Introduction

Understanding the complexities of veterans disability benefits is crucial for former service members as they navigate their financial landscape. We know that these benefits provide essential support for those facing service-related challenges. However, they also bring up important questions about tax implications.

As many veterans look ahead to their financial planning, clarity around the taxability of these benefits becomes vital. What do you need to know to ensure you maximize your entitlements while steering clear of potential tax pitfalls?

It's common to feel overwhelmed by these questions, but remember, you're not alone in this journey. We're here to help you understand your options and make informed decisions.

Define Veterans Disability Benefits

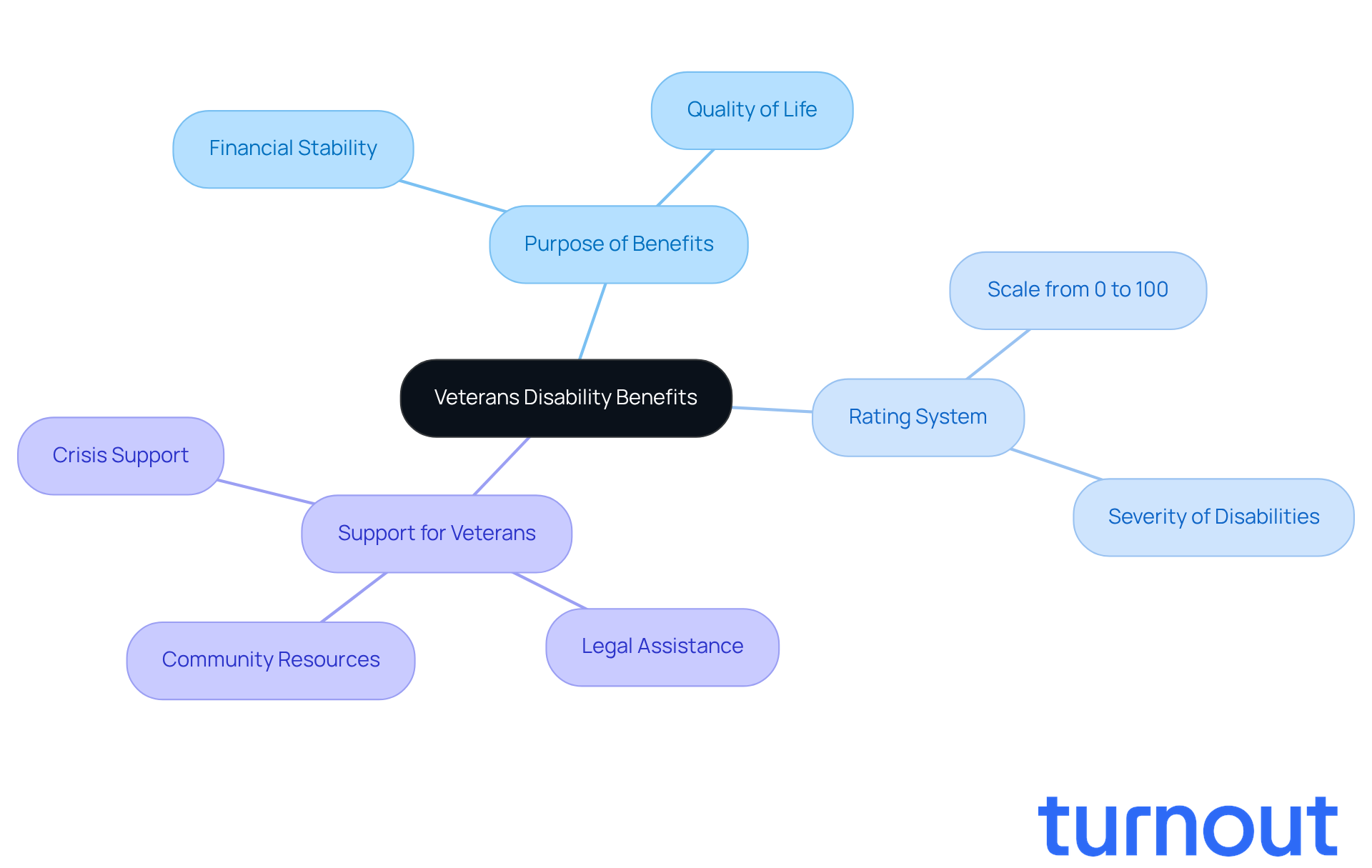

Compensation for service members is more than just financial support; it’s a lifeline provided by the Department of Veterans Affairs (VA) for those facing challenges due to injuries or illnesses sustained during active military duty. We understand that navigating these difficulties can be overwhelming, and these benefits are designed to help you manage the impact of your impairments.

