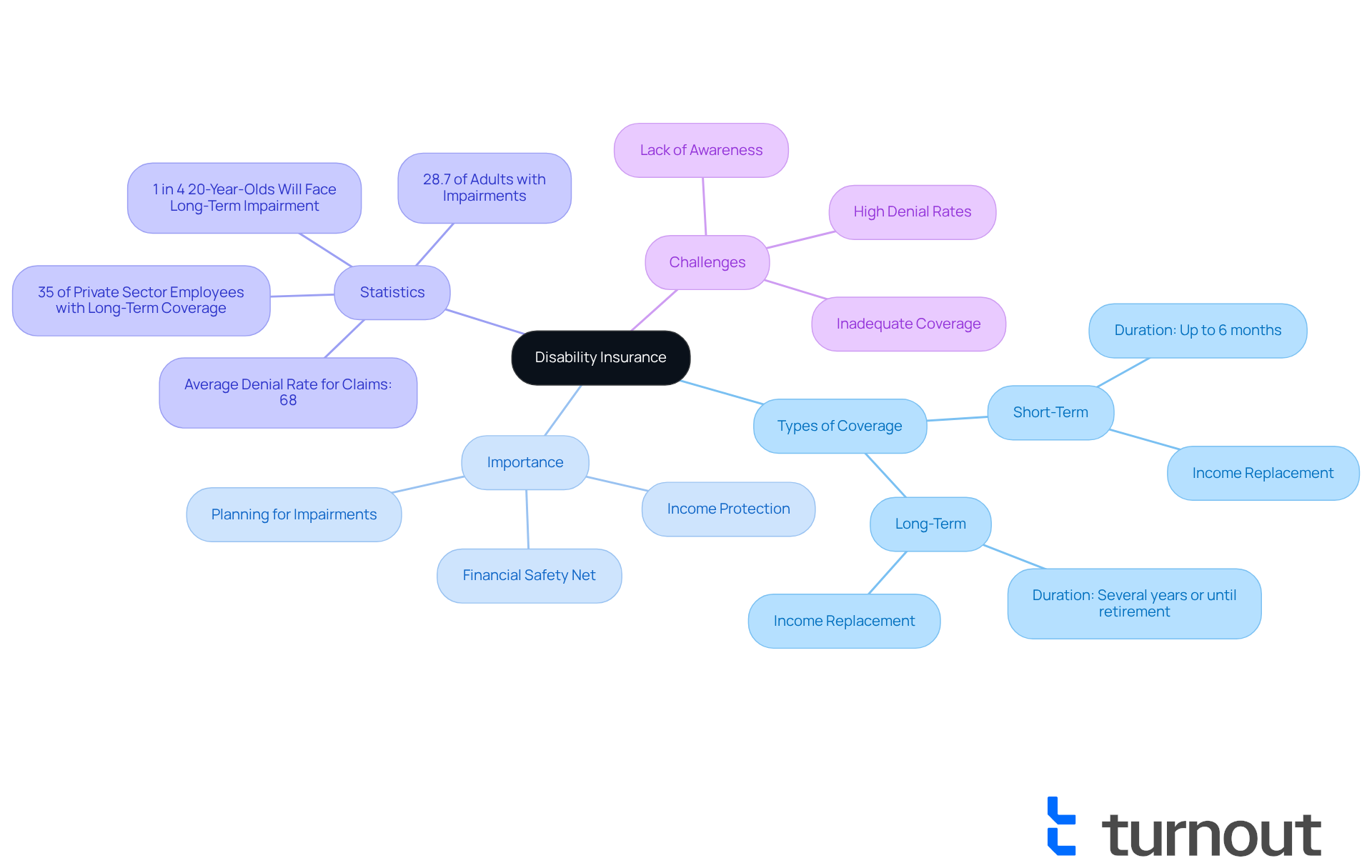

Disability coverage is more than just a financial safety net; it’s a lifeline for those unable to work due to illness or injury. It provides essential income replacement, helping you manage living expenses during recovery. Typically, this coverage falls into two categories: short-term and long-term disability insurance. Short-term policies often cover a limited duration, usually up to six months, while long-term policies can extend for several years or even until retirement age. Understanding this distinction is crucial for choosing the right coverage that fits your unique needs and financial situation.

