Introduction

Navigating long-term disability insurance can feel overwhelming, can't it? Many people face challenges, especially when certain companies are known for poor customer service and unjust claim denials. It's crucial to know which insurers to avoid if you're seeking peace of mind and financial security during tough times.

As you explore your options, you might wonder: how can you protect yourself from the pitfalls of the worst long-term disability insurance companies? This article is here to help. We’ll shine a light on the most problematic insurers, discuss their practices, and offer strategies to help you navigate the complexities of claims effectively.

Remember, you are not alone in this journey. We understand that seeking assistance can be daunting, but together, we can find the right path forward.

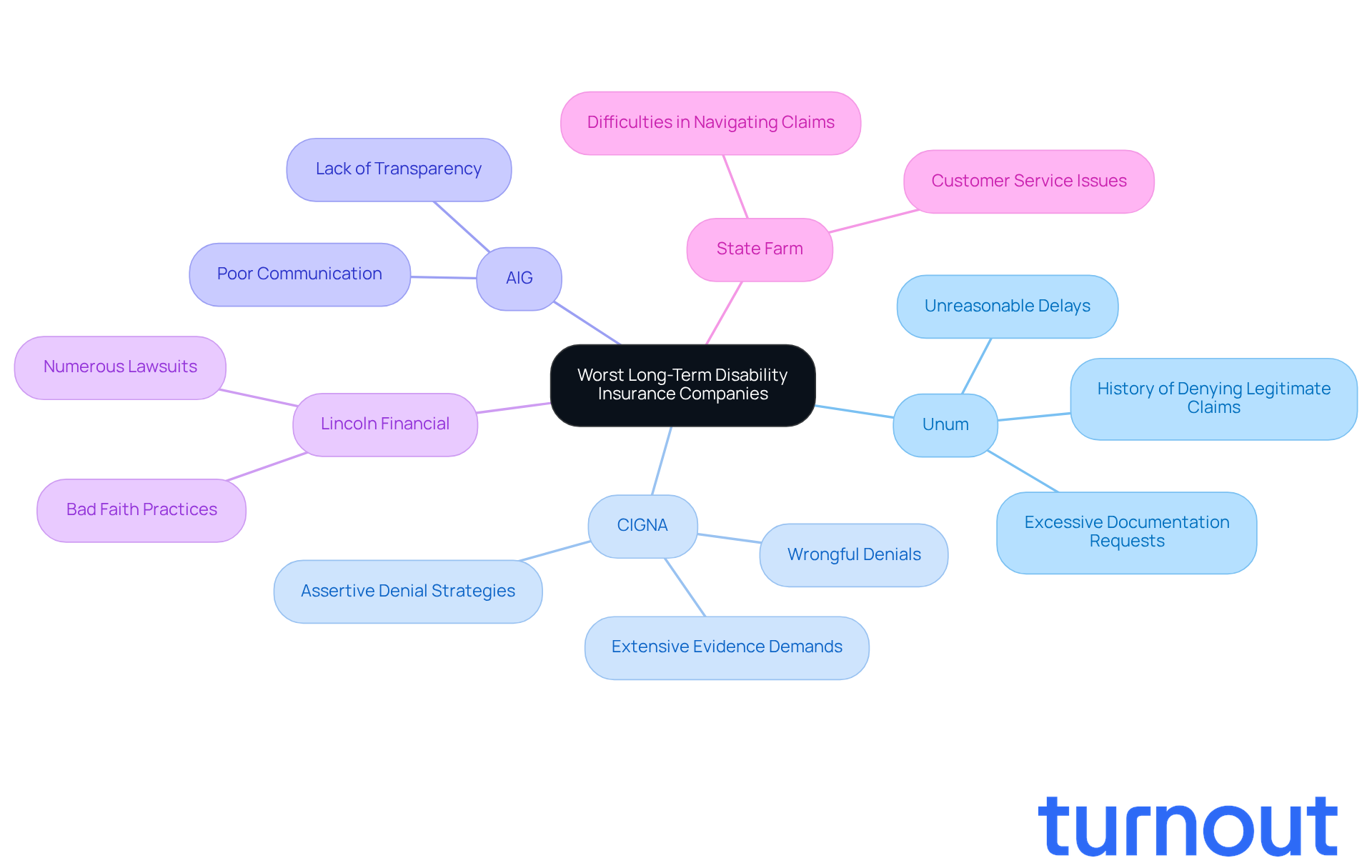

Identifying the Worst Long-Term Disability Insurance Companies

Due to their handling of requests and customer support, many providers are considered among the worst long term disability insurance companies. We understand how frustrating this can be for policyholders. Here are some notable companies to be aware of:

