Overview

You may be wondering if you can draw both Disability Insurance and Social Security Retirement Benefits at the same time. The good news is, yes, you can! However, it’s important to understand that doing so might affect the amount you receive from each program.

We understand that navigating these benefits can be overwhelming. While both programs have specific eligibility criteria, the financial implications can be significant. For instance, once you start receiving retirement benefits, your disability payments could potentially decrease. This is a crucial factor to consider as you plan for your long-term financial future.

It's common to feel uncertain about how these decisions will impact your life. We’re here to help you make informed choices that align with your needs. Take the time to evaluate your options carefully, and don’t hesitate to reach out for assistance. You are not alone in this journey.

Introduction

Navigating the complexities of Social Security benefits can feel overwhelming, especially for those facing disabilities. You might be wondering if it’s possible to receive both Social Security Disability Insurance (SSDI) and retirement benefits at the same time. This article aims to shed light on the eligibility criteria, application processes, and financial implications of collecting both benefits, providing you with the clarity and guidance you need.

We understand that the intricacies of timing, payout levels, and tax consequences can raise important questions. Can you truly maximize your financial support without risking your benefits? Exploring these nuances may help you find the best path forward in your journey. Remember, you are not alone in this process, and we’re here to help.

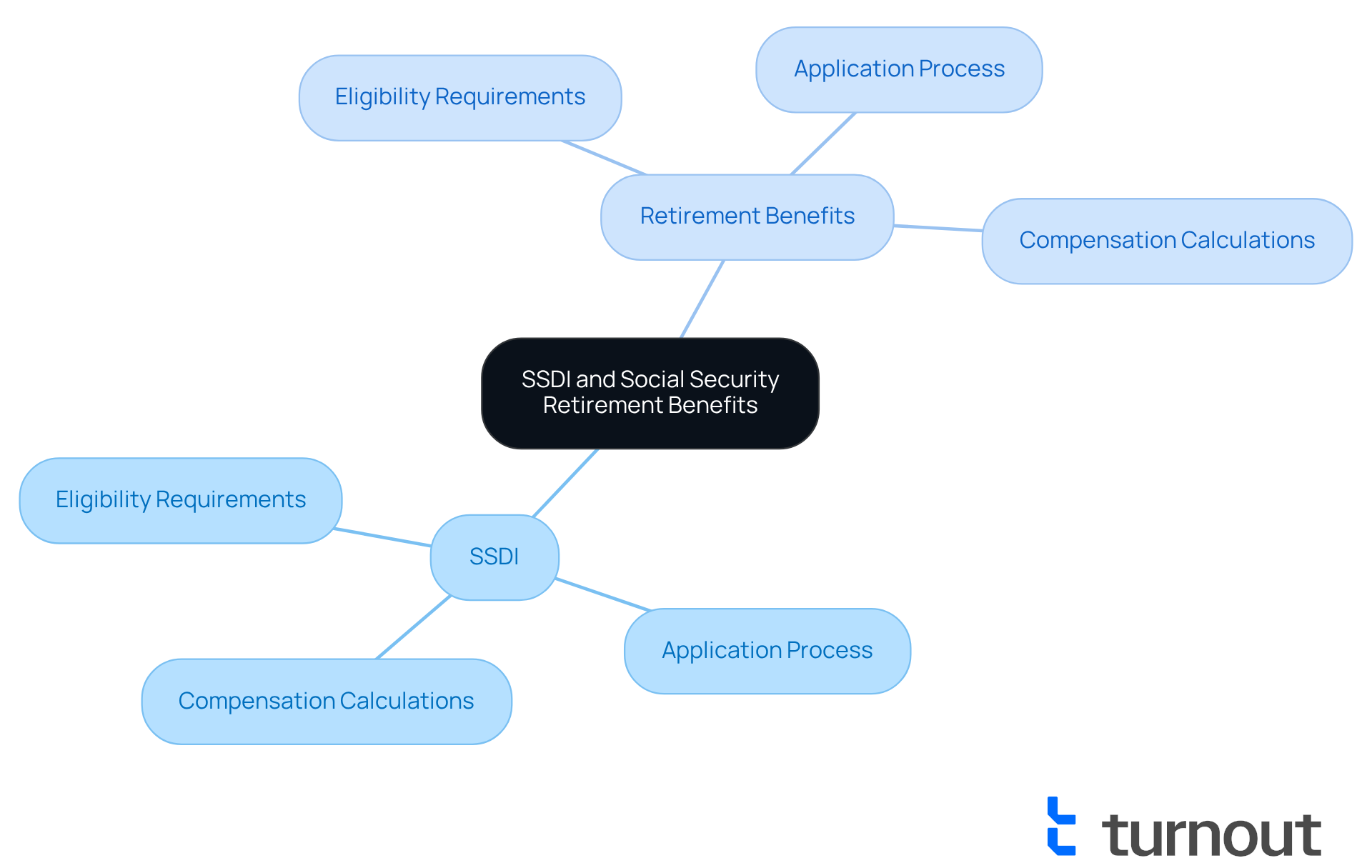

Understand SSDI and Social Security Retirement Benefits

