Introduction

Navigating the complexities of tax debt can feel overwhelming for many Canadians, especially when dealing with obligations to the Canada Revenue Agency (CRA). We understand that millions are grappling with unpaid taxes, and it’s crucial to know the relief options available to help regain financial stability.

However, the journey toward tax debt relief often comes with its own set of challenges. What strategies can truly lighten this burden? How can you avoid common pitfalls along the way?

You are not alone in this journey. We’re here to help you explore the paths to relief and support you every step of the way.

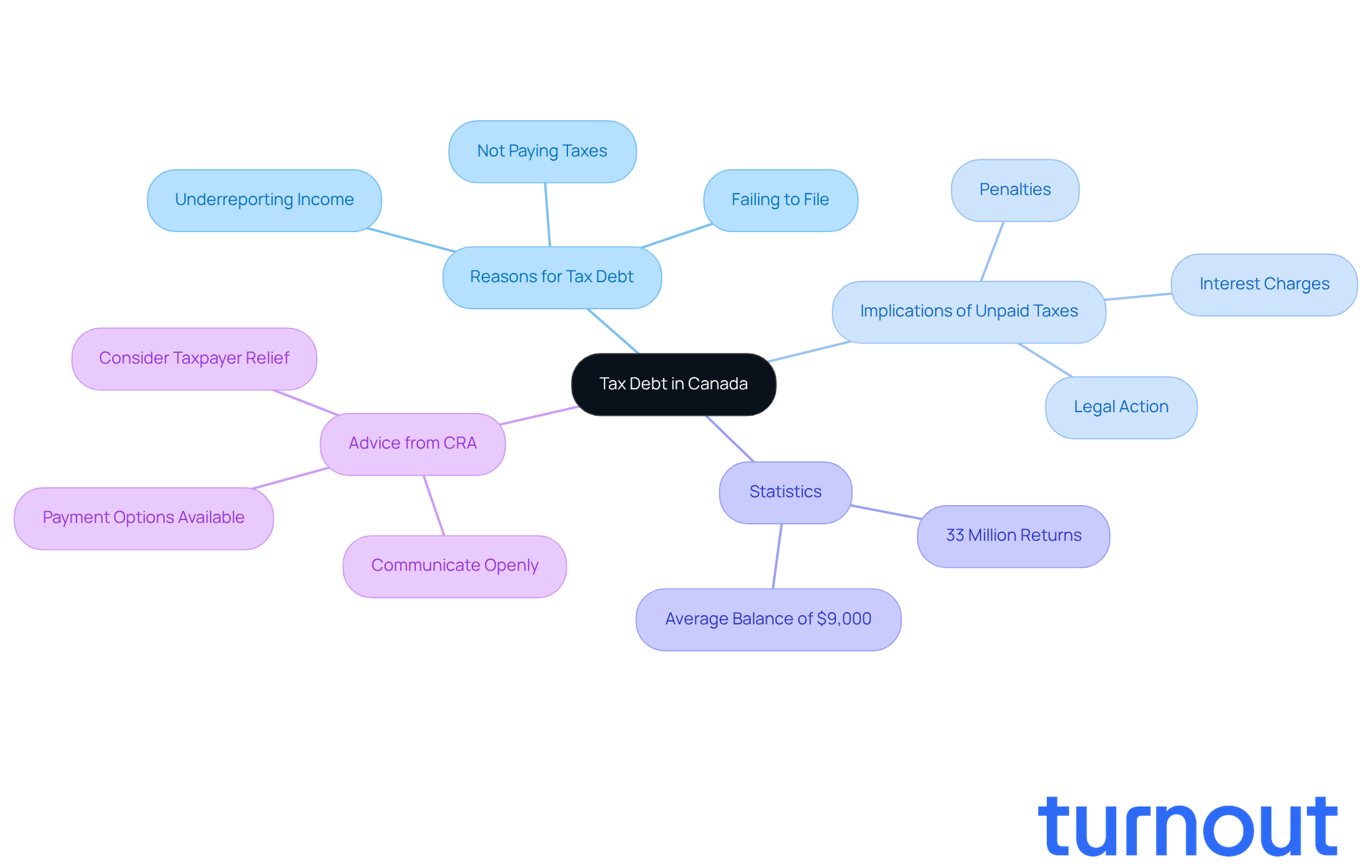

Understand Tax Debt in Canada

Financial obligations can feel overwhelming, especially when they involve owing money to the Canada Revenue Agency (CRA) due to unpaid levies. This situation can arise for various reasons, such as:

- Underreporting income

- Failing to file tax returns

- Simply not paying taxes owed

We understand that navigating these obligations can be stressful, and it’s vital to grasp their implications. Unresolved tax issues can lead to penalties, interest charges, and even legal action.

