Introduction

Navigating the complexities of garnishment can feel overwhelming, especially when it comes to Social Security Disability benefits. Many recipients find comfort in knowing that their payments are typically protected from private creditors. However, the situation becomes more complicated when federal debts are involved.

We understand that this can be a source of anxiety for many. This article will explore the legal protections available for beneficiaries and the specific circumstances that might put their benefits at risk. What happens when essential support is threatened by debt obligations? How can individuals effectively navigate these challenging waters to protect their financial stability?

You're not alone in this journey, and we're here to help you understand your rights and options.

Define Garnishment in the Context of Social Security Disability Benefits

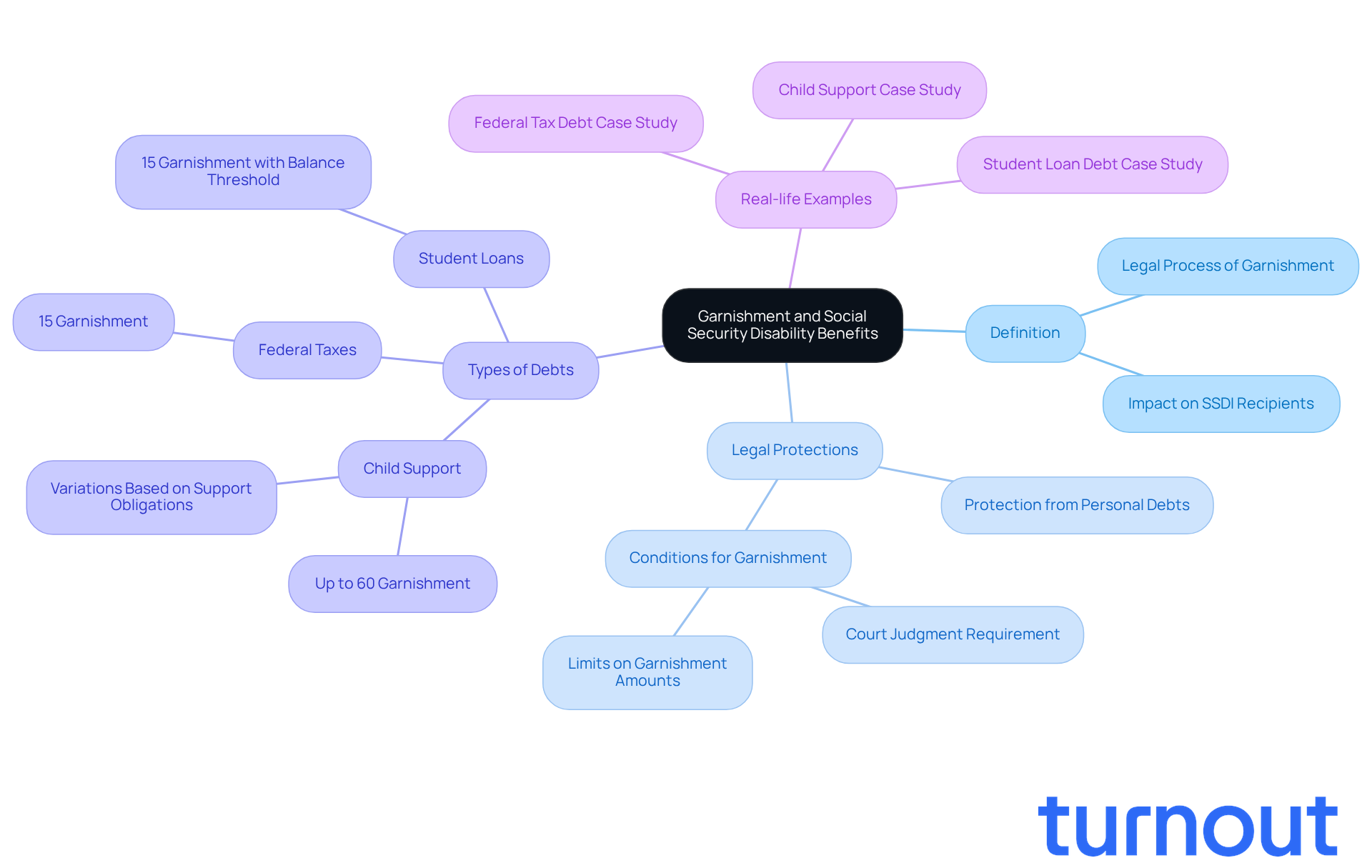

Garnishment can feel overwhelming, especially when it involves your hard-earned money. It’s a legal process that allows a portion of your earnings to be withheld to pay off a debt. In the realm of Social Security Disability assistance, this withholding happens when a court instructs the Social Security Administration (SSA) to retain a specific amount from your payments to settle certain debts. Often, creditors or government entities initiate this process to recover funds for obligations like child support, alimony, or federal taxes. Understanding garnishment, particularly regarding the question of can social security disability be garnished, is crucial for recipients, as it helps you know your rights and the potential risks of having your assistance garnished.