We understand that the importance of coverage for impairments offered by disability companies cannot be overstated. Did you know that around 28.7% of adults in the U.S. live with some type of impairment? This statistic underscores the necessity for thoughtful financial planning. Furthermore, the Social Security Administration estimates that one in four 20-year-olds will face a long-term impairment before reaching age 67. This reality highlights the significance of securing suitable coverage.

Statistics reveal that approximately 35% of private sector employees have access to long-term support coverage. However, many feel their protection is inadequate, often limited to monthly benefits that don’t reflect their actual earnings. This gap can leave individuals vulnerable during critical times. Case studies indicate that a significant number of Americans lack adequate coverage from disability companies, leaving families unprepared for the economic challenges that unexpected impairments can bring.

In the realm of personal finance, monetary advisors stress the importance of income protection as a key component of a comprehensive wealth management plan. It not only safeguards against income loss but also ensures that you can maintain your standard of living when faced with unforeseen health challenges. Grasping the nuances of short-term versus long-term coverage is essential for making informed choices that protect your financial stability. Remember, you are not alone in this journey; we’re here to help you navigate these important decisions.

Criteria for Comparison: What to Look for in Disability Insurance Providers

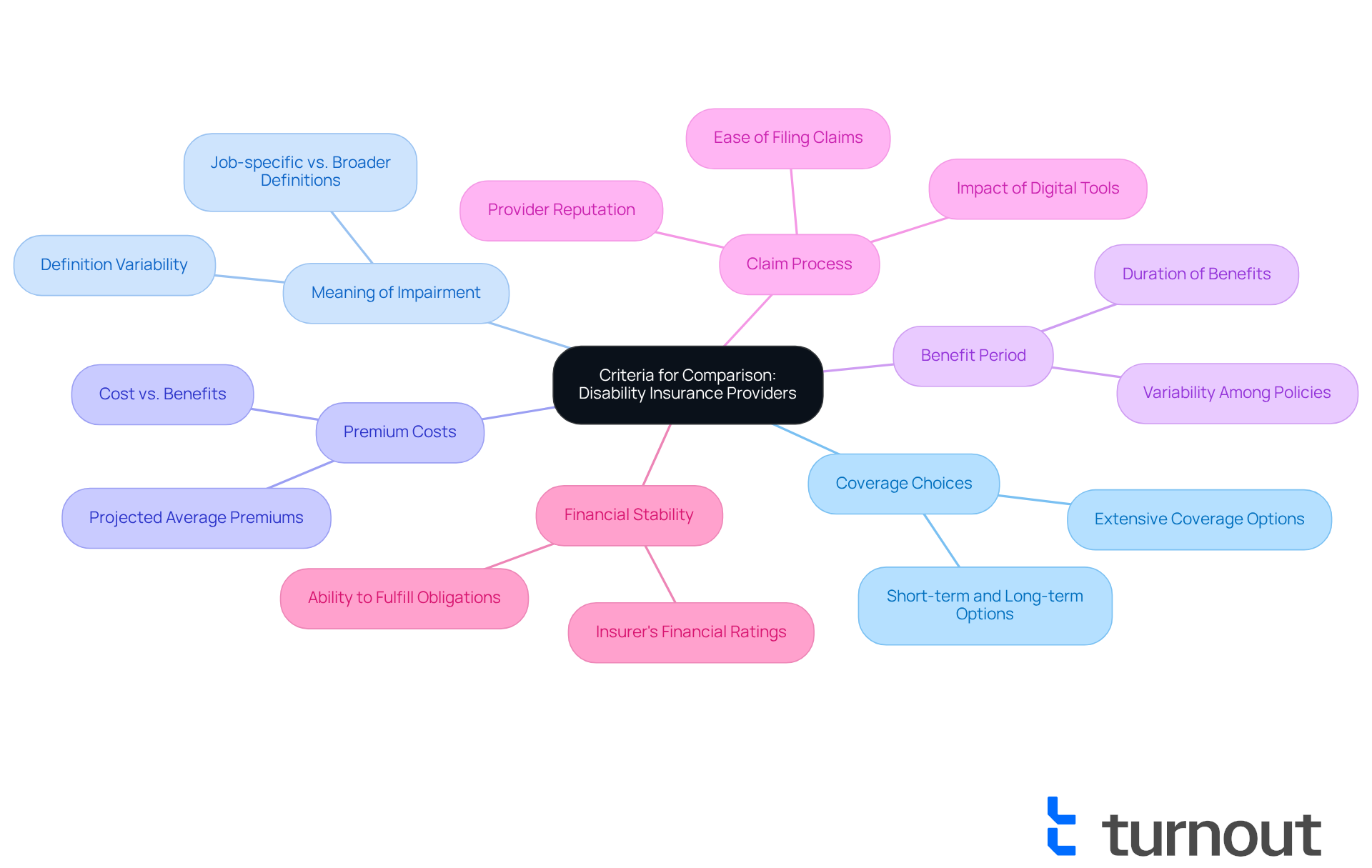

When evaluating disability insurance providers, it’s important to consider several essential criteria that can guide your decision-making process:

-

Coverage Choices: We understand that having the right protection is crucial. Look for plans that offer extensive coverage, including both short-term and long-term incapacity options. This way, you can feel secure knowing you have support during various stages of recovery.

-

