Introduction

Navigating the world of tax deductions can often feel like deciphering a complex puzzle. We understand that understanding the relationship between tax allowances and dependents can be particularly challenging. These two concepts are not just crucial for optimizing your tax returns; they can also significantly impact your financial outcomes.

As you seek clarity on whether allowances equate to dependents, it’s common to feel overwhelmed. You might find yourself questioning how these elements intertwine and influence potential credits and deductions. What are the key differences? How can you ensure you’re maximizing your tax benefits while avoiding common pitfalls?

We’re here to help you through this journey. Understanding these aspects can empower you to make informed decisions and feel more confident about your tax situation.

Define Tax Allowances and Dependents

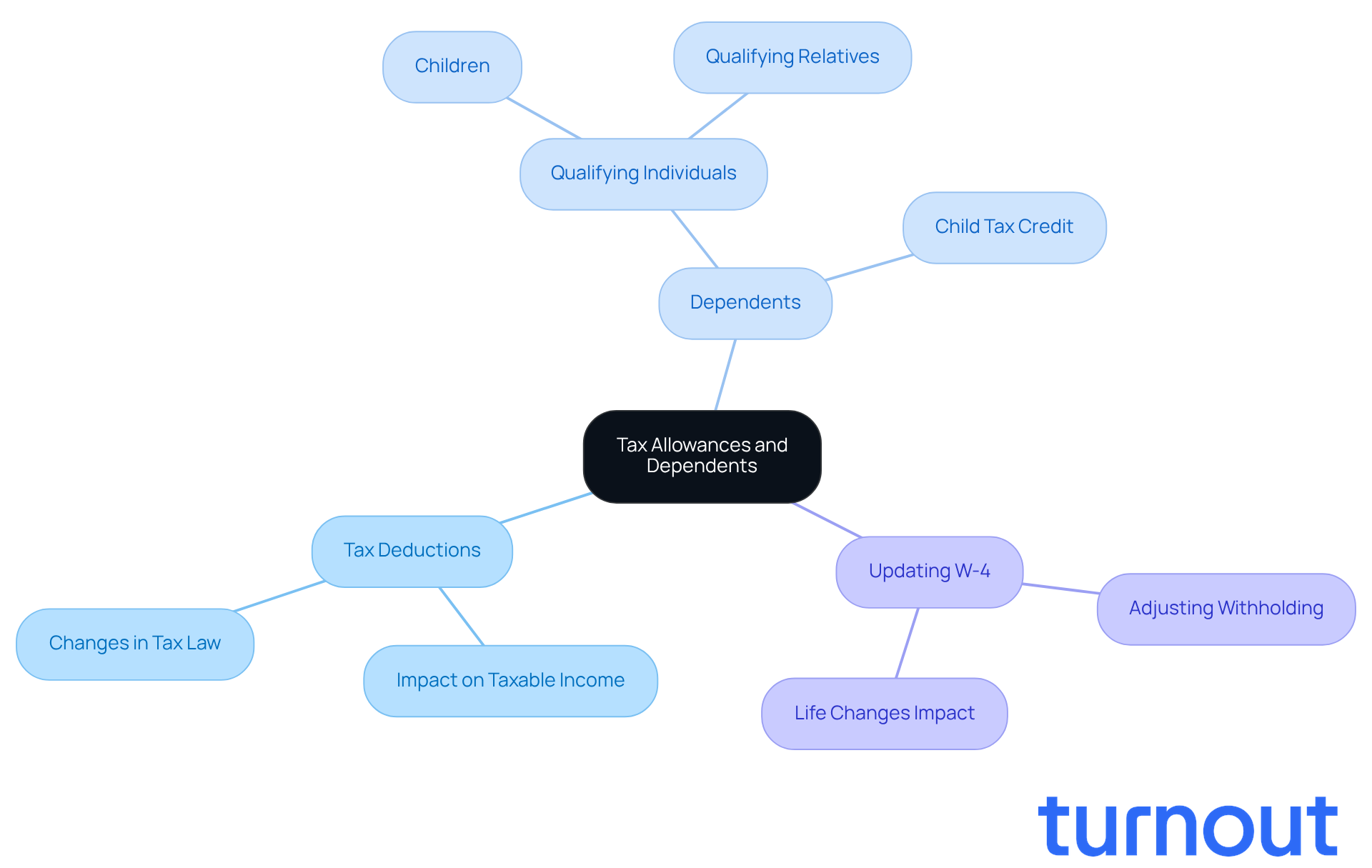

Tax deductions can feel a bit overwhelming, can’t they? These are specific amounts that reduce the earnings subject to tax withholding from your paycheck. In the past, exemptions were used on the W-4 form to determine how much federal tax was deducted from your salary. But since the 2020 update to the W-4, exemptions are no longer requested. Instead, you can adjust your withholding by clearly stating your dependents and other financial factors.

Dependents are those special individuals - like children or qualifying relatives - who depend on you for financial support. When you list these individuals on your tax return, it can significantly lower your taxable income. This might lead to a smaller tax bill or even a larger refund. For example, you can claim a child tax credit for each qualifying child, which could save you thousands of dollars.

Understanding whether tax exemptions are allowances the same as dependents is crucial for maximizing your tax benefits. If you have two dependents, you might see a noticeable drop in your taxable income. On the other hand, if you previously relied on exemptions, it’s important to update your W-4 to reflect your current financial situation. This shift in perspective can empower you to navigate the complexities of tax filings and improve your financial outcomes.

We’re here to help you through this process. Remember, you’re not alone in this journey. Take a moment to review your tax situation and see how you can benefit from claiming your dependents.

Understand the Relationship Between Allowances and Dependents

Tax exemptions and the question of whether allowances are the same as dependents are two important concepts in the world of taxation, and they’re more connected than you might think. We understand that navigating tax withholding can feel overwhelming, especially when it directly impacts your take-home pay throughout the year. But there’s good news! Having dependents can open the door to various tax credits and deductions that can significantly ease your overall tax burden.

