Overview

We understand that navigating short-term disability benefits during pregnancy can feel overwhelming. These benefits can provide crucial financial support during prenatal care, childbirth, and postpartum recovery. However, eligibility depends on specific criteria outlined in individual policies.

It's important to familiarize yourself with these criteria, which may include:

- Your employment status

- Medical certification

Preparing the necessary documentation can significantly enhance your chances of a successful claim. Remember, you are not alone in this journey; we're here to help you through the process.

Take the time to gather your documents and understand your policy. This proactive step can make a world of difference in ensuring you receive the support you need during this special time.

Introduction

Navigating the complexities of short-term disability insurance can feel overwhelming, especially for expectant mothers facing the financial implications of pregnancy. We understand that this crucial coverage serves as a safety net during such a significant life change. However, it also raises important questions about eligibility, benefits, and the application process.

With nearly half of employees feeling financially insecure, the stakes are high. Can short-term disability truly support maternity leave? Or do many find themselves unprepared when it matters most? It's common to feel uncertain about these issues, but exploring these critical aspects can empower you to make informed decisions.

You deserve to secure the financial assistance you need during this transformative time. Remember, you are not alone in this journey. We're here to help you understand your options and navigate the path ahead.

Understand Short-Term Disability Insurance for Pregnancy

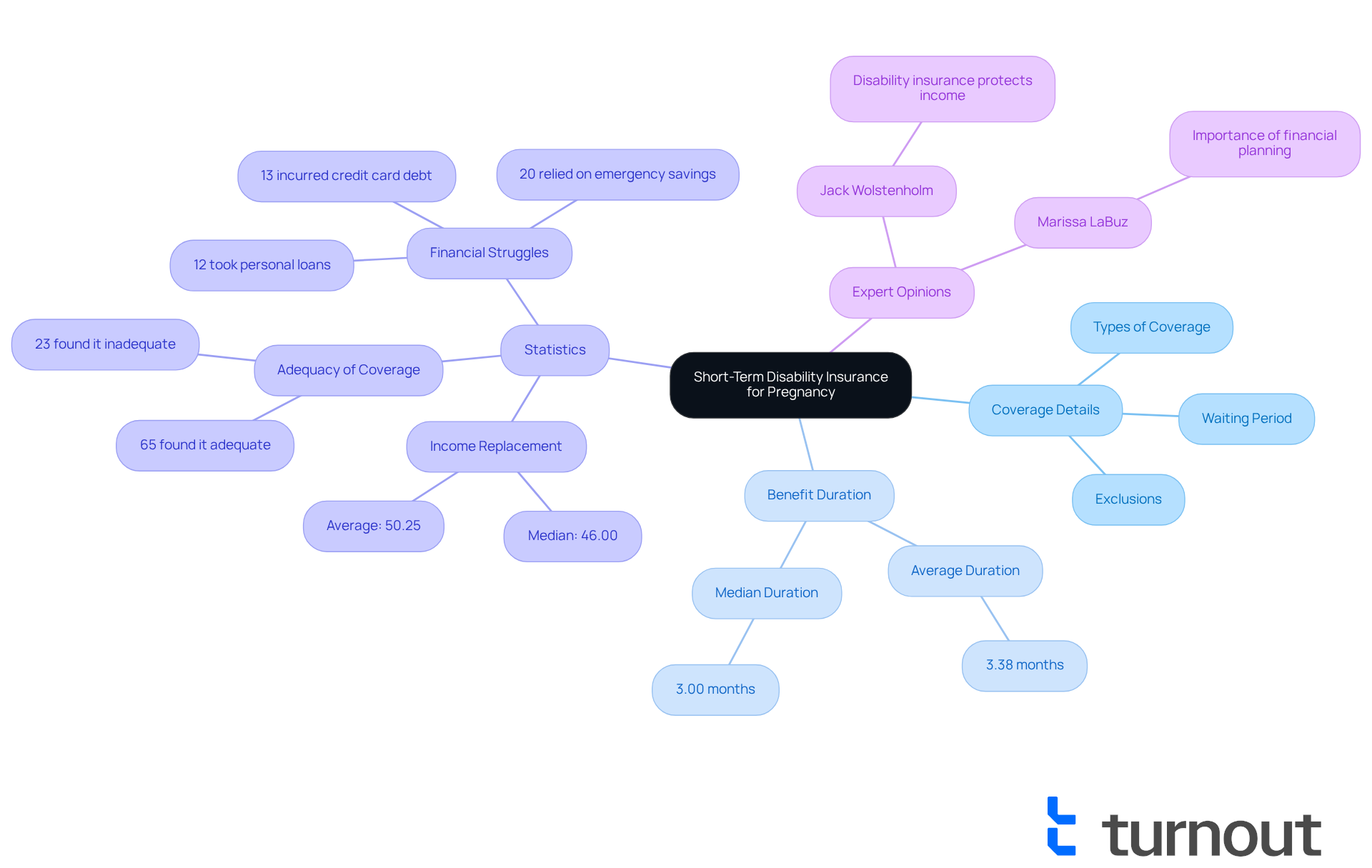