Meaning of Impairment: It’s common to feel confused about how impairment is defined in policies. Understanding these guidelines is vital, as they can significantly impact your eligibility for benefits. Some policies may only cover impairments that prevent you from doing your specific job, while others might offer broader definitions.

-

Premium Costs: Comparing premium costs against the benefits offered can be overwhelming. While lower premiums may seem appealing, they often come with reduced coverage or higher deductibles, which could leave you vulnerable when you need help the most. In 2025, the average premium for individual long-term coverage is projected to be 1-3% of annual income, influenced by various factors.

-

Benefit Period: Assessing how long benefits will be paid if a claim is approved is essential. Policies can vary widely, with some offering benefits for just a few months and others extending until retirement age. Knowing this can help you plan for the future.

-

Claim Process: Investigating the claims process is crucial. How straightforward is it to file a claim? What’s the provider’s reputation for handling claims in a timely and fair manner? A smooth claims process can significantly reduce stress during challenging times. In fact, digital tools have been shown to reduce approval times by 30% in 2025, highlighting the importance of efficiency in claims processing.

-

Financial Stability: Researching the financial ratings of the insurer is a key step. You want to ensure they have the resources to fulfill their obligations to policyholders. A financially stable company is more likely to be there for you when you need them most.

These criteria are essential for navigating the complexities of coverage related to disability companies and impairments. They can assist you in finding a provider from disability companies that aligns with your specific needs and preferences. As consumer preferences evolve, particularly in 2025, understanding these factors can empower you to make informed decisions about your coverage options. It’s important to note that only 43% of employed Americans had any type of coverage for disabilities in 2025, underscoring the necessity of being well-informed about available choices. Remember, you are not alone in this journey, and we’re here to help.

