Introduction

Navigating the complexities of Social Security can feel overwhelming. We understand that many individuals face challenges when trying to differentiate between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). With millions of Americans relying on these benefits, it’s crucial to recognize the eligibility criteria and application processes to maximize financial support.

But can individuals truly access both SSDI and SSI at the same time? What does this mean for their overall benefits? These are common questions that many people have. This article aims to delve into the intricacies of these programs, offering insights and guidance for those seeking to optimize their assistance options. Remember, you are not alone in this journey, and we’re here to help.

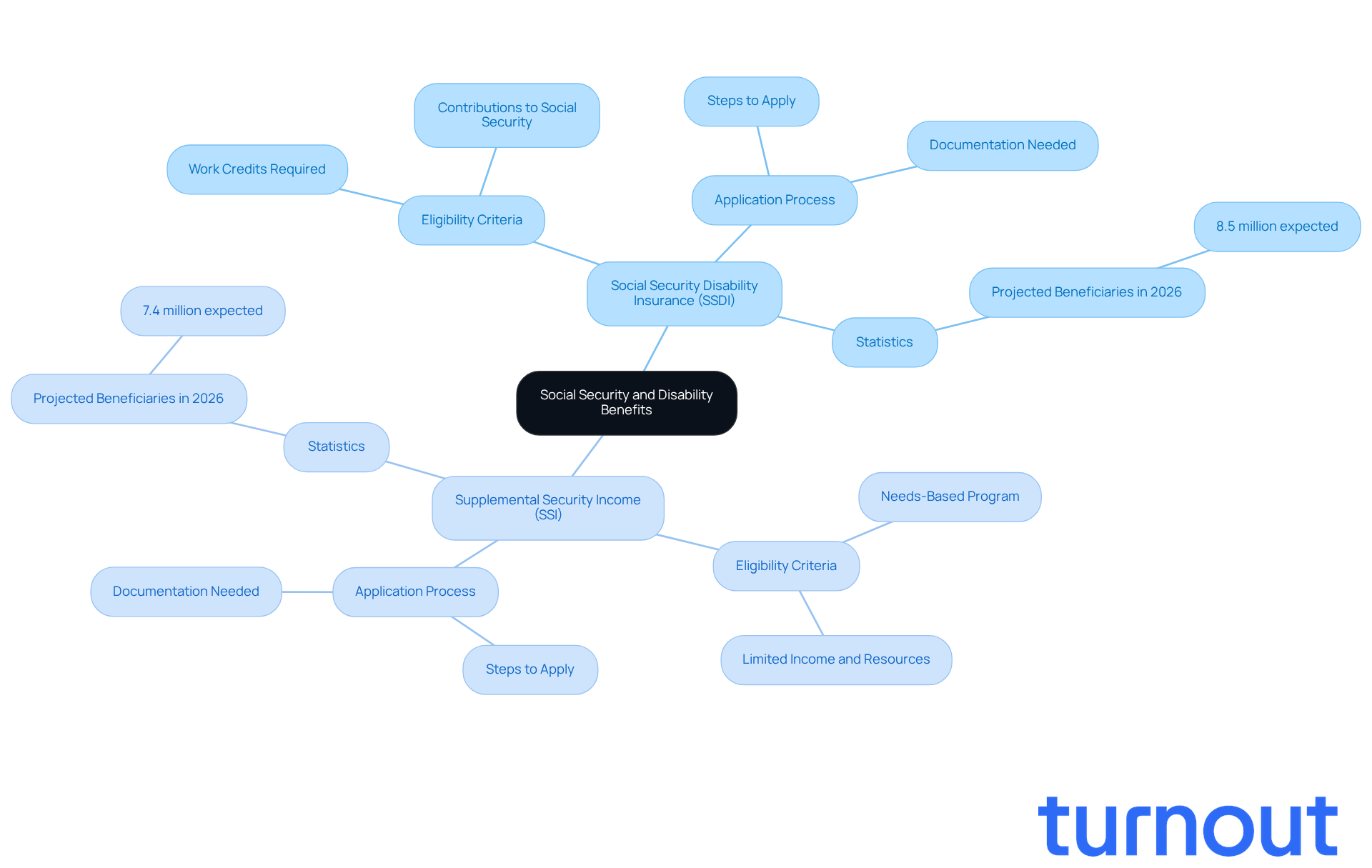

Understand Social Security and Disability Benefits

Navigating the world of Social Security can feel overwhelming, but understanding the two primary types of assistance - Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) - is crucial. SSDI is designed for those who have worked and contributed to Social Security taxes, while SSI is a needs-based program for individuals with limited income and resources, regardless of their work history. Recognizing these differences is essential, as the eligibility criteria and application processes vary significantly. For instance, SSDI requires a specific number of work credits, while SSI focuses on financial need. Knowing these distinctions can help you determine which program suits your situation best.

In 2026, around 8.5 million Americans are expected to receive SSDI support, while approximately 7.4 million will rely on SSI. This underscores the importance of understanding which program you may qualify for, especially as the Social Security Administration updates eligibility criteria. Recent changes emphasize the need for accurate reporting of income and resources, which can significantly impact your benefits. Financial advisors recommend that individuals familiarize themselves with these distinctions and stay informed about updates to maximize their advantages. For example, knowing the 2026 earnings limits - $24,480 for those under full retirement age and $65,160 for those reaching full retirement age - can empower beneficiaries to navigate their options more effectively. Additionally, being aware of the updated guidance on reporting responsibilities and penalties for SSI interview failures is crucial, as these factors can affect eligibility.

Turnout is here to help you access tools and services that simplify these complex financial and governmental systems. With trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, Turnout supports clients in understanding their options without needing legal representation. Real-world stories of individuals successfully navigating these benefits can offer valuable insights into the process. Remember, you are not alone in this journey; we’re here to help you every step of the way.

