Overview

Understanding attorney fees can be overwhelming, especially when it comes to tax deductions. We know that navigating these financial waters can be challenging. The good news is that attorney fees may be tax deductible if they relate to income-generating activities or business operations. However, personal legal expenses typically don’t qualify for these deductions.

It’s essential to grasp the differences between what is deductible and what isn’t. Tax laws, like the Tax Cuts and Jobs Act of 2017, have changed how these deductions can be claimed. This can feel confusing, but you’re not alone in this journey. Many people share your concerns, and it’s perfectly normal to seek clarity.

By understanding these distinctions, you can make informed decisions that benefit your financial situation. Remember, we’re here to help you navigate these complexities. If you have questions or need assistance, don’t hesitate to reach out. You deserve to feel confident about your financial choices.

Introduction

Navigating the financial implications of legal services can feel overwhelming, especially when it comes to attorney fees. We understand that costs can vary widely based on location and the complexity of your case, leaving many individuals wondering if these expenses are tax deductible. This article aims to shed light on the intricacies of attorney fees, clarifying what can and cannot be deducted. By understanding these tax rules, you can uncover potential benefits that may ease your financial burden.

As tax regulations continue to evolve, it’s common to feel uncertain about how to maximize your financial advantages. How can you navigate the complexities of attorney fees while avoiding common pitfalls? We’re here to help you find clarity and confidence in this journey.

