Introduction

As you approach or navigate retirement, the thought of garnishing your retirement benefits can feel overwhelming. Many individuals share this concern, especially in a world where financial pressures seem to mount daily. Understanding whether your pensions, 401(k)s, and Social Security payments are at risk of garnishment is essential for protecting your financial future.

It's common to feel anxious about potential income reductions during retirement. You might wonder: how can you manage the complexities of garnishment laws while ensuring your financial stability? This article aims to shed light on the intricacies of retirement benefit garnishment. We’ll explore its legal context, the emotional impacts it can have, and share strategies to help you navigate these challenges effectively.

Remember, you are not alone in this journey. Many retirees face similar worries, and together, we can find ways to address them. Let's take a closer look at how to safeguard your hard-earned benefits and maintain your peace of mind.

Define Garnishment of Retirement Benefits

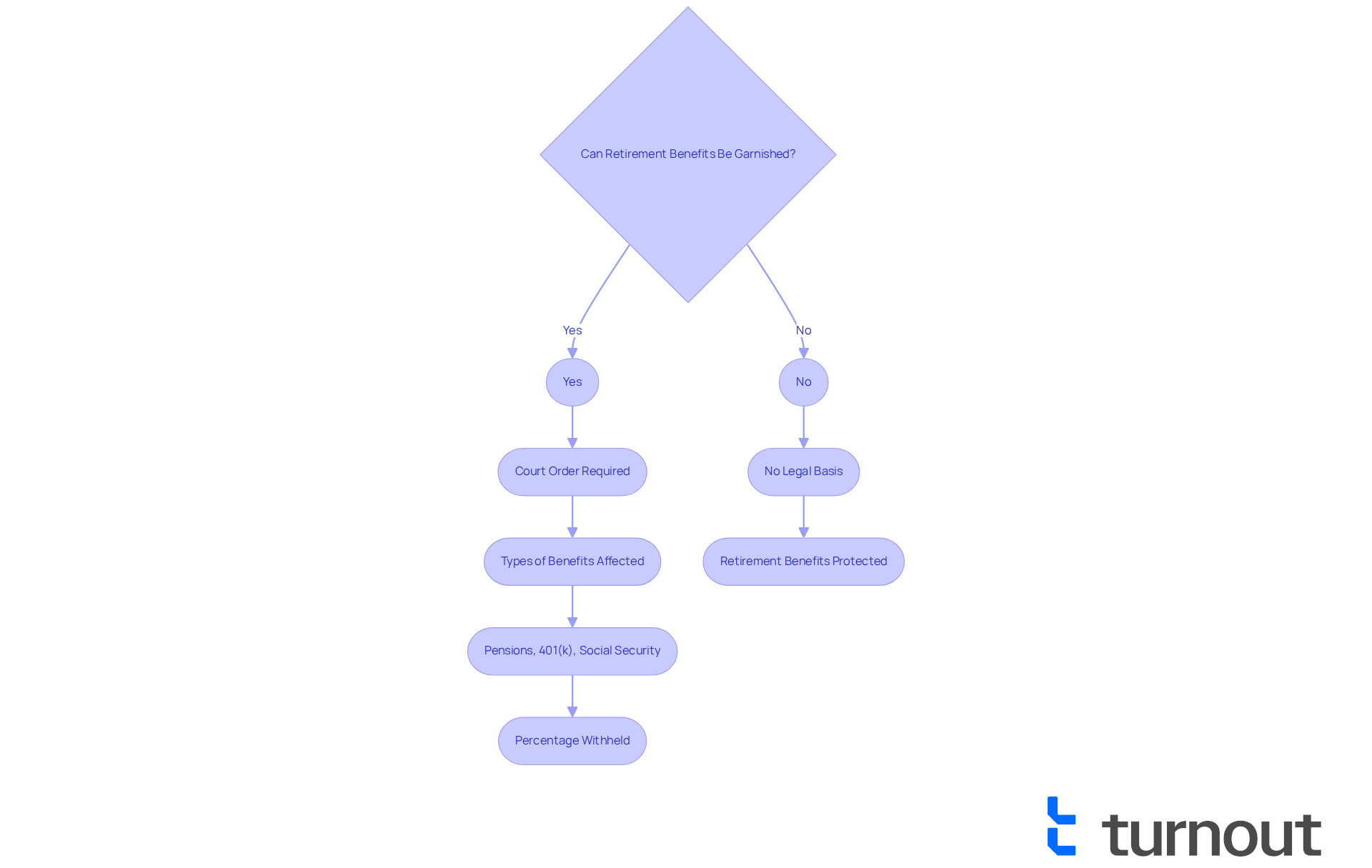

The process of garnishment raises concerns about whether retirement benefits can be garnished, making it a daunting experience. It’s a legal process where a portion of your retirement income is withheld to pay off a debt, leading to the inquiry of whether retirement benefits can be garnished. This can include pensions, 401(k)s, and even Social Security payments. Typically, a court order is required, and the rules around wage attachment can vary based on the type of benefit and the nature of the debt. Understanding these nuances is crucial, especially for those relying on fixed incomes during retirement.

