Overview

Making payments to the IRS can feel overwhelming, but we want to assure you that there are various methods available to ease your experience. You can choose from options like:

- Direct Pay

- EFTPS

- Credit or debit cards

- Checks

- Cash transactions

Each of these methods caters to different preferences and needs, making it easier for you to find what works best for your situation.

It's common to feel anxious about timely payments, but selecting a suitable method can help you avoid penalties. We understand that navigating these choices can be challenging, and that’s why it’s important to explore all your options. Remember, you are not alone in this journey; we’re here to help you make an informed decision.

Take a moment to reflect on which payment method resonates with you. Whether you prefer the convenience of online payments or the familiarity of checks, there’s a solution that can fit your lifestyle. Your peace of mind is important, and with the right choice, you can ensure that your payments are made on time.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, and we understand that many individuals face this common challenge. Knowing how to make payments to the IRS is essential for effective financial management. With various payment options available—ranging from direct bank transfers to mobile transactions—you have the opportunity to choose methods that suit your needs best.

As the IRS increasingly shifts towards digital transactions, you may wonder: what are the most efficient ways to meet these obligations? How can you avoid the pitfalls of late payments? Exploring these options can empower you to take control of your financial responsibilities while minimizing stress and penalties. Remember, you are not alone in this journey, and we’re here to help guide you through it.

Understanding IRS Payment Options

Navigating tax obligations can be challenging, so it's important to know how can you , which offers various payment options designed to help you manage these responsibilities with ease. Understanding these methods is essential for effective financial planning, and we're here to guide you through this journey. The primary options include:

- : This method allows you to pay directly from your bank account without any fees. It’s a secure and straightforward way to settle your tax obligations. In fact, 93% of taxpayers chose Direct Pay during the 2025 tax filing season, highlighting its popularity and reliability.

- (EFTPS): Designed for both individuals and businesses, EFTPS lets you arrange transactions in advance. This provides flexibility and control over your tax obligations, making it especially beneficial if you prefer handling transactions electronically.

- : You can also settle your taxes using credit or debit cards through authorized processors. However, be mindful that this option incurs processing fees that do not contribute to the tax owed, which may deter some from using it.

- Check or Money Order: Traditional methods of payment are still available, allowing you to send your dues to the IRS. While familiar, this approach can lead to longer processing times. Paper checks are over 16 times more likely to be lost, stolen, altered, or delayed compared to electronic transactions. Additionally, the IRS plans to starting September 30, 2025, making it vital to transition to .

- Cash Transactions: If you prefer not to use electronic methods, cash transactions can be made at select retail partners, providing a convenient alternative.

When considering each payment option, it is important to understand how can you make payments to the IRS and the unique advantages and considerations that come with them. It's important to choose the method that best fits your financial situation and preferences. As the IRS moves toward digital transactions, utilizing options like Direct Pay and EFTPS can enhance security and efficiency, ensuring a prompt resolution of your tax obligations. We understand that sharing bank information with the IRS can raise concerns, but remember that essential information for electronic transfers is already included with paper checks. You're not alone in this journey; we're here to help you make the best choice for your financial peace of mind.