Disability Insurance is a federal program designed to provide financial support to those who can’t work due to a qualifying disability. If you’re considering applying for SSDI, it’s important to know that you must have worked a certain number of years and contributed to Social Security taxes. On the flip side, Social Security Retirement Benefits are available to individuals who have reached retirement age—typically 62 or older—and have earned enough work credits through their employment history. Understanding these differences is crucial, as it impacts your eligibility and the potential to answer the question: can you draw disability and social security at the same time for benefits from both programs.

Both programs are managed by the Social Security Administration (SSA). While they serve different groups, there can be overlaps for individuals who are wondering, can you draw disability and social security at the same time? We understand that navigating these options can feel overwhelming. That’s why getting familiar with the eligibility requirements, application processes, and compensation calculations for each program is the first step toward making informed decisions.

You’re not alone in this journey. Many people face similar challenges, and we’re here to help you through it. Take the time to explore your options and reach out for assistance if needed. Remember, understanding your rights and benefits can empower you to secure the support you deserve.

Evaluate Eligibility for SSDI and Retirement Benefits

Navigating the world of Social Security Disability Insurance can feel overwhelming, but you’re not alone in this journey. To qualify, you need to meet specific criteria: a qualifying disability that prevents you from engaging in substantial gainful activity, sufficient work credits earned through employment, and a medical condition that aligns with the Social Security Administration's definition of disability. If you’re nearing the end of your career, it’s important to know that you generally need to have reached the minimum age and accumulated about 40 work credits, which is roughly 10 years of employment.

