Introduction

Navigating the complexities of Social Security benefits and potential garnishments can feel overwhelming, especially for those who depend on these essential funds for their livelihood. We understand that this situation can bring about a lot of stress and uncertainty. While federal laws offer significant protections against creditors, certain obligations - like unpaid taxes or child support - can lead to unexpected deductions from these benefits.

This raises an important question: under what circumstances can Social Security be garnished for a civil lawsuit? And how can beneficiaries safeguard their rights? It's common to feel anxious about these issues, but understanding these intricacies is vital for anyone wanting to maintain their financial stability amidst potential legal challenges.

You're not alone in this journey. We're here to help you navigate these waters and ensure you know your rights.

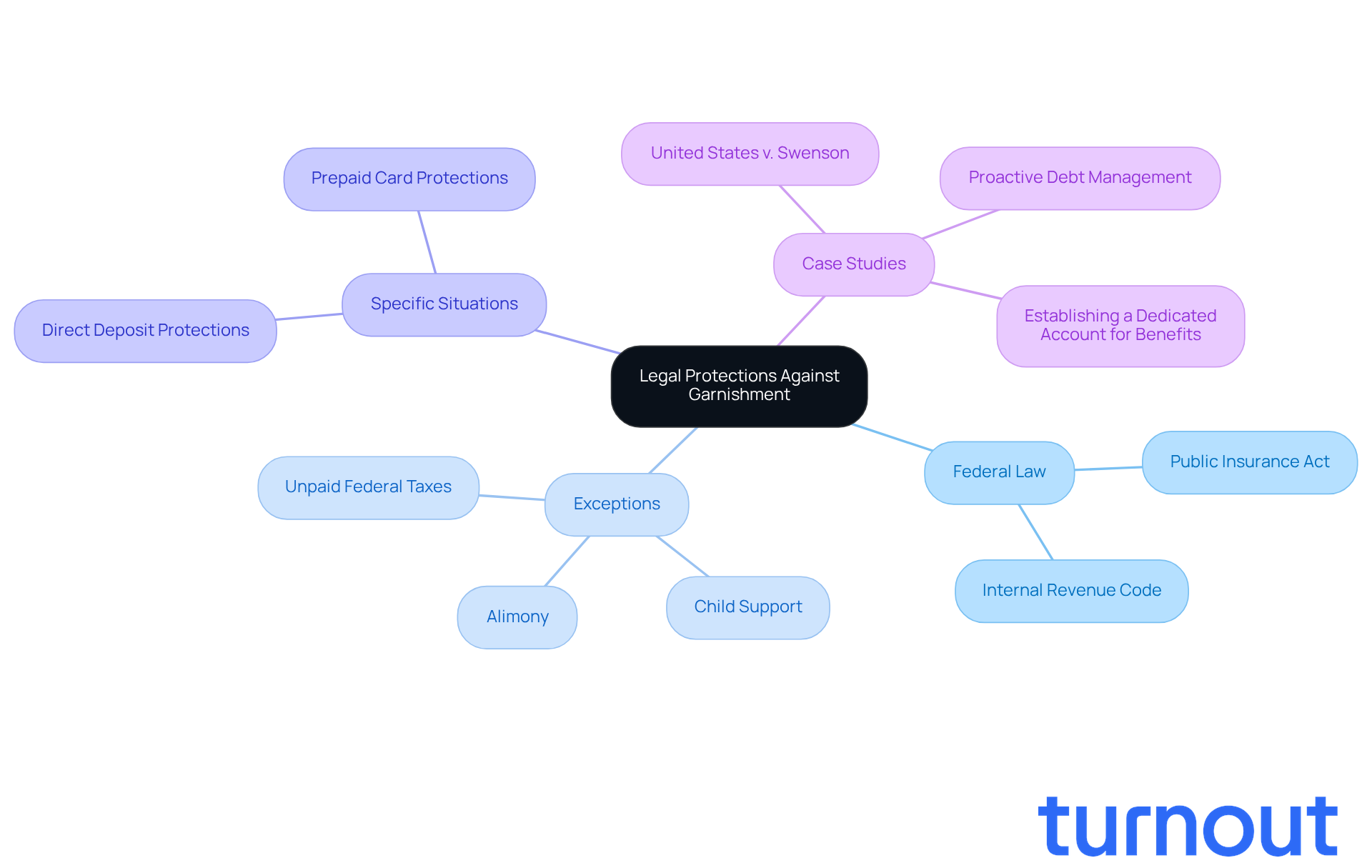

Explore Social Security: Legal Protections Against Garnishment

Federal law plays a crucial role in protecting your vital funds from being seized, ensuring that most creditors can't collect debts from you. The Public Insurance Act outlines specific exceptions that help maintain these protections, especially for individuals with disabilities. However, there are certain situations where withholding can occur, such as unpaid federal taxes, child support, and alimony obligations. For instance, the Internal Revenue Code allows the Secretary of the Treasury to impose levies on retirement payments to recover unpaid federal taxes. Additionally, state child support enforcement agencies can seize payments for court-ordered child support, with caps of up to 60% or 65% if payments are late.

We understand that navigating these rules can be overwhelming. It's essential for beneficiaries to know their rights. Many public assistance recipients are unaware of the safeguards against wage withholding, which can jeopardize their financial stability. Legal protections are in place to help you, and understanding them is vital. For example, funds received through direct deposit or on a prepaid card are generally protected from creditors, adding an extra layer of security to your payments.

Case studies highlight the effectiveness of these protections. In the case of United States v. Swenson, the Ninth Circuit ruled that social welfare payments are not subject to seizure under the Mandatory Victims Restitution Act. This ruling confirms that such payments are not considered community property and cannot be taken to settle a spouse's debts. This emphasizes the importance of the Act's provisions, which prioritize protecting your entitlements from creditors.

It's important to actively manage your finances. If you suspect improper withholding of your government assistance, don't hesitate to reach out to Turnout. They offer trained nonlawyer advocates and IRS-licensed enrolled agents who can help you navigate these complexities. By understanding your legal safeguards and utilizing the services provided by Turnout, you can better protect your financial well-being against potential collection actions. Remember, you are not alone in this journey.