While tax obligations themselves don’t directly impact your credit score, it’s important to know that the CRA doesn’t report these obligations to credit bureaus. However, if you struggle to manage them, actions like wage garnishments or tax liens may appear on public records, potentially affecting your credit score. Familiarizing yourself with the types of financial obligations - like income levies, GST, and corporate charges - can help you understand your situation better and the possible repercussions.

In 2025, the CRA received over 33 million individual income tax returns, with a staggering total balance owing of approximately $75,774,977,000. For instance, 8.25 million returns had an average balance of around $9,000, highlighting the prevalence of tax debt among Canadians. Real-life examples show the serious consequences of unpaid levies: individuals who neglect to communicate with the CRA risk worsening their situations, which can lead to involvement from collection agencies.

The CRA encourages taxpayers to reach out if they can’t pay their taxes immediately. They’re willing to work with you to find solutions. Remember, you’re not alone in this journey. Understanding these elements can empower you to make informed decisions toward alleviating your tax obligations. We’re here to help.

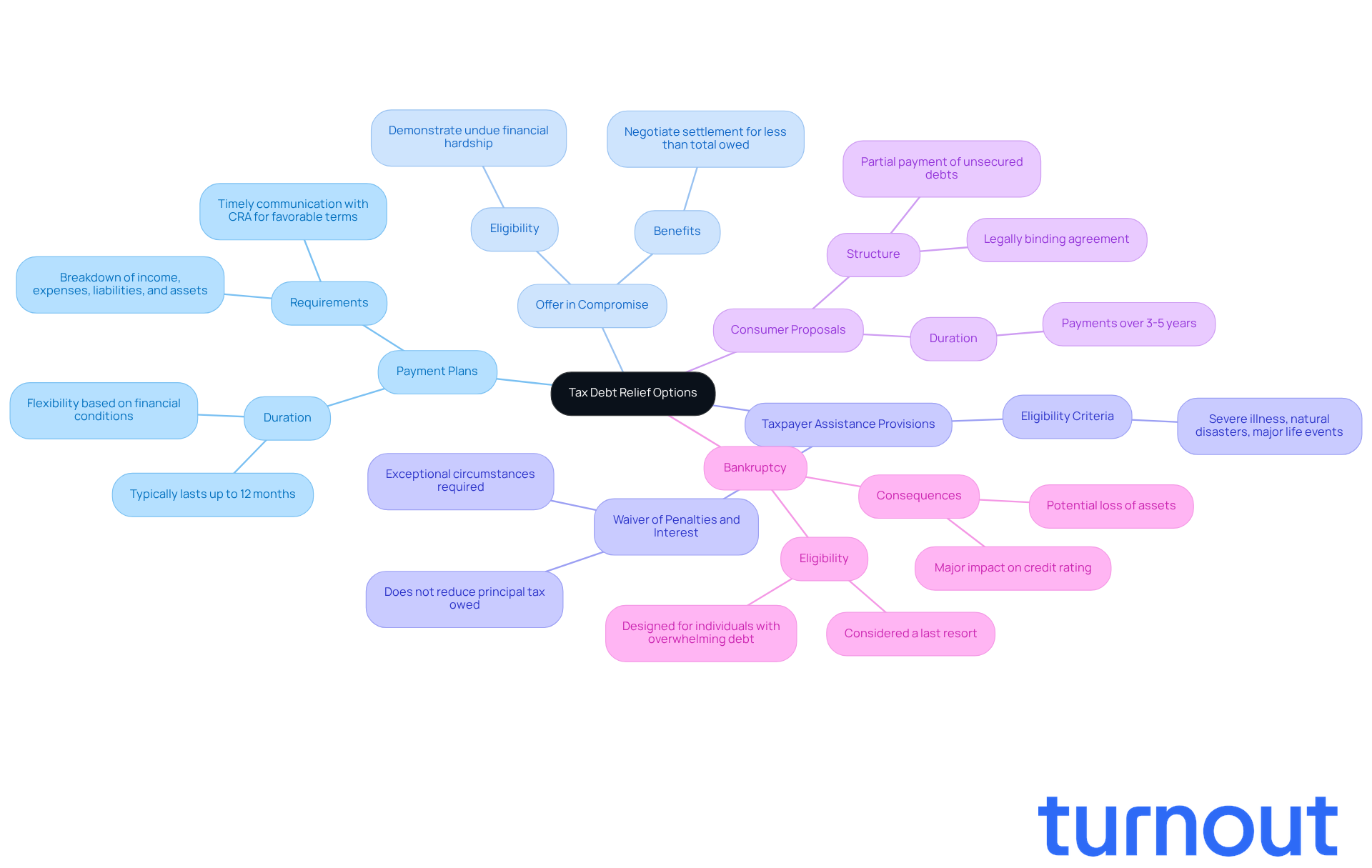

Explore Tax Debt Relief Options

Facing tax debt can feel overwhelming, and it’s important to know that free tax debt relief options are available to help ease your financial burden. Here are several relief options designed to support you on your journey to stability:

-

Payment Plans: The Canada Revenue Agency (CRA) offers structured payment arrangements that allow you to settle your tax debts in manageable installments. Typically lasting up to 12 months, these plans can be adjusted based on your unique financial situation. The CRA may request a breakdown of your monthly income, expenses, liabilities, and assets before approving your plan. By communicating with the CRA in a timely manner, you may secure more favorable repayment terms, making it easier to manage your cash flow.

