Overview

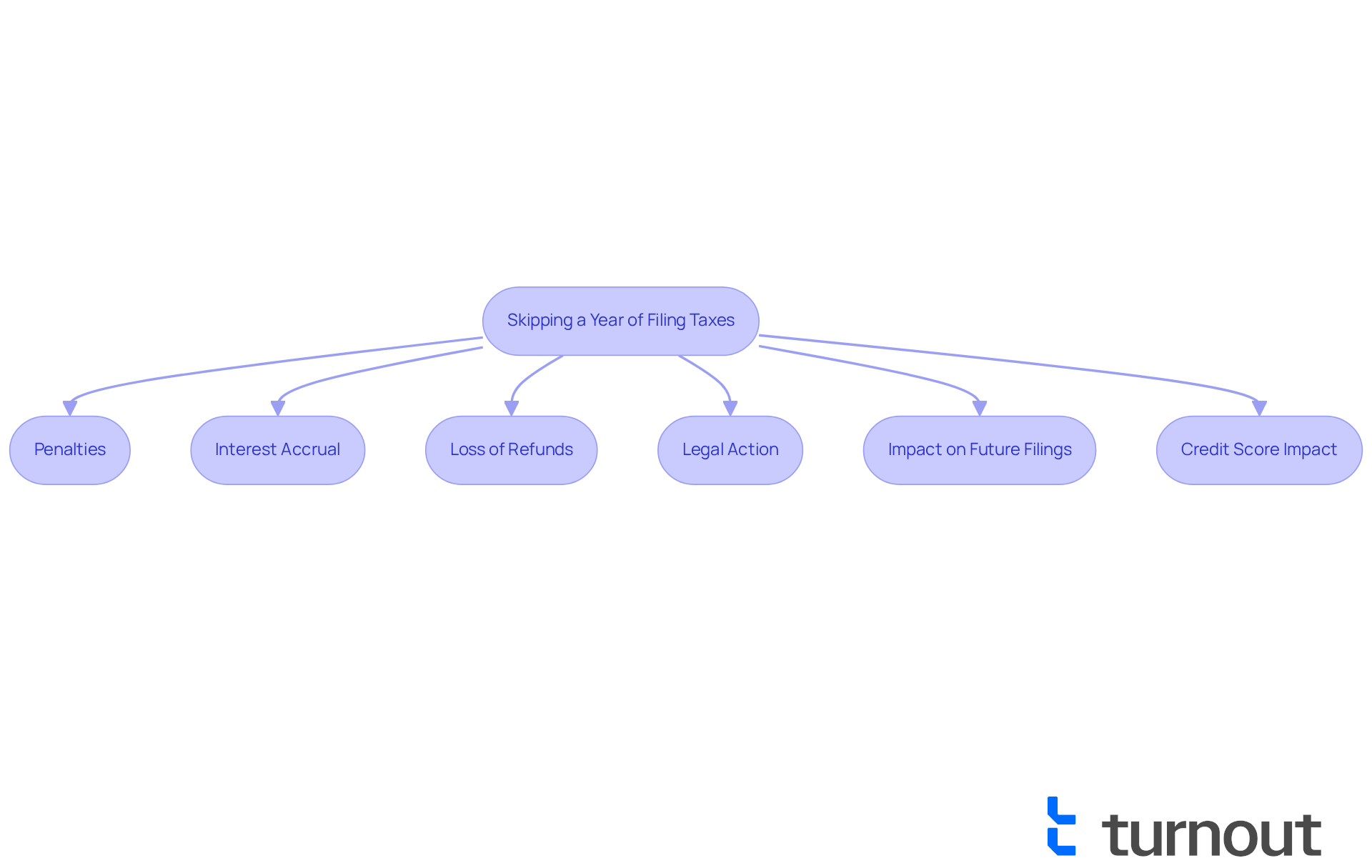

We understand that facing tax obligations can be overwhelming. Skipping a year of filing taxes isn’t just a minor oversight; it can lead to significant consequences. You might encounter penalties, interest accrual, and even the loss of potential refunds. In some cases, there could be legal repercussions as well.

It’s common to feel anxious about what happens if you fail to file. The reality is that not filing can result in a cumulative failure-to-file fee and ongoing interest on any unpaid taxes. This can complicate your future filings, making the process even more daunting. That’s why it’s so important to adhere to your tax obligations.

Remember, you’re not alone in this journey. Many people face similar challenges, and there are solutions available to help you navigate these issues. If you find yourself in this situation, we’re here to help. Taking action now can prevent these serious problems down the line.