The impact of wage attachment is significant, particularly for retirees. Many depend on a steady income, and the thought of losing even a small portion can be overwhelming. For instance, around 450,000 federal student loan borrowers aged 62 and older may see their Social Security payments reduced due to deductions for defaulted loans, with up to 15% of their monthly payments potentially withheld. This situation underscores the vulnerability of retirees to financial pressures, especially when it raises the question of whether retirement benefits can be garnished. With a potential 24% reduction in Social Security support on the horizon, the financial landscape for retirees is becoming increasingly uncertain.

At Turnout, we’re dedicated to making it easier for you to access government assistance and support. We offer guidance for those navigating these complex issues. Real-life examples illustrate how wage withholding affects individuals. Many retirees find it challenging to cover essential expenses when part of their income is diverted to settle debts. As Maryalene LaPonsie wisely noted, "If your Social Security benefits were to decrease, a pension could offer a monetary cushion." This highlights the importance of having diverse income streams to soften the blow of deductions.

Understanding how wage attachment works is vital to determine if retirement benefits can be garnished. It’s important to be aware of the possibility of withholding and to explore options for relief, such as proving economic hardship or seeking help from consumer advocacy groups like Turnout. With the risk of decreased Social Security payments looming, proactive financial planning becomes even more critical for retirees facing potential income deductions. Remember, you’re not alone in this journey, and we’re here to help.

