Introduction

Navigating federal tax returns can feel overwhelming, especially when it comes to amending a previously filed document. We understand that this process can be complex, and you're not alone in feeling this way. With about 3% of taxpayers submitting revised filings each year, knowing how to check the status of your amended federal tax return is crucial for ensuring compliance and accuracy.

But what happens when the process becomes confusing or unexpected issues arise? It’s common to feel lost or frustrated. This guide is here to help you every step of the way. We’ll outline the steps to effectively track your amended return and address common challenges that may come up. You deserve to take control of your financial records, and we’re here to support you in this journey.

Understand Amended Federal Tax Returns

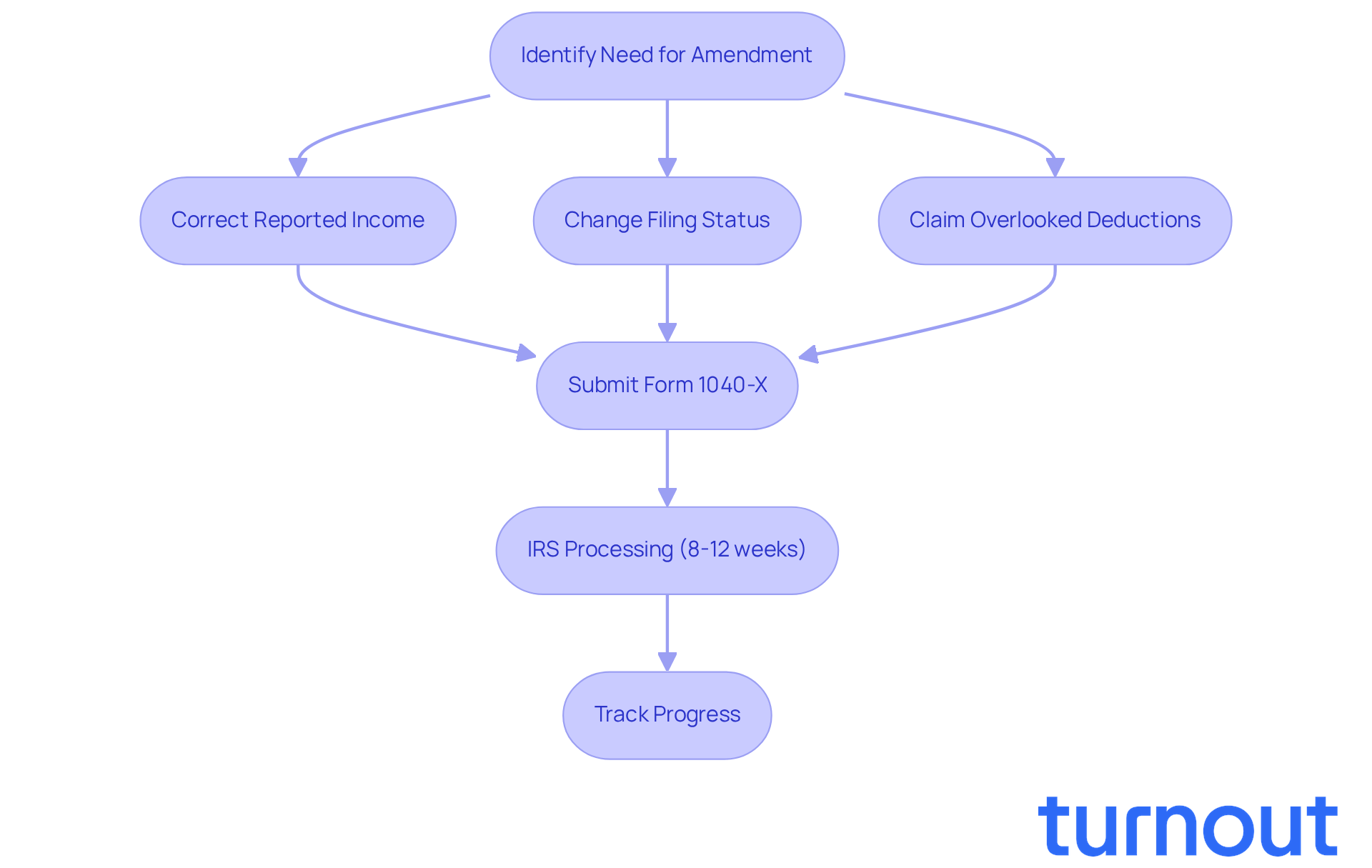

Submitting a revised federal tax document using Form 1040-X can feel daunting, especially when you're trying to correct mistakes or make adjustments to your amended federal tax return status. We understand that life can get busy, and sometimes things slip through the cracks. Common reasons for submitting a revised tax form include:

- Correcting reported income

- Changing your filing status

- Claiming deductions that you may have initially overlooked

It's important to remember that changes can only be made for submissions filed within the last three tax years. If you're considering a substantial modification, be aware that it might lead to increased examination by the IRS. This is why seeking advice from a CPA can be a wise step in navigating the adjustment process. You're not alone in this journey; many people find themselves in similar situations.