-

Unum: Often criticized for unreasonable delays and excessive documentation requests, Unum has a troubling history of denying legitimate claims. This can lead to significant frustration for those who have paid into their policies. Long-term incapacity insurance providers are legally obligated to act in good faith and honor valid requests, yet Unum's practices often fall short of this commitment.

-

CIGNA: Known for its assertive denial strategies, CIGNA frequently demands extensive evidence of disability. This can leave applicants feeling overwhelmed and frustrated. Even loyal policyholders have reported wrongful denials, which underscores the importance of vigilance when dealing with this insurer. Common reasons for denial include failure to disclose pre-existing conditions and inadequate medical examinations.

-

AIG: This company has faced criticism for its lack of transparency and poor communication with policyholders. Many consumers have expressed concerns about the difficulty in obtaining clear information regarding their requests, which can add to the challenges faced by those seeking benefits.

-

Lincoln Financial: Frequently noted for bad faith practices, Lincoln Financial has been involved in numerous lawsuits over denied benefits. Advocates for policyholders stress the importance of understanding your rights when dealing with such companies. Many individuals may not be aware of the legal protections available to them.

-

State Farm: While primarily known for automobile and property coverage, State Farm has also faced criticism for its management of disability requests, particularly in terms of customer service and responsiveness. Many consumers have reported difficulties in navigating the process, which can complicate obtaining benefits.

Based on customer feedback, legal matters, and industry analyses, these firms are identified as the worst long term disability insurance companies. It's crucial for prospective policyholders to understand their histories before acquiring coverage. Remember, pursuing legal support can be vital. For instance, Sokolove Law has successfully secured over $143 million for clients with rejected requests, emphasizing the importance of advocacy in these situations. You're not alone in this journey, and we're here to help.

