Introduction

Feeling trapped under the weight of tax debt can be overwhelming. We understand that this situation can feel daunting, but there’s hope. The IRS offers a potential reprieve through the Currently Not Collectible (CNC) status. This classification allows eligible individuals to pause collection efforts, giving you a crucial opportunity to regain financial stability without the looming threat of wage garnishments or bank levies.

However, navigating the application process can be complex and challenging. How can you effectively demonstrate financial hardship and secure this vital status? This guide breaks down the essential steps to apply for CNC status, ensuring that you can approach the process with clarity and confidence. Remember, you are not alone in this journey; we’re here to help.

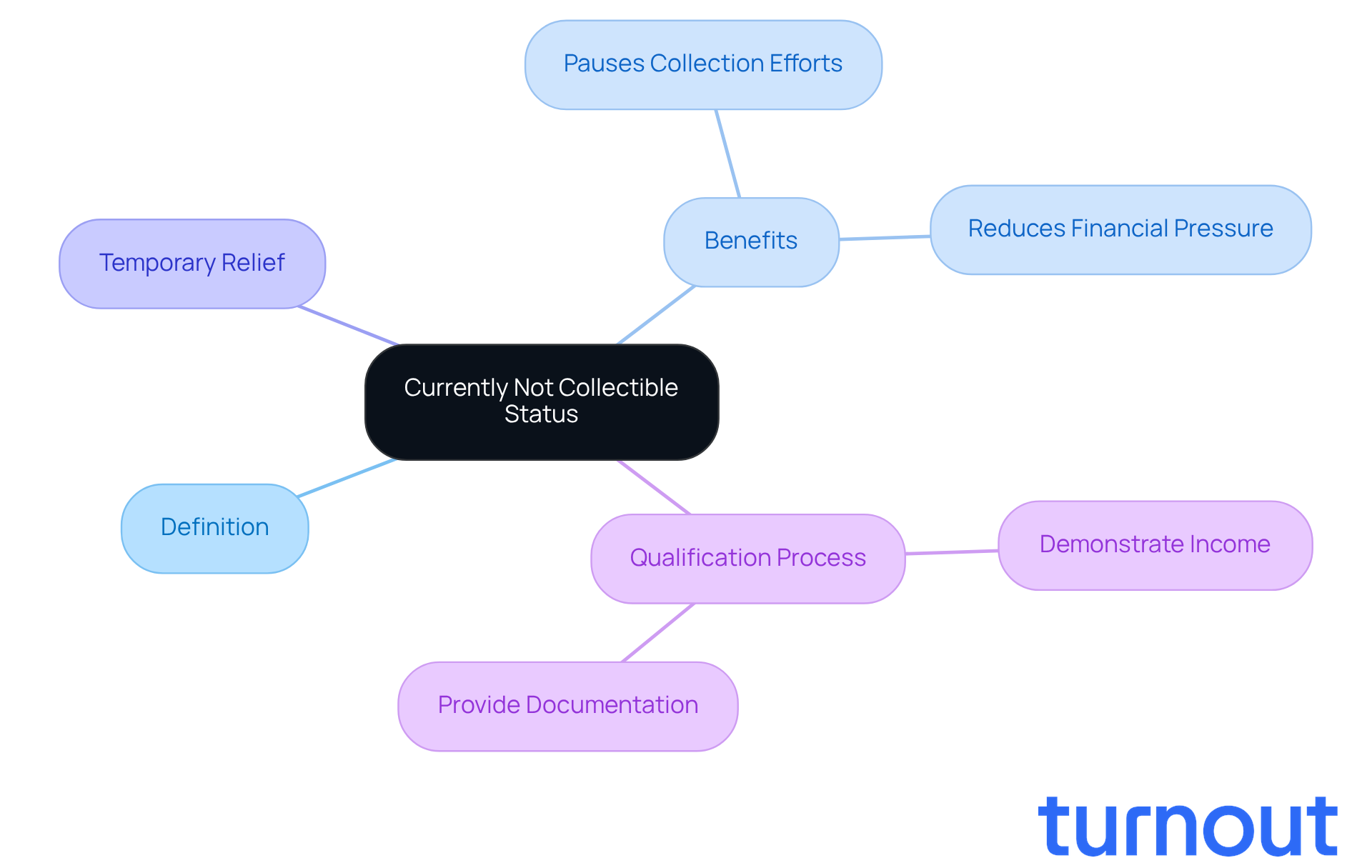

Understand Currently Not Collectible Status

If you're feeling overwhelmed by tax debt, you're not alone. The classification of Currently Not Collectible (CNC) is a lifeline provided by the IRS for individuals who cannot afford to pay their tax obligations without encountering significant hardship. When you receive this designation, the IRS pauses its collection efforts, meaning you won’t have to worry about wage garnishments or bank levies for the time being.

This can be a huge relief for anyone grappling with financial challenges. It gives you a chance to catch your breath and focus on stabilizing your economic situation without the constant pressure of urgent payments. However, it’s important to remember that while your account may be currently not collectible under CNC status, it doesn’t erase your tax debt. It merely puts collection activities on hold.

To qualify for CNC designation, you’ll need to demonstrate that your current income isn’t enough to cover your basic living expenses. This usually involves providing documentation to the IRS. We understand that this process can feel daunting, but know that you’re not alone in this journey. We're here to help you navigate these challenges and find the support you need.

