Introduction

Navigating the complexities of disability insurance payments can feel overwhelming, especially when it comes to understanding taxation. We know that as you plan for your financial future, it’s essential to determine whether these benefits are taxable. What if the source of your premium payments changes? Or what if you have additional income to consider?

This article aims to shed light on the intricacies of disability insurance tax obligations. We’re here to help you manage your financial responsibilities with confidence. Together, we’ll explore the key aspects of taxation related to disability benefits, ensuring you feel informed and empowered in your decision-making.

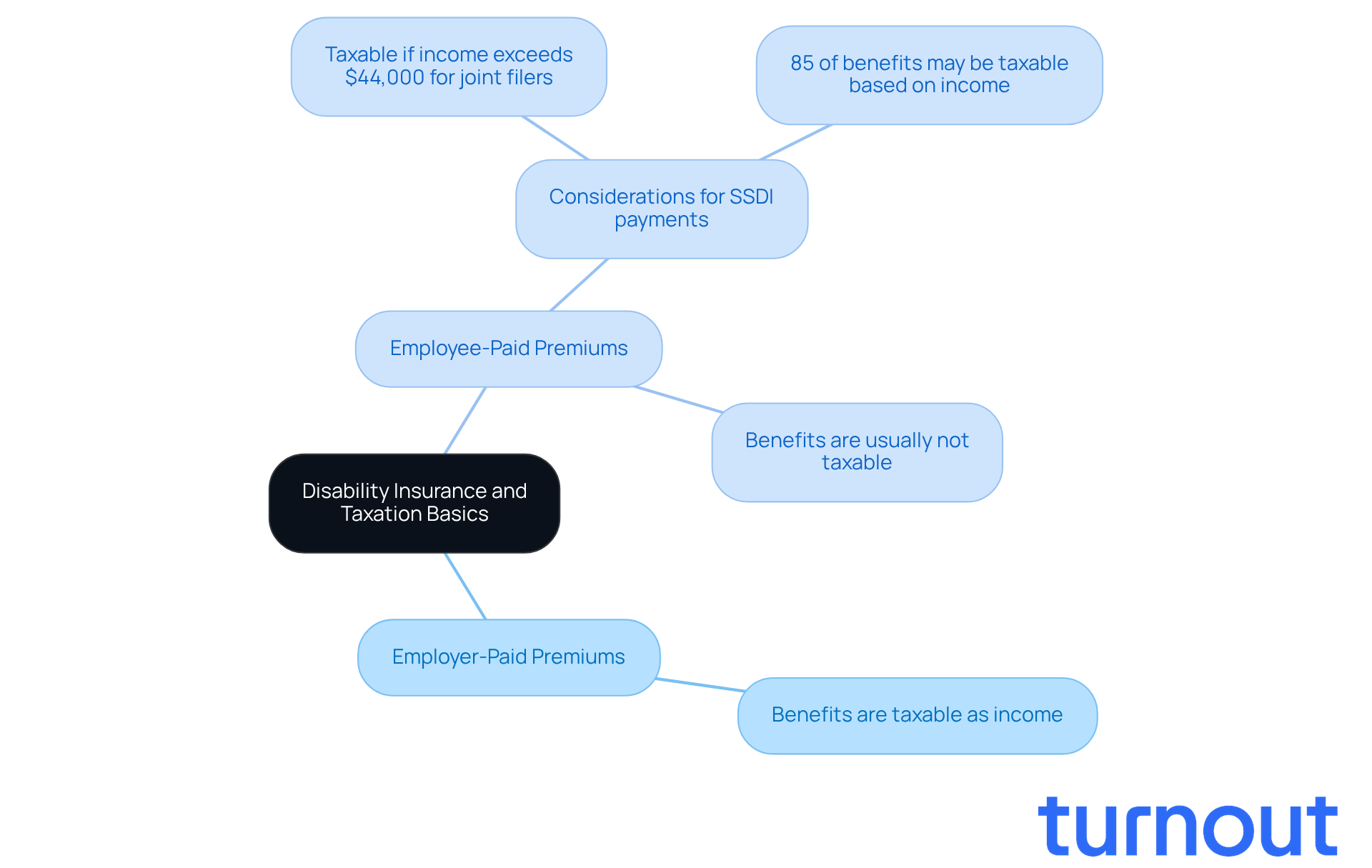

Clarify Disability Insurance and Taxation Basics

Disability insurance is designed to replace a portion of your earnings if you find yourself unable to work due to illness or injury. We understand that navigating these benefits can be overwhelming, particularly regarding the question of whether disability insurance payments are taxable. It is crucial for your financial planning to know if and how disability insurance payments are taxable.

