Introduction

Navigating the complexities of short-term disability insurance can feel overwhelming, especially for expectant parents. We understand that the financial implications of pregnancy-related medical conditions weigh heavily on your mind. This guide aims to illuminate the critical steps you can take when applying for short-term disability during pregnancy, ensuring you know your rights and options.

It's common to wonder: what happens if your application is denied or if the documentation isn't sufficient? Delving into this topic reveals not only the benefits of short-term disability coverage but also the potential pitfalls that could impact your family's financial stability during this pivotal time. Remember, you are not alone in this journey; we're here to help you navigate these challenges.

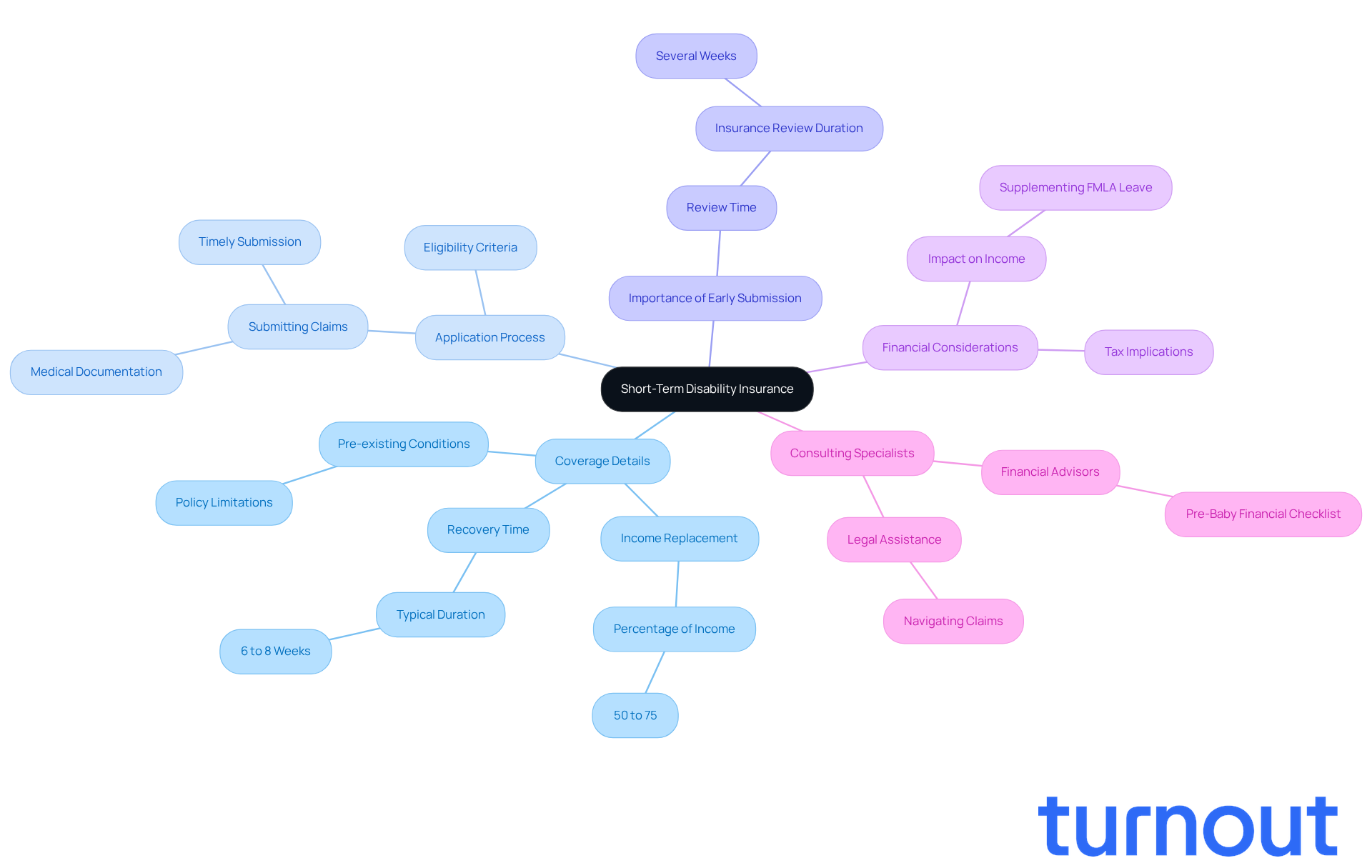

Understand Short-Term Disability Insurance

Short-term disability coverage (STD) serves as a crucial financial safety net for those temporarily unable to work due to medical conditions, and it raises the question: can I apply for short term disability while pregnant? It’s common to feel overwhelmed by the thought of navigating these options, but understanding your coverage can make a significant difference. Typically, STD plans replace a portion of your income-usually between 50% to 75%-for a specified duration, which can range from several weeks to a few months. While many plans recognize pregnancy as a qualifying condition, it's important to understand how I can apply for short term disability while pregnant, as the specifics can vary widely among insurance providers. For instance, most short-term benefits plans cover six to eight weeks of recovery time after delivery, with eight weeks often designated for C-section births.

We understand that reviewing your coverage details can feel daunting, but it’s essential to grasp any limitations, such as waiting periods or exclusions for pre-existing conditions. Did you know that around 22% of short-term benefits requests are linked to pregnancy? This highlights the importance of establishing a policy before conception, as some plans may include stipulations regarding pre-existing conditions. Additionally, short-term income protection insurance can help supplement your earnings during FMLA leave if your employer doesn’t offer paid family leave, providing further financial assistance during maternity leave.

Real-world examples show just how vital it is to submit requests promptly. When considering if I can apply for short-term disability while pregnant, supplying thorough medical documentation, such as due dates and any restrictions, is crucial. Insurance companies typically take several weeks to review claims, so early submission is advisable. It’s also important to consider potential tax consequences based on employer contributions to premiums, making it essential to evaluate your financial situation concerning STD coverage.

Consulting with coverage specialists can offer valuable guidance in navigating these regulations. As one financial advisor wisely notes, "If you’re thinking about starting a family, it’s a really good time to check in with your financial advisor, who can help run through a pre-baby financial checklist." Understanding your rights and the specifics of your coverage will empower you to advocate effectively for the benefits you deserve. Remember, you are not alone in this journey; we’re here to help.