You might be relieved to know that SSDI payments are generally protected from being seized for personal debts, such as credit card bills or medical expenses. However, the question remains whether can social security disability be garnished for federal debts, including unpaid taxes or student loans. Legal experts emphasize that wage withholding can only occur under specific conditions, usually requiring a court ruling. So, while creditors may threaten seizure, remember that SSDI recipients have legal protections in place to safeguard their essential benefits.

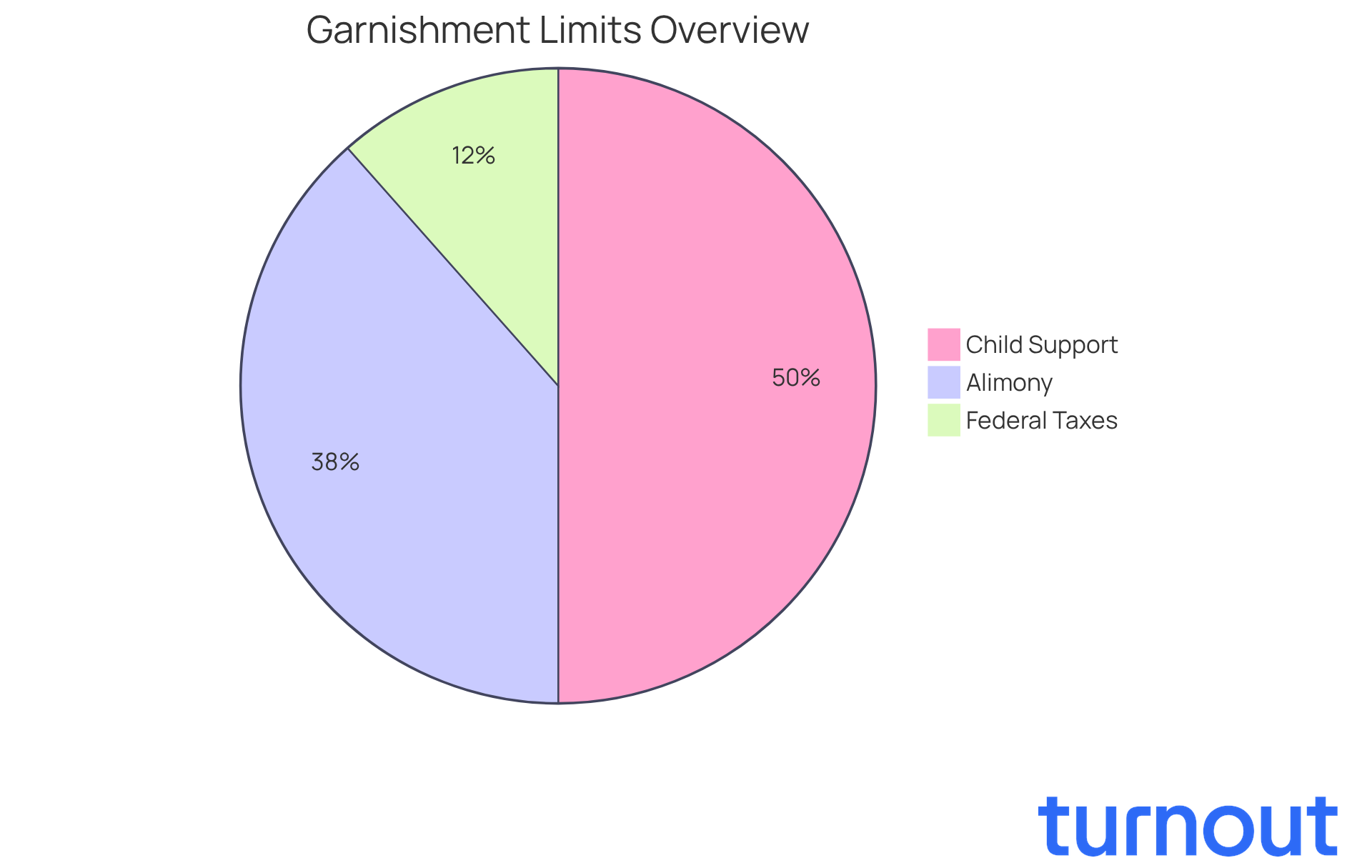

Real-life examples can shed light on the complexities of garnishment. For instance, if you’re facing child support obligations, you could see up to 60 percent of your Social Security payments garnished, depending on your situation. Similarly, individuals with federal student loans might have 15 percent of their benefits withheld, as long as their remaining balance stays above a certain threshold. These scenarios highlight the importance of understanding the garnishment process and seeking professional advice to protect your benefits effectively, particularly when asking, can social security disability be garnished?