Generally, the taxability of disability benefits hinges on how the premiums were paid:

- Employer-Paid Premiums: If your employer covers the premiums, the benefits you receive are typically taxable as income.

- Employee-Paid Premiums: If you pay the premiums with after-tax dollars, the question of whether disability insurance payments are taxable arises, and generally, the benefits are usually not taxable.

It's important to remember that when considering if disability insurance payments are taxable, the IRS views these payments as earnings. This means they may be subject to federal taxation based on your overall income, especially regarding the question of whether disability insurance payments are taxable. For instance, Mark Debofsky notes, 'The tax status of impairment payments raises the question of whether disability insurance payments are taxable, as it relies on their origin and the method of premium payment.' If you have significant additional earnings, you might find that a portion of your Social Security Disability Insurance (SSDI) payments becomes taxable, particularly if your total earnings exceed $44,000 for joint filers, where 85% of the payments may be subject to tax.

Familiarizing yourself with these basics will empower you to navigate your tax obligations effectively, especially regarding if and when disability insurance payments are taxable. Remember, submitting a tax return for support payments is essential to ensure you meet your tax responsibilities. You're not alone in this journey; we're here to help you understand and manage your financial future.

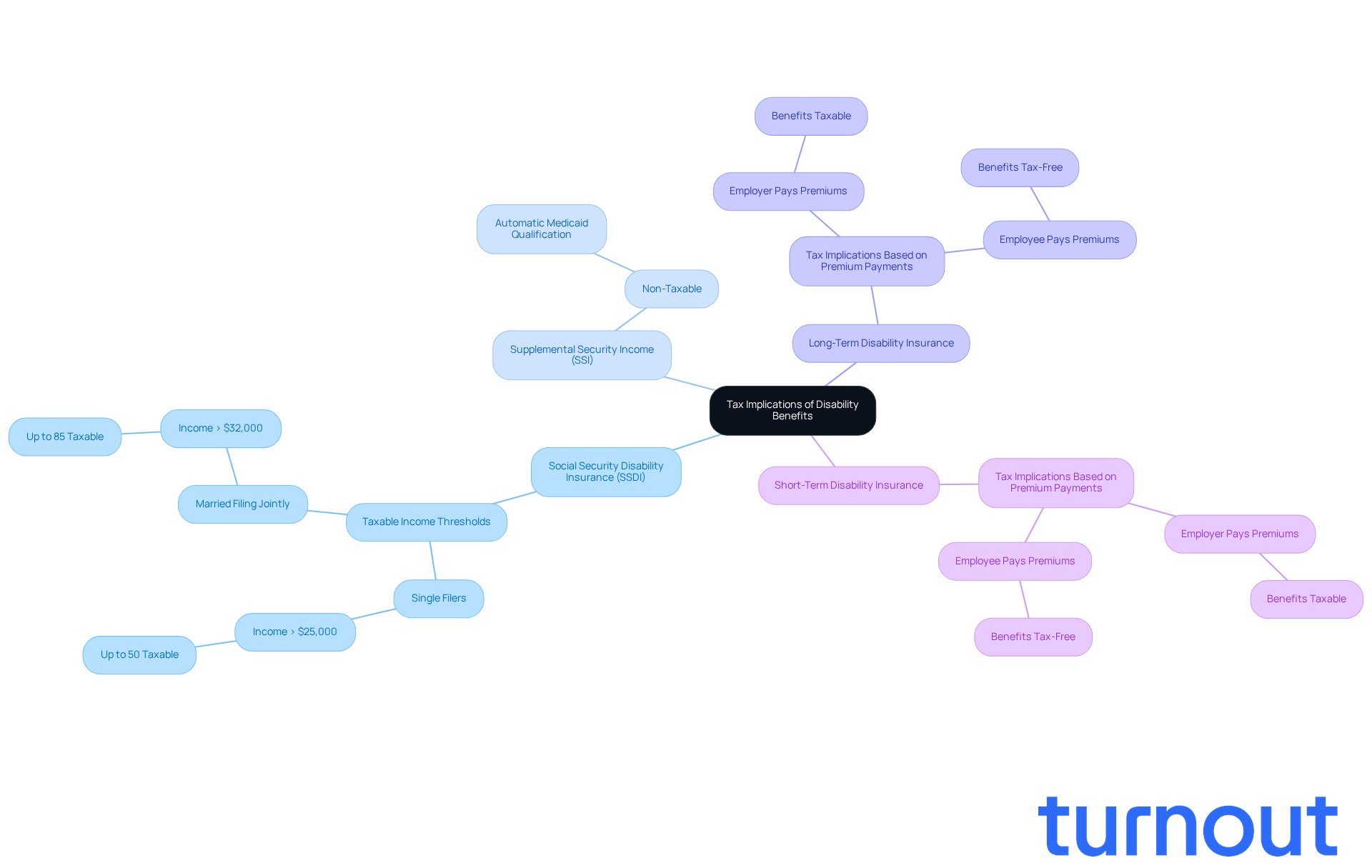

Examine Tax Implications of Different Disability Benefits

Navigating the world of disability benefits can feel overwhelming, particularly when it involves understanding if are disability insurance payments taxable. We know that many of you are seeking clarity on how these benefits affect your financial situation. Let’s break it down together.

-