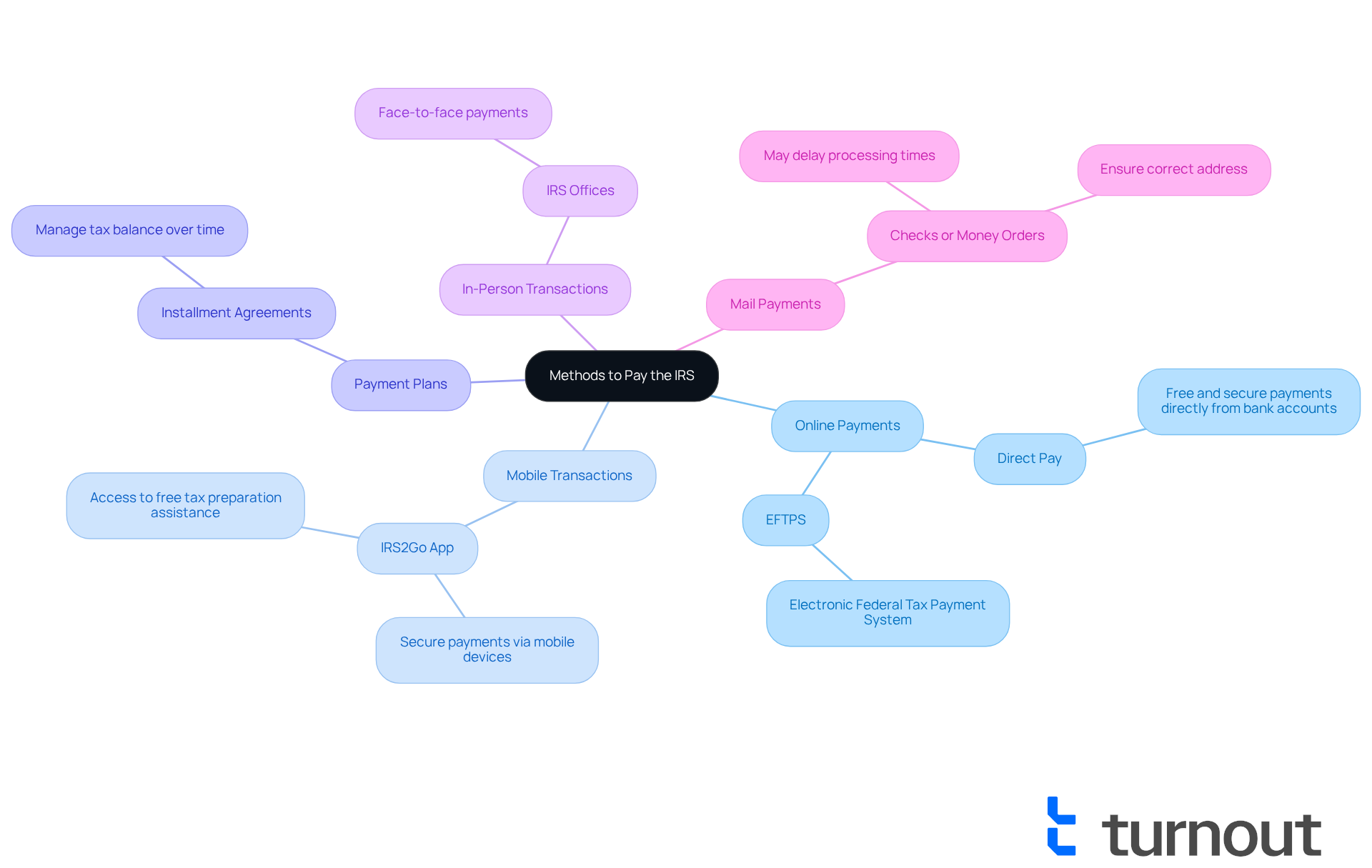

Exploring Methods to Pay the IRS

Taxpayers often wonder, can you using several methods, each designed to accommodate different preferences and situations? We understand that navigating tax payments can be overwhelming, so we're here to assist you with questions like, can you make payments to the IRS?

- Online Payments: Through the , taxpayers can utilize Direct Pay or the . These methods are quick, safe, and can you make payments to the IRS while offering prompt confirmation of the transaction, ensuring peace of mind as you fulfill your responsibilities.

- : The IRS2Go app enables taxpayers to conduct transactions directly from their mobile devices, providing unmatched convenience for those who are active. You can pay securely using your bank accounts or credit/debit cards, and the app also offers access to free tax preparation assistance in both English and Spanish.

- : If you’re unable to pay your tax bill in full, can you make payments to the IRS by setting up installment agreements? Taxpayers can apply for a financial arrangement online, allowing you to manage your balance over time while avoiding collection actions.

- In-Person Transactions: For those who prefer face-to-face interactions, visiting designated IRS offices or authorized collection locations allows you to make contributions in person.

- Mail Payments: Sending a check or money order via mail remains an option, although it may delay processing times. Be sure to send funds to the correct address and allow sufficient time for delivery.

Understanding these methods empowers you to choose the most appropriate option for your situation, ensuring you meet your obligations effectively. It’s important to note that by 2025, roughly 30% of individuals are expected to use mobile transactions, indicating a significant shift towards digital methods in tax administration. With the approaching September 30, 2025, cutoff for the , we encourage you to adjust swiftly to these changes. Remember, you are not alone in this journey; we’re here to support you every step of the way.

