Overview

We understand that checking your Missouri tax refund status can be a bit daunting. To make this process easier, gather essential information such as:

- Your Social Security number

- Filing classification

- Anticipated reimbursement amount

- The tax year

This article provides a step-by-step guide to help you navigate the Missouri Department of Revenue website and input your details accurately.

It's common to feel anxious about potential delays, but accuracy is key to ensuring a smooth verification of your refund status. By following the outlined steps, you can gain peace of mind knowing that you're taking the right actions. Remember, you're not alone in this journey; we're here to help you every step of the way.

Introduction

Navigating the complexities of tax refunds can feel overwhelming, especially for residents of Missouri who may be uncertain about their reimbursement status. We understand that this uncertainty can cause anxiety, and that’s why knowing how to check your tax refund is so important. It not only alleviates worry but also empowers you to stay informed about your finances.

However, with various requirements and potential pitfalls, it's common to feel lost in the process. How can you ensure a smooth experience while verifying your Missouri tax refund? This guide offers a clear, step-by-step approach designed to help you efficiently check your refund status while addressing the common challenges you may encounter. Remember, you're not alone in this journey—we're here to help.

Gather Required Information for Your Tax Refund Status

To check your state of Missouri tax refund status, it's important to gather a few essential pieces of information. We understand that this process can feel overwhelming, but having the right details will help you navigate it more smoothly.

- Social Security Number: Start with the first Social Security number listed on your tax return.

- Filing Classification: Identify your filing classification, whether you are single, married filing jointly, or another status.

- Anticipated Reimbursement Amount: Enter the whole dollar amount you expect to receive as a reimbursement.

- Tax Year: Specify the tax year for which you are checking the reimbursement status.

By preparing this information in advance, you can make the process quicker and more efficient.

It's common to feel uncertain when verifying the state of Missouri tax refund status; roughly 30% of taxpayers in Missouri encounter challenges, often due to missing or incorrect details. Tax professionals emphasize how crucial it is to gather the required information accurately to avoid delays. Remember, you are not alone in this journey.

According to the state's Department of Revenue, "The region allows specific deductions and credits that can lower your taxable income and overall tax obligation." For the 2025 tax year, please ensure you are aware of the requirements for the state of Missouri tax refund. These may include additional documentation for certain situations, such as proof of income or residency. By preparing ahead of time, you can approach your inquiry about returns with confidence, knowing that help is available when you need it.