People often ask, can you get short term disability for pregnancy, as short-term coverage provides crucial financial support for those temporarily unable to work due to health issues. This coverage typically replaces a portion of your salary for a limited time, allowing you to concentrate on your health and recovery. Since policies can differ significantly among providers, it’s important to fully understand the specific terms of your coverage. Generally, temporary leave for pregnancy raises the question: can you get short term disability for pregnancy to cover time off for prenatal care, childbirth, and postpartum recovery?

We understand that navigating these options can be overwhelming. Familiarizing yourself with your policy’s waiting period, benefit duration, and any exclusions is vital. For instance, the average benefit duration for temporary incapacity coverage is around 3.38 months, with many plans replacing about 50.25% of your monthly earnings.

Experts stress the importance of knowing your coverage. As Jack Wolstenholm, a risk management expert, noted, "Disability coverage safeguards your earnings if injury or illness restricts your capacity to work." This is particularly significant for expectant mothers. In fact, 65% of women with temporary coverage reported that it provided adequate financial support during unpaid maternity leave. However, real-world experiences tell a different story: 23% of mothers with temporary illness insurance found the financial assistance lacking, leading them to rely on savings or credit.

By understanding whether you can get short term disability for pregnancy, you can better manage the complexities of maternity leave and ensure you have the financial support you need during this important life event. Remember, you are not alone in this journey, and we’re here to help.

