Overview

You can still file your 2023 taxes if you meet the income thresholds and understand how your disability benefits affect your taxable earnings. We understand that navigating this process can feel overwhelming. This article outlines essential steps to help you assess your eligibility with confidence.

- First, it's important to check your earnings against IRS limits.

- Understanding the tax implications of SSDI and SSI is crucial, as these benefits can significantly impact your taxable income.

- Additionally, considering available tax credits can provide further support.

Remember, you are not alone in this journey. We’re here to help guide you through the filing process, ensuring you have the information you need to make informed decisions. Together, we can navigate these challenges.

Introduction

Navigating the complexities of tax filing can feel particularly daunting for disabled individuals. We understand that unique financial circumstances may apply, and this can add to the stress of the process. Understanding eligibility, deadlines, and available resources is crucial for ensuring a smooth filing experience.

What happens if you’re unsure about your filing status or potential benefits? It’s common to feel overwhelmed, but this guide aims to demystify the process. We offer essential steps and insights designed to empower disabled individuals. Together, we can approach your 2023 tax returns with confidence.

Assess Your Eligibility to File 2023 Taxes

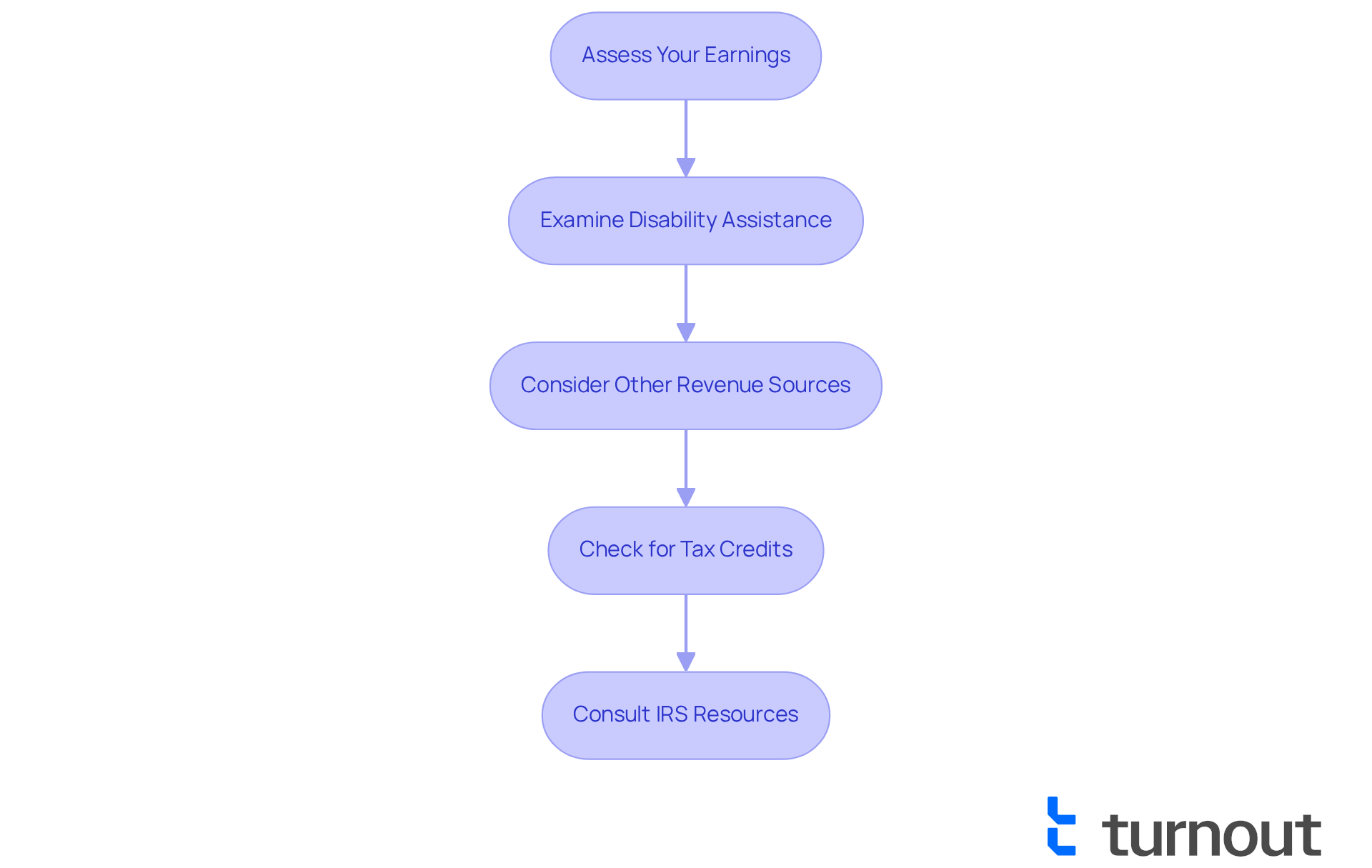

To assess your eligibility to file taxes for 2023, let’s walk through some important steps together:

-

Assess Your Earnings: First, take a moment to verify if your overall earnings surpass the IRS submission limit for your tax status. For 2023, the threshold for single filers under 65 is $14,600, while for married couples filing jointly, it is $25,000. If your earnings fall below these amounts, you may not need to file, which can be a relief.

-

Examine Disability Assistance: If you receive Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), it’s crucial to understand how these resources affect your taxable earnings. SSDI is typically subject to taxation if your overall earnings exceed certain thresholds, whereas SSI is not considered taxable income. According to the IRS, "revenue from SSI, Social Security Disability Insurance (SSDI), or military disability assistance is not regarded as 'earned income.'" Remember, Turnout can assist you in navigating these complexities, ensuring you understand how your benefits impact your tax situation.

-

Consider Other Revenue Sources: Don’t forget to include any additional earnings such as wages, pensions, or investment returns. If your total earnings surpass the threshold, you might be asking, can I still file 2023 taxes, but you’re not alone in this process.

-

Check for Tax Credits: Even if you are not required to file, consider doing so to claim refundable tax credits, such as the Earned Income Tax Credit (EITC) or the Credit for the Elderly or Disabled. The EITC can provide significant financial support, and refunds received do not count as income for federal assistance programs for at least 12 months after receipt. This could make a meaningful difference for you.

-

Consult IRS Resources: Finally, utilize IRS resources like Publication 524 for detailed information on credits available for disabled individuals. This publication outlines eligibility criteria for the Credit for the Elderly or Disabled, which can help reduce your tax burden.

By following these steps, and with the support of Turnout’s expertise—our trained non-legal advocates and IRS-licensed enrolled agents—you can gain a clearer understanding of your tax responsibilities and also find out if you can still file 2023 taxes along with the potential advantages available to you. Remember, you are not alone in this journey, and we’re here to help.