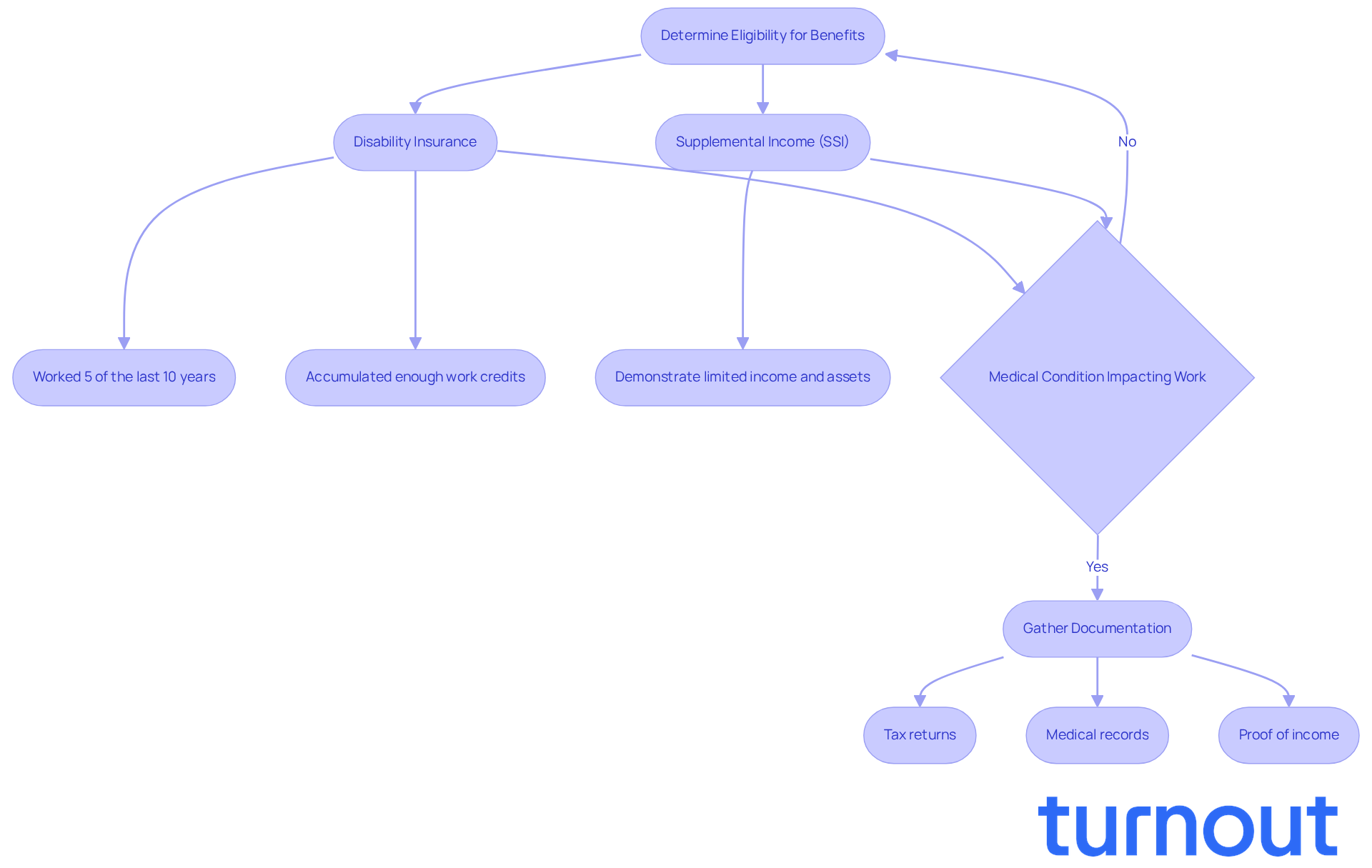

Determine Eligibility for Benefits

Navigating the world of Disability Insurance can feel overwhelming, especially when you're trying to understand your eligibility. To qualify, you need to have worked for at least five of the past ten years and accumulated enough work credits. On the other hand, Supplemental Income (SSI) eligibility is based on your income and resources; you must demonstrate limited income and assets. Both programs require a medical condition that significantly impacts your ability to work.

As we look ahead to February 2026, it's important to be aware that disability benefits eligibility for new applicants may decrease by up to 20%. This change could particularly affect older workers, with a projected 30% decline for those aged 50 and above. To assess your eligibility, gathering the right documentation is crucial. This includes:

- Tax returns

- Medical records

- Proof of income

For example, compiling your tax documents alongside medical evaluations can help substantiate your claims.

We understand that this process can be daunting, but using the Social Security Administration's (SSA) online tools can help you verify your eligibility status and clarify the specific criteria that apply to your situation. Disability advocates stress the importance of thorough documentation, reminding us that "gathering the right information is essential for a successful application." It's also vital to stay informed about the current income limits for SSI eligibility in 2026, as these limits are designed to ensure that assistance reaches those who genuinely need it.

By staying organized and informed, you can navigate the complexities of these programs more effectively. Remember, you are not alone in this journey. Turnout offers access to trained nonlawyer advocates who can guide you through this process, ensuring you have the support you need without the necessity of legal representation.