Determine Eligibility Requirements for Short-Term Disability

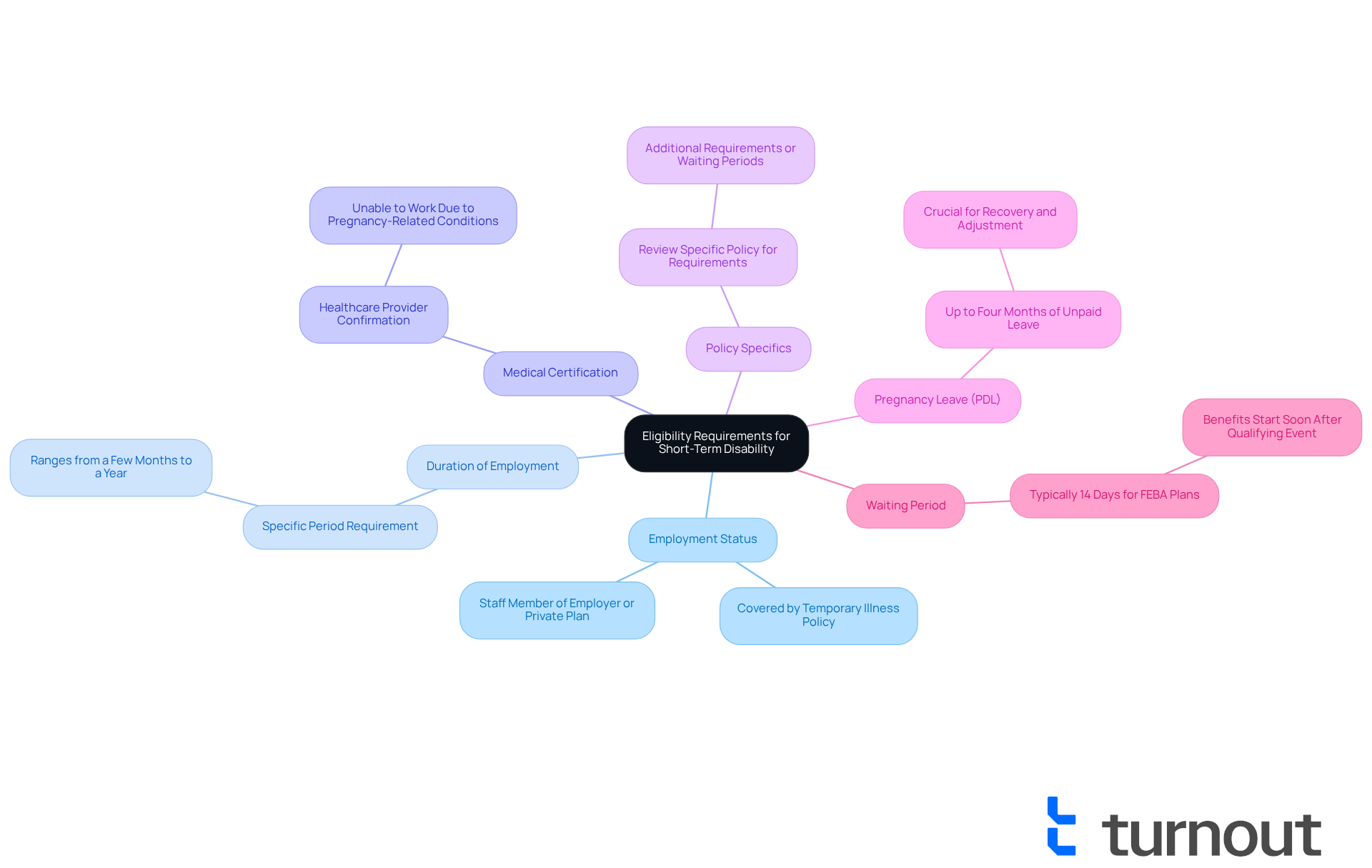

It can feel overwhelming to navigate the world of short-term disability benefits, especially when wondering, can you get short term disability for pregnancy? We understand that this is a significant time in your life, and knowing what you need to qualify can help ease some of that stress. Here are the key criteria you typically need to meet:

- Employment Status: You should be a staff member covered by a temporary illness policy, whether through your employer or a private plan.

- Duration of Employment: Many policies require you to have worked for a specific period before becoming eligible, often ranging from a few months to a year.

- Medical Certification: A healthcare provider must confirm that you are unable to work due to pregnancy-related conditions, which can include complications or recovery from childbirth.

- Policy Specifics: It’s essential to review your specific policy for any additional requirements or waiting periods, as these can vary significantly between plans.

- Pregnancy Leave (PDL): Employees may take up to four months of unpaid leave for pregnancy-related issues, which is crucial for recovery and adjustment after childbirth.

- Waiting Period: For FEBA temporary incapacity plans, the waiting period is usually just 14 days, meaning benefits can start fairly soon after the qualifying event.

Statistics show that nearly 46% of employees feel their financial situation isn’t improving. This highlights how vital it is to understand these criteria to determine if you can get short term disability for pregnancy in order to secure financial support during maternity leave. HR experts emphasize that understanding can you get short term disability for pregnancy and enrolling in temporary coverage proactively is essential. This ensures protection for pregnancy-related claims, which might be viewed as pre-existing conditions if the policy isn’t in place before conception.

Moreover, when considering financial support, one might ask, can you get short term disability for pregnancy, as this insurance typically covers up to 70% of a worker's earnings, providing crucial financial assistance during this important time. Understanding these eligibility criteria can empower you to move forward with your submission. Remember, you’re not alone in this journey, and we’re here to help you every step of the way.

