Introduction

Navigating the complexities of tax filing can feel overwhelming, especially for individuals with disabilities. You might be wondering: can I file my 2023 taxes now? It’s completely understandable to have questions about eligibility criteria, potential benefits, and the necessary documentation. These elements are crucial for ensuring a smooth filing process.

Many individuals in similar situations seek clarity on their tax obligations. The challenge often lies in deciphering the intricate rules and available resources that could significantly ease your burden. What steps can you take to not only meet filing requirements but also maximize your potential refunds and credits?

We’re here to help you through this journey. You are not alone in this. Together, we can explore the options available to you, ensuring that you feel supported every step of the way.

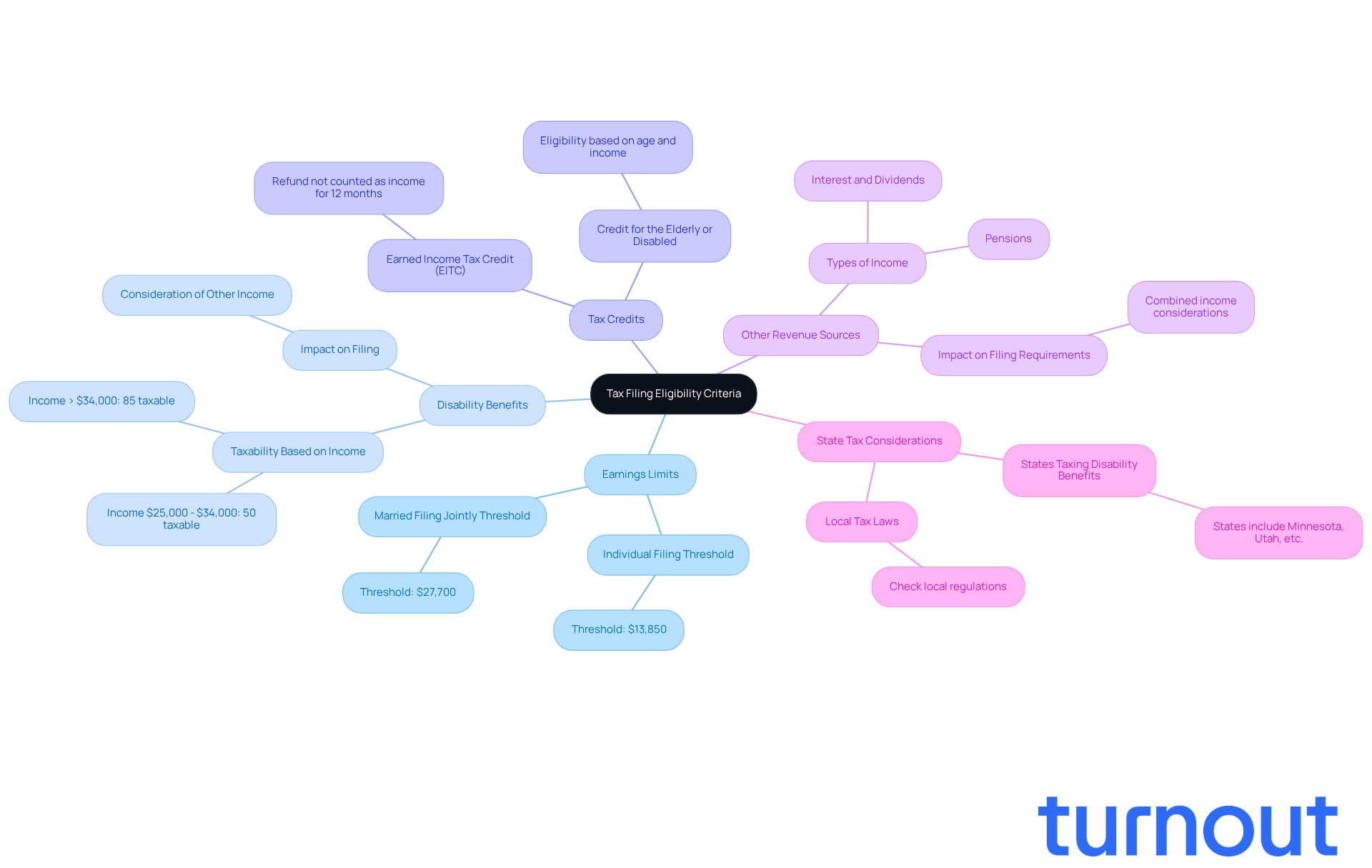

Understand Your Tax Filing Eligibility Criteria

To determine your tax filing requirements, let’s take a moment to consider a few important criteria that might resonate with your situation:

-

Earnings Limits: We understand that navigating finances can be challenging. For 2023, if you’re filing as an individual, you’ll need to submit your taxes if your earnings exceed $13,850. For married couples filing jointly, the threshold is $27,700. If your total earnings fall below these amounts, you might not need to file, leading to the question, can I file 2023 taxes now?

-

Disability Benefits: It’s common to feel uncertain about how disability benefits affect your taxes. Generally, Social Security Disability Insurance benefits are taxable if your total earnings surpass certain limits. For instance, if you’re an individual filer and your earnings are between $25,000 and $34,000, you may need to include up to 50% of your disability benefits in your taxable income. If your earnings exceed $34,000, that figure can rise to 85%. Understanding how your disability benefits interact with other income sources is crucial for your financial peace of mind, particularly when asking, 'can I file 2023 taxes now?'

-

Tax Credits: You might be eligible for credits like the Earned Income Tax Credit (EITC) or the Credit for the Elderly or Disabled, which can significantly influence your decision to file. For example, if you are wondering can I file 2023 taxes now, the EITC refund isn’t considered earnings for federal assistance programs for at least 12 months after you receive it. This can be particularly beneficial for those who are wondering, 'can I file 2023 taxes now' while receiving disability benefits. Take Jesse, a 58-year-old retiree on permanent and total disability, who calculated a credit of $46 using Schedule R. This illustrates how these credits can positively impact your tax obligations.

-

Other Revenue Sources: It’s important to include all types of income, such as pensions, interest, or dividends, as these can affect your filing requirement. If you receive disability benefits and have additional income, you may wonder, can I file 2023 taxes now to avoid underpayment penalties? We know this can feel overwhelming, but can I file 2023 taxes now to help manage that feeling, as you’re not alone in this.

-

State Tax Considerations: Be mindful that some states impose taxes on disability benefits, which can affect your overall tax liability. Checking your local tax laws can help you understand your obligations better.

We encourage you to consult a tax professional who can provide personalized guidance tailored to your unique situation. Remember, you’re not alone in this journey, and understanding your obligations and potential benefits can make a significant difference.