Understanding the significance of the amended federal tax return status is crucial for maintaining accurate tax records and ensuring compliance with IRS regulations. After you submit your revised document, the IRS typically needs 8 to 12 weeks to process it. During this time, we encourage you to track the progress of your amendment. This proactive approach can help ensure a timely resolution.

Did you know that roughly 3% of taxpayers submit revised filings each year? This highlights just how important this procedure is in rectifying tax records and preventing potential penalties. Remember, we're here to help you through this process.

Follow Steps to Check Your Amended Return Status

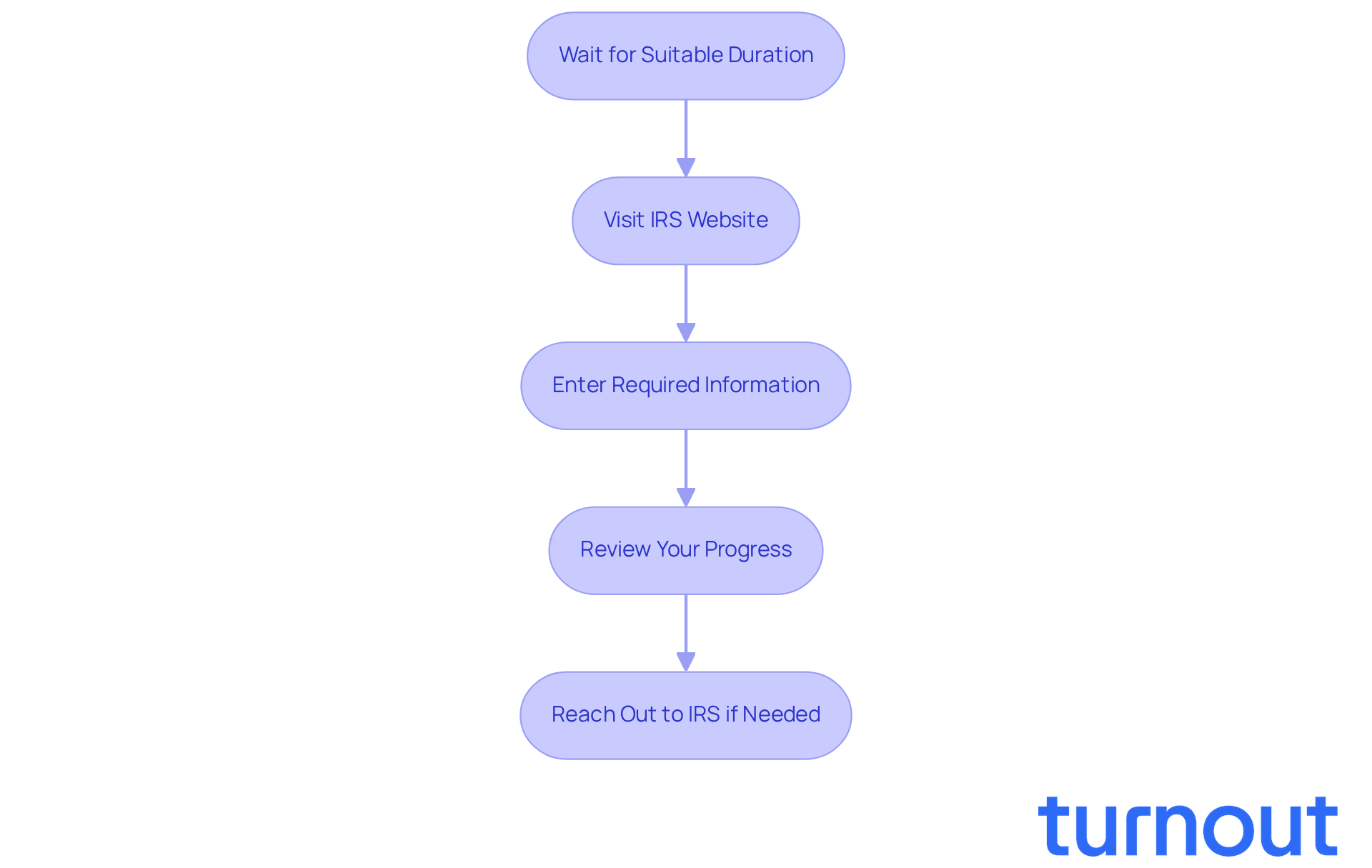

Checking the amended federal tax return status can feel daunting, but we're here to help you through it. Follow these simple steps to stay informed about your submission:

-

Wait for the Suitable Duration: It’s important to give it some time. Make sure at least three weeks have passed since you submitted your revised documentation. This is the minimum time the IRS needs to process your submission.