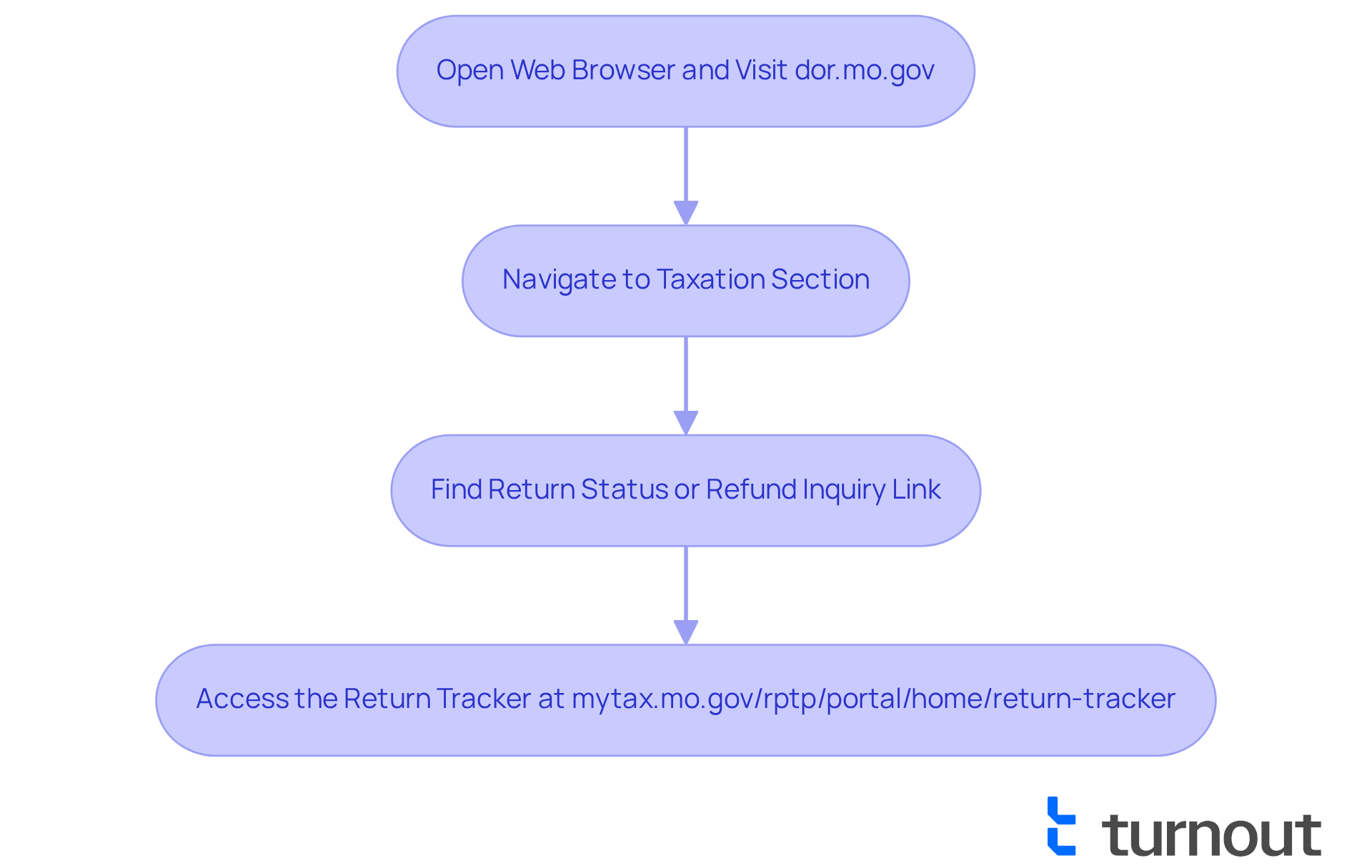

Access the Missouri Department of Revenue Website

We understand that checking your tax refund status can feel overwhelming at times. To help you through this process, follow these simple steps:

- Open your web browser and visit the official website of the Department of Revenue: dor.mo.gov.

- Navigate to the Taxation section, where you'll find helpful resources.

- Look for the Return Status or Refund Inquiry link. This will guide you to the Return Inquiry System for the state of Missouri tax refund, making it easier for you to find the information you need.

- Alternatively, if you prefer a direct approach, you can access the Return Tracker for your state of Missouri tax refund at mytax.mo.gov/rptp/portal/home/return-tracker.

Remember, you're not alone in this journey, and we're here to help you every step of the way.

