Introduction

Navigating the complexities of tax filings can often feel overwhelming. We understand that mistakes can happen, leading to the need for an amendment. Knowing how to check the status of a federal tax amendment is essential for anyone seeking clarity and peace of mind about their financial responsibilities.

It's common to feel anxious when waiting for the IRS to process your amendment, which can take several weeks. You might be wondering: how can you efficiently track your amended return status and ensure that your corrections are being handled properly? This guide is here to help.

We’ll walk you through a step-by-step approach to demystifying the process. By the end, you’ll feel empowered to take control of your amended tax returns with confidence. Remember, you are not alone in this journey; we’re here to help.

Understand Amended Tax Returns

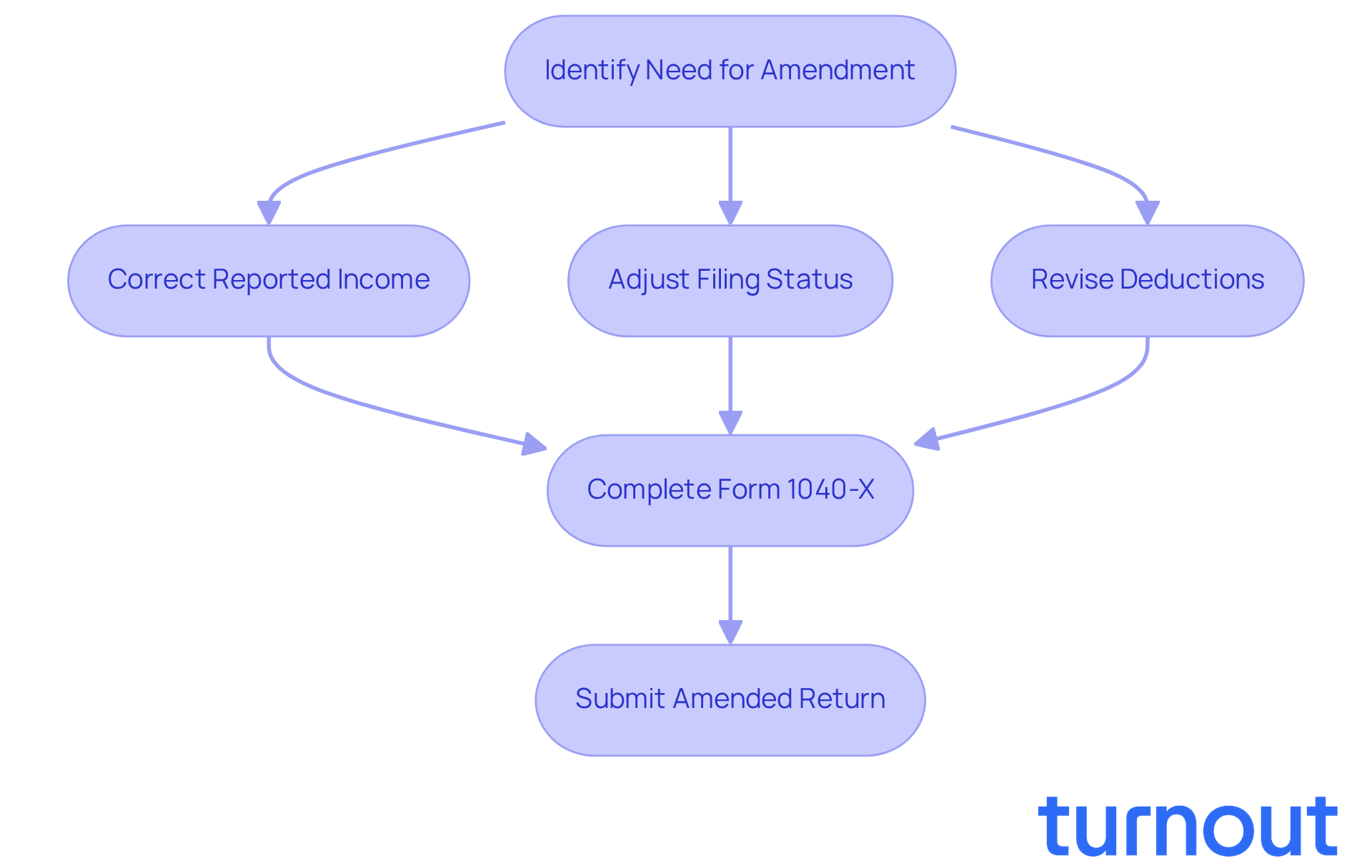

A revised tax document is more than just a form; it’s a vital step towards correcting mistakes and ensuring your tax filings are accurate. We understand that navigating tax issues can be overwhelming, and that’s why it’s important to know how to amend your tax statement when needed. Common reasons for submitting an amended tax form include:

- Correcting reported income

- Adjusting your filing status

- Revising deductions

The designated form for this purpose is Form 1040-X. This tool allows you to rectify mistakes and potentially claim refunds you deserve. Remember, modifications can only be made for submissions filed within the last three tax years, and processing these changes may take several weeks.