-

Visit the IRS Website: Head over to the IRS 'Where's My Amended Return?' tool at IRS.gov. This tool is designed to help you track your return.

-

Enter Required Information: You’ll need to provide your Social Security number, date of birth, and ZIP code. Double-check that this information matches what you submitted on your revised document.

-

Review Your Progress: After entering your details, you’ll see one of three statuses: Received, Adjusted, or Completed. This will provide you with a clear idea of your amended federal tax return status in the processing queue.

-

Reach Out to the IRS if Needed: If you encounter any issues or if your situation hasn’t changed after 12 weeks, don’t hesitate to call the IRS at 1-866-464-2050 for assistance. Remember, you’re not alone in this journey.

Troubleshoot Common Issues with Amended Return Status

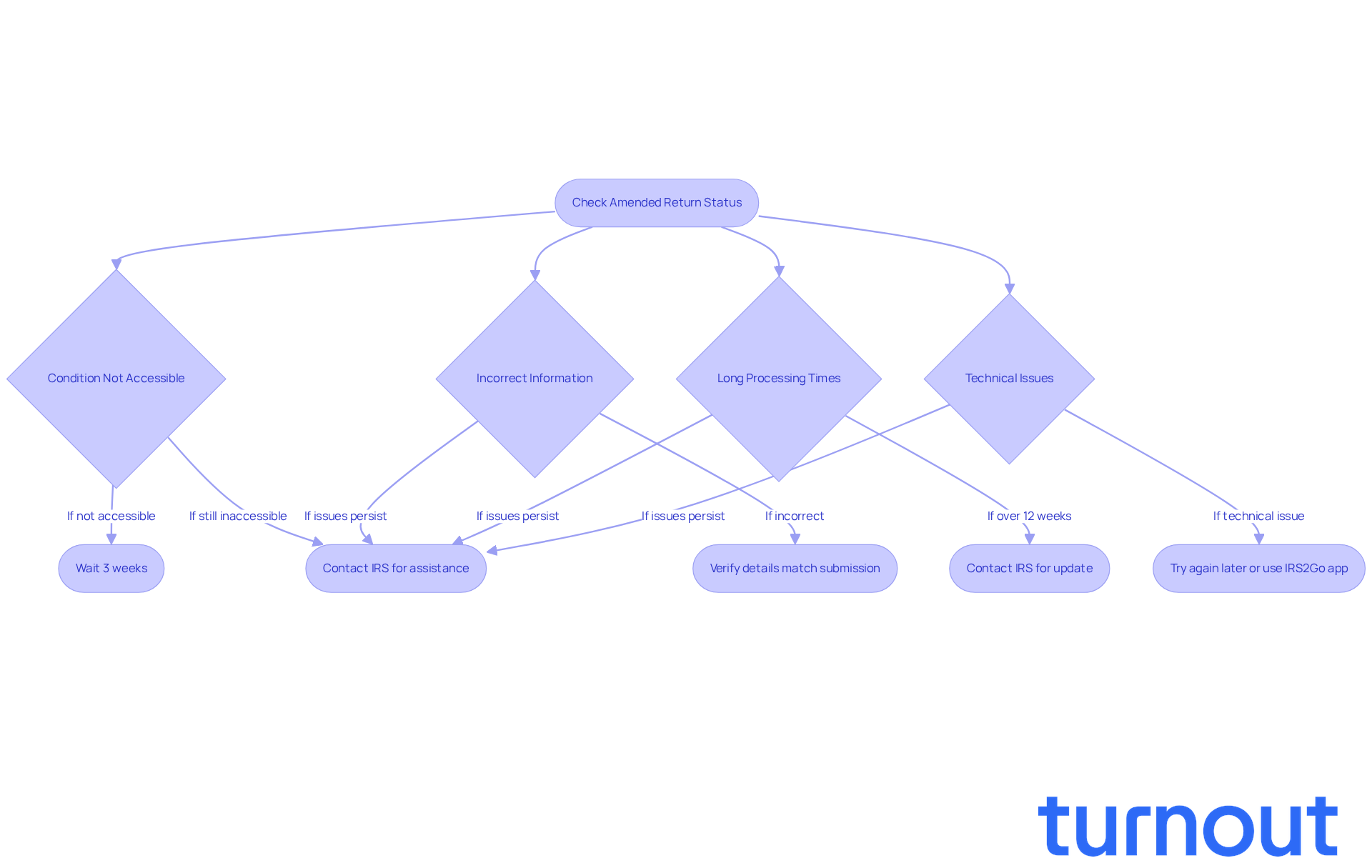

While checking the amended federal tax return status, you may encounter a few common issues. We understand that this can be a stressful time, so let’s walk through them together:

- Condition Not Accessible: If your condition isn’t accessible, it could mean that the IRS hasn’t finished processing your filing yet. It’s best to wait at least three weeks after submission before checking back.

- Incorrect Information: Make sure that the details you provided match your revised submission exactly. Any discrepancies can lead to errors in retrieving your information.

- Long Processing Times: If it’s been over 12 weeks since you filed, it might be time to reach out to the IRS for an update. Typically, processing times for revised submissions range from 8 to 12 weeks, but due to significant backlogs, they can extend up to 20 weeks. Unfortunately, only a small percentage of these are completed without issues.

- Technical Issues: If the IRS website is down or you’re facing technical difficulties, don’t worry! Try again later or use the IRS2Go mobile app for updates. This app can provide real-time information and help ease some of the uncertainty surrounding your refund.

If your revised filing status remains inaccessible, consider contacting the IRS directly for assistance. Tax experts suggest having your Social Security number and other relevant details ready to speed up the process. As Erin M. Collins, National Taxpayer Advocate, highlights, "The success of the filing season will be defined by how well the IRS is able to assist the millions of taxpayers who experience problems." Understanding these common issues can help you navigate the complexities of your amended federal tax return status more effectively. Remember, you’re not alone in this journey, and we’re here to help.

Access Resources for Managing Your Amended Return

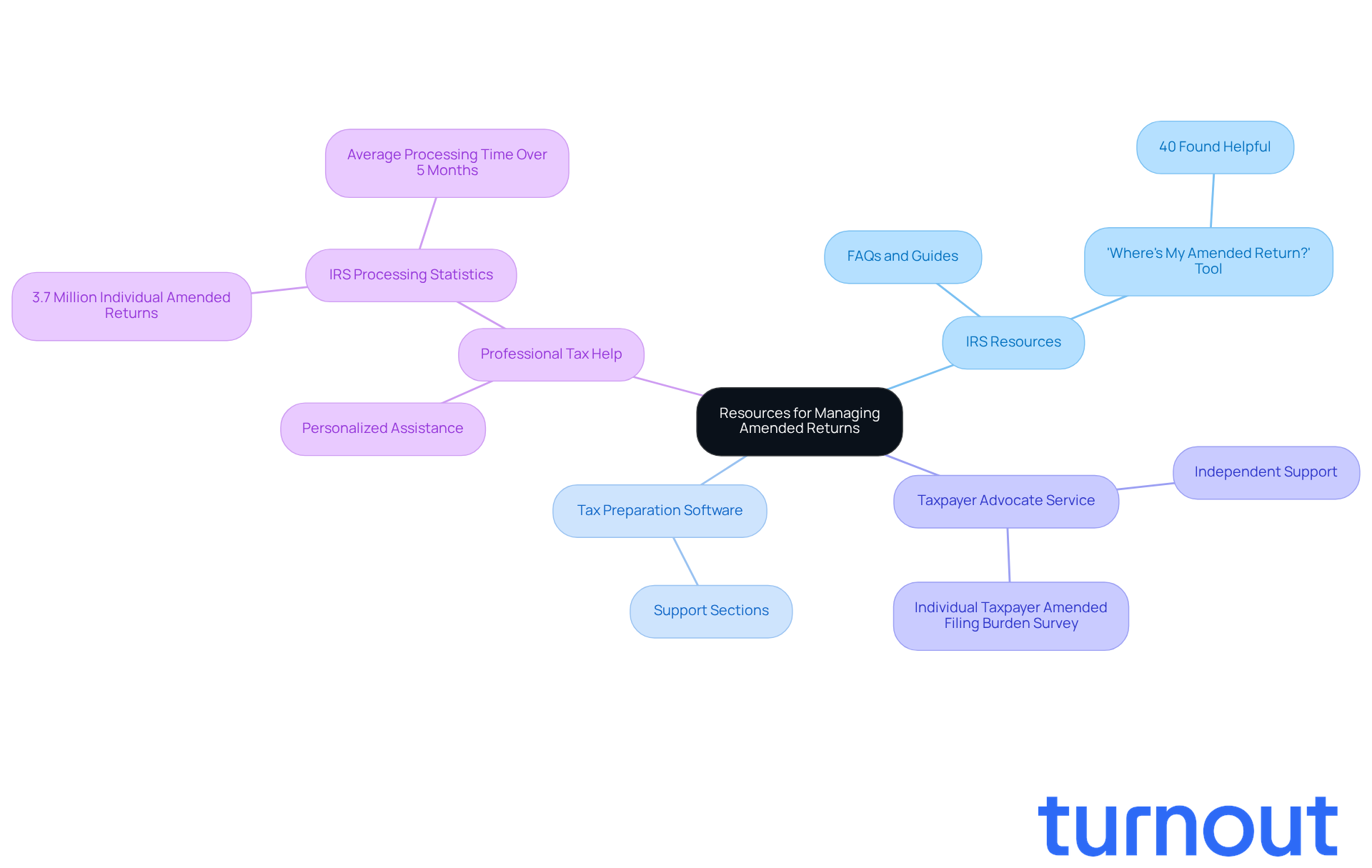

Managing your amended federal tax return status can feel overwhelming, but you’re not alone in this journey. Here are some resources that can help you navigate the process with confidence:

-

IRS Resources: The IRS website is a treasure trove of information on revised filings. You’ll find FAQs and comprehensive guides that can clarify your questions. Plus, the 'Where's My Amended Return?' tool allows you to track your submission's progress. However, it’s worth noting that only 40% of taxpayers found this tool helpful for understanding their amended federal tax return status. This highlights the importance of seeking additional support if your amended federal tax return status is unclear.

-

Tax Preparation Software: If you used tax software for your revised filing, take a moment to explore the support sections of these platforms. They often provide valuable assistance for monitoring your status.

-

Taxpayer Advocate Service: If you encounter significant challenges with your amended federal tax return status, the Taxpayer Advocate Service (TAS) is here for you. This independent organization within the IRS is dedicated to helping taxpayers like you resolve issues and navigate the complexities of the tax system. Recent reports show that TAS is actively working to enhance taxpayer experiences, demonstrating their commitment to advocacy and support. They’re also conducting the Individual Taxpayer Amended Filing Burden Survey to gather insights on the time and costs involved in amending filings, shedding light on the challenges many taxpayers face.

