Overview

We understand that facing significant back taxes can be overwhelming. It's important to know that the IRS can take your house if you owe a substantial amount and have not responded to their communications. This typically occurs after a Notice of Federal Tax Lien and a Final Notice of Intent to Levy have been issued.

However, it's reassuring to note that the IRS usually resorts to property seizure as a last measure. They will explore various collection methods before taking such drastic actions. Understanding your rights and options is crucial in preventing these situations.

You are not alone in this journey. We’re here to help you navigate your options and find a solution that works for you. Remember, knowledge is power, and taking proactive steps can make a significant difference.

Introduction

Navigating the complexities of tax obligations can feel overwhelming, especially when the daunting question arises: can the IRS take your house? We understand that the Internal Revenue Service has significant authority to recover unpaid taxes, but this power comes with limitations and legal protocols.

It’s crucial for homeowners facing the possibility of property seizure to grasp the framework that governs IRS actions. What options are available for those in this situation, and how can you protect your home from the IRS's reach? The answers to these pressing concerns may offer the guidance you need to navigate this challenging landscape.

Remember, you are not alone in this journey.

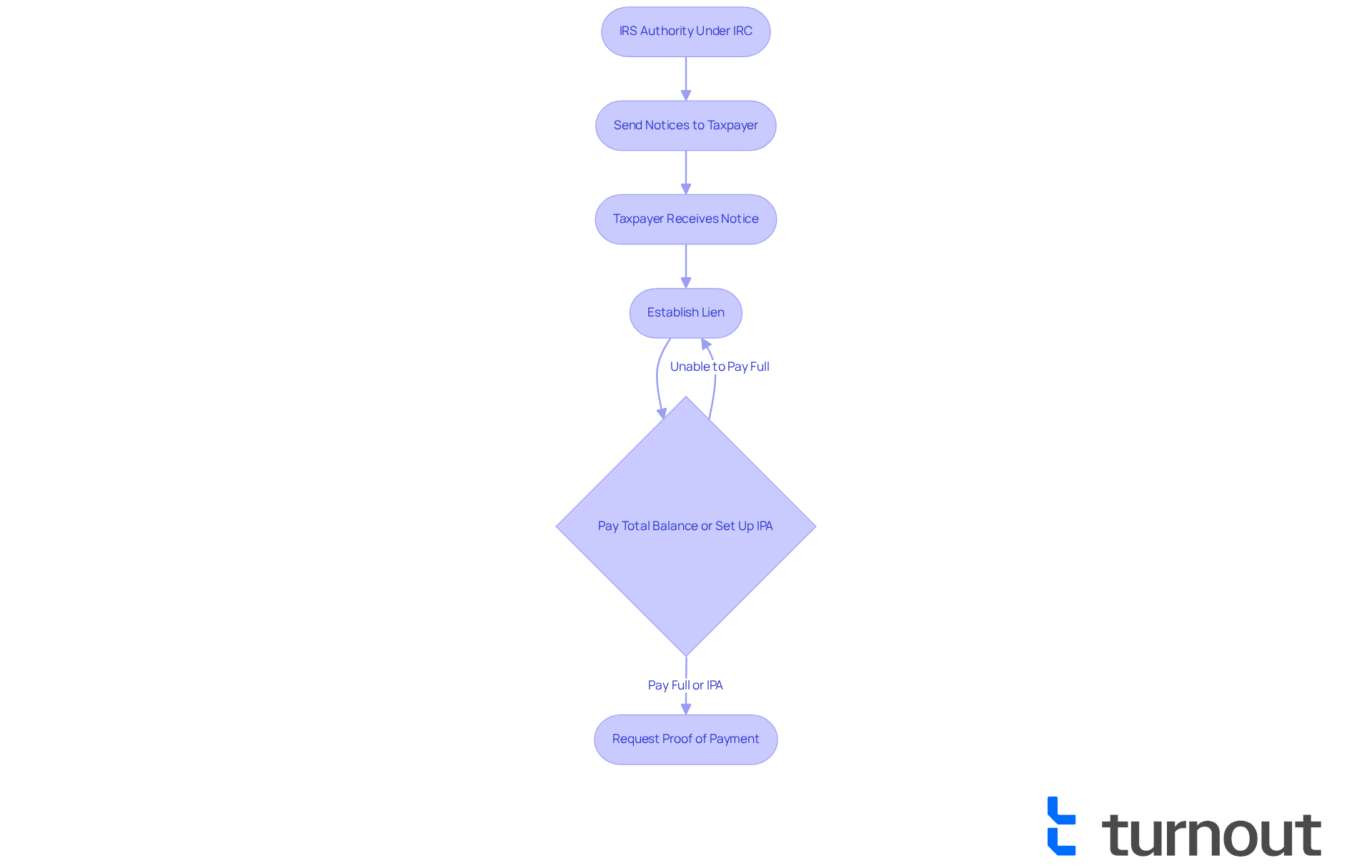

Understanding IRS Authority: Legal Framework for Property Seizure

Navigating the complexities of the Internal Revenue Service (IRS) can be daunting, particularly when you wonder, can the IRS take your house for unpaid taxes? The IRS operates within a legal framework that allows it to recover outstanding payments, primarily guided by the Internal Revenue Code (IRC). This framework outlines the necessary procedures and limitations for tax collection, ensuring that taxpayers are treated fairly.

