Introduction

Navigating the complexities of Social Security benefits can feel overwhelming. We understand that many Americans depend on these programs for financial support, and it’s essential to grasp the differences between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

You might be wondering: can you collect both Social Security and disability benefits at the same time? This question is crucial for those seeking assistance. In this article, we’ll explore the eligibility criteria, potential offsets, and application strategies that can help you maximize your benefits.

Our goal is to support you in securing the financial stability you need. Remember, you’re not alone in this journey, and we’re here to help.

Understand the Difference Between Social Security and Disability Benefits

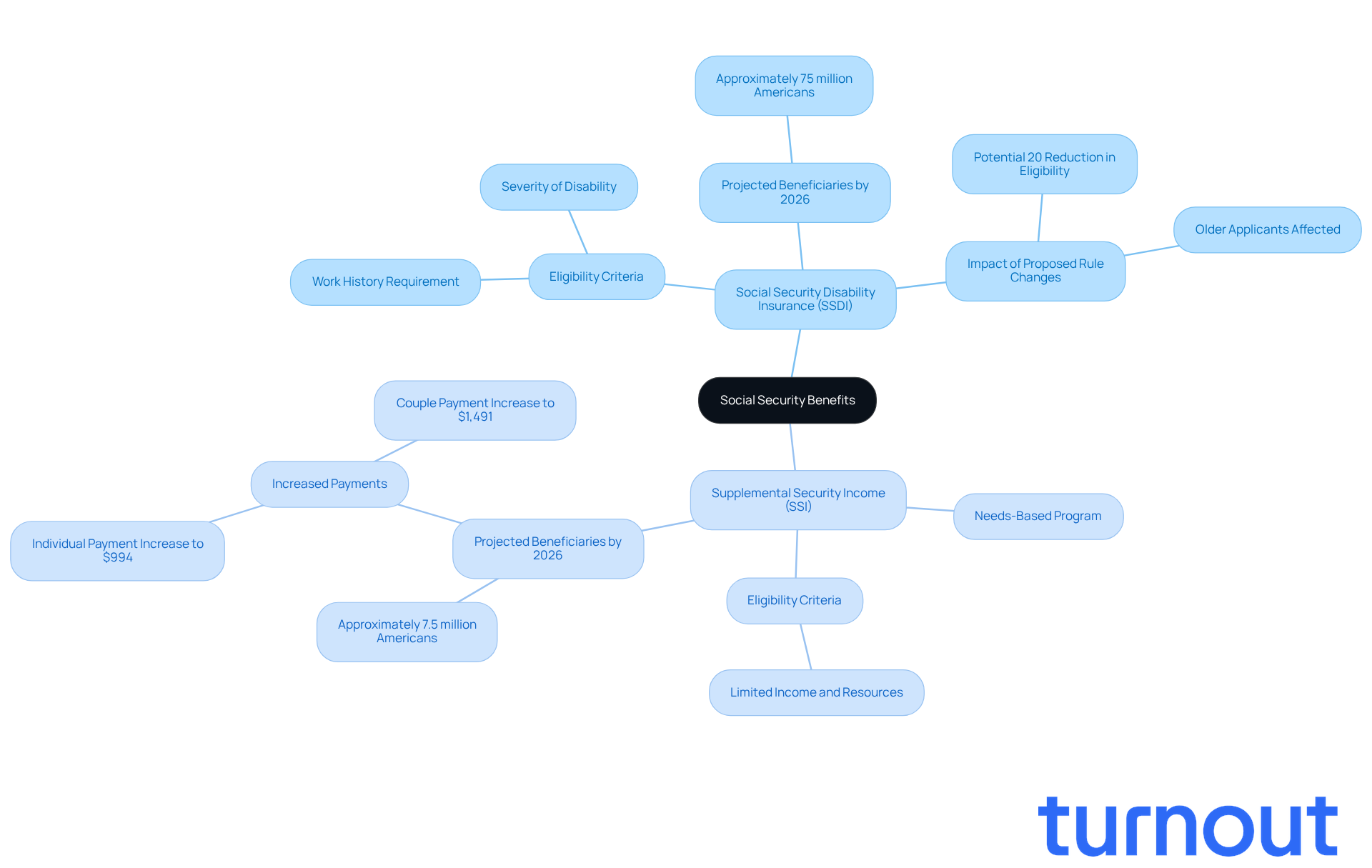

Social Security benefits come in two main forms: Social Security Disability Insurance and Supplemental Security Income (SSI).

