Introduction

Navigating the world of Social Security Disability Insurance (SSDI) can feel overwhelming. We understand that the complexities of retroactive pay can add to your stress. This financial lifeline is crucial for those who have faced prolonged disability before their application was approved, potentially covering up to a year of benefits.

However, many individuals miss out on these vital funds due to a lack of awareness or missteps in the application process. It’s common to feel lost in the details. What steps must you take to ensure eligibility and successfully claim retroactive pay? How can you avoid the common pitfalls that lead to delays or denials?

We're here to help you navigate this journey with confidence.

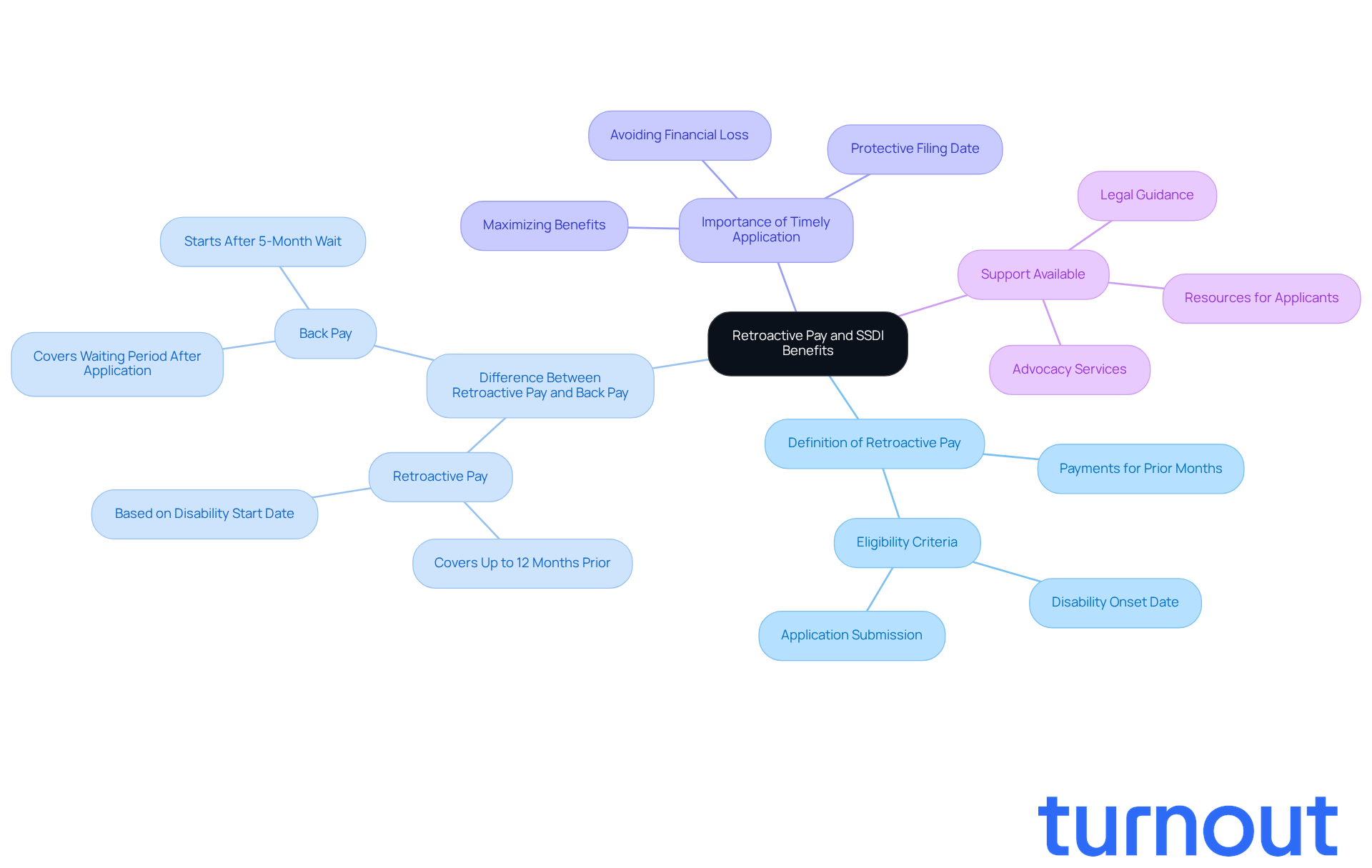

Understand Retroactive Pay and SSDI Benefits

Retroactive pay can be a lifeline for those navigating the complexities of disability benefits. It refers to the payments you may receive for the months leading up to your approval for benefits. Did you know that Social Security Disability Insurance provides for retroactive pay SSDI for up to 12 months prior to your application submission? As long as you can demonstrate that your disability began during that time, this could significantly boost your total benefits. Imagine receiving a lump sum that covers a year’s worth of support - it can make a world of difference.

However, it’s essential to understand the distinction between retroactive pay and back pay. Retroactive pay compensates you for the time from when your disability started until you applied for benefits. In contrast, back pay covers the waiting period after you submit your application until it gets approved, typically starting after a mandatory five-month wait. Knowing these differences is crucial for your financial planning. Missing out on retroactive pay SSDI could mean losing thousands of dollars.

At Turnout, we’re dedicated to making access to government benefits and financial aid easier for you. Our trained nonlawyer advocates are here to guide you through the intricacies of disability claims. Unfortunately, many applicants miss out on retroactive pay SSDI simply because they delay applying. We understand that it can be overwhelming, but applying as soon as you believe your disability prevents you from working is vital to maximizing your benefits.

Experts emphasize that without legal counsel, individuals may overlook essential assistance they’re entitled to. You are not alone in this journey, and we’re here to help you navigate these challenges. Remember, understanding retroactive pay SSDI can be the key to securing the support you need.

