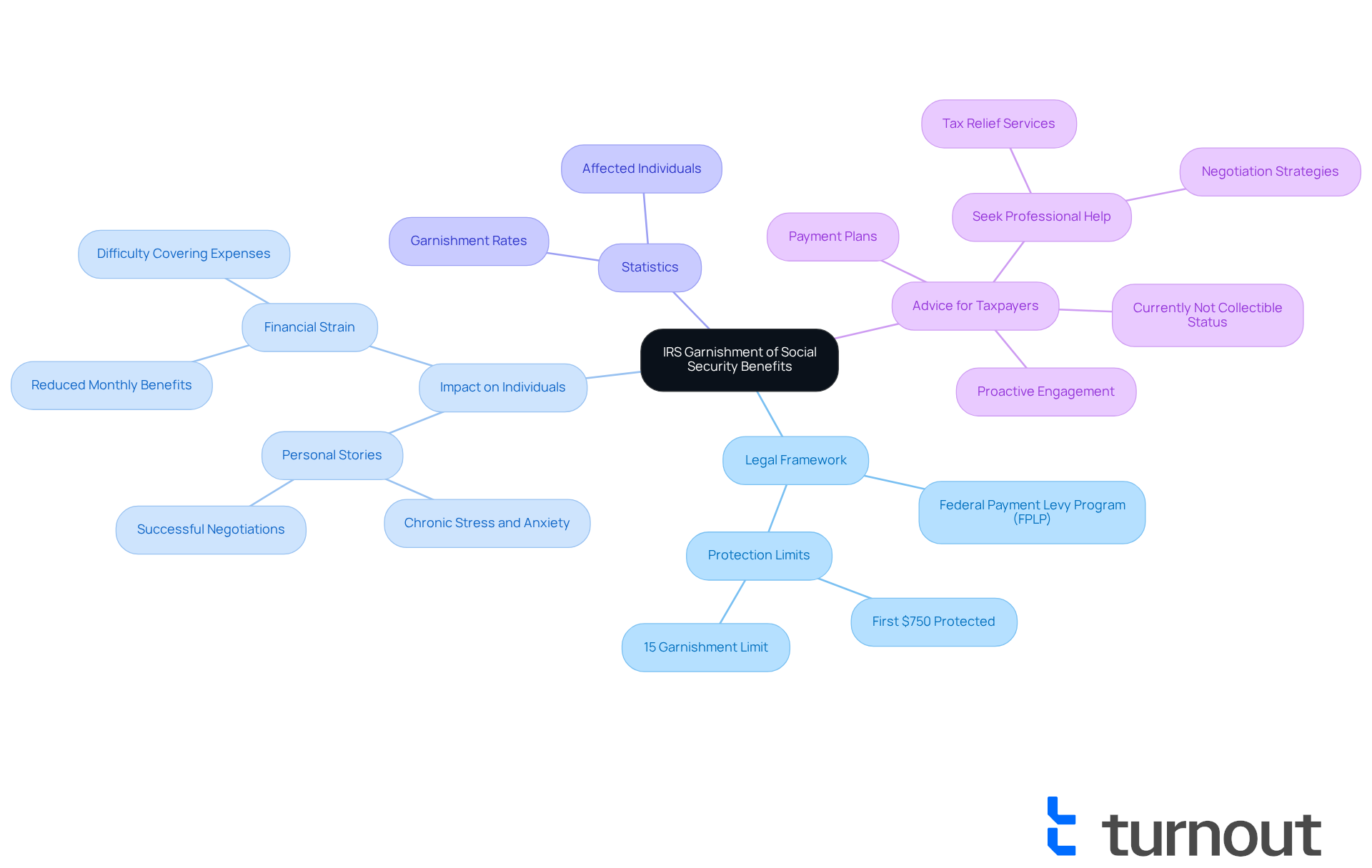

Overview

We understand that facing garnishment of Social Security benefits can be a daunting experience. The IRS has the authority to garnish Social Security benefits, including up to 15% of Social Security Disability Insurance (SSDI) payments, in order to recover unpaid federal taxes. However, it's important to note that the first $750 of your monthly benefits is protected from such actions.

This garnishment can lead to significant financial hardship for those who rely on these essential funds. It's common to feel overwhelmed and anxious about your financial situation. That's why understanding your rights and available options is crucial. By being informed, you can take steps to mitigate the impact of garnishment.

