Overview

We understand that the IRS can access your bank account under certain conditions, which may feel daunting. This primarily occurs for tax enforcement purposes, such as audits, levies, and summonses. It’s important to know that these actions can happen without prior notification to account holders, which can be unsettling.

The article highlights the legal framework the IRS uses, including its ability to issue summonses for bank records. This emphasizes the importance of maintaining accurate financial records. By doing so, you can ensure compliance and mitigate potential consequences.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges and provide the support you need.

Introduction

The power of the IRS to access bank accounts can be a source of significant concern for many taxpayers. As the agency ramps up its audit efforts in the coming years, it's common to feel anxious about what this means for your financial privacy. Understanding the implications of this authority is crucial for anyone looking to protect their personal information while ensuring compliance with tax obligations.

With the potential for audits, levies, and summonses, many individuals find themselves asking:

- How far can the IRS go in scrutinizing personal financial records?

- What does this mean for you if you find yourself under the agency's watchful eye?

These questions are not just legal concerns; they are deeply personal ones that can impact your peace of mind.

We understand that navigating these waters can feel overwhelming. You are not alone in this journey, and it's important to be informed and prepared. By staying aware of your rights and responsibilities, you can take proactive steps to safeguard your financial wellbeing.

Define IRS Access to Bank Accounts

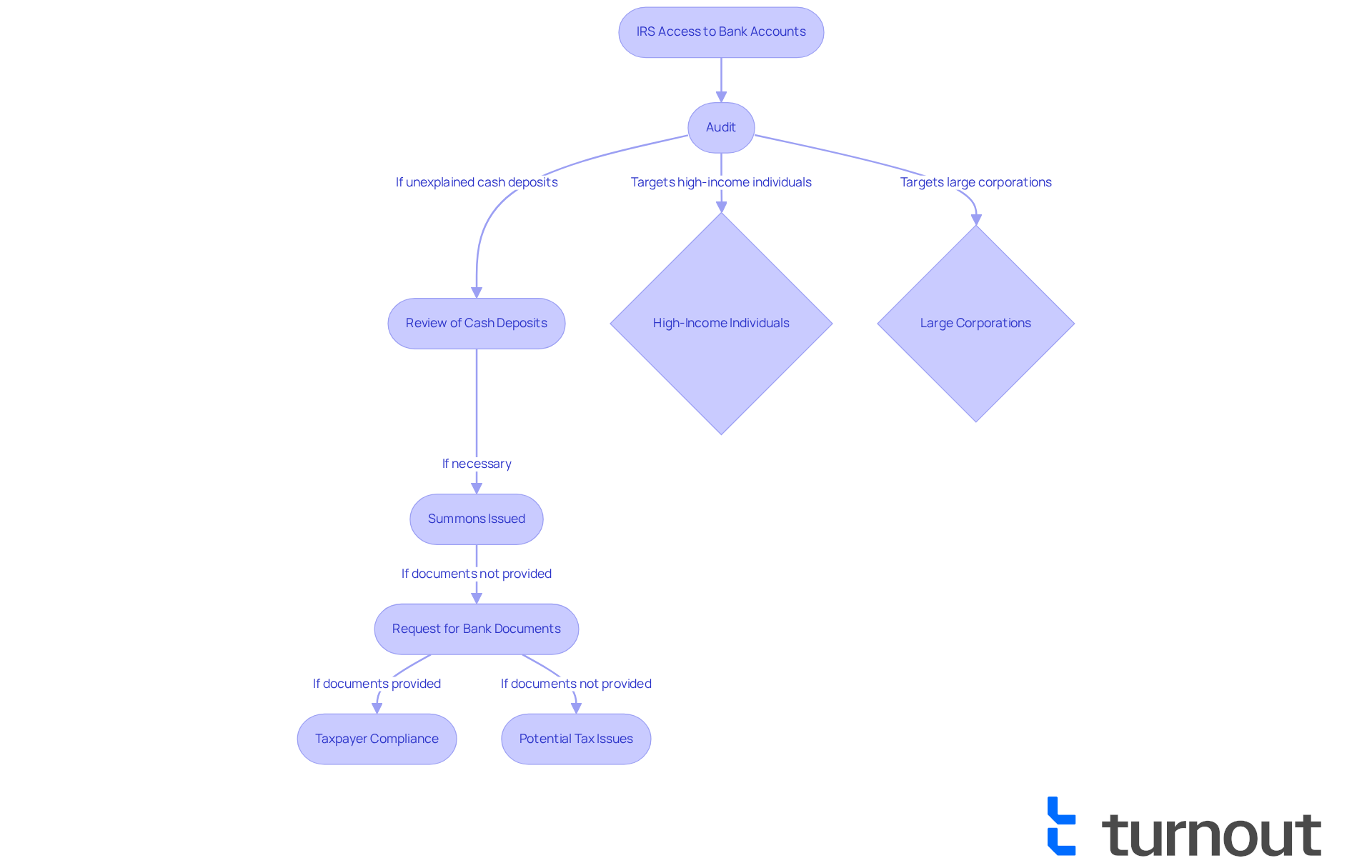