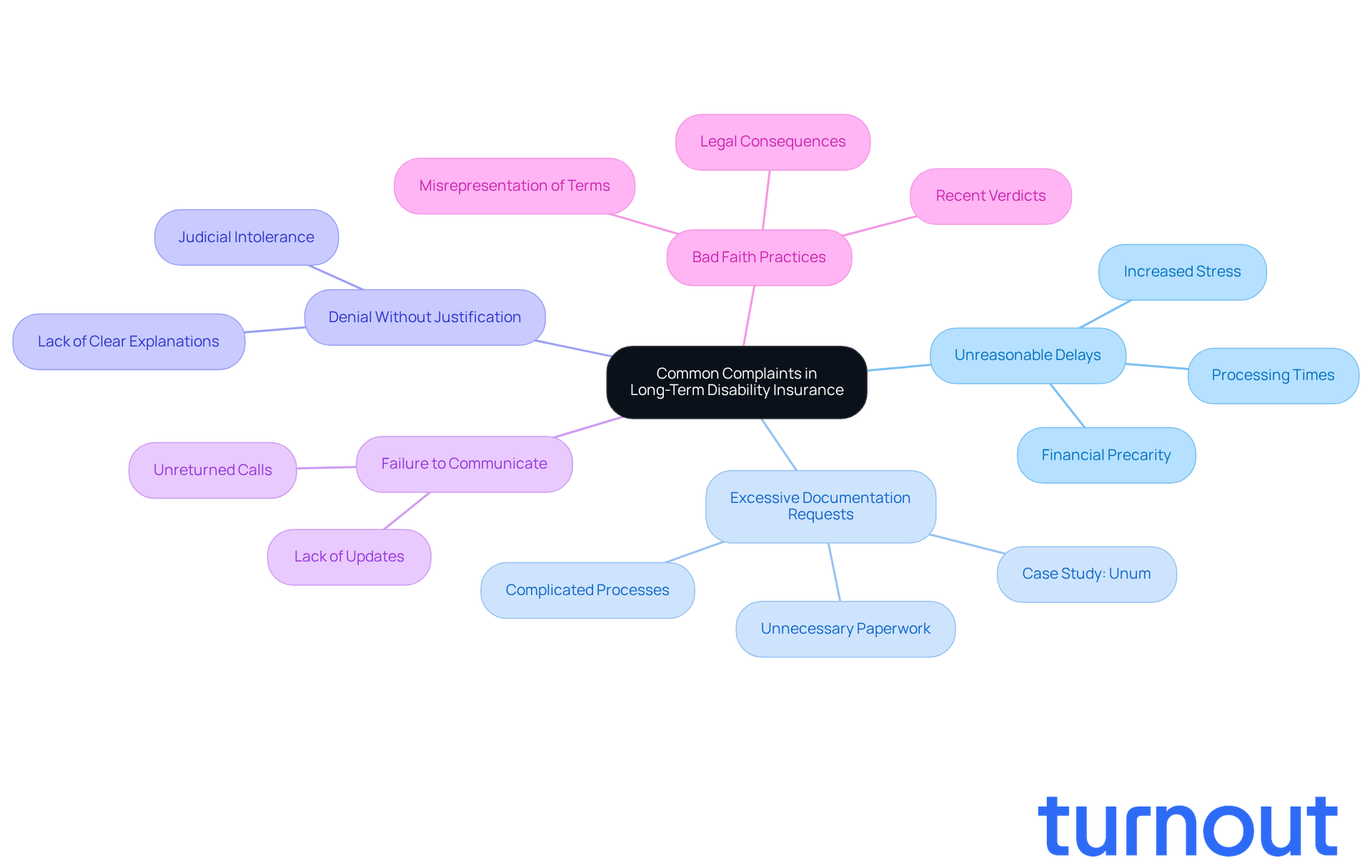

Examining Common Complaints and Bad Faith Practices

Navigating the long-term disability insurance landscape can be incredibly frustrating for many consumers. We understand that you might be feeling overwhelmed by the challenges that come with it. Here are some common concerns that people often face:

- Unreasonable Delays: It’s common to feel anxious when insurers take an excessive amount of time to process claims. This can leave you in a precarious financial situation. In 2025, statistics revealed that processing delays have become a significant issue, with many requests taking months to settle. Recent reports highlight that insurers are increasingly sluggish in their response times, adding to your stress.

- Excessive Documentation Requests: Companies like Unum and CIGNA are known for requiring more paperwork than necessary. This can complicate the process and extend resolution times, making it hard for you to provide the required information promptly. For instance, a case study involving Unum showed that applicants often faced demands for extensive medical records that weren’t relevant, leading to unnecessary delays.

- Denial Without Justification: It’s disheartening when requests are rejected without clear explanations. Many insurers fail to communicate the reasons behind their decisions, leaving you feeling powerless and frustrated. Recent verdicts indicate that juries are becoming less tolerant of such practices, emphasizing the need for insurers to provide clear justifications.

- Failure to Communicate: We understand how stressful it can be when communication breaks down. Insurers like Lincoln Financial have received numerous complaints about unreturned calls and a lack of updates on claims. This lack of transparency can heighten your anxiety during an already challenging time.

- Bad Faith Practices: Unfortunately, some insurers engage in tactics that can be incredibly frustrating. This includes misrepresenting policy terms or disregarding medical evidence. Such actions not only frustrate claimants but can also lead to legal consequences for insurers. Recent verdicts in 2025 have shown that juries are increasingly intolerant of these bad faith practices, awarding significant damages to affected policyholders.

By recognizing these frequent grievances, you can better prepare yourself for the challenges that may arise when considering a long-term coverage policy. Remember, you are not alone in this journey, and we’re here to help you navigate these complexities.