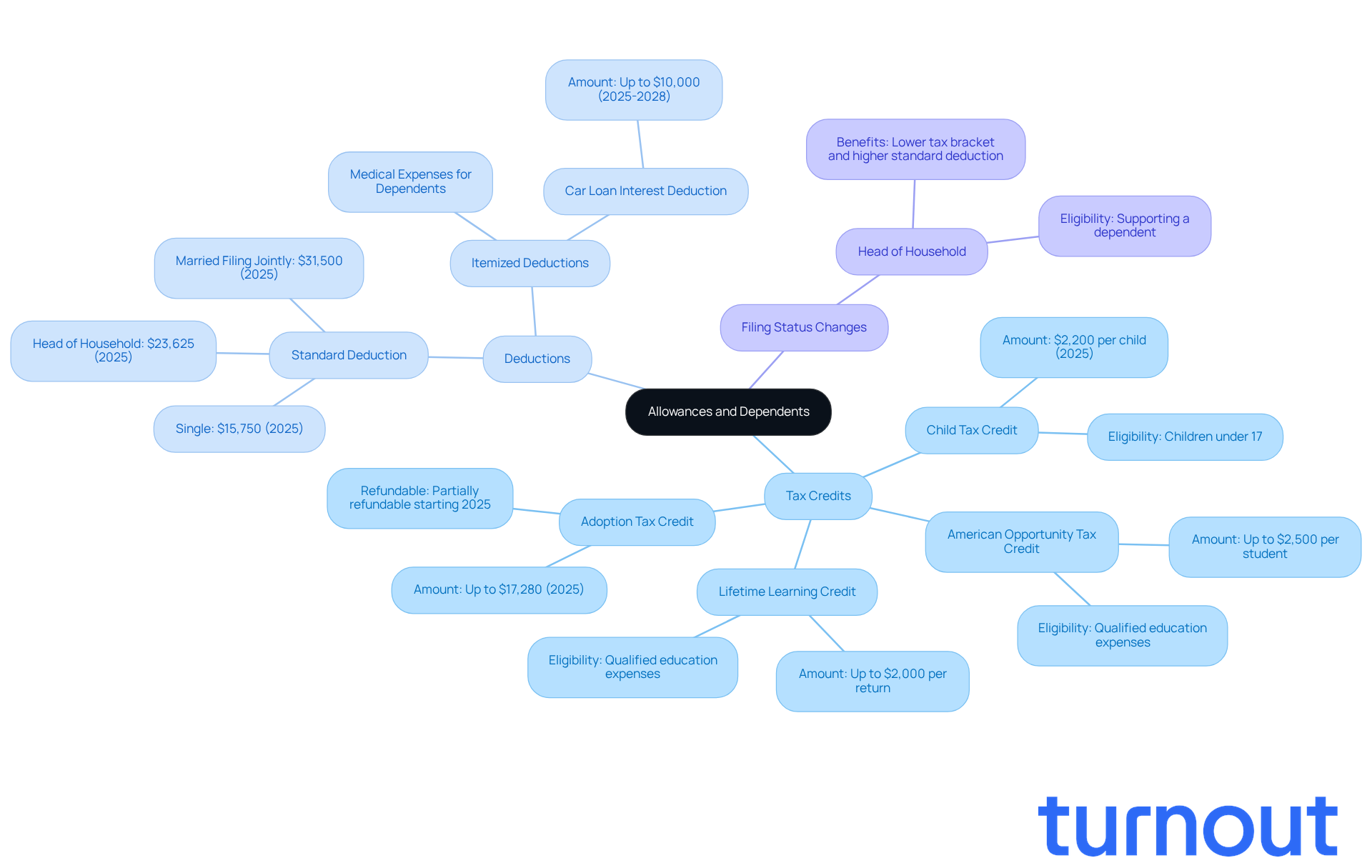

For example, if you declare children, you may qualify for the Child Tax Credit, which offers up to $2,200 per child in 2025. This could lower your tax liability dollar-for-dollar, providing much-needed relief. Additionally, if you support others, you might benefit from the American Opportunity Tax Credit and the Lifetime Learning Credit, which can give you up to $2,500 and $2,000 per student, respectively.

Claiming a qualifying individual can also allow you to change your filing status to head of household. This change can lead to a reduced tax bracket and a higher standard deduction, resulting in even more savings. And let’s not forget about the Adoption Tax Credit, which will be partially refundable starting in 2025, offering extra financial support for families.

Understanding how these elements interact is crucial for optimizing your tax situation, particularly in knowing if allowances are the same as dependents. We’re here to help you take full advantage of the benefits available to you. Remember, it’s essential to follow IRS regulations when claiming individuals to ensure compliance and maximize your tax advantages. You are not alone in this journey; we’re here to support you every step of the way.

Determine Your Allowances Based on Dependent Status

It can feel overwhelming to determine if allowances are the same as dependents based on your dependent status, but we're here to help. Follow these simple steps to navigate this process with confidence:

-

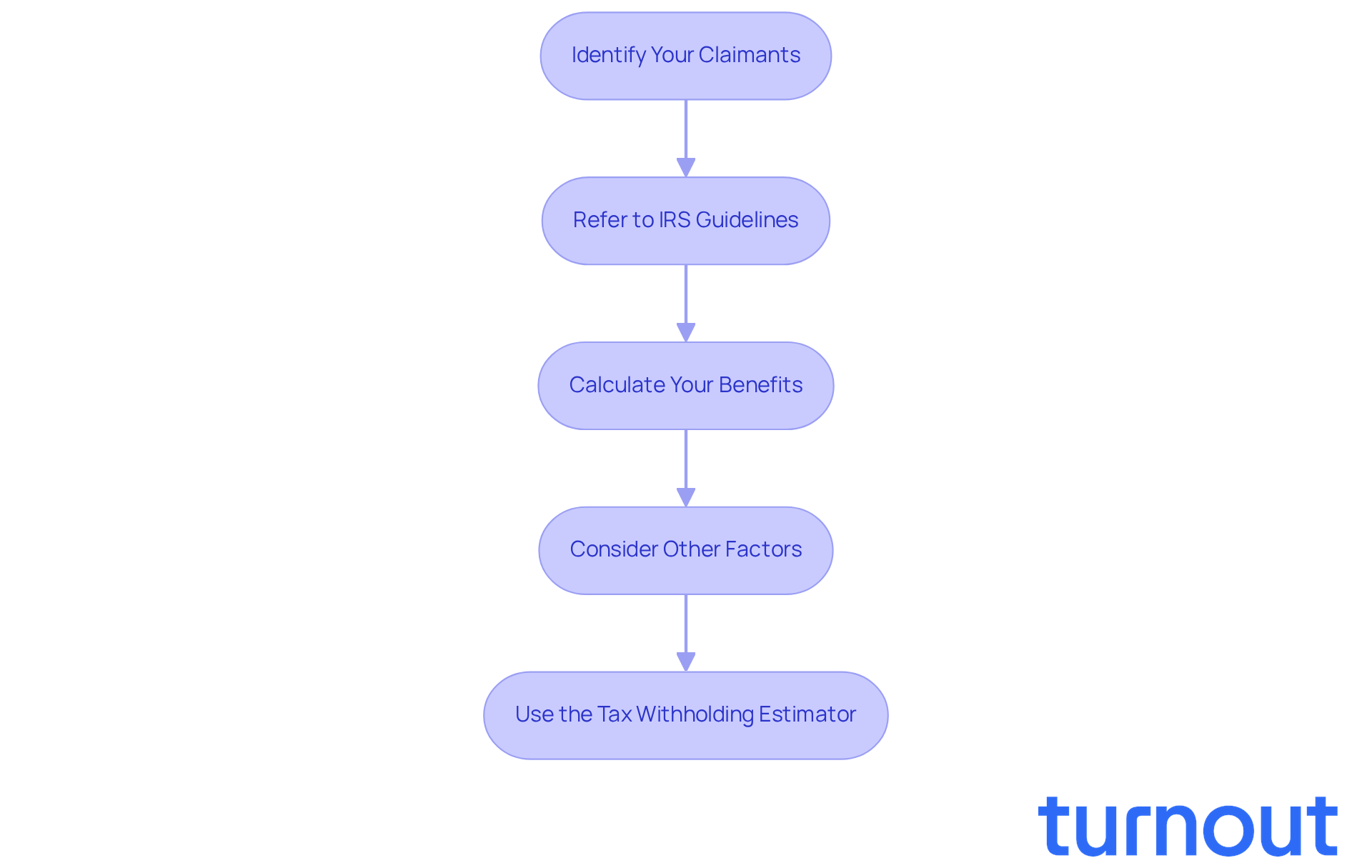

Identify Your Claimants: Start by listing all individuals you can claim, like your children or qualifying relatives. This is an important first step.

-

Refer to IRS Guidelines: It's essential to consult the IRS guidelines for the current tax year. Understanding if allowances are the same as dependents can make a significant difference in how many individuals you can claim. Did you know that the average taxpayer claims about two individuals for tax purposes? This can greatly affect your tax calculations.

-

Calculate Your Benefits: For each dependent, you may claim an additional benefit. For instance, if you have two children, you might wonder if allowances are the same as dependents, allowing you to claim two extra credits on your W-4 form. This directly decreases the amount deducted from your paycheck. However, keep in mind that claiming zero exemptions leads to maximum withholding. While this might result in a larger refund, it may not be the best choice for everyone.

-

Consider Other Factors: Think about your filing status and any other income sources that could impact your tax situation. Adjust your allowances to ensure you’re not over- or under-withheld. It’s common to feel uncertain about this, but the IRS recommends checking your withholding after major life events or changes in income. This can help you avoid unexpected tax bills or refunds. Plus, if you’re a senior aged 65 or older, starting in 2025, you can claim an extra deduction of $6,000, which might also influence your overall tax situation.