We understand that navigating these waters can be daunting. If you find yourself in this situation, don’t hesitate to reach out for help. You are not alone in this journey, and there are resources available to support you.

Identify Situations Where Social Security Disability Benefits Can Be Garnished

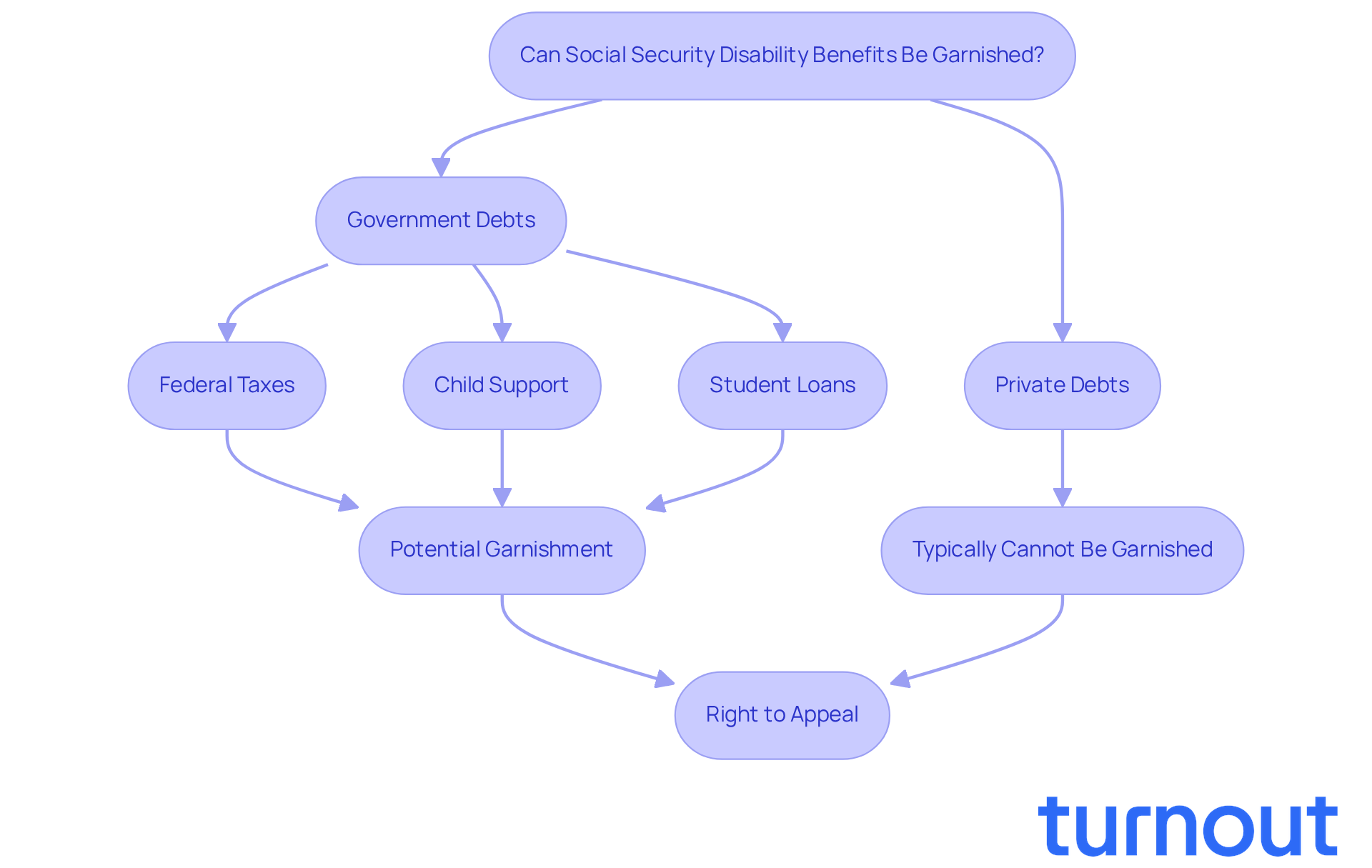

Navigating disability assistance can be challenging, and we understand that many may worry about garnishment. It's important to know that, under certain circumstances, the question of whether Social Security Disability can be garnished arises, primarily for debts owed to government entities. For example, the Federal Administration (SSA) has the authority to withhold payments to recover unpaid federal taxes, child support, or alimony. Additionally, if someone fails to repay federal student loans, a portion of their assistance might also be withheld.