As of 2026, millions of former service members are receiving these essential benefits, which vary based on the severity of their disabilities. The VA uses a rating system from 0% to 100%, ensuring that assistance is proportional to your degree of impairment. This structured approach not only helps you maintain a quality of life after your service but also underscores the importance of these benefits in providing financial stability for you and your family.

You are not alone in this journey. Many have walked this path and found support through these programs. If you’re facing challenges, remember that we’re here to help you explore your options and ensure you receive the assistance you deserve.

Context and Importance of Veterans Disability Benefits

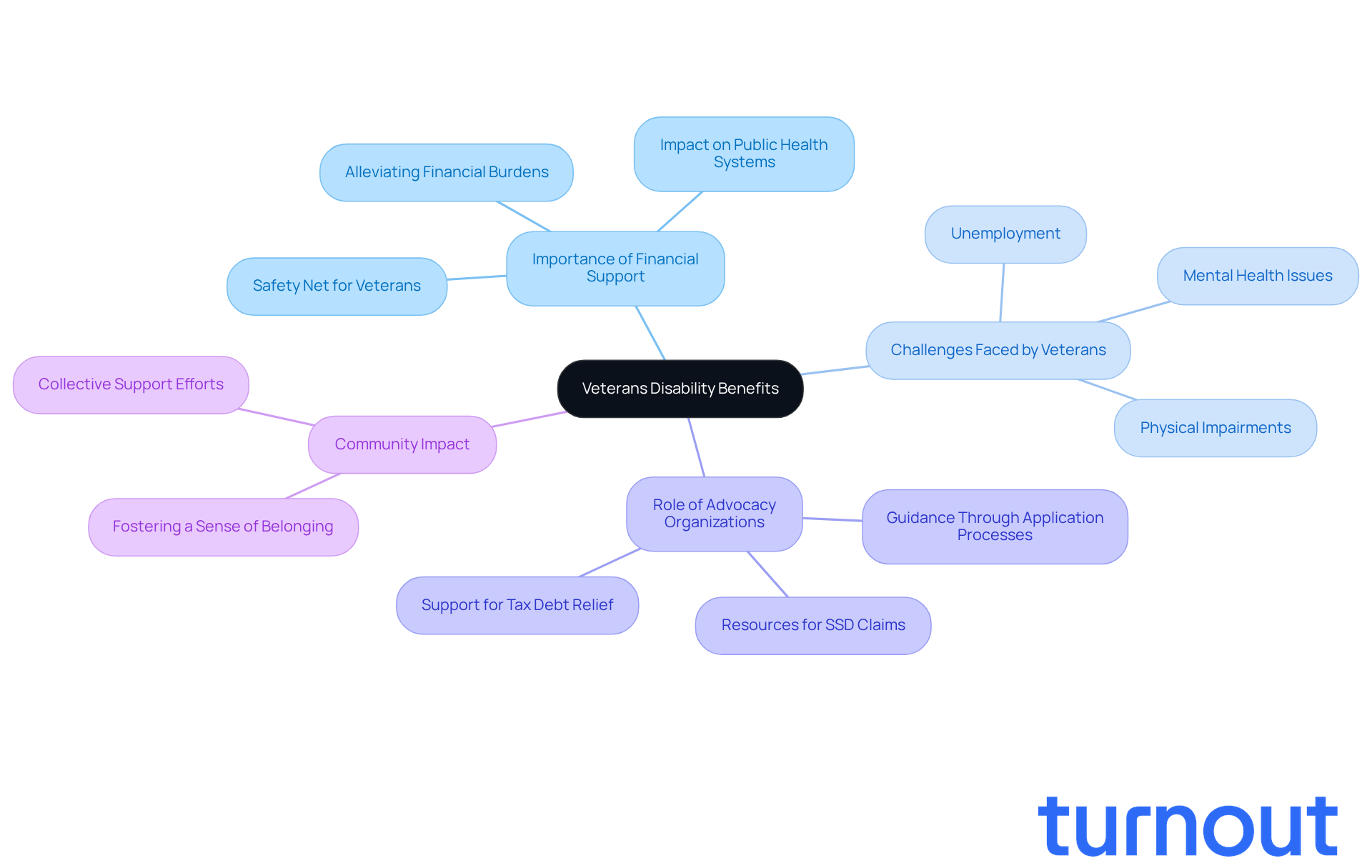

Veterans' support payments are more than just financial aid; they serve as a vital safety net for those who have dedicated their lives to serving our country. We understand that many former service members face significant challenges, such as unemployment, mental health issues, and physical impairments. For countless individuals, these benefits are crucial for a successful transition back into civilian life, offering the necessary support to navigate this journey.