It’s common to feel anxious about tax filings, especially when errors occur. According to tax experts, frequent mistakes often arise from misreported income or missed deductions. This highlights the importance of a thorough review before submission. Each year, around 2-3% of taxpayers submit revised documents. While changes aren’t the norm, they are crucial for maintaining tax precision.

Real-world examples show that many taxpayers have successfully utilized Form 1040-X to correct their filings, leading to significant refunds and peace of mind. If you find yourself in this situation, remember: you’re not alone in this journey. We’re here to help you navigate the process and ensure your tax filings reflect your true financial situation.

Steps to Check Your Amended Tax Return Status

-

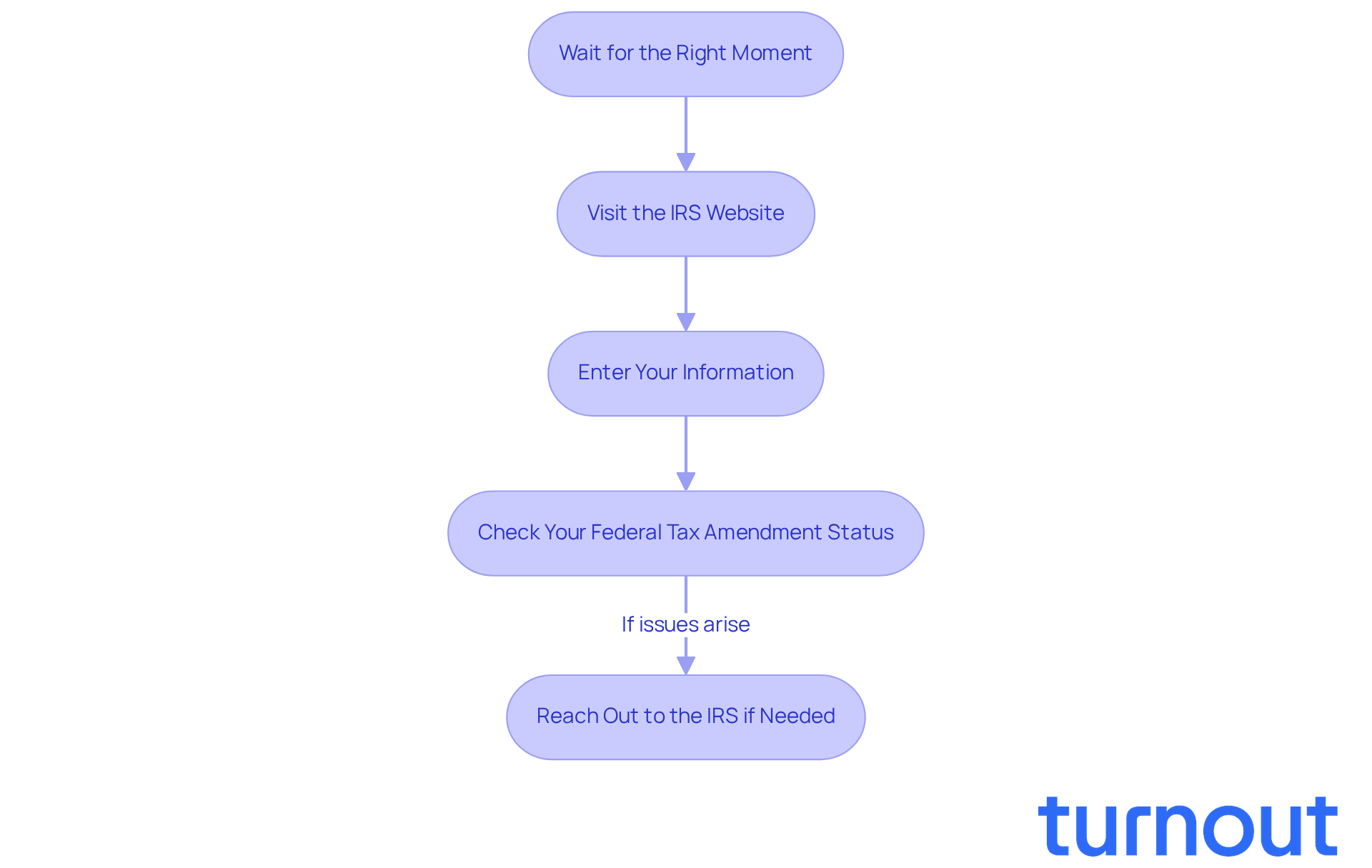

Wait for the Right Moment: After you’ve submitted your revised filing, it’s important to give yourself some time. We recommend waiting at least three weeks before checking the status. This allows the IRS enough time to process your submission related to federal tax amendment status. Generally, you should expect the federal tax amendment status of your Form 1040-X to be processed within 8 to 12 weeks, but sometimes it can take up to 16 weeks. We understand that waiting can be tough, but patience is key.

-

Visit the IRS Website: When you’re ready, head over to the IRS 'Where's My Amended Return?' tool at IRS.gov. This helpful online resource is available 24/7, except for brief maintenance periods. It’s a great way to stay informed about your submission.

-

Enter Your Information: To check your status, you’ll need to provide your Social Security number, date of birth, and ZIP code. Make sure this information matches what you submitted on your revised filing. We know it can feel overwhelming, but this step is straightforward.

-

Check your federal tax amendment status: Once you enter your information, the tool will show you the status of your revised submission. It will indicate whether it’s pending, processing, or finished. Keep in mind that the 'Where's My Amended Return?' tool may not provide status for certain submissions, like business tax filings or those sent by mail. As of 2025, millions of taxpayers have relied on this tool to effectively track their amendments, so you’re in good company.

-

Reach Out to the IRS if Needed: If you run into any issues or your status hasn’t updated after 12 weeks, don’t hesitate to call the IRS at 1-866-464-2050 for assistance. Tax experts recommend this step to help address any potential problems promptly. Remember, you’re not alone in this journey; we’re here to help.

