Overview

We understand that navigating the complexities of legal fees can be overwhelming. It's important to know that legal fees can be tax deductible when they are directly related to business operations. These expenses are considered ordinary and necessary for generating income, which can provide some relief.

On the other hand, personal legal expenses, such as those arising from divorce or personal disputes, are typically not deductible. This distinction can be significant, and it’s common to feel confused about what qualifies.

We’re here to help you understand these differences and guide you through your options. Remember, you are not alone in this journey.

Introduction

Navigating the complexities of tax deductibility can feel overwhelming, especially when it comes to understanding legal fees. We understand that distinguishing between business and personal legal expenses can significantly impact your financial strategies and tax obligations. This article will explore whether legal fees are tax deductible, highlighting the criteria that separate deductible business costs from non-deductible personal expenses.

As you strive to optimize your tax situation, remember: you are not alone in this journey. Together, we can navigate these regulations to ensure compliance while maximizing your potential deductions.

Understanding Tax Deductibility of Legal Fees

Navigating the tax deductibility of professional expenses can feel overwhelming. We understand that this is a complex area, governed by specific IRS guidelines that can leave many feeling uncertain. Generally, if professional costs are considered ordinary and necessary expenses incurred during your operations, then these expenses are legal fees tax deductible. This means that if these costs are directly linked to generating income or protecting your business interests, it is important to understand whether they are legal fees tax deductible and could qualify for deductions.

However, it’s important to recognize that personal expenses, such as those arising from divorce or personal conflicts, typically do not qualify for deductions. Understanding these distinctions is crucial for you to maximize your deductions while ensuring compliance with tax regulations. Remember, you are not alone in this journey; many face similar challenges. By familiarizing yourself with these guidelines, you can take proactive steps toward your financial well-being.