Social Security Disability Insurance (SSDI): If you’re receiving SSDI, it’s important to understand if are disability insurance payments taxable when your total earnings exceed certain thresholds. For individual filers, if your overall earnings go beyond $25,000, up to 50% of your SSDI payments could be taxable. For married couples filing jointly, the limit is set at $32,000. If your combined earnings exceed this, up to 85% of your benefits may be subject to tax. Remember, the IRS states that Social Security payments, including SSDI, raise the question of whether are disability insurance payments taxable based on your income and filing status.

-

Supplemental Security Income (SSI): On a brighter note, SSI payments are not taxable. This program is designed to support low-income individuals, ensuring that you don’t face additional tax burdens. Plus, if you’re receiving SSI, you may automatically qualify for Medicaid assistance, which can be a huge relief.

-

Long-Term Disability Insurance: The tax implications here depend on who pays the premiums. If your employer covers the premiums, those benefits are taxable. However, if you pay the premiums with after-tax dollars, you can generally enjoy tax-free benefits.

-

Short-Term Disability Insurance: Similar to long-term disability, the tax implications hinge on who pays the premiums. If your employer pays, the benefits are taxable; if you pay for them, they’re usually not taxable.

Understanding these distinctions is crucial for accurately reporting your earnings and clarifying whether are disability insurance payments taxable to avoid unexpected tax liabilities. For instance, if you’re a single SSDI recipient receiving $2,000 monthly and an additional $1,000 from part-time work, you won’t owe taxes as long as your total earnings stay under the $25,000 limit. Conversely, a married couple with total earnings exceeding $44,000 might find that up to 85% of their SSDI payments are taxable.

We encourage you to consult with a financial advisor for personalized insights into your situation, especially regarding SSI tax status and implications. As financial advisor Merryl Jones wisely points out, "It's essential to comprehend how these advantages interact with your overall tax situation to prevent surprises during tax season." Remember, you’re not alone in this journey; we’re here to help.