The IRS has the power to access financial records, which raises the question: can the IRS look at your bank account under specific conditions, mainly for tax enforcement purposes? This access is facilitated through various mechanisms, including audits, levies, and summonses. We understand that this can be concerning. Although the IRS does not regularly oversee banking records, it can acquire monetary documents when probing tax adherence matters, raising the question, can the IRS look at your bank account? For instance, during an audit, an IRS revenue agent may scrutinize unexplained cash deposits to ensure all income is reported accurately.

In 2025, the IRS intends to greatly raise audits, especially focusing on high-income individuals earning $10 million or more and large corporations with assets exceeding $250 million. This may entail more thorough inquiries into monetary records, which can feel overwhelming. Statistics show that a significant proportion of IRS audits require access to bank details. In fact, IRS Criminal Investigation (IRS-CI) reported on March 28, 2025, that 87.3% of criminal investigations recommended for prosecution had a related Bank Secrecy Act (BSA) filing. This highlights the agency's dependence on monetary data to combat tax fraud and other economic crimes.

Moreover, if taxpayers do not supply requested documents during an audit, the IRS may issue a summons to acquire these documents directly from banks or monetary institutions, frequently without informing the holders of the accounts. It's common to feel anxious about these situations. Understanding when the IRS can look at your bank account is essential for individuals seeking to manage their privacy and responsibilities effectively.

For instance, if a taxpayer receives payments via merchant services such as PayPal, the IRS can observe transaction amounts reported on Form 1099-K if there are enough transactions. This underscores the importance of maintaining accurate financial records and being aware of the IRS's capabilities in monitoring financial activities. Additionally, seeking assistance from tax experts can help individuals manage their IRS-related issues more effectively. Remember, you are not alone in this journey.