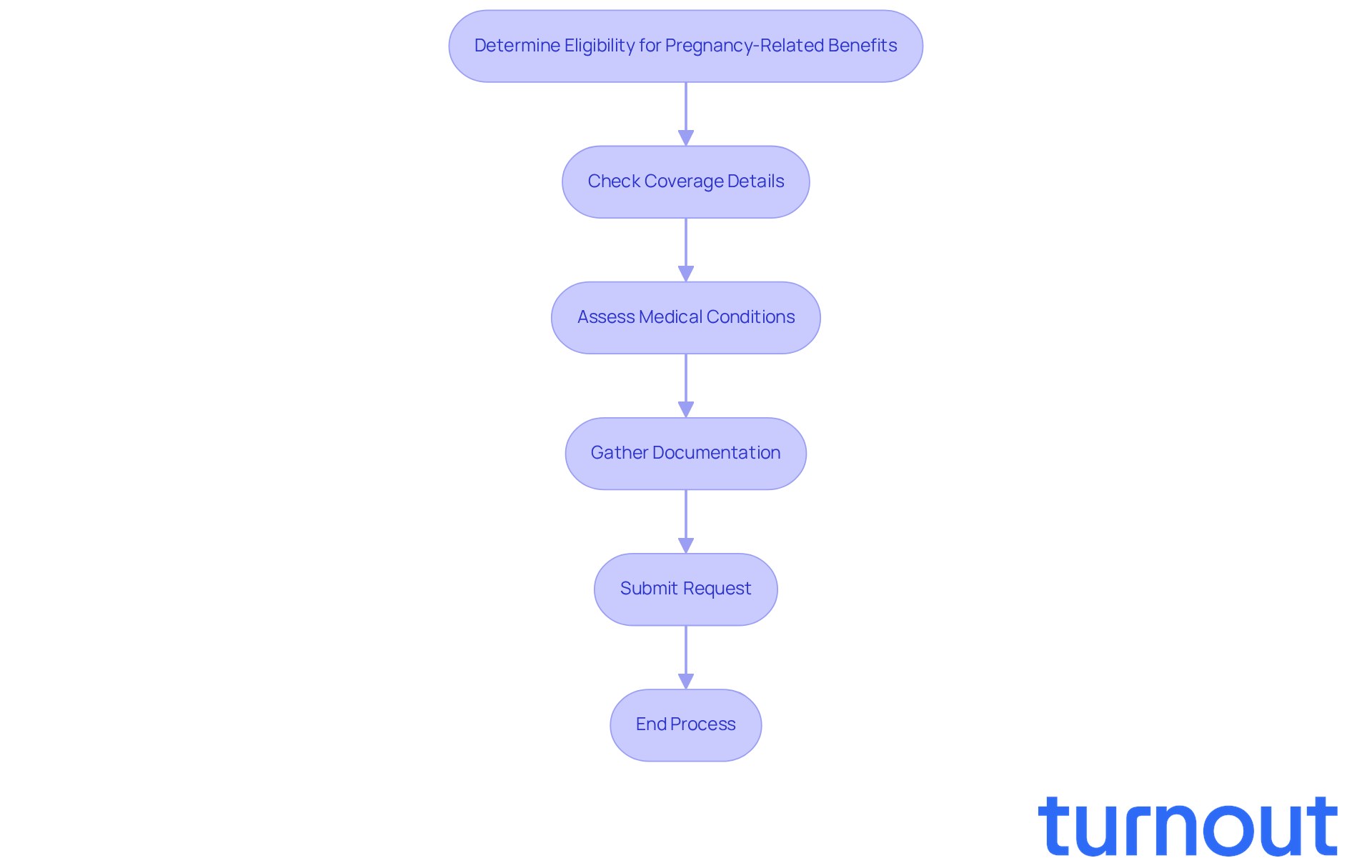

Determine Eligibility for Pregnancy-Related Benefits

If you're wondering can I apply for short term disability while pregnant, it's important to start by looking closely at your coverage details. We understand that navigating this process can feel overwhelming. Most policies allow you to request benefits if you can demonstrate an inability to work due to pregnancy-related conditions, leading to the question: can I apply for short term disability while pregnant, such as in cases of severe morning sickness, complications, or recovery from childbirth?

If you are wondering, 'can I apply for short term disability while pregnant,' typically, you may qualify for benefits starting up to four weeks before your due date and extending up to six weeks after giving birth, or eight weeks for cesarean deliveries. It's crucial to provide medical documentation from your healthcare provider that certifies your inability to work. Collecting all essential documentation, including medical notes and any required forms from your employer or insurance provider, will help streamline the processing.

Recent changes in short-term benefits have highlighted the need for thorough documentation. Insurers often require detailed medical records to validate requests. Remember, successful requests often hinge on clear communication with your insurer and the prompt submission of all necessary paperwork. You're not alone in this journey; we're here to help you every step of the way.