Statistics show that veterans receiving disability assistance often experience higher rates of mental health challenges. This underscores the importance of such support in facilitating access to healthcare and essential services. By alleviating some financial burdens, these benefits can also reduce the strain on public health systems and social services, allowing veterans to focus on their recovery and reintegration.

Advocacy organizations play a key role in this process, ensuring that former military personnel are aware of their rights and the assistance available to them. They guide veterans through the often complex application processes, helping them secure the support they need. Turnout, while not a law firm and not providing legal advice, offers valuable resources that assist consumers in navigating these intricate systems. This includes support for SSD claims and tax debt relief. By employing skilled nonlawyer advocates and IRS-licensed enrolled agents, Turnout streamlines access to government assistance and financial support.

This collective effort not only enhances individual well-being but also fosters a sense of community and belonging among former service members. Remember, you are not alone in this journey. We’re here to help you every step of the way.

Tax Implications of Veterans Disability Benefits

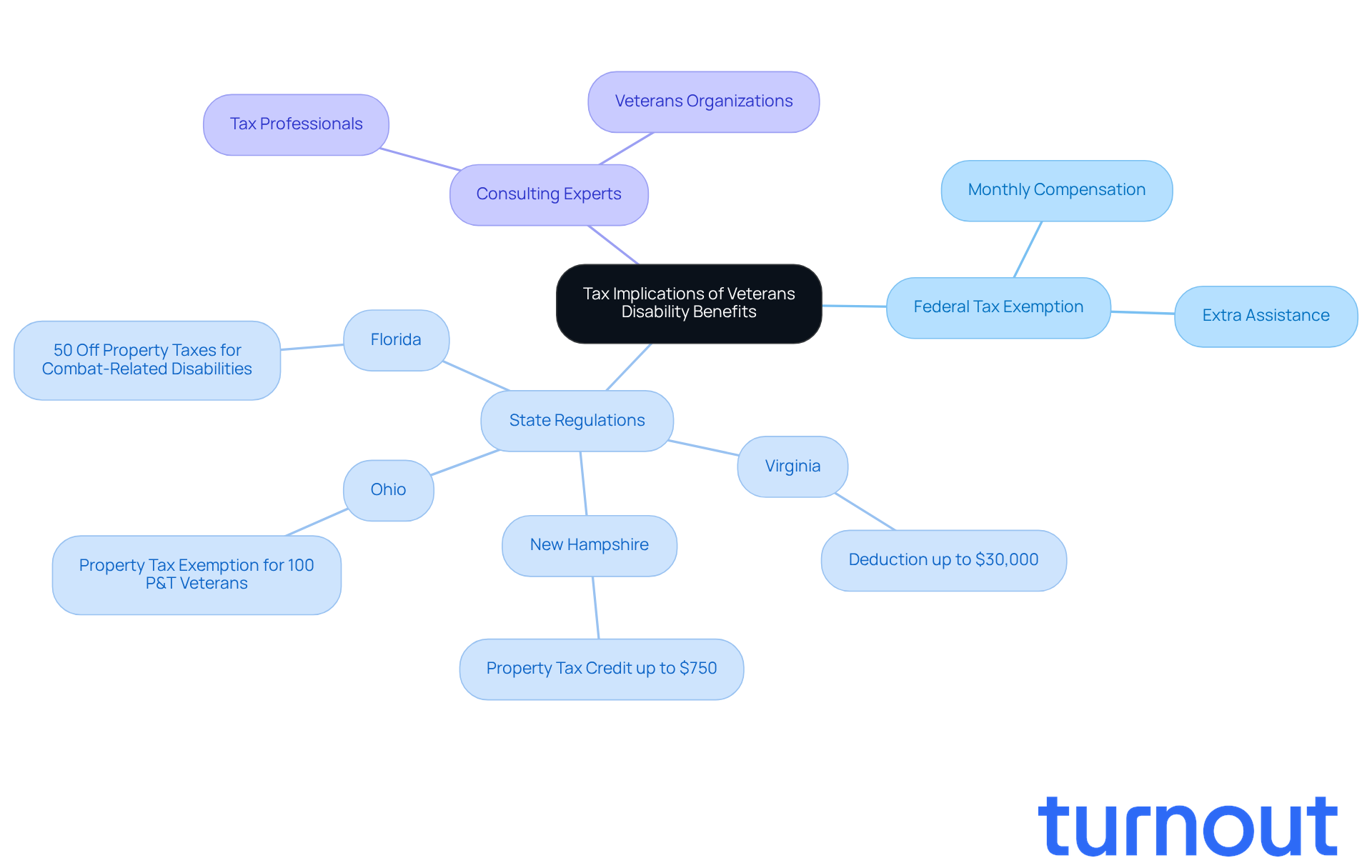

If you're a former military member, you might be relieved to know that when considering whether veterans disability benefits are taxable, assistance payments are typically free from federal income tax. This means you don’t have to declare these payments as income on your tax returns. It is important to know whether veterans disability benefits are taxable, as both monthly compensation payments and any extra assistance for service-connected disabilities fall under this tax-exempt status. According to IRS guidelines, the question of whether veterans disability benefits are taxable is clarified, as these benefits aren’t considered gross income, allowing you to keep the full amount of your compensation without worrying about tax deductions.

However, it’s important to note that while the federal government doesn’t tax these benefits, some states have different rules. For instance, Virginia allows military retirees to deduct up to $30,000 of retirement or survivor payments from taxable income in 2024. Meanwhile, New Hampshire offers property tax credits for those who served. We understand that navigating these regulations can be overwhelming, so it’s wise to consult local tax laws or a tax expert to ensure you’re maximizing your benefits.

Understanding these tax implications is crucial for effective financial planning. It empowers you to fully utilize the support available to you. Real-world examples show just how significant this knowledge can be. For example, former service members who secured a higher compensation rate may qualify for federal tax refunds if they file amended returns.

Interacting with tax experts can provide you with personalized guidance, helping you manage the complexities of tax regulations efficiently. Remember, you’re not alone in this journey; we’re here to help you navigate these important financial matters.