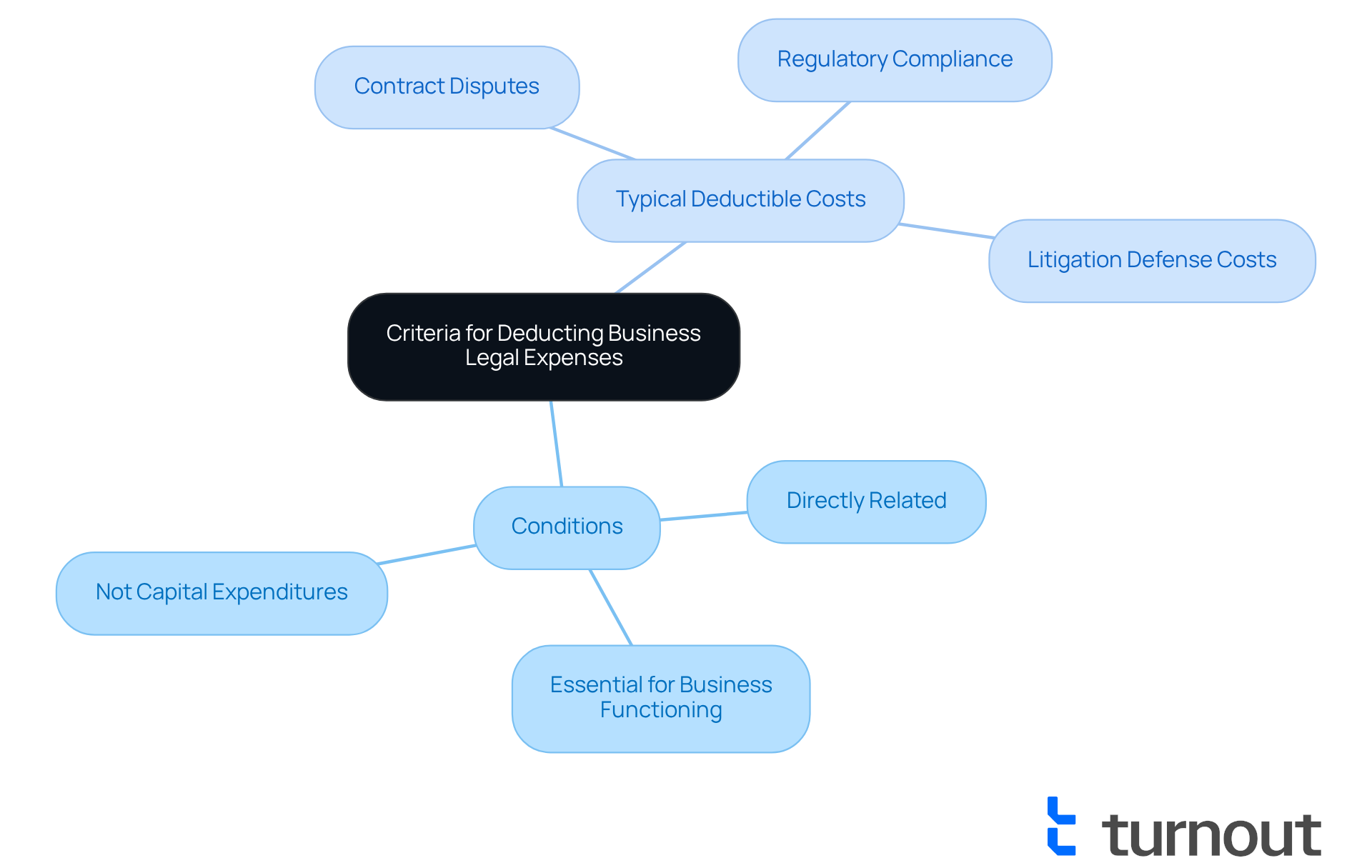

Criteria for Deducting Business Legal Expenses

We understand that navigating tax reductions can be challenging. To qualify, it's important to know that operational costs must meet specific conditions. They need to be directly related to your business, essential for its functioning, and not classified as capital expenditures.

Typical deductible costs include:

- Expenses for contract disputes

- Compliance with regulations

- Various legal matters, which are legal fees tax deductible that impact your organization directly

It's common to feel overwhelmed by legal complexities, but remember that costs incurred while defending against litigation related to your business activities are legal fees tax deductible.

Keeping thorough documentation of these expenses is crucial. This not only validates your claims during tax submissions but also provides peace of mind. You're not alone in this journey; we're here to help you navigate these requirements and ensure that you can take full advantage of available tax reductions.

