Introduction

Navigating financial challenges can be tough, and understanding the intricacies of Social Security benefits is essential for many individuals. Millions rely on both Social Security Disability Insurance (SSDI) and Retirement Benefits, and the possibility of receiving these benefits simultaneously offers a crucial opportunity for financial support.

But how do these systems interact? What does it mean for those seeking both forms of assistance? We understand that these questions can feel overwhelming. Exploring the eligibility requirements and application processes can illuminate the path to maximizing these benefits.

By ensuring you have the right information, you can feel more equipped to secure the support you need. Remember, you are not alone in this journey. We're here to help you navigate these options and find the assistance that best suits your situation.

Define Social Security Disability and Retirement Benefits

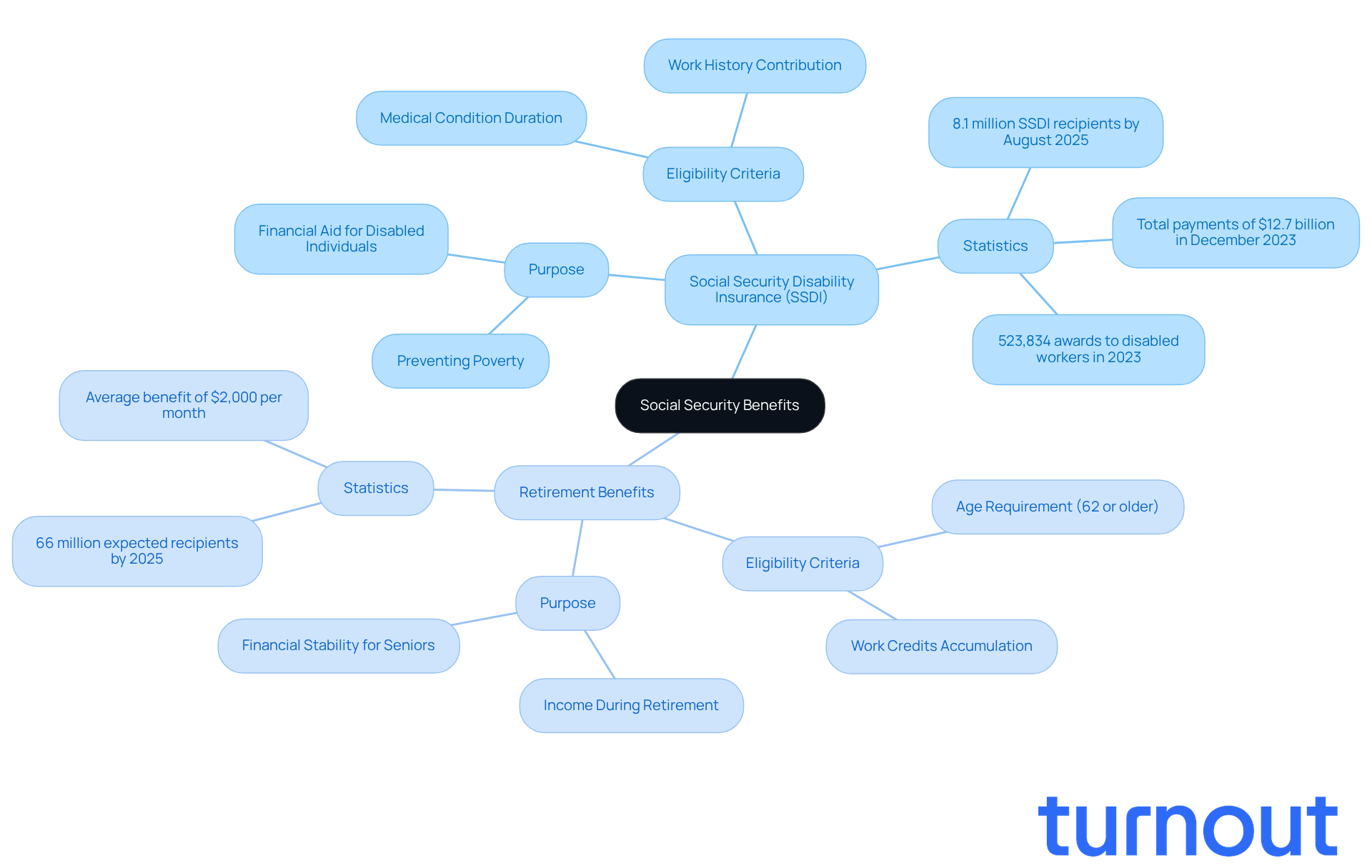

Social Security Disability Insurance (SSDI) is a vital federal program designed to provide financial aid to those unable to work due to a medical condition expected to last at least one year or result in death. We understand that facing such challenges can be overwhelming, and this program is here to support individuals who have contributed to the Social Security system through their work history. It ensures that during tough times, you have the assistance you need.

On the other hand, Retirement Benefits are payments made to individuals who have reached a certain age, typically 62 or older, and have earned enough work credits throughout their careers. These benefits aim to provide income during retirement, a time when many are no longer part of the workforce. It's common to feel uncertain about how to navigate these systems, but knowing your options can make a significant difference.

Understanding these definitions is crucial as they lay the groundwork for exploring how benefits, such as can you receive disability and social security at the same time, can work together. Many individuals may qualify for both SSDI and Retirement Benefits, raising the question of whether can you receive disability and social security at the same time, which allows them to receive financial support during their working years and into retirement. In 2025, approximately 66 million Americans are expected to receive Social Security retirement support, highlighting the program's importance in ensuring financial stability. Additionally, around 8.1 million people are projected to receive SSDI support as of August 2025, underscoring the significance of these programs for countless Americans.

Real-world examples show that for many, these benefits are not just supplementary income; they are essential lifelines that can profoundly impact quality of life. We’re here to help you navigate these systems effectively, ensuring you receive the financial assistance you deserve. Remember, you are not alone in this journey.