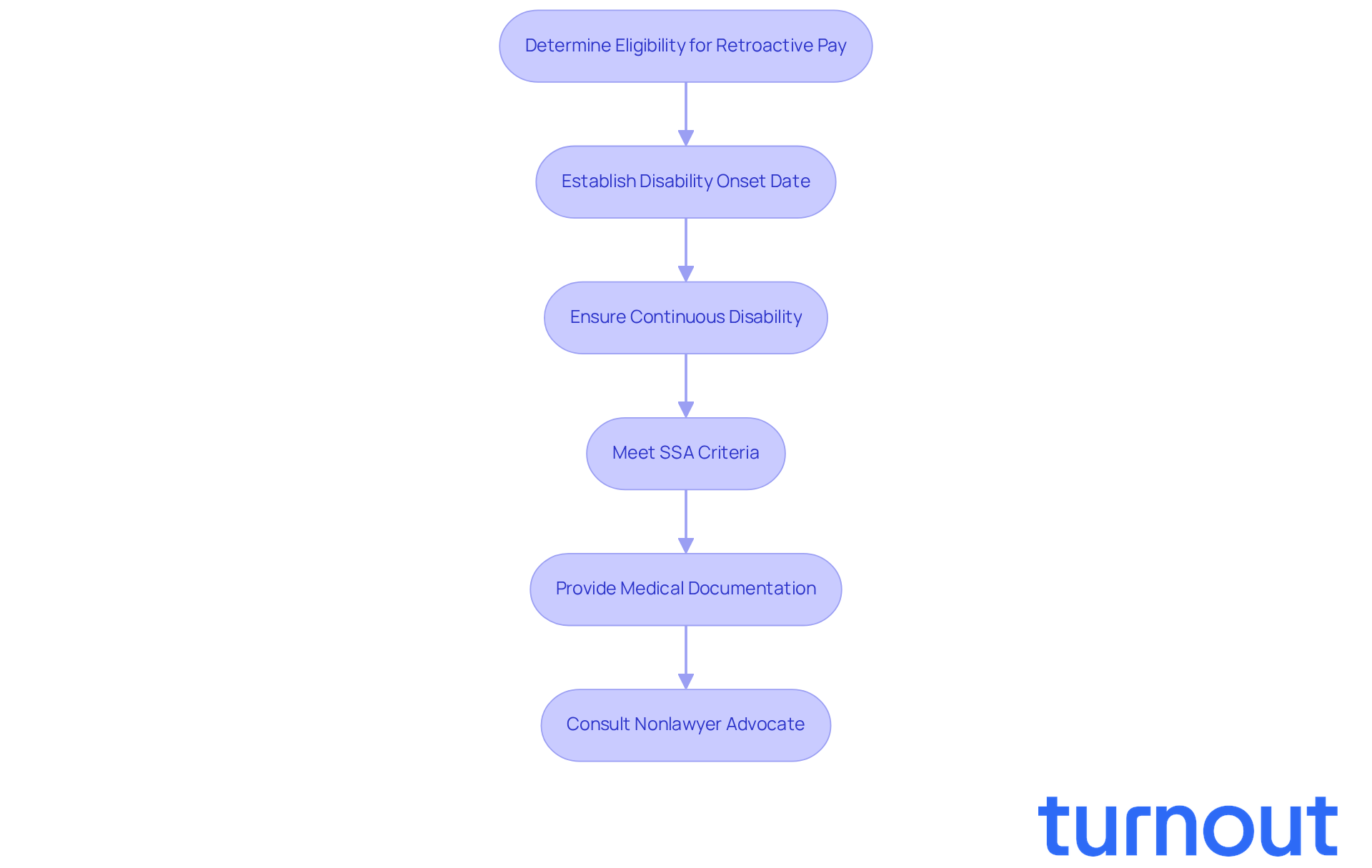

Determine Your Eligibility for Retroactive Pay

Determining your eligibility for retroactive pay can feel overwhelming, but we're here to help. The first step is to establish your disability onset date, which marks when your disability began. This date is crucial because it dictates how far back you can request benefits.

It's important to ensure that you've been continuously disabled and that your condition meets the Social Security Administration's (SSA) criteria for SSDI. You’ll also need to provide medical documentation that supports your claim. If your disability started at least five months before your application date, you may qualify for retroactive benefits.

We understand that navigating these requirements can be challenging. That’s why it’s recommended to speak with a trained nonlawyer advocate from Turnout. They specialize in assisting clients with SSD requests, guiding you through the process without the need for legal representation. Remember, you are not alone in this journey.