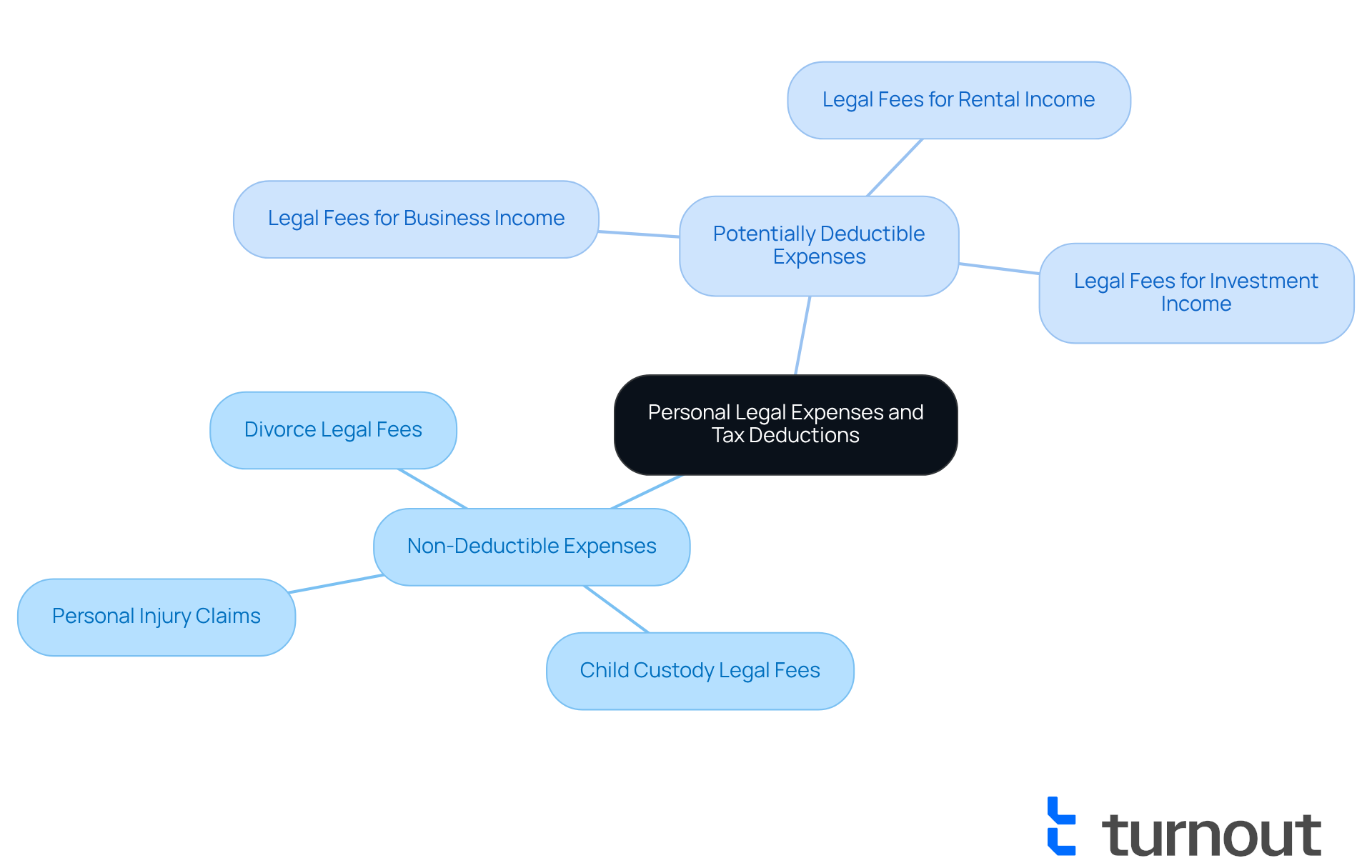

Conditions for Deducting Personal Legal Expenses

Navigating personal legal costs can be overwhelming, and it’s important to understand if legal fees are tax deductible under tax regulations. Typically, personal legal costs, such as those related to divorce, child custody, or personal injury claims, are not deductible, which raises the question of whether legal fees are tax deductible. The IRS sees these expenses as personal in nature, which means they don’t qualify for tax deductions.

However, it is important to understand whether legal fees are tax deductible. Certain personal expenses incurred in the generation or collection of taxable income, such as those that are legal fees tax deductible, may be deductible. We understand that this can be confusing, and it’s common to feel uncertain about your specific situation. That’s why it’s crucial to consult with a tax professional who can guide you through these nuances.

Remember, you are not alone in this journey. Seeking help can make a significant difference in understanding your options and ensuring you are making the most informed decisions. We're here to help you navigate these challenges.

Comparative Summary of Business vs. Personal Legal Fee Deductions

In summary, we understand that navigating if professional fees are legal fees tax deductible can be challenging. It's important to recognize that these costs vary significantly between commercial and personal contexts. Typically, expenses associated with operations are deductible if they are usual, essential, and directly linked to your organizational activities. However, it is important to note that personal legal expenses are usually not deductible, raising the question of whether are legal fees tax deductible, with only a few exceptions.

This distinction is crucial for you to understand, as it can greatly influence your overall tax strategy and financial planning. By maintaining accurate records and familiarizing yourself with the criteria for deductions, you can navigate the complexities of tax law more effectively. Remember, you're not alone in this journey, and we're here to help you every step of the way.

Conclusion

Understanding the tax deductibility of legal fees is crucial for both individuals and businesses aiming to optimize their financial situations. We understand that navigating these regulations can feel overwhelming, especially when distinguishing between business and personal legal expenses. This distinction is vital, as it directly impacts what can be claimed as a deduction.

Legal fees incurred for business operations are generally deductible, but personal legal expenses, particularly those related to personal matters, usually do not qualify. It's common to feel uncertain about these rules, but knowing that business legal fees must be ordinary, necessary, and directly related to income-generating activities to be deductible can help clarify the situation.

On the other hand, personal legal fees are typically non-deductible unless they relate to the generation of taxable income. Maintaining meticulous records is essential, and we encourage you to consult with tax professionals who can guide you through these complex regulations effectively.

Ultimately, understanding the nuances of legal fee deductions can significantly influence your tax strategies and financial planning. By being informed and proactive, you can ensure compliance while maximizing your potential deductions. Remember, as tax laws evolve, staying updated on the criteria for deductible legal fees is vital for making informed financial decisions. You are not alone in this journey; we're here to help you navigate these complexities.

Frequently Asked Questions

What are legal fees tax deductible?

Legal fees are tax deductible if they are considered ordinary and necessary expenses incurred during business operations and are directly linked to generating income or protecting business interests.

Are all legal fees deductible?

No, personal expenses, such as those arising from divorce or personal conflicts, typically do not qualify for deductions.

Why is it important to understand the tax deductibility of legal fees?

Understanding the tax deductibility of legal fees is crucial for maximizing your deductions while ensuring compliance with tax regulations.

Who can benefit from understanding legal fees tax deductibility?

Anyone navigating the complexities of tax regulations related to professional expenses can benefit, as many face similar challenges in this area.