Variations and Eligibility for Veterans Disability Benefits

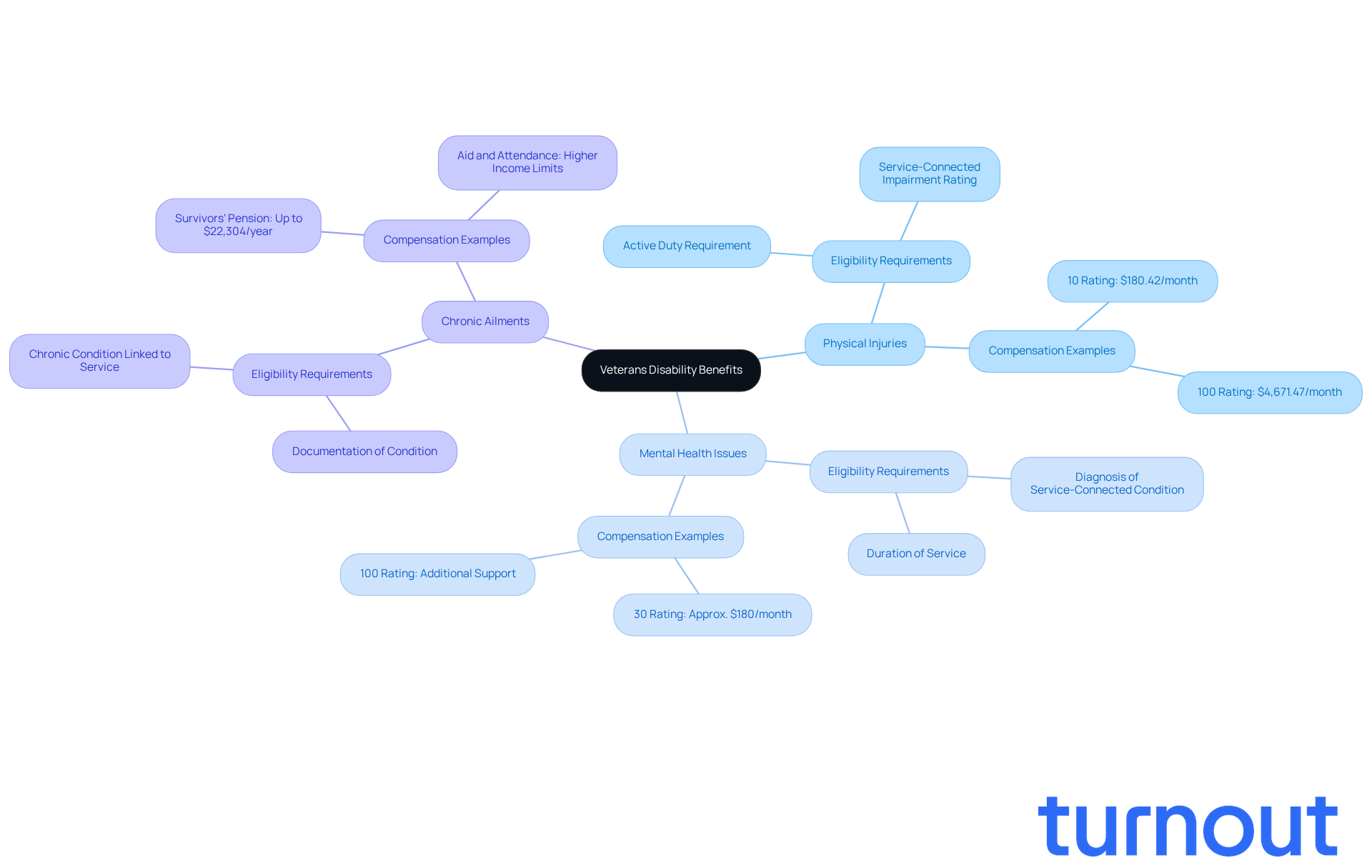

Navigating the world of military personnel's impairment assistance can feel overwhelming. We understand that many former service members face challenges when seeking the support they deserve. Qualification hinges on several key factors, such as the type of impairment, duration of service, and discharge status. To qualify, you must have served on active duty and have a current impairment linked to your military service.

The VA categorizes impairments into various groups, including:

- Physical injuries

- Mental health issues

- Chronic ailments

Each category has specific eligibility requirements for assistance. For example, if you have a service-connected impairment rating of 10% or greater, you’re entitled to monthly compensation. Those rated at 100% may access additional support, including housing assistance and educational aid.

Looking ahead, it’s estimated that around 5 million former service members will seek support for service-related disabilities in 2026. This highlights the importance of understanding these distinctions as you navigate the application process. Real-world examples show that veterans rated at 30% might receive monthly compensation of about $180.42, while those at 100% could see payments exceeding $4,671.47. Understanding whether veterans disability benefits are taxable is crucial for securing the benefits you rightfully deserve.

At Turnout, we’re here to help. We provide tools and services designed to assist veterans in navigating these complex processes. Our trained nonlawyer advocates are ready to support you with SSD claims, and we collaborate with IRS-licensed enrolled agents for tax debt relief. You’re not alone in this journey; we’re committed to ensuring you receive the guidance you need without the necessity of legal representation.

Conclusion

Veterans disability benefits are more than just financial support; they are a vital lifeline for those who have served our country. If you’re a veteran grappling with the effects of service-related injuries or illnesses, understanding these benefits is essential. It’s not just about the money; it’s about ensuring you receive the full support you deserve.