Troubleshoot Common Issues with Amended Return Status

-

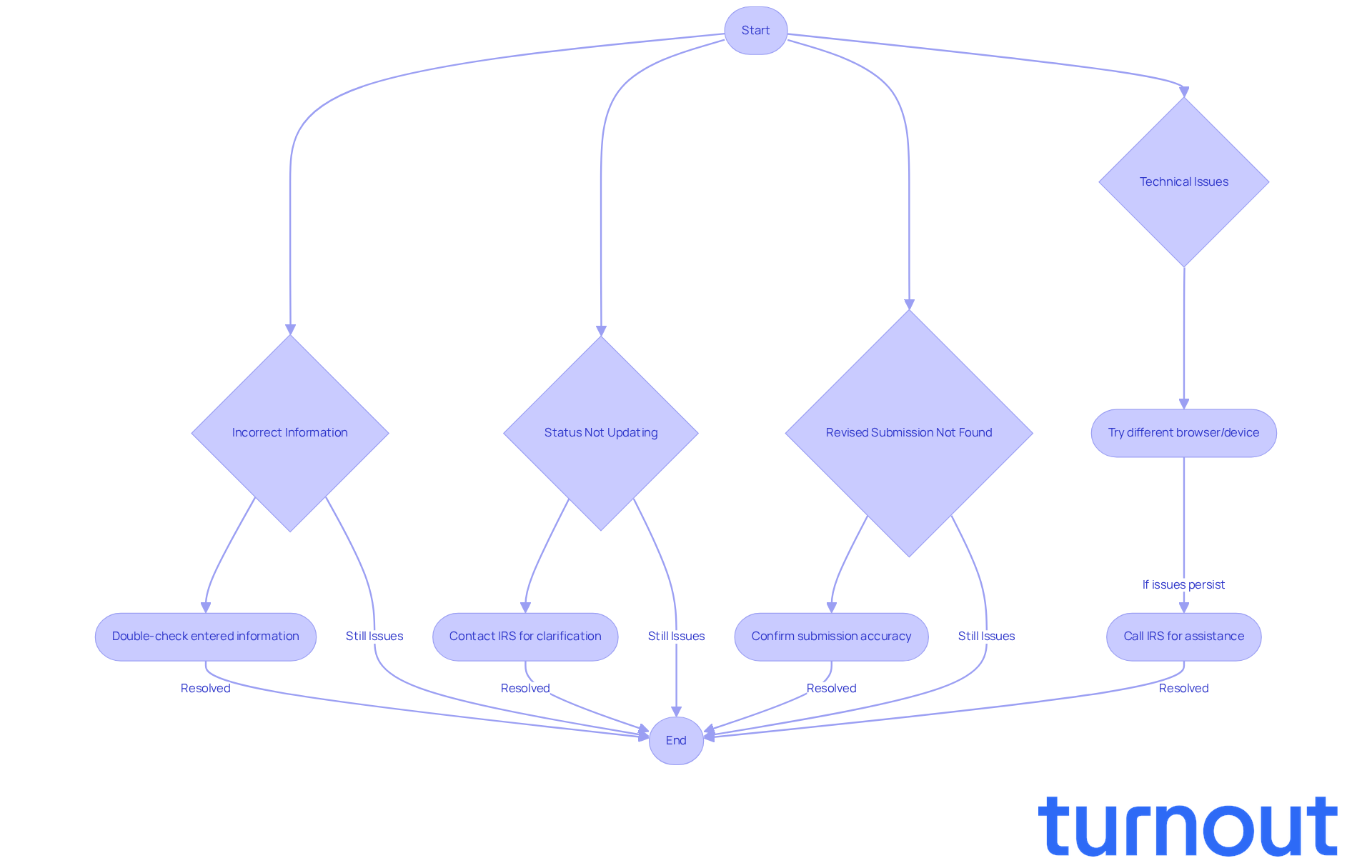

Incorrect Information: We understand that receiving an error message can be frustrating. If this happens, please double-check the information you entered. Make sure your Social Security number, date of birth, and ZIP code are correct. Remember, we’re here to help you navigate these processes, ensuring you have the right information to access your benefits.

-

Status Not Updating: It’s common to feel anxious if your status hasn’t changed after 12 weeks. This may be due to processing delays. We encourage you to contact the IRS for clarification. Turnout can assist you in understanding these delays and guide you on the next steps.

-

Revised Submission Not Found: If the tool indicates that your revised submission cannot be located, it’s important to confirm that you filed it accurately and that it was received by the IRS. You might need to provide proof of submission. Our trained nonlawyer advocates at Turnout are here to guide you through this verification process.

-

Technical Issues: Experiencing technical difficulties with the IRS website can be frustrating. If this happens, try accessing it from a different browser or device. Alternatively, you can call the IRS for assistance. Remember, Turnout is also available to help you troubleshoot these issues, ensuring you can effectively manage your tax-related concerns.