Gather Required Documentation for Your Application

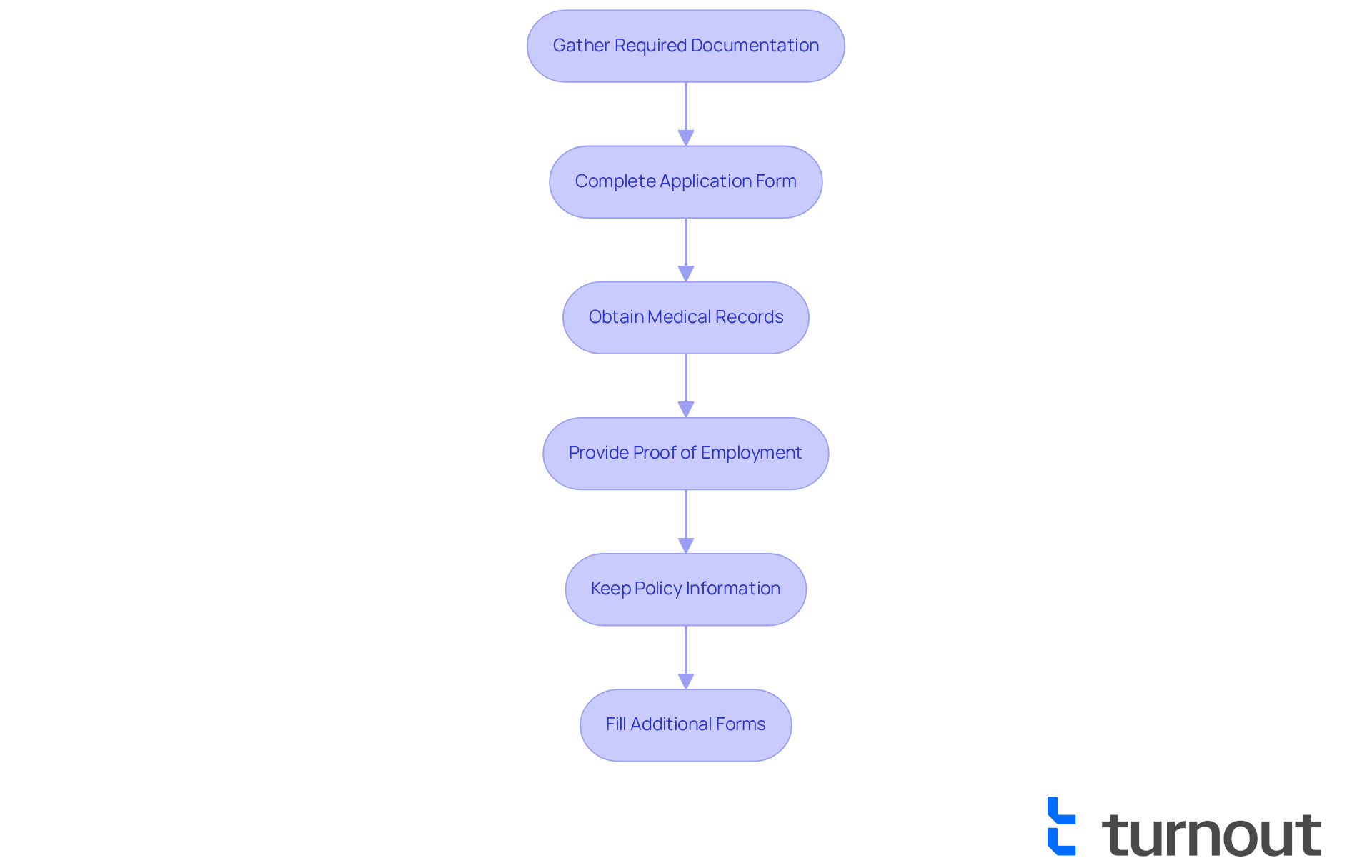

Preparing to apply for short-term disability for pregnancy can feel overwhelming, but you’re not alone in this journey. To help ease the process, gather the following documentation:

- Application Form: Start by completing the application form provided by your insurance company.

- Medical Records: It’s crucial to obtain medical documentation from your healthcare provider that outlines your pregnancy and any complications that may affect your ability to work. This documentation is essential, as the average approval rate for temporary leave claims associated with pregnancy raises the question, can you get short term disability for pregnancy? Comprehensive preparation can make a significant difference.

- Proof of Employment: Include pay stubs or a letter from your employer confirming your employment status and duration.

- Policy Information: Keep a copy of your short-term incapacity policy handy to reference coverage details.

- Additional Forms: Some insurers may require specific forms to be filled out by your healthcare provider. Make sure these are completed accurately.

Having these documents ready will simplify your submission process and enhance your likelihood of acceptance. Remember, prompt and thorough entries are essential in managing the intricacies of claims related to disabilities.

It’s common to feel anxious about potential complications during the claims process, such as disputes with insurance companies. Being well-prepared is key. We’re here to help you navigate this process with confidence.