We understand that navigating the complexities of these benefits can feel overwhelming. That’s why it’s important to know that at the federal level, these benefits are tax-exempt. However, state regulations can vary, and being aware of eligibility criteria and the application process is crucial. Real-world examples show how this knowledge can lead to better financial outcomes, including potential federal tax refunds for those qualifying for higher compensation rates.

Ultimately, the significance of veterans disability benefits extends far beyond financial aid. They play a crucial role in fostering recovery and helping you reintegrate into civilian life. Remember, you’re not alone in this journey. We encourage you to seek out resources and expert guidance to navigate these complexities effectively. By doing so, you can fully leverage the support available to you, enhancing your overall well-being and quality of life. You deserve this support, and we’re here to help.

Frequently Asked Questions

What are Veterans Disability Benefits?

Veterans Disability Benefits are financial support provided by the Department of Veterans Affairs (VA) to service members facing challenges due to injuries or illnesses sustained during active military duty.

Who can receive Veterans Disability Benefits?

Millions of former service members are eligible to receive these benefits, which are designed for those who have sustained impairments during their military service.

How does the VA determine the amount of benefits a veteran receives?

The VA uses a rating system that ranges from 0% to 100% to assess the severity of a veteran's disabilities, ensuring that assistance is proportional to the degree of impairment.

Why are Veterans Disability Benefits important?

These benefits are crucial for maintaining a quality of life after military service and providing financial stability for veterans and their families.

What should veterans do if they need assistance with their benefits?

Veterans facing challenges are encouraged to seek support and explore their options to ensure they receive the benefits they deserve.