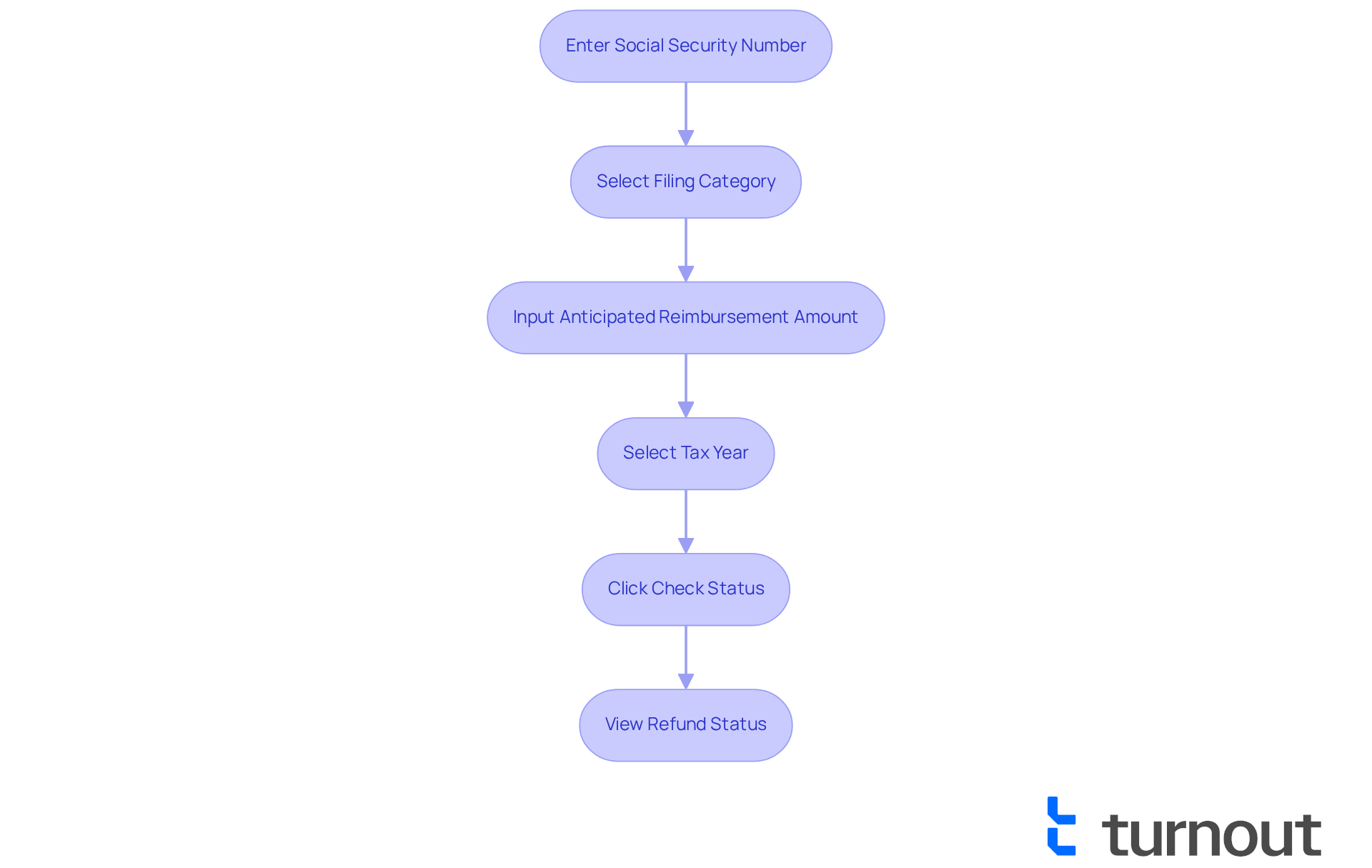

Input Your Personal Information to Check Status

Once you are on the Missouri Return Inquiry System page, we invite you to follow these simple steps:

- Enter your Social Security Number: Please input the first social security number shown on your tax return.

- Select your Filing Category: Choose your filing category from the dropdown menu.

- Input the Anticipated Reimbursement Amount: Enter the whole dollar amount of your expected reimbursement.

- Select the Tax Year: Choose the appropriate tax year for your return.

- Click on the Check Status button to submit information regarding your state of Missouri tax refund.

After you submit, the system will display your information regarding the state of Missouri tax refund, including whether it has been processed or if there are any issues.

We understand that verifying your reimbursement can sometimes be challenging. Frequent issues may arise, such as mathematical mistakes on your return, utilizing various form types, or supplying incomplete details. For instance, if you accidentally input an incorrect reimbursement amount or forget to select the right tax year, it could lead to delays in processing your state of Missouri tax refund. If you encounter difficulties, please ensure that all information is accurate and complete before resubmitting your inquiry.

In the state of Missouri, tax refunds for electronically filed returns are typically processed within five business days, while paper returns may take up to four weeks after mailing. If you need further assistance, remember that you're not alone in this journey. Consider utilizing resources like H&R Block, which offers guidance on tax adjustments and deductions that may be relevant to your situation. We're here to help you navigate these challenges with care.

