Introduction

Understanding the potential impact of IRS levies on Social Security checks is crucial for those who rely on these benefits for their financial stability. We understand that facing the possibility of reduced income can be unsettling, especially when it happens without prior warning. With the IRS equipped to automatically withhold a portion of federal payments through the Federal Payment Levy Program, many individuals find themselves in a difficult situation.

This article delves into the mechanisms of IRS levies and the specific risks they pose to Social Security benefits. We’ll explore various strategies available to safeguard against such financial disruptions. How can you effectively navigate this complex landscape and protect your vital income from unexpected tax actions? You're not alone in this journey, and we're here to help.

Define IRS Levies and Their Mechanism

An IRS seizure can feel overwhelming. It’s a legal action where your property is taken to settle a tax debt. This might mean garnishing your wages, seizing your bank accounts, or it raises the question of can the IRS take your Social Security check. We understand that this can be a distressing situation, especially if you rely on those benefits for your monthly income.

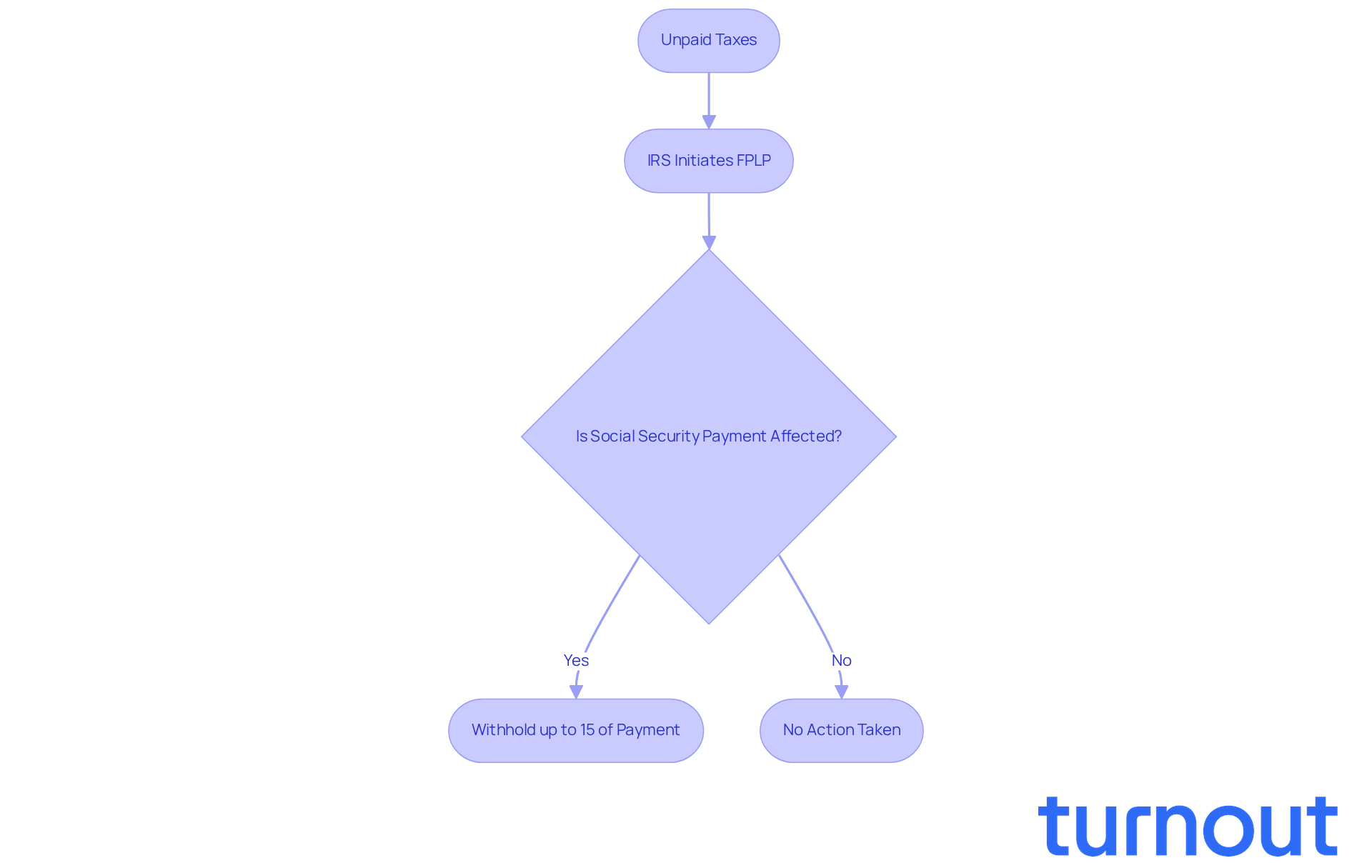

When the IRS can’t recover a tax obligation through other means - like sending notifications and requests for payment - they often enforce a lien. It’s crucial to grasp how this works, particularly for those receiving Social Security benefits. Did you know that a common concern is can the IRS take your Social Security check, as they can take up to 15% of your payments through the Federal Payment Levy Program (FPLP)? This program automates the collection process for overdue taxes, which can significantly impact your financial stability.

At Turnout, we’re here to help you navigate these challenges. We offer a range of tools and services, including personalized consultations with trained nonlawyer advocates and IRS-licensed enrolled agents. Our advocates can guide you in understanding your rights and options, while our enrolled agents can negotiate with the IRS on your behalf.