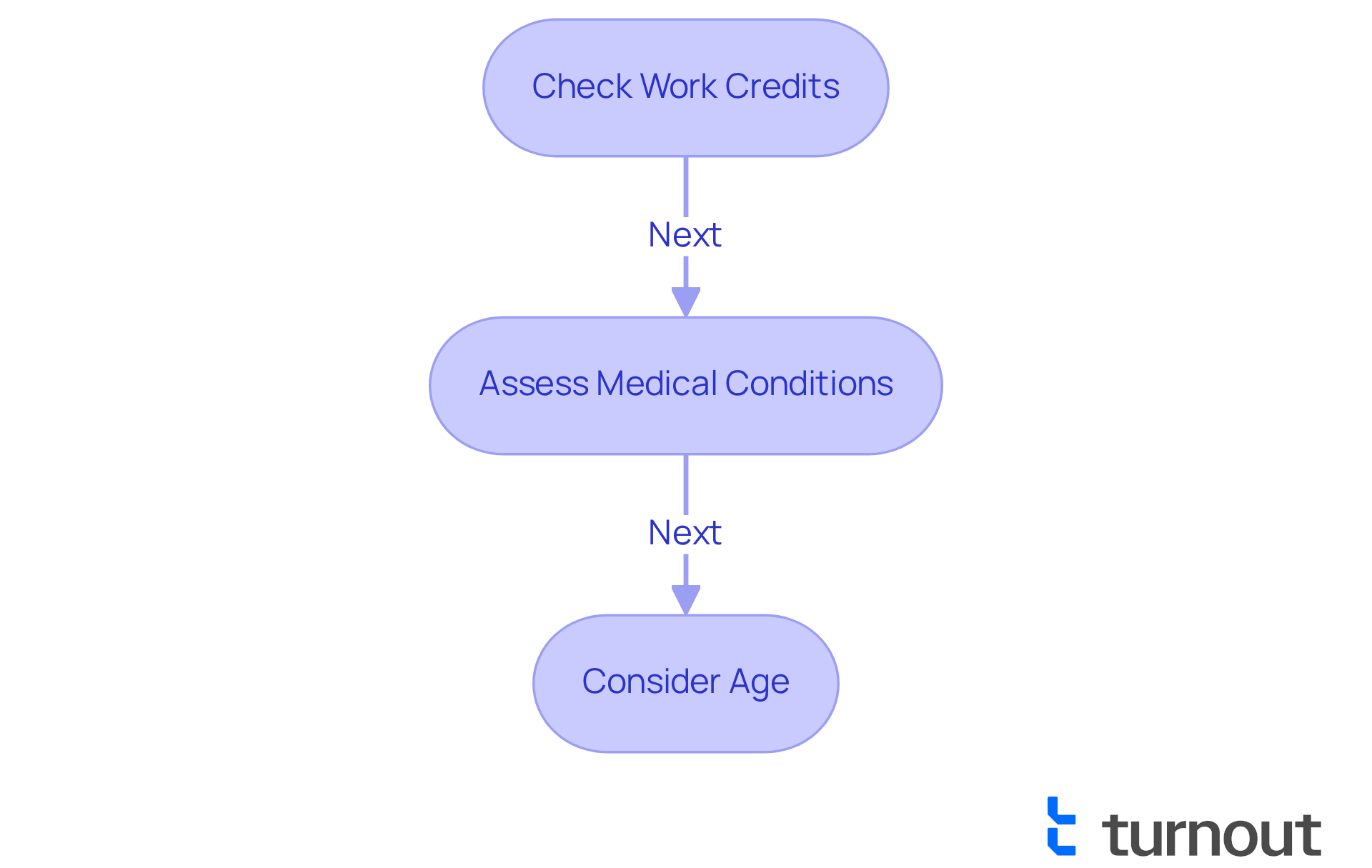

To evaluate your eligibility, consider these steps:

-

Check Work Credits: Take a moment to review your work history through the SSA's online portal. This will help you verify that you have enough credits for both disability support and pension options. In 2025, you earn one work credit for every $1,810 in wages, with a maximum of four credits available each year.

-

Assess Medical Conditions: It’s crucial to consult the SSA's Blue Book to see if your medical condition qualifies as a disability. This resource outlines the criteria for various conditions, providing clarity on your situation.

-

Consider Age: If you’re approaching retirement age, it’s helpful to understand how your age impacts your eligibility for pension advantages. For example, individuals aged 31 or older typically need at least 20 credits earned in the 10 years leading up to their disability onset.

By carefully assessing these elements, you can gain a clearer insight into your qualifications for social security assistance and determine if you can draw disability and social security at the same time. Remember, paying attention to detail in your application process can significantly influence approval rates and help you avoid common pitfalls that lead to delays. We’re here to help you every step of the way.