Identify Eligibility Requirements for Dual Benefits

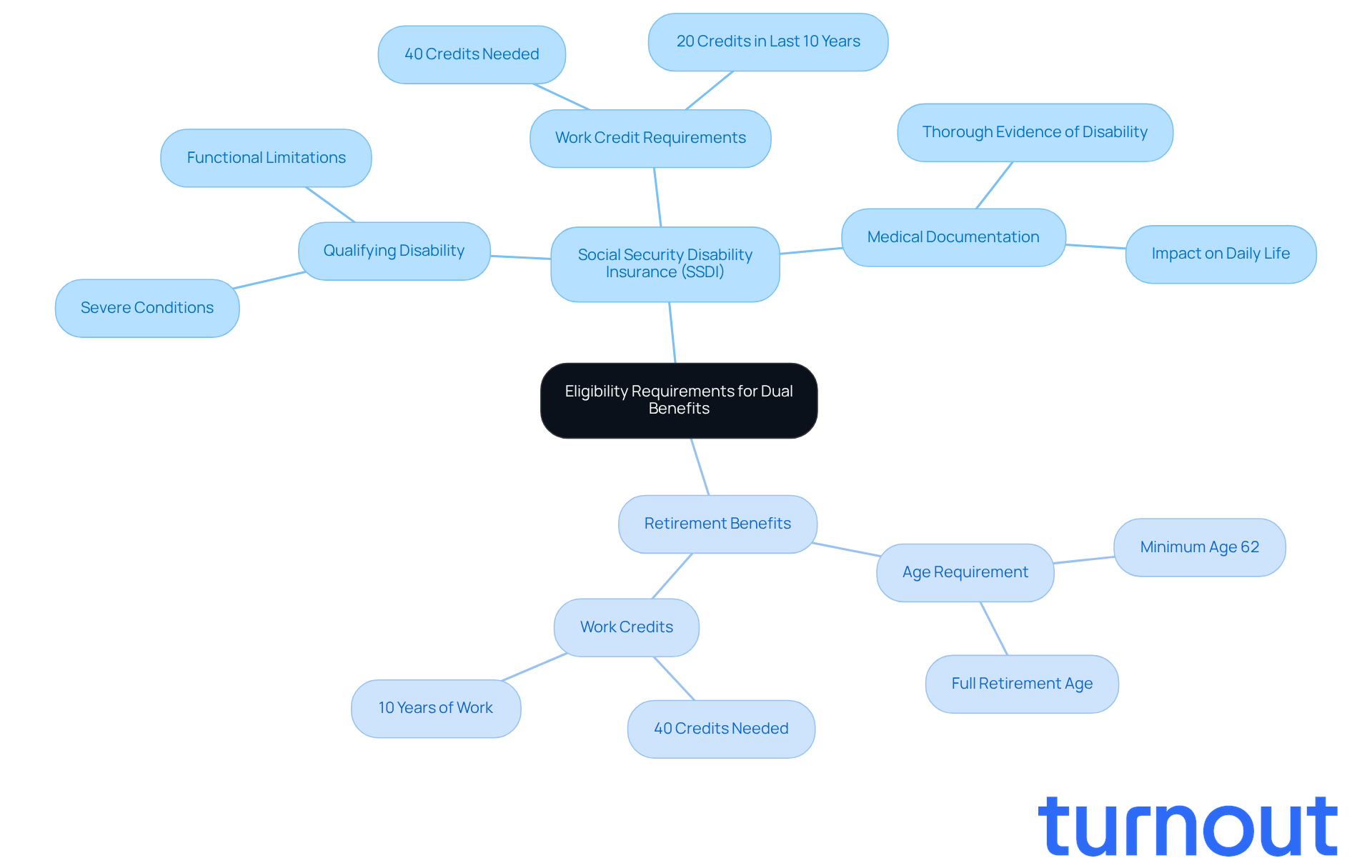

Navigating the world of Social Security benefits can feel overwhelming, especially when you're facing health challenges. To qualify for Social Security Disability Insurance (SSDI), you need to show that you have a qualifying disability and meet certain work credit requirements. Typically, this means having at least five years of employment within the last ten years. In 2025, most applicants will need 40 credits, which you earn at a rate of one credit for every $1,690 in wages or self-employment income.

If you're considering Retirement Benefits, it's important to know that you must be at least 62 years old and have the same 40 credits, usually equating to about ten years of work. While it’s possible to qualify for both SSDI and Retirement Benefits, keep in mind that the question of can you receive disability and social security at the same time for the same work record must be considered. Instead, your disability payments will automatically transition to retirement payments once you reach full retirement age, which is generally around 66 or 67, depending on when you were born.

Understanding these requirements is crucial, especially for older applicants who may face unique challenges. The Social Security Administration (SSA) recognizes that transitioning to new job roles can be difficult for many. This acknowledgment can positively influence your disability claims, particularly if you’re dealing with serious conditions like arthritis, heart disease, or cancer, which tend to have higher approval rates.

Experts stress the importance of providing thorough medical documentation that clearly shows how your disabilities affect your daily life and work capabilities. This approach can significantly enhance your chances of approval for both disability and Retirement Benefits, ensuring you receive the support you need during tough times.

Remember, you’re not alone in this journey. We’re here to help you navigate these complexities and advocate for the benefits you deserve.