Context and Legal Framework of IRS Access

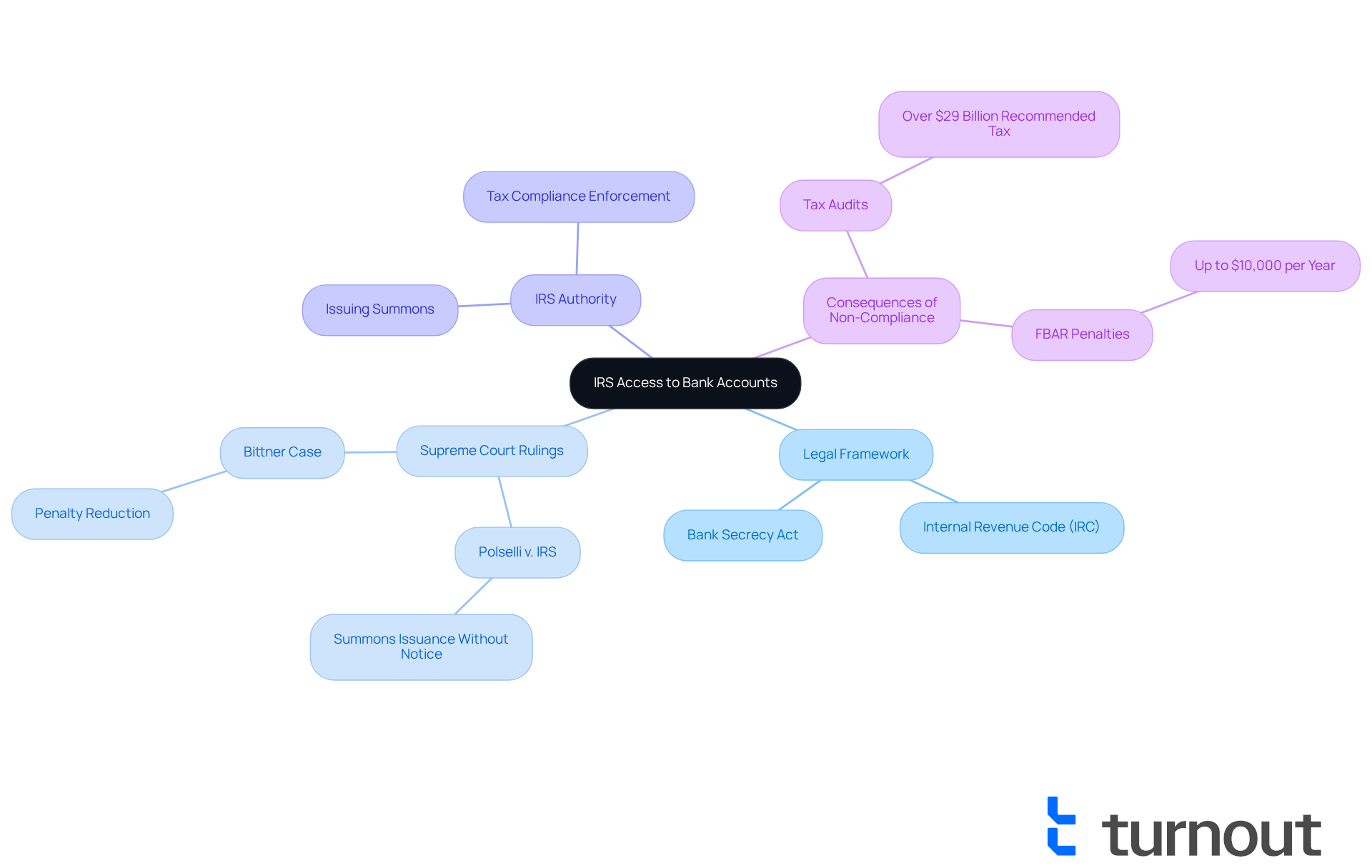

Navigating the legal landscape surrounding the question of can the IRS look at your bank account can feel overwhelming. It's important to understand that this structure is based on various statutes and regulations, including the Internal Revenue Code (IRC) and the Bank Secrecy Act. The IRS has the authority to issue summonses to banks to obtain records without notifying account holders, as confirmed by recent Supreme Court rulings. We understand that this can raise concerns about privacy and compliance.

This legal authority is designed to assist the IRS in enforcing tax compliance and investigating potential tax fraud. For instance, the Supreme Court's decision in Polselli v. Internal Revenue Service reaffirmed that the IRS can issue summonses without advance notice to holders. This strengthens the agency's ability to access financial records as part of its enforcement activities. It's common to feel anxious about such measures, but knowing the facts can help ease your worries.

Furthermore, the IRS can impose fines of up to $10,000 each year for every asset that is not disclosed on the FBAR form. This underscores the importance of compliance and the potential repercussions of overlooking these requirements. Understanding this context is crucial for individuals who are concerned about their financial privacy and wondering if the IRS can look at your bank account. Remember, you are not alone in this journey; we’re here to help you navigate these complexities.