Navigate the Application Process for SSDI and Retirement Benefits

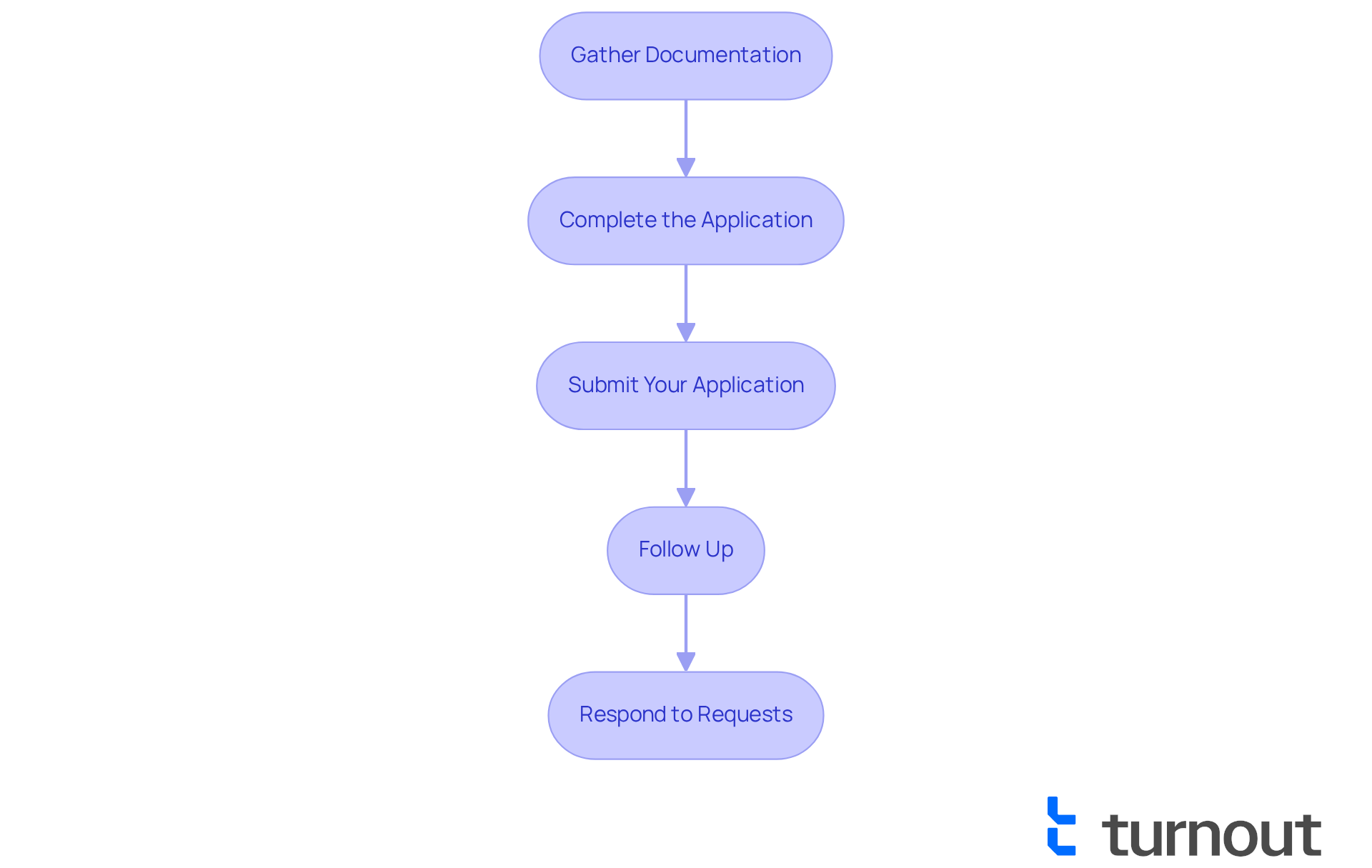

Navigating the application process for Security Disability Insurance (SSDI) and retirement benefits can feel overwhelming. We understand that this journey requires careful attention to detail, and we’re here to help you through each step.

-

Gather Documentation: Start by collecting essential documents like your identification number, medical records, work history, and any other pertinent information. Common documentation includes proof of income, tax returns, and medical evidence supporting your disability claim. Having everything ready can ease your mind.

-

Complete the Application: You can submit your application online via the Social Security Administration (SSA) website, by phone, or in person at your local SSA office. Accuracy is crucial; make sure all sections are filled out completely to minimize delays. It’s common to feel anxious about this part, but taking your time can make a difference.

-

Submit Your Application: After completing the application, submit it along with the required documentation. Remember to keep copies for your records. This way, you can track your submission and feel more in control.

-

Follow Up: Keep an eye on your application status. You can check online or contact the SSA for updates. It’s vital to stay informed, as claims pending for over six years may indicate data issues rather than delays in decision-making. We know how important it is to have clarity during this process.

