Introduction

Navigating the complexities of disability benefits can feel overwhelming. We understand that many factors influence the amount of assistance you may receive. It’s crucial to grasp the intricacies of programs like Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) if you’re seeking financial support.

How can you effectively calculate your potential benefits? It’s common to feel uncertain about whether you’re receiving the maximum support available. This guide breaks down essential steps and resources, empowering you to confidently navigate the disability payment calculation process. Remember, you’re not alone in this journey; we’re here to help.

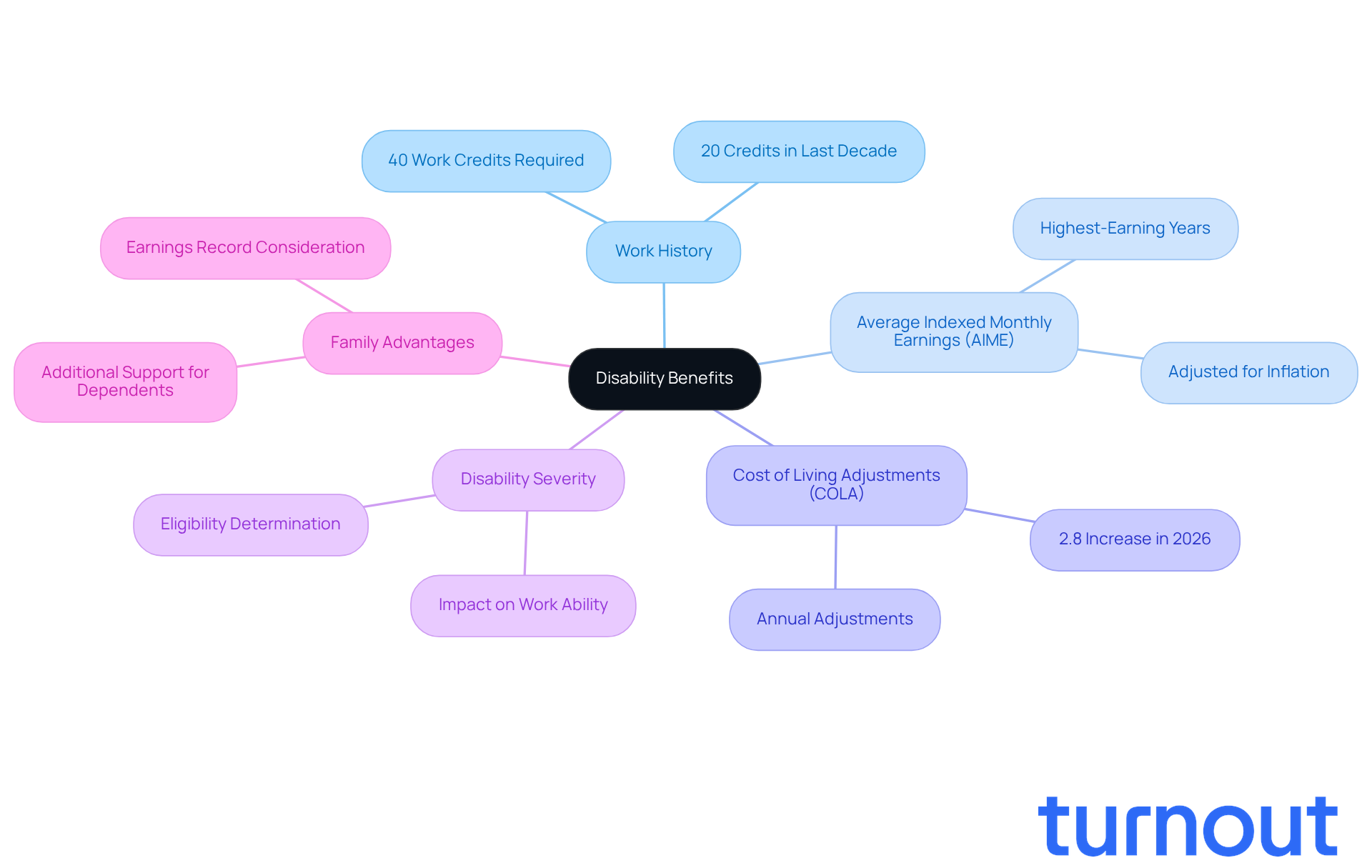

Understand Disability Benefits and Their Calculation Factors

Navigating the world of disability assistance can feel overwhelming, but understanding the key programs available can make a significant difference. Two primary sources of support are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI). Let’s explore the essential factors that can influence your disability payment calculations, so you can feel more empowered in this journey:

