Introduction

Navigating the labyrinth of Social Security benefits can feel overwhelming. We understand that understanding the intersection of Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) is no easy task. These programs are here to provide crucial financial support for individuals unable to work due to disabilities. Yet, many people may not realize that it’s possible to receive both benefits at the same time.

The challenge often lies in deciphering the eligibility requirements. It’s common to feel uncertain about how your unique circumstances might allow for concurrent benefits. Can you truly maximize your financial support by combining these two essential safety nets? The answer is yes, and we’re here to help you explore this possibility.

Understand Social Security and Disability Benefits

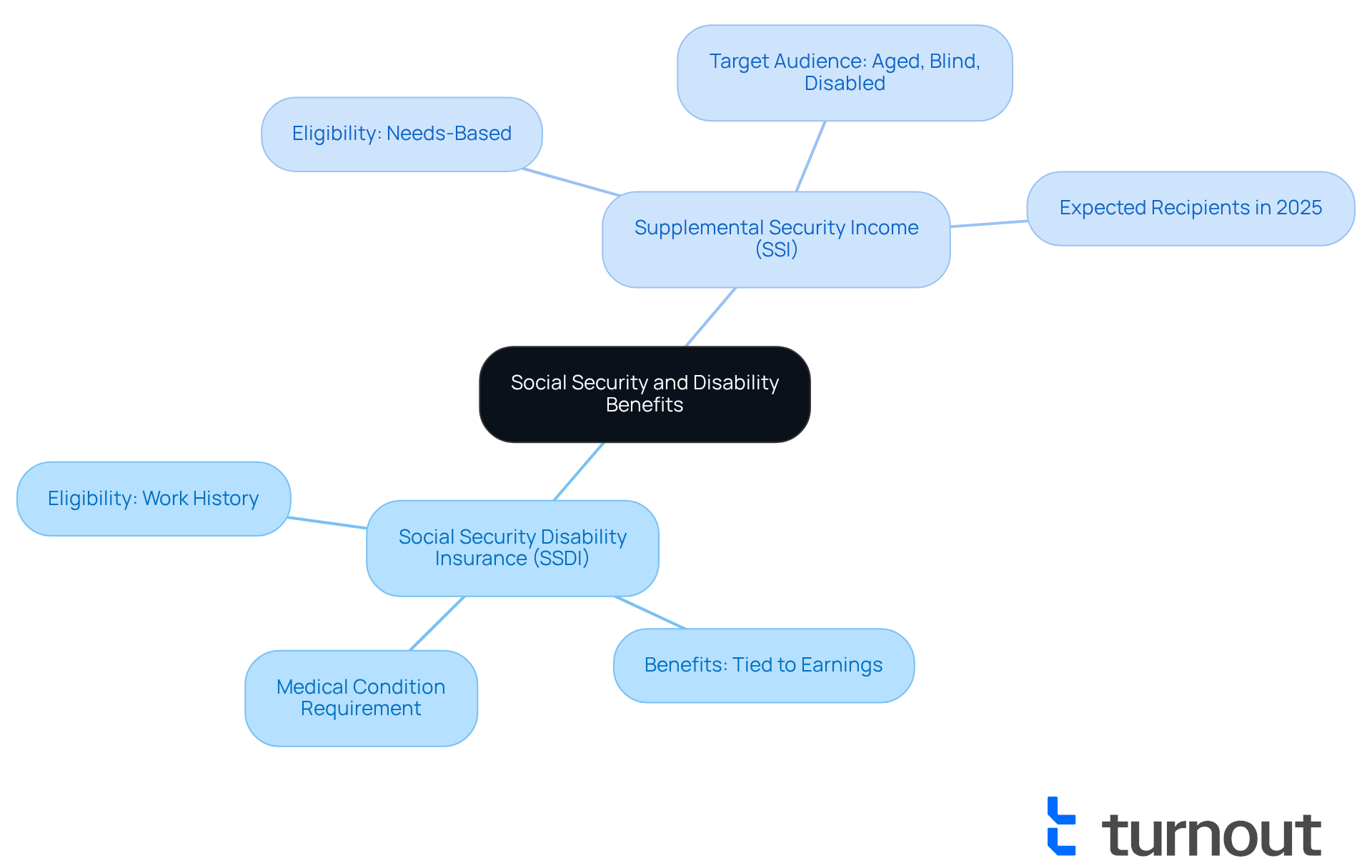

Social Security benefits provide essential financial support for individuals who can’t work due to disabilities. Let’s explore two key programs that can help you:

-

Social Security Disability Insurance (SSDI): This program is for those who have contributed to Social Security through their work history. To qualify, you need a medical condition that meets the Social Security Administration's (SSA) definition of disability. The benefits you receive are tied to your earnings history, meaning that higher wages in the past can lead to larger monthly payments.

-

Supplemental Security Income (SSI): On the other hand, SSI is a needs-based program for individuals with limited earnings and resources, regardless of their work background. To be eligible, you must be aged, blind, or disabled, with earnings below a certain threshold. In 2025, around 7.5 million individuals are expected to receive SSI, highlighting its vital role in supporting those in need.

Understanding the differences between SSDI and SSI is crucial for determining your eligibility for assistance. We understand that navigating these options can be overwhelming. Financial advisors often stress the importance of evaluating your unique situation to answer the question, can you receive social security and disability at the same time, as some individuals may qualify for both programs. For example, if you’re receiving SSDI but your income falls below the SSI threshold, you could be eligible for additional support.

In 2025, the eligibility requirements for SSI will be updated, ensuring that those who need help can access the assistance they deserve. Remember, Turnout is not a law firm and does not provide legal advice or representation. However, by effectively navigating these programs, you can maximize your benefits and secure the financial stability you need during tough times.

Turnout offers tools and services to help you navigate these complex financial and governmental systems. With assistance for SSD claims and tax debt relief, you’re not alone in this journey. Utilizing trained nonlawyer advocates and IRS-licensed enrolled agents, Turnout simplifies the process of accessing these benefits. We're here to help you every step of the way.

Evaluate Eligibility Requirements for Both Benefits

Determining your eligibility for SSDI and SSI can feel overwhelming, but we're here to help you navigate this process with care and understanding. Follow these steps to find clarity:

-

Assess Your Work History for SSDI:

- Generally, you need to have worked in jobs covered by Social Security for at least 5 out of the last 10 years. Take a moment to review your Social Security statement and check your work credits.

- It's important to ensure that your disability aligns with the SSA's definition, which requires that your condition significantly impairs your ability to work. In 2025, nearly 71 million beneficiaries will see a cost-of-living adjustment (COLA) of 2.8 percent, highlighting the importance of maintaining financial stability through these benefits.

-

Evaluate Your Financial Situation for SSI:

- For SSI, your income and resources must fall below specific limits. As of 2025, the earnings threshold for a person is $2,019 per month, with elevated limits for couples.

- Take the time to calculate your total resources, including cash, bank accounts, and property (excluding your primary residence), to ensure you meet the eligibility criteria.

-

Gather Necessary Documentation:

- For SSDI, prepare your medical records, work history, and any documentation that supports your disability claim. The SSA processed 8 percent more initial disability claims in 2025, indicating a growing need for thorough documentation to support your application.

- For SSI, collect proof of income, resources, and any other relevant financial information to demonstrate your eligibility.

-

Consider Concurrent Benefits:

- If you qualify for both SSDI and SSI, you may receive concurrent benefits. This usually happens when your disability payment is low enough that you can also qualify for SSI. It's wise to check the SSA guidelines for specific thresholds, as changes in regulations could impact your eligibility.

By carefully evaluating these criteria, you can determine your eligibility for Social Security and disability benefits. Remember, you're not alone in this journey, and taking these steps can set the stage for a successful application process.

Prepare Your Application

Preparing your application for SSDI and SSI can feel overwhelming, but you’re not alone in this journey. By following these essential steps, you can navigate the process with confidence:

-

Choose the Right Application Method:

- You can submit your applications for SSDI and SSI online through the SSA website, by phone, or in person at your local Social Security office. Think about which method feels most comfortable for you.

