Introduction

Navigating the complexities of tax filings can feel overwhelming, especially when it comes to correcting errors through an amended return. We understand that nearly one in five paper submissions contains mistakes, making it essential to grasp the process of revising a tax return. This knowledge not only ensures compliance but also helps optimize potential refunds.

It's common to feel uncertain about the status of your amended return, raising questions about processing times and potential pitfalls. You're not alone in this journey. Many taxpayers grapple with these concerns. So, how can you effectively track your amended return and address any issues that may arise during this critical process? We're here to help.

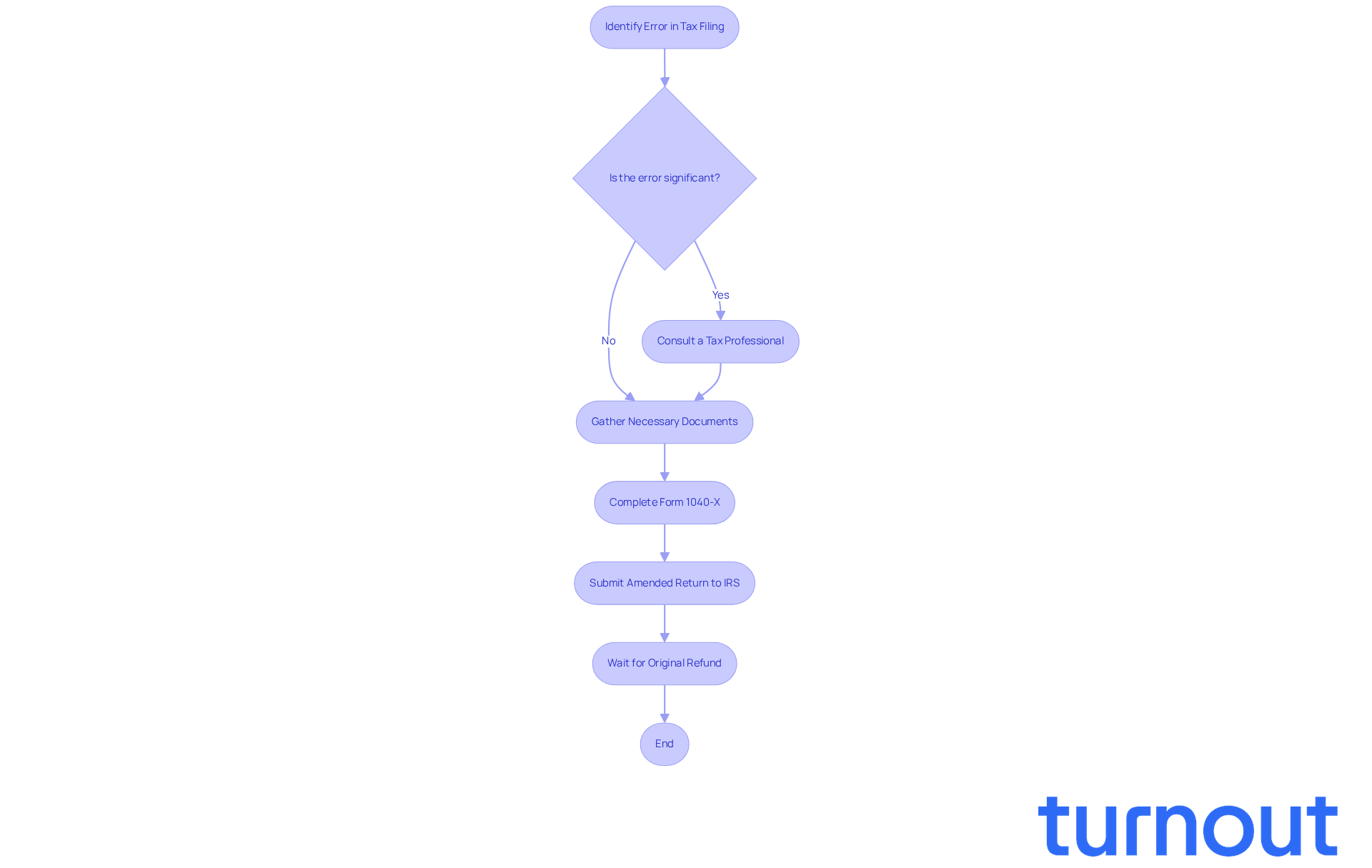

Understand What an Amended Return Is

A revised submission is an important tax document you present to the IRS when you need to fix mistakes or omissions in a previously filed tax declaration. Typically, this involves using Form 1040-X, which allows you to adjust your filing status, income, deductions, or credits. Understanding the purpose of a revised submission is crucial, as it can significantly impact your tax obligation and eligibility for refunds.

We understand that errors on tax filings are not uncommon. In fact, the IRS indicates that about 21% of paper submissions contain mistakes, while e-filing reduces this percentage to just 1%. If you notice errors after submitting your initial filing-like incorrect income reporting or missed deductions-submitting a revised document is essential to correct these issues and ensure compliance with tax regulations.

For instance, if you realize you omitted income from a Form W-2 or received a corrected information statement, submitting a revised filing is vital to address these inconsistencies. Additionally, if you need to request a tax credit that you initially overlooked, a revised submission can help you secure the highest refund possible.

Form 1040-X is specifically designed for this purpose, allowing you to make necessary changes and submit them to the IRS. Most personal tax filings can be corrected by sending in Form 1040-X. Remember, you typically have three years from the original filing date to submit an amendment regarding my amended return status. It’s wise to wait until you receive your original refund before submitting an amendment to avoid complications. By proactively addressing errors, you can steer clear of potential penalties, such as receiving a CP2000 notice from the IRS for unpaid taxes.

If you need assistance, consider reaching out to tax professionals, like those at H&R Block, who can guide you through the amendment process. In summary, submitting a revised filing is a straightforward process that can lead to better tax outcomes, ensuring your submissions are accurate and comply with IRS regulations. You're not alone in this journey; we're here to help.