Complete and Submit Your Short-Term Disability Application

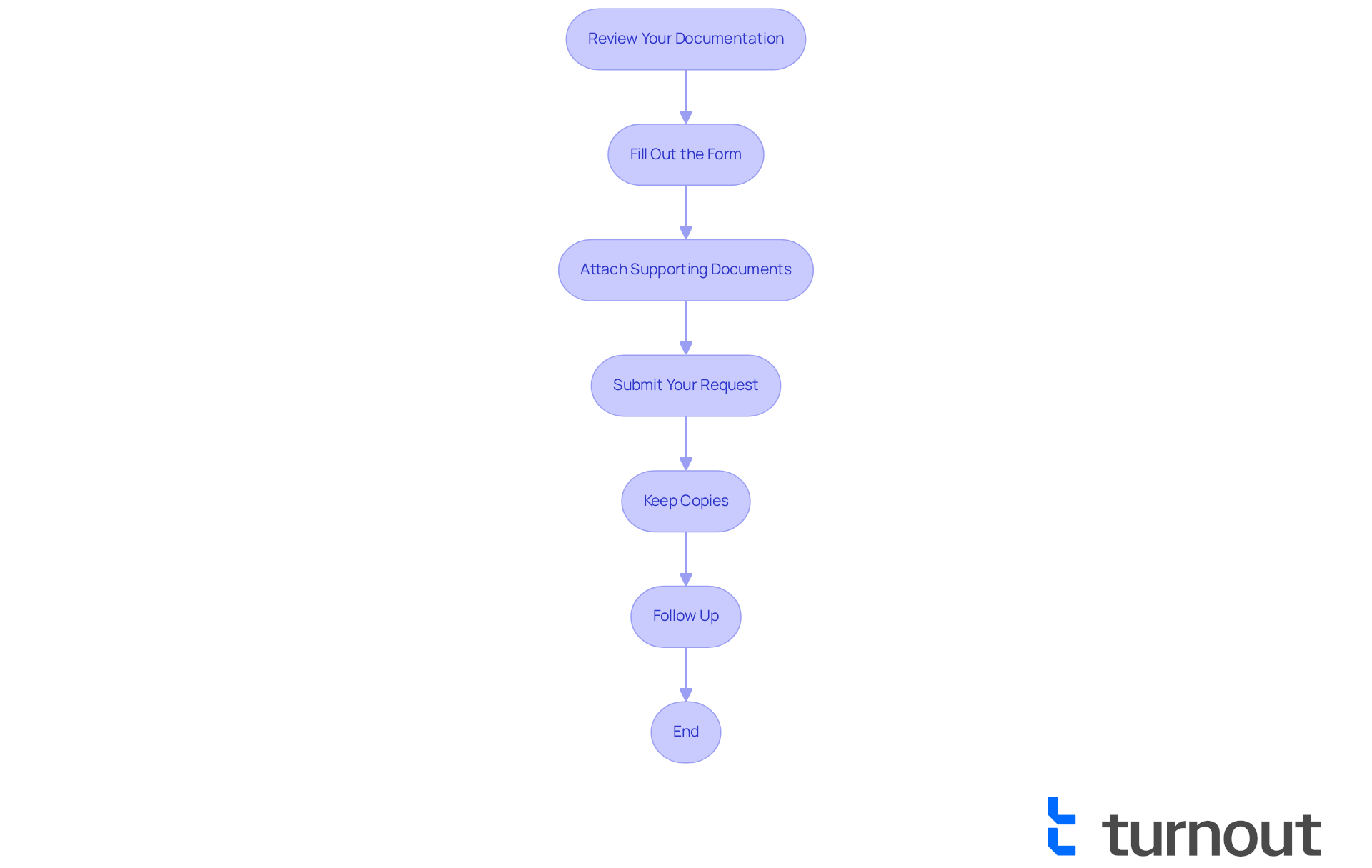

Navigating the process of submitting your short-term disability application can feel overwhelming, but we're here to help. By following these steps, you can ensure a smoother experience:

- Review Your Documentation: Take a moment to verify that all required documents are complete and accurate. This simple step can prevent delays in processing.

- Fill Out the Form: Carefully complete the form, making sure to provide all requested information. Honesty and thoroughness are crucial here.

- Attach Supporting Documents: Gather and include all necessary documentation. Organizing everything and clearly labeling it will make it easier for you and your insurer.

- Submit Your Request: Send your request using the method specified by your insurer—whether online, by mail, or in person.