However, it’s crucial to recognize that private creditors typically cannot garnish Social Security Disability payments for personal debts, leading to the important question of whether Social Security Disability can be garnished. Understanding this distinction is vital for beneficiaries, as it helps clarify their rights and the protections available to them. If benefits are directly deposited into a bank account, the law protects two months' worth of benefits from being withheld, providing a safety net for those facing financial difficulties.

If you believe that SSDI deductions are unjust or improper, remember that you have the right to appeal. At Turnout, we’re here to help you navigate these complex financial systems. We offer various tools and services, including guidance from trained nonlawyer advocates and IRS-licensed enrolled agents. Our goal is to ensure you comprehend your rights and options regarding SSD claims and potential deductions, all without the need for legal representation. You are not alone in this journey; we’re here to support you every step of the way.

Explore Protections Against Garnishment for Social Security Disability Benefits

Navigating the world of Disability payments can be overwhelming, especially when it comes to understanding your rights. Federal law offers strong protections to ensure you receive the support you need. For instance, Section 207 of the Social Security Act clearly states that social security disability can not be garnished to pay off debts owed to private creditors.

When discussing government debts, one might wonder, can social security disability be garnished? You might be relieved to know that only up to 15% of your payments can be withheld for federal tax obligations. However, in cases of child support or alimony, deductions can be higher, reaching 50-65%.

These legal safeguards are essential. They help ensure that you maintain a minimum standard of living, even if you have outstanding debts. Understanding these protections is vital for anyone relying on Disability assistance. It empowers you to address any potential withholding concerns with confidence.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges and ensure you receive the support you deserve.

Examine Real-Life Examples of Garnishment Impacting Social Security Disability Recipients