Identify Debts That Can Garnish Social Security Benefits

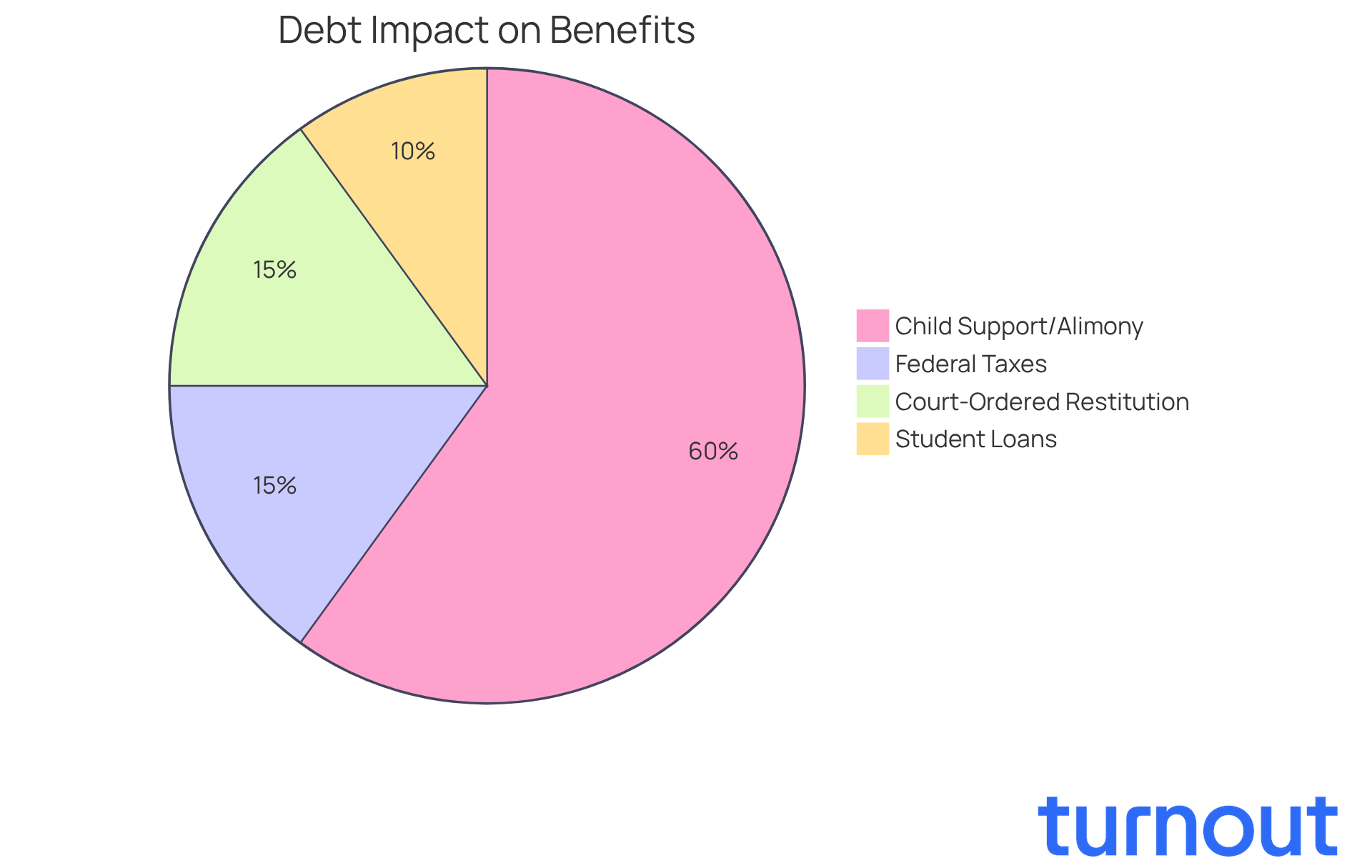

Specific debts raise the question of whether social security can be garnished for a civil lawsuit, which can significantly impact your financial stability. We understand that navigating these challenges can be overwhelming. Here are some key categories to consider:

-

Federal Taxes: Did you know the IRS can garnish up to 15% of your Social Security benefits for unpaid federal taxes? This can create substantial financial strain. At Turnout, our trained nonlawyer advocates are here to help you negotiate these debts, potentially saving you significant amounts.

-

Responsibilities related to child support and alimony raise the question: can social security be garnished for a civil lawsuit, leading to deduction rates ranging from 50% to 65% of your entitlements? We’re here to assist you in managing these responsibilities effectively, emphasizing proactive debt management.

-

Student Loans: Defaulted federal student loans may also lead to wage withholding, complicating your financial situation. Turnout provides support to help you navigate these challenges and explore options for relief.

The complexity of financial management increases when considering whether social security can be garnished for a civil lawsuit, as court-ordered restitution payments can be deducted from Social Security benefits. Understanding these possible deductions is essential, and Turnout is here to guide you through these responsibilities.

In summary, grasping these potential deductions is crucial for you. It empowers you to manage your financial obligations more effectively. Remember, you are not alone in this journey; Turnout is here to help when you need it.