It’s important to know that the IRS can levy various assets, including real estate, leading to concerns about whether can the IRS take your house, but they must adhere to specific protocols. For instance, before taking any seizure actions, the IRS is required to send a series of notices to the taxpayer. This process ensures that individuals are fully aware of their tax liabilities and the potential consequences of non-payment. The legal structure aims to balance the government's need to collect taxes with the rights of taxpayers, ensuring due process is followed.

If you find yourself facing a tax warrant, you may wonder, can the IRS take your house, as it establishes a lien against both real and personal assets? This raises the question of whether can the IRS take your house, as they have a legal claim to your assets until your tax obligation is settled. We understand that this can be overwhelming, but individuals facing tax warrants have options. You must pay the total warranted balance in full to satisfy the IRS's claims. However, if full payment is unfeasible, you can establish an installment payment agreement (IPA) to prevent further collection actions. This agreement allows the warrant to remain as a lien on your assets until the total balance is resolved.

Additionally, after satisfying the warrant, you can request proof of payment, which provides necessary documentation for the removal of the lien. Understanding these rights and the legal framework is crucial as it empowers you to take informed actions regarding your financial obligations. You may also qualify for a release or subordination of lien under certain conditions.

To better understand your situation, consider using the New York State Tax Warrants search tool to check for any tax warrants. Furthermore, the Outstanding Judgment Balance Due letter can serve as proof of payment, and a Notice of Pending Warrant Satisfaction can confirm that the process of satisfying the tax warrant is underway. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