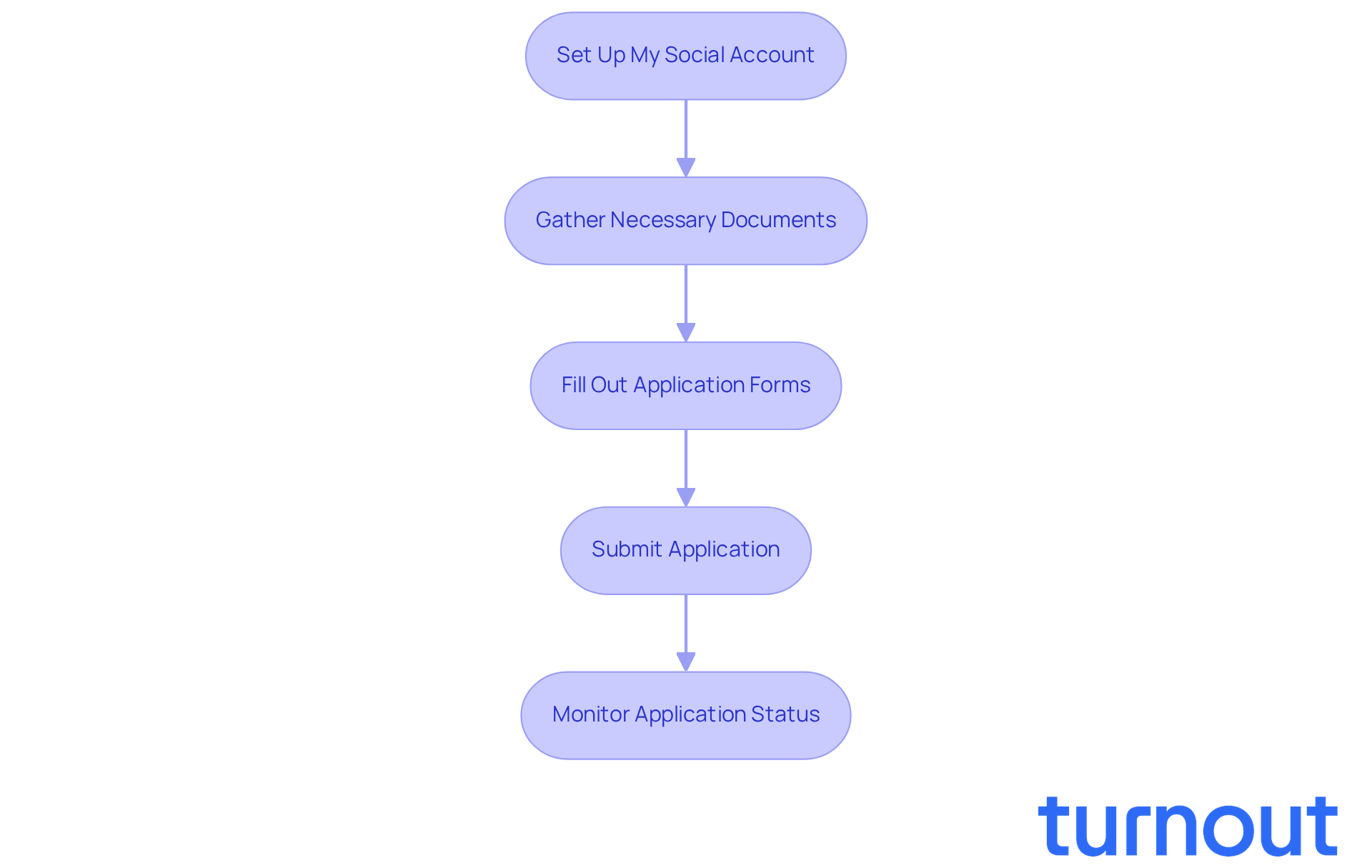

Apply for Social Security and Disability Benefits

Applying for SSDI or SSI can feel overwhelming, but we're here to help you through it. You can conveniently complete your application online through the SSA website, by phone, or in person at your local SSA office. Start by setting up a My Social account; this will simplify the process and allow you to monitor your application status easily.

Gathering the necessary documents is crucial. Make sure you have your Social Insurance number, comprehensive medical records, and a detailed work history ready. When filling out the application forms, it’s essential to ensure that all information is accurate and complete to avoid any delays.

The review process typically takes three to five months, and it’s important to know that the Social Welfare Administration approves about 20-25% of initial disability applications. After you submit your application, keep an eye on your status through your account or by contacting the SSA. It’s common to feel anxious about potential follow-up requests for additional information or documentation, but remember, this is a normal part of the process.

Recent updates to the application process in 2026 highlight the importance of thorough documentation and clear communication. These elements can significantly enhance your chances of approval. As of 2026, the maximum Social Security payment is $5,251 per month, which is an important consideration for your financial planning.

Many individuals have successfully navigated this process online, benefiting from the streamlined features and support provided by the SSA. While Turnout is not a law firm and does not provide legal representation, we offer assistance through trained nonlawyer advocates. They can help you navigate the complexities of SSD claims, ensuring you have the support you need throughout the application process. Remember, you are not alone in this journey.