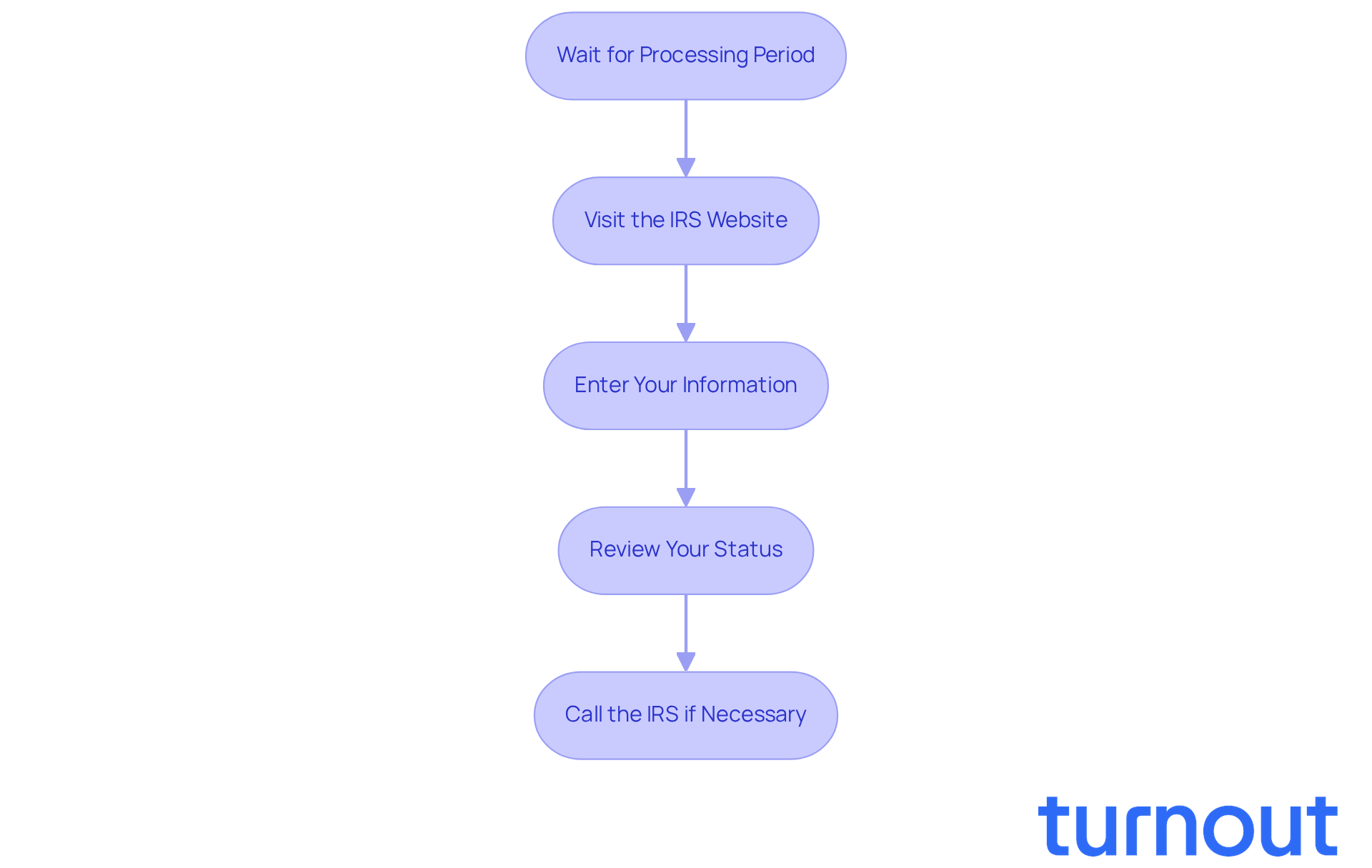

Follow Steps to Check Your Amended Return Status

Checking my amended return status can feel overwhelming, but we're here to help you through it. Just follow these simple steps to stay informed:

-

Wait for the Processing Period: After you submit your revised filing, it’s important to give it some time. Typically, the IRS takes about three weeks to start processing. However, keep in mind that it can take anywhere from 8 to 12 weeks for Form 1040-X to be fully processed, and in some cases, it may stretch to 16 weeks.

-

Visit the IRS Website: Head over to the IRS 'Where's My Amended Return?' tool at IRS.gov. This tool is designed to provide you with the latest updates.

-

Enter Your Information: You’ll need to input your Social Security number, date of birth, and ZIP code. Make sure this information matches what you submitted on your revised filing to avoid any hiccups.

-

Review Your Status: Once you’ve entered your details, the tool will show you the status of your amended return. You’ll see whether it’s received, adjusted, or completed. This can provide some peace of mind about my amended return status.

-

Call the IRS if Necessary: If you run into any issues or your status hasn’t changed after the expected time, don’t hesitate to reach out. You can call the IRS at 866-464-2050 for assistance. Just be ready to share your personal information for verification.

Remember, you’re not alone in this journey. We understand that waiting can be stressful, but taking these steps can help you stay informed and feel more in control.