We understand that navigating these options can be overwhelming. Social Security Disability Insurance is for those who have contributed to Social Security through their work history but now find themselves unable to work due to a qualifying disability. Eligibility hinges on the severity of the disability and the applicant's work history. By 2026, around 75 million Americans will benefit from this insurance, underscoring its vital role in providing financial support to those who have contributed to the system.

On the flip side, SSI is a needs-based program that offers financial assistance to individuals with limited income and resources, regardless of their work history. As we look ahead to 2026, approximately 7.5 million Americans will receive SSI support, aimed at helping those who may not have enough work experience to qualify for disability insurance.

Understanding these differences is crucial. They directly affect eligibility and the application process. Disability benefits are calculated based on your earnings record, while SSI benefits depend on your financial situation. Recent changes to eligibility criteria for both programs could complicate things further; for instance, Social Security Disability Insurance eligibility might see a decrease of up to 20% overall, particularly affecting older applicants who may face additional challenges due to age.

Consider this: a person with a strong employment background who becomes disabled may qualify for Social Security Disability Insurance. In contrast, someone with limited work experience but significant financial need might be eligible for Supplemental Security Income. By grasping these nuances and seeking guidance from Turnout's expert advocates, you can navigate the benefits system more effectively, enhancing your chances of securing the support you need. Remember, you are not alone in this journey.

Evaluate Your Eligibility for Collecting Both Benefits

Navigating the world of Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) can feel overwhelming. We understand that you may have questions about your eligibility, and we're here to help you through this process.