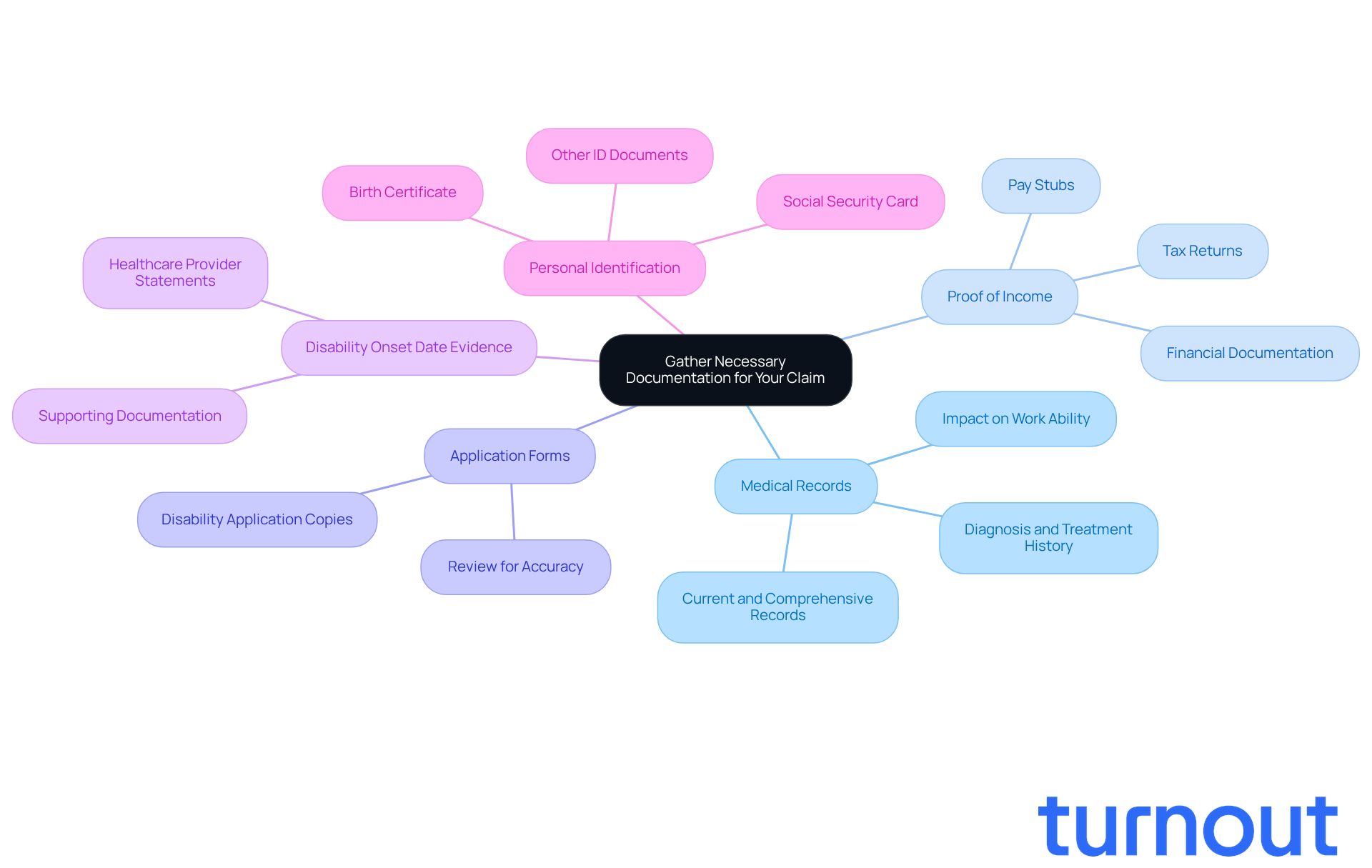

Gather Necessary Documentation for Your Claim

Navigating the process of claiming retroactive pay ssdi can feel overwhelming, but you’re not alone. Turnout is here to help you every step of the way. To successfully claim what you deserve, gathering a few key documents is essential:

-

Medical Records: These should clearly outline your diagnosis, treatment history, and how your disability impacts your ability to work. Reliable medical evidence is crucial, as it significantly affects the outcome of SSDI applications and retroactive pay ssdi. Our trained nonlawyer advocates can guide you on which specific medical documentation will be most effective.

-

Proof of Income: Be sure to include tax returns, pay stubs, or any other income documentation that supports your claim. This information helps establish your financial status during the period in question. Our team is ready to advise you on how to present this information effectively.

-

Application Forms: Keep copies of all forms submitted to the Social Security Administration (SSA), including your disability application. Accurate documentation is vital; errors can lead to delays or denials. Turnout can assist you in reviewing these forms to ensure everything is complete.

-

Disability Onset Date Evidence: Collect documentation that supports your claimed onset date, such as medical records or statements from healthcare providers. This evidence is critical for establishing the timeline of your disability. Our advocates can help you compile this information.

-

Personal Identification: Don’t forget to include a copy of your Social Security card, birth certificate, or other identification. This helps verify your identity and eligibility.

It’s important to remember that Turnout is not a law firm and does not provide legal representation. Organizing these documents clearly and systematically can make the process smoother. Successful disability benefits requests often stem from well-structured documentation that presents a compelling argument for retroactive pay ssdi. Regular communication with your healthcare providers can ensure your medical records are current and thorough, further strengthening your submission.

Recent articles emphasize the importance of careful documentation in SSDI requests, noting that many initial submissions are rejected due to inadequate or outdated information. By taking the time to gather and organize these documents, with the support of Turnout's trained advocates, you can significantly improve your chances of a successful request. Remember, we’re here to help you through this journey.