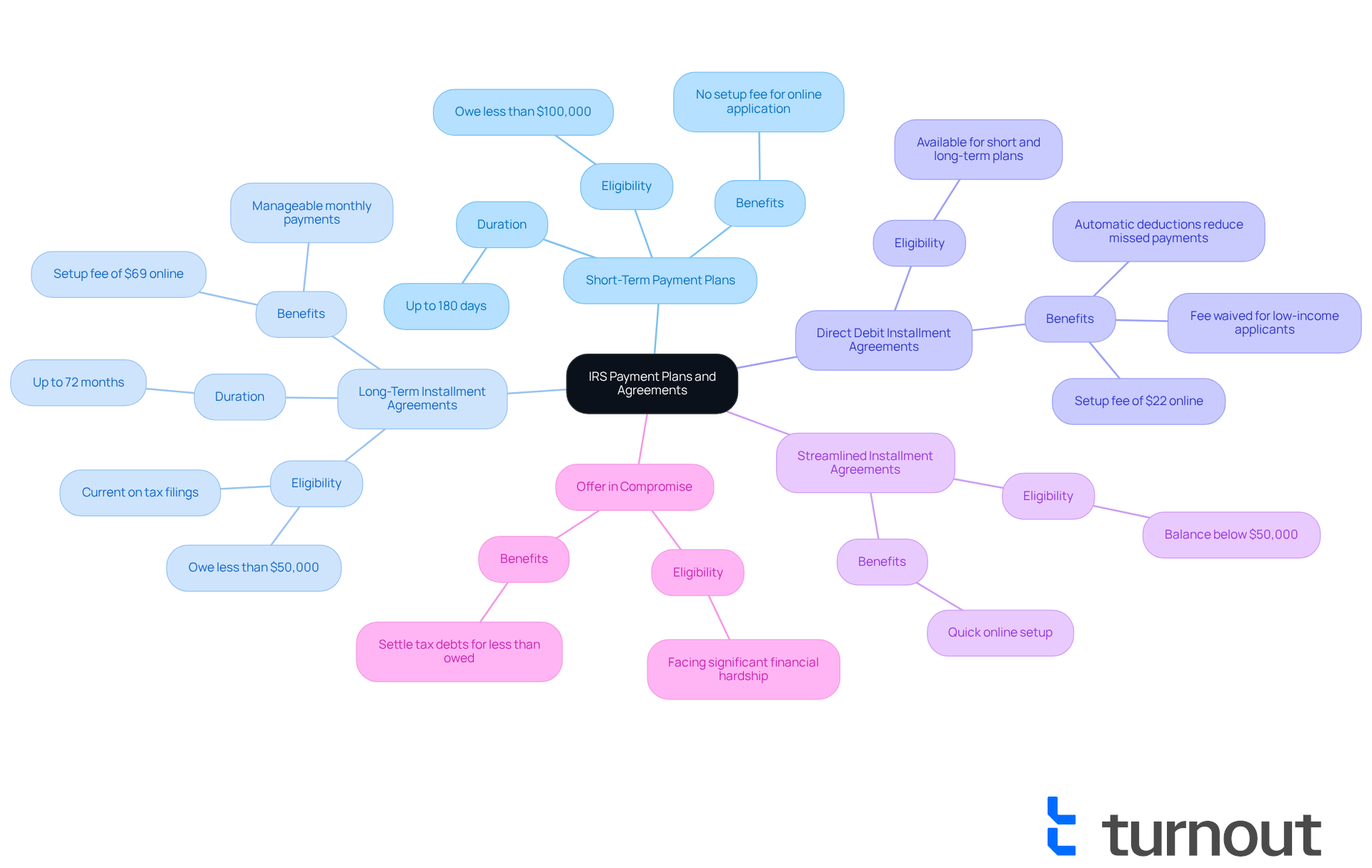

Navigating IRS Payment Plans and Agreements

For taxpayers who are feeling overwhelmed by their , a common question is, can you make payments to the IRS, as they provide a range of payment plans and agreements to help lighten the financial load.

- : If you owe less than $100,000, you can apply for a short-term payment plan, giving you up to 180 days to pay off the total amount. This option is perfect for those who anticipate being able to settle their debts quickly.

- : For individuals needing more time, long-term installment agreements allow for payments over a period of up to 72 months. To qualify, you must owe less than $50,000 and be current on your tax filings. While this choice offers manageable monthly payments, be aware that it might increase the total amount due due to interest and penalties.

- Direct Debit Installment Agreements: This method involves setting up automatic deductions from your bank account, making the process smoother and reducing the chances of missed payments. The setup fee is $22 when applied online, but low-income applicants can have this fee waived, making it a more affordable option for many.

- Streamlined Installment Agreements: If your balance is below $50,000, these agreements can be quickly established online, minimizing administrative hurdles and speeding up the resolution process.

- : If you're facing significant , you might qualify for an Offer in Compromise, which allows you to settle your tax debts for less than what you owe. This option can be especially helpful for those who cannot pay their full tax liabilities.