Comparative Analysis of Leading Disability Insurance Companies

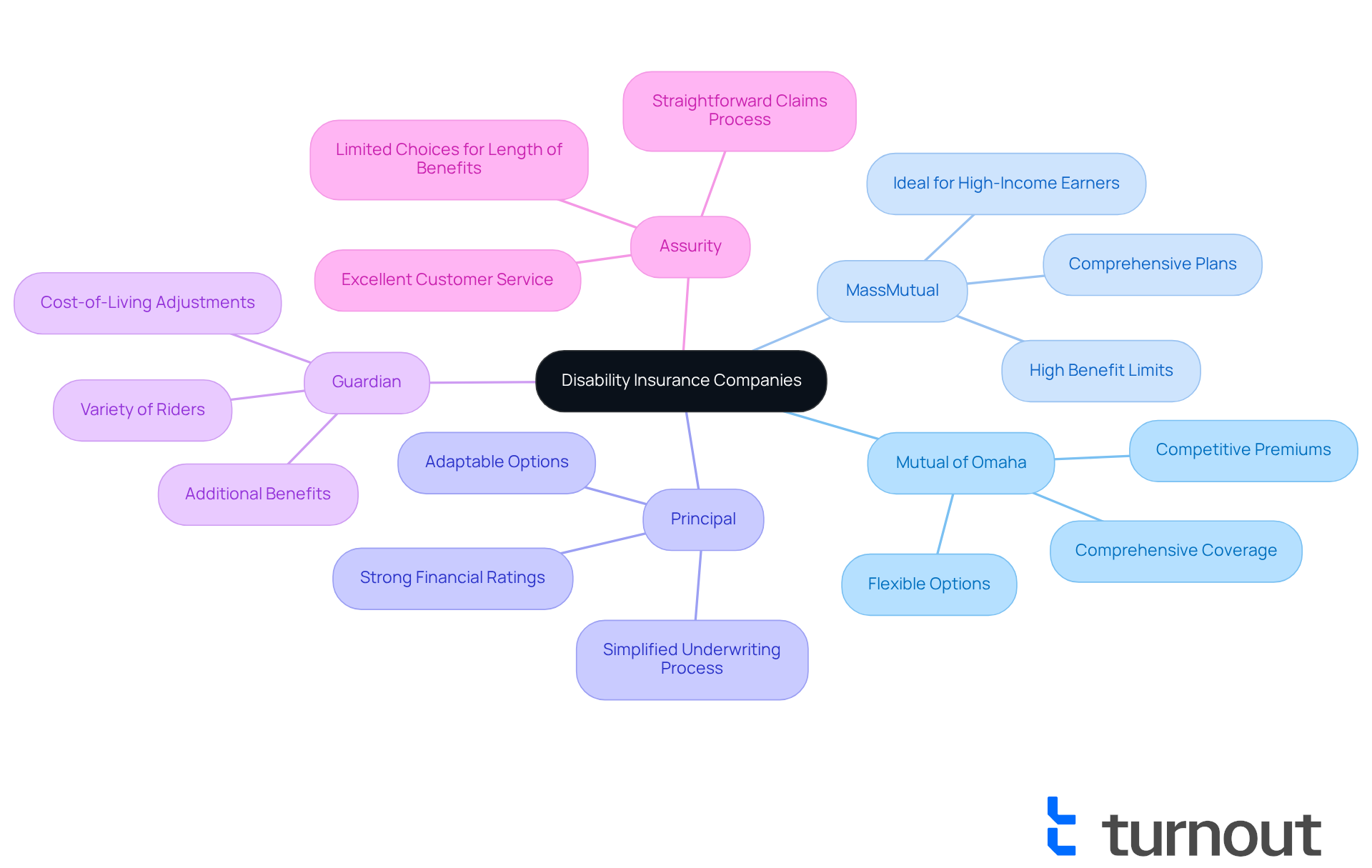

In 2025, navigating the disability insurance market can feel overwhelming. We understand that finding the right coverage is crucial for your peace of mind. Here are some companies that stand out, each offering unique strengths to meet your needs:

-

Mutual of Omaha: Known for its comprehensive coverage options and competitive premiums, it’s often recommended for both short-term and long-term disability insurance. This could be a great choice if you’re looking for flexibility.

-

MassMutual: With comprehensive plans and high benefit limits, MassMutual is ideal for high-income earners. If you’re concerned about protecting your income, this might resonate with you.

-

Principal: Acknowledged for its adaptable options and strong financial ratings, Principal is a reliable selection for those seeking customization. You deserve a plan that fits your unique situation.

-

Guardian: Offering a variety of riders and additional benefits, such as cost-of-living adjustments, Guardian can enhance the value of your policy. It’s comforting to know you have options that grow with you.

-

Assurity: Noted for its straightforward claims process and excellent customer service, Assurity is often favored by those who prioritize ease of access. We know how important it is to have support when you need it most.