Introduction

Navigating the complexities of tax obligations can feel overwhelming. We understand that many people worry about the repercussions of skipping a year of filing taxes. It’s a common concern, and recognizing the potential consequences is essential for maintaining financial stability and managing future tax situations.

What really happens when individuals choose to forgo their tax responsibilities? It’s important to explore the implications of such decisions and to know that there are resources available to help avoid pitfalls. This guide will walk you through the intricacies of tax filing requirements, the effects of skipping a year, and the support systems designed to ensure compliance and peace of mind.

You are not alone in this journey. We’re here to help you understand your options and navigate these challenges with confidence.

Understand Your Tax Filing Obligations

Navigating tax filing obligations can feel overwhelming, and you might ask yourself, 'can I skip a year of filing taxes?', but we're here to help you understand what you need to do. Let’s break it down together:

-

Income Level: If you're a single filer in 2025, you’ll need to file a tax return if your gross income exceeds $14,600. For married couples filing jointly, the threshold is $29,200. Knowing these numbers is crucial for understanding your filing requirements.

-

Tax Status: Your tax status—whether you’re single, married, or head of household—plays a significant role in determining your income threshold. It’s important to know your status to accurately assess your obligations.

-

Special Circumstances: There are situations where you must file, no matter your income level. For example, if you earn self-employment income over $400, receive unemployment benefits, or claim certain tax credits, filing is necessary.

-

State Requirements: Don’t forget to check your state’s tax submission rules. They can vary significantly from federal regulations, and it’s essential to be aware of them.

-

IRS Resources: The IRS website is a fantastic resource for confirming your filing requirements based on your unique situation. It can help clear up any confusion and ensure you stay compliant.

-

Expert Insights: Tom O’Saben, Director of Tax Content at the National Association of Tax Professionals, shares an important point: "The increases in the standard deduction by 2026 will shift more income into the ‘zero bracket’ — meaning it will not be taxed because the deduction covers more." Staying informed about these changes can make a big difference in your tax situation.

-

Statistics: Did you know that in the 2025 submission season, the average refund for American taxpayers was $3,453? This shows the potential benefits of filing, even if you’re not required to. Understanding these figures can motivate you to file and possibly receive a refund.

We understand that tax season can be stressful, but remember, you’re not alone in this journey. If you have questions or need assistance, don’t hesitate to reach out for help.

Evaluate the Consequences of Skipping a Year

We understand that the question of 'can I skip a year of filing taxes' can feel overwhelming, as it can lead to several serious consequences. Here’s what you need to know:

-

Penalties: The IRS imposes a failure-to-file fee of 5% of the outstanding dues for each month your return is delayed, capped at 25%. This penalty can add up quickly, increasing your overall tax liability. However, there are options for relief, like the First Time Penalty Abate or Administrative Waiver, which can help ease these burdens for those asking, can I skip a year of filing taxes?

-

Interest Accrual: Alongside penalties, interest on unpaid dues compounds over time, further increasing your debt. The late-payment fee is 0.5% of the unpaid amount for each month the dues remain unsettled, also capped at 25% of the outstanding invoice.

-

Loss of Refunds: If you’re due a refund for the year you skipped, can I skip a year of filing taxes and still have the chance to claim it if I don’t file within three years? This means any potential financial relief could slip away.

-

Legal Action: In extreme cases, failing to file can lead to serious legal repercussions, including potential criminal charges for tax evasion. While the government has a six-year limit to charge individuals with criminal tax evasion, it raises the question: can I skip a year of filing taxes, since it can collect owed taxes and impose penalties indefinitely?

-

Impact on Future Filings: Not submitting can complicate your future tax situation and raise the question, can I skip a year of filing taxes? The IRS may file a substitute declaration on your behalf, which might not include deductions or credits you’re eligible for, potentially leading to a larger tax bill.

-

Credit Score Impact: Unresolved tax issues can negatively affect your credit score, making it harder to secure loans or mortgages. Taxpayers often face significant fines that can accumulate quickly, underscoring the importance of timely tax filing.

-

Context of Tax Protestors: Some individuals skip filing due to misconceptions about tax obligations, often linked to the tax protestor movement. This can lead to severe financial and legal consequences, highlighting the need to understand your tax responsibilities.

We’re here to help you navigate these challenges. Remember, you’re not alone in this journey, and seeking assistance can make a world of difference.