-

Professional Tax Help: If the process feels daunting, consider reaching out to a tax expert. They can provide personalized assistance, ensuring your revised submission is handled accurately and efficiently. With the IRS processing over 3.7 million individual amended federal tax return statuses last fiscal year, which took an average of over 5 months, professional guidance can be invaluable in helping you avoid potential pitfalls.

Remember, you’re not alone in this. We’re here to help you every step of the way.

Conclusion

Submitting an amended federal tax return can feel daunting, and we understand that. But knowing the process is essential for ensuring accuracy and compliance. By following the steps outlined and utilizing the resources available, you can navigate the complexities of checking your amended return status and address any issues that may come up.

Throughout this article, we've shared crucial insights. Timely submission is vital, and using the IRS's tracking tools can make a difference. We also discussed common challenges you might face during this process. You’ve learned how to check your amended return status, troubleshoot common issues, and access resources that can help you manage your filings. Remember, seeking professional help when needed is a sign of strength and underscores the value of informed decision-making in tax matters.

Ultimately, being proactive and informed can significantly ease the stress associated with amended federal tax returns. By taking advantage of the resources available, including IRS tools and professional assistance, you can ensure your amended returns are processed smoothly. This not only helps maintain accurate tax records but also protects you against potential penalties. Embrace the journey of amending your tax return with confidence, knowing that support is available every step of the way.

Frequently Asked Questions

What is an amended federal tax return?

An amended federal tax return is a revised tax document submitted using Form 1040-X to correct mistakes or make adjustments to a previously filed tax return.

Why might someone need to submit an amended tax return?

Common reasons for submitting an amended tax return include correcting reported income, changing filing status, and claiming overlooked deductions.

How far back can you amend a federal tax return?

Changes can only be made for submissions filed within the last three tax years.

What should I be aware of when making substantial modifications to my tax return?

Substantial modifications may lead to increased examination by the IRS, so seeking advice from a CPA can be beneficial.

How long does it take for the IRS to process an amended return?

The IRS typically needs 8 to 12 weeks to process an amended return after submission.

How can I track the progress of my amended tax return?

It is encouraged to track the progress of your amendment proactively during the processing time to ensure a timely resolution.

What percentage of taxpayers submit revised filings each year?

Roughly 3% of taxpayers submit revised filings each year, highlighting the importance of the amendment process in correcting tax records.