Understand Key Deadlines and Requirements

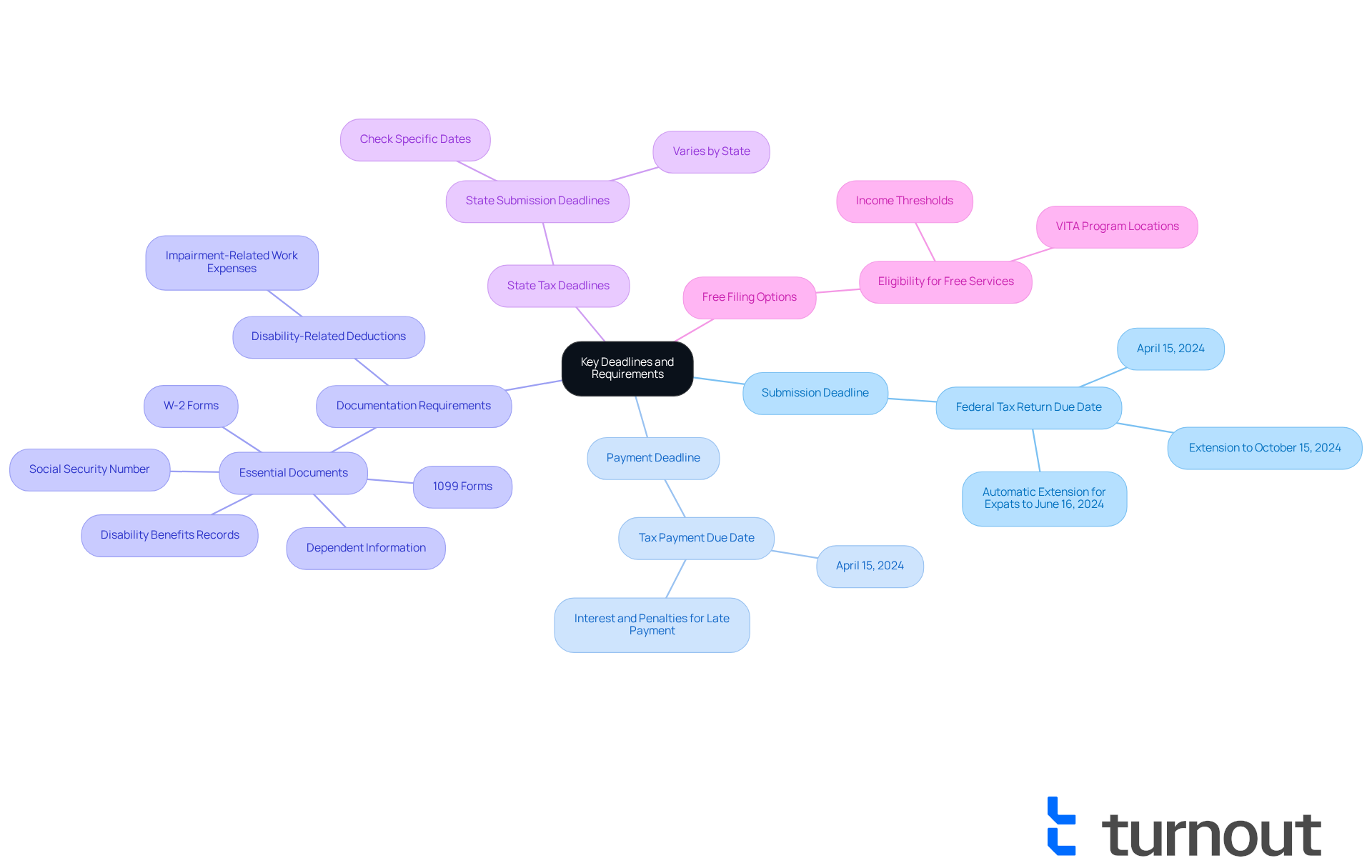

To successfully file your taxes, it’s important to be aware of some key deadlines and requirements that can make this process smoother for you:

-

Submission Deadline: We understand that keeping track of deadlines can be stressful. The due date for submitting your 2023 federal tax return is April 15, 2024; however, can I still file 2023 taxes after this date? If you need a little more time, you can file for an extension to find out if you can still file 2023 taxes, which gives you until October 15, 2024, to submit your return. For those living outside the U.S., an automatic extension is granted until June 16, 2024.

-

Payment Deadline: If you owe taxes, please remember that payment is also due by April 15, 2024. This helps you avoid any interest and penalties. If you reside in federally recognized disaster zones, you may be eligible for tax assistance, including deferred submission and payment deadlines. We know that these situations can be overwhelming, so don’t hesitate to seek help if needed.

-

Documentation Requirements: Gathering essential documents can feel daunting, but it’s crucial. Make sure to have your W-2 forms, 1099 forms for any freelance work, and records of any disability benefits received. Don’t forget your Social Security number and information about any dependents. Tax advisors emphasize that accurate documentation is key for claiming any disability-related deductions or credits. For example, you might qualify for deductions related to impairment-related work expenses.

-

State Tax Deadlines: It’s common to overlook state tax submission deadlines, which may differ from federal deadlines. Many states align with federal timelines, but it’s wise to confirm specific dates to avoid any surprises.

-

Free Filing Options: If your income falls below a certain threshold, you may qualify for free tax preparation services through programs like VITA (Volunteer Income Tax Assistance). We encourage you to visit the IRS website to find nearby VITA locations that can assist you with your returns. Remember, you are not alone in this journey, and help is available.