Understanding these financial options is crucial for managing your effectively, especially when considering how can you make payments to the IRS to avoid hefty penalties. Tax professionals often stress the importance of addressing tax debts proactively; ignoring them can lead to greater financial stress and complications. We encourage you to pay as much as you can, as quickly as possible, to minimize overall costs. The IRS also recommends using the on IRS.gov to apply for these plans and to check your tax information through your Individual Online Account. Remember, the IRS will not contact you via phone, text, or social media to demand immediate payment, which can help alleviate concerns about potential scams. You're not alone in this journey, and there are resources available to support you.

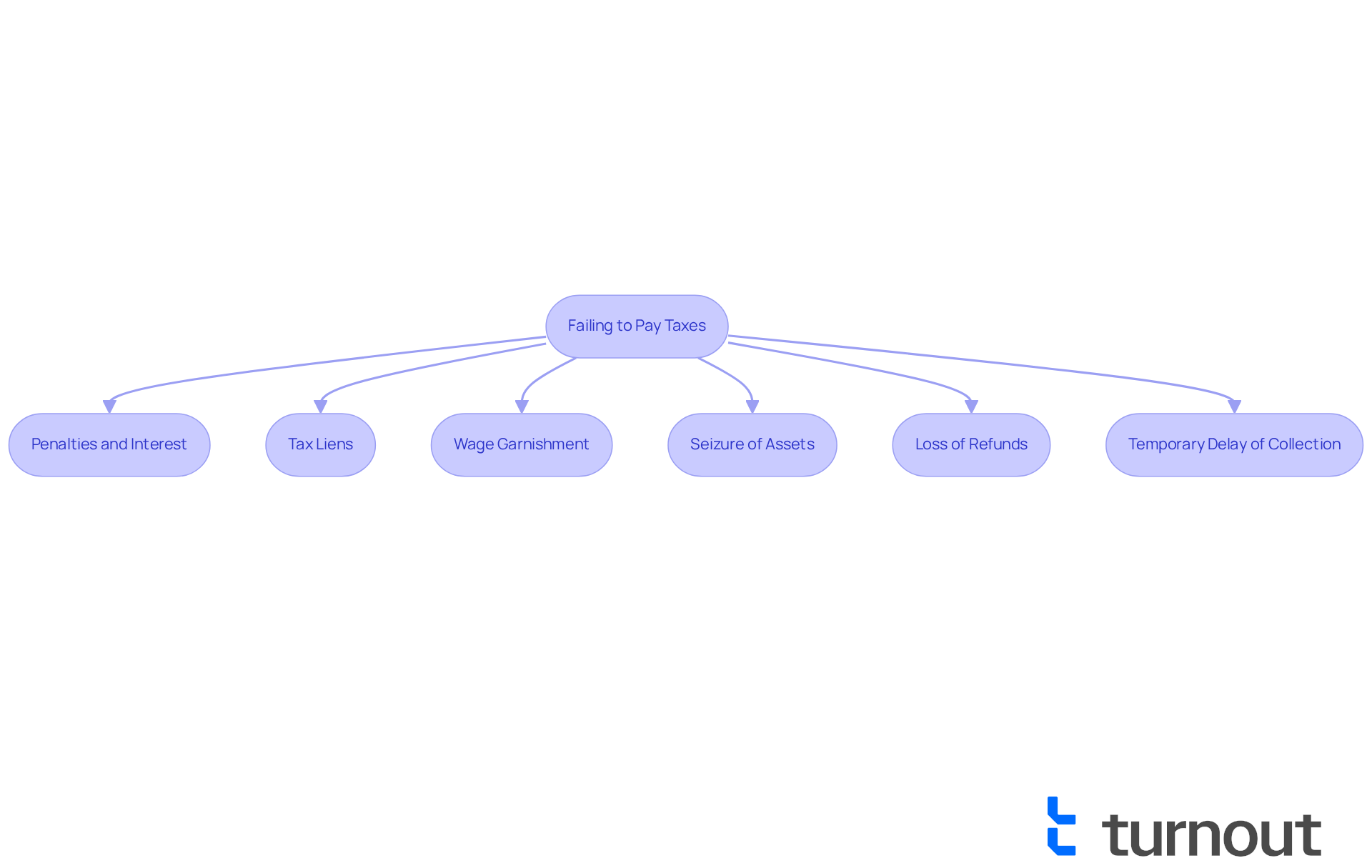

Understanding the Consequences of Non-Payment

Failing to pay taxes can lead to serious consequences, and we understand that this can be a source of stress for many. It's important to be aware of what may happen if .