To make this process easier, consider using the Tax Withholding Estimator on the IRS website. It can help you assess your withholding requirements based on your family member status. Remember, you’re not alone in this journey, and taking these steps can lead to a more manageable tax experience.

Clarify Common Misconceptions About Allowances and Dependents

Tax season can be overwhelming, and it’s common to feel confused about tax allowances and dependents. Let’s clarify some misconceptions that might be causing you stress:

-

There is a misconception that allowances are the same as dependents.

Clarification: The question of whether allowances are the same as dependents primarily reduces the amount deducted from your paycheck. In contrast, dependents can qualify you for various tax credits, which may lower your overall tax bill. -

Misunderstanding: You must declare the same number of exemptions as dependents.

Clarification: You can claim more allowances than the number of individuals relying on you, depending on your unique financial situation and tax strategy. This flexibility can help you manage your cash flow better throughout the year. -

Misconception: Claiming dependents automatically boosts your refund.

Clarification: While claiming dependents can lead to valuable tax credits, your total refund depends on your overall tax situation, including your income and deductions. Understanding your complete financial picture is crucial for effective tax planning. -

Important Note: Remember, all income must be reported, even if you don’t receive a Form 1099-K. This is vital for staying compliant with your tax obligations. Additionally, submitting a new W-4 after significant life changes can help you avoid under- or over-withholding, ensuring your tax withholdings match your financial situation.

By addressing these misconceptions and highlighting the importance of accurate reporting and withholding, you can approach your tax filings with greater confidence. Remember, you’re not alone in this journey; we’re here to help you maximize your benefits while minimizing potential pitfalls.

Conclusion

Understanding the distinction between tax allowances and dependents is crucial for optimizing your financial benefits during tax season. We know that navigating these terms can be overwhelming, but recognizing their differences can empower you to make informed decisions. While allowances adjust your paycheck withholdings, dependents can lead to significant tax credits and deductions that reduce your overall tax liability.

Throughout this article, we’ve shared key insights, such as the importance of accurately listing dependents on your tax returns and the potential savings from various tax credits. It’s common to feel uncertain about your withholding status, especially after life changes. Regularly reviewing this information can help ensure you’re maximizing your benefits. We clarified misconceptions surrounding allowances and dependents, emphasizing that they serve different purposes in the tax system.

Ultimately, taking proactive steps to understand and manage tax allowances and dependents can lead to substantial financial advantages. By leveraging available credits and ensuring proper withholding, you can alleviate the stress of tax season and enhance your overall financial well-being. Remember, you’re not alone in this journey. Engaging with IRS resources and seeking guidance can further aid you in making informed decisions, ensuring that no potential benefits are overlooked. We’re here to help you navigate this process with confidence.

Frequently Asked Questions

What are tax allowances and how do they affect my paycheck?

Tax allowances are specific amounts that reduce the earnings subject to tax withholding from your paycheck. They help determine how much federal tax is deducted from your salary.

What changes were made to the W-4 form in 2020 regarding exemptions?

The 2020 update to the W-4 form eliminated the use of exemptions. Instead, taxpayers are now required to adjust their withholding by stating their dependents and other financial factors.

Who qualifies as a dependent for tax purposes?

Dependents are individuals, such as children or qualifying relatives, who rely on you for financial support. Listing these individuals on your tax return can lower your taxable income.

How can claiming dependents affect my tax bill or refund?

Claiming dependents can significantly lower your taxable income, which may result in a smaller tax bill or a larger refund. For instance, you can claim a child tax credit for each qualifying child, potentially saving you thousands of dollars.

Are tax exemptions and allowances the same as dependents?

No, tax exemptions and allowances are not the same as dependents. Understanding the difference is crucial for maximizing your tax benefits, as dependents can directly reduce your taxable income.

What should I do if I previously relied on exemptions for tax withholding?

If you previously relied on exemptions, it is important to update your W-4 form to reflect your current financial situation, including any dependents you may have.

How can I better navigate the complexities of tax filings?

Reviewing your tax situation and claiming your dependents can empower you to navigate tax filings more effectively and improve your financial outcomes.