-

Complete the Application Forms:

- Take your time to accurately fill out the required forms. For SSDI, share detailed information about your work history, medical condition, and treatment. If you’re applying for SSI, include details about your earnings and resources, as this program is designed for individuals with minimal to no earnings.

-

Submit Supporting Documents:

- Don’t forget to attach all necessary documentation, like medical records and proof of income. Clear and legible documents can help avoid delays in processing your claim.

-

Review Your Application:

- Before you hit submit, take a moment to thoroughly review your application for completeness and accuracy. It’s common to overlook details, but even small mistakes can impact your approval rates and delay your benefits.

-

Keep Copies of Everything:

- Make copies of your application and all supporting documents for your records. This will be invaluable if you need to follow up on your application status or address any issues that arise.

By following these steps, you can enhance the quality of your application and increase your chances of receiving the benefits you deserve. Remember, we’re here to help you every step of the way.

Conclusion

Navigating the complexities of Social Security and disability benefits can feel overwhelming, especially when you're seeking financial support during tough times. We understand that distinguishing between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) is crucial. Each program serves different needs and has its own eligibility criteria. For those who qualify, the possibility of receiving both benefits simultaneously can offer a much-needed sense of financial security. This highlights the importance of thorough evaluation and documentation.

To help you assess your eligibility for SSDI and SSI, consider key steps such as:

- Evaluating your work history

- Assessing your financial situation

- Gathering the necessary documentation for your application

Preparing a comprehensive application is essential to enhance your chances of approval. With anticipated changes to eligibility requirements in 2025, it’s common to feel uncertain about how these adjustments may impact your benefits. Staying informed and proactive is vital.

Ultimately, the journey toward securing Social Security and disability benefits can be daunting, but it’s a vital step toward achieving financial stability. Engaging with resources like financial advisors and advocacy groups can provide valuable support as you navigate this process. Remember, you are not alone in this journey. By taking informed action and understanding your available options, you can maximize your benefits and ensure you receive the assistance you need to thrive despite your circumstances.

Frequently Asked Questions

What are Social Security benefits?

Social Security benefits provide essential financial support for individuals who cannot work due to disabilities.

What is Social Security Disability Insurance (SSDI)?

SSDI is a program for individuals who have contributed to Social Security through their work history. To qualify, you need a medical condition that meets the SSA's definition of disability, and the benefits you receive are based on your earnings history.

How does earnings history affect SSDI benefits?

The benefits you receive from SSDI are tied to your earnings history, meaning that higher wages in the past can lead to larger monthly payments.

What is Supplemental Security Income (SSI)?

SSI is a needs-based program for individuals with limited earnings and resources, regardless of their work background. Eligibility requires being aged, blind, or disabled, with earnings below a certain threshold.

How many people are expected to receive SSI in 2025?

In 2025, around 7.5 million individuals are expected to receive SSI, highlighting its vital role in supporting those in need.

What is the importance of understanding the differences between SSDI and SSI?

Understanding the differences between SSDI and SSI is crucial for determining your eligibility for assistance, as some individuals may qualify for both programs.

Can you receive Social Security and disability benefits at the same time?

Yes, some individuals may qualify for both SSDI and SSI. For example, if you’re receiving SSDI but your income falls below the SSI threshold, you could be eligible for additional support.

Will the eligibility requirements for SSI change in 2025?

Yes, the eligibility requirements for SSI will be updated in 2025 to ensure that those who need help can access the assistance they deserve.

Does Turnout provide legal advice for Social Security benefits?

No, Turnout is not a law firm and does not provide legal advice or representation, but it offers tools and services to help navigate Social Security and disability benefits.

How can Turnout assist individuals with SSD claims?

Turnout simplifies the process of accessing benefits by utilizing trained nonlawyer advocates and IRS-licensed enrolled agents to provide assistance for SSD claims and tax debt relief.