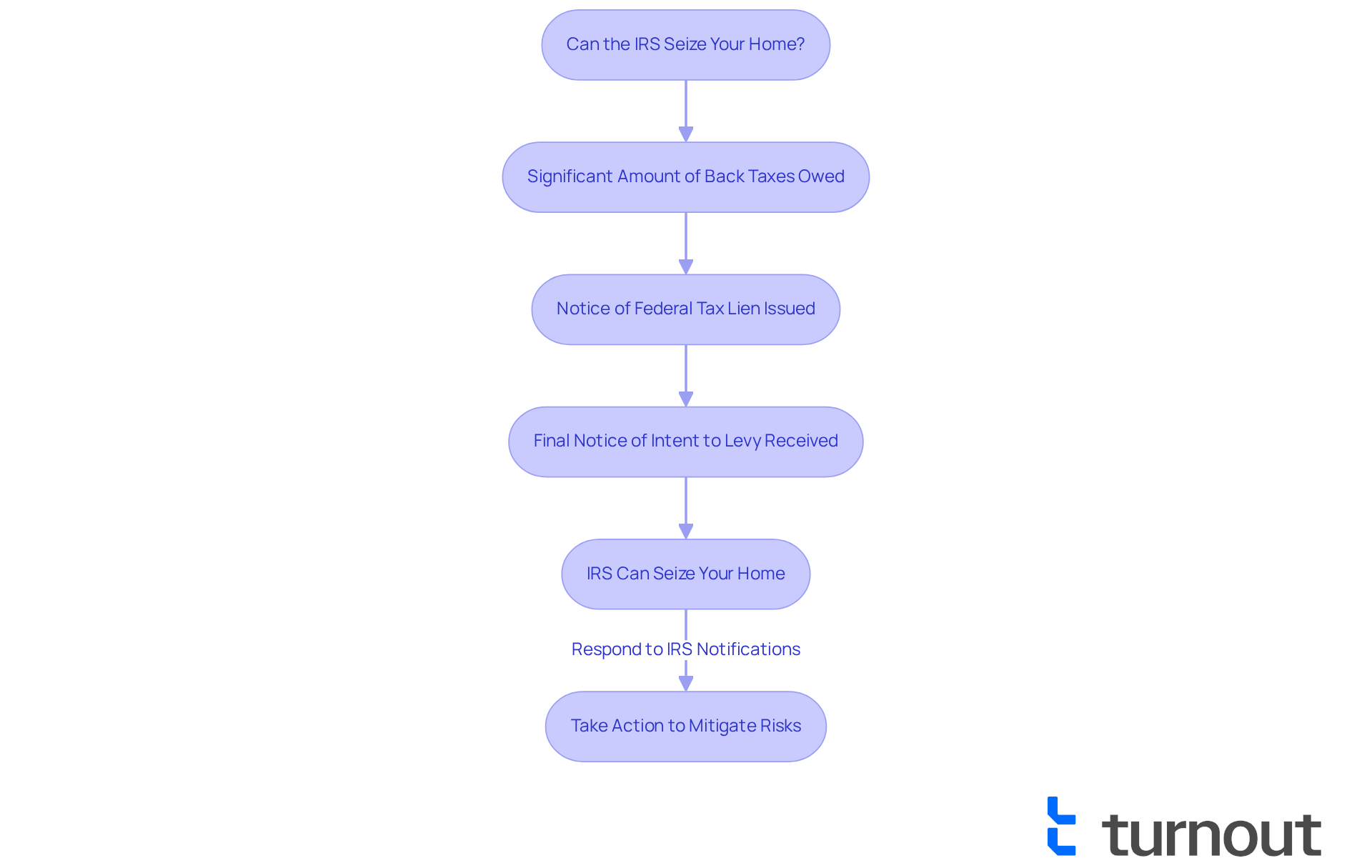

Conditions for IRS Seizure: When Can the IRS Take Your Home?

Facing the possibility of whether the IRS can take your house can be overwhelming. It’s important to understand that this usually happens under specific circumstances, particularly when someone owes federal dues and hasn’t responded to IRS communications, raising the concern of can the IRS take your house. Here are the key requirements to be aware of:

- The taxpayer must owe a significant amount of back taxes.

- The IRS must have issued a Notice of Federal Tax Lien, which publicly documents the government's claim against the taxpayer's assets.

- The taxpayer must have received a Final Notice of Intent to Levy, informing them of the upcoming confiscation.

We understand that this situation can feel daunting. It’s vital to recognize that the IRS typically explores all other collection methods before resorting to confiscation. This means that confiscation is often seen as a last resort for tax recovery.

In 2025, statistics indicated that the IRS issued over 100,000 tax liens. This highlights the seriousness of unpaid taxes and raises the question, can the IRS take your house due to property confiscation? If you find yourself facing home confiscation, know that you are not alone in this journey. Promptly responding to IRS notifications can significantly impact your situation. By planning ahead and understanding these conditions, you can take steps to mitigate the risks associated with IRS actions, which raises the question: can the IRS take your house? Remember, we're here to help you navigate through this challenging time.