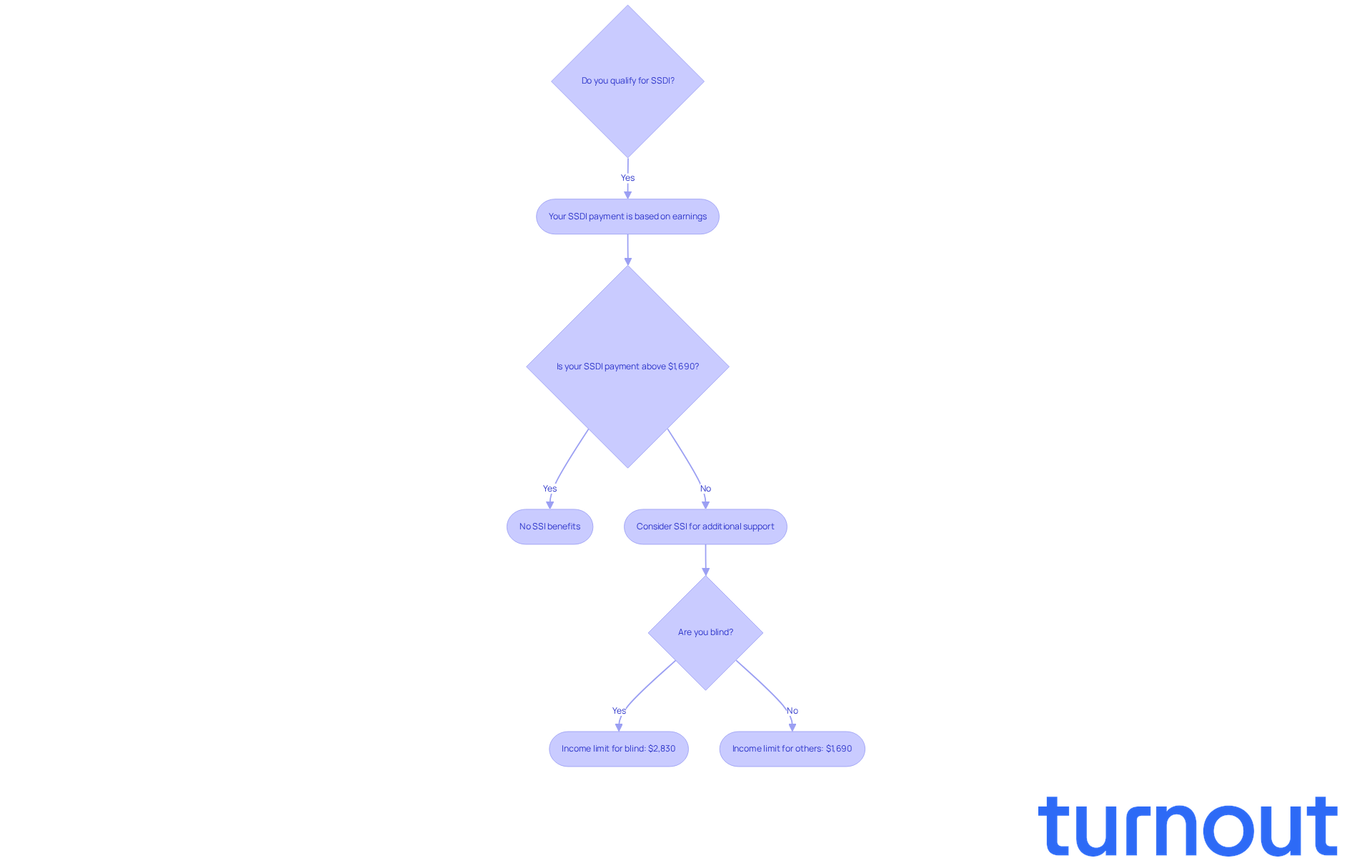

SSDI Eligibility: To qualify for SSDI, you need to have worked in jobs covered by Social Security and have a qualifying disability that prevents you from engaging in substantial gainful activity (SGA). Typically, this means you should have earned 40 work credits, with at least 20 of those earned in the last 10 years. For 2026, the SGA threshold for non-blind applicants will be $1,690 per month, while for blind applicants, it will rise to $2,830 per month.

SSI Eligibility: SSI is designed for individuals with limited income and resources. You must be aged 65 or older, blind, or disabled to qualify. In 2026, the income limit for SSI is set at $994 per month for individuals, reflecting a 2.8% increase from the previous year. Additionally, the maximum monthly SSI allowance for a couple is $1,491, and for an essential person, it is $498.

If you find yourself eligible for both SSDI and SSI, you may be asking, can I collect social security and disability at the same time to enjoy the simultaneous advantages? This can be especially beneficial if your SSDI payments are low enough to still qualify for SSI. For example, if your SSDI payment falls below the SSI income threshold, you may wonder, can I collect social security and disability at the same time, as this can significantly enhance your financial assistance. Disability advocates emphasize that understanding whether can I collect social security and disability at the same time can greatly improve your overall financial stability.

At Turnout, we’re dedicated to assisting you in navigating these complex processes. Our trained nonlawyer advocates are here to help you gather the necessary documentation and understand your eligibility for these benefits. Please remember, Turnout is not a law firm and does not provide legal advice. To evaluate your eligibility, start by gathering your work history, medical documentation, and financial information. This preparation will empower you to understand which benefits you may qualify for and how to proceed with your applications. You are not alone in this journey.

Assess How Benefits Interact and Potential Offsets

When considering both SSDI and SSI, it’s essential to understand how these benefits interact, especially regarding the question, can I collect social security and disability at the same time? We know that navigating these systems can be overwhelming, but you’re not alone in this journey.

SSDI Benefits: If you qualify for SSDI, your monthly benefit amount is based on your earnings record. In 2026, the average disability payment is expected to rise to around $1,630, reflecting a 2.8% cost-of-living adjustment (COLA). If your disability benefits are low, you may still qualify for SSI to help boost your income.

SSI Offsets: It’s important to note that if you receive disability benefits, the amount you get from SSI may be reduced. For example, in 2026, the income limit for most disability beneficiaries is $1,690 per month. However, for blind disability beneficiaries, this limit is higher at $2,830 per month. If your disability payment exceeds these amounts, your SSI benefits could be reduced or even terminated.