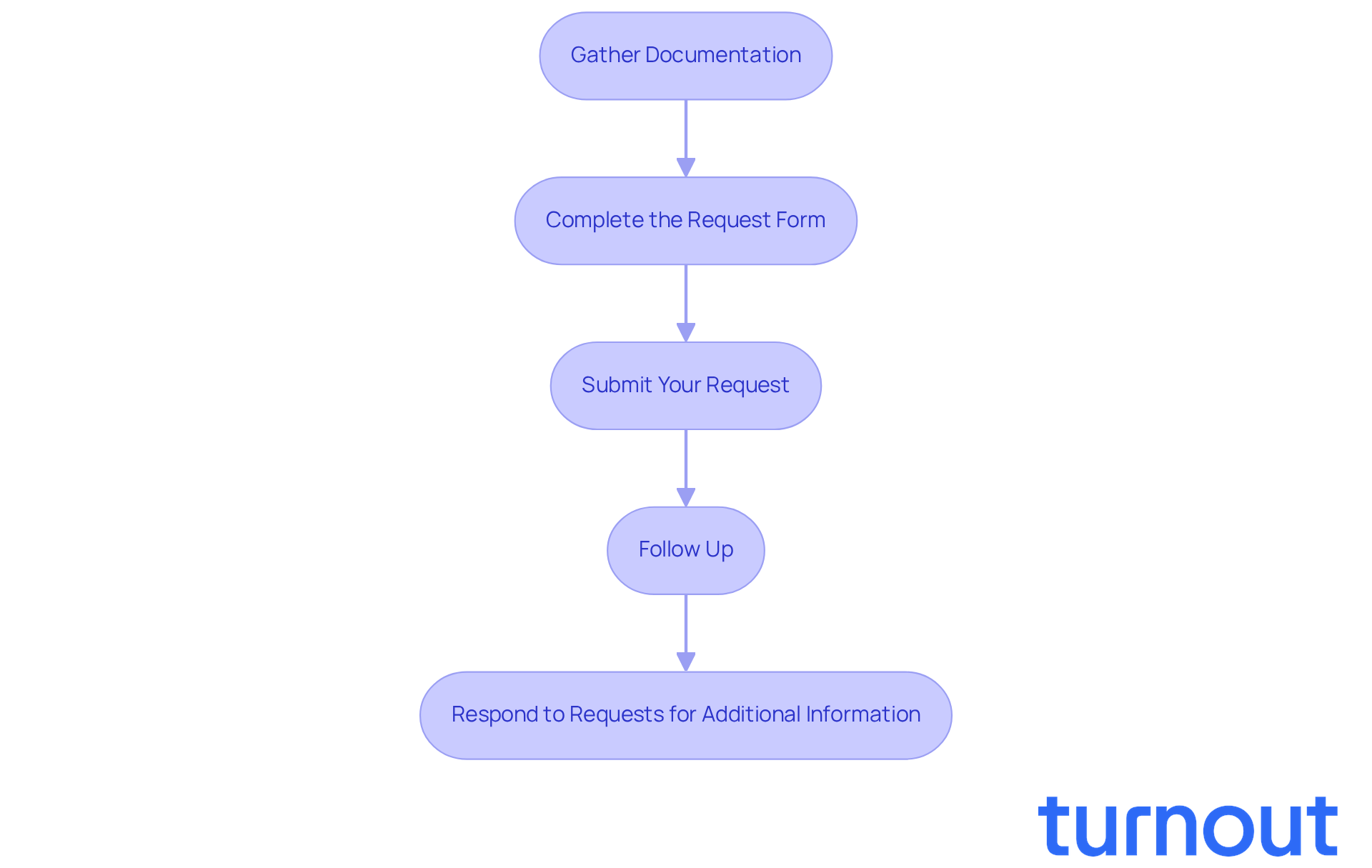

File Your Short-Term Disability Claim

Filing your short-term disability claim can feel overwhelming, but we're here to help you through it. By following these essential steps, you can navigate the process with greater confidence:

-

Gather Documentation: Start by collecting all necessary documents, such as your coverage policy, medical records, and any forms required by your employer or provider. Accurate medical records are crucial; they should clearly indicate your condition and how it affects your ability to work.

-

Complete the Request Form: Take your time filling out the request form. Provide detailed information about your condition and its impact on your work capabilities. Make sure every section is completed to avoid unnecessary delays.

-

Submit Your Request: Once your form is ready, send it along with your supporting documents to your coverage provider. You can often do this online, via fax, or by mail, depending on what your insurer requires. Remember, nearly 40% of American adults struggle to pay an unexpected $400 bill without borrowing money, so timely submissions are vital.

-

Follow Up: After submitting your request, it’s a good idea to follow up with your insurance company. Confirm they received your request and ask about the processing timeline. Keeping detailed records of all communications can help you stay organized and may expedite the process.

-

Respond to Requests for Additional Information: Be ready to provide any extra documentation or information the insurer might ask for. Promptly submitting this information can lead to a faster approval process, as the average approval duration for short-term benefits can vary from a few days to a few weeks after filing.