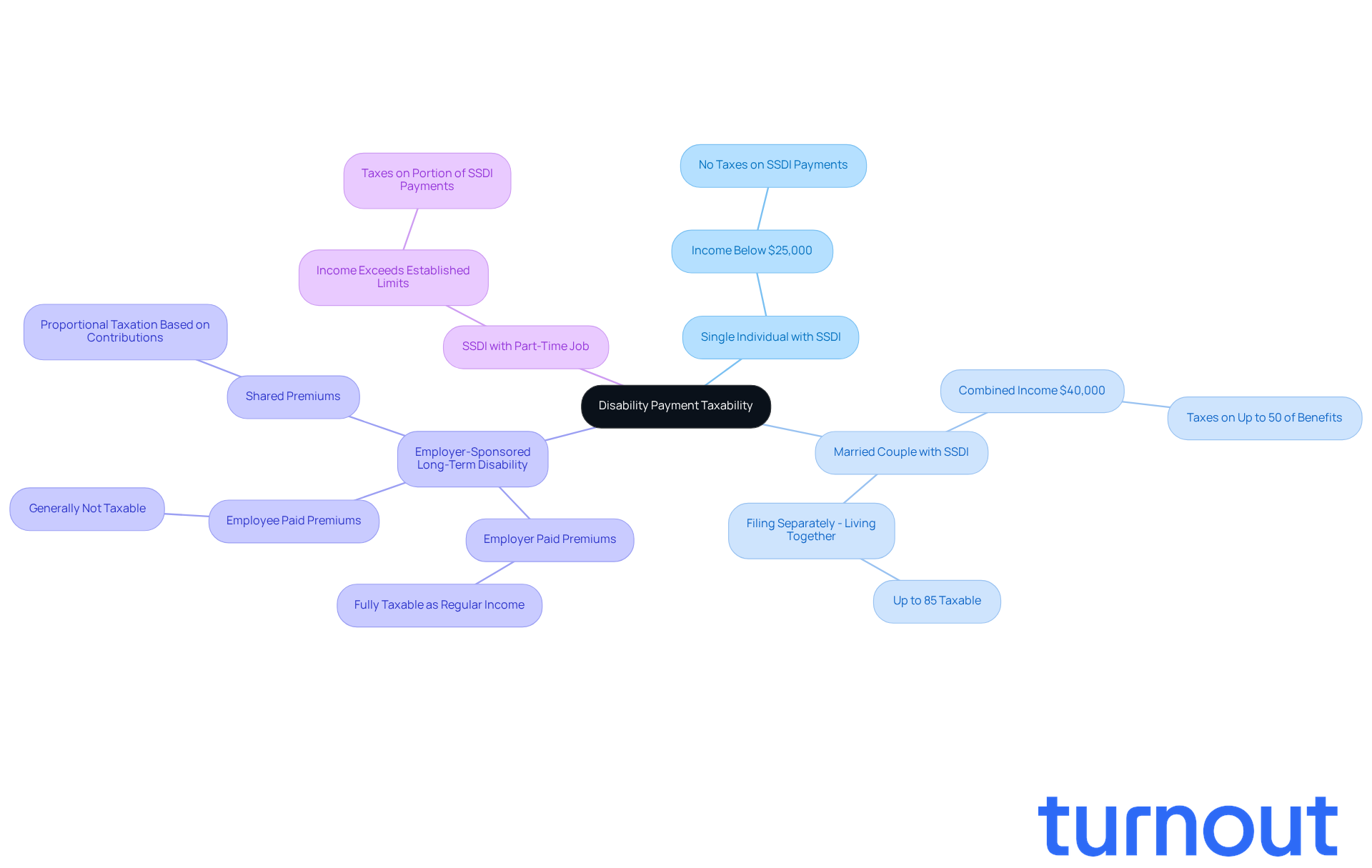

Analyze Scenarios Affecting Disability Payment Taxability

Understanding how various factors affect whether or not disability insurance payments are taxable can feel overwhelming. Let’s break it down with some relatable scenarios:

- Scenario 1: Imagine a single individual receiving SSDI benefits without any additional income. If their total earnings remain below $25,000, they won’t have to worry about taxes on their SSDI payments.

- Scenario 2: Now, consider a married couple whose combined earnings reach $40,000, including SSDI assistance. In this case, they might be responsible for taxes on up to 50% of their benefits, as their earnings exceed the $32,000 threshold.

- Scenario 3: Think about someone receiving long-term disability support from an employer-sponsored policy. Since the employer covered the premiums, these benefits are fully taxable as regular income.

- Scenario 4: Lastly, picture a person who receives both SSDI and income from a part-time job. If their total earnings go beyond the established limits, they may face taxes on a portion of their SSDI payments.