Understand the Legal Context of Garnishment

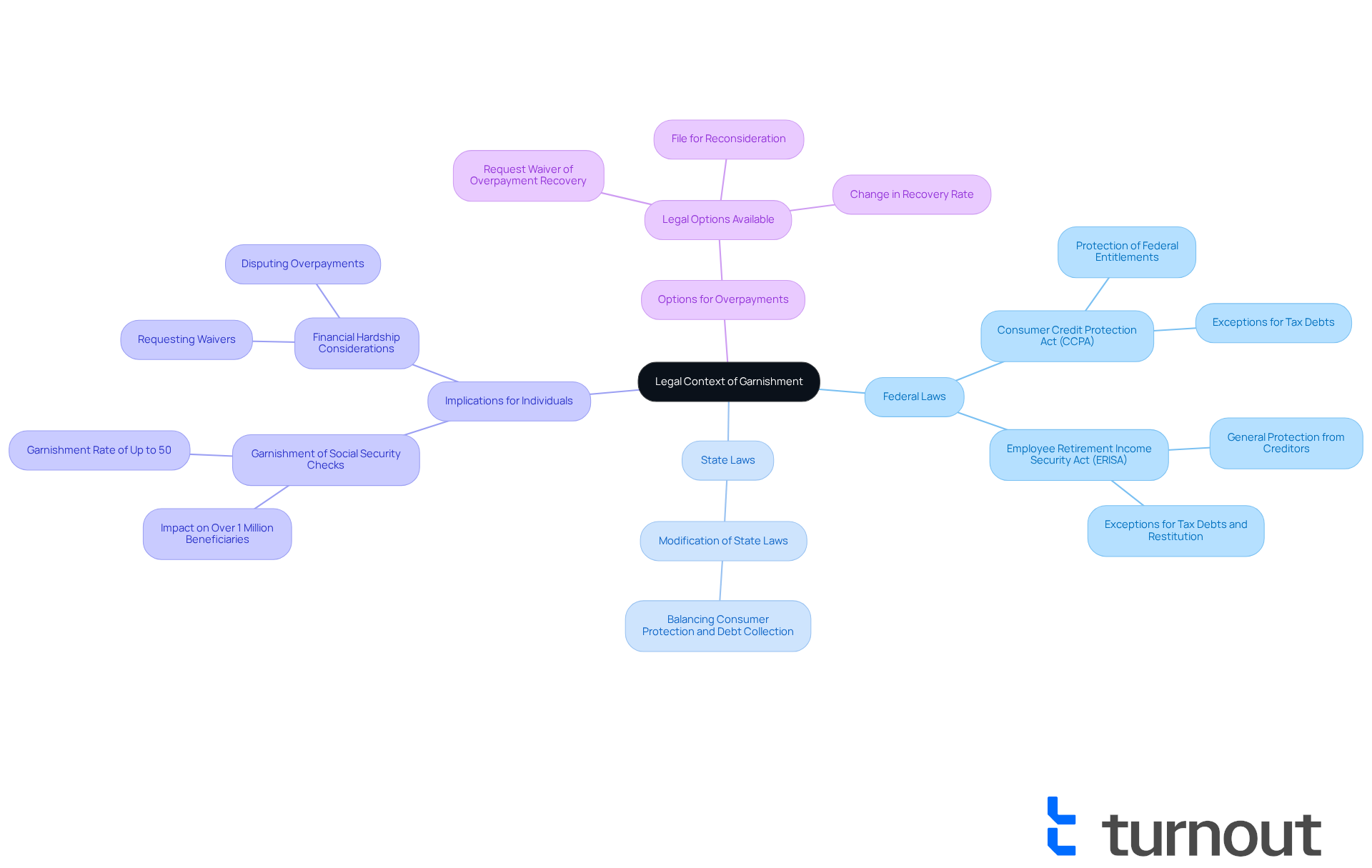

Navigating wage attachment can be challenging, and it’s important to understand the legal framework that governs it. Both federal and state laws play a role in determining when wage attachment can occur. The Consumer Credit Protection Act (CCPA) is particularly significant, as it protects certain federal entitlements, like Social Security, from being seized for most private debts. However, it’s crucial to remember that the federal government can garnish retirement benefits for specific obligations, leading to the question of whether retirement benefits can be garnished for unpaid taxes or child support.

Starting July 24, overpaid Social Security recipients may see their checks garnished by up to 50%. This change could impact over 1 million beneficiaries, which understandably raises concerns. Additionally, it is important to understand if retirement benefits can be garnished, as retirement accounts under the Employee Retirement Income Security Act (ERISA) are generally protected from creditors, though there are exceptions for tax debts and court-ordered restitution.

As Faith Mullen insightfully notes, "This article does not contend, as others have, for the elimination of wage withholding, but instead for the modification of state laws to achieve a better balance between safeguarding individuals and facilitating the collection of rightful debts." Understanding these legal safeguards is essential for anyone facing potential wage withholding. It can help you protect your financial stability.

If you find yourself dealing with overpayments, know that you have options. You can request a waiver of overpayment recovery or dispute the amount owed. These steps can significantly lessen the impact of withholding. Remember, you are not alone in this journey, and we’re here to help you navigate these challenges.