Define Attorney Fees and Their Purpose

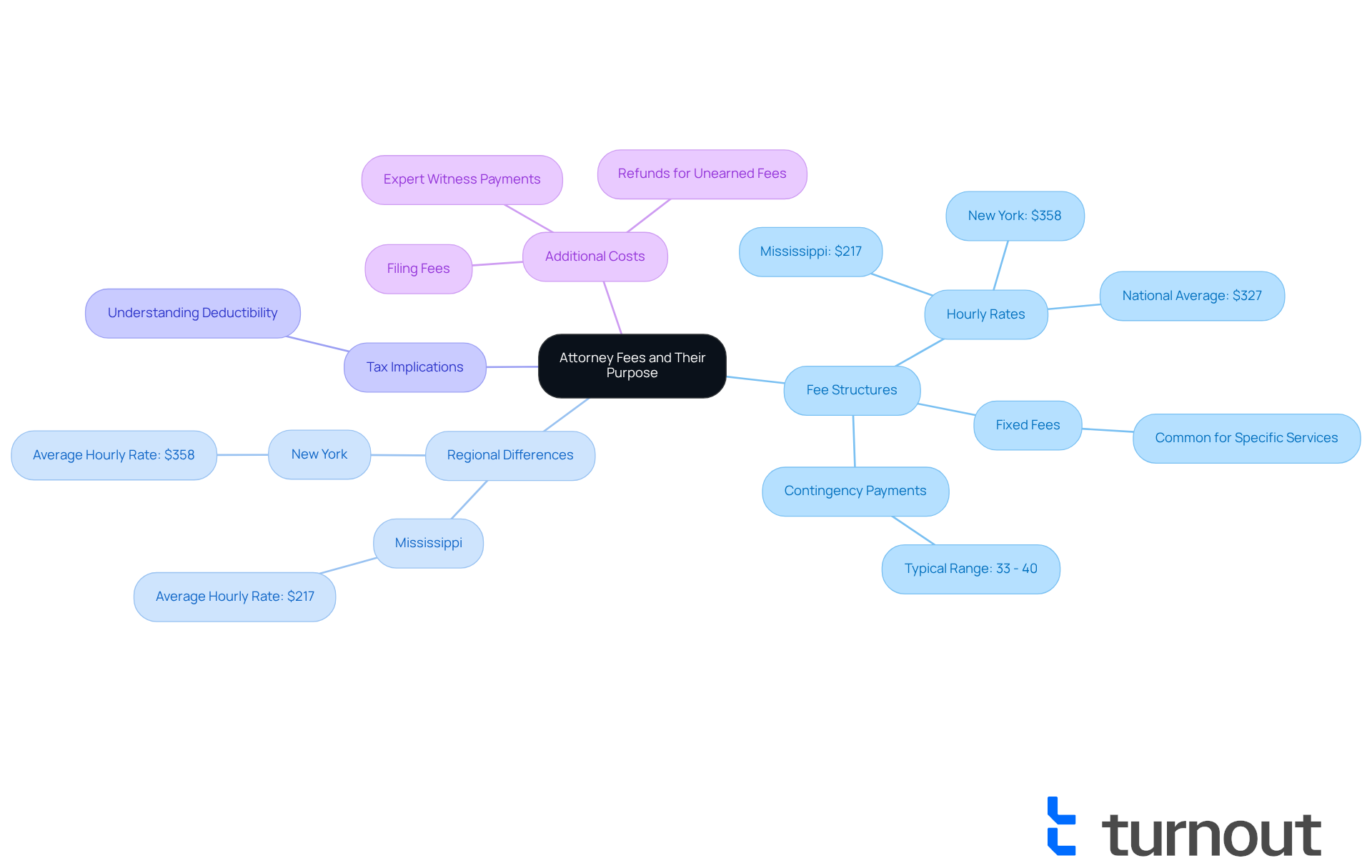

Navigating the costs of professional advisory services can feel overwhelming, especially when you’re already facing challenges. Charges can vary significantly based on the complexity of your case, the expertise of the provider, and the fee arrangement you agree upon. Common payment structures include:

- Hourly rates

- Fixed fees for specific services

- Contingency payments, where you only pay if you achieve a successful outcome

For instance, in 2025, the typical hourly rate for professional services ranges from $217 in Mississippi to $358 in New York, with a national average of $327 per hour. This highlights how regional differences can affect costs, influenced by local supply and demand. Contingency fees usually fall between 33% to 40% of the recovery amount, making them a popular choice when upfront costs might be too high.

Understanding these fee structures is essential for you, as they can significantly impact whether or not attorney fees are tax deductible when pursuing legal actions or claims for benefits. We understand that transparency around charges is crucial. Clients should be aware of potential additional costs, like filing fees or payments for expert witnesses, that may arise during the process.

Moreover, if you decide to discontinue the service provider's assistance during your case, it’s important to know about the possibility of refunds for unearned fees. By grasping the nuances of these fee arrangements, you can make informed decisions that align with your financial situation. Remember, you are not alone in this journey; we’re here to help you navigate these complexities.