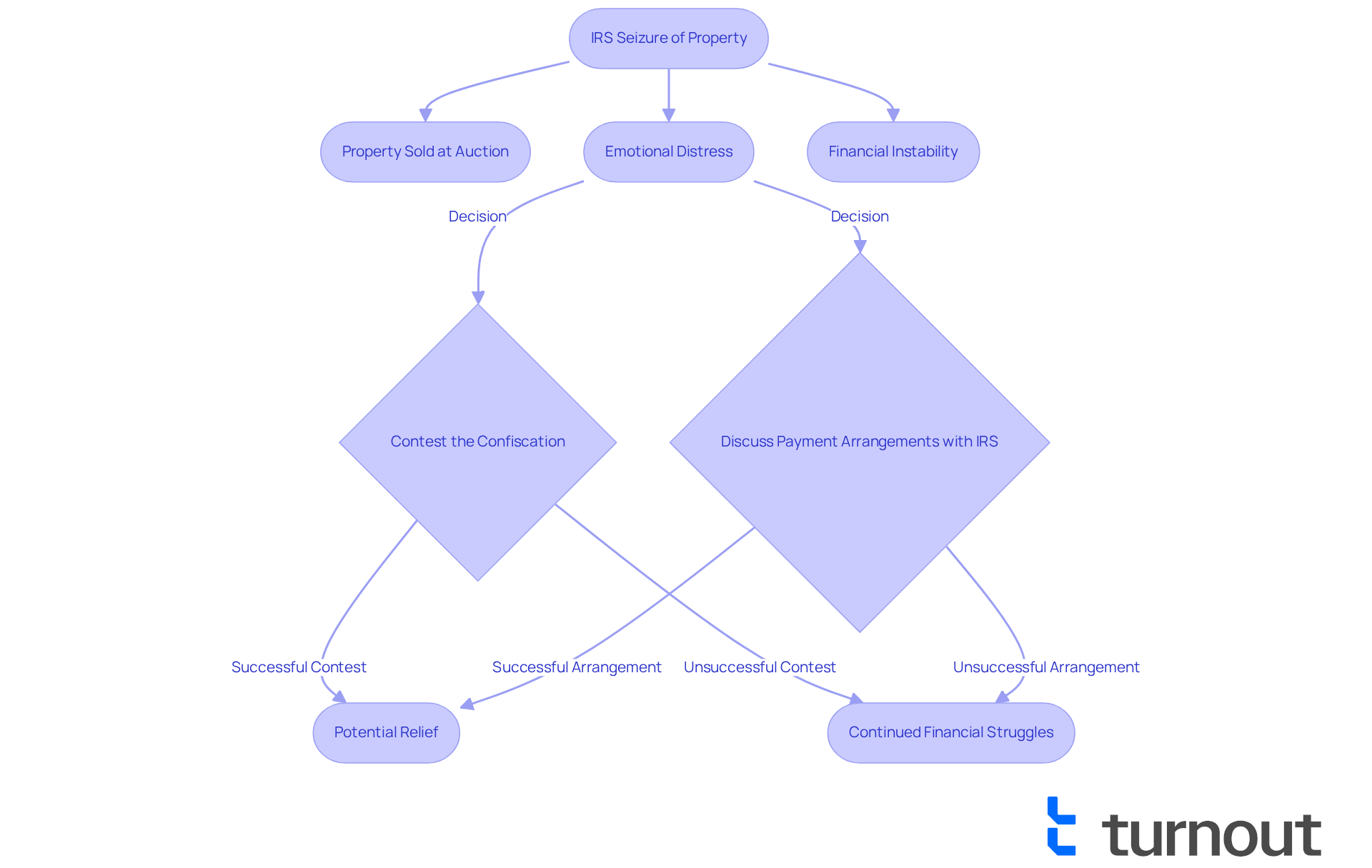

Implications of IRS Seizure: Consequences and Processes for Homeowners

Homeowners may wonder, can the IRS take your house, as the consequences of an IRS confiscation can be devastating. When the IRS seizes a property, it can raise concerns about the question, can the IRS take your house, as the property may be sold at auction to recover owed taxes, potentially leading to the loss of one's home. This not only disrupts financial stability but also inflicts significant emotional distress on families. Many homeowners struggle to find new housing and rebuild their financial lives after such an event. In Fiscal Year 2024, the IRS closed over 505,000 tax return audits, resulting in more than $29 billion in recommended additional tax, highlighting the agency's extensive enforcement capabilities.

We understand that the emotional impact of an IRS confiscation is profound. Families often encounter uncertainty and anxiety about their future. For example, consider the elderly couple who lost their dress shop due to IRS actions. Their business assets were liquidated, leaving them in a precarious situation. Furthermore, the IRS may impose penalties and interest on unpaid taxes, complicating matters even more.