Explore the Effects of Garnishment on Consumers

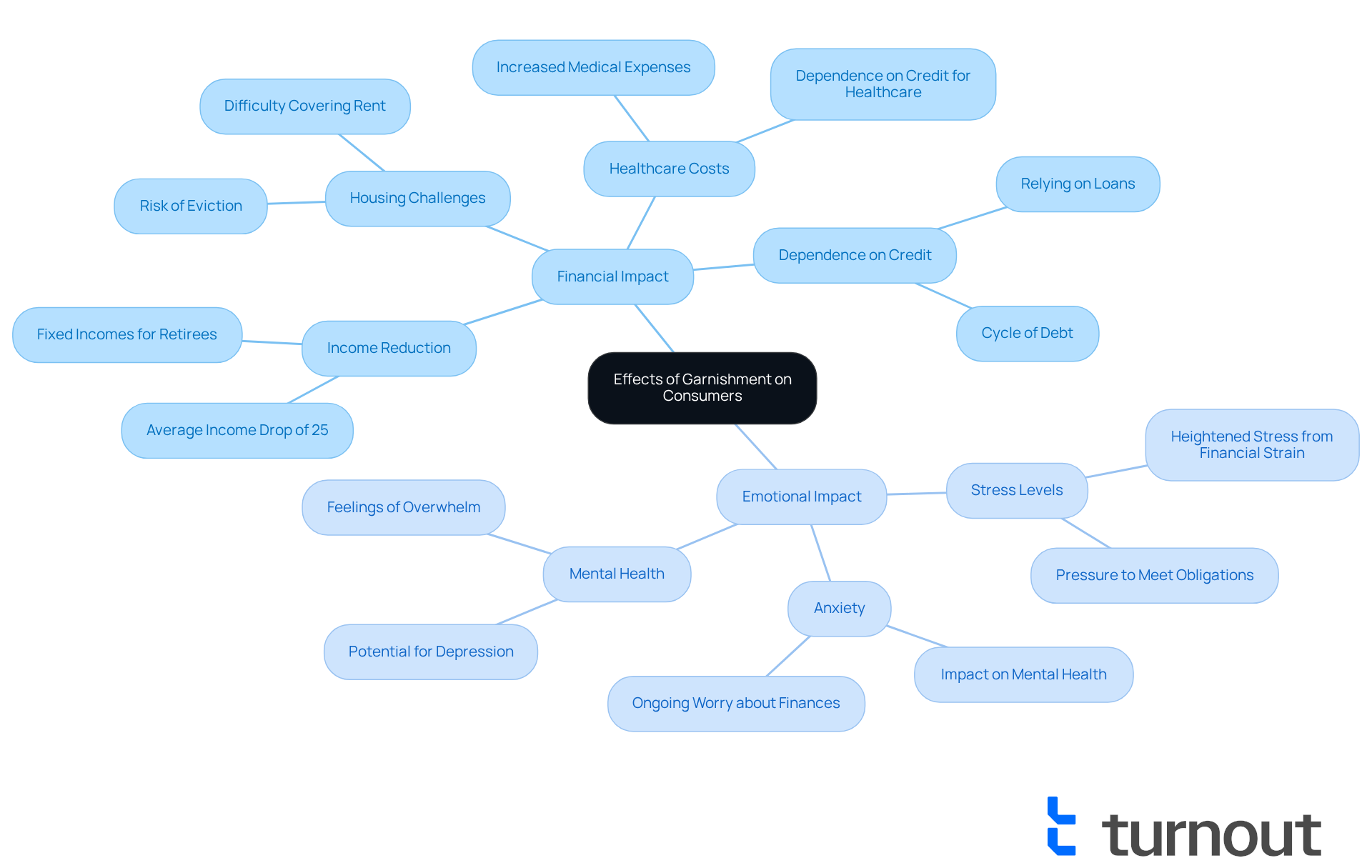

The impact of wage withholding on consumers, especially retirees, can be significant and varied. Many retirees depend on fixed incomes, and the question of whether retirement benefits can be garnished can lead to considerable economic strain. This reduction in income often makes it tough to cover essential living expenses like housing, healthcare, and food. Financial experts suggest that retirees may experience an average income drop of up to 25% due to these deductions, which can heighten their vulnerability.

Beyond the financial aspects, the emotional toll of reduced income can be profound. Individuals facing garnishment often report heightened levels of stress and anxiety, which can negatively affect their overall well-being. The pressure to meet financial obligations with fewer resources can create a cycle of debt, forcing many to rely on credit or loans to fill the gap. This situation impacts not only their economic stability but also their mental health, as the ongoing worry about making ends meet can feel overwhelming.

Understanding whether and how retirement benefits can be garnished is crucial for individuals, particularly retirees. It empowers them to advocate for their rights and seek assistance when confronted with wage withholding. By recognizing the emotional and financial challenges posed by income withholding, individuals can better navigate their circumstances and explore available options for relief.