Outline the Application Process for Disability and Retirement Benefits

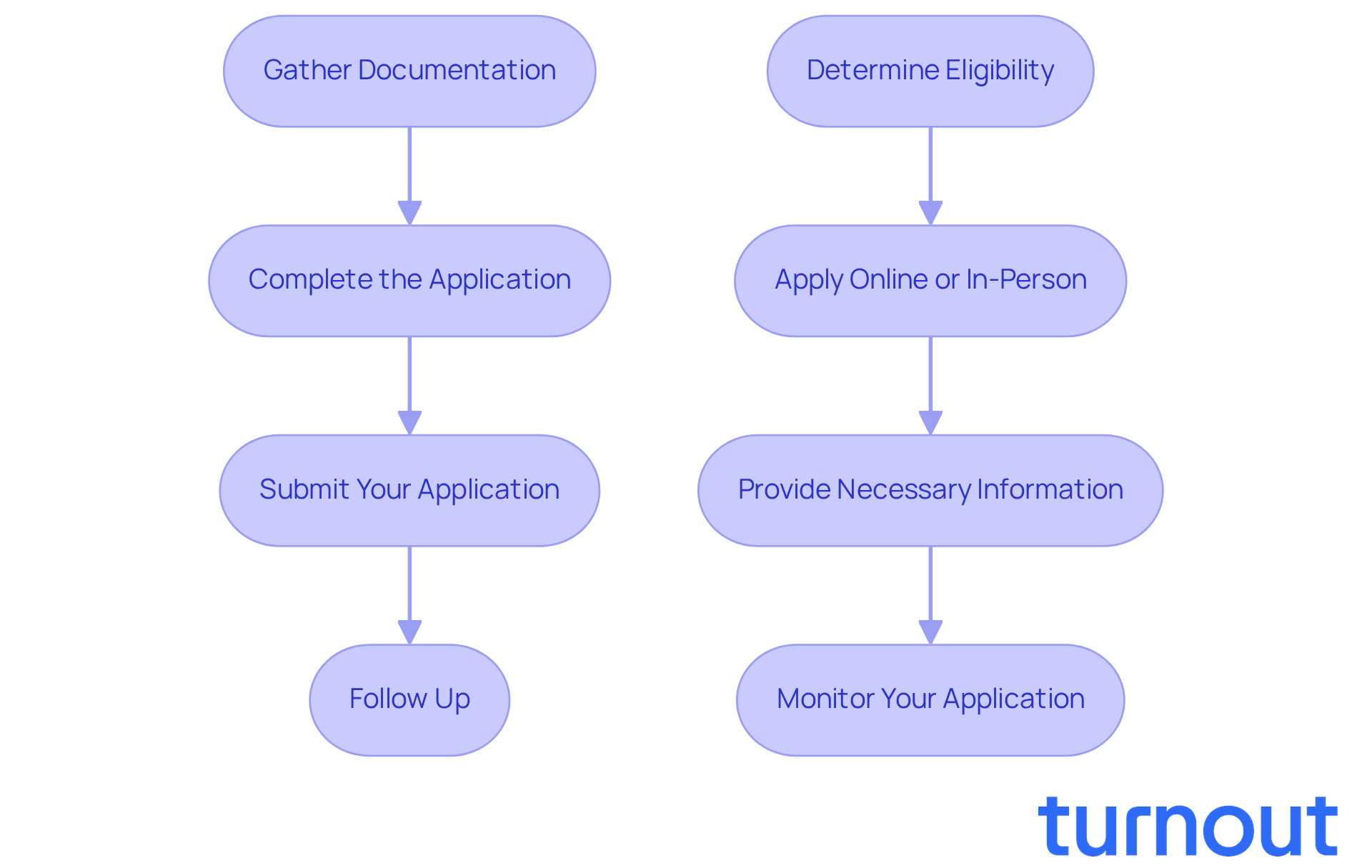

Navigating the application process for Social Security Disability Insurance (SSDI) can feel overwhelming, but you’re not alone. Here’s a step-by-step guide to help you through:

- Gather Documentation: Start by collecting essential documents like medical records and employment history. These will support your claim and make the process smoother.

- Complete the Application: You can apply online through the Social Security Administration (SSA) website, by phone, or in person at your local SSA office. It’s important to ensure that all information is accurate and complete to avoid delays. Remember, the initial review can take 3-5 months.

- Submit Your Application: Once everything is in order, submit your application along with all required documentation. Keep in mind that the SSA may ask for additional information during their review.

- Follow Up: After you submit, keep track of your application status. You can monitor your progress through your my Social Security account. It’s crucial to respond promptly to any requests from the SSA.

When it comes to Retirement Benefits, the process is quite similar:

- Determine Eligibility: First, confirm that you meet the age and job credit requirements. Generally, this means having 40 credits, with 20 earned in the last 10 years.

- Apply Online or In-Person: You can use the SSA website or visit your local office to apply. Completing the application online makes it more accessible.

- Provide Necessary Information: Have your Social Security number, work history, and any other required documentation ready. This preparation can help streamline the process.