It’s essential for homeowners to be aware of their rights during this process. You have the capacity to contest the confiscation and discuss payment arrangements with the IRS. Taxpayers can challenge proposed adjustments in Tax Court without paying the tax first, provided they file a petition within 90 days of receiving a statutory notice of deficiency. Understanding these rights is crucial for homeowners who may wonder, can the IRS take your house?. It empowers you to take action and pursue relief from the IRS's aggressive collection practices.

Remember, Turnout is not a law firm and does not provide legal advice. However, our trained nonlawyer advocates are here to support you in understanding your options and rights. You are not alone in facing these difficulties. We're here to help you navigate this challenging journey.

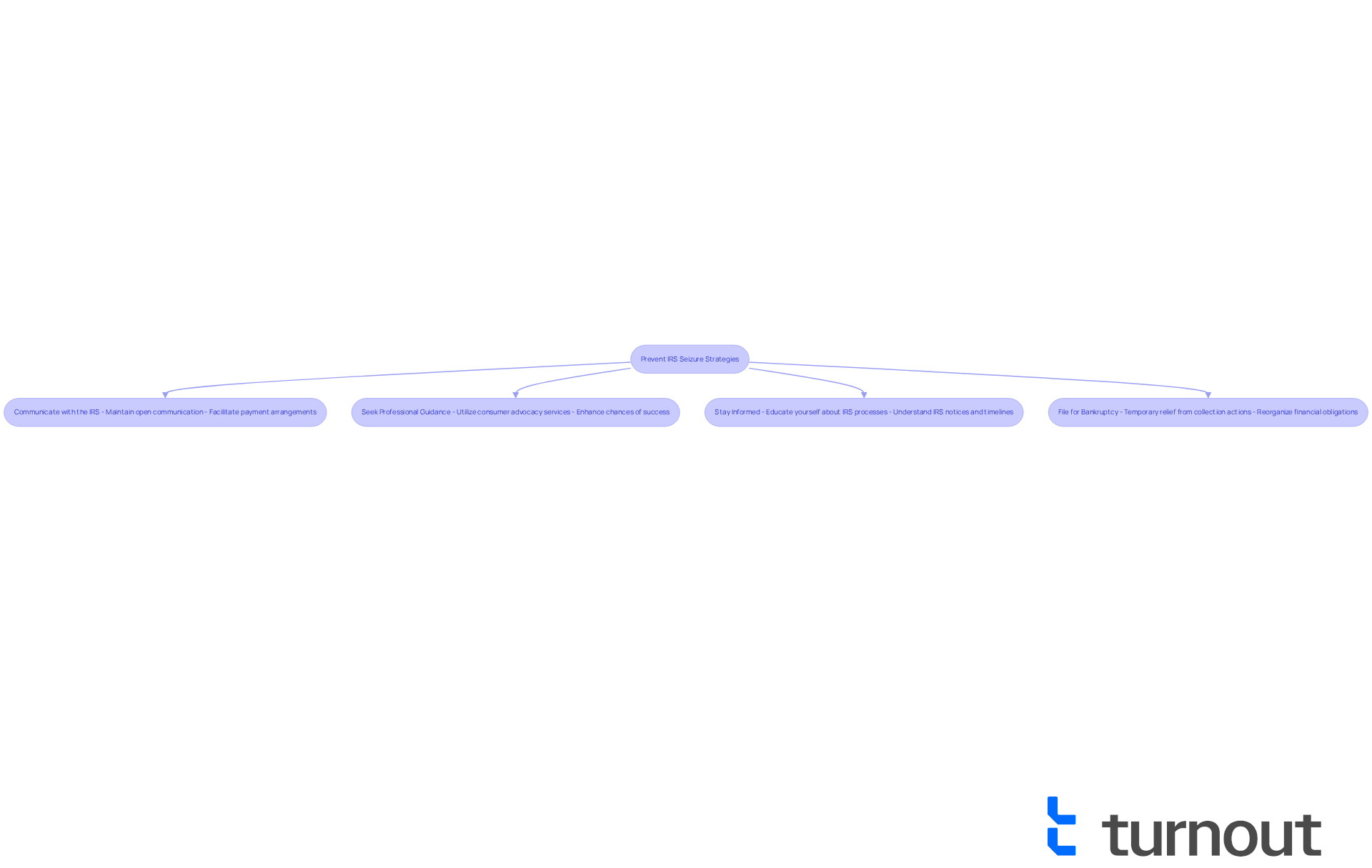

Preventing IRS Seizure: Strategies and Options for Homeowners

Avoiding an IRS confiscation requires proactive involvement and a clear understanding of your options. We understand that facing tax issues can be overwhelming, but there are essential steps you can take to regain control:

- Communicating with the IRS: Maintaining open lines of communication is crucial. This can facilitate payment arrangements or offers in compromise, allowing you to settle your debts for less than the total amount owed. As Nick Nemeth wisely states, "Prompt action is essential to protect your assets and stop the IRS in its tracks."