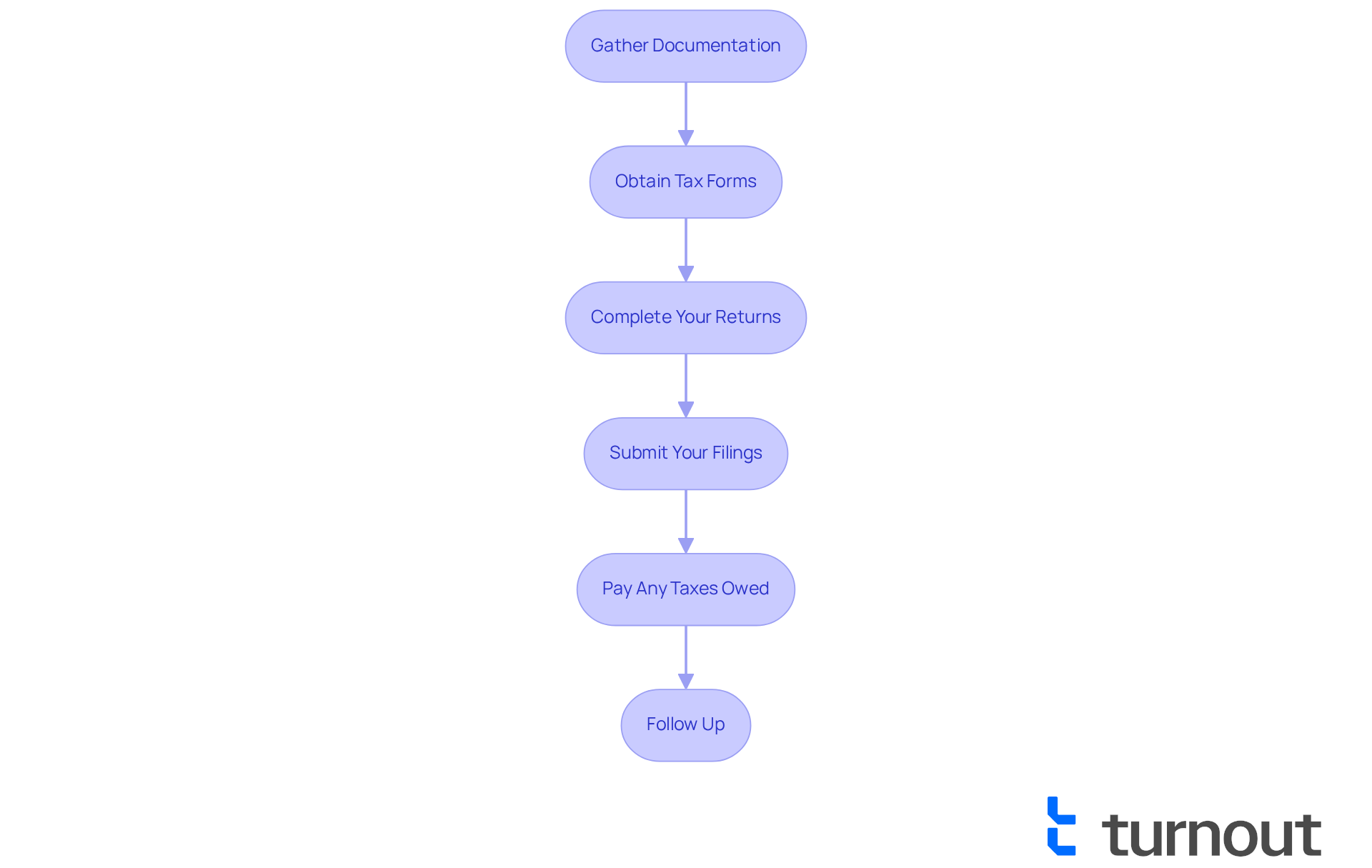

File Past Due Tax Returns Effectively

Filing past due tax returns can feel overwhelming, and you may be asking yourself, can I skip a year of filing taxes, but you’re not alone in this journey. Let’s walk through the steps together, ensuring you feel supported every step of the way.

-

Gather Documentation: Start by collecting all necessary documents, like W-2s, 1099s, and any other income statements for the years you missed. If you can’t find your original records, don’t worry! You can request transcripts from the IRS or get copies from your employers and financial institutions.

-

Obtain Tax Forms: Head over to the IRS website to download the right tax forms for the years you need to file. It’s important to use the correct forms for each tax year since requirements can change.