- Monitor Your Application: Just like with SSDI, follow up on your application status and respond to any requests from the SSA. Benefits for Retirement typically convert automatically from SSDI at full retirement age, ensuring continuity of support.

It’s important to know that SSDI payments usually start six months after the onset date of the disability, and in some cases, payments may be retroactive for up to 12 months. By following these steps, you can navigate the application process more effectively, increasing your chances of approval.

Turnout utilizes trained nonlawyer advocates to assist clients with SSD claims, ensuring you have the support needed throughout this journey. Real-world examples show that having thorough documentation and prompt communication with the SSA can significantly enhance the likelihood of a successful application. Remember, we’re here to help you every step of the way.

Examine How Benefits Interact and Affect Each Other

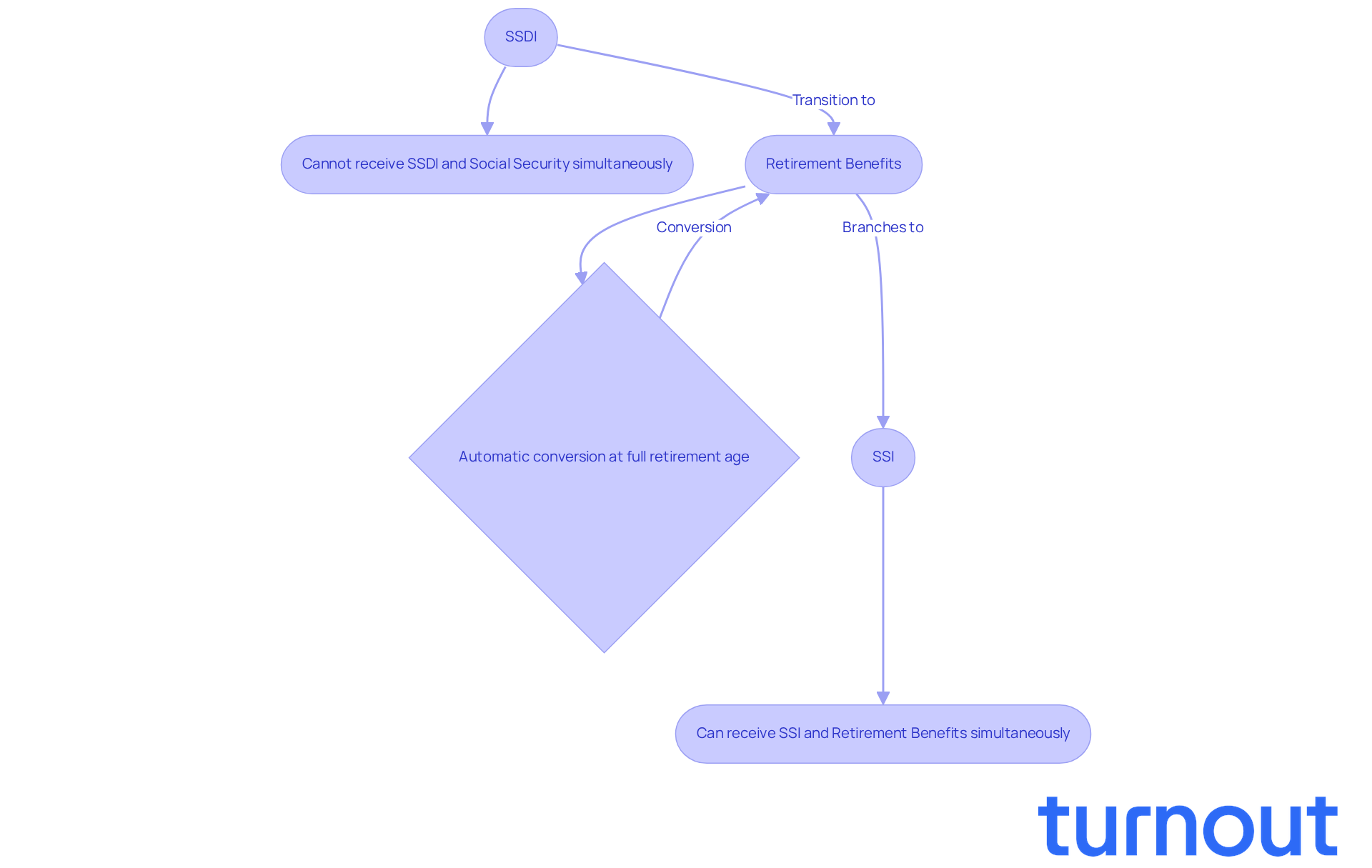

Navigating Social Security Disability Insurance (SSDI) can feel overwhelming, especially when considering how it transitions into retirement benefits. When you receive SSDI, your support is based on your earnings history. Once you reach full retirement age, your disability payments automatically convert to retirement payments, and the amount stays the same. This means you effectively access your retirement benefits early through SSDI.

However, it’s important to understand that the question of can you receive disability and social security at the same time for the same work record is not permissible. Once you hit retirement age, you’ll transition smoothly from SSDI to Retirement Benefits, ensuring there’s no interruption in your payments. This automatic conversion typically happens in the month you reach full retirement age, making the process seamless.

For those who qualify for Supplemental Security Income (SSI), there’s good news: you can receive both SSI and Retirement Benefits at the same time, as these programs operate independently. SSI assistance continues past age 65, as long as you meet the program's income and resource requirements. Understanding these interactions is crucial for managing your benefits effectively, helping you make informed decisions about your financial future.

We understand that this process can be complex, which is why Turnout is here to help. We offer access to trained nonlawyer advocates who can guide you through the intricacies of disability claims and tax relief options. These advocates are dedicated to helping you understand your benefits and navigate the application processes with ease.