Identify Conditions for Tax Deductibility of Attorney Fees

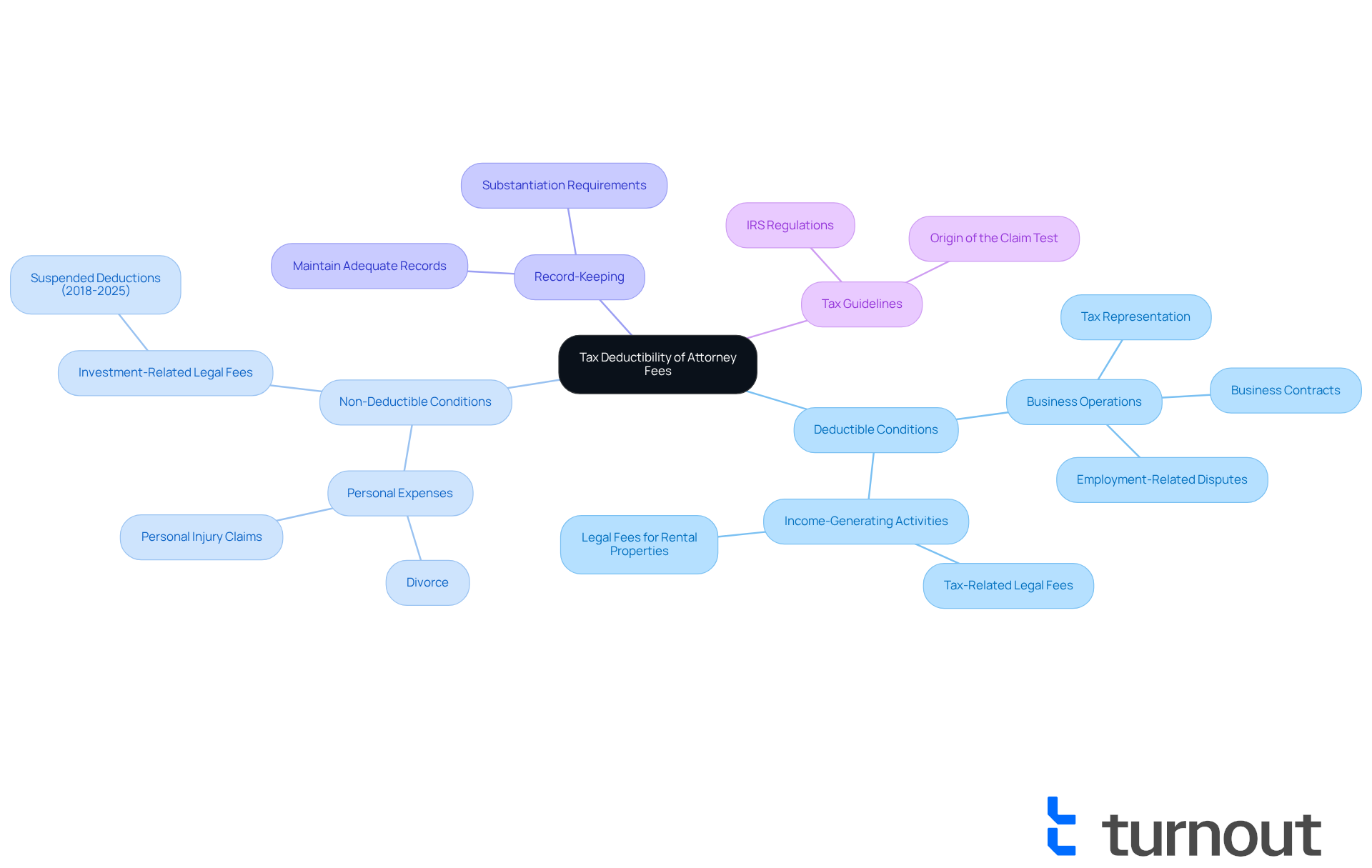

Navigating whether attorney fees are tax deductible can feel overwhelming, and we understand that. It's important to know that costs incurred while pursuing income-generating activities or business operations, including whether attorney fees are tax deductible, may be deductible. For instance, if you’re dealing with job conflicts or seeking tax guidance, you may wonder, are attorney fees tax deductible, as these costs can often be claimed as reductions, especially when they relate to retrieving taxable income.

However, it’s essential to recognize that personal expenses, like those from divorce or personal injury claims, typically don’t qualify for tax relief. Keeping precise records and referring to tax guidelines is crucial in assessing your eligibility for reductions.

As we look ahead to 2025, the requirements for deducting legal costs remain strict. Interestingly, around 20% of taxpayers indicate such subtractions on their returns. The 'origin of the claim' test, established in United States v. Gilmore, plays a vital role in determining the deductibility of these charges.

It’s also important to note that various specified deductions have been halted for tax years 2018 to 2025, which affects the deductibility of certain expenses. Understanding these nuances can be key to maximizing your potential tax benefits. Remember, you’re not alone in this journey; we’re here to help you navigate these complexities.

Differentiate Between Types of Deductible Legal Fees

Understanding if attorney fees are tax deductible can feel overwhelming, but we're here to help. It's important to know whether attorney fees are tax deductible, as these expenses can be classified based on their purpose. Charges related to your business, such as those from contract negotiations or defending against discrimination claims, raise the question of whether attorney fees are tax deductible. Even expenses for whistleblower protection claims may qualify. However, personal legal issues, such as estate planning or family law, usually aren't deductible. Recognizing these distinctions is crucial for maximizing your tax benefits, particularly in understanding whether attorney fees are tax deductible, while staying compliant with regulations.

Tax consultants emphasize the importance of meticulously recording all related expenses, particularly to determine if attorney fees are tax deductible. Keeping detailed invoices and proof of payment can substantiate your claims. For example, a customer from San Bernardino managed to deduct $500 of estate planning costs on their California return, even though these costs offered no federal tax advantage. This highlights the potential for state tax savings, especially for those facing significant legal expenses.

The Tax Cuts and Jobs Act of 2017 has also impacted the deductibility of professional service expenses, suspending many miscellaneous itemized allowances until at least 2026. Staying informed about changing tax regulations is essential for optimizing allowances tied to your business activities. As one tax specialist noted, "You can subtract costs that are typical and essential expenditures directly associated with the functioning of your business as a business expense." This underscores the importance of consulting knowledgeable professionals to effectively navigate the complexities of tax regulations, particularly to understand if and how attorney fees are tax deductible.