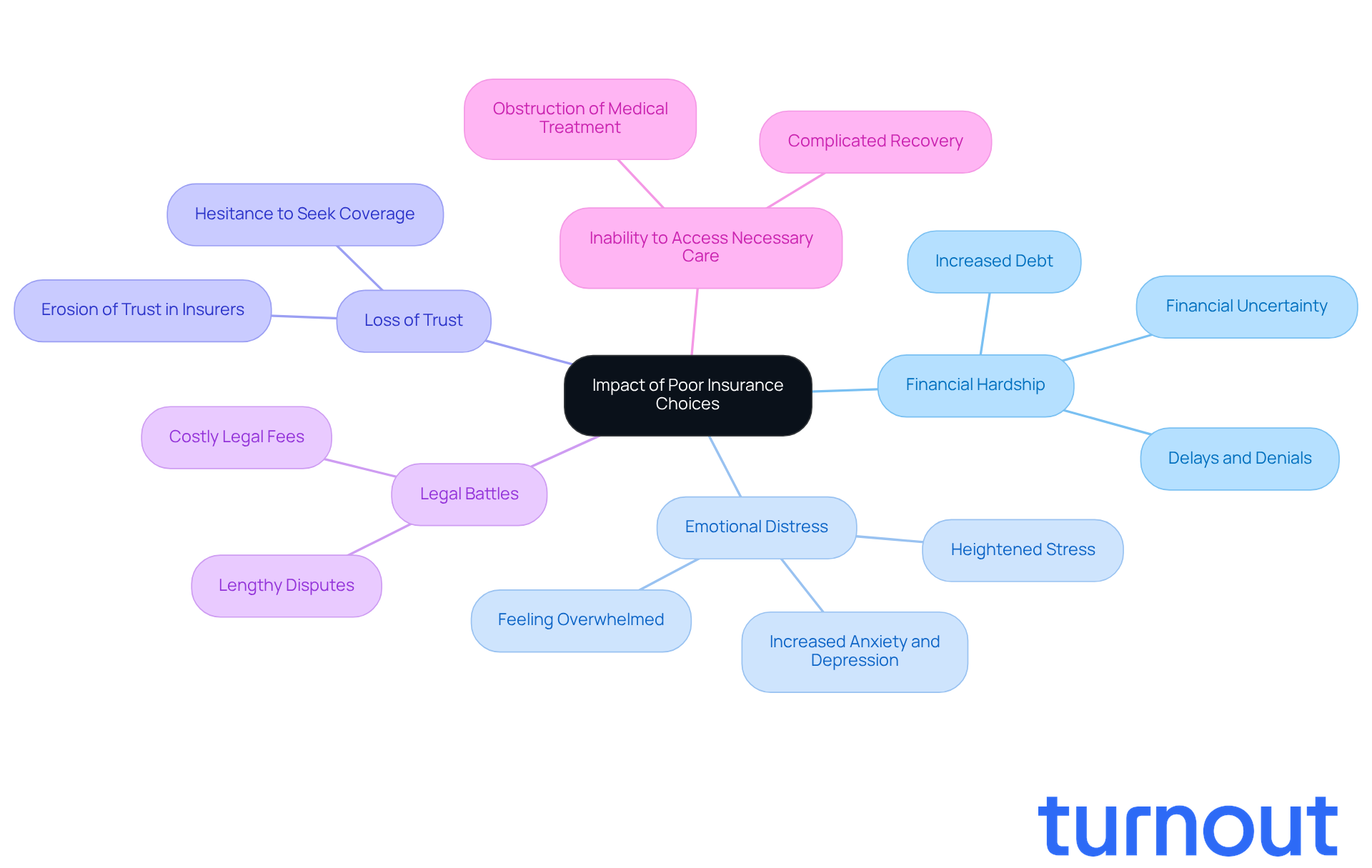

Understanding the Impact of Poor Insurance Choices on Claimants

Choosing the right long-term disability insurance provider is crucial, especially to avoid the worst long term disability insurance companies, as the consequences of a poor choice can be significant. We understand that many claimants face challenges, and it’s important to recognize the potential impacts:

- Financial Hardship: Delays and denials can lead to serious financial strain, especially for those relying on benefits to cover essential living expenses. In 2025, many individuals shared that prolonged application processes left them with increased debt and financial uncertainty.

- Emotional Distress: Navigating a complicated claims process can heighten stress, worsening existing health issues and leading to increased anxiety and depression. It’s common to feel overwhelmed, and statistics show that many applicants experience emotional distress due to these delays, highlighting the psychological burden of insufficient support.