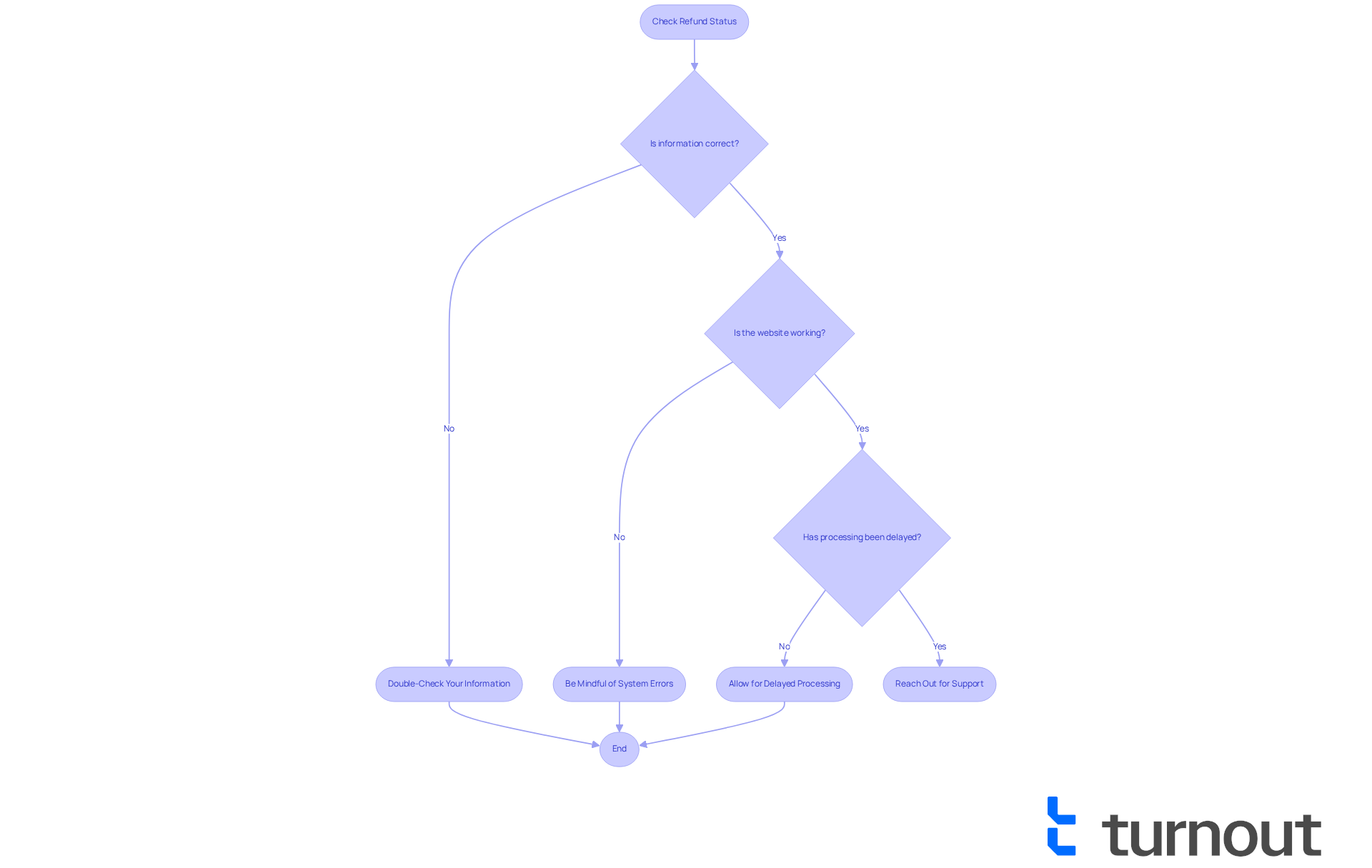

Troubleshoot Common Issues When Checking Your Refund Status

We understand that checking your refund status can sometimes be frustrating. If you encounter issues, consider these helpful tips:

- Double-Check Your Information: Ensure that your Social Security Number, filing category, refund amount, and tax year are entered correctly. Even small discrepancies can lead to errors.

- Be Mindful of System Errors: If the website isn't responding, it’s okay to try again later or switch to a different browser. Technical glitches happen to everyone.

- Allow for Delayed Processing: If you recently filed your return, it may take a few days for the system to update your status. We recommend waiting at least 5 business days for e-filed returns or 3-4 weeks for paper returns before checking again.

- Reach Out for Support: If you continue to experience difficulties, remember that you are not alone. For assistance with your state of Missouri tax refund, contact the Missouri Department of Revenue at 1-573-751-3505. We're here to help you through this process.

Conclusion

Checking the status of your Missouri tax refund can feel overwhelming, but with the right information and tools, you can navigate this process with ease. This guide is designed to help you gather essential details—like your Social Security number, filing classification, anticipated reimbursement amount, and the relevant tax year—so you can approach the Missouri Department of Revenue website confidently.

We understand that accurately inputting your personal information is crucial. Common pitfalls can lead to delays, and we want to help you avoid those. It’s also important to know the typical processing times for electronically filed returns versus paper returns. Should you encounter any issues during your status check, we’ve included helpful troubleshooting tips to guide you.

In summary, checking your Missouri tax refund status isn’t just about accessing information; it’s about being proactive and prepared. By ensuring that all your details are entered correctly and knowing when to seek assistance, you can significantly enhance your experience. Remember, you are not alone in this journey—empowerment through knowledge is key. We encourage you to leverage the resources available through the Missouri Department of Revenue, and don’t hesitate to seek help if you need it. Taking action now can lead to a smoother and more efficient tax refund experience.

Frequently Asked Questions

What information do I need to check my Missouri tax refund status?

To check your Missouri tax refund status, you need your Social Security number, your filing classification (e.g., single, married filing jointly), the anticipated reimbursement amount (in whole dollars), and the tax year for which you are checking the status.

Why is it important to gather this information before checking my tax refund status?

Gathering the required information in advance helps make the process quicker and more efficient, reducing the chances of encountering challenges, which about 30% of taxpayers in Missouri experience due to missing or incorrect details.

What challenges might I face when checking my tax refund status?

Common challenges include missing or incorrect details, which can lead to delays in processing your refund. It is essential to have accurate information to avoid these issues.

Are there specific deductions or credits I should be aware of for the Missouri tax refund?

Yes, the state allows specific deductions and credits that can lower your taxable income and overall tax obligation. It is advisable to be aware of these for the tax year you are inquiring about.

What additional documentation might I need for certain situations regarding my tax refund?

Depending on your situation, you may need additional documentation such as proof of income or residency to support your tax refund inquiry.

What should I do if I need help while checking my tax refund status?

If you need help, remember that assistance is available, and you can reach out to tax professionals or the Missouri Department of Revenue for guidance.