Each of these disability companies contributes something special to the table. As you consider your options, remember that you’re not alone in this journey. Take the time to reflect on your individual needs, and don’t hesitate to reach out for help. We're here to support you in making the best choice for your future.

Making the Right Choice: Selecting the Best Disability Insurance for Your Needs

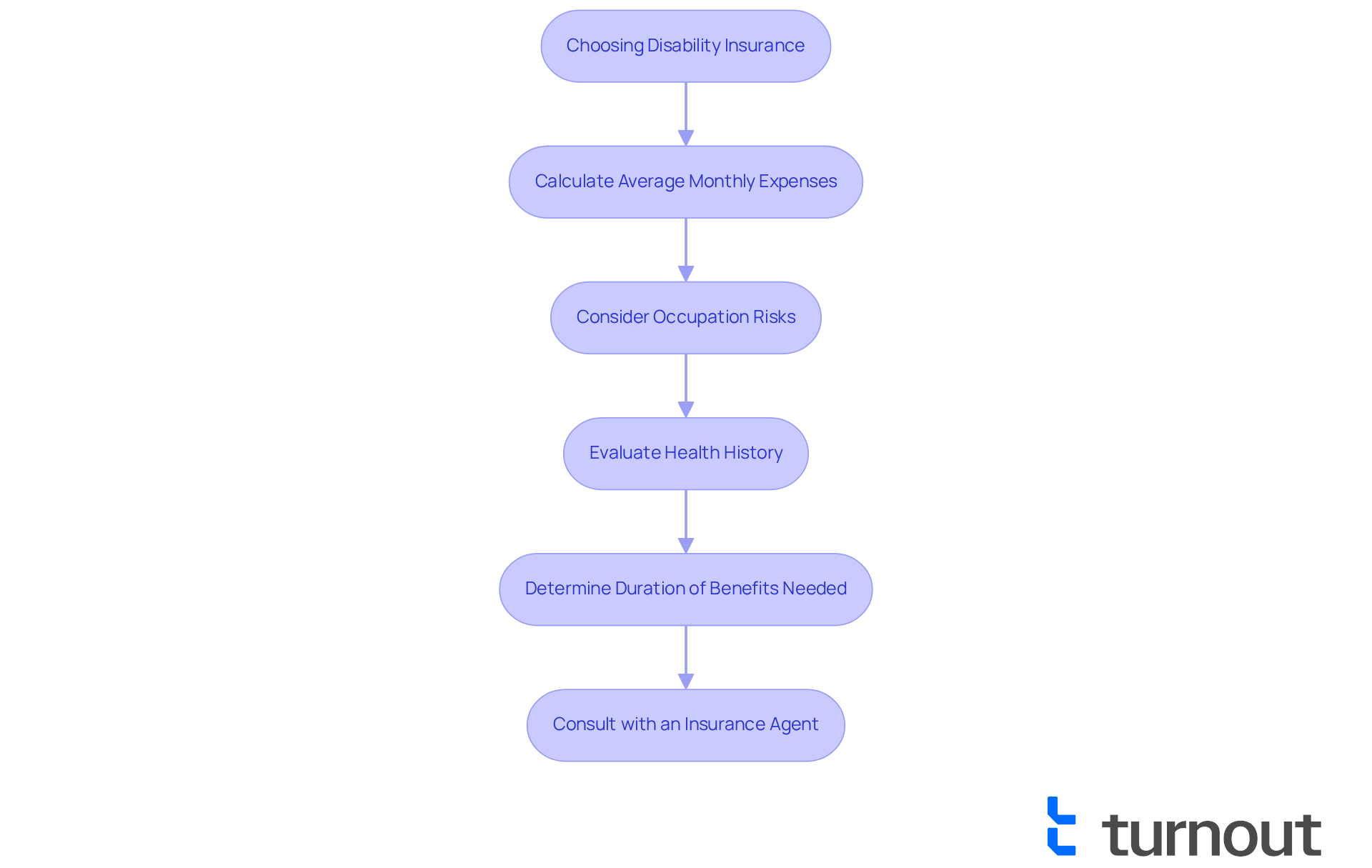

Choosing the right insurance for disabilities companies can feel overwhelming, but you’re not alone in this journey. Start by calculating your average monthly expenses. For many disabled individuals in the U.S., this can be significant - often exceeding $2,000. Understanding this figure is crucial, as it helps determine the income replacement you might need if a disability occurs.