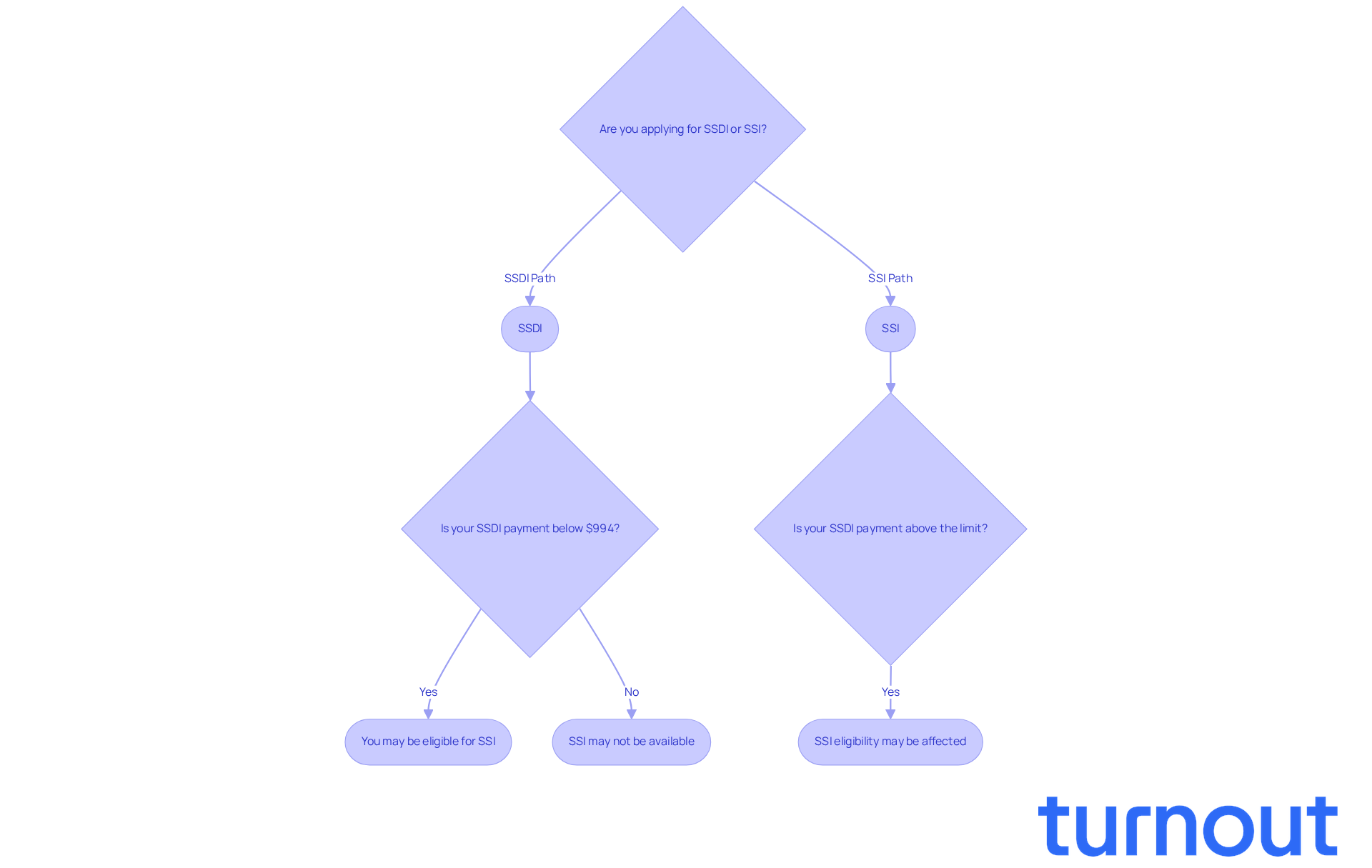

Navigate Overlaps Between Benefits

Navigating the world of Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) can feel overwhelming. We understand that many are seeking the financial support they deserve. It is crucial to understand how these benefits interact, especially when considering can you get social security and disability at the same time, as qualifying for both SSDI and SSI can provide essential assistance.

For example, if your SSDI payment is below the maximum SSI amount, you may be eligible for SSI to help supplement your income. However, it’s important to note that your disability payments can impact your SSI eligibility, especially if they exceed certain limits. In 2026, the highest federal SSI payment will rise to $994 monthly for individuals. This means that if your SSDI amount is $750, SSI could provide an additional $190 to reach that limit.