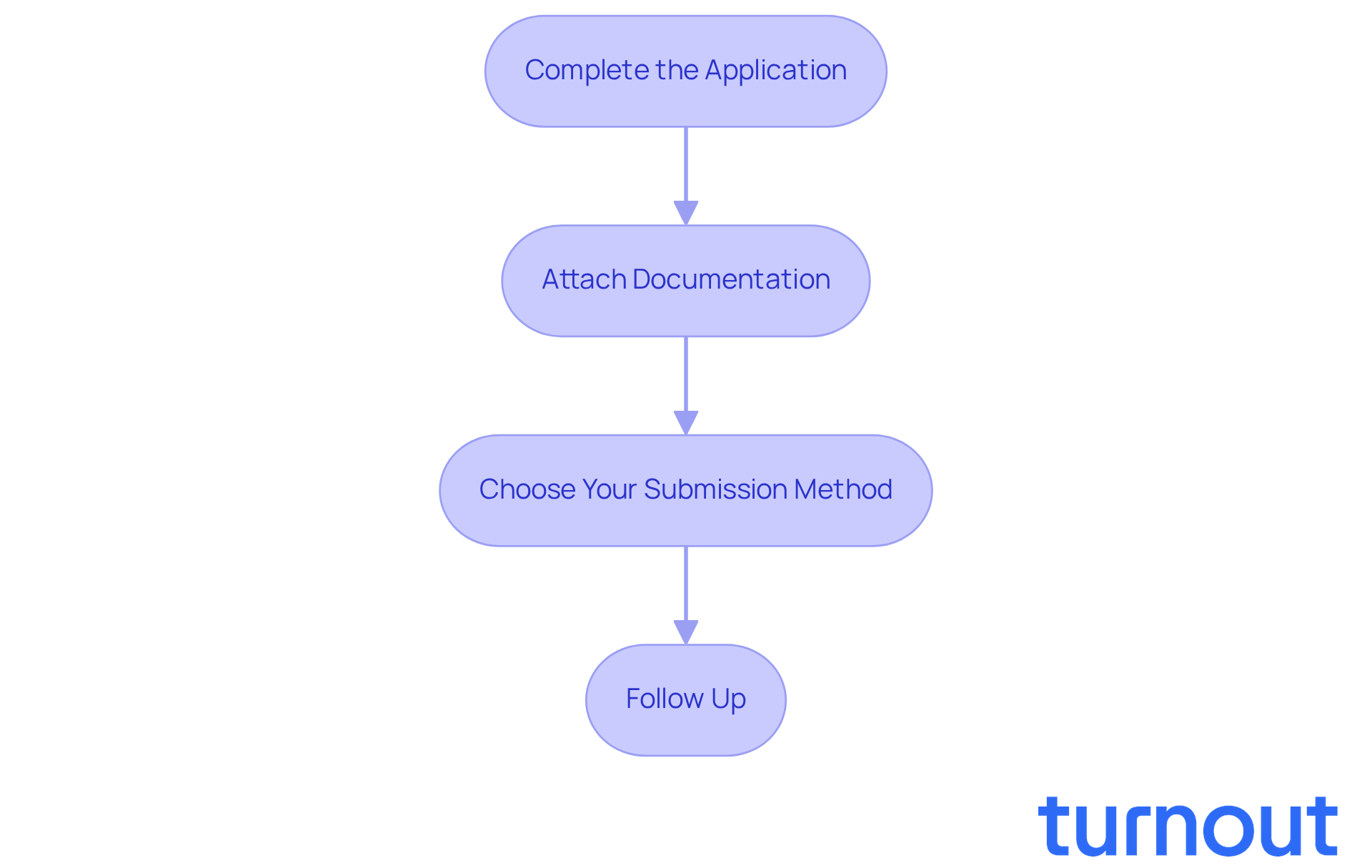

Submit Your Claim for Retroactive Pay

To submit your claim for retroactive pay, let’s walk through these steps together:

-

Complete the Application: It’s important to fill out your SSDI application completely. Providing all necessary information helps avoid delays, and we understand how frustrating that can be.

-

Attach Documentation: Gather and organize your supporting documents, like medical records and work history. Clearly label each item to make the review process smoother. Remember, thorough preparation can make a big difference.

-

Choose Your Submission Method: You have options! Submit your request online via the SSA website, by mail, or in person at your local SSA office. Online submissions are usually faster, but visiting in person can help clarify any questions right away.