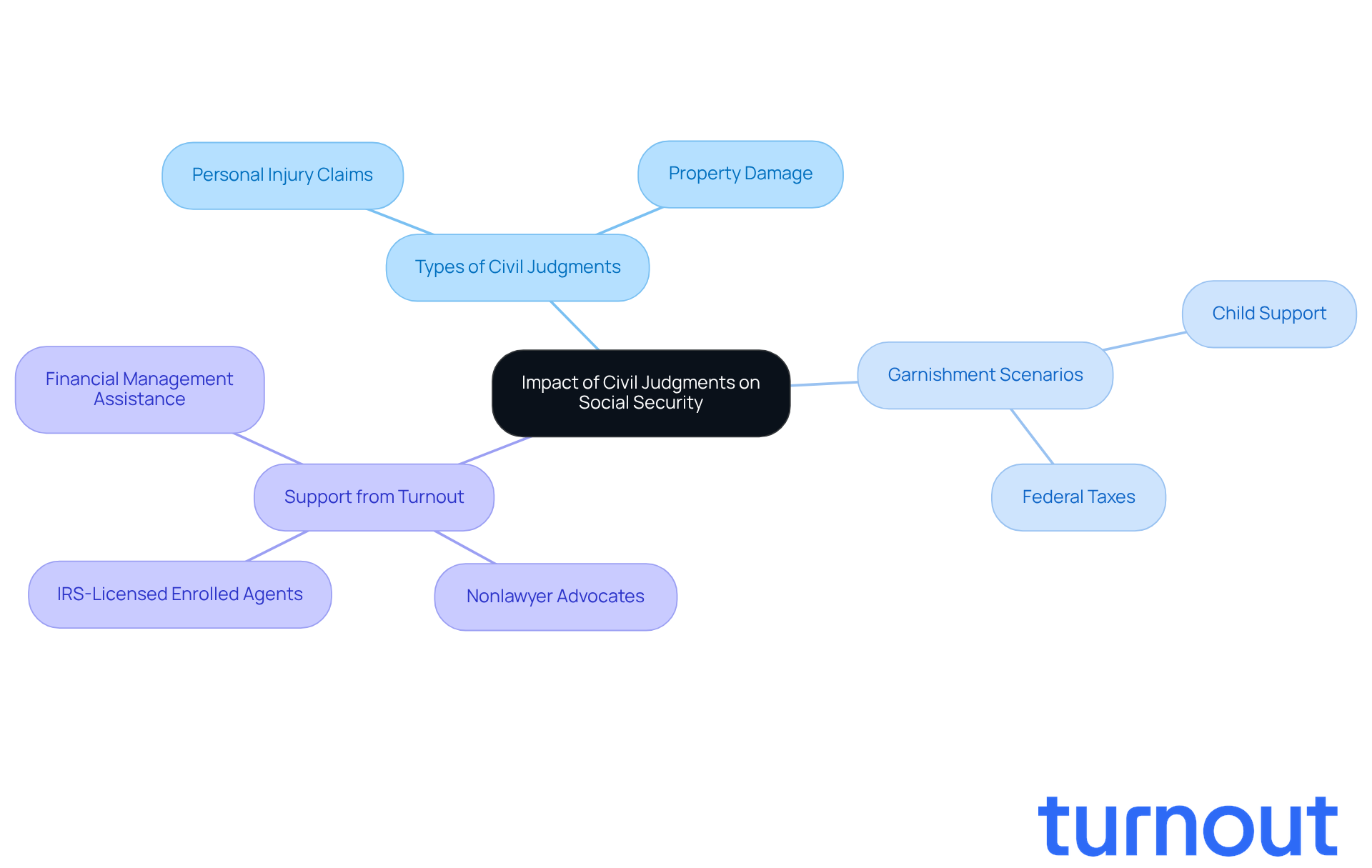

Understand the Impact of Civil Judgments on Social Security

Civil judgments can significantly impact welfare payments, and it’s crucial for recipients to understand the safeguards in place. We know that government benefits are generally protected from seizure due to most civil judgments, including those related to personal injury claims and property damage. However, certain court orders can lead to wage withholding, especially for obligations like child support or federal taxes.

It’s common to feel overwhelmed by these complexities. Recent reports indicate that over one million beneficiaries are currently facing garnishments of up to 50% of their monthly payments due to overpayment recovery efforts. This highlights the importance of being aware of potential garnishment situations.

While Social Security payments are typically shielded from civil judgments, one may wonder, can social security be garnished for a civil lawsuit? For instance, if a lender secures a court ruling for specific debts, it raises the question of whether social security can be garnished for a civil lawsuit. Beneficiaries should remain vigilant about the types of decisions that could lead to asset seizure.

We’re here to help. Turnout offers valuable support in navigating these challenging circumstances. It’s important to note that Turnout is not a law firm and does not provide legal advice. Instead, they utilize trained nonlawyer advocates and collaborate with IRS-licensed enrolled agents to assist clients through their processes. Understanding these nuances can empower you to manage your financial obligations while protecting your essential income. You are not alone in this journey.