Looking ahead, there’s potential for the return of various itemized deductions in 2025, which could reinstate deductibility for certain estate planning costs. Keeping an eye on legislative changes is vital. Remember, you are not alone in this journey; seeking guidance can make a significant difference.

Examine Non-Deductible Legal Fees and Common Misconceptions

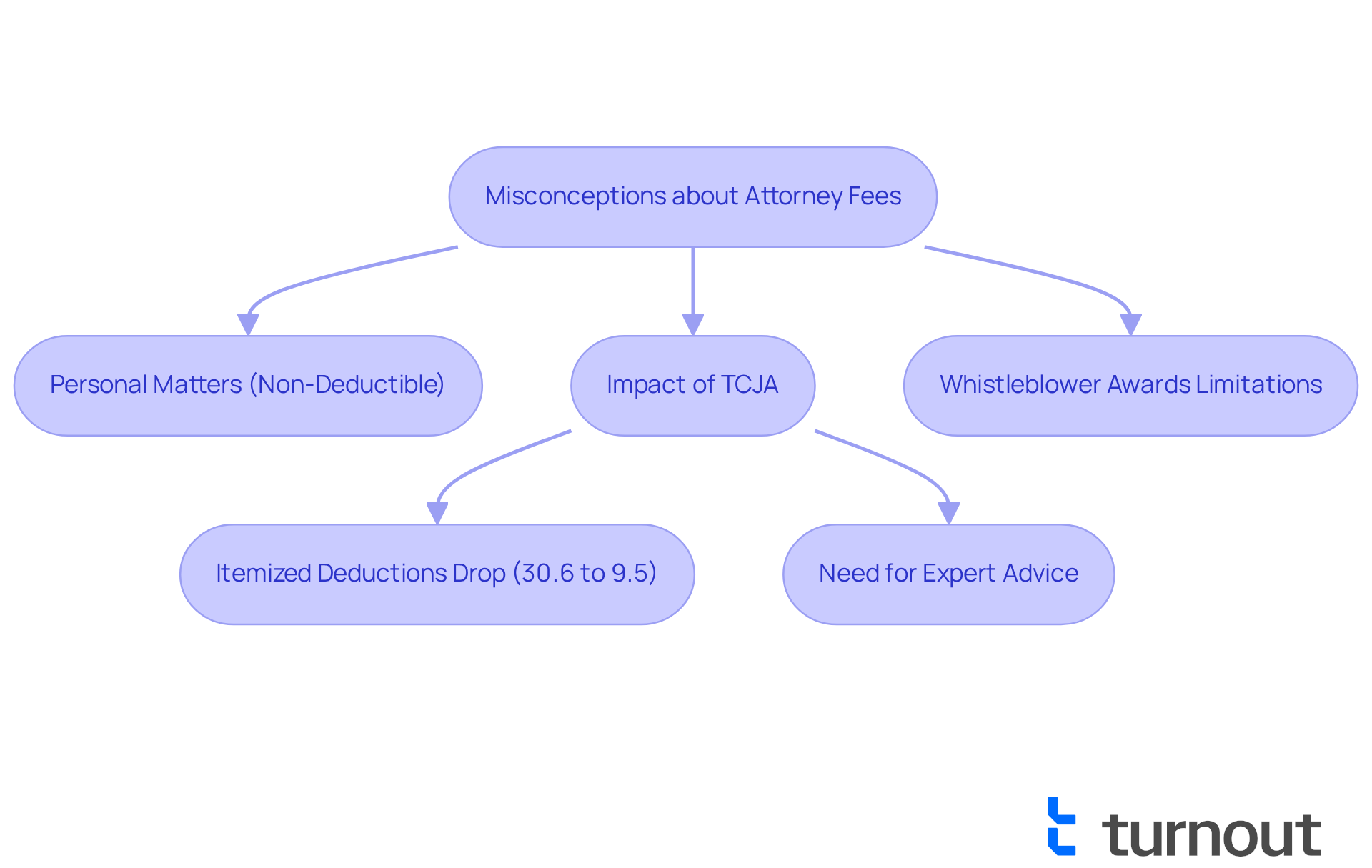

Many individuals mistakenly believe that attorney fees are tax deductible. We understand that navigating these financial waters can be confusing. Unfortunately, fees related to personal matters, like divorce or personal injury claims, are generally not deductible.