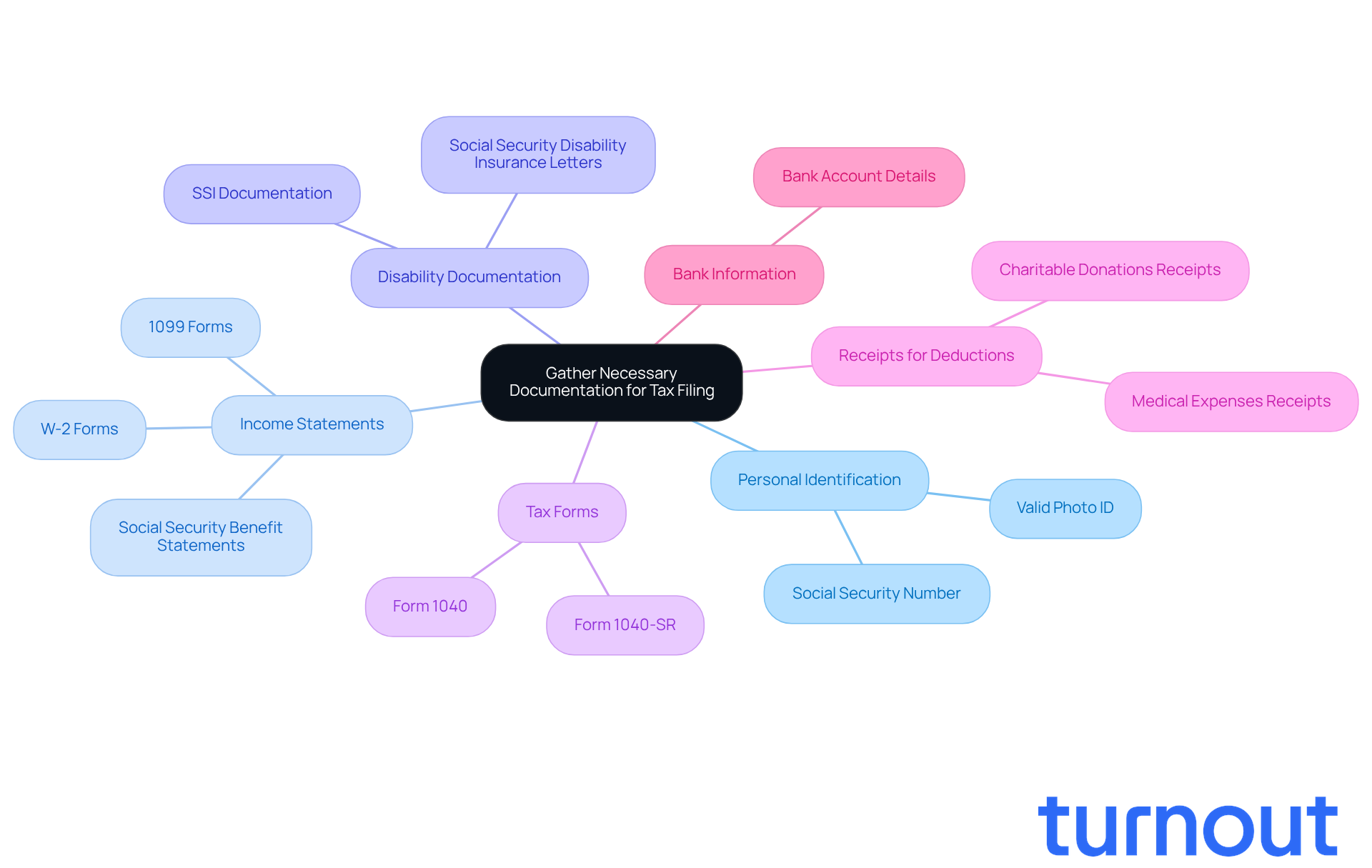

Gather Necessary Documentation for Tax Filing

To ensure a smooth tax filing process, we understand that gathering the right documents can feel overwhelming. Here’s a helpful checklist to guide you:

- Personal Identification: Have your Social Security number and a valid photo ID ready.

- Income Statements: Collect W-2 forms from employers, 1099 forms for any freelance work, and Social Security benefit statements.

- Disability Documentation: Include any letters or forms related to your disability benefits, such as Social Security Disability Insurance or SSI documentation.

- Tax Forms: Obtain the necessary tax forms, like Form 1040 or 1040-SR for seniors.

- Receipts for Deductions: Gather receipts for medical expenses, charitable donations, or other deductions you plan to claim.

- Bank Information: Have your bank account details ready for direct deposit of any refunds.

Organizing these documents in advance can really streamline your tax filing and answer the question, can I file 2023 taxes now, reducing stress and helping you maximize potential refunds and credits. If you’re receiving SSDI, it’s especially important to keep track of any additional forms, like the SSA-1099, which details your Social Security benefits for the year. By preparing these documents ahead of time, you can navigate the tax process with greater confidence and clarity.

Additionally, consider utilizing the Volunteer Income Tax Assistance (VITA) program. This program offers free tax preparation assistance specifically for individuals with disabilities, ensuring you have the support you need.

It’s important to note that Turnout is not a law firm and does not provide legal advice. Instead, we utilize trained nonlawyer advocates and work with IRS-licensed enrolled agents to help you navigate these processes. We’re here to ensure you receive the support you need during tax season, especially if you’re dealing with SSD claims or tax debt relief. Remember, you are not alone in this journey.