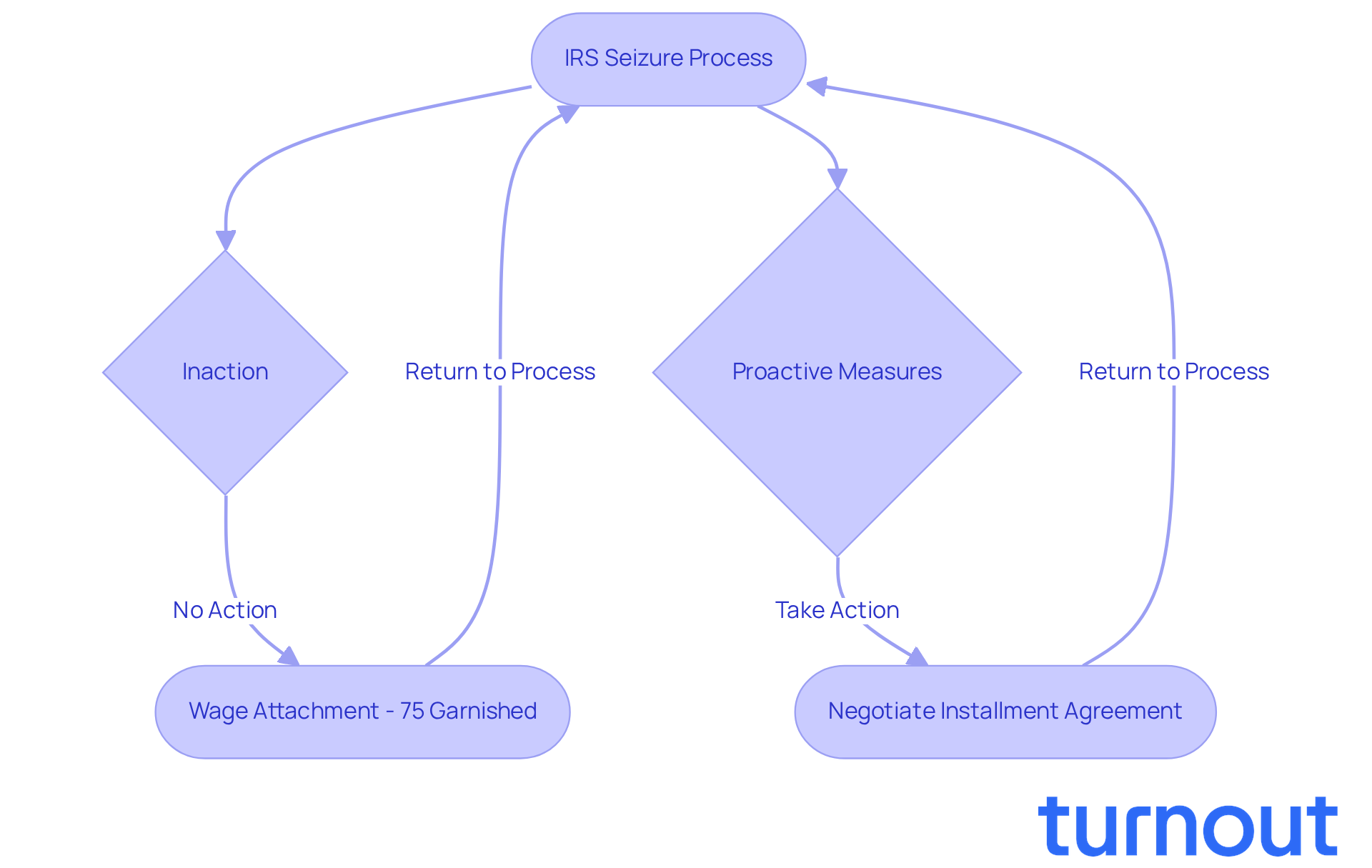

Consider this: one individual, overwhelmed by IRS notices, neglected the situation until a wage attachment resulted in over 75% of their take-home pay being garnished. On the other hand, another person took immediate action after receiving a final notice. They successfully negotiated an installment agreement, preventing any levy from being executed. These stories highlight the importance of understanding IRS procedures and their potential effects on your Social Security benefits, particularly the question of can the IRS take your Social Security check.

You are not alone in this journey. If you’re facing similar challenges, reach out to us. Together, we can explore your options and find a way forward.

Explore the Federal Payment Levy Program (FPLP) and Its Impact on Social Security

The Federal Payment Levy Program (FPLP) is designed to help the IRS recover unpaid taxes, raising the question: can the IRS take your Social Security check by automatically withholding a portion of federal payments, including those benefits? This means that if you have outstanding tax obligations, you may wonder, can the IRS take your Social Security check by seizing up to 15% of your monthly payment until your tax debt is resolved. We understand that this can be concerning, as it may happen without prior notification, leaving you in a difficult financial situation.

Many Social Security recipients have unexpectedly faced reduced income due to the FPLP. It’s common to feel overwhelmed by such sudden changes. This highlights the importance of managing your tax responsibilities proactively. By staying informed, you can prevent unexpected financial strain and maintain your peace of mind.

Since its initiation in July 2000, the FPLP has effectively collected overdue taxes, and there are plans to expand it to include additional federal payments. Each year, this program collects significant amounts from various federal payments, underscoring its role in tax enforcement. For Social Security recipients, understanding the implications of the FPLP is crucial, particularly when considering if can the IRS take your Social Security check. It emphasizes the need to remain aware of your tax responsibilities to avoid any unexpected decreases in your income.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges and ensure you have the support you need.