By following these steps and maintaining open communication, you can manage this process more effectively. Remember, you are not alone in this journey, and taking these actions can significantly enhance your chances of a successful outcome.

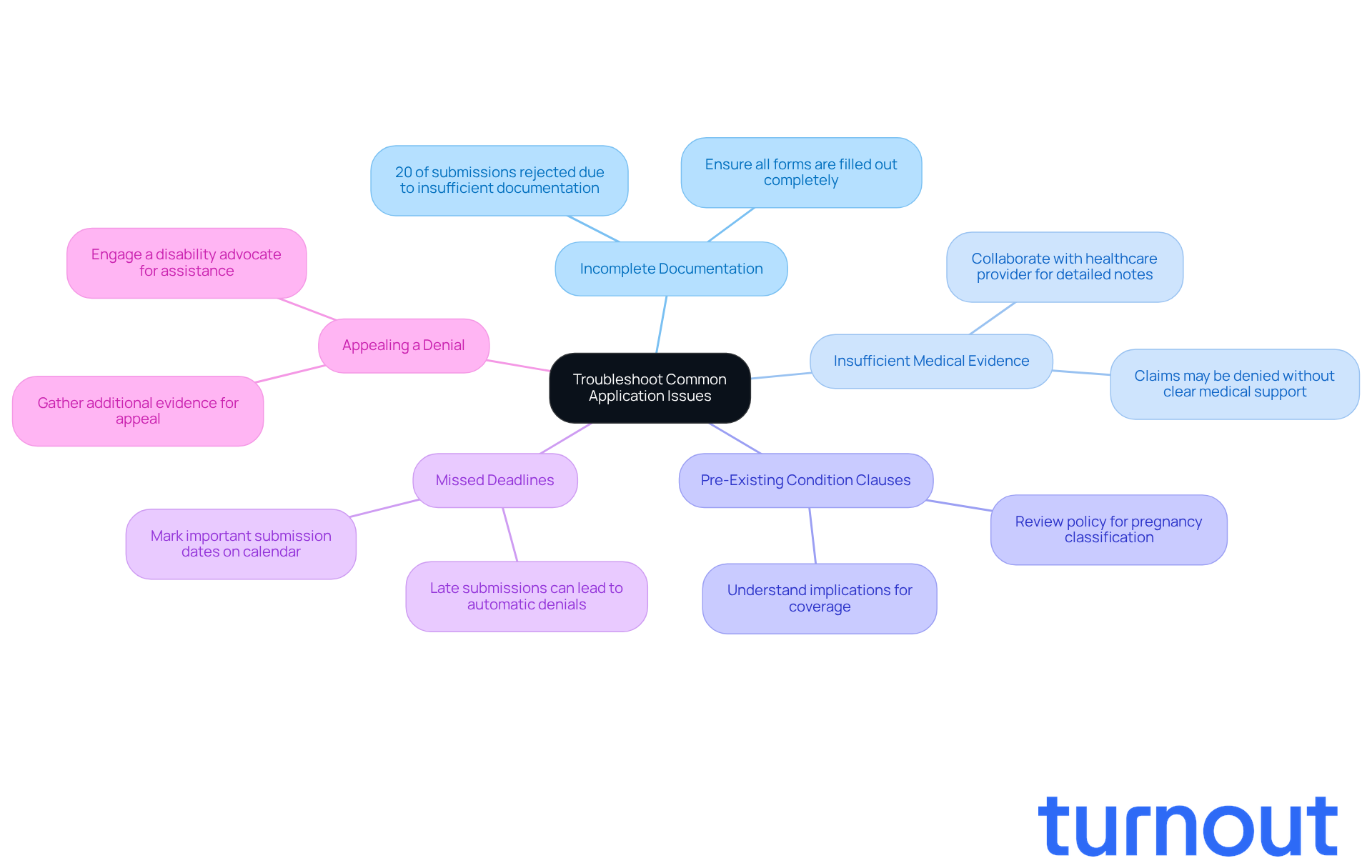

Troubleshoot Common Application Issues

When applying for short-term disability benefits during pregnancy, we understand that you may face several common challenges:

-

Incomplete Documentation: It’s crucial to ensure that all required forms are filled out completely and accurately. Lacking information can lead to delays or refusals, with nearly 20% of submissions rejected due to insufficient documentation.