Remember, you are not alone in this journey. We're here to help you navigate these challenges and explore potential solutions. Reach out to professionals who can provide guidance and support tailored to your situation.

Introduction

The intersection of tax obligations and Social Security benefits can feel overwhelming for many Americans. We understand that the IRS's authority to garnish these vital funds raises significant concerns. With millions potentially facing deductions from their Social Security payments, it’s essential to grasp the implications of IRS garnishment.

What happens when the very support designed to provide financial stability is at risk? This article explores the complexities of IRS garnishment, delving into the legal framework, personal impacts, and proactive steps you can take to safeguard your benefits amidst growing tax pressures.

You are not alone in this journey, and we’re here to help you navigate these challenges.

Understanding IRS Garnishment of Social Security Benefits

The question of whether can the IRS garnish Social Security funds can feel overwhelming and distressing. This lawful procedure raises the question: can the IRS garnish Social Security by retaining a portion of a person's Social Security disbursements to recover unpaid tax obligations? It often occurs when a taxpayer has outstanding federal taxes, raising the concern of whether can the IRS garnish Social Security to take necessary measures. Social welfare payments, which are intended to assist those with disabilities or retirees, may also be garnished under certain circumstances, potentially causing significant financial strain for those affected.

In 2025, the pressing concern is whether can the IRS garnish Social Security for disabled individuals. The IRS can seize up to 15% of monthly Social Security disability payments, leading one to ask, can the IRS garnish Social Security based on the total payment amount? For instance, if someone receives $1,500 in Social Security Disability Insurance (SSDI), the IRS might deduct $225, leaving only $1,275 for essential expenses. This reduction can severely hinder the ability to cover daily living costs, leading to increased financial hardship.

Statistics reveal that millions of Americans face deductions from their Social Security payments, leading to concerns about whether can the IRS garnish Social Security due to tax obligations. The first $750 of monthly Social Security benefits is protected from non-tax debt collections, but amounts exceeding this limit may be subject to garnishment. This legal framework is governed by the Federal Payment Levy Program (FPLP), which has been in effect since February 2002, leading to the question of whether can the IRS garnish Social Security payments to collect delinquent tax debts.

Real-world experiences highlight the challenges faced by individuals affected by IRS garnishment. One person shared a painful story of having their SSDI payments garnished, which led to chronic stress and anxiety from reduced income. Another individual successfully negotiated with the IRS to halt a garnishment, illustrating the importance of understanding your rights and options. Seeking expert help can provide valuable guidance in navigating these complex situations, ensuring that individuals can manage their tax responsibilities while protecting their essential benefits.

Maintaining open communication with the IRS is vital to avoid garnishments. Taxpayers have 30 days from the final notice to arrange payment before the IRS begins deducting 15% from their payments. Ignoring IRS notices can lead to serious consequences, including ongoing garnishment and additional penalties. Therefore, proactive engagement and understanding of available options—such as applying for 'Currently Not Collectible' status or negotiating payment plans—can significantly ease the financial burden caused by garnishment. Remember, you are not alone in this journey; we’re here to help .