Next, think about your occupation and its associated risks. Some professions, especially those in high-risk categories, may require more extensive coverage. For instance, if you work in a physically demanding job, the likelihood of injury is higher, making comprehensive regulations essential.

Your health history is another important factor. Pre-existing conditions can affect both your eligibility and premium rates. It’s vital to be open about your medical background. Also, consider how long you might need benefits. If you have significant savings, a short-term policy covering up to six months might suffice. However, if your resources are limited, long-term coverage options could provide support until retirement.

We understand that navigating this process can be challenging. Consulting with a knowledgeable insurance agent or advocate can be invaluable. They can offer personalized suggestions based on your unique circumstances, ensuring you choose a policy that meets your financial needs and risk profile.

By following these steps, you can make an informed decision that protects your financial future against the uncertainties related to disability companies. Remember, we’re here to help you every step of the way.

Conclusion

Navigating the world of disability insurance is crucial for protecting your financial stability when faced with unexpected health challenges. We understand that selecting the right coverage can feel overwhelming, but it’s essential. The right policy acts as a vital support system when you’re unable to work due to illness or injury. By grasping the differences between short-term and long-term policies, along with the various criteria for comparison, you empower yourself to make informed decisions that truly reflect your unique needs.

In this article, we’ve highlighted key considerations for evaluating disability insurance providers. Think about factors like:

- Coverage choices

- Definitions of impairment

- Premium costs

- Benefit periods

- Claims processes

- Financial stability

These elements are pivotal in ensuring that the policy you choose adequately protects you against potential income loss. Additionally, our comparative analysis of leading disability insurance companies showcases the diverse options available, each catering to different preferences and requirements.

Ultimately, embarking on the journey to secure the best disability insurance policy is a proactive step in your financial planning. By taking the time to assess your individual circumstances and consulting with knowledgeable professionals, you can choose a policy that not only meets your current needs but also offers peace of mind for the future. Remember, making informed decisions today can lead to greater security tomorrow. Disability insurance is a vital component of a comprehensive financial strategy, and you are not alone in this journey.

Frequently Asked Questions

What is disability insurance?

Disability insurance is a financial safety net that provides income replacement for individuals unable to work due to illness or injury, helping them manage living expenses during recovery.

What are the two main types of disability insurance?

The two main types of disability insurance are short-term and long-term disability insurance. Short-term policies typically cover a limited duration, usually up to six months, while long-term policies can extend for several years or until retirement age.

Why is it important to understand the distinction between short-term and long-term disability insurance?

Understanding the distinction is crucial for choosing the right coverage that fits your unique needs and financial situation, ensuring adequate protection during periods of inability to work.

What percentage of adults in the U.S. live with some type of impairment?

Approximately 28.7% of adults in the U.S. live with some type of impairment.

What does the Social Security Administration estimate about long-term impairments?

The Social Security Administration estimates that one in four 20-year-olds will face a long-term impairment before reaching age 67, highlighting the importance of securing suitable coverage.

How many private sector employees have access to long-term disability coverage?

Approximately 35% of private sector employees have access to long-term support coverage.

What issues do many individuals face regarding their disability coverage?

Many individuals feel their protection is inadequate, often limited to monthly benefits that do not reflect their actual earnings, leaving them vulnerable during critical times.

Why is income protection important in personal finance?

Income protection is a key component of a comprehensive wealth management plan, as it safeguards against income loss and ensures individuals can maintain their standard of living when faced with unforeseen health challenges.

How can individuals navigate their disability insurance decisions?

It is important to grasp the nuances of short-term versus long-term coverage to make informed choices that protect financial stability. Seeking assistance from financial advisors can also help in navigating these decisions.