-

Follow Up: After you submit, keep an eye on your request status. You can create an account on the SSA website or call their office. Regular follow-ups are key to ensuring your request is processed smoothly and to address any potential issues promptly.

We understand that waiting for the review process, which typically takes three to five months, can be challenging. Setting realistic expectations is important. Many successful requests for disability benefits, such as retroactive pay ssdi, are backed by extensive documentation and clear communication with the SSA. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

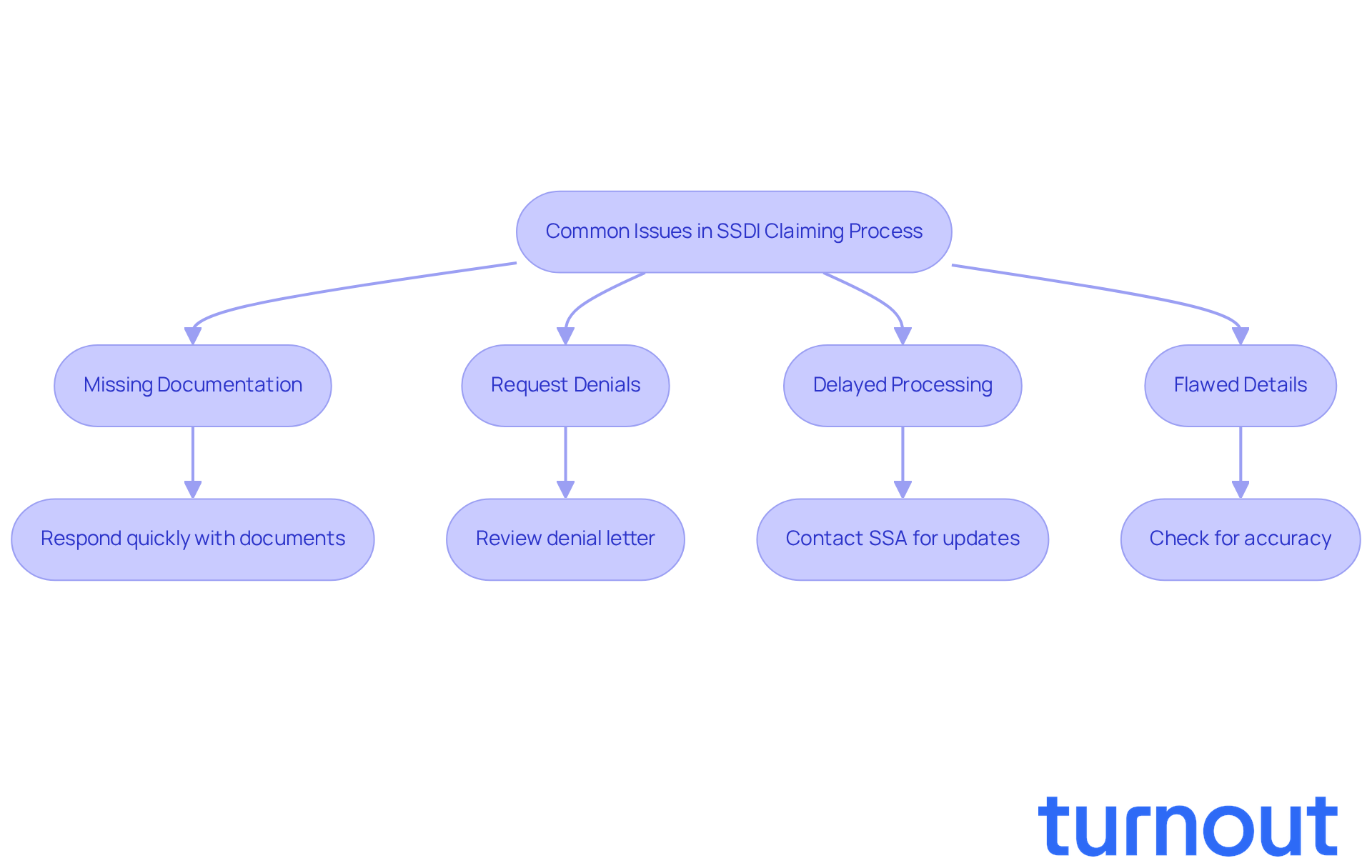

Troubleshoot Common Issues in the Claiming Process

Navigating the SSDI claiming process can feel overwhelming, and it’s common to encounter challenges along the way. Here are some key areas to keep an eye on and how you can address them:

-

Missing Documentation: If the Social Security Administration (SSA) asks for more information, it’s important to respond quickly with the necessary documents. Missing paperwork is a frequent cause of delays and denials, and we understand how frustrating that can be.