- Work History: Your SSDI assistance is closely tied to your work history and the contributions you've made to Social Security through FICA taxes. Generally, you’ll need 40 work credits, with at least 20 earned in the last decade before your disability began.

- Average Indexed Monthly Earnings (AIME): This figure represents your highest-earning years, adjusted for inflation. The Social Security Administration (SSA) uses it to calculate your Primary Insurance Amount (PIA).

- Cost of Living Adjustments (COLA): Each year, benefits may be adjusted for inflation, which can impact the total amount you receive. For example, in 2026, SSDI disbursements will see a 2.8% COLA increase, raising the average monthly amount from $1,586 to $1,630. This adjustment is crucial for keeping up with rising living costs.

- Disability Severity: The severity of your condition and how it affects your ability to work are vital in determining how much disability money will I get and your eligibility.

- Family Advantages: If you have dependents, additional support may be available based on your earnings record, further enhancing your financial assistance.

We understand that this process can be complex and daunting. It’s important to note that Turnout is not a law firm and does not provide legal representation. Instead, we utilize trained nonlawyer advocates who are here to help you navigate these complexities. By comprehending these factors, you can better maneuver through the intricacies of support programs and prepare for the computation process. Remember, you are not alone in this journey.

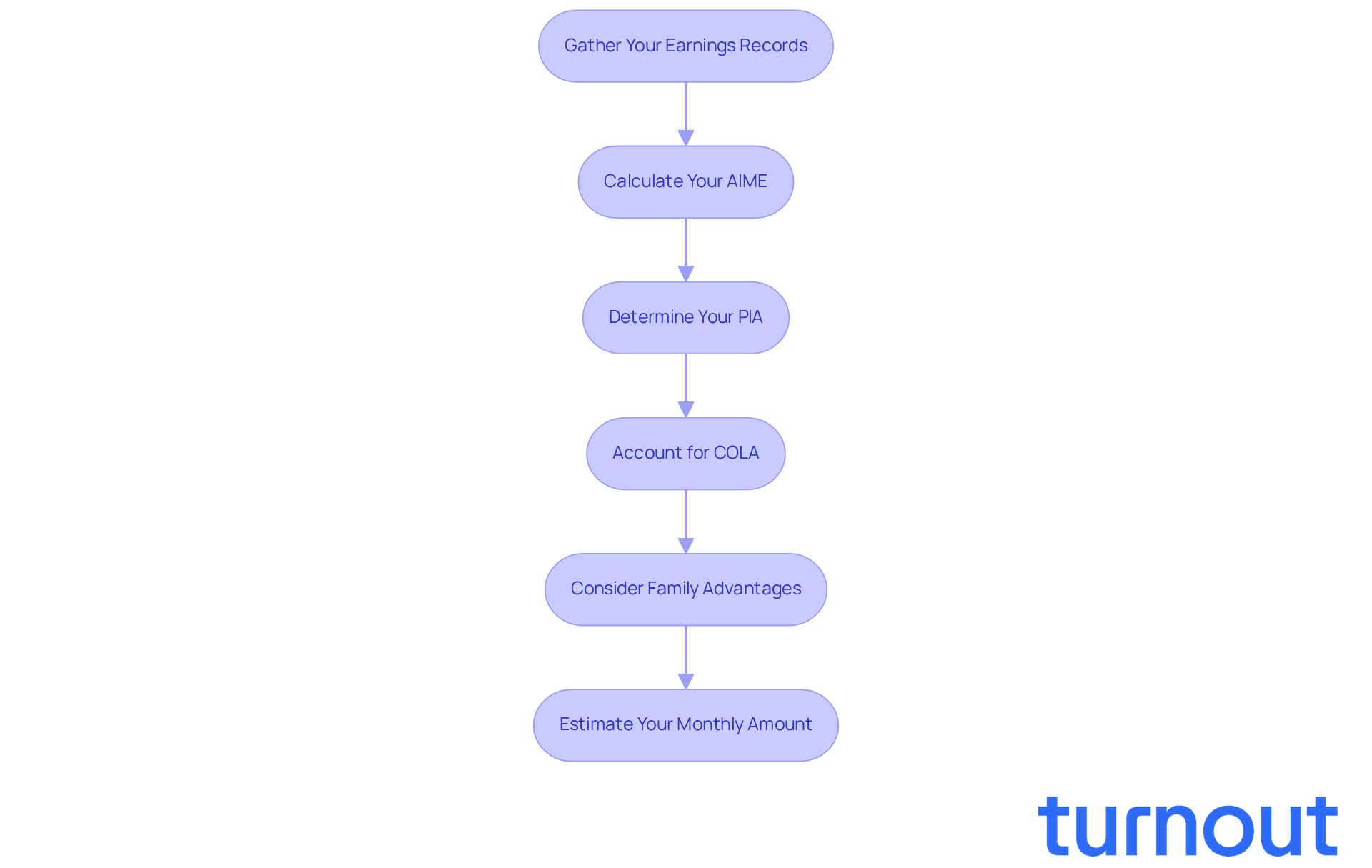

Follow the Step-by-Step Calculation Process for Disability Payments

Calculating how much disability money will I get can feel overwhelming, but we're here to help you through the process. Follow these steps to gain clarity and confidence in your benefits:

-

Gather Your Earnings Records: Start by collecting your Social Security Statement. This document outlines your earnings history and the taxes you've contributed to Social Security. It’s vital for ensuring accurate calculations, and having it on hand can ease your mind.

-

Calculate Your AIME: Next, determine your Average Indexed Monthly Earnings (AIME). This involves averaging your highest-earning years - up to 35 years - adjusted for inflation. This figure is crucial as it serves as the foundation for your Primary Insurance Amount (PIA).

-

Determine Your PIA: Use the Social Security Administration's (SSA) formula to calculate your PIA. This formula applies varying percentages to different portions of your AIME. You can find this information on the SSA website or through their calculators, making it easier for you to navigate.

-

Account for COLA: Don’t forget to adjust your PIA for any Cost of Living Adjustments (COLA) that may apply. This ensures your benefits keep pace with inflation, reflecting current economic conditions and helping you maintain your standard of living.

-

Consider Family Advantages: If you have dependents, include any extra support based on your earnings history. This can significantly improve your family's monthly income, providing them with the security they deserve.

-

Estimate Your Monthly Amount: Finally, combine your PIA with any extra advantages to calculate your total monthly assistance. This step is essential for understanding the full scope of your benefits.

By following these steps, you can reach a well-informed assessment of how much disability money you will get. Remember, you’re not alone in this journey, and taking these steps can empower you to navigate the complexities of the system with confidence.