Explore Resources for Amended Tax Returns

-

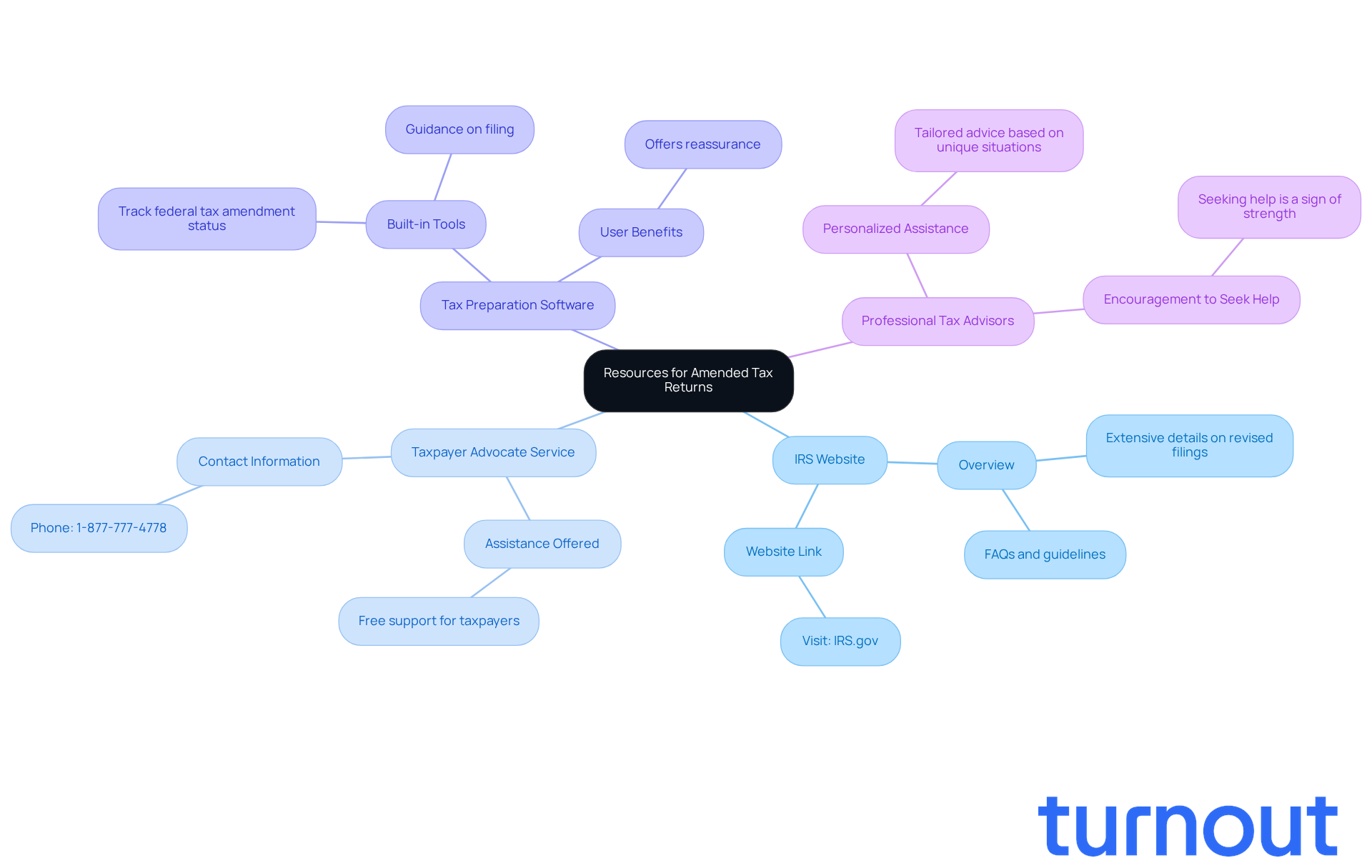

IRS Website: We understand that navigating tax filings can be overwhelming. The IRS provides extensive details about revised filings, including FAQs and guidelines. For more information, visit IRS.gov. You're not alone in this journey.

-

Taxpayer Advocate Service: If you encounter issues with the IRS, remember that help is available. The Taxpayer Advocate Service offers free assistance to taxpayers who need support. You can reach them at 1-877-777-4778. We're here to help you through this.

-

Many tax preparation software programs come equipped with built-in tools to help you track the federal tax amendment status of your amended return. They also provide guidance on filing, making the process a bit easier. It's common to feel uncertain, but these tools can offer some reassurance.

-

Professional Tax Advisors: If you find yourself needing personalized assistance, consider consulting a tax professional. They can provide tailored advice based on your unique situation. Remember, seeking help is a sign of strength, and you deserve the best support possible.

Conclusion

Amending a federal tax return is an essential process that allows you to correct errors and ensure your financial records are accurate. We understand that navigating this process can feel overwhelming. From filing an amended return using Form 1040-X to checking the status of that amendment, knowing how to proceed is crucial for maintaining your financial integrity and potentially reclaiming any refunds owed to you.

It's important to wait for the right time to check the status of your amended return. Utilizing the IRS's online tools can make this easier, and knowing what information you need to access your submission status is key. Common issues, like entering incorrect information or facing status update delays, can be frustrating. But remember, resources are available to help you, including the IRS website and professional tax advisors.