Take Action: Steps to Protect Your Social Security from Garnishment

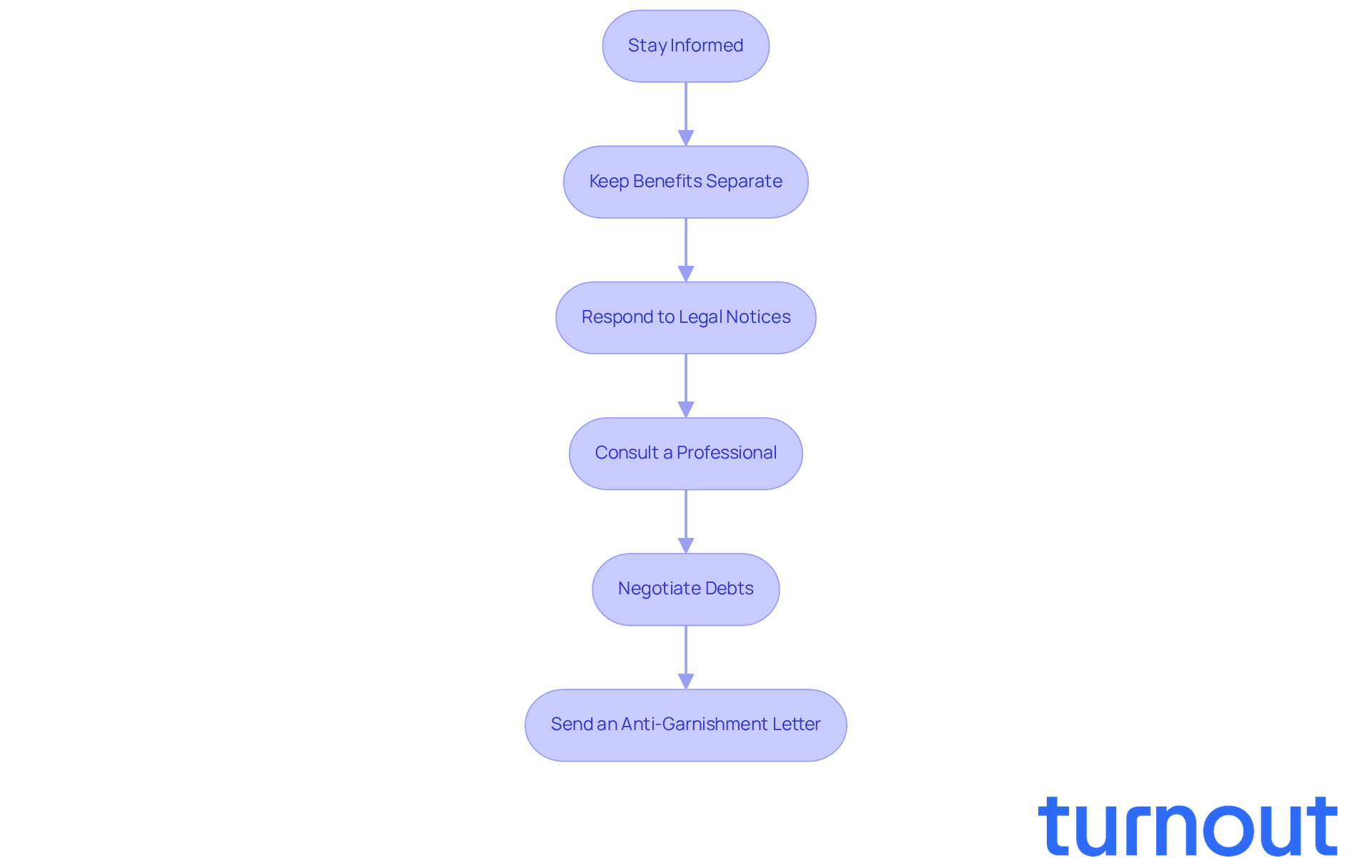

To safeguard your Social Security benefits from garnishment, consider implementing these compassionate strategies:

-

Stay Informed: We understand that managing financial obligations can be overwhelming. Regularly reviewing your debts helps you identify which ones might lead to wage deductions. Knowing your liabilities is crucial for taking proactive steps.