Mechanisms of IRS Access to Bank Records

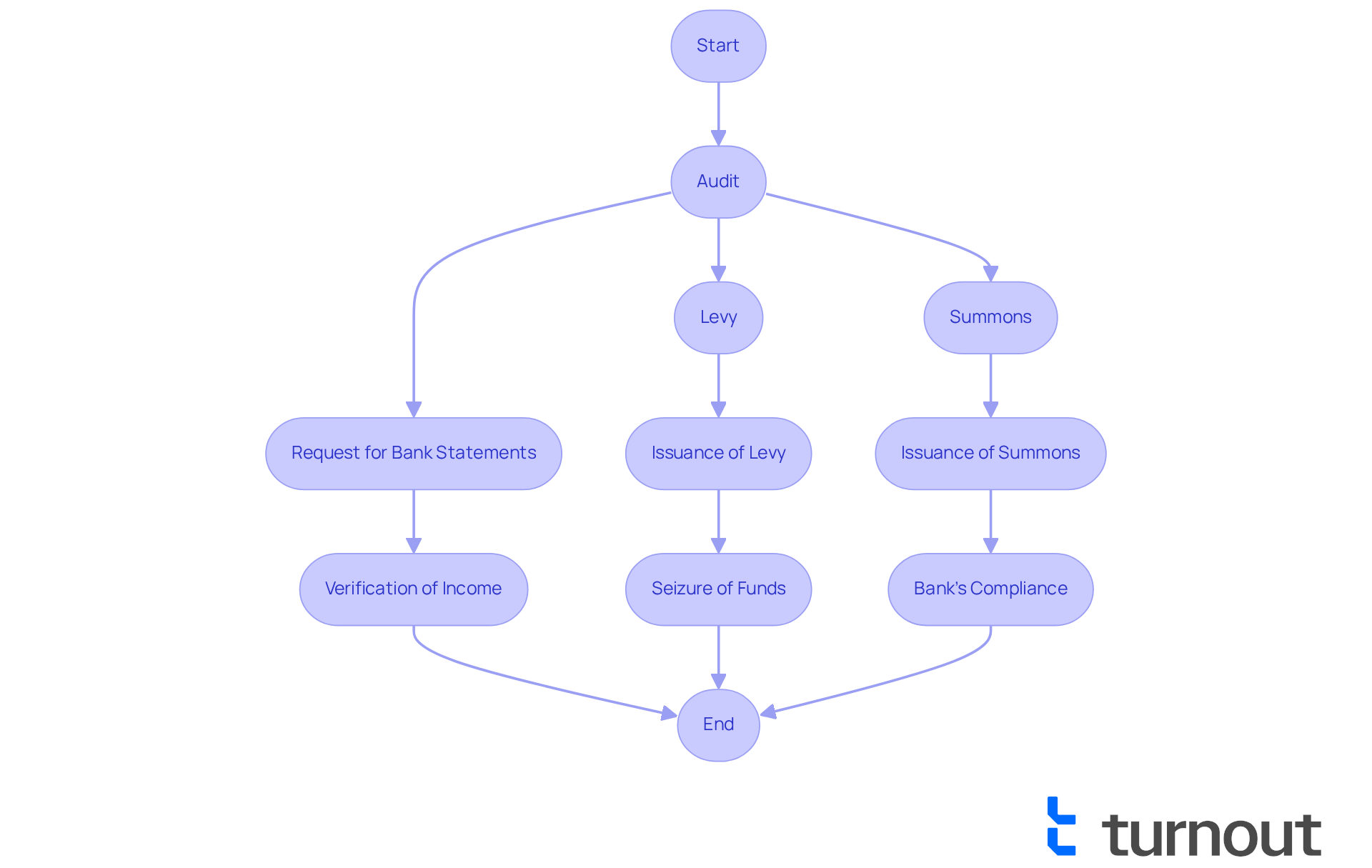

Navigating the complexities of IRS procedures can be daunting, especially when you're unsure if the IRS can look at your bank account to access records. The IRS employs various mechanisms, such as audits, levies, and summonses, which can feel overwhelming. During an audit, a common question is, can the IRS look at your bank account, as they may request bank statements and transaction records to verify income and expenses. If you owe back taxes, a levy allows the IRS to seize funds directly from your financial institution. In 2024 alone, the IRS issued thousands of levies, highlighting its proactive collection efforts.

It's also important to understand that the question of 'can the IRS look at your bank account' is answered by the fact that the IRS can issue a summons to a bank, compelling it to provide account records, often without the account holder's knowledge. This process can be particularly unsettling, as you may not even realize that your financial information is under scrutiny. Experts emphasize the importance of maintaining accurate financial records. Ines Zemelman, an accredited enrolled agent, reminds us, "By being accurate and thorough when preparing your tax return and keeping good records, you can minimize your chances of being audited and ensure that you're in compliance with tax laws."