If you meet the criteria for both SSDI and SSI, you may wonder, can I collect social security and disability at the same time, as the total amount you receive will depend on your disability payment and the SSI income thresholds. It’s crucial to calculate how much you will receive from each program to understand your total financial support. For instance, if your SSDI payment is $1,800, you wouldn’t receive SSI, as it exceeds the limit.

To evaluate how these benefits will interact in your specific case, consider reaching out to Turnout's trained advocates. They can provide personalized guidance tailored to your situation. Turnout is dedicated to streamlining access to government assistance and financial support, ensuring you understand these offsets to optimize your benefits effectively. Remember, we’re here to help you every step of the way.

Apply for Social Security and Disability Benefits Effectively

Applying for Social Security and Disability benefits can feel overwhelming, but you’re not alone in this journey. Here are some essential steps to guide you through the process:

-

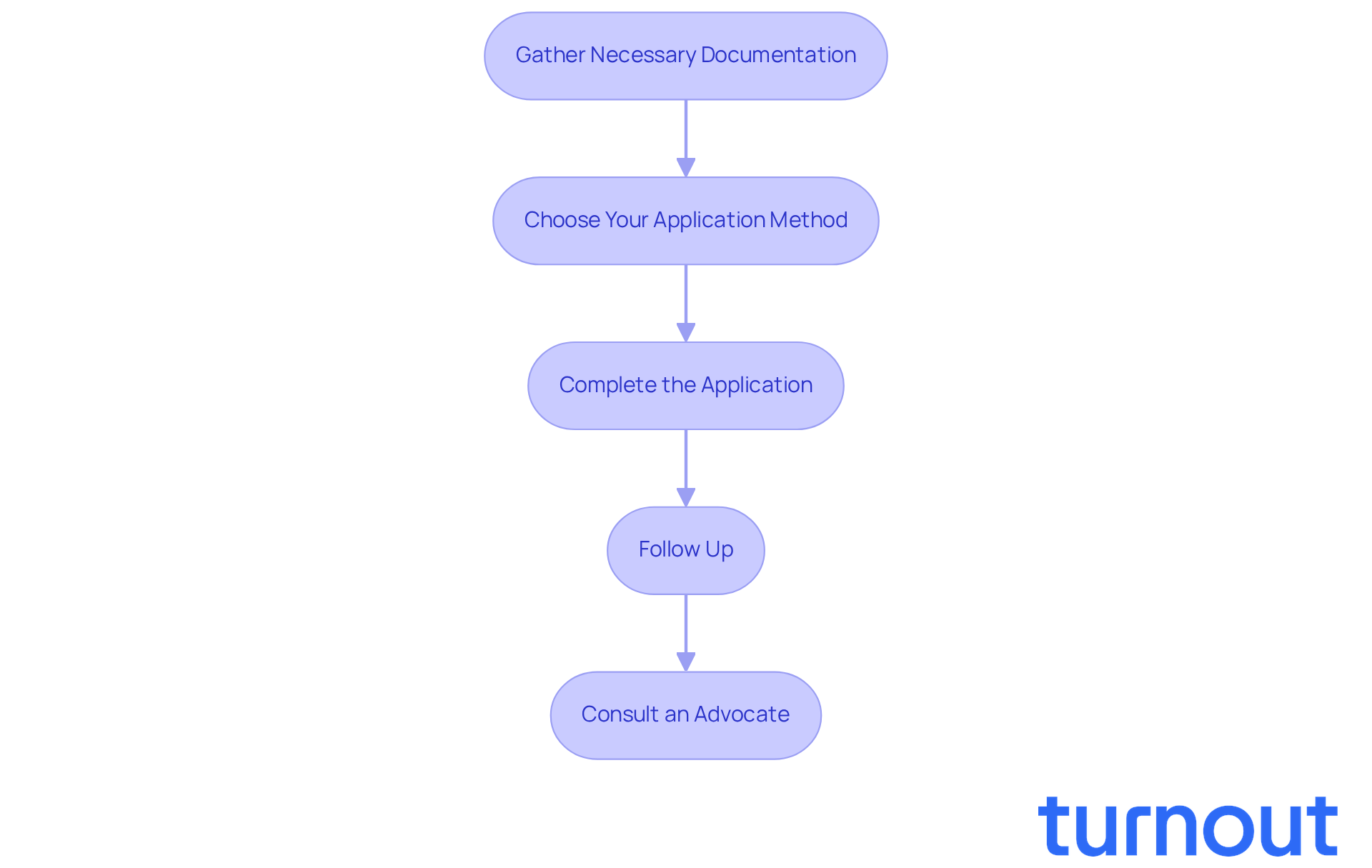

Gather Necessary Documentation: Start by collecting all required papers, such as your Social Security number, birth certificate, medical records, and a detailed employment history. It’s crucial that your medical documentation clearly outlines your disability and how it affects your ability to perform tasks. This clarity is vital for your application.

-

Choose Your Application Method: You have options! You can apply online through the Social Security Administration (SSA) website, by phone, or in person at your local SSA office. Many find that online applications are faster and more convenient, allowing you to complete the process from the comfort of your home.

-

Complete the Application: When filling out the application, take your time to provide accurate and detailed information. Be honest about your medical condition and work history. Remember, discrepancies can lead to delays or even denials, so clarity is key.

-

Follow Up: After you submit your application, it’s important to keep track of its status. You can check online or contact the SSA directly. If they request additional information, respond promptly. The SSA typically allows only 10 to 30 days for responses, so staying on top of this can help avoid unnecessary delays.

-

Consult an Advocate: If you encounter challenges or have questions during the application process, consider reaching out to a disability support advocate. Their expertise can provide personalized assistance and help you navigate any hurdles, significantly improving your chances of a successful application.

By following these steps, you can enhance your likelihood of obtaining the benefits you need. Remember, the average processing time for SSDI applications can take 3 to 5 months for initial decisions, so patience is essential. We’re here to help you every step of the way.

Conclusion