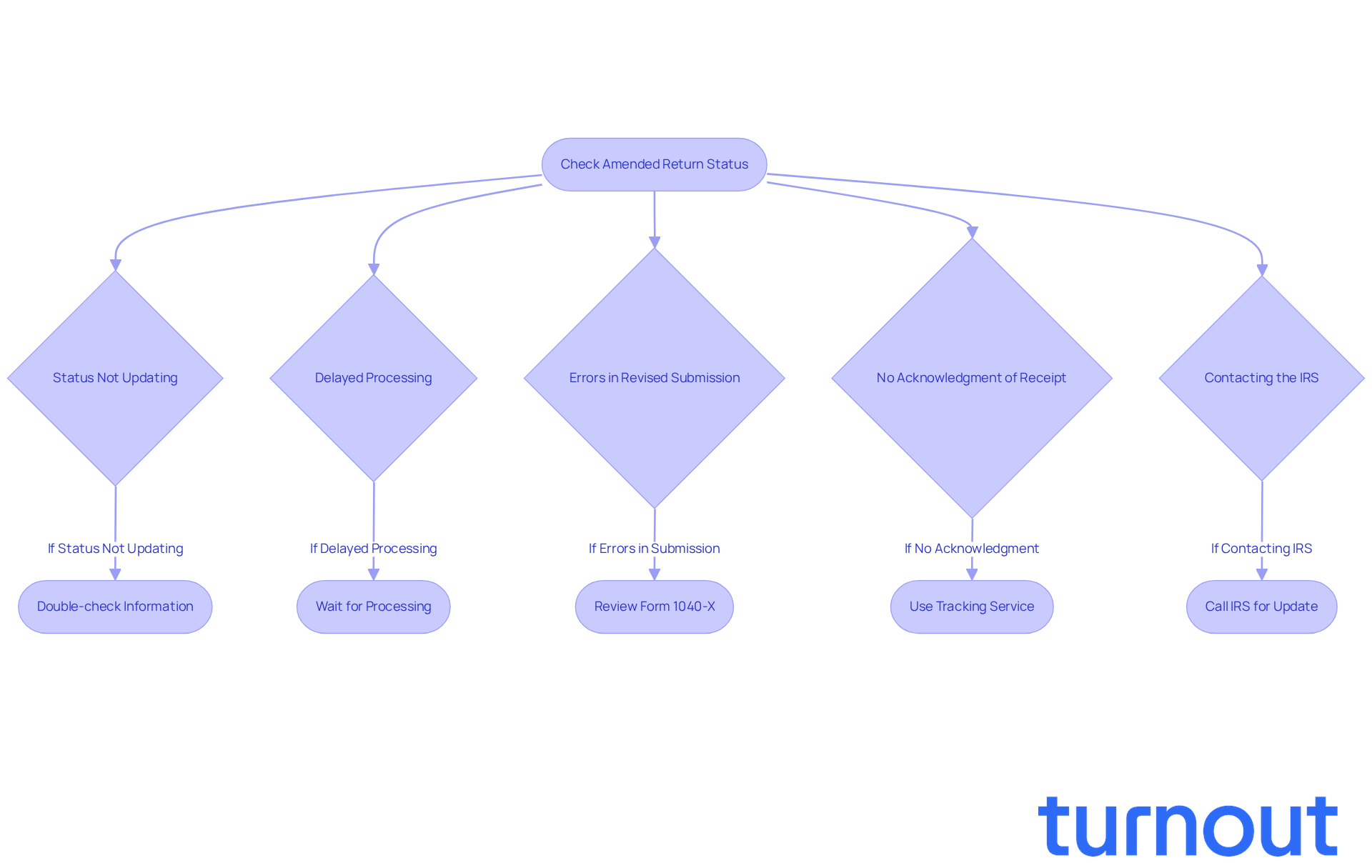

Troubleshoot Common Issues with Amended Return Status

When checking my amended return status, it’s common to run into a few bumps along the way. We understand how stressful this can be, so let’s walk through some typical issues you might encounter:

-

Status Not Updating: If your status hasn’t changed after three weeks, it’s important to double-check your information. Make sure your Social Security number, date of birth, and ZIP code are all entered correctly. It’s easy to overlook these details, and we’re here to help you get it right.

-

Delayed Processing: Sometimes, the IRS takes longer than usual to process returns, especially when they’re dealing with a high volume of submissions or additional evaluations. As of mid-2023, there were about 1.43 million unprocessed revised tax filings, with processing times often exceeding 20 weeks. If it’s been more than 12 weeks since you filed, don’t hesitate to reach out to the IRS for an update. You deserve to know where your return stands.

-

Errors in Your Revised Submission: Mistakes in your revised submission can lead to significant delays. Common errors include incorrect calculations or missing documents. Take a moment to review your Form 1040-X carefully for any inaccuracies. If you find something, don’t worry; correcting it is part of the process.

-

No Acknowledgment of Receipt: The IRS doesn’t send confirmation when they receive your revised submission, which can be unsettling. If you filed by mail, consider using a service that provides tracking. This way, you can confirm delivery and ease your mind about whether your submission was received.