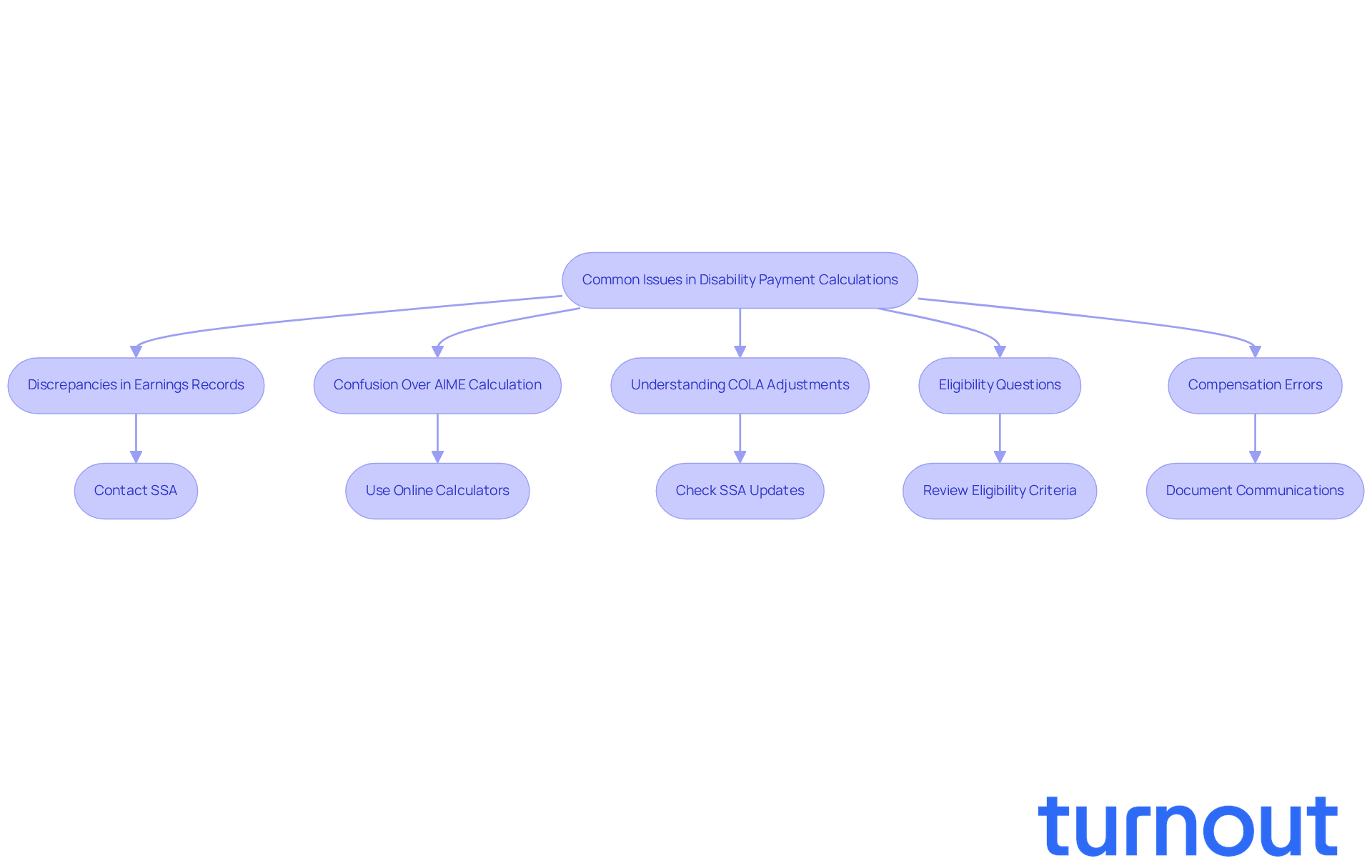

Troubleshoot Common Issues in Disability Payment Calculations

Navigating assistance payments can be challenging, and it's completely normal to encounter a few bumps along the way. Here’s how to troubleshoot some common issues you might face:

-

Discrepancies in Earnings Records: If your earnings history seems off, don’t hesitate to reach out to the Social Security Administration (SSA) for a review. Make sure to have your documentation handy, like W-2 forms or tax returns, to support your claim.

-

Confusion Over AIME Calculation: Unsure about how to calculate your Average Indexed Monthly Earnings (AIME)? You’re not alone! The SSA offers online calculators, or you can consult with a disability advocate who can help clarify the process and ensure everything is accurate.

-

Understanding COLA Adjustments: If you’re wondering how Cost-of-Living Adjustments (COLA) affect your benefits, check out the SSA’s annual updates or visit their website for the latest information on these adjustments.

-

Eligibility Questions: Feeling uncertain about your eligibility for benefits? Take a moment to review the SSA’s eligibility criteria, or seek guidance from a qualified advocate who can provide personalized advice tailored to your situation.