- Keep Copies: Retain duplicates of your submission and all provided documents. This can be beneficial for future reference.

- Follow Up: After submission, reach out to your insurer to confirm receipt of your request and inquire about the anticipated timeline for processing.

It's important to understand that approximately 70% of short-term disability requests are denied, often due to incomplete documentation or not meeting eligibility criteria. Common reasons for denial include insufficient medical evidence, not meeting the required waiting period, or failing to provide necessary information about your condition. To improve your chances of acceptance, ensure your submission is comprehensive and well-supported. Experts recommend including all relevant medical documentation and clearly explaining your condition and its impact on your ability to work.

If you find yourself submitting after your leave starts, remember that you have 30 days from the initial day of leave to submit your request. By following these steps, you can significantly enhance your likelihood of a successful claim. You're not alone in this journey, and taking these actions can make a real difference.

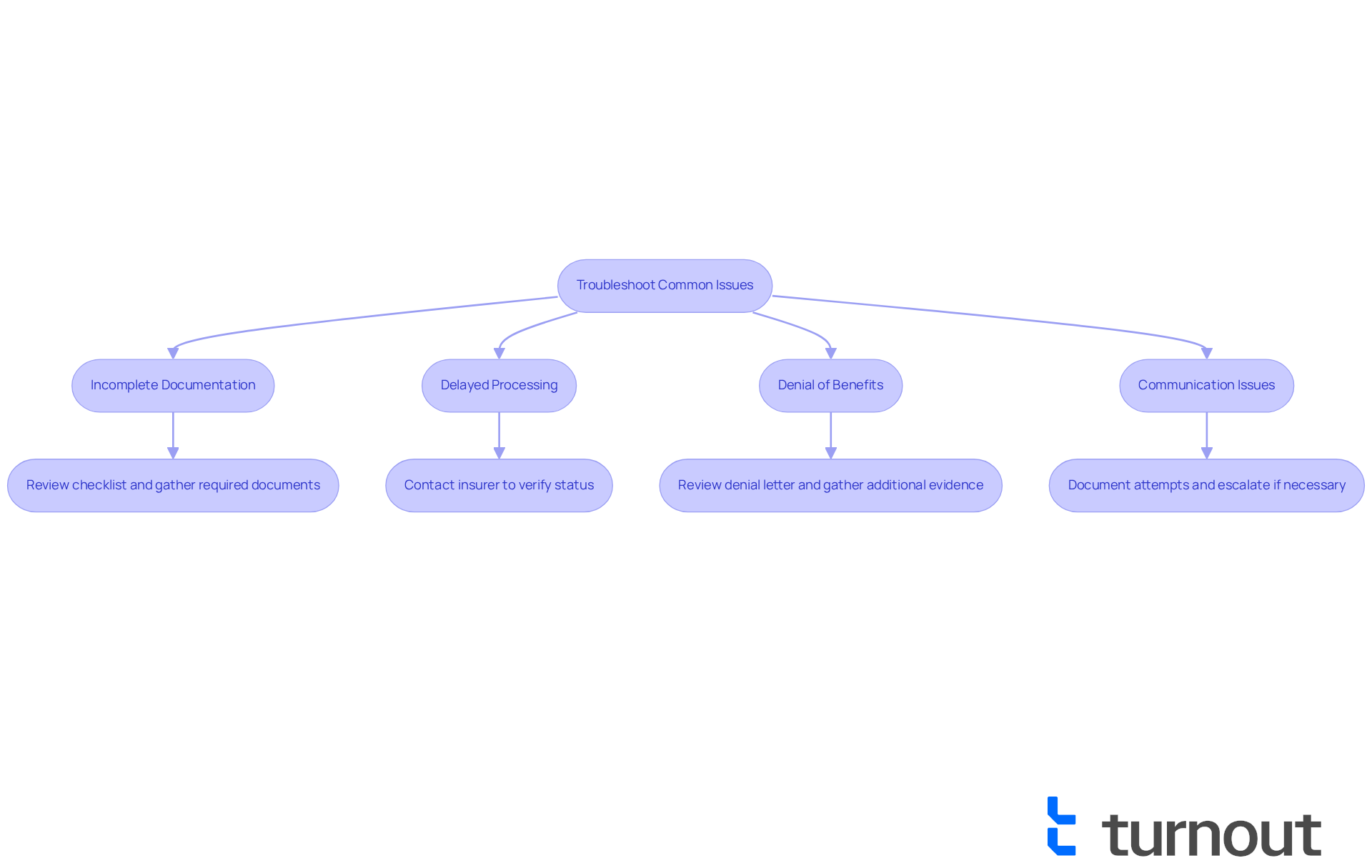

Troubleshoot Common Issues During the Application Process

Navigating the submission process can be challenging, and it’s completely normal to encounter a few bumps along the way. Here’s how you can troubleshoot some common issues with care and understanding:

-

Incomplete Documentation: If your submission is returned due to missing documents, take a moment to review the checklist. Gathering the required items promptly can make a big difference. Remember, ensuring that reviewing doctors have complete medical records helps avoid misunderstandings.

-

Delayed Processing: Have you noticed that you haven’t received a response within the expected timeframe? It’s a good idea to reach out to your insurer to verify the status of your request. Many consumers report spending several weeks troubleshooting delays, so staying proactive is key. You’re not alone in this.

-

Denial of Benefits: If your application is denied, it’s important to carefully review the denial letter for the reasons provided. You may have the option to appeal the decision. Gathering additional documentation or clarification from your healthcare provider can strengthen your case. Keep in mind that the overall approval rate for reconsideration is around 15%, so a strong appeal, possibly involving new evidence, is essential.

-

Communication Issues: Are you having trouble reaching your insurer? Document your attempts and consider escalating the issue to a supervisor. Clear communication is vital, and keeping a record of your interactions can help resolve misunderstandings.

By being proactive and prepared, you can navigate these challenges more effectively. Remember, we’re here to help, and you are not alone in this journey.

Conclusion

Understanding the complexities of short-term disability for pregnancy is crucial for expectant mothers seeking financial support during this important time. Securing coverage can ease stress, allowing you to focus on your health and recovery. By getting familiar with policy specifics, eligibility requirements, and the application process, you can navigate the intricacies of short-term disability insurance with confidence.

Key insights from this guide emphasize the importance of knowing your coverage, meeting eligibility criteria, and gathering necessary documentation. With nearly half of employees feeling their financial situation is stagnant, grasping the nuances of short-term disability can empower you to secure the support you need. Being proactive in the application process and addressing common issues can significantly enhance your chances of a successful claim.

The journey through pregnancy can be challenging, but having a solid understanding of short-term disability options can make a significant difference. Taking informed steps toward securing financial assistance not only provides peace of mind but also allows new mothers to focus on their well-being and the joy of welcoming their child. Remember, advocating for yourself during this process is essential to ensure that the support you need is accessible and effective.

Frequently Asked Questions

Can you get short-term disability for pregnancy?

Yes, short-term disability insurance can provide financial support for individuals temporarily unable to work due to pregnancy-related issues, including prenatal care, childbirth, and postpartum recovery.

What does short-term disability insurance cover during pregnancy?

It typically covers a portion of your salary for a limited time, allowing you to focus on your health and recovery during pregnancy and after childbirth.

How long does short-term disability coverage usually last?

The average benefit duration for temporary incapacity coverage is around 3.38 months.

What percentage of my salary can I expect to receive from short-term disability insurance?

Many plans replace about 50.25% to 70% of your monthly earnings during the coverage period.

What are the eligibility requirements for short-term disability insurance for pregnancy?

Key criteria include being a staff member covered by a temporary illness policy, having worked for a specific duration (often a few months to a year), obtaining medical certification from a healthcare provider, and reviewing your specific policy for any additional requirements or waiting periods.

Is there a waiting period before benefits start?

Yes, for FEBA temporary incapacity plans, the waiting period is usually 14 days, meaning benefits can begin shortly after the qualifying event.

How does short-term disability insurance impact financial stability during maternity leave?

While many women find it provides adequate financial support during unpaid maternity leave, some may still find the assistance lacking, leading them to rely on savings or credit.

What is Pregnancy Leave (PDL)?

Pregnancy Leave allows employees to take up to four months of unpaid leave for pregnancy-related issues, which is important for recovery and adjustment after childbirth.

Why is it important to understand short-term disability coverage before conception?

Enrolling in temporary coverage proactively is essential to ensure protection for pregnancy-related claims, which might be viewed as pre-existing conditions if the policy isn't in place before conception.