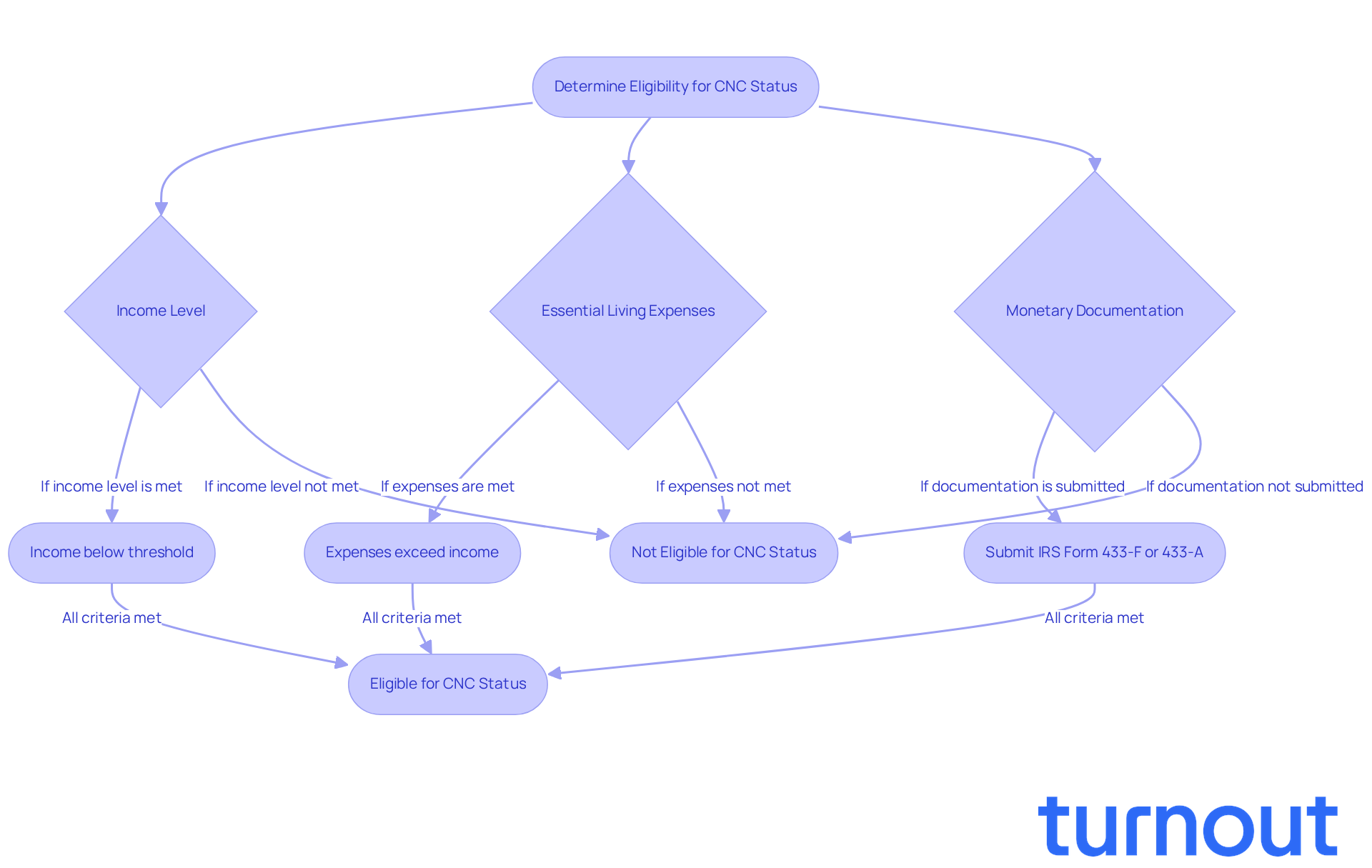

Determine Eligibility for CNC Status

If you're feeling overwhelmed by your tax obligations, you're not alone. Many taxpayers find themselves in a situation where paying their taxes could lead to significant hardship. To qualify for status that is currently not collectible (CNC), it’s essential to demonstrate this hardship to the IRS. Here’s what you need to know:

-

Income Level: First, you’ll need to show that your income is below a certain threshold. This threshold varies based on your household size and where you live. In 2026, the average income levels for CNC qualification reflect the necessity for individuals to maintain basic living standards.

-

Essential Living Expenses: The IRS will look at whether your income can cover your necessary living expenses, such as housing, food, and healthcare. If your essential expenses exceed your income, you may be eligible for a status that is currently not collectible.

-

Monetary Documentation: To apply, you’ll need to submit detailed financial information, typically using IRS Form 433-F or Form 433-A. These forms outline your income, expenses, assets, and liabilities, which help the IRS accurately assess your financial situation.

It’s important to remember that while you’re in CNC status, interest and penalties will continue to accrue on your tax balance. The IRS may also file a Notice of Federal Tax Lien (NFTL), which could affect your credit. Before applying for CNC designation, it’s wise to gather your financial documents and evaluate your situation against these criteria. This preparation can significantly enhance your chances of approval, especially if you’re truly facing economic hardship. Remember, you’re not alone in this journey, and we’re here to help you navigate through it.