-

Respond to Requests: Be prepared to provide additional information if the SSA requests it. Prompt responses can significantly expedite the review process. Remember, you’re not alone in this; many have faced similar requests.

Turnout provides access to trained nonlawyer advocates who can assist you throughout this process, ensuring you have the support needed to navigate the complexities of SSD claims. It’s important to note that Turnout is not a law firm and does not provide legal advice. Recent changes in the application process, such as the elimination of the reconsideration step in ten states, have impacted award rates. For instance, the average approval rate for disability claims submitted from 2010 to 2019 was around 31%, with a significant 67% of claims being rejected. Understanding these statistics can help set realistic expectations.

Examples of successful navigation through the disability benefits application process often emphasize the significance of comprehensive documentation and prompt follow-ups. Additionally, it’s crucial to note that the most common nonmedical reason for denial is insufficient recent work credits. By following these steps and taking initiative, you can improve your likelihood of obtaining the rewards you deserve. Remember, we’re here to support you every step of the way.

Assess the Impact of Collecting Both Benefits

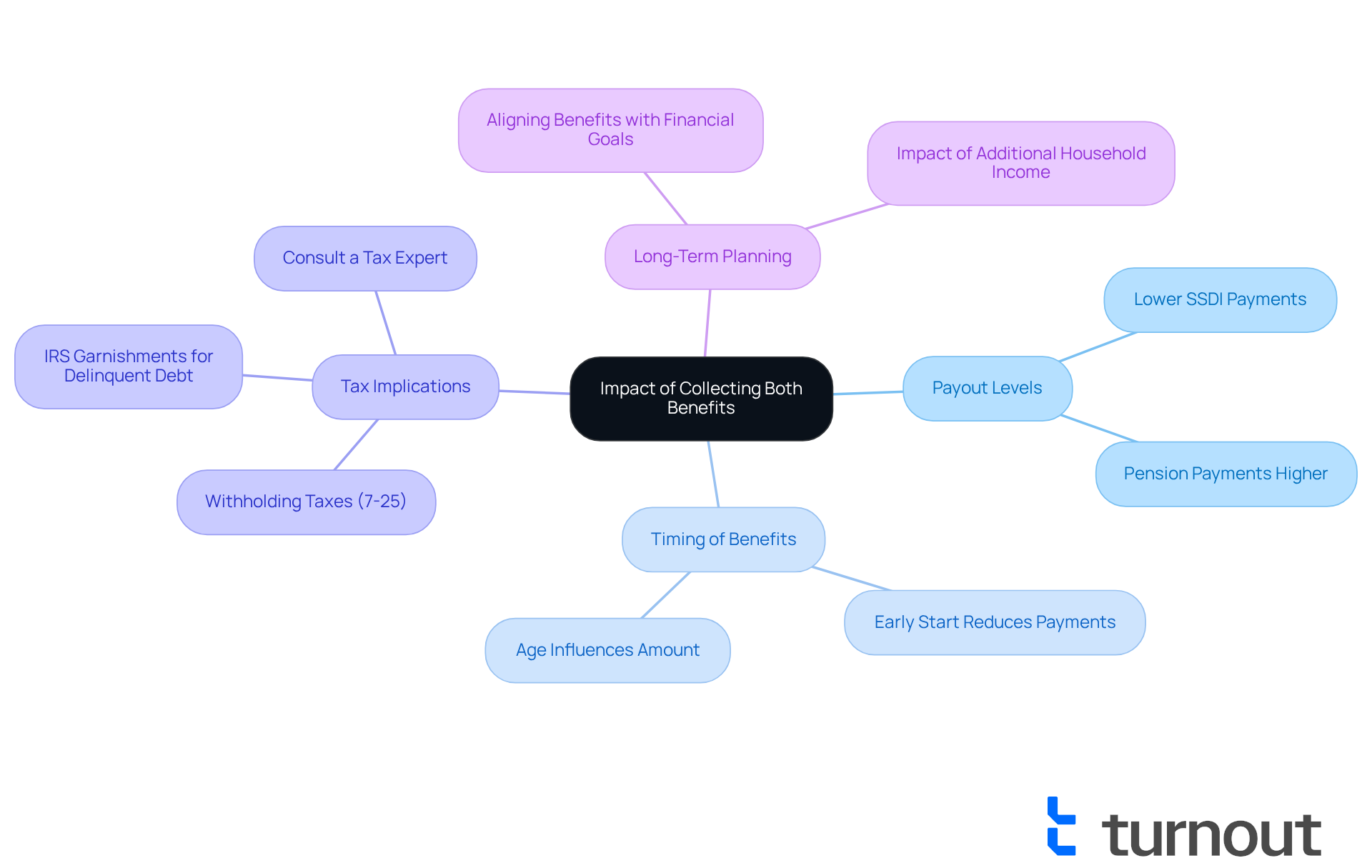

Navigating the world of Social Security Disability Insurance and Social Security Retirement Benefits can feel overwhelming, but understanding can you draw disability and social security at the same time is crucial for your financial well-being. Here are some important points to consider:

-

Payout Levels: It’s important to know that disability payments are usually lower than pension payments. Once you start receiving your pension, your SSDI amount might decrease. This can significantly impact your financial planning.

-

Timing of Benefits: The age at which you begin receiving pension payments can greatly influence the amount you receive. Starting benefits early might lead to lower monthly payments, which could affect your overall financial stability.

-

Tax Implications: Both disability payments and retirement funds may be subject to federal income tax, depending on your total income. While withholding taxes from SSDI payments is optional, it can range from 7% to 25%. It’s wise to consult a tax expert to understand how these benefits fit into your financial picture, especially if you have other income sources.

-

Long-Term Planning: Think about how receiving both benefits aligns with your long-term financial goals. If you have additional income in your household, you might find yourself paying more in taxes, even with lower annual amounts. A financial advisor can help you navigate these complexities and make informed decisions about managing your benefits.