The Tax Cuts and Jobs Act of 2017 added to this complexity by removing many miscellaneous itemized allowances. This change has significant implications for consumers. For instance, the percentage of filers opting for itemized deductions dropped from 30.6% in 2017 to just 9.5% in 2022. This shift illustrates how the TCJA has altered taxpayer behavior.

Moreover, charges associated with whistleblower awards are limited to the amount reported in the person's earnings for that tax year. This means they are non-deductible beyond that limit. Tax experts emphasize the importance of understanding if attorney fees are tax deductible to avoid unexpected liabilities.

As one specialist pointed out, the modifications implemented by the TCJA have changed how charges are managed. It’s crucial to prepare meticulously if you might encounter non-deductible costs. We understand that this can feel overwhelming.

IRS recommendations are expected to clarify complex areas like professional expenses. It’s essential to seek advice when managing your tax responsibilities. Remember, you are not alone in this journey. We’re here to help you navigate these challenges and enhance your financial outcomes.

Practical Implications for Consumers Navigating Legal Fees

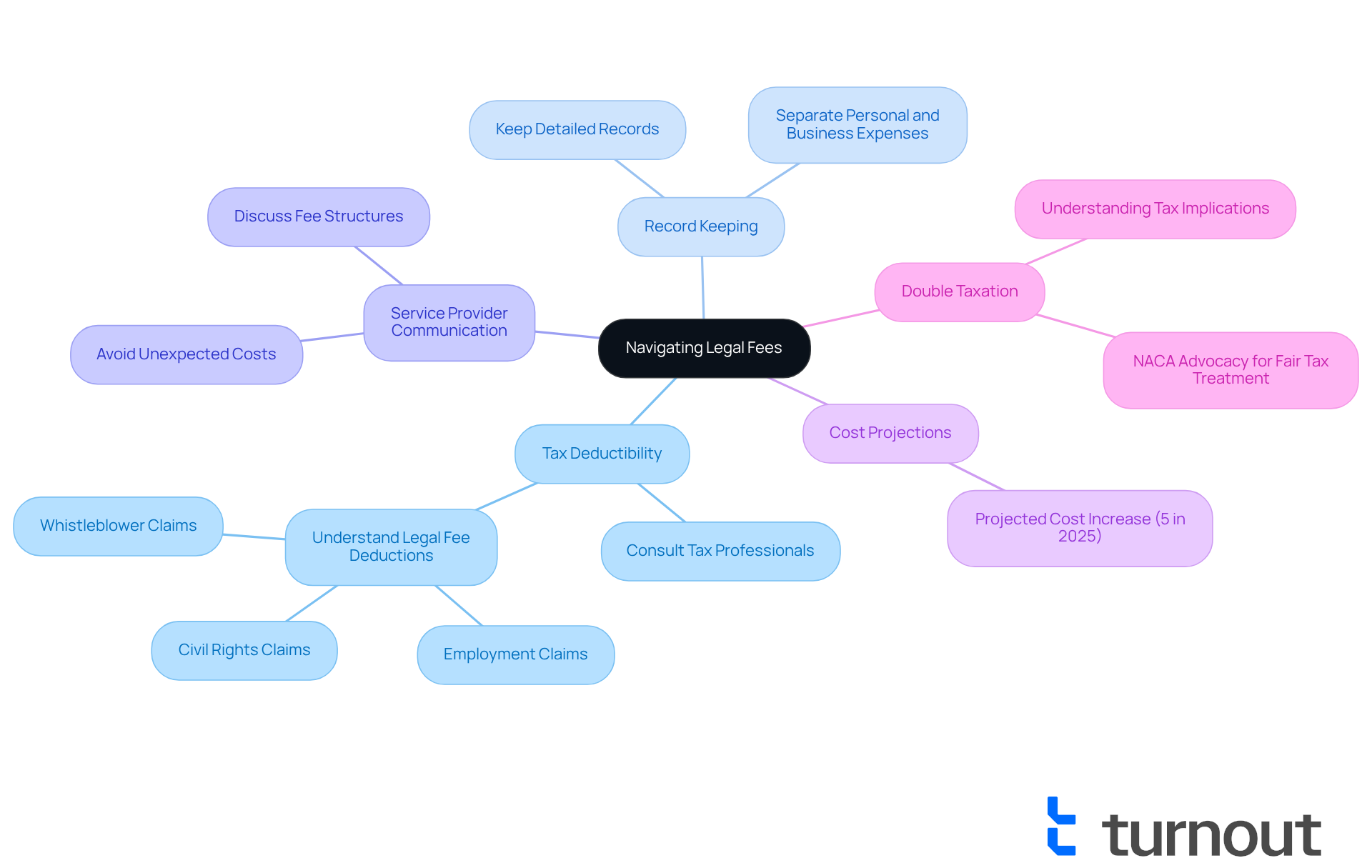

Navigating the costs associated with legal matters can be overwhelming, especially when considering if attorney fees are tax deductible, and understanding the tax consequences is crucial for effective financial planning. We know that keeping detailed records of all expenses related to professional services can significantly impact your tax benefits. As CPA Janet Berry-Johnson wisely advises, "If your expenses include both personal and business-related matters, divide the costs and deduct only the part associated with business operations." Consulting with tax professionals can help you maximize your deductions, ensuring you get the most out of your situation.

It's also important to have open conversations with your service providers about their fee structures. This proactive approach can help you avoid unexpected costs down the line. Looking ahead, it's projected that average costs incurred by consumers will rise by 5% in 2025. This highlights the need to stay informed and prepared.

Moreover, be aware of the potential for double taxation on expenses related to professional services, as noted by NACA. By carefully navigating these complexities, you can better manage your financial responsibilities, including understanding if attorney fees are tax deductible. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Conclusion

Understanding the complexities of attorney fees and their potential tax implications is crucial for your financial well-being. We know that navigating these waters can be overwhelming. While some attorney fees may be deductible—especially those tied to business activities—personal legal expenses often don’t qualify. It’s common to feel confused about these distinctions, but they’re essential for optimizing your deductions and avoiding unnecessary liabilities.