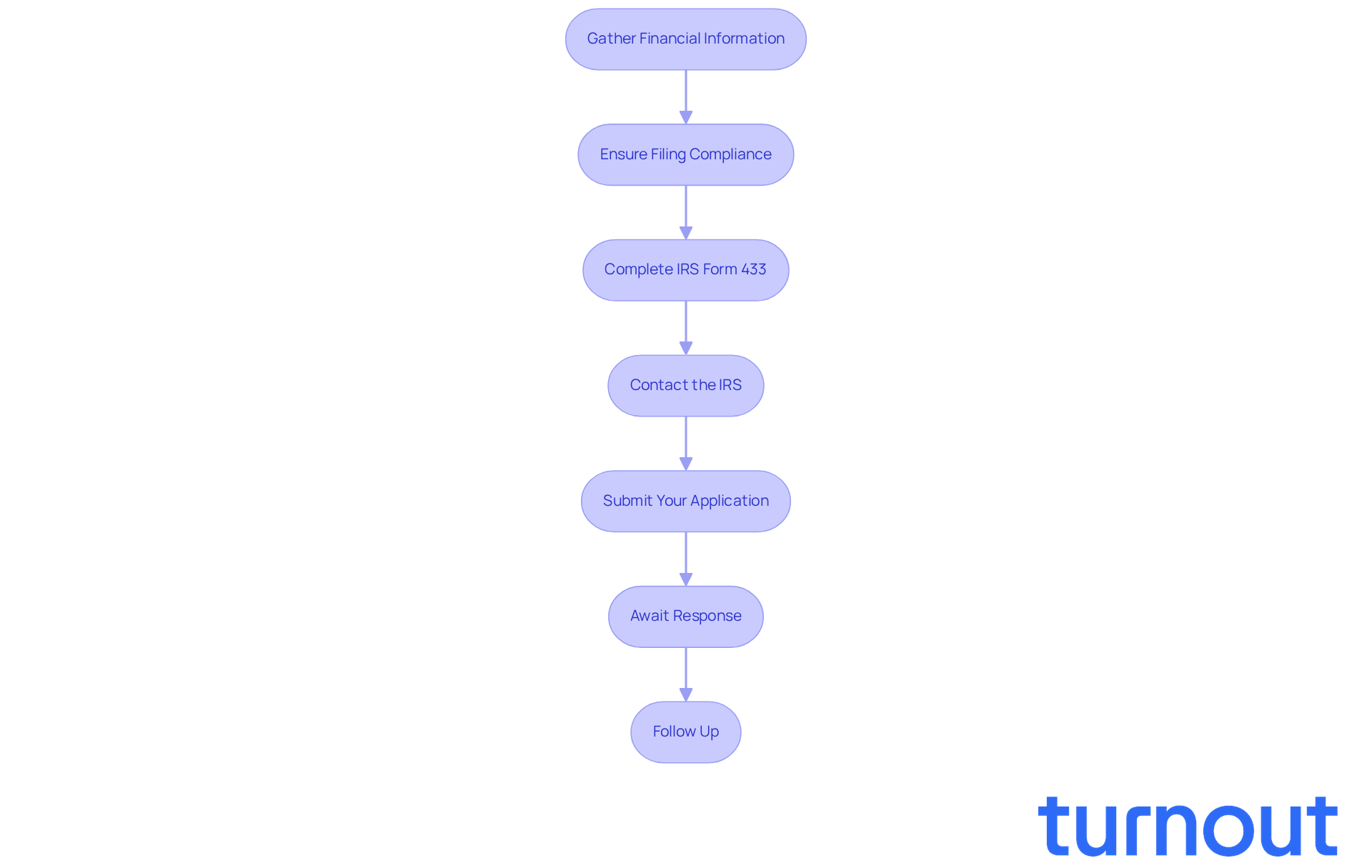

Follow the Application Steps for CNC Status

Applying for a status that is currently not collectible (CNC) can feel overwhelming, but we're here to help you through it. Follow these essential steps to navigate the process with confidence:

-

Gather Financial Information: Start by collecting all necessary financial documents. This includes at least three months of recent pay stubs, expense reports, and any relevant tax returns. Having this comprehensive information ready will be crucial for completing the required IRS forms.

-

Ensure Filing Compliance: We understand that keeping up with tax obligations can be stressful. Before requesting CNC classification, make sure you’re compliant with all filing requirements, including submitting any past-due tax returns. The IRS won’t grant a designation of currently not collectible to taxpayers who haven’t met these obligations.

-

Complete IRS Form 433: Depending on your situation, fill out the appropriate version of IRS Form 433. Use Form 433-F for individuals, Form 433-A for self-employed individuals, or Form 433-B for businesses. This form requires detailed information about your income, expenses, and assets, which the IRS will use to assess your financial hardship.

-

Contact the IRS: Reach out to the IRS at 800-829-1040 or the number provided in your tax notice. Discuss your situation and express your intent to apply for CNC designation, which is currently not collectible. Handling this process over the phone can often expedite your application, making it a bit easier for you.

-

Submit Your Application: Once you’ve completed Form 433, send it along with your supporting documentation to the IRS. You can submit this information by mail or fax, depending on the instructions provided by the IRS representative. Ensure all documents are accurate and complete to avoid delays, as discrepancies can result in your CNC request being currently not collectible.

-

Await Response: After submitting your application, the IRS will review your information. Be prepared to provide additional documentation if requested. The review process for CNC applications can take several weeks or even months, so patience is essential. Once approved for CNC designation, wage garnishments and bank levies will be paused, providing you with some much-needed relief from collection actions.