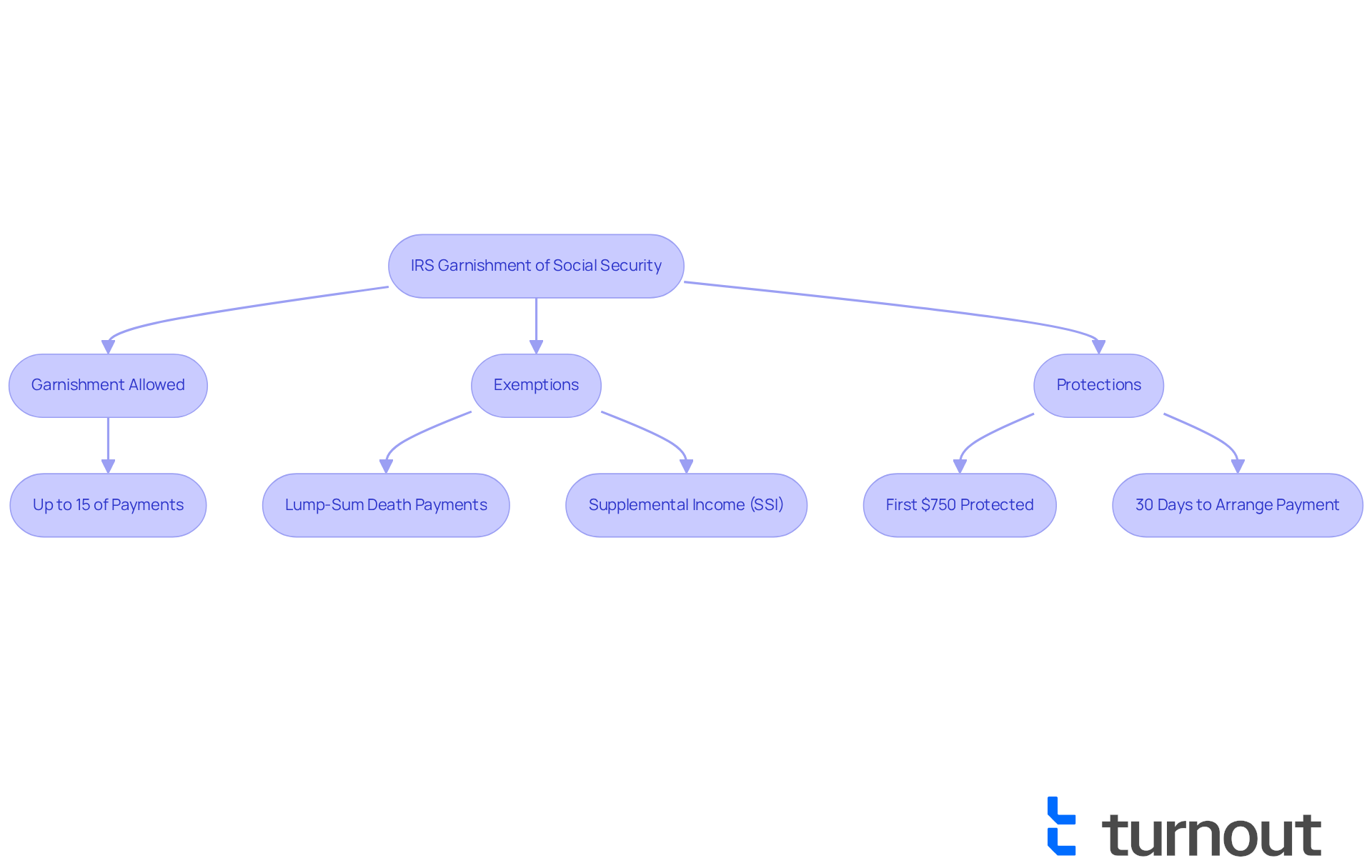

Legal Basis for IRS Garnishment of Social Security

Understanding if and how can the IRS garnish Social Security funds can be overwhelming, especially when you’re already facing financial difficulties. The Federal Payment Levy Program (FPLP) raises the question of whether the IRS can garnish Social Security payments, including disability benefits, retirement funds, and survivor benefits, to recover unpaid federal taxes. However, it’s important to know that this authority comes with specific protections designed to support you.

The IRS can only garnish a portion of your payments, ensuring you have enough income to cover your essential living costs. Specifically, they can take up to 15% of your Social Insurance payments. Certain allowances, like lump-sum death payments and Supplemental Income (SSI), are exempt from garnishment, which can provide some relief.

Additionally, under the 1996 Debt Collection Improvement Act, the first $750 of your monthly Social Assistance payments is protected from non-tax obligations. If you find yourself in this situation, remember that you have 30 days from the final notice to arrange payment of your tax debt before the 15% levy begins.

We understand that navigating these legal boundaries can be daunting. It’s crucial to recognize both the IRS's capabilities and the protections available to safeguard your essential income, especially in the context of whether the IRS can garnish Social Security. You are not alone in this journey, and we’re here to help you through it.

