Introduction

Navigating the labyrinth of tax amendments can feel overwhelming. We understand that the process may seem daunting, but grasping their significance is essential for maximizing your potential refunds. These adjustments give you the chance to correct previous mistakes, like missed deductions or incorrect income reporting, which can significantly affect your financial situation.

However, checking the status of an amended return can often lead to confusion and uncertainty. How can you effectively track your tax amendment refund status without losing patience? You're not alone in this journey. This guide offers a clear, step-by-step approach to help you demystify the process, ensuring you stay informed and empowered as you navigate your financial path.

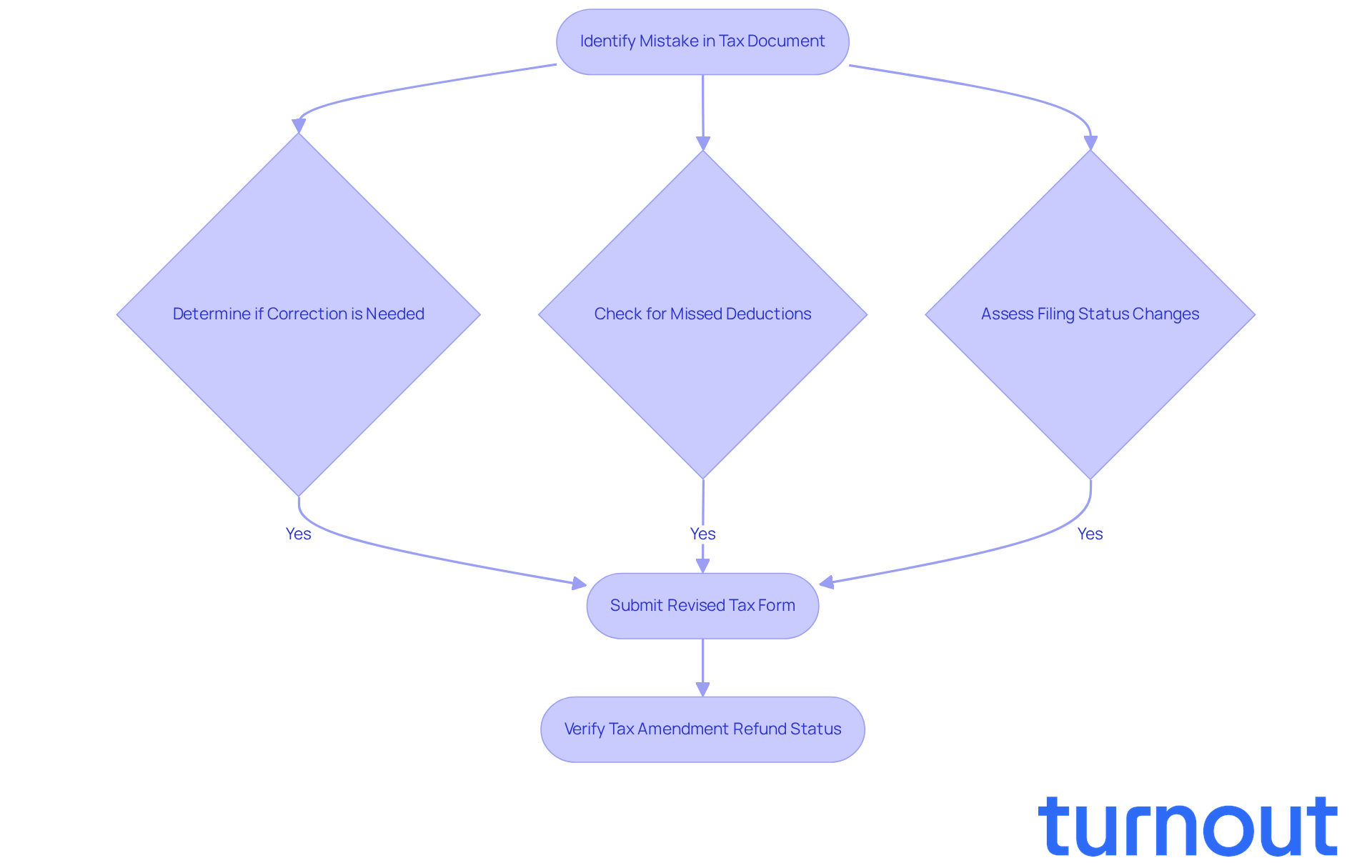

Understand Tax Amendments and Their Importance

Tax amendments are important adjustments you can make to a tax document you've already submitted. They give you the chance to correct mistakes, like reporting the wrong income, missing out on deductions, or changes in your filing status.

We understand that navigating taxes can be overwhelming, and that’s why it’s crucial to recognize the significance of these amendments. They can greatly impact your tax liability and the refunds you might receive. For instance, if you discover that you missed a deduction that could improve your tax amendment refund status, submitting a corrected form can help you reclaim that money.