-

Offer in Compromise: This program allows you to negotiate a settlement for less than the total amount owed, especially if you can show that full payment would cause undue financial hardship. This option can provide free tax debt relief for those facing significant financial difficulties.

-

Taxpayer Assistance Provisions: If you’ve encountered exceptional circumstances-like severe illness, natural disasters, or other major life events-you might qualify for a waiver of penalties and interest. The CRA can waive these charges through taxpayer relief, though it won’t reduce the principal tax owed. This provision can help lighten the overall burden of your tax obligations, making repayment more manageable.

-

Consumer Proposals: A consumer proposal is a legal arrangement that lets you negotiate with creditors, including the CRA, to pay a portion of your debts over a set period. This option can halt collection efforts and interest charges, providing a structured way to regain your financial footing.

-

Bankruptcy: As a last resort, filing for bankruptcy can eliminate certain tax obligations. However, it’s crucial to understand that this option comes with significant long-term consequences, including a major impact on your credit rating and potential loss of assets.

Researching these options is vital to find the one that offers free tax debt relief and best fits your financial situation. Many individuals have successfully used CRA payment plans to regain control over their finances, showcasing the effectiveness of these structured arrangements. As David Sklar, a Licensed Insolvency Trustee, wisely notes, "Whether revamping your budget, arranging a payment plan with the CRA, obtaining a consolidation loan, or filing a consumer proposal, we can find the right solution to achieve the tax burden assistance you need."

Remember, you’re not alone in this journey. Interacting with a Licensed Insolvency Trustee can provide valuable insights into navigating these options and finding the financial support you deserve.