-

Contacting the IRS: If you’re still facing issues, you can call the IRS at 866-464-2050. Be ready to provide your personal details for verification and ask about your revised submission. Remember, the IRS is working hard to process submissions quickly, but seasonal backlogs can affect timelines, especially after the April 15 tax deadline.

By understanding these common challenges and knowing how to address them, you can navigate the revised filing process with greater confidence. Remember, you’re not alone in this journey, and we’re here to help.

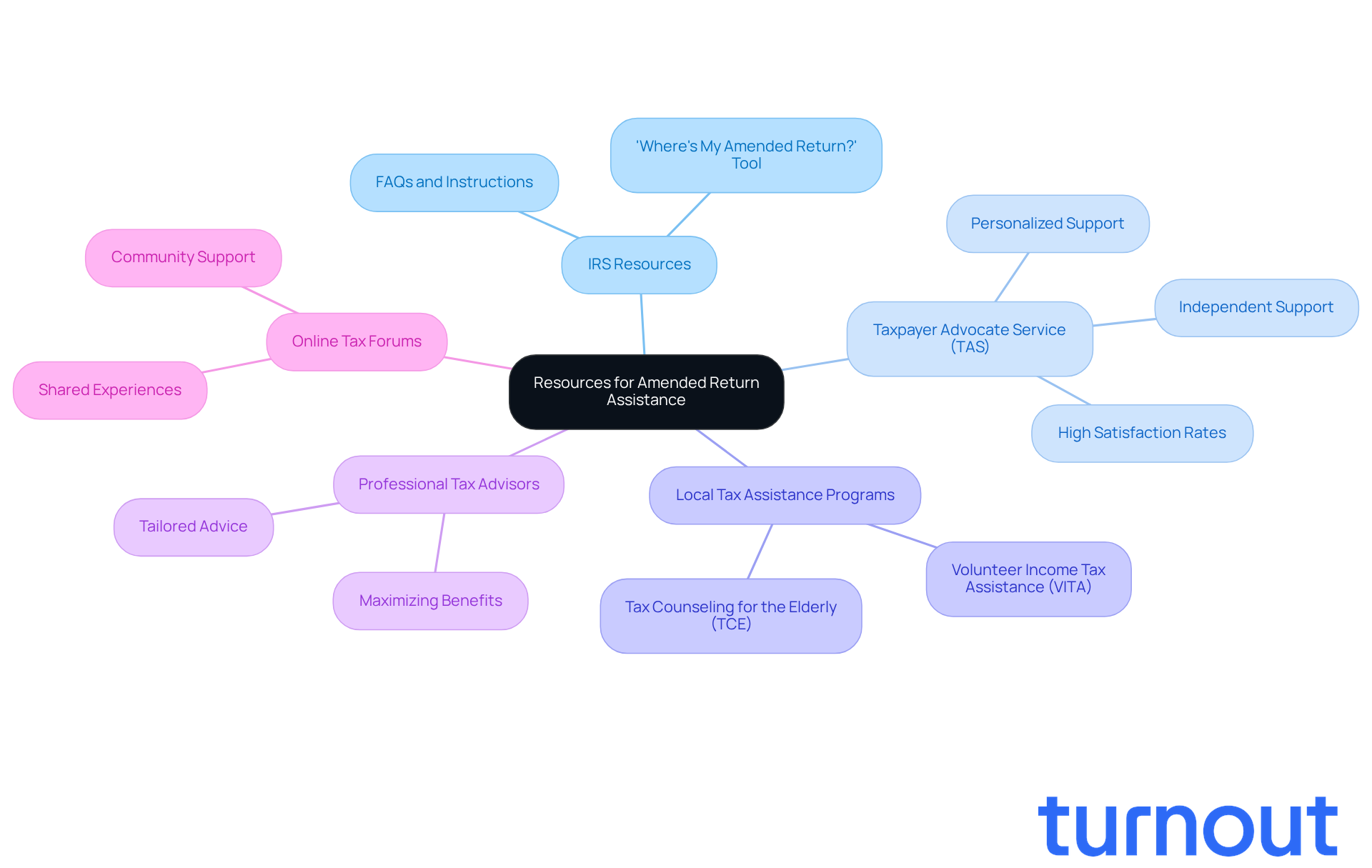

Access Resources for Further Assistance with Your Amended Return

If you’re feeling overwhelmed with my amended return status, know that you’re not alone. There are resources available to help you navigate this process with confidence:

-

IRS Resources: The IRS website is a treasure trove of information on revised filings. You’ll find FAQs and detailed instructions that can guide you. Plus, the 'Where's My Amended Return?' tool offers real-time updates on your case status, so you can stay informed.

-

Taxpayer Advocate Service (TAS): This independent organization within the IRS is here to support you. TAS is dedicated to helping taxpayers resolve issues and navigate the tax system. Many who have reached out to them report high satisfaction rates, highlighting their commitment to effective assistance. You can connect with them directly through their website for personalized support. Remember, as TAS says, "We are here to ensure that every taxpayer receives the help they need to navigate the complexities of the tax system."

-

Local Tax Assistance Programs: Consider reaching out to Volunteer Income Tax Assistance (VITA) or Tax Counseling for the Elderly (TCE) programs in your area. These programs provide free tax help to eligible individuals, making it easier for you to get the assistance you need.

-

Professional Tax Advisors: If your situation feels a bit more complex, consulting a tax professional can be a great step. They can offer tailored advice and assistance with my amended return status, ensuring I maximize my benefits while complying with all requirements.

-

Online Tax Forums: Engaging with online communities or forums can also be beneficial. Here, you can ask questions and share experiences with others who have navigated similar processes. These platforms often provide valuable insights and support from peers who understand what you’re going through.

Remember, seeking help is a sign of strength. You don’t have to face this journey alone.

Conclusion

Understanding the process of checking your amended return status is crucial if you've made corrections to your tax filings. We know it can be overwhelming, but by following the steps outlined in this guide, you can stay informed about your amended returns and effectively address any issues that may arise.

Submitting a revised tax return using Form 1040-X is essential for correcting any inaccuracies from your original filing. It's common to feel uncertain about the next steps, but this article highlights typical processing times and provides a clear, step-by-step approach to checking the status of your amended return. You'll also find useful tools and resources available through the IRS. We discuss common issues, such as status updates, processing delays, and submission errors, along with practical solutions to help you overcome these challenges.

Staying proactive during the amendment process can lead to better tax outcomes and peace of mind. Remember, you're not alone in this journey. Utilizing the resources available - whether through the IRS, professional tax advisors, or community programs - empowers you to navigate your amended return status with confidence. Taking these steps not only facilitates a smoother experience but also ensures compliance with tax regulations, allowing for a more accurate and beneficial resolution to any tax-related concerns.

Frequently Asked Questions

What is an amended return?

An amended return is a revised submission to the IRS used to correct mistakes or omissions in a previously filed tax declaration, typically using Form 1040-X.

Why is it important to submit an amended return?

Submitting an amended return is important because it can significantly impact your tax obligation and eligibility for refunds by correcting errors such as incorrect income reporting or missed deductions.

How common are errors in tax filings?

Errors in tax filings are not uncommon; about 21% of paper submissions contain mistakes, while e-filing reduces this percentage to just 1%.

What is Form 1040-X used for?

Form 1040-X is specifically designed for making necessary changes to personal tax filings, allowing taxpayers to adjust their filing status, income, deductions, or credits.

How long do I have to submit an amended return?

You typically have three years from the original filing date to submit an amendment.

Should I wait to receive my original refund before submitting an amendment?

Yes, it is wise to wait until you receive your original refund before submitting an amendment to avoid complications.

What are the consequences of not correcting errors on my tax return?

Failing to correct errors can lead to potential penalties, such as receiving a CP2000 notice from the IRS for unpaid taxes.

Can I get help with the amendment process?

Yes, you can reach out to tax professionals, such as those at H&R Block, for guidance through the amendment process.