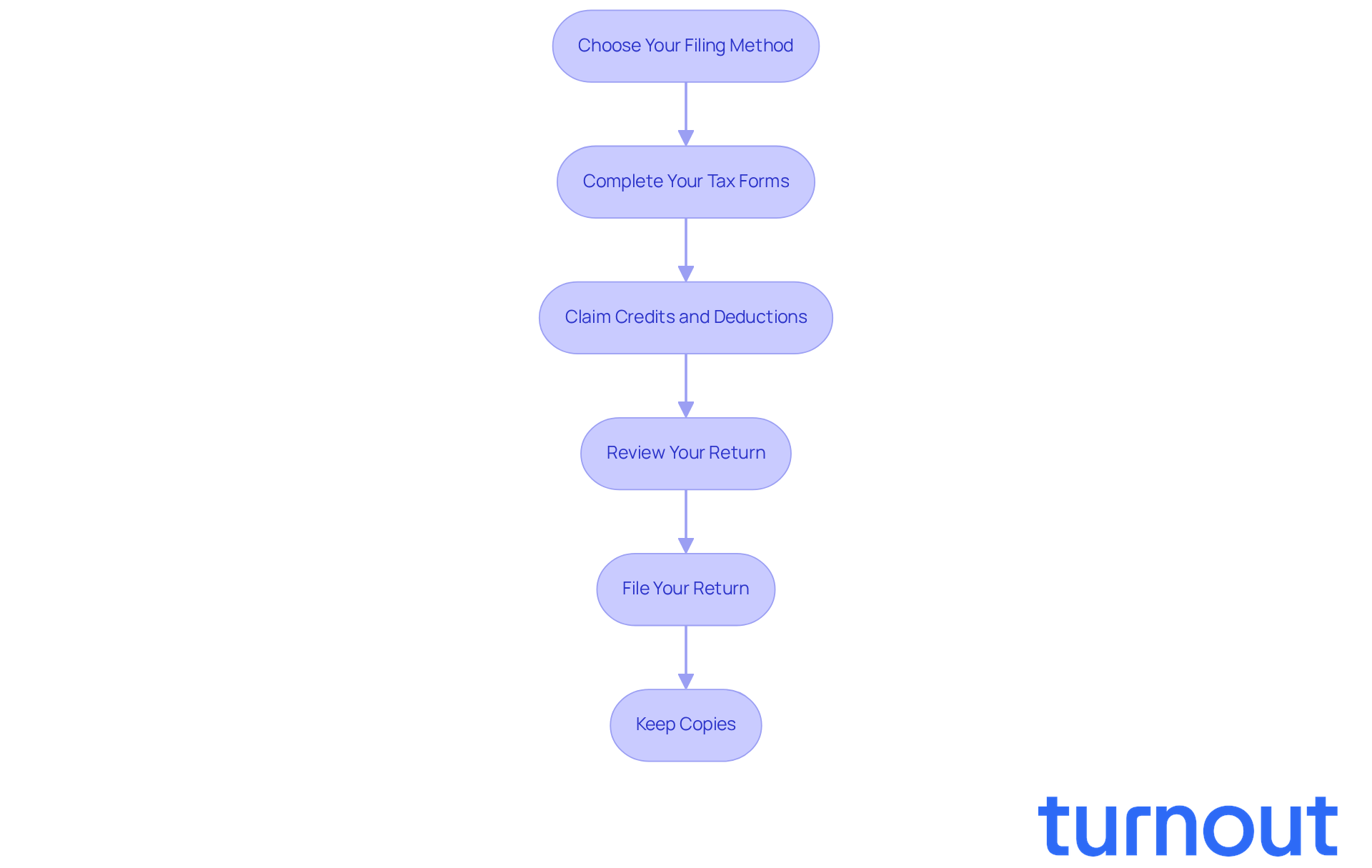

Follow the Step-by-Step Process to File Your Taxes

Filing your taxes can feel overwhelming, but if you're wondering, can I file 2023 taxes now? We're here to help you through it. Follow these steps to make the process smoother:

-

Choose Your Filing Method: Think about how you want to file. You can do it online with tax software, work with a tax professional, or mail a paper return. Many individuals with disabilities find that online filing is the most accessible and efficient option.

-

Complete Your Tax Forms: Take your time filling out the necessary forms. It’s important to report all your income and deductions accurately. If you receive Social Security Disability Insurance, check the IRS instructions for guidance, as specific forms may apply to your situation.

-

Claim Credits and Deductions: Don’t forget to claim any credits you qualify for, like the Earned Income Tax Credit (EITC) or the Credit for the Elderly or Disabled. For example, if you receive SSDI and have qualifying children, you might be eligible for the EITC. IRS publications can provide detailed information on these credits.