Navigate Your Options When Facing an IRS Levy on Social Security

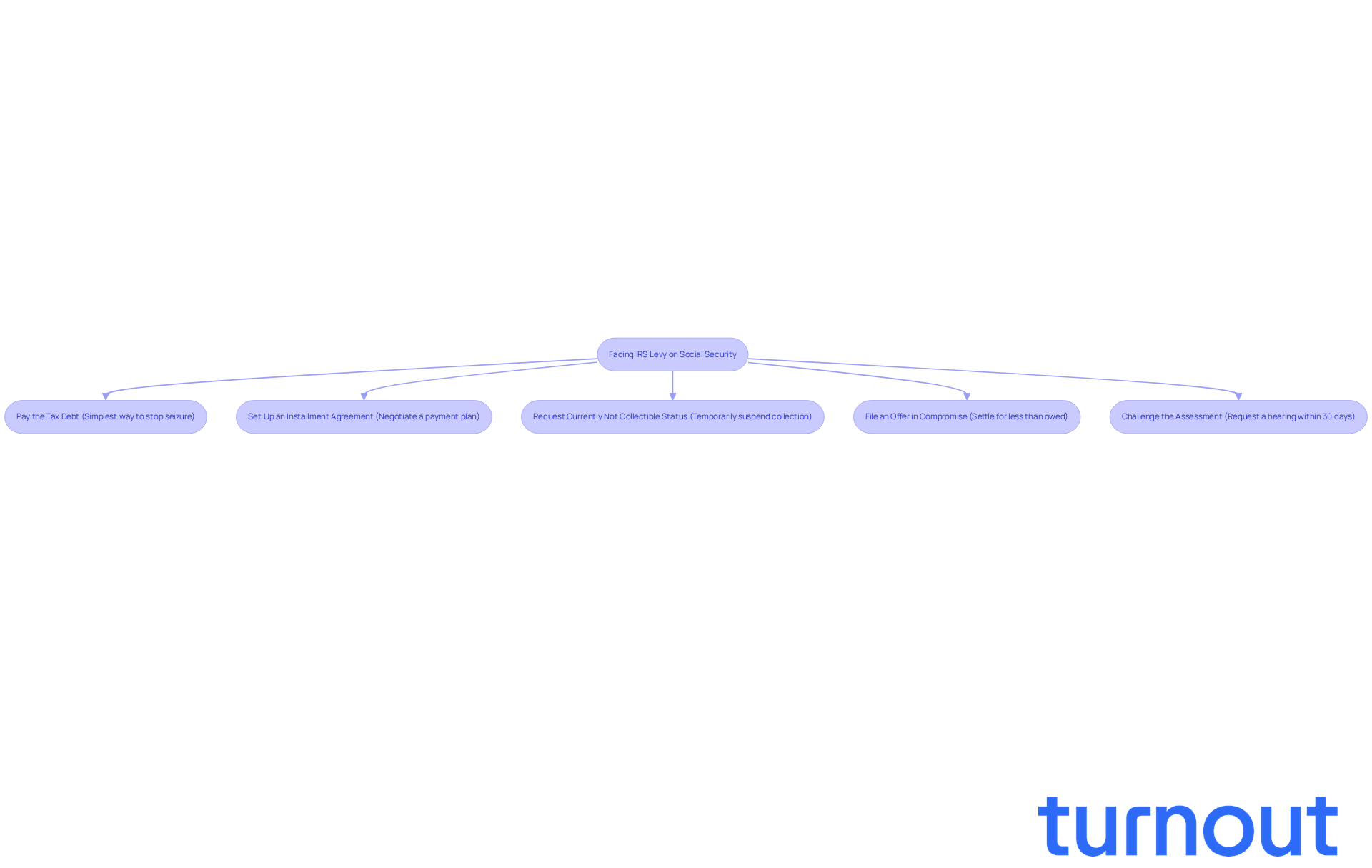

If you’re facing an IRS levy on your Social Security benefits, it’s understandable to feel overwhelmed about whether the question is, can the IRS take your Social Security check? But there are several options available to help you regain control of your financial situation:

-

Pay the Tax Debt: The simplest way to stop the seizure is to settle your tax debt completely. This action can provide immediate relief.

-

Set Up an Installment Agreement: If paying the full amount isn’t possible, consider negotiating a payment plan with the IRS. This arrangement allows you to pay off your debt gradually while halting the charge. Many Social Security beneficiaries find success with installment agreements, particularly when they are concerned about whether the IRS can take your Social Security check, as these agreements can be tailored to fit individual circumstances.

-

Request Currently Not Collectible (CNC) Status: If you’re experiencing financial hardship, you can request CNC status. This designation may temporarily suspend collection actions, giving you some breathing room during tough times.

-

File an Offer in Compromise: This option lets you settle your tax debt for less than what you owe, as long as you can show that paying the full amount would cause significant financial strain. The IRS will consider various factors, including your income and expenses, when evaluating these offers.

-

Challenge the Assessment: You have the right to contest the assessment by requesting a hearing within 30 days of receiving the notice. This process allows you to present your case, which could lead to a favorable outcome that stops the imposition.