Key insights include the various fee structures attorneys might use and the specific conditions under which fees can be deducted. The Tax Cuts and Jobs Act of 2017 has brought significant changes, limiting many deductions. We understand that keeping track of these details can be daunting, which is why maintaining meticulous records and consulting with tax professionals is so important. These practices can greatly influence your financial outcomes related to legal expenses.

Ultimately, staying informed about the evolving landscape of tax regulations and understanding the nuances of attorney fees will empower you to make informed decisions. Engaging with knowledgeable advisors and being proactive in discussions with your legal service providers can lead to better management of legal costs and potential tax benefits. Remember, you are not alone in this journey. As the landscape continues to change, awareness and preparation will be key to effectively navigating the complexities of attorney fees and their tax implications.

Frequently Asked Questions

What are the main types of attorney fee structures?

The main types of attorney fee structures include hourly rates, fixed fees for specific services, and contingency payments, where you only pay if you achieve a successful outcome.

How do hourly rates for attorney services vary by location?

Hourly rates can vary significantly by location; for example, in 2025, the typical hourly rate ranges from $217 in Mississippi to $358 in New York, with a national average of $327 per hour.

What is a contingency fee, and how much is it typically?

A contingency fee is a payment structure where the attorney is paid a percentage of the recovery amount only if the case is successful. Contingency fees typically range from 33% to 40% of the recovery amount.

Are attorney fees tax deductible?

Attorney fees may be tax deductible if they are incurred while pursuing income-generating activities or business operations. However, personal expenses, such as those from divorce or personal injury claims, typically do not qualify for tax relief.

What is the 'origin of the claim' test, and why is it important?

The 'origin of the claim' test, established in United States v. Gilmore, is crucial for determining the deductibility of attorney fees. It assesses whether the legal costs are related to income-generating activities.

What percentage of taxpayers claim deductions for attorney fees?

Approximately 20% of taxpayers indicate deductions for attorney fees on their tax returns.

What should clients be aware of regarding additional costs when hiring an attorney?

Clients should be aware of potential additional costs, such as filing fees or payments for expert witnesses, that may arise during the legal process.

Is it possible to receive a refund for unearned attorney fees if services are discontinued?

Yes, if a client decides to discontinue the service provider's assistance during their case, it’s important to know about the possibility of refunds for unearned fees.