-

Follow Up: If you don’t receive a response within a reasonable timeframe, don’t hesitate to follow up with the IRS. Inquiring about the progress of your application can help ensure it’s processed smoothly.

Real-life examples show that many individuals successfully achieve CNC designation by thoroughly documenting their financial situations, as their debts are currently not collectible and they maintain compliance with filing requirements. Remember, while CNC designation offers temporary relief from collection actions, it doesn’t erase your tax debt, which continues to accumulate interest. Use this time wisely to stabilize your finances and explore long-term resolution options. You are not alone in this journey.

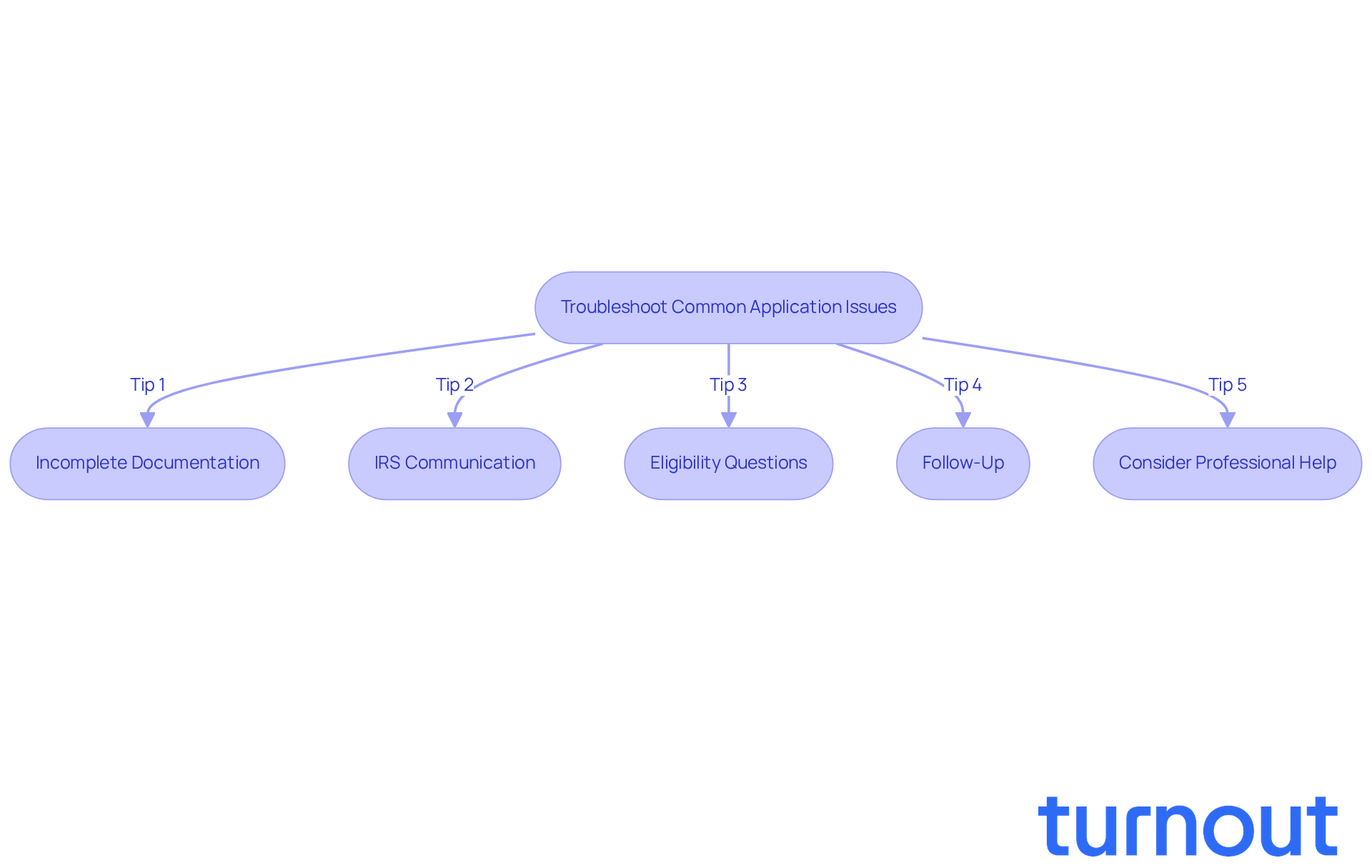

Troubleshoot Common Application Issues

Navigating the application process for a designation that is currently not collectible can be challenging, and we understand that you may face several common hurdles. Here are some supportive tips to help you through:

-

Incomplete Documentation: It’s crucial to submit all necessary monetary documents with your application. Missing information can lead to delays or denials. Make sure your Form 433 is fully completed and accurate. Incomplete submissions are a leading cause of CNC application denials, making it crucial to ensure that applications are currently not collectible.

-

IRS Communication: If you receive a notice from the IRS asking for more information, respond promptly. Not providing the requested documentation can result in your CNC application being denied. Keeping open lines of communication is vital, as the IRS may also conduct yearly assessments to see if you still qualify as currently not collectible under CNC designation.

-

Eligibility Questions: Be ready to address any inquiries the IRS may have about your eligibility for classification as currently not collectible. Clearly outline how your expenses exceed your income and provide detailed explanations of your financial situation. Tax professionals emphasize that clarity and thoroughness in your responses can significantly impact the outcome.

-

Follow-Up: If you haven’t heard back within the expected timeframe, don’t hesitate to reach out to the IRS to check on your application’s progress. Regular follow-ups can help resolve any issues quickly and keep your application on track.

-

Consider Professional Help: If you’re facing persistent issues or feeling overwhelmed, consulting a tax professional or advocate can be incredibly beneficial. The Taxpayer Advocate Service (TAS) is a valuable resource that assists taxpayers experiencing financial hardship and can help you navigate the CNC application process effectively.

By following these tips and utilizing available resources, you can enhance your chances of successfully obtaining CNC status. Remember, you’re not alone in this journey, and we’re here to help alleviate the stress associated with the application process.

Conclusion

Applying for Currently Not Collectible (CNC) status can be a vital lifeline for those grappling with overwhelming tax debts. This designation allows the IRS to pause collection efforts, giving you a much-needed break from financial pressures. However, it’s important to remember that while CNC status offers relief from immediate collection actions, it doesn’t erase the underlying tax debt.

In this guide, we’ve outlined key steps to help you navigate the application process:

- Gather necessary financial documentation

- Ensure compliance with filing requirements

- Complete the appropriate IRS forms

- Maintain communication with the IRS

Each step is crucial in securing CNC status. If you encounter common issues, don’t hesitate to seek professional assistance; it can significantly boost your chances of a successful application.

Ultimately, seeking CNC status is a proactive step toward managing your financial hardship. By understanding the eligibility requirements and the application process, you can take control of your tax situation. Embracing this opportunity not only alleviates immediate stress but also lays the groundwork for long-term financial recovery. Remember, taking action today can lead to a more stable and secure tomorrow. You are not alone in this journey; we’re here to help.

Frequently Asked Questions

What does Currently Not Collectible (CNC) status mean?

Currently Not Collectible (CNC) status is a designation by the IRS for individuals who cannot afford to pay their tax obligations without facing significant hardship. This status pauses IRS collection efforts, such as wage garnishments or bank levies.

What relief does CNC status provide?

CNC status offers relief by allowing individuals to focus on stabilizing their financial situation without the pressure of urgent tax payments, as the IRS temporarily halts collection activities.

Does CNC status erase my tax debt?

No, CNC status does not erase your tax debt. It only puts collection activities on hold while you manage your financial challenges.

How can I qualify for CNC designation?

To qualify for CNC designation, you must demonstrate that your current income is insufficient to cover your basic living expenses, typically by providing documentation to the IRS.

Is the process of obtaining CNC status difficult?

The process can feel daunting, but individuals are encouraged to seek support and guidance to help navigate the challenges involved in obtaining CNC status.