If you receive a summons, remember that you have the right to challenge it in federal court within 20 days if it seems overly broad or unjustified. Understanding the differences between audits, levies, and summonses is crucial for taxpayers, as each mechanism serves a distinct purpose in the IRS's enforcement strategy. Additionally, the IRS has the authority to freeze or confiscate bank holdings if individuals are indebted on back taxes, which raises the concern of can the IRS look at your bank account, leading to significant financial strain.

We understand that these situations can be stressful. You're not alone in this journey; seeking help and guidance can make a difference. Taking proactive steps to understand your rights and responsibilities can empower you to navigate these challenges with confidence.

Consequences of IRS Access for Individuals

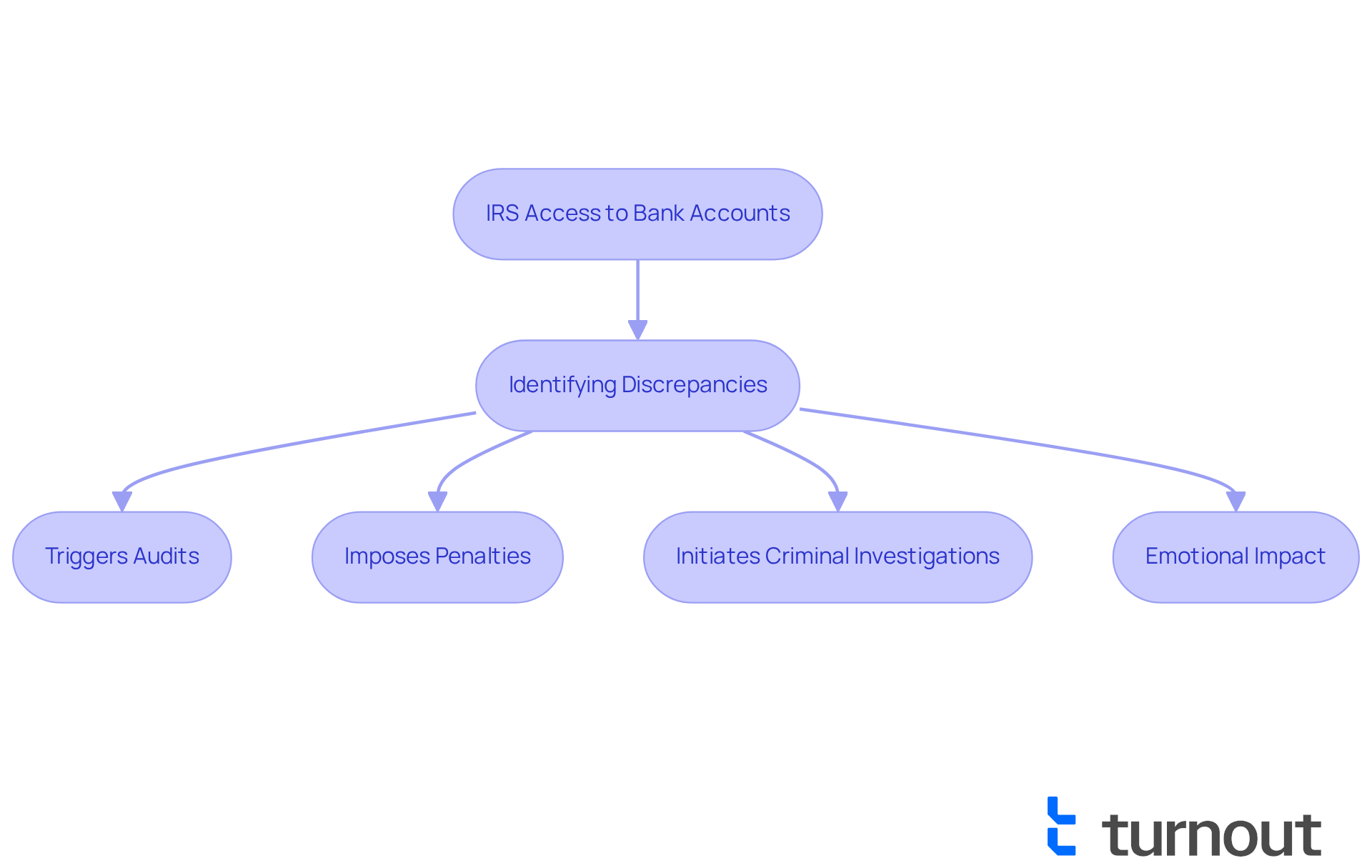

The consequences for individuals can be profound when considering if the IRS can look at your bank account. We understand that when the IRS identifies discrepancies in reported income or unreported assets, it can trigger audits, impose penalties, or, in extreme cases, initiate criminal investigations. The emotional impact of having one's monetary privacy invaded is significant, often leading to stress and anxiety. It's common to feel heightened levels of anxiety as you navigate the complexities of IRS scrutiny.

Moreover, individuals may encounter sudden monetary pressure if they wonder, can the IRS look at your bank account and withdraw funds to resolve tax obligations. In 2025, the IRS plans to significantly increase audits on high-income individuals, with audit rates projected to rise to 16.5% for those with total positive income over $10 million in tax year 2026. The average penalties for unreported income can be substantial, as the IRS focuses on compliance among wealthy taxpayers.

Understanding these potential consequences is crucial for effectively managing your financial affairs and ensuring adherence to tax obligations. Engaging with tax compliance experts can provide valuable insights into navigating these challenges. They can help you mitigate risks associated with IRS scrutiny, particularly in ensuring that necessary documentation is readily accessible. Remember, you are not alone in this journey; we’re here to help.

Conclusion

Understanding the extent of IRS access to bank accounts is crucial for individuals looking to safeguard their financial privacy. We recognize that this topic can feel overwhelming, but it’s important to know that you are not alone in this journey. The IRS holds the authority to scrutinize financial records under specific circumstances, particularly for tax enforcement. This access is facilitated through various mechanisms, including audits, levies, and summonses, which can significantly impact taxpayers. By recognizing these processes, you can better prepare for potential inquiries and take steps to protect your interests.