- Seeking Professional Guidance: Utilizing consumer advocacy services can provide personalized assistance in navigating tax issues and understanding your rights. Engaging with professionals can significantly enhance your chances of success. Many taxpayers who proactively address their tax debts report high success rates with Installment Agreements and Offers in Compromise.

- Staying Informed: It’s common to feel lost when it comes to tax obligations. Educating yourself about IRS processes can empower you to act swiftly. Understanding IRS notices, like CP501 and LT11, and their timelines can help you avoid falling behind and prevent escalation of collection actions.

- Filing for Bankruptcy: In certain situations, filing for bankruptcy can provide temporary relief by halting IRS collection actions. While it offers a chance to reorganize your finances, it’s important to understand that bankruptcy requires a thorough reorganization of your financial obligations.

By implementing these strategies, you can significantly reduce the risk of property seizure and answer the question of whether the IRS can take your house, ultimately regaining control over your financial situation. Remember, engaging with the IRS early and understanding the negotiation landscape can lead to successful payment arrangements. You are not alone in this journey, and many have found success by proactively addressing their tax debts.

Conclusion

Navigating the complexities of IRS authority and the potential for property seizure can be overwhelming for homeowners. We understand that the fear of losing your home due to unpaid taxes is a heavy burden. Therefore, grasping the legal framework surrounding IRS actions is essential. The IRS has specific procedures designed to protect taxpayers, but being aware of your rights and options is crucial when facing tax liabilities.

Key insights from this discussion highlight the importance of open communication with the IRS and the proactive steps you can take to reduce the risk of seizure:

- Establishing payment agreements

- Understanding the implications of tax liens

Being informed empowers you to make strategic decisions. It's common to feel uncertain, but recognizing the conditions under which the IRS can act—such as owing significant back taxes and receiving proper notifications—can help you navigate your obligations more effectively.

Ultimately, the message is clear: taking timely action and seeking professional guidance can significantly influence the outcome of your tax-related challenges. Remember, you are not alone in this journey. Many homeowners have successfully navigated these challenges with the right approach. By understanding your rights and options, you can protect your home and regain control over your financial future. We encourage you to remain vigilant, educated, and proactive in addressing your tax situation.

Frequently Asked Questions

Can the IRS take my house for unpaid taxes?

Yes, the IRS can levy various assets, including real estate, for unpaid taxes, but they must follow specific protocols and procedures outlined in the Internal Revenue Code (IRC).

What is the process the IRS must follow before seizing assets?

Before taking any seizure actions, the IRS is required to send a series of notices to the taxpayer, ensuring that individuals are aware of their tax liabilities and the potential consequences of non-payment.

What happens if I have a tax warrant?

A tax warrant establishes a lien against both real and personal assets, giving the IRS a legal claim to your assets until your tax obligation is settled.

What options do I have if I face a tax warrant?

You can pay the total warranted balance in full to satisfy the IRS's claims, or if full payment is not feasible, you can establish an installment payment agreement (IPA) to prevent further collection actions.

What documentation can I request after satisfying a tax warrant?

After satisfying the warrant, you can request proof of payment, which provides necessary documentation for the removal of the lien.

Are there any conditions under which I can qualify for a release or subordination of lien?

Yes, under certain conditions, you may qualify for a release or subordination of lien, which can help in managing your tax obligations.

How can I check for any tax warrants against me?

You can use the New York State Tax Warrants search tool to check for any existing tax warrants.

What is the Outstanding Judgment Balance Due letter?

The Outstanding Judgment Balance Due letter serves as proof of payment for your tax obligations.

What is a Notice of Pending Warrant Satisfaction?

A Notice of Pending Warrant Satisfaction confirms that the process of satisfying the tax warrant is underway.