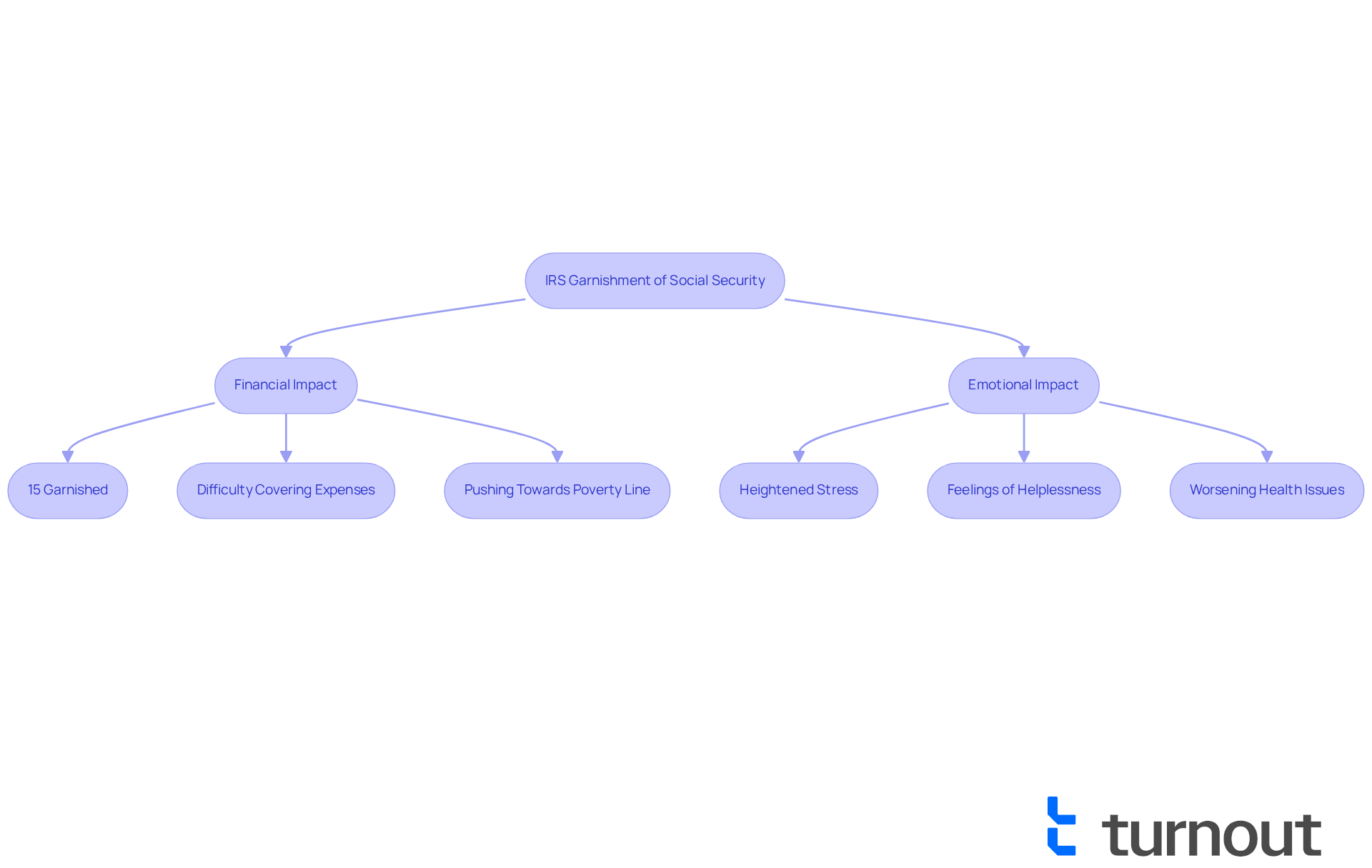

Implications of Garnishment on Social Security Benefits

Concerns often arise regarding the effects of IRS garnishment on Social Security payments, particularly for disabled individuals who rely on these funds as their primary source of income, leading to the question: can the IRS garnish Social Security? A decrease in support can lead to significant financial hardship, making it difficult to cover essential expenses like housing, food, and medical care. For example, when discussing if the IRS can garnish Social Security payments, it's important to note that up to 15% may be garnished for tax debts, pushing recipients closer to the poverty line, especially when they are already managing limited resources.

We understand that the emotional toll of having a portion of benefits garnished is equally troubling. Many individuals experience heightened stress and anxiety, exacerbating the challenges they face due to their disabilities. Real-world stories reveal this impact: people have shared feelings of helplessness and despair when confronted with reduced income, which can worsen existing health issues and create a cycle of financial instability.