We understand that this can be a daunting experience, but remember, you are not alone in this journey. There are resources and support systems available to help you manage these challenges. Don't hesitate to reach out for assistance; taking that first step can make a world of difference.

Identify Strategies for Managing Garnishment

Managing wage deductions can feel overwhelming, but you’re not alone in this journey. It’s essential to take a proactive approach and understand your rights as a consumer. Familiarizing yourself with the specific protections available in your state can make a significant difference. By reaching out to creditors promptly, you might find opportunities for negotiated agreements or payment plans that can prevent wage seizure altogether. Did you know that about 30% of individuals facing wage withholding successfully negotiate with creditors? Early engagement truly matters.

Seeking legal counsel is another crucial step. Lawyers can help you explore options like applying for exemptions or contesting the seizure in court. For instance, Vincent Davis managed to contest a judgment that had grown due to high post-judgment interest rates, leading to its dismissal. Similarly, Maria Perez defended herself against a wage deduction for a debt she didn’t even recall. These stories highlight how important legal representation can be in navigating these complex situations.

If you’re facing significant financial challenges, consider reaching out to a financial advisor or an advocacy organization. They can provide vital resources and support. Consumer advocates stress that understanding your rights is key to managing garnishment effectively. As April Kuehnhoff from the National Consumer Law Center points out, "For someone making only small payments, it’s easy to find yourself in a situation where the debt isn’t decreasing because of high interest rates." This is especially true since post-judgment interest rates can vary widely between states, with some reaching as high as 12%. By staying informed and proactive, you can lessen the negative impact of garnishment, especially regarding how can retirement benefits be garnished. Remember, we’re here to help you through this.

Conclusion

Understanding the complexities of whether retirement benefits can be garnished is crucial for retirees who depend on a fixed income. The thought of having a portion of these benefits withheld due to debts can lead to significant financial uncertainty and stress. With various laws governing garnishment, including federal protections for certain benefits, it’s essential for individuals to be aware of their rights and how these actions can impact their financial stability.

This article explores the legal context of garnishment, detailing how different types of retirement benefits, like pensions and Social Security, may be affected. It sheds light on the emotional and financial toll that wage withholding can impose on retirees. We understand that this can be overwhelming, which is why proactive financial planning and legal awareness are so important. By sharing real-life examples and strategies for managing garnishment, we hope to empower individuals to seek help and explore options for relief.

Ultimately, the message is clear: awareness and preparedness are key when facing potential garnishment. Retirees are encouraged to understand their rights, seek legal counsel when necessary, and utilize available resources to safeguard their financial well-being. Taking proactive steps can truly make a difference in managing the impact of garnishment on retirement benefits, ensuring that individuals can maintain their quality of life during their retirement years. Remember, you are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What is garnishment of retirement benefits?

Garnishment of retirement benefits is a legal process where a portion of your retirement income, such as pensions, 401(k)s, or Social Security payments, is withheld to pay off a debt.

Is a court order required for garnishment of retirement benefits?

Yes, typically a court order is required for the garnishment of retirement benefits.

Can Social Security payments be garnished?

Yes, Social Security payments can be garnished, especially in cases like defaulted federal student loans, where up to 15% of monthly payments may be withheld.

How does wage attachment affect retirees?

Wage attachment can significantly impact retirees, as many rely on a steady income. Losing even a small portion of their income can be overwhelming and may hinder their ability to cover essential expenses.

What is the potential impact of reduced Social Security payments for retirees?

There is a potential for a 24% reduction in Social Security support, which can create financial uncertainty for retirees who depend on these payments.

What options do retirees have if their benefits are garnished?

Retirees can explore options for relief, such as proving economic hardship or seeking assistance from consumer advocacy groups.

Why is it important for retirees to have diverse income streams?

Having diverse income streams, such as pensions, can provide a financial cushion if Social Security benefits are reduced, helping retirees manage their expenses more effectively.

How can organizations like Turnout assist retirees facing these issues?

Organizations like Turnout offer guidance and support for individuals navigating the complexities of garnishment and can help retirees access government assistance.