Navigating the complexities of Social Security and Disability benefits can feel overwhelming. We understand that the interplay between Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) significantly impacts financial stability, especially for those who qualify for both. By recognizing the eligibility criteria for each program and how they interact, you can make informed decisions about your benefits.

This article highlights key differences between SSDI and SSI, including their eligibility requirements and how benefits are calculated. It's essential to evaluate your financial situation and work history to determine the best course of action. Additionally, we discussed the potential offsets between these benefits, underscoring the need for careful planning to maximize your support. With the right preparation and guidance, navigating the application process can become much more manageable.

Ultimately, seeking assistance from knowledgeable advocates is crucial. They can provide tailored advice and support throughout your journey. By understanding the benefits available and how to effectively apply for them, you can enhance your chances of securing the financial assistance you need. Embracing this proactive approach not only fosters greater awareness but also ensures that you can access the resources that will help you lead a more stable and fulfilling life. Remember, you are not alone in this journey; we're here to help.

Frequently Asked Questions

What are the two main forms of Social Security benefits?

The two main forms of Social Security benefits are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

Who is eligible for Social Security Disability Insurance (SSDI)?

SSDI is for individuals who have contributed to Social Security through their work history and are now unable to work due to a qualifying disability. Eligibility is based on the severity of the disability and the applicant's work history.

What is Supplemental Security Income (SSI)?

SSI is a needs-based program that provides financial assistance to individuals with limited income and resources, regardless of their work history.

How many Americans are expected to benefit from SSDI and SSI by 2026?

By 2026, approximately 75 million Americans will benefit from SSDI, while around 7.5 million Americans will receive SSI support.

How are benefits calculated for SSDI and SSI?

Disability benefits for SSDI are calculated based on the applicant's earnings record, whereas SSI benefits depend on the individual's financial situation.

What recent changes have affected eligibility for SSDI and SSI?

Recent changes to eligibility criteria could complicate the process; for SSDI, eligibility may decrease by up to 20% overall, particularly impacting older applicants.

Can a person with limited work experience qualify for any Social Security benefits?

Yes, a person with limited work experience but significant financial need might qualify for Supplemental Security Income (SSI).

How can individuals navigate the benefits system effectively?

Understanding the differences between SSDI and SSI and seeking guidance from expert advocates can help individuals navigate the benefits system more effectively.