-

Keep Benefits Separate: It’s wise to set up a dedicated bank account just for your retirement deposits. This separation not only simplifies your finances but also makes it easier to demonstrate that your income is protected from seizure. Certain bank accounts are legally safeguarded, meaning creditors can’t access funds that are excluded, like government assistance income.

-

Respond to Legal Notices: If you receive any court summons or notices about debts, it’s important to respond promptly. Ignoring these communications can jeopardize your rights and lead to unfavorable outcomes. Remember, you’re not alone in this; many face similar challenges.

-

Consult a Professional: Engaging with a qualified advocate or attorney who specializes in Social Security and debt issues can be incredibly beneficial. Their expertise can guide you through complex situations and help you explore your options effectively.

-

Negotiate Debts: Whenever possible, try negotiating with creditors to settle debts before they escalate to garnishment actions. Proactive negotiation can prevent the need for legal intervention and protect your benefits.

-

Send an Anti-Garnishment Letter: If your sole monthly income comes from government assistance, consider sending an anti-garnishment letter to your bank. This letter informs the bank that creditors should not withdraw money from your account without your permission. Make sure to include your bank's name and address, your account number, and remember to date and sign it. Keeping a copy for your records is also a good idea.

By taking these steps, you can significantly enhance the security of your Social Security benefits and understand if can social security be garnished for a civil lawsuit. Remember, we’re here to help you navigate this journey.

Conclusion

Understanding the complexities of Social Security garnishment is essential for protecting your vital financial resources. We know that navigating this issue can be overwhelming, but it’s important to recognize the legal protections that shield Social Security benefits from most creditors. However, there are exceptions, such as unpaid federal taxes and child support obligations, that you should be aware of. By knowing your rights, you can help ensure your financial stability remains intact, even in the face of potential garnishment.

Key insights include:

- The types of debts that can lead to garnishment

- The impact of civil judgments

- The proactive steps you can take to safeguard your benefits

Organizations like Turnout play a crucial role in helping individuals navigate these complex financial landscapes. They empower you to manage your debts effectively while securing your essential income.

Ultimately, being informed and proactive is your best defense against the risk of garnishment. Consider taking steps like:

- Separating your benefits into dedicated accounts

- Responding promptly to legal notices

- Seeking professional advice

These actions can significantly enhance your financial security. Remember, recognizing the importance of these safeguards and acting decisively is vital to protecting your rights and benefits against potential garnishment actions. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What legal protections does federal law provide against garnishment of Social Security funds?

Federal law protects vital funds from being seized by most creditors, ensuring that individuals, especially those with disabilities, have safeguards against garnishment.

In what situations can Social Security funds be garnished?

Social Security funds can be withheld for unpaid federal taxes, child support, and alimony obligations. For example, the Internal Revenue Code allows for levies on retirement payments to recover unpaid federal taxes, and state child support enforcement agencies can seize payments for court-ordered child support.

What are the caps on child support garnishment from Social Security payments?

Child support payments can be garnished up to 60% of Social Security payments, or up to 65% if the payments are late.

How can beneficiaries protect their rights regarding wage withholding?

Beneficiaries should be aware of their rights and the legal protections in place against wage withholding, as many public assistance recipients are unaware of these safeguards.

Are funds received through direct deposit or prepaid cards protected from creditors?

Yes, funds received through direct deposit or on a prepaid card are generally protected from creditors, providing an extra layer of security.

Can Social Security payments be seized to settle a spouse's debts?

No, as established in the case of United States v. Swenson, social welfare payments are not subject to seizure under the Mandatory Victims Restitution Act and cannot be taken to settle a spouse's debts.

What should I do if I suspect improper withholding of my government assistance?

If you suspect improper withholding, you should reach out to Turnout, which offers trained nonlawyer advocates and IRS-licensed enrolled agents to help navigate these complexities.

How can understanding legal safeguards benefit me?

Understanding your legal safeguards can help you better protect your financial well-being against potential collection actions, ensuring that you are aware of your rights and the protections available to you.