Many individuals have successfully navigated these options, especially through installment agreements that fit their financial situations. Remember, you’re not alone in this journey. Consulting with a tax professional can provide valuable insights and strategies tailored to your specific needs, particularly if you’re facing financial hardship. We’re here to help you find the best path forward.

Implement Strategies to Prevent IRS Levies on Social Security

To safeguard your Social Security benefits from IRS levies, consider these supportive strategies:

-

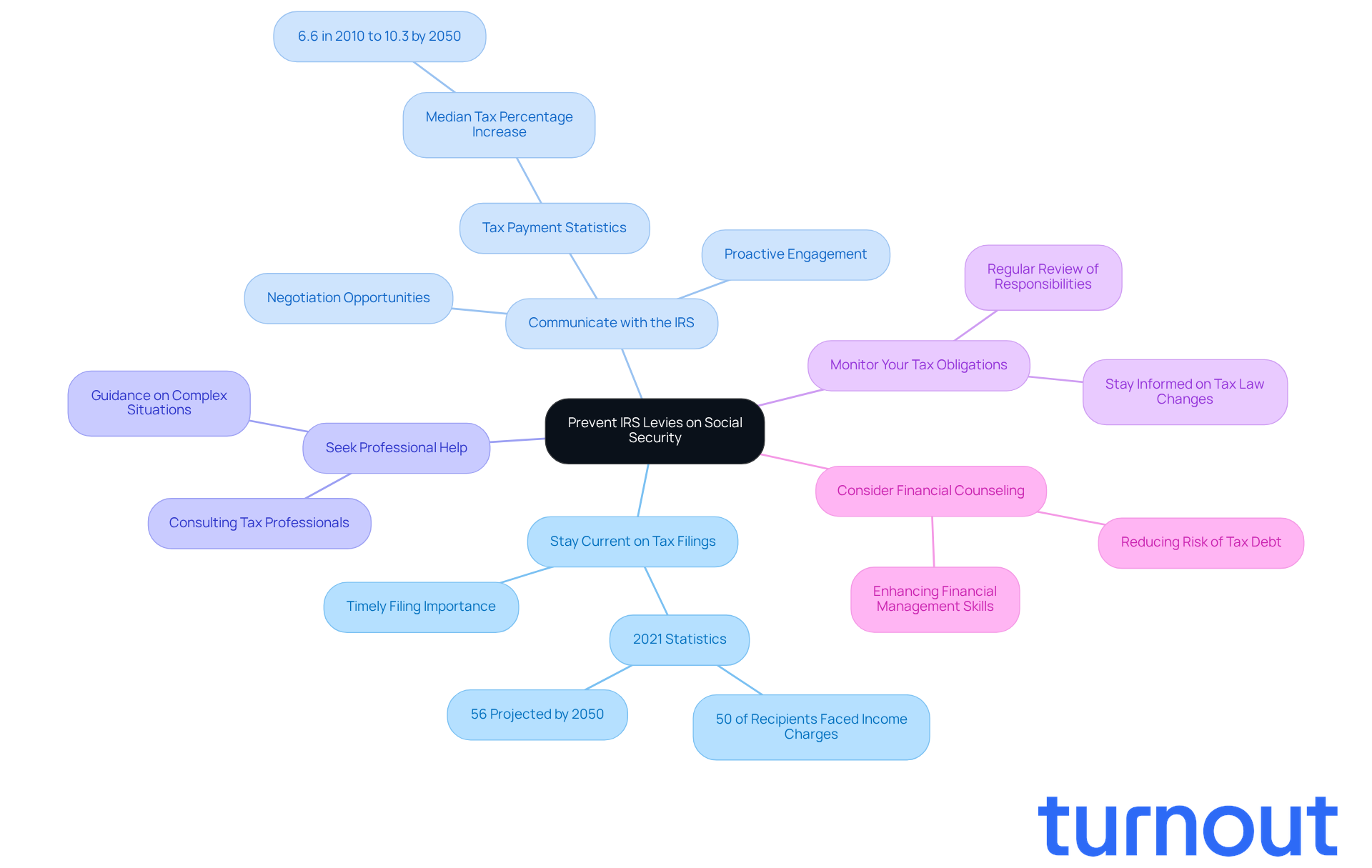

Stay Current on Tax Filings: We understand that keeping up with tax returns can feel overwhelming. Timely filing is crucial. Make sure to submit your returns on or before the deadline and pay any dues owed. This simple step can help prevent triggering a levy. Did you know that in 2021, about half of Social Security recipients faced income charges? By 2050, forecasts suggest that over 56% of recipient families will have obligations. Staying on top of your filings is more important than ever.