-

Compensation Errors: If you believe you’ve received an incorrect compensation amount, it’s important to act quickly. Reach out to the SSA to report the issue, and remember to document all communications while keeping records of your payments for reference.

By addressing these common concerns proactively, you can help ensure a smoother calculation process and avoid potential delays in receiving your benefits. Remember, you’re not alone in this journey, and we’re here to help!

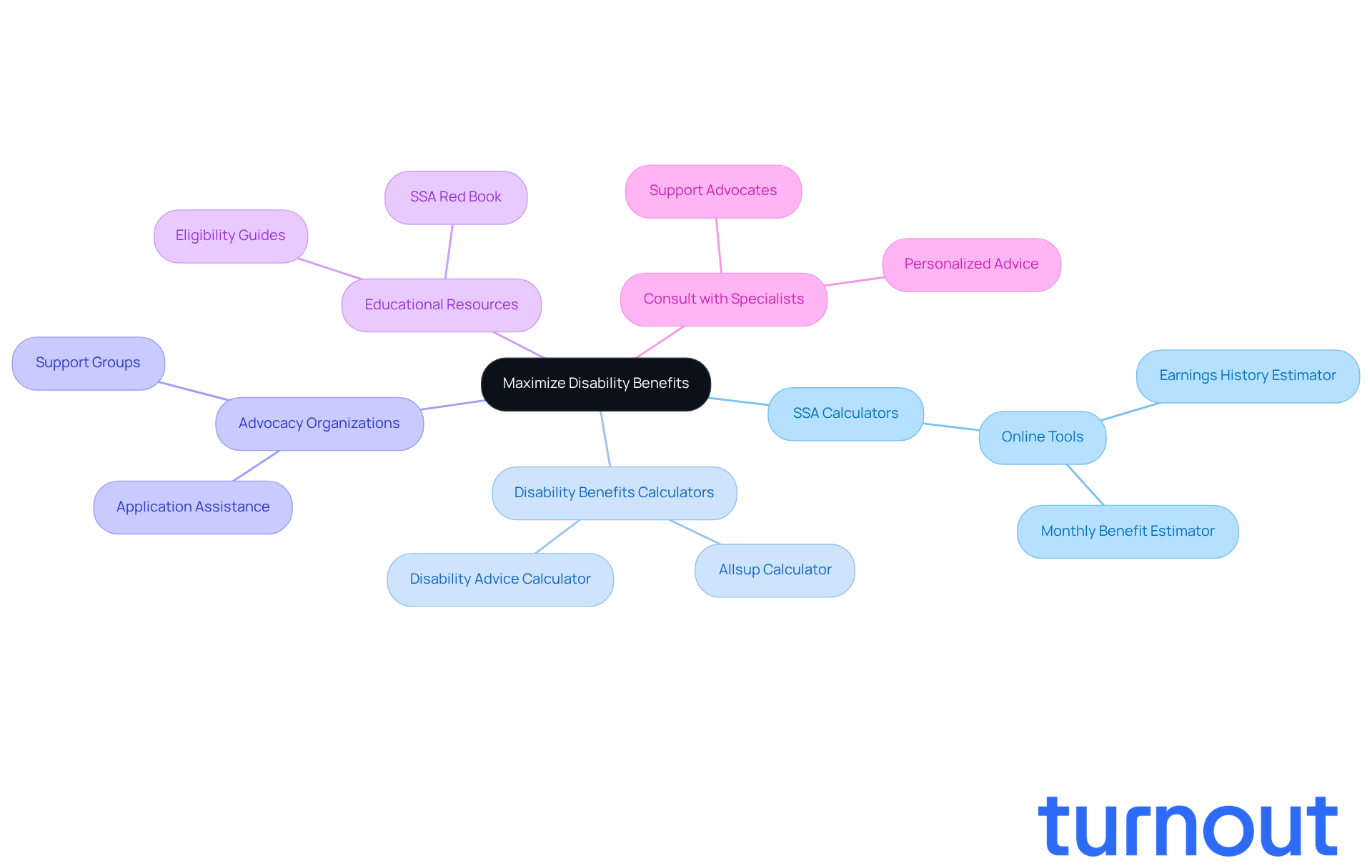

Utilize Resources and Tools to Maximize Your Disability Benefits

To maximize your disability benefits, we understand that navigating how much disability money will I get can feel overwhelming. But don’t worry; there are resources and tools available to help you every step of the way:

-

Social Security Administration (SSA) Calculators: The SSA offers a variety of online calculators that estimate your benefits based on your earnings history. These tools are essential for understanding how much disability money will I get each month and can be easily accessed on the SSA's official website.