These scenarios highlight the importance of evaluating your overall earnings and understanding if disability insurance payments are taxable. We understand that navigating these tax responsibilities can be challenging, but you’re not alone in this journey. By staying informed, you can better manage your financial situation and ensure you’re prepared for any tax implications.

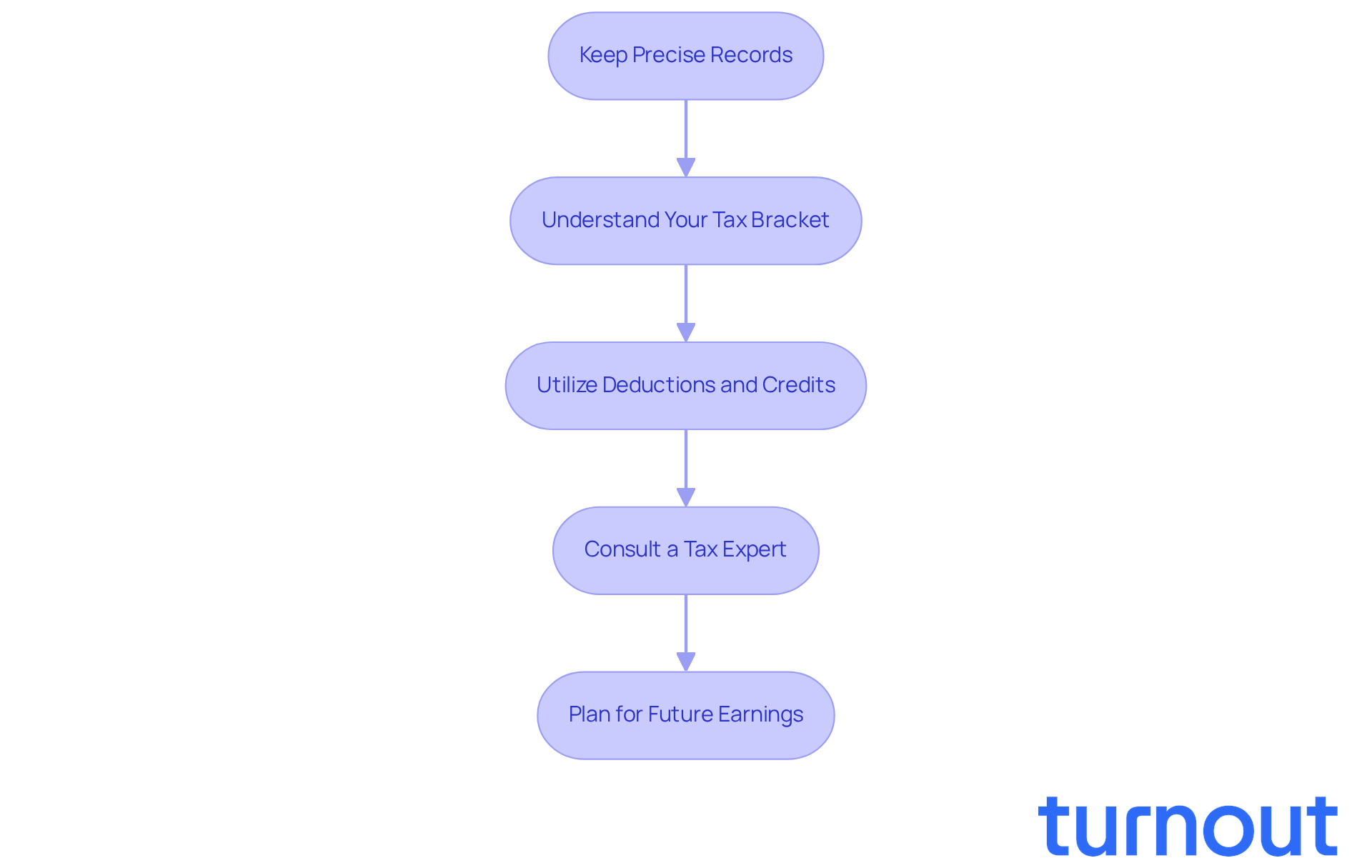

Implement Strategies for Managing Disability Tax Liabilities

Managing tax liabilities related to disability benefits can feel overwhelming, especially when considering if disability insurance payments are taxable, but you’re not alone in this journey. Here are some caring strategies to help you navigate this process:

-

Keep Precise Records: It’s essential to maintain detailed records of all your income sources, including disability benefits. This practice not only ensures compliance but also helps you maximize potential deductions. Remember, every little detail counts!