It's common to feel overwhelmed by the emotional repercussions of Social Assistance payment garnishment, which can seep into various aspects of life. The fear of not being able to afford basic necessities often leads to a sense of losing control, further affecting mental well-being. Recognizing these implications is crucial for individuals navigating their financial situations. Proactive steps can help mitigate the negative effects of garnishment and pave the way toward a brighter future. Remember, you are not alone in this journey, and there are resources available to support you.

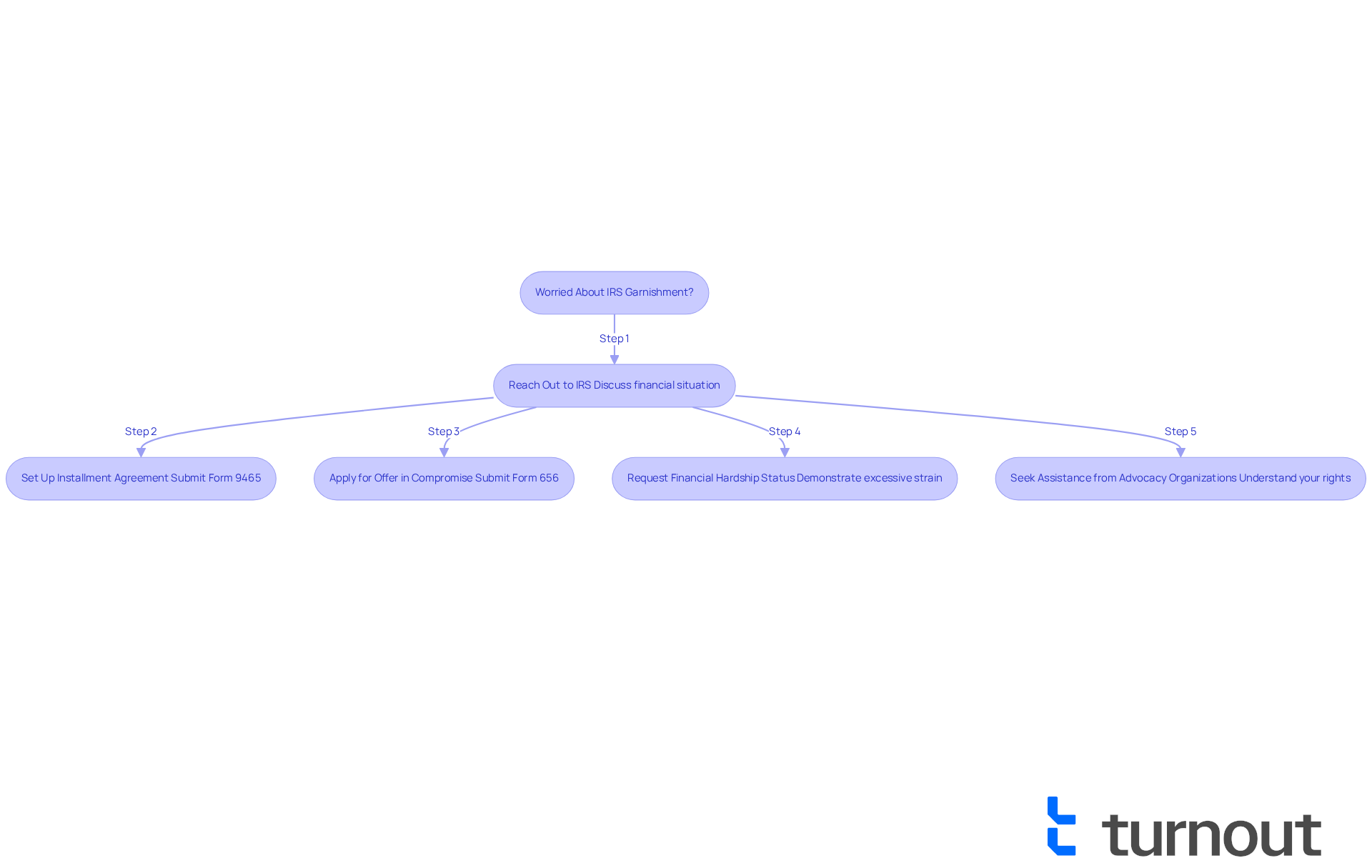

How to Stop IRS Garnishment of Social Security Benefits

If you're worried about whether the IRS can garnish Social Security, know that there are proactive steps you can take. First and foremost, reaching out to the IRS is crucial. By discussing your financial situation, you can explore options for resolving your tax debt. One effective solution is setting up an IRS installment agreement. This allows you to pay off your debt over time, helping to protect your benefits from garnishment as long as you maintain the agreement. To initiate this process, simply submit Form 9465, which requests a monthly payment plan based on what you can afford.