- Loss of Trust: Negative experiences with insurers can erode trust in the entire insurance system. This can make individuals hesitant to seek necessary coverage in the future, affecting their willingness to engage with financial systems.

- Legal Battles: Unfortunately, many claimants find themselves caught in lengthy legal disputes with their insurers. These battles can be costly and time-consuming, adding to the emotional strain for those already facing health challenges.

- Inability to Access Necessary Care: For individuals with impairments, delays in receiving benefits can obstruct access to vital medical treatment and support services, complicating their recovery and overall well-being.

These impacts underscore the importance of selecting a reliable coverage provider rather than one of the worst long term disability insurance companies. Remember, you are not alone in this journey, and being aware of the risks associated with poor coverage decisions can empower you to make informed choices.

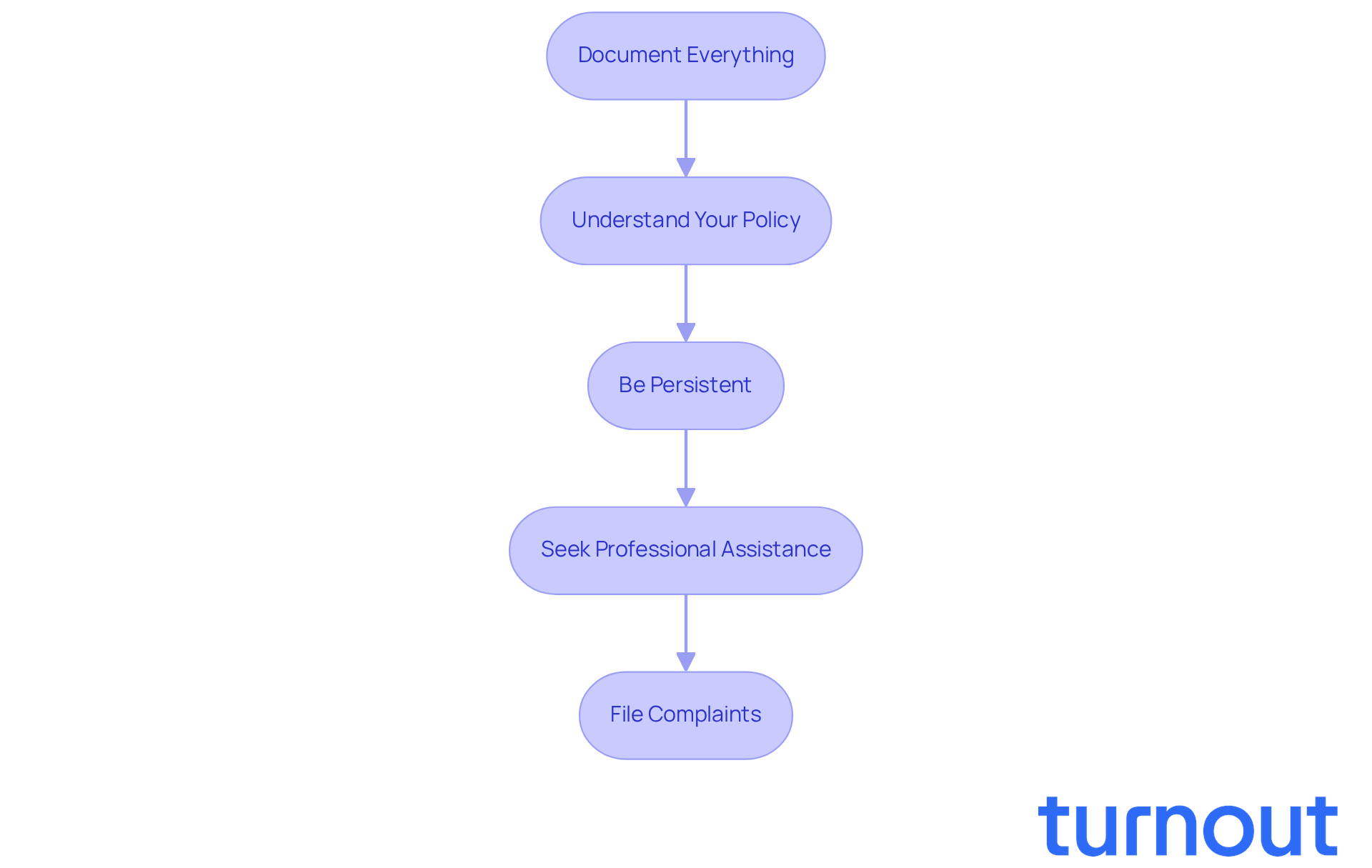

Navigating Claims: Strategies for Dealing with Poor Insurers

Facing one of the worst long term disability insurance companies known for poor practices can be daunting. But you’re not alone in this journey. Here are some strategies that can help improve your chances of a successful claim:

- Document Everything: Keep detailed records of all communications with the insurer. Note down dates, times, and the names of representatives you speak with. This can be invaluable.

- Understand Your Policy: Familiarize yourself with the terms and conditions of your policy. Knowing what is covered and what documentation is required can empower you.

- Be Persistent: It’s common to feel frustrated, but following up regularly on the status of your request is crucial. Don’t hesitate to escalate issues to higher management if necessary.

- Seek Professional Assistance: Consider employing an advocate or lawyer who specializes in benefits. Their expertise can guide you through the process and provide valuable advice.

- File Complaints: If you encounter bad faith practices, submitting complaints to state regulators or considering legal action can hold the provider accountable.

These strategies can help you navigate the often challenging landscape of claims related to the worst long term disability insurance companies. Remember, you deserve the benefits you’re entitled to, and we’re here to help you every step of the way.

Conclusion

Avoiding the worst long-term disability insurance companies is crucial for ensuring that your claims are handled fairly and efficiently. We understand that navigating this landscape can be overwhelming, especially when faced with companies known for poor customer service, unreasonable delays, and bad faith practices. Recognizing these pitfalls empowers you to make informed choices when selecting your insurance provider.

Key points to consider include the troubling histories of companies like:

- Unum

- CIGNA