-

Insufficient Medical Evidence: Claims may be denied if the medical documentation doesn’t clearly support your inability to work. Collaborating closely with your healthcare provider can help you obtain detailed notes and certifications that substantiate your condition.

-

Pre-Existing Condition Clauses: Some plans may categorize pregnancy as a pre-existing condition, which could result in denial of benefits. It’s important to carefully review your policy to understand these terms and their implications for your coverage.

-

Missed Deadlines: Be vigilant about any deadlines for submitting your request. Late submissions can lead to automatic denials, so marking important dates on your calendar can help you avoid missing them.

-

Appealing a Denial: If your claim is denied, remember that you have the right to appeal. Gather additional evidence, review the denial letter for specific reasons, and submit a formal appeal with supporting documentation. Engaging a disability advocate can provide valuable assistance in navigating the appeals process and improving your chances of success.

By proactively addressing these issues, you can enhance your likelihood of securing the benefits you need during this critical time, including understanding if you can apply for short term disability while pregnant. Remember, you are not alone in this journey, and we’re here to help.

Conclusion

Navigating the complexities of short-term disability while pregnant can be challenging. We understand that this significant life event brings a mix of emotions and concerns. But knowing the essentials is key to securing the benefits you need during this time. Applying for short-term disability insurance while pregnant is not only possible; it’s often necessary for many expecting parents. With the right knowledge and preparation, you can advocate for the financial support required.

This article delves into critical aspects such as:

- Eligibility for pregnancy-related benefits

- Necessary documentation

- The step-by-step process for filing a claim

It’s important to understand your individual policy details, including waiting periods, exclusions, and the need for thorough medical documentation. Addressing common application issues can significantly enhance your chances of a successful claim, ensuring that you receive the support you deserve.

Ultimately, being proactive in understanding short-term disability coverage and its implications can make a world of difference. Whether it’s consulting with a financial advisor or gathering the right documentation, taking these steps empowers you to navigate the process with confidence. As your journey into parenthood approaches, ensuring financial stability through short-term disability benefits is a vital consideration that should not be overlooked. Remember, you are not alone in this journey; we’re here to help.

Frequently Asked Questions

What is short-term disability insurance (STD)?

Short-term disability insurance (STD) provides financial support for individuals temporarily unable to work due to medical conditions, typically replacing 50% to 75% of their income for a specified duration.

Can I apply for short-term disability while pregnant?

Yes, many short-term disability plans recognize pregnancy as a qualifying condition, but the specifics can vary among insurance providers.

How long does short-term disability coverage last after childbirth?

Most short-term benefits plans cover six to eight weeks of recovery time after delivery, with eight weeks often designated for C-section births.

What should I know about my short-term disability coverage before applying while pregnant?

It's essential to review your coverage details for limitations such as waiting periods or exclusions for pre-existing conditions, as well as any stipulations regarding pregnancy.

What percentage of short-term disability claims are related to pregnancy?

Approximately 22% of short-term disability benefits requests are linked to pregnancy.

How can short-term income protection insurance assist during maternity leave?

Short-term income protection insurance can supplement earnings during Family and Medical Leave Act (FMLA) leave if your employer does not offer paid family leave.

What documentation is needed when applying for short-term disability while pregnant?

Thorough medical documentation, including due dates and any restrictions, is crucial when submitting a claim for short-term disability.

How long does it take for insurance companies to review claims?

Insurance companies typically take several weeks to review claims, so early submission is advisable.

Are there any tax consequences related to short-term disability coverage?

Yes, there may be potential tax consequences based on employer contributions to premiums, so it's important to evaluate your financial situation regarding STD coverage.

Who can I consult for guidance on short-term disability insurance?

Consulting with coverage specialists or a financial advisor can provide valuable guidance in navigating short-term disability insurance regulations and policies.