By carefully considering these factors, you can determine if you can draw disability and social security at the same time, allowing you to better prepare for your financial future and make the most of the benefits available to you. Remember, you’re not alone in this journey; we’re here to help you every step of the way.

Conclusion

Understanding the potential to draw both Social Security Disability Insurance (SSDI) and Social Security Retirement Benefits simultaneously is crucial for anyone navigating their financial future. We know that this intersection of programs can feel overwhelming, but it also offers unique opportunities. It’s important to consider eligibility, application processes, and the implications of receiving benefits from both sources.

Assessing work credits, medical qualifications, and age requirements is key to determining your eligibility. We understand that the application process can be daunting, requiring meticulous attention to detail—from gathering necessary documentation to following up on claims. The financial implications of receiving both benefits, including payout levels and tax considerations, further highlight the need for informed decision-making.

Ultimately, the journey toward securing SSDI and Social Security retirement benefits can significantly impact your financial stability. By understanding the intricacies involved and seeking guidance when necessary, you can navigate this complex landscape more effectively. Remember, taking proactive steps today can empower you to make the most of the benefits available, ensuring a more secure and informed financial future. You're not alone in this journey; we're here to help.

Frequently Asked Questions

What is SSDI?

SSDI, or Social Security Disability Insurance, is a federal program that provides financial support to individuals who cannot work due to a qualifying disability.

Who is eligible for SSDI?

To be eligible for SSDI, individuals must have worked a certain number of years and contributed to Social Security taxes.

What are Social Security Retirement Benefits?

Social Security Retirement Benefits are available to individuals who have reached retirement age, typically 62 or older, and have earned enough work credits through their employment history.

Can you draw both SSDI and Social Security Retirement Benefits at the same time?

Yes, there can be overlaps for individuals who are wondering if they can draw both benefits simultaneously, but it is important to understand the eligibility criteria for each program.

How are SSDI and Social Security Retirement Benefits managed?

Both programs are managed by the Social Security Administration (SSA).

What should I consider when applying for SSDI or Social Security Retirement Benefits?

It is crucial to understand the eligibility requirements, application processes, and compensation calculations for each program to make informed decisions.

What should I do if I need help navigating these options?

If you feel overwhelmed, take the time to explore your options and consider reaching out for assistance to understand your rights and benefits better.