-

Request Denials: If your request is denied, take a moment to carefully review the denial letter. Understanding the specific reasons can help you move forward. Remember, you have 60 days from the date of denial to file an appeal, which is crucial for maintaining your eligibility for benefits.

-

Delayed Processing: If your claim seems to be taking longer than expected, don’t hesitate to reach out to the SSA for an update. Delays often happen due to missing information or high submission volumes, especially with staffing reductions at the SSA.

-

Flawed Details: Make sure all the information in your submission is accurate and up-to-date. Errors can lead to significant delays or outright denials. In fact, the SSA reported that 62% of initial applications were denied in 2024, often due to such inaccuracies.

By being proactive and aware of these common issues, you can significantly enhance your chances of a successful SSDI application. Remember, while Turnout is not a law firm and does not provide legal representation, having experienced support from trained nonlawyer advocates can greatly improve approval rates for SSD claims at the hearing level. You don’t have to navigate this process alone - consider seeking assistance to help overcome these challenges. We're here to help you every step of the way.

Conclusion

Understanding the complexities of retroactive pay related to Social Security Disability Insurance (SSDI) is crucial for individuals facing disabilities. We know that navigating this process can feel overwhelming, but this guide is here to help you claim the retroactive pay you deserve. By applying promptly and ensuring thorough documentation, you can maximize your benefits and secure your financial stability.

Have you ever wondered about the difference between retroactive pay and back pay? Grasping these concepts can empower you to prepare for the financial support you need. This article has outlined essential steps to help you on your journey. Start by determining your eligibility based on the onset date of your disability. Gather the necessary documentation and submit your claims effectively.

It's common to face challenges during the claiming process, such as missing paperwork or request denials. But don’t worry; practical solutions are available to help you navigate these hurdles. With the support of trained nonlawyer advocates, like those at Turnout, you can streamline your claims and improve your chances of receiving the benefits you need.

Taking proactive steps to understand and claim retroactive pay SSDI is vital for securing the financial assistance you deserve. We encourage you to act promptly and seek guidance to ensure you don’t miss out on potential benefits. By staying informed and organized, you can navigate the SSDI process with confidence, ensuring you receive the support necessary to enhance your quality of life. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is retroactive pay in relation to SSDI benefits?

Retroactive pay refers to the payments you may receive for the months leading up to your approval for Social Security Disability Insurance (SSDI) benefits, specifically for up to 12 months prior to your application submission, as long as you can demonstrate that your disability began during that time.

How does retroactive pay differ from back pay?

Retroactive pay compensates for the time from when your disability started until you applied for benefits, while back pay covers the waiting period after you submit your application until it gets approved, typically starting after a mandatory five-month wait.

Why is it important to apply for SSDI benefits as soon as possible?

Applying as soon as you believe your disability prevents you from working is vital to maximizing your benefits, as delays may lead to missing out on retroactive pay SSDI, potentially resulting in the loss of thousands of dollars.

What is the first step in determining eligibility for retroactive pay?

The first step is to establish your disability onset date, which marks when your disability began, as this date dictates how far back you can request benefits.

What criteria must be met to qualify for retroactive benefits?

You must ensure that you have been continuously disabled and that your condition meets the Social Security Administration's (SSA) criteria for SSDI. Additionally, you will need to provide medical documentation that supports your claim.

How can Turnout assist individuals in navigating the SSDI process?

Turnout provides trained nonlawyer advocates who specialize in assisting clients with SSD requests, guiding them through the process without the need for legal representation.