-

Disability Benefits Calculators: Websites like Allsup and Disability Advice provide user-friendly calculators to help you estimate your monthly SSDI payments. These platforms simplify the process, allowing you to input your information and quickly determine how much disability money will I get.

-

Advocacy Organizations: Connecting with groups that advocate for individuals with disabilities can provide you with tailored support. These organizations are ready to assist you in the application process and help you navigate the complexities of securing your entitlements.

-

Educational Resources: The SSA’s publications and guides, such as the SSA Red Book, offer detailed explanations of eligibility requirements and the application process. Familiarizing yourself with these resources can enhance your understanding and preparedness.

-

Consult with Specialists: If you have specific questions or concerns, seeking guidance from a support advocate can provide you with personalized advice based on your unique situation. Their expertise can be invaluable in maximizing your benefits.

By leveraging these resources, you can deepen your understanding of how much disability money will I get and improve your chances of receiving the maximum support available. Remember, the 2026 Cost-of-Living Adjustment (COLA) will increase SSDI payments, making it even more important to stay informed and utilize these tools effectively. You are not alone in this journey; we’re here to help!

Conclusion

Understanding how to calculate disability benefits is crucial for anyone navigating the complexities of financial support. We understand that this journey can feel overwhelming, but by breaking down essential factors like work history, Average Indexed Monthly Earnings (AIME), and Cost of Living Adjustments (COLA), you can gain clarity on the financial assistance you may be entitled to. This guide empowers you to take control of your path toward securing the benefits you deserve.

Key insights revealed include:

- The importance of accurately gathering earnings records

- Calculating AIME

- Considering family advantages that can enhance monthly assistance

It’s common to feel confused about these details, but addressing common issues proactively - like discrepancies in earnings or confusion over calculations - can significantly streamline the process. Utilizing resources like SSA calculators and advocacy organizations plays a pivotal role in maximizing your benefits.

Ultimately, understanding the calculation of disability payments is not just about numbers; it’s about ensuring financial stability and support during difficult times. With the right tools and knowledge, you can navigate this process with confidence and advocate for your rightful benefits. Remember, you are not alone in this journey. Taking these steps not only enhances your personal preparedness but also reinforces the importance of community support in overcoming challenges related to disability assistance.

Frequently Asked Questions

What are the primary sources of disability assistance?

The two primary sources of disability assistance are Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

How is SSDI assistance determined?

SSDI assistance is closely tied to your work history and the contributions you've made to Social Security through FICA taxes. Generally, you need 40 work credits, with at least 20 earned in the last decade before your disability began.

What is Average Indexed Monthly Earnings (AIME)?

AIME represents your highest-earning years, adjusted for inflation, and is used by the Social Security Administration (SSA) to calculate your Primary Insurance Amount (PIA).

How do Cost of Living Adjustments (COLA) affect disability payments?

Benefits may be adjusted for inflation each year through COLA, impacting the total amount you receive. For example, in 2026, SSDI disbursements will see a 2.8% COLA increase, raising the average monthly amount from $1,586 to $1,630.

What role does disability severity play in determining benefits?

The severity of your condition and its impact on your ability to work are vital factors in determining how much disability money you will receive and your eligibility.

Are there additional benefits available for individuals with dependents?

Yes, if you have dependents, additional support may be available based on your earnings record, which can enhance your financial assistance.

What kind of assistance does Turnout provide for navigating disability benefits?

Turnout utilizes trained nonlawyer advocates to help individuals navigate the complexities of disability assistance programs, although it does not provide legal representation.