-

Review Your Return: Before you submit, double-check all your entries for accuracy. Make sure your Social Security number and bank details are correct. Errors can delay your refund, which usually arrives within 21 days for electronic submissions.

-

File Your Return: You can submit your tax return electronically or mail it to the right IRS address. If you choose to mail it, consider using certified mail for tracking purposes to ensure your return is received.

-

Keep Copies: It’s essential to keep copies of your filed return and all supporting documents. This will be helpful for any future inquiries or audits.

By following these steps, you may wonder, can I file 2023 taxes now while navigating the tax submission process with confidence? Remember, you’re not alone in this journey, and taking these steps can help you meet deadlines and maximize your potential refunds.

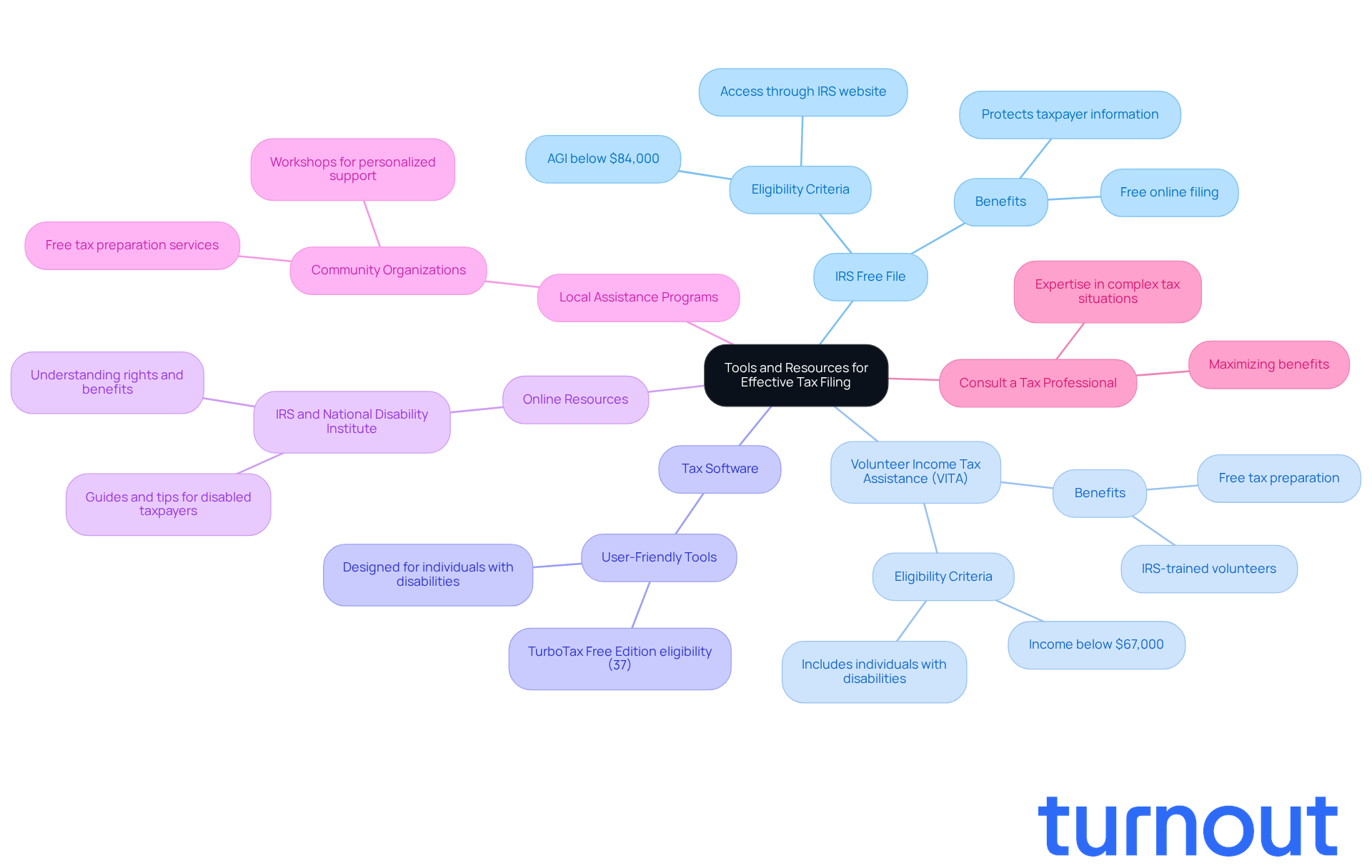

Utilize Tools and Resources for Effective Tax Filing

For individuals with disabilities, navigating tax filing can feel overwhelming, leading them to ask, can I file 2023 taxes now? But don’t worry; there are essential tools and resources available to help you through this process.