Many individuals have shared their experiences, noting that their SSDI payments transitioned to retirement payments without any issues, allowing them to maintain financial stability. Financial planners often recommend consulting with a professional to grasp the implications of this transition, especially regarding tax reporting and potential changes in income eligibility. This proactive approach can empower you to maximize your benefits and prepare for any adjustments in your financial landscape. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Navigating the world of Social Security Disability Insurance (SSDI) and Retirement Benefits can feel overwhelming, but it’s a journey you don’t have to face alone. Understanding how these benefits work together is essential, especially for those dealing with health challenges or nearing retirement. By clarifying the differences between SSDI and Retirement Benefits, you can take charge of your financial future and ensure you receive the support you truly need.

This article walks you through the steps to apply for both benefits, highlighting the importance of thorough documentation and a clear understanding of the application process. It’s important to note that while SSDI payments transition seamlessly to retirement benefits once you reach full retirement age, you cannot receive both for the same work record. This knowledge is crucial for making informed decisions about your financial planning and maximizing the resources available to you.

We understand that the Social Security system can be daunting, but remember, you’re not alone in this. Seeking help from trained advocates or professionals can empower you to explore your options and secure the benefits you deserve. By taking proactive steps and staying informed, you can effectively manage the complexities of disability and retirement benefits, paving the way for a stable financial future.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial aid to individuals unable to work due to a medical condition expected to last at least one year or result in death. It supports those who have contributed to the Social Security system through their work history.

Who qualifies for SSDI?

Individuals who are unable to work due to a qualifying medical condition and have sufficient work credits from their employment history are eligible for SSDI.

What are Retirement Benefits?

Retirement Benefits are payments made to individuals who have reached a certain age, typically 62 or older, and have earned enough work credits throughout their careers to provide income during retirement.

Can individuals receive both SSDI and Retirement Benefits?

Yes, many individuals may qualify for both SSDI and Retirement Benefits, allowing them to receive financial support during their working years and into retirement.

How many Americans are expected to receive Social Security retirement support in 2025?

Approximately 66 million Americans are expected to receive Social Security retirement support in 2025.

How many people are projected to receive SSDI support as of August 2025?

Around 8.1 million people are projected to receive SSDI support as of August 2025.

Why are SSDI and Retirement Benefits important?

These benefits are crucial for many individuals as they provide essential financial support, significantly impacting their quality of life during challenging times.