For those who qualify, negotiating an Offer in Compromise (OIC) can significantly reduce your overall tax burden. This option enables you to resolve your debt for less than the total amount owed. To apply for an OIC, you’ll need to submit Form 656 along with detailed financial information to demonstrate your inability to pay the full amount.

In some cases, you may also apply for financial hardship status. This can temporarily halt garnishment if you can demonstrate that it would lead to excessive financial strain, especially in relation to whether the IRS can garnish Social Security. Real-life examples illustrate how effective these strategies can be. One individual successfully negotiated with the IRS to uphold their payment plan, ensuring their Social Security payments remained unaffected. Another person shared how they benefited from Turnout's tax relief services, which helped them navigate their tax situation and achieve a favorable outcome.

Seeking assistance from consumer advocacy organizations can also provide valuable support. These organizations can help you understand your rights and ensure you receive the benefits you deserve without unnecessary interference. Remember, by taking these steps, you can effectively manage your tax obligations while also considering if the IRS can garnish Social Security. You're not alone in this journey, and we're here to help.

Conclusion

The ability of the IRS to garnish Social Security benefits is a complex issue that can significantly impact individuals relying on these funds for their livelihood. We understand that this situation can feel overwhelming. While the IRS does have the authority to garnish up to 15% of Social Security payments to recover unpaid taxes, it’s important to know that legal protections exist to ensure that a portion of these benefits remains untouchable. Recognizing these nuances helps individuals navigate their financial obligations without losing sight of their essential income.

Key insights from the article highlight the various aspects of IRS garnishment:

- There are specific protections afforded to Social Security payments, and understanding these can help alleviate some anxiety.

- The implications of such garnishment on recipients’ financial stability are significant, and it’s common to feel stressed when facing these challenges.

- Knowing one’s rights and available options, such as negotiating payment plans or applying for hardship status, is crucial in managing these circumstances.

Ultimately, it is vital for individuals facing potential IRS garnishment to remain informed and proactive. Engaging with the IRS, exploring options for resolving tax debts, and seeking assistance from advocacy organizations can empower individuals to protect their Social Security benefits. Remember, you are not alone in this journey. By taking these steps, you can navigate the complexities of tax obligations while safeguarding your essential income, ensuring you maintain the support needed for your daily living expenses.

Frequently Asked Questions

Can the IRS garnish Social Security benefits?

Yes, the IRS can garnish Social Security benefits to recover unpaid tax obligations, specifically taking up to 15% of monthly Social Security disability payments.

How does the IRS determine the amount to garnish from Social Security benefits?

The IRS can deduct 15% from the total amount of Social Security Disability Insurance (SSDI) payments. For example, if an individual receives $1,500 in SSDI, the IRS might deduct $225, leaving $1,275 for the individual.

Are there any protections for Social Security benefits against garnishment?

Yes, the first $750 of monthly Social Security benefits is protected from non-tax debt collections. However, amounts exceeding this limit may be subject to garnishment.

What is the Federal Payment Levy Program (FPLP)?

The Federal Payment Levy Program (FPLP) is a legal framework that allows the IRS to garnish federal payments, including Social Security, to collect delinquent tax debts. It has been in effect since February 2002.

What should someone do if they receive a notice of garnishment from the IRS?

It is crucial to maintain open communication with the IRS. Taxpayers have 30 days from the final notice to arrange payment before garnishment begins. Ignoring notices can lead to ongoing garnishment and additional penalties.

What options do individuals have to prevent or stop garnishment?

Individuals can apply for 'Currently Not Collectible' status, negotiate payment plans, or seek expert help to understand their rights and options regarding IRS garnishment.

What impact can garnishment have on individuals receiving Social Security benefits?

Garnishment can lead to significant financial strain, making it difficult for individuals to cover daily living costs and causing chronic stress and anxiety due to reduced income.