- AIG

- Lincoln Financial

- State Farm

These companies have received negative feedback for their handling of claims. Common complaints-such as excessive documentation requests, lack of communication, and outright denials without justification-illustrate the struggles many policyholders face. The emotional and financial impacts of choosing an unreliable insurer highlight the importance of understanding the risks involved.

Ultimately, being proactive in documenting interactions, understanding policy terms, and seeking professional assistance can significantly improve your chances of a successful claim. By advocating for yourself and being aware of the challenges posed by these companies, you can navigate the complexities of long-term disability insurance more effectively. Remember, you are not alone in this journey. Prioritize informed decisions and seek support when facing difficulties, ensuring that your rights and needs as a policyholder are upheld.

Frequently Asked Questions

What are some companies identified as the worst long-term disability insurance providers?

Notable companies identified as the worst long-term disability insurance providers include Unum, CIGNA, AIG, Lincoln Financial, and State Farm.

What issues are commonly associated with Unum?

Unum is often criticized for unreasonable delays, excessive documentation requests, and a troubling history of denying legitimate claims, which can frustrate policyholders.

How does CIGNA handle disability claims?

CIGNA is known for its assertive denial strategies, frequently demanding extensive evidence of disability, which can overwhelm applicants. Reports of wrongful denials are common among policyholders.

What are the concerns regarding AIG's customer service?

AIG has faced criticism for a lack of transparency and poor communication, making it difficult for policyholders to obtain clear information about their requests.

What legal issues has Lincoln Financial encountered?

Lincoln Financial has been noted for bad faith practices and has been involved in numerous lawsuits over denied benefits, highlighting the importance of understanding legal rights for policyholders.

What challenges do consumers face with State Farm regarding disability insurance?

State Farm has received criticism for its management of disability requests, particularly in terms of customer service and responsiveness, complicating the process of obtaining benefits.

Why is it important for prospective policyholders to understand the histories of these companies?

Understanding the histories of these companies is crucial for prospective policyholders to make informed decisions before acquiring coverage, as many have faced significant issues with claims handling.

How can policyholders seek help if their claims are denied?

Pursuing legal support can be vital for denied claims. For example, Sokolove Law has successfully secured over $143 million for clients with rejected requests, emphasizing the importance of advocacy.