It’s common to feel uncertain about the process, but remember, you generally need to submit a revised tax form within three years of your initial filing date to determine your tax amendment refund status and request any additional refunds. This knowledge is vital, as it underscores the importance of verifying the tax amendment refund status of your revised submission.

We're here to help you through this journey, ensuring you don’t miss out on what you deserve.

Follow the Steps to Check Your Amended Tax Return Status

To check the status of your amended tax return, follow these caring steps:

-

Wait for the Appropriate Timeframe: We understand that waiting can be tough. You can check your tax amendment refund status approximately three weeks after submission. The IRS usually handles corrected submissions within 8 to 12 weeks, but sometimes it may take up to 16 weeks due to various factors like mistakes or missing details. Patience is key during this time.

-

Visit the IRS Website: When you're ready, access the IRS 'Where's My Amended Return?' tool at IRS.gov. This helpful tool is available 24/7, except for scheduled maintenance on Mondays from midnight to 3 a.m. Eastern time and occasional Sundays from 1 to 7 a.m. Eastern time.

-

Enter Your Information: To get started, provide your Social Security number, date of birth, and ZIP code. Make sure this information matches what you submitted on your revised filing to avoid any discrepancies.

-

Review Your Status: After entering your information, you’ll see the status of your revised submission. It may indicate whether your submission is pending, processing, or approved. If it’s still pending after 12 weeks, it might need further review due to errors or missing information. Please note that the 'Where's My Amended Return?' tool cannot provide updates for specific categories of returns, such as business transactions and those handled by specialized units.

-

Call the IRS if Required: If you encounter any issues or your situation hasn’t changed after the expected processing time, don’t hesitate to reach out to the IRS at 1-866-464-2050 for assistance. For current-year refund information, you can call 800-829-1954. Be prepared to provide your personal information for verification.

By following these steps, you can effectively track your tax amendment refund status and stay informed about any possible refunds. Remember, you’re not alone in this journey; we’re here to help.