Follow the Steps to File Your 2023 Taxes

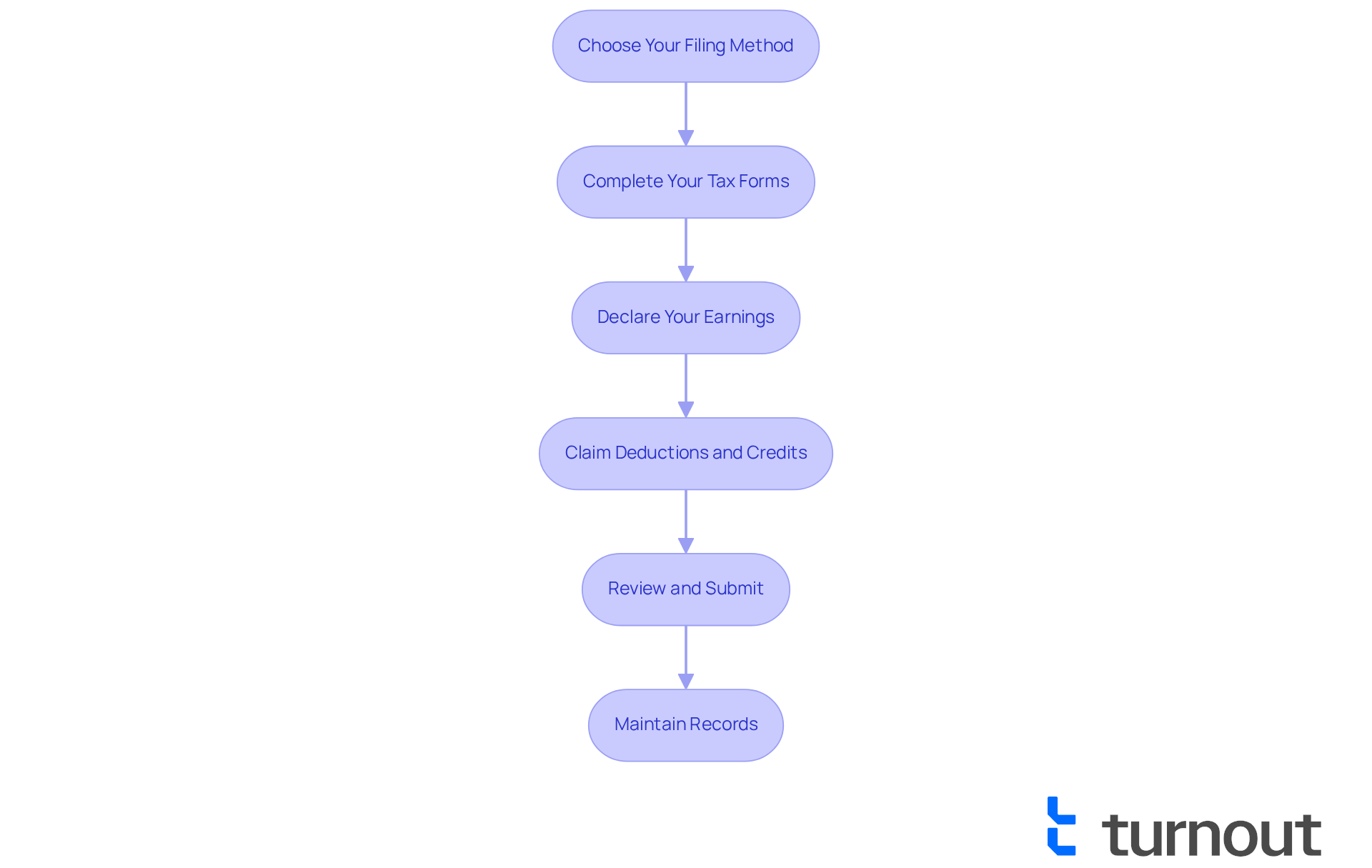

While filing your 2023 taxes can feel overwhelming, you might wonder, can I still file 2023 taxes? We're here to guide you through the process with care and understanding. Follow these steps to make it easier:

-

Choose Your Filing Method: Decide whether to file online using tax software, through a tax professional, or by mailing a paper return. Many find that online submission is the simplest and quickest approach, especially for those who may benefit from accessible interfaces.

-

Complete Your Tax Forms: If you choose to file online, the software will assist you with the necessary forms. For those mailing their returns, use Form 1040 for your federal return. Don’t forget to include any additional schedules if applicable, such as Schedule R for the Credit for the Elderly or Disabled.

-

Declare Your Earnings: It's important to accurately disclose all sources of income, including wages, disability payments, and any other revenue. Remember, if your disability payments come from an employer, they are generally taxable and should be reported on Form 1040. If you receive Social Security disability assistance, these payments are typically not taxed if they are your only source of income.

-

Claim Deductions and Credits: Identify any deductions or credits you might qualify for, such as the Child and Dependent Care Credit or the Credit for the Elderly or Disabled. For tax year 2021, the maximum qualifying expenses for this credit increased significantly, allowing for greater financial relief. Be sure to attach any necessary forms or schedules to your return to receive the benefits you deserve. Remember, the Earned Income Tax Credit (EITC) does not affect certain public benefits for 12 months, which is crucial for those concerned about their benefits during tax time.