Understanding these details is vital for maximizing your benefits. Consulting with a benefits advocate can make a significant difference. At Turnout, our trained nonlawyer advocates are here to help you navigate these overlaps effectively. While we don’t provide legal advice or representation, we’re dedicated to ensuring you understand your options and receive the financial support you need. Remember, you are not alone in this journey.

Troubleshoot Common Application Issues

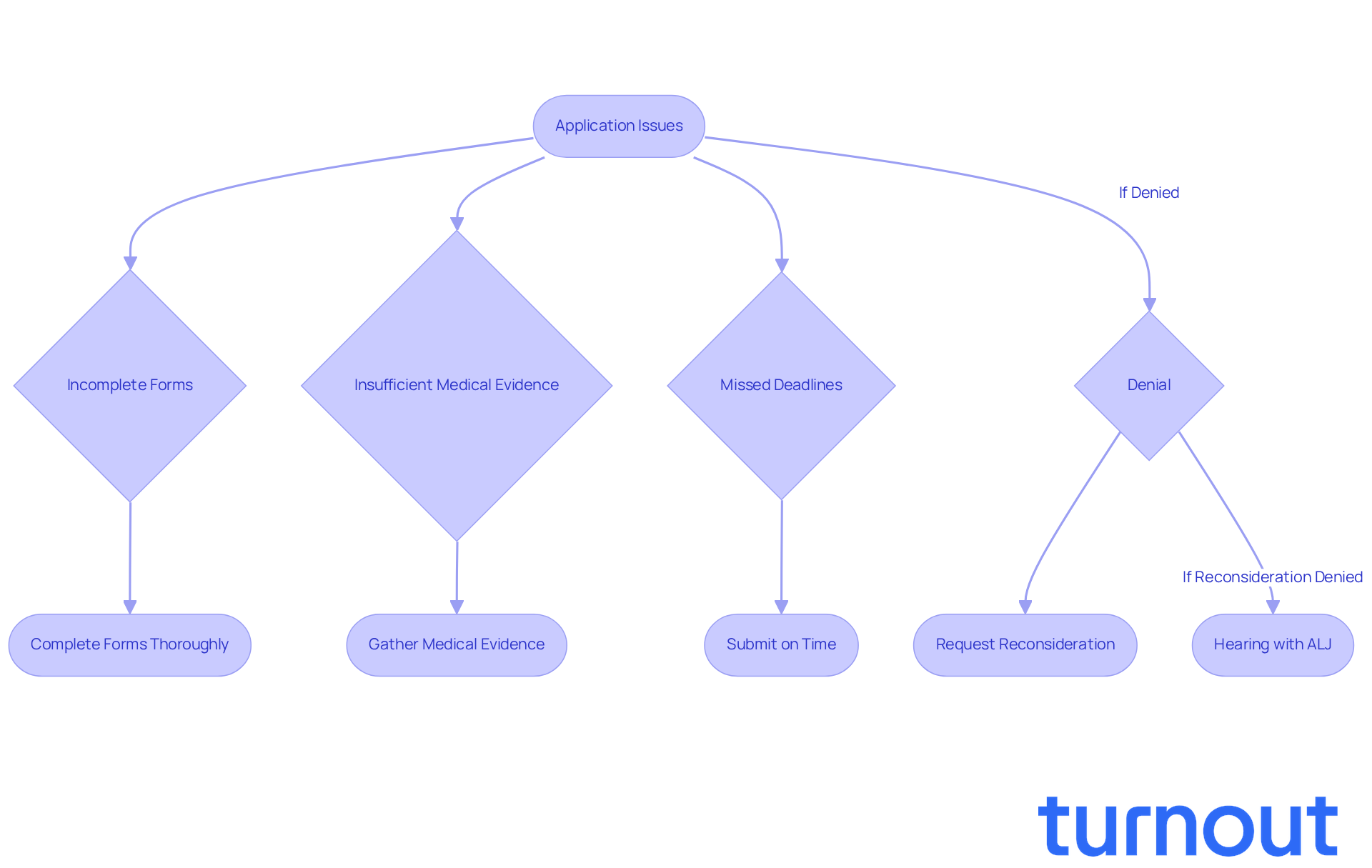

Navigating the SSDI and SSI application process can be challenging, and it's common to encounter issues like incomplete forms, insufficient medical evidence, and missed deadlines. We understand that these hurdles can feel overwhelming. To tackle these challenges effectively, make sure all forms are completed accurately and thoroughly. Keeping copies of all submitted documents is essential; you might need to refer to them later.