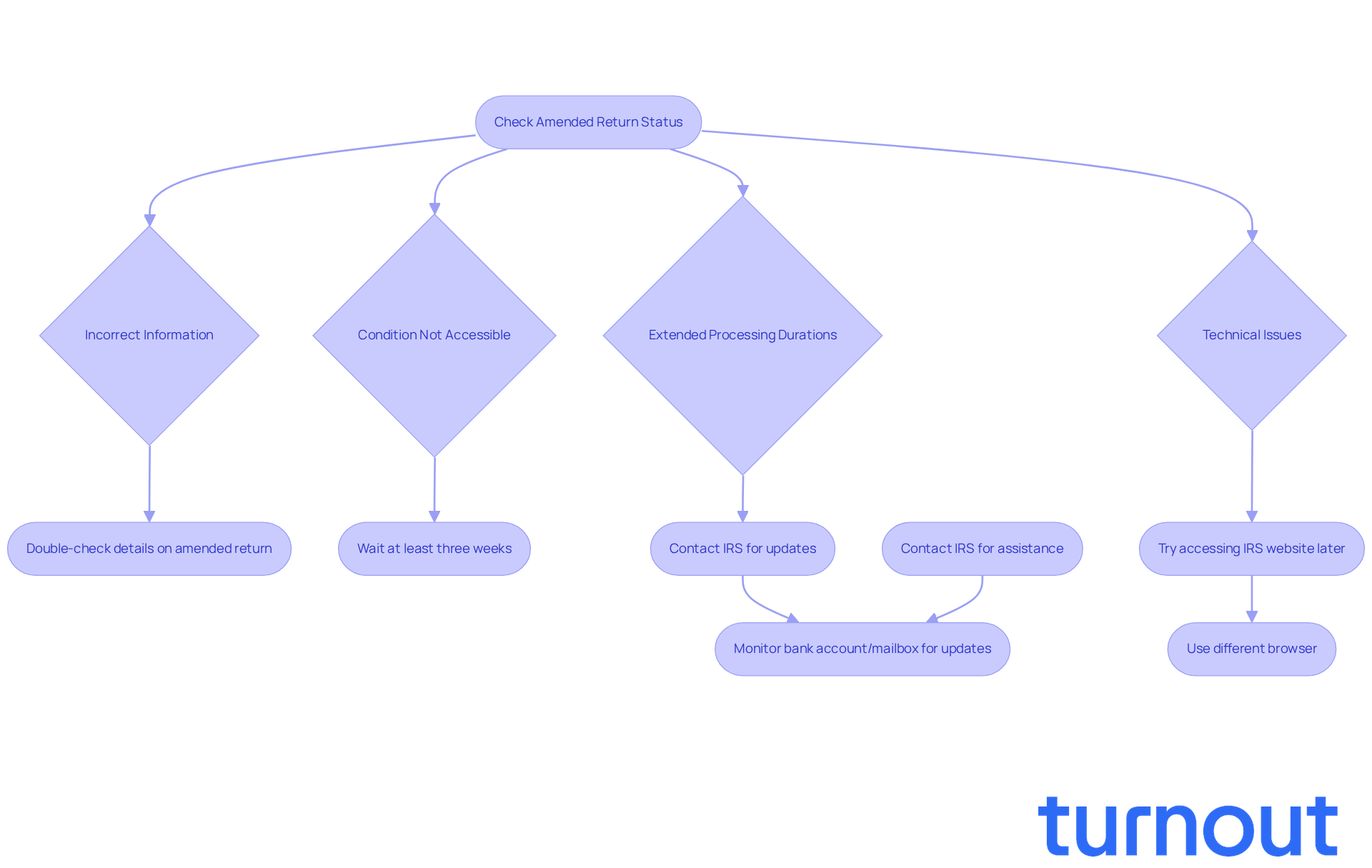

Troubleshoot Common Issues with Amended Return Status Checks

When reviewing the tax amendment refund status of your modified tax filing, it’s common to encounter a few challenges. We understand that this process can be stressful, so here’s how to troubleshoot effectively:

-

Incorrect Information: Double-check that the details you entered match exactly what was on your amended return. Even small mistakes, like a typo in your Social Security number or ZIP code, can obstruct access to your information.

-

Condition Not Accessible: If your condition isn’t accessible yet, it might simply be too early to check. Typically, waiting at least three weeks after submitting your revised document is a good rule of thumb before trying to confirm your tax amendment refund status.

-

Extended Processing Durations: If it’s been over 12 weeks since you submitted your revised filing and you still can’t verify your status, don’t hesitate to reach out to the IRS for assistance. They can provide updates on your processing timeline. As Mark Friedlich, Vice President of US Affairs for Wolters Kluwer Tax & Accounting, noted, the IRS is working hard to handle these submissions quickly, but it’s important to be prepared for longer wait times for refunds or processing.

-

Technical Issues: If you’re having trouble accessing the IRS website, try again later or use a different browser. If problems persist, contacting the IRS can also help you get updates on the situation.

-

Follow-Up on Refunds: If your revised filing impacts the tax amendment refund status and results in a refund, be ready for some additional processing time. Keep an eye on your bank account or mailbox for updates regarding your refund. Remember, the Where’s My Amended Return tool is available 24/7, except for Mondays from 12 - 3 a.m. Eastern time and occasional Sundays from 1 - 7 a.m. Eastern time.

By understanding these common issues and knowing how to resolve them, you can approach the process of checking your revised status with greater confidence and efficiency. It’s also crucial to remember that the responsibility to correct errors on taxes lies with you, even if the mistake was made by someone else. While audits are generally rare, filing an amended return may increase the chances of an audit due to discrepancies.

You are not alone in this journey, and we’re here to help you navigate through it.

Conclusion

Understanding the process of checking your tax amendment refund status is essential for anyone looking to correct their tax filings. We know that tax amendments can feel overwhelming, but they allow you to make necessary adjustments to previously submitted returns, ensuring accuracy and potentially increasing your refunds. By familiarizing yourself with the steps and tools available, you can confidently navigate this often complex landscape.

This article outlines a clear, step-by-step approach to checking the status of an amended tax return. Remember, patience and attention to detail are key. Key points include:

- The appropriate timeframe for checking status

- How to effectively use the IRS's online tools

- Troubleshooting common issues that may arise during the process

Each step is designed to empower you, ensuring you remain informed and proactive about your financial rights.

Ultimately, staying informed about tax amendments and the refund process is crucial for maximizing your potential refunds and correcting errors. We encourage you to take action promptly, utilize available resources, and seek assistance when needed. By doing so, you can ensure you receive the refunds you deserve and maintain your financial well-being. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What are tax amendments?

Tax amendments are adjustments you can make to a tax document you've already submitted, allowing you to correct mistakes such as reporting incorrect income, missing deductions, or changes in your filing status.

Why are tax amendments important?

Tax amendments are important because they can significantly impact your tax liability and the refunds you may receive. Correcting errors or claiming missed deductions can help you reclaim money you are entitled to.

How can tax amendments affect my refund?

If you discover that you missed a deduction that could enhance your tax refund, submitting a corrected form as a tax amendment can help you reclaim that money.

How long do I have to submit a tax amendment?

You generally need to submit a revised tax form within three years of your initial filing date to determine your tax amendment refund status and request any additional refunds.

What should I verify after submitting a tax amendment?

After submitting a tax amendment, it is vital to verify the tax amendment refund status of your revised submission to ensure you receive any potential refunds you are eligible for.