Key insights from this discussion reveal that the IRS's ability to access bank accounts is not merely a matter of routine oversight. It serves as a critical tool in combating tax fraud and ensuring compliance. With a projected increase in audits targeting high-income individuals and corporations, understanding the legal framework and implications of IRS scrutiny becomes even more vital. The potential consequences of non-compliance, including penalties and legal repercussions, highlight the importance of maintaining accurate financial records. Seeking professional guidance when necessary can make a significant difference in navigating these challenges.

Ultimately, the message is clear: being informed about the IRS's capabilities and your rights can empower you to navigate the complexities of tax compliance with confidence. Taking proactive measures to understand and manage your financial obligations is essential in today's regulatory environment. Engaging with tax professionals and staying informed can truly help mitigate risks associated with IRS access to bank accounts. Remember, we’re here to help you through this process.

Frequently Asked Questions

Can the IRS access my bank account?

Yes, the IRS can access financial records, including bank accounts, primarily for tax enforcement purposes through mechanisms such as audits, levies, and summonses.

Under what conditions can the IRS look at my bank account?

The IRS can look at your bank account during audits, particularly if there are unexplained cash deposits or if they are investigating tax compliance issues.

How does the IRS plan to increase audits in the future?

In 2025, the IRS plans to significantly increase audits, especially targeting high-income individuals earning $10 million or more and large corporations with assets exceeding $250 million.

What is the relationship between IRS audits and bank records?

A significant proportion of IRS audits require access to bank details, as highlighted by the IRS Criminal Investigation division, which reported that 87.3% of criminal investigations recommended for prosecution involved related Bank Secrecy Act filings.

What happens if I do not provide documents during an IRS audit?

If taxpayers do not supply requested documents during an audit, the IRS may issue a summons to obtain these documents directly from banks or financial institutions, often without notifying the account holders.

How can the IRS monitor payments from services like PayPal?

The IRS can observe transaction amounts from merchant services such as PayPal through Form 1099-K if there are sufficient transactions, emphasizing the importance of maintaining accurate financial records.

What should I do if I am concerned about IRS access to my financial information?

It is advisable to maintain accurate financial records and consider seeking assistance from tax experts to manage any IRS-related issues effectively.