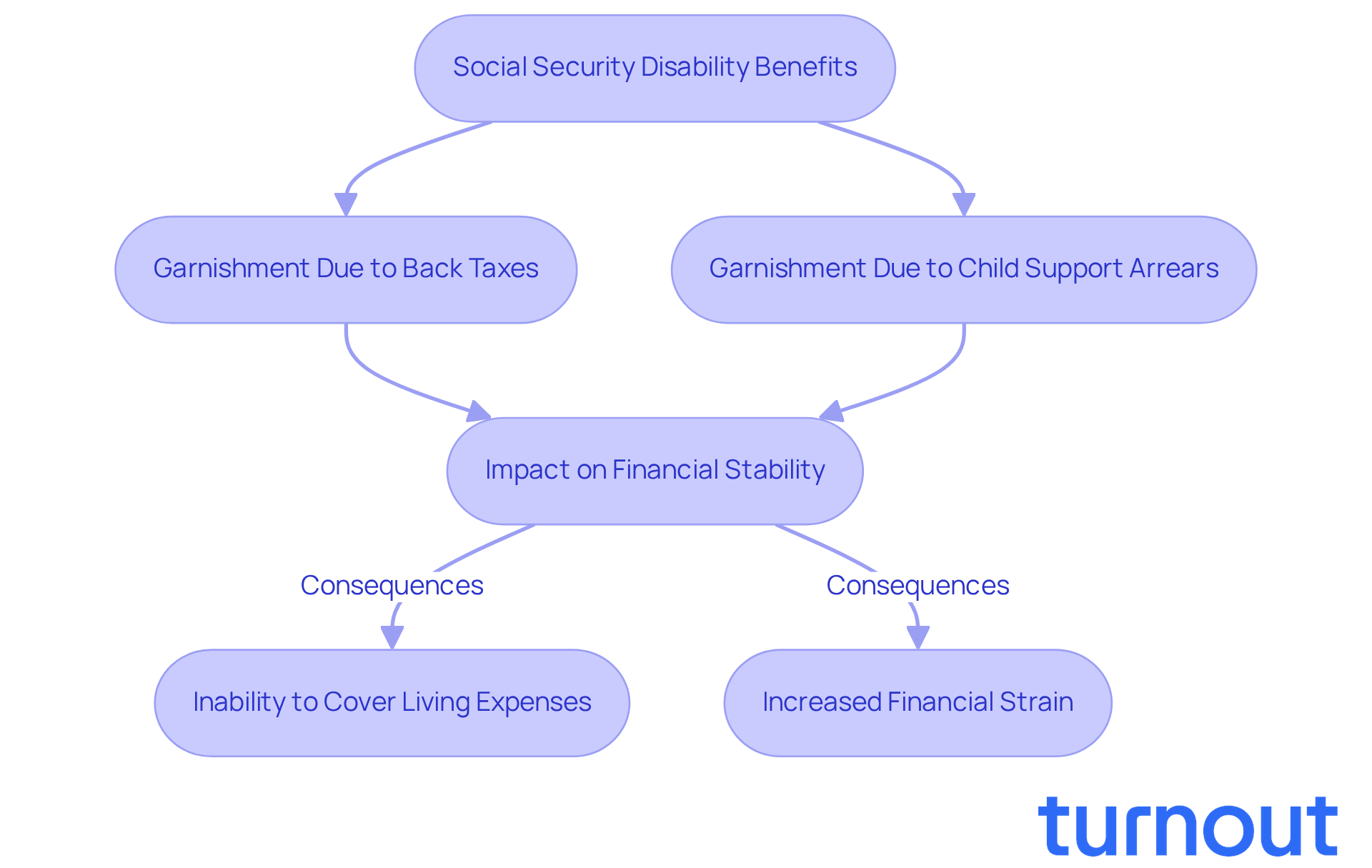

Real-life examples illustrate how social security disability can be garnished, affecting the recipients and revealing the complexities and challenges these individuals often face. For instance, one recipient found that a portion of their monthly support was withheld due to back taxes. This situation significantly impacted their ability to cover essential living expenses.

In another case, a beneficiary dealing with child support arrears experienced substantial deductions from their benefits. This led to increased financial strain, making it even harder to manage daily needs.

These situations highlight the critical need for recipients to understand whether social security disability can be garnished and the potential consequences. We understand that navigating these issues can be overwhelming.

Moreover, they underscore the importance of effective advocacy and support systems. These resources can help individuals navigate these challenges and protect their financial stability. Remember, you are not alone in this journey. We're here to help.

Conclusion

Understanding the complexities surrounding Social Security Disability benefits and garnishment is crucial for those who may worry about their financial security. We know that garnishment can happen under certain circumstances, especially for government debts. However, there are protections in place to safeguard the essential support that beneficiaries rely on. Recognizing these nuances empowers you to navigate your financial situation with confidence.

This article has highlighted key points, including the legal framework that protects SSDI payments from private creditors and the limited circumstances under which garnishment can occur. Real-life examples illustrate the challenges individuals face when portions of their benefits are withheld. It’s important to be aware of these issues and take proactive measures to protect your rights.

Ultimately, staying informed about garnishment laws and available protections is vital for anyone relying on Social Security Disability benefits. Seeking professional guidance and utilizing available resources can help you navigate these challenges effectively. Remember, you deserve to maintain your financial stability and access the support you need. We're here to help you through this journey.

Frequently Asked Questions

What is garnishment in the context of Social Security Disability benefits?

Garnishment is a legal process that allows a portion of your earnings to be withheld to pay off a debt. In relation to Social Security Disability benefits, it occurs when a court instructs the Social Security Administration (SSA) to retain a specific amount from your payments to settle certain debts.

Who typically initiates the garnishment process for Social Security Disability benefits?

Creditors or government entities usually initiate the garnishment process to recover funds for obligations such as child support, alimony, or federal taxes.

Can Social Security Disability payments be garnished for personal debts?

Generally, SSDI payments are protected from being seized for personal debts, such as credit card bills or medical expenses.

Are there circumstances under which Social Security Disability benefits can be garnished for federal debts?

Yes, SSDI benefits can be garnished for federal debts, including unpaid taxes or student loans, but this typically requires a court ruling.

How much of Social Security payments can be garnished for child support obligations?

Up to 60 percent of your Social Security payments can be garnished for child support obligations, depending on your specific situation.

What percentage of Social Security benefits can be withheld for federal student loans?

Individuals with federal student loans may have 15 percent of their benefits withheld, as long as their remaining balance stays above a certain threshold.

What should I do if I am facing garnishment of my Social Security Disability benefits?

It is important to seek professional advice to understand the garnishment process and to protect your benefits effectively. There are resources available to support you in this situation.