-

Review and Submit: Take a moment to double-check all information for accuracy. If you're submitting electronically, follow the prompts to send your return. If mailing, ensure you send it to the correct address and consider using certified mail for tracking. Tax professionals suggest reviewing your return multiple times to avoid errors that could delay processing.

-

Maintain Records: After submitting, keep a copy of your return and all supporting documents for at least three years in case of an audit. This includes any documentation related to your disability benefits and tax credits claimed, as these may be requested by the IRS.

Real-world examples show that many individuals with disabilities successfully navigate the tax submission process with the right tools and support. While it may take a bit longer to finalize your financial returns due to the complexities involved, you might wonder, can I still file 2023 taxes using software designed for accessibility to significantly streamline the process? Additionally, free tax preparation services are available through programs like VITA, offering tailored assistance to meet your needs. As the IRS reminds us, "Don’t miss out on a potential refund by not completing your tax return." You are not alone in this journey; help is available.

Utilize Resources and Tools for Successful Filing

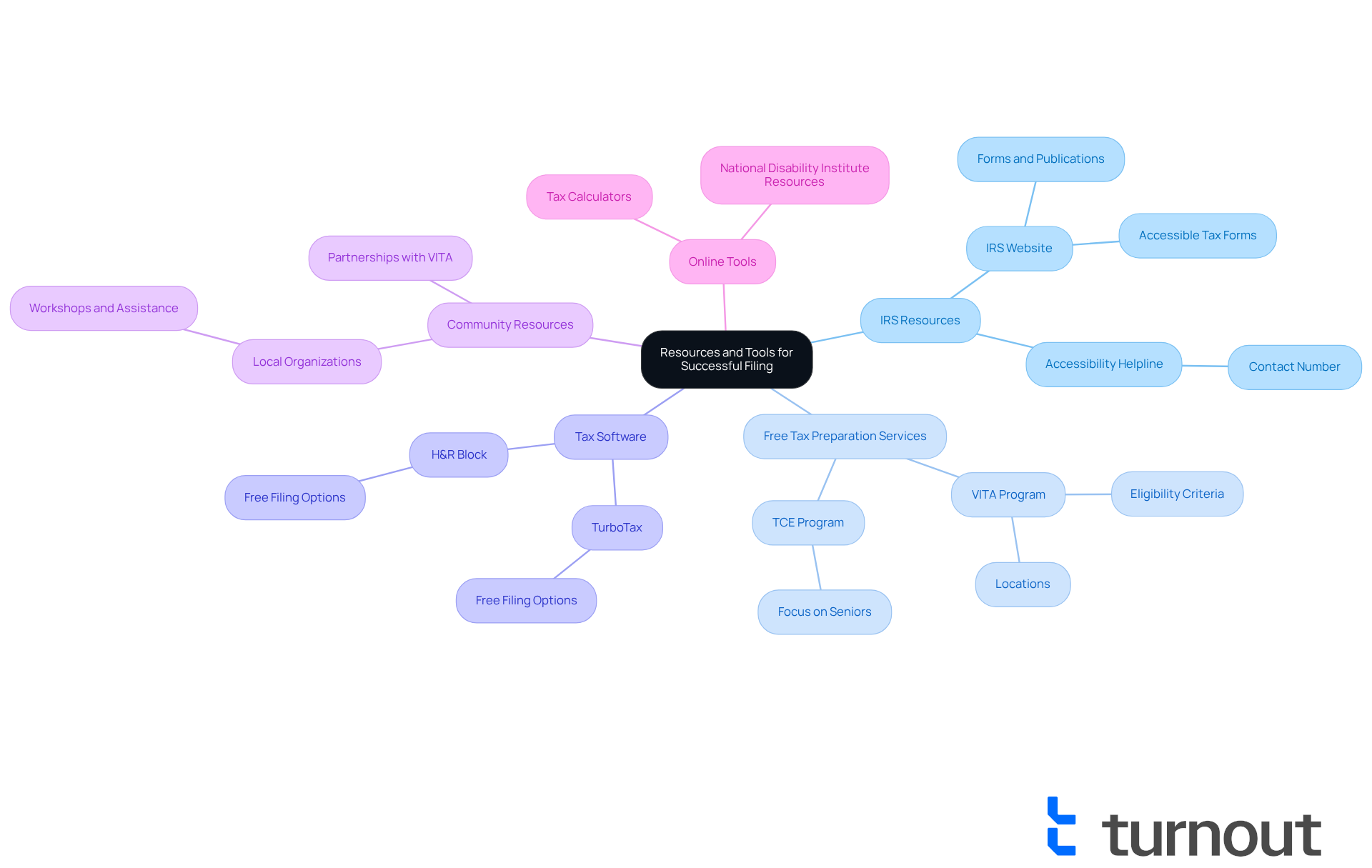

To assist you in filing your taxes, we understand that you might be asking, can I still file 2023 taxes, as this process can feel overwhelming. That's why we want to share some valuable resources and tools that can help you navigate your tax submission with ease:

-

IRS Resources: Visit the IRS website for comprehensive information on tax submission. Here, you'll find forms, publications, and FAQs specifically for individuals with disabilities. If you prefer paper copies of accessible tax forms, you can call 800-TAX-FORM or 800-829-3676 to request them.

-

Free Tax Preparation Services: It's common to seek help, and local VITA sites or the Tax Counseling for the Elderly (TCE) program offer free tax preparation assistance for qualifying individuals. VITA sites provide free tax help to those who generally make $67,000 or less. You can easily find locations through the IRS website.

-

Tax Software: Consider using user-friendly tax software like TurboTax or H&R Block. These tools often provide guidance tailored for individuals with disabilities. While H&R Block is no longer part of the IRS Free File Program, many still offer free submission options for straightforward returns.

-

Community Resources: Check with local organizations that support individuals with disabilities. They may offer workshops or assistance with tax preparation. Organizations serving persons with disabilities are encouraged to partner with VITA to provide free tax preparation services on-site during tax season.

-

Online Tools: You can also use online calculators to estimate your tax refund or liability. Websites such as the National Disability Institute offer tools and resources specifically designed for individuals with disabilities to manage tax submissions effectively.

By leveraging these resources, you can simplify your tax filing experience and determine if you can still file 2023 taxes. Remember, you are not alone in this journey, and we’re here to help ensure you receive the support you need.

Conclusion

Navigating the complexities of tax filing can feel daunting, especially for disabled individuals. However, it's important to know that help is available. This article sheds light on the critical aspects of:

- Assessing eligibility

- Understanding the implications of disability benefits

- Being aware of the key deadlines and requirements for filing taxes in 2023

By following these steps, you can confidently manage your tax responsibilities and explore potential credits and deductions.

We recognize that assessing earnings against IRS thresholds can be challenging. The role of disability assistance in determining tax obligations is significant, and there are resources available, such as:

- Free tax preparation services

- User-friendly software

to support you. Remember, accurate documentation and awareness of both federal and state submission deadlines are vital to avoid penalties and maximize potential refunds.

Ultimately, filing taxes should not be a source of anxiety. By utilizing the resources and support available, you can take control of your financial situation, ensuring you meet your tax obligations while uncovering potential benefits. It's crucial to act, seek assistance, and make informed decisions regarding tax filing, all of which contribute to your financial well-being and peace of mind. You are not alone in this journey; we're here to help.

Frequently Asked Questions

How can I assess my eligibility to file taxes for 2023?

To assess your eligibility, first verify if your overall earnings exceed the IRS submission limits for your tax status. For 2023, the threshold for single filers under 65 is $14,600, and for married couples filing jointly, it is $25,000. If your earnings are below these amounts, you may not need to file.

How does receiving disability assistance affect my taxable earnings?

If you receive Social Security Disability Insurance (SSDI), it may be taxable if your overall earnings exceed certain thresholds. However, Supplemental Security Income (SSI) is not considered taxable income. SSDI and SSI are not regarded as "earned income" by the IRS.

What additional sources of income should I consider when assessing my tax filing?

You should include all additional earnings such as wages, pensions, or investment returns when assessing your total earnings for tax filing eligibility.

Should I file my taxes even if I'm not required to?

Yes, even if you are not required to file, you may want to do so to claim refundable tax credits like the Earned Income Tax Credit (EITC) or the Credit for the Elderly or Disabled, which can provide significant financial support.

What resources can I use to understand tax credits available for disabled individuals?

You can consult IRS resources such as Publication 524, which provides detailed information on credits available for disabled individuals and outlines eligibility criteria for the Credit for the Elderly or Disabled.

How can Turnout assist me with my tax filing questions?

Turnout offers support through trained non-legal advocates and IRS-licensed enrolled agents who can help you navigate your tax responsibilities and understand the potential advantages available to you.