Ultimately, being proactive in understanding and managing your amended tax returns not only alleviates anxiety but also empowers you to take control of your financial situation. By following the outlined steps and utilizing available resources, you can confidently navigate the complexities of tax amendments, ensuring your filings reflect your true financial circumstances. Taking action now can lead to peace of mind and potentially significant financial benefits in the future. You're not alone in this journey, and we're here to help.

Frequently Asked Questions

What is an amended tax return?

An amended tax return is a revised tax document that corrects mistakes in your original tax filings to ensure accuracy.

Why would someone need to submit an amended tax return?

Common reasons for submitting an amended tax return include correcting reported income, adjusting your filing status, and revising deductions.

What form is used to file an amended tax return?

The designated form for filing an amended tax return is Form 1040-X.

How long do I have to submit an amended tax return after filing my original return?

Modifications can only be made for submissions filed within the last three tax years.

How long does it take to process an amended tax return?

Processing an amended tax return may take several weeks.

What are some common mistakes that lead to the need for an amended tax return?

Frequent mistakes include misreported income and missed deductions, which highlight the importance of a thorough review before submission.

How many taxpayers typically submit amended tax returns each year?

Each year, around 2-3% of taxpayers submit amended tax returns.

Can filing an amended return lead to a refund?

Yes, many taxpayers have successfully used Form 1040-X to correct their filings, leading to significant refunds.

What support is available for those needing to file an amended tax return?

There are resources available to help navigate the process of filing an amended tax return and ensure that your tax filings accurately reflect your financial situation.