If you receive a denial, remember, this isn’t the end of your journey. You have the right to appeal the decision. Familiarize yourself with the appeals process, which usually starts with requesting a reconsideration and may lead to a hearing before an administrative law judge (ALJ). Many applicants who initially face denial find success through persistence in the appeals process, highlighting the importance of not giving up.

Consider enlisting the help of a disability advocate. They can significantly enhance your chances of approval by guiding you through complex issues and ensuring your application is strong. Advocates clarify requirements and assist in gathering necessary documentation, making the process smoother and more manageable.

Remember, Turnout is not a law firm and does not provide legal representation. As you plan your next steps, keep in mind that in 2026, the substantial gainful activity (SGA) cut-off is set at $1,690 per month, which is crucial for determining your eligibility. You're not alone in this journey; we're here to help.

Conclusion

Navigating the relationship between Social Security and disability benefits can feel overwhelming. We understand that many individuals are seeking clarity and support in these complex systems. The possibility of receiving both Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) can significantly enhance financial stability for those in need. Recognizing the eligibility criteria, application processes, and potential overlaps between these benefits is crucial for maximizing assistance.

Throughout this article, we’ve highlighted key insights, including:

- The distinct eligibility requirements for SSDI and SSI

- The importance of accurate documentation

- The potential impact of upcoming changes in 2026

Staying informed about the evolving landscape of Social Security benefits is vital. It empowers individuals to advocate for their rights and access the support they deserve. Utilizing resources like Turnout can provide essential guidance in navigating these complexities.

Ultimately, the journey to secure Social Security and disability benefits may seem daunting, but remember: support is available. By remaining proactive, organized, and informed, you can successfully traverse the application process and overcome common challenges. Embracing the resources and assistance available can empower you to make the most of your entitlements and ensure you receive the financial stability you need. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What are the two primary types of Social Security assistance?

The two primary types of Social Security assistance are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). SSDI is for individuals who have worked and contributed to Social Security taxes, while SSI is a needs-based program for those with limited income and resources, regardless of their work history.

What are the eligibility criteria for SSDI and SSI?

To qualify for SSDI, individuals must have worked for at least five of the past ten years and accumulated enough work credits. SSI eligibility is based on demonstrating limited income and assets, along with having a medical condition that significantly impacts the ability to work.

How many Americans are expected to receive SSDI and SSI support in 2026?

In 2026, around 8.5 million Americans are expected to receive SSDI support, while approximately 7.4 million will rely on SSI.

What recent changes should individuals be aware of regarding Social Security benefits?

Recent changes emphasize the need for accurate reporting of income and resources, which can significantly impact benefits. Additionally, eligibility criteria may be updated, and it is essential to be aware of the 2026 earnings limits for SSDI and SSI.

What are the earnings limits for SSDI in 2026?

The earnings limits for SSDI in 2026 are $24,480 for individuals under full retirement age and $65,160 for those reaching full retirement age.

What documentation is necessary to assess eligibility for disability benefits?

Necessary documentation includes tax returns, medical records, and proof of income. Compiling these documents can help substantiate claims for benefits.

How might disability benefits eligibility change for new applicants by February 2026?

Disability benefits eligibility for new applicants may decrease by up to 20% by February 2026, particularly affecting older workers, with a projected 30% decline for those aged 50 and above.

How can individuals verify their eligibility status for Social Security benefits?

Individuals can use the Social Security Administration's (SSA) online tools to verify their eligibility status and clarify the specific criteria that apply to their situation.

What resources does Turnout provide to assist individuals with Social Security benefits?

Turnout offers access to trained nonlawyer advocates for SSD claims and IRS-licensed enrolled agents for tax debt relief, helping clients understand their options without needing legal representation.