-

IRS Free File: If your adjusted gross income is below $84,000, you can take advantage of the IRS Free File program. This allows you to file your federal taxes online at no cost. Designed to assist low-income individuals, including those with disabilities, this program makes the tax submission process much easier. Just remember, you need to access Free File through the IRS website to qualify for these free services.

-

Volunteer Income Tax Assistance (VITA): VITA sites offer free tax assistance for individuals earning $67,000 or less, including those with disabilities. Staffed by IRS-trained volunteers, these sites can help you prepare and e-file your federal and state tax returns, ensuring you receive all eligible credits and deductions.

-

Tax Software: Consider using tax preparation software specifically designed for individuals with disabilities. Many of these programs feature user-friendly tools that simplify the submission process, making it easier to manage your tax obligations. Did you know that about 37% of filers qualify for TurboTax Free Edition? It’s a fantastic option for accessible tax preparation.

-

Online Resources: Websites like the IRS and the National Disability Institute provide valuable guides and tips tailored for disabled taxpayers. These resources can help you understand your rights and the benefits available to you.

-

Local Assistance Programs: Don’t forget to explore local community organizations, such as libraries and community centers. They often offer free tax preparation services or workshops, specifically catering to individuals with disabilities, ensuring you receive personalized support.

-

Consult a Tax Professional: If your tax situation feels complex, it might be wise to consult a tax professional experienced in working with disabled individuals. Their expertise can help you navigate intricate tax issues and maximize your benefits.

By leveraging these resources, you can enhance your tax filing experience and determine if you can file 2023 taxes now, making the process both efficient and effective. Remember, you’re not alone in this journey; we’re here to help!

Conclusion

Understanding the complexities of tax filing can feel overwhelming, especially for disabled individuals. But navigating this process effectively is crucial. This article has highlighted essential steps and considerations that can empower you to confidently determine your tax filing obligations for 2023.

We recognize that understanding earnings limits is vital. It’s also important to know how disability benefits can affect your taxable income and the potential eligibility for valuable tax credits. Gathering the right documentation is key, and utilizing resources like the IRS Free File program and Volunteer Income Tax Assistance (VITA) can simplify your filing experience. By following the step-by-step process outlined, you can ensure that you meet your tax obligations while maximizing potential refunds and credits.

In conclusion, taking proactive steps to understand your tax responsibilities is essential. Remember, you’re not alone in this journey. By leveraging the insights and tools discussed, you can navigate the tax filing process with greater ease and confidence. Engaging with a tax professional or utilizing community resources can further enhance your experience, ensuring you receive the support you need during tax season. Taking action now can lead to a smoother filing process and potentially beneficial financial outcomes.

Frequently Asked Questions

What are the earnings limits for tax filing in 2023?

For 2023, individuals need to file taxes if their earnings exceed $13,850. For married couples filing jointly, the threshold is $27,700.

How do disability benefits affect tax filing?

Social Security Disability Insurance benefits are taxable if total earnings surpass certain limits. If an individual’s earnings are between $25,000 and $34,000, up to 50% of their disability benefits may be taxable. If earnings exceed $34,000, that figure can rise to 85%.

What tax credits might influence the decision to file taxes?

Eligible credits such as the Earned Income Tax Credit (EITC) or the Credit for the Elderly or Disabled can significantly impact the decision to file. The EITC refund is not considered earnings for federal assistance programs for at least 12 months after receipt.

What types of income should be included when determining tax filing requirements?

All types of income, including pensions, interest, and dividends, should be included as they can affect your filing requirement.

Are there state tax considerations for disability benefits?

Yes, some states impose taxes on disability benefits, which can affect overall tax liability. It is important to check local tax laws to understand your obligations.

Should I consult a professional for tax advice?

Yes, it is encouraged to consult a tax professional for personalized guidance tailored to your unique situation.