- Penalties and Interest: The imposes , which can accumulate rapidly. For instance, the 'failure to file' penalty is 5% of owed amounts per month, capped at 25%. Meanwhile, the 'failure to pay' penalty is 0.5% per month, also capped at 25%. In 2025, the IRS has adjusted these penalties to reflect inflation, resulting in higher fines for late filing and late payment. Interest on unpaid taxes continues to accrue until the balance is fully paid, further increasing the total amount owed over time. If you've made efforts to comply with tax laws but faced uncontrollable circumstances, you may qualify for penalty relief, which can alleviate some of the financial burden.

- : The IRS may file a tax lien against your property, which can severely impact credit ratings and hinder your ability to secure loans or mortgages. In 2025, the threshold for 'seriously delinquent' tax debt will rise to $65,000. This makes it essential to stay aware of your obligations and the possible consequences of your tax debt.

- : In extreme cases, the IRS can garnish wages, taking a portion of your paycheck to satisfy the debt. This can create significant financial strain, especially if you're already facing economic challenges.

- Seizure of Assets: The IRS has the authority to confiscate assets, including bank accounts and property, to recover unpaid dues. This drastic measure underscores the importance of addressing tax obligations promptly.

- Loss of Refunds: If you owe back taxes, your future tax refunds may be withheld until the debt is settled. This can create additional financial hardship, particularly for those relying on refunds for essential expenses.

- : If you're facing financial difficulties, you can request a temporary delay of the collection process from the IRS. If approved, this can provide some relief, although penalties and interest will continue to accrue.

Understanding these consequences emphasizes the importance of addressing tax obligations promptly. We encourage you to explore your , such as setting up an online payment plan, and seek assistance if needed to understand how you can make payments to the IRS to avoid these severe repercussions. As tax professional Mark Kohler wisely notes, "Taxpayers should be proactive in managing their obligations to avoid the pitfalls of penalties and interest." Remember, you are not alone in this journey, and we're here to help.

Conclusion

Navigating the complexities of tax payments is essential for maintaining your financial well-being. We understand that understanding how to make payments to the IRS can feel overwhelming. Fortunately, there are various options available—from Direct Pay and EFTPS to payment plans and traditional methods—that empower you to choose the method that best suits your individual circumstances. As the IRS transitions towards more digital solutions, being informed about these options can significantly enhance your efficiency and security in managing tax obligations.

Throughout this article, we’ve highlighted key insights regarding the diverse payment methods offered by the IRS. Direct Pay stands out as a popular choice for its simplicity and lack of fees, while EFTPS provides flexibility for both individuals and businesses. It’s important to understand payment plans and the potential consequences of non-payment, as neglecting these obligations can have financial implications.

Ultimately, staying proactive about your tax responsibilities is vital. By exploring the available IRS payment options and understanding the associated risks of non-payment, you can navigate your tax obligations with confidence. Embracing digital transactions and utilizing payment plans can lead to a more manageable financial future. If you’re feeling overwhelmed, remember that seeking guidance and support is always encouraged. You are not alone in this journey, and there are resources available to assist you in making informed decisions regarding IRS payments.

Frequently Asked Questions

What are the primary payment options available for settling tax obligations with the IRS?

The primary payment options include Direct Pay, Electronic Federal Tax Payment System (EFTPS), credit or debit card transactions, check or money order, and cash transactions at select retail partners.

What is Direct Pay and why is it popular among taxpayers?

Direct Pay allows you to pay directly from your bank account without any fees. It is secure and straightforward, and 93% of taxpayers chose this method during the 2025 tax filing season, highlighting its popularity and reliability.

How does the Electronic Federal Tax Payment System (EFTPS) work?

EFTPS is designed for both individuals and businesses, allowing you to arrange transactions in advance, providing flexibility and control over your tax obligations.

Are there fees associated with paying taxes using a credit or debit card?

Yes, paying taxes with credit or debit cards incurs processing fees that do not contribute to the tax owed, which may deter some taxpayers from using this option.

What are the drawbacks of using checks or money orders to pay taxes?

While checks and money orders are traditional payment methods, they can lead to longer processing times. Paper checks are over 16 times more likely to be lost, stolen, altered, or delayed compared to electronic transactions, and the IRS plans to phase out paper checks starting September 30, 2025.

Can I pay my taxes in cash, and if so, how?

Yes, you can make cash transactions at select retail partners, providing a convenient alternative for those who prefer not to use electronic methods.

What should I consider when choosing a payment option for my taxes?

It is important to understand the unique advantages and considerations of each payment method and to choose the one that best fits your financial situation and preferences.

Is it safe to share bank information with the IRS for electronic payments?

While sharing bank information can raise concerns, it's important to note that essential information for electronic transfers is already included with paper checks, ensuring security in the process.