-

Complete Your Returns: Take your time filling out the forms accurately. Report all income and claim any deductions or credits you qualify for. Being thorough helps avoid errors that could complicate things later. Remember, the IRS usually requires you to submit the last six years of tax documents to stay compliant, and if you're considering whether 'can I skip a year of filing taxes,' be aware that not filing within three years might lead to losing the chance to claim refunds or credits.

-

Submit Your Filings: Once you’ve completed your returns, it’s time to file them. You can do this electronically if you’re eligible, or you can mail them to the appropriate IRS address. Sending them via certified mail is a smart move; it gives you proof of submission, which can be crucial if any issues come up.

-

Pay Any Taxes Owed: If you owe taxes, try to pay as much as you can. This helps reduce penalties and interest, which can keep piling up until your balance is settled. The IRS offers secure online payment methods, like IRS Direct Pay and the Electronic Federal Tax Payment System (EFTPS), to make managing your tax liabilities easier.

-

Follow Up: After you’ve submitted everything, keep an eye on your IRS account for updates. It’s common to feel anxious during this time, but you can use tools like the 'Where's My Refund?' tool to track the status of your submissions and refunds.

By following these steps, you can navigate the process of submitting overdue tax documents with greater confidence and clarity. Remember, we’re here to help you through this!

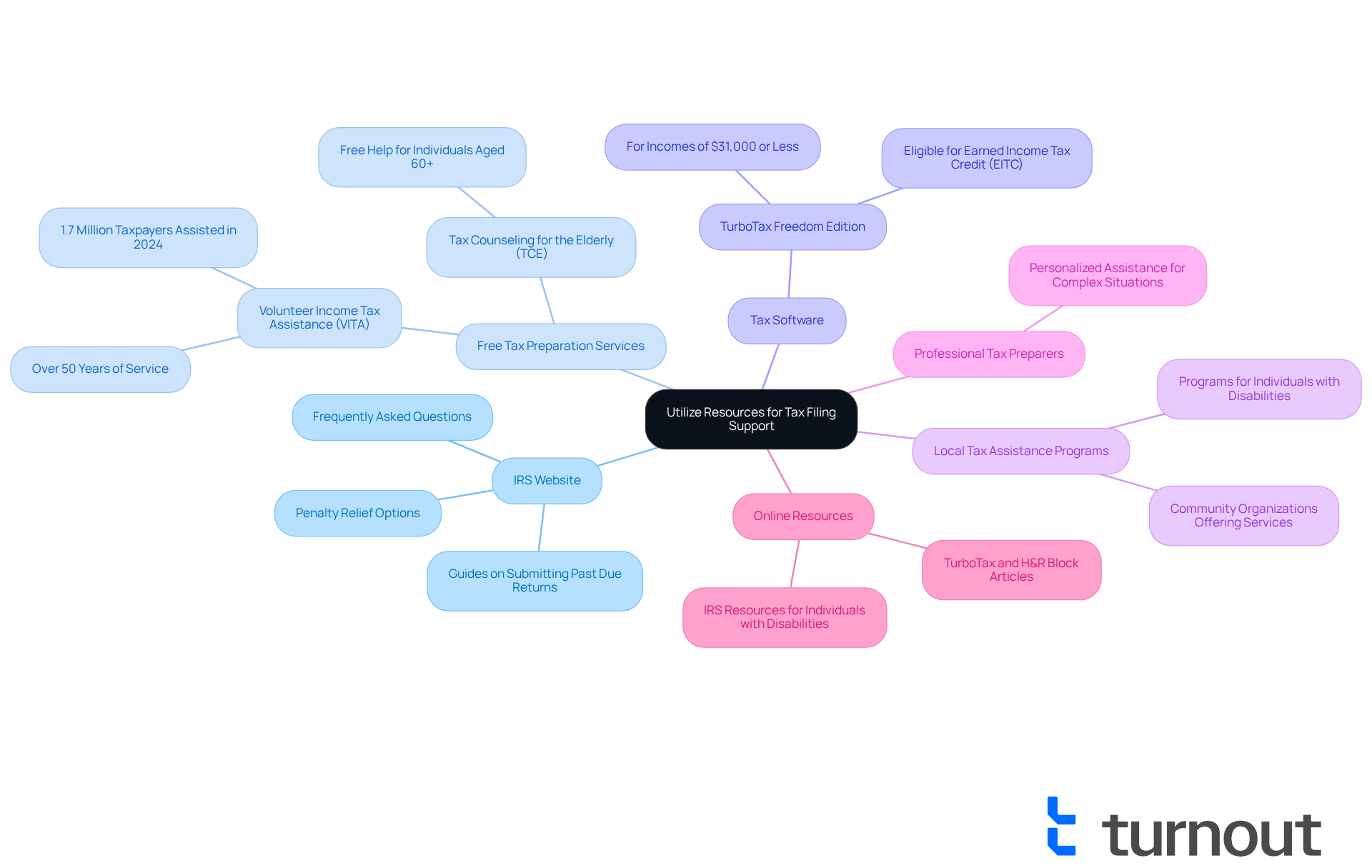

Utilize Resources for Tax Filing Support

Finding the right support for your tax filing needs can feel overwhelming, but you’re not alone in this journey. Here are some resources that can help you navigate the process with confidence:

-

IRS Website: The IRS provides a wealth of information, including guides on submitting past due returns, penalty relief options, and answers to frequently asked questions. It’s a great starting point to understand your obligations and options.

-

Free Tax Preparation Services: Programs like Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) offer free tax help for those who qualify. VITA has been around for over 50 years, showcasing its reliability and significant impact. In 2024 alone, nearly 28,000 volunteers assisted almost 1.7 million taxpayers. That’s a testament to the support available to you!

-

Tax Software: Consider using tax preparation software to guide you through the submission process. Tools like TurboTax Freedom Edition are available for individuals with incomes of $31,000 or less or those eligible for the Earned Income Tax Credit (EITC). These resources can help ensure you don’t miss any deductions or credits.

-

Local Tax Assistance Programs: Many community organizations offer free or low-cost tax preparation services. Check your local listings, community centers, libraries, and schools for programs, especially those aimed at individuals with disabilities. There’s help available right in your neighborhood!

-

Professional Tax Preparers: If your tax situation feels complex, consulting a tax professional can provide personalized assistance. They can help ensure you comply with tax laws while addressing your unique needs.

-

Online Resources: Websites like TurboTax and H&R Block offer valuable articles, tools, and calculators to help you understand your tax situation and filing requirements. The IRS also provides resources specifically designed for individuals with disabilities, enhancing accessibility and support during tax season.

We understand that tax season can be stressful, but remember, there are many resources available to help you. Don’t hesitate to reach out and take advantage of these services. You deserve the support you need!

Conclusion

Understanding the complexities of tax filing obligations is crucial for anyone considering skipping a year of filing taxes. We understand that navigating these responsibilities can feel overwhelming. It’s important to be aware of income thresholds, tax status, and special circumstances that require filing, regardless of income levels. By grasping these foundational concepts, you can make informed decisions and avoid unnecessary complications.

The consequences of failing to file taxes can be serious. You might face accumulating penalties, interest on unpaid dues, and even the potential loss of refunds. It’s common to feel anxious about the risk of legal repercussions and how it might negatively impact your future filings and credit scores. This is why compliance is so important. Remember, there are resources available to support you, such as the IRS website, free tax preparation services, and professional tax assistance.

Ultimately, the significance of timely tax filing cannot be overstated. By prioritizing compliance and utilizing available resources, you can safeguard your financial health and avoid the pitfalls associated with skipping a year of filing taxes. Taking proactive steps today can lead to a more secure financial future, ensuring that potential refunds and credits are not left on the table.

You are not alone in this journey. We’re here to help you navigate these challenges and ensure you feel confident in your tax responsibilities.

Frequently Asked Questions

What are the income thresholds for filing taxes in 2025?

For single filers in 2025, you need to file a tax return if your gross income exceeds $14,600. For married couples filing jointly, the threshold is $29,200.

How does my tax status affect my filing obligations?

Your tax status—whether you’re single, married, or head of household—determines your income threshold for filing taxes, making it essential to know your status to assess your obligations accurately.

Are there circumstances where I must file taxes regardless of my income level?

Yes, you must file taxes if you earn self-employment income over $400, receive unemployment benefits, or claim certain tax credits, regardless of your income level.

Do I need to consider state tax requirements as well?

Yes, it’s important to check your state’s tax submission rules, as they can vary significantly from federal regulations.

Where can I find more information about my tax filing requirements?

The IRS website is a great resource for confirming your filing requirements based on your unique situation and can help clear up any confusion.

What insight does Tom O’Saben provide regarding tax changes?

Tom O’Saben mentions that increases in the standard deduction by 2026 will shift more income into the 'zero bracket', meaning it will not be taxed because the deduction covers more income.

What was the average tax refund for American taxpayers in 2025?

The average refund for American taxpayers in the 2025 submission season was $3,453, highlighting the potential benefits of filing taxes even if you’re not required to.