-

Understand Your Tax Bracket: Familiarizing yourself with your tax bracket can help you anticipate your tax liability and plan accordingly. For instance, if you find yourself in the highest 37% bracket, be aware that new restrictions on itemized deductions will come into play in 2026. This change could decrease your allowable deductions by about 5.41% of the lower of total itemized deductions or taxable earnings in that bracket. Understanding this can significantly impact your overall tax strategy.

-

Utilize Deductions and Credits: Explore the tax deductions and credits available to you, such as medical expenses or the Earned Income Tax Credit (EITC). Starting in 2026, all taxpayers can claim an above-the-line deduction for charitable donations up to $1,000 for individuals and $2,000 for married couples filing jointly, even if they don’t itemize. This can be a great way to reduce your taxable income.

-

Consult a Tax Expert: Navigating the complexities of tax regulations can be daunting. Consulting with a tax expert can provide you with tailored advice that suits your unique situation. Many individuals pursuing disability assistance often seek to understand whether disability insurance payments are taxable, and they find that professional guidance is invaluable in clarifying their obligations and optimizing their tax situations. Remember, you don’t have to do this alone.

-

Plan for Future Earnings: If you anticipate changes in your income, like returning to work, it’s wise to plan ahead. Understanding how these changes may affect your tax situation is crucial. For example, if your income exceeds certain thresholds, your deductions might be limited, which means you may need to adjust your financial planning.

By implementing these strategies, you can better manage your tax liabilities and ensure compliance with tax regulations. We’re here to help you secure a more stable financial future.

Conclusion

Understanding the tax implications of disability insurance payments is crucial for your financial well-being. We know that navigating these waters can be overwhelming, but recognizing how premium payments-whether made by employers or employees-affect the taxability of benefits is key. This knowledge can significantly shape your financial decisions, helping you prepare for any tax liabilities that may arise.

Let’s break it down. There’s a difference between SSDI, SSI, long-term, and short-term disability benefits, each carrying its own tax implications based on how premiums are paid. For example, SSDI payments might be taxable depending on your total earnings, while SSI benefits remain untaxed, offering some relief for those with lower incomes. It’s important to understand how your income level can influence your tax responsibilities, and we’ll share practical scenarios to clarify these points.

Staying informed about your tax obligations related to disability benefits is essential. We encourage you to implement strategies that can ease this process. Keeping accurate records, consulting with tax experts, and planning for future earnings can help you navigate the complexities of tax regulations. By taking these proactive steps, you can secure a more stable financial future while ensuring you meet your tax responsibilities.

Remember, you’re not alone in this journey. We’re here to help you understand and manage these challenges. Together, we can work towards a brighter financial outlook.

Frequently Asked Questions

What is the purpose of disability insurance?

Disability insurance is designed to replace a portion of your earnings if you are unable to work due to illness or injury.

Are disability insurance payments taxable?

The taxability of disability insurance payments depends on how the premiums were paid. If your employer pays the premiums, the benefits are typically taxable. If you pay the premiums with after-tax dollars, the benefits are usually not taxable.

How does the IRS view disability insurance payments?

The IRS views disability insurance payments as earnings, which means they may be subject to federal taxation based on your overall income.

What factors can affect the taxability of Social Security Disability Insurance (SSDI) payments?

If you have significant additional earnings, a portion of your SSDI payments may become taxable, especially if your total earnings exceed $44,000 for joint filers, where up to 85% of the payments may be subject to tax.

Why is it important to understand the tax implications of disability insurance?

Understanding the tax implications is crucial for effective financial planning and ensuring you meet your tax obligations regarding disability insurance payments.

What should you do regarding tax returns for disability insurance payments?

It is essential to submit a tax return for support payments to ensure you meet your tax responsibilities.