-

Communicate with the IRS: It’s common to feel anxious if you owe taxes. Proactive communication with the IRS can make a difference. Engaging with them opens the door for negotiations on payment plans or alternative arrangements, which might help you avoid a levy, as concerns arise about whether the IRS can take your Social Security check. Studies show that effective communication can significantly improve outcomes in tax debt resolution. For instance, the median percentage of benefits paid as income tax among families filing a tax return is projected to rise from 6.6% in 2010 to 10.3% by 2050.

-

Seek Professional Help: If you’re feeling uncertain about your tax obligations, remember that you’re not alone. Consulting a tax professional or an advocate can provide valuable guidance. Their expertise can help you navigate complex tax situations and avoid potential pitfalls.

-

Monitor Your Tax Obligations: Regularly reviewing your tax responsibilities is a proactive step. Stay informed about any changes in tax laws that may impact your situation. Understanding these changes can empower you to make informed decisions and avoid unexpected liabilities.

-

Consider Financial Counseling: Engaging in financial counseling can be a game-changer. It enhances your financial management skills, helping you steer clear of situations that could lead to tax debt. This proactive approach can empower you to maintain control over your finances and reduce the risk of IRS intervention.

Remember, we’re here to help you navigate these challenges. You are not alone in this journey.

Conclusion

Understanding the implications of IRS levies on Social Security benefits is crucial for anyone facing tax obligations. We understand that this can be a daunting situation. While the IRS does have the authority to seize a portion of Social Security checks, there are various options available to help you regain control over your financial situation. By taking proactive steps, such as negotiating payment plans or seeking professional assistance, you can navigate these challenges effectively.

Key insights discussed include the mechanism of IRS levies, particularly through the Federal Payment Levy Program (FPLP), which can automatically withhold a portion of benefits for unpaid taxes. It's common to feel overwhelmed, but strategies for preventing levies - like staying current on tax filings and maintaining open communication with the IRS - are essential for safeguarding your financial stability. The experiences shared illustrate that timely action can make a significant difference in avoiding severe financial repercussions.

Ultimately, it is vital for you to remain informed and proactive regarding your tax responsibilities. By understanding the options available and seeking support when needed, you can mitigate the risks of IRS levies on Social Security benefits. Remember, taking control of your financial future starts with knowledge and action. You are not alone in this journey, and we're here to help.

Frequently Asked Questions

What is an IRS levy?

An IRS levy is a legal action where the IRS takes your property to settle a tax debt. This can include garnishing wages or seizing bank accounts.

Can the IRS take my Social Security check?

Yes, the IRS can take up to 15% of your Social Security payments through the Federal Payment Levy Program (FPLP) to collect overdue taxes.

What is the Federal Payment Levy Program (FPLP)?

The FPLP is a program that automates the collection of overdue taxes, allowing the IRS to take a portion of certain federal payments, including Social Security checks.

What should I do if I receive IRS notices?

It is important to take immediate action upon receiving IRS notices. Ignoring them can lead to severe consequences, such as wage garnishment.

How can Turnout help with IRS levy issues?

Turnout offers personalized consultations with trained nonlawyer advocates and IRS-licensed enrolled agents who can guide you in understanding your rights and negotiate with the IRS on your behalf.

What are the potential consequences of neglecting IRS notices?

Neglecting IRS notices can result in severe actions like wage attachments, which may lead to a significant portion of your take-home pay being garnished.

What options do I have if I'm facing an IRS levy?

You can explore options such as negotiating an installment agreement with the IRS, which can prevent a levy from being executed.