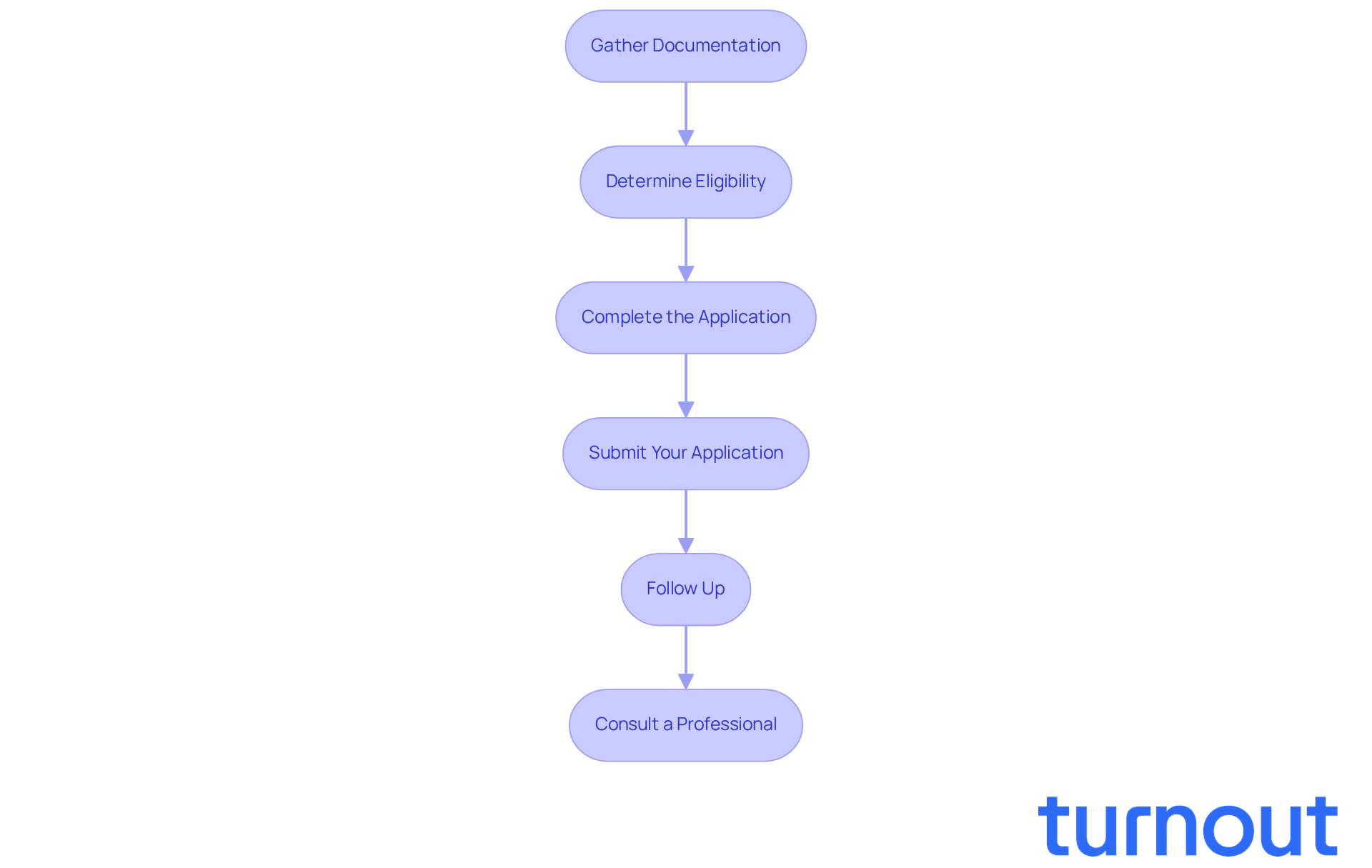

Take Action: Apply for Tax Debt Forgiveness

Applying for tax debt forgiveness can feel overwhelming, but you’re not alone in this journey. Here are some essential steps to guide you:

-

Gather Documentation: Start by collecting all relevant financial documents, like tax returns and income statements. This information is crucial for your application, as it helps illustrate your financial situation and strengthens your request for assistance.

-

Determine Eligibility: Take a moment to review the eligibility criteria for available assistance options, such as the Offer in Compromise or Taxpayer Relief Provisions. Ensuring you meet all requirements can save you from unnecessary delays.

-

Complete the Application: When you’re ready, accurately fill out the necessary forms. For an Offer in Compromise, you’ll need to complete Form 656 and provide a detailed financial disclosure, outlining your income, expenses, and assets.

-

Submit Your Application: Once everything is complete, send your application and supporting documents to the CRA. Remember to keep copies for your records. Timely submission is key to speeding up the review process.

-

Follow Up: After you submit, keep an eye on the status of your application. It’s common to feel anxious during this time, but be prepared to provide additional information if the CRA requests it, as this can significantly impact processing time.

-

Consult a Professional: If you’re feeling overwhelmed, consider reaching out to a licensed insolvency trustee or a tax professional. Their expertise can help you navigate the complexities of the application process and improve your chances of success.

Real-world examples show just how impactful tax obligation assistance can be. Many clients have successfully reduced their tax liabilities by over 90% through Offers in Compromise, proving the effectiveness of these programs. Plus, the average processing time for tax forgiveness applications in 2026 is expected to be quicker than in previous years. As one tax consultant wisely noted, "Gathering comprehensive documentation is the cornerstone of a successful application." By following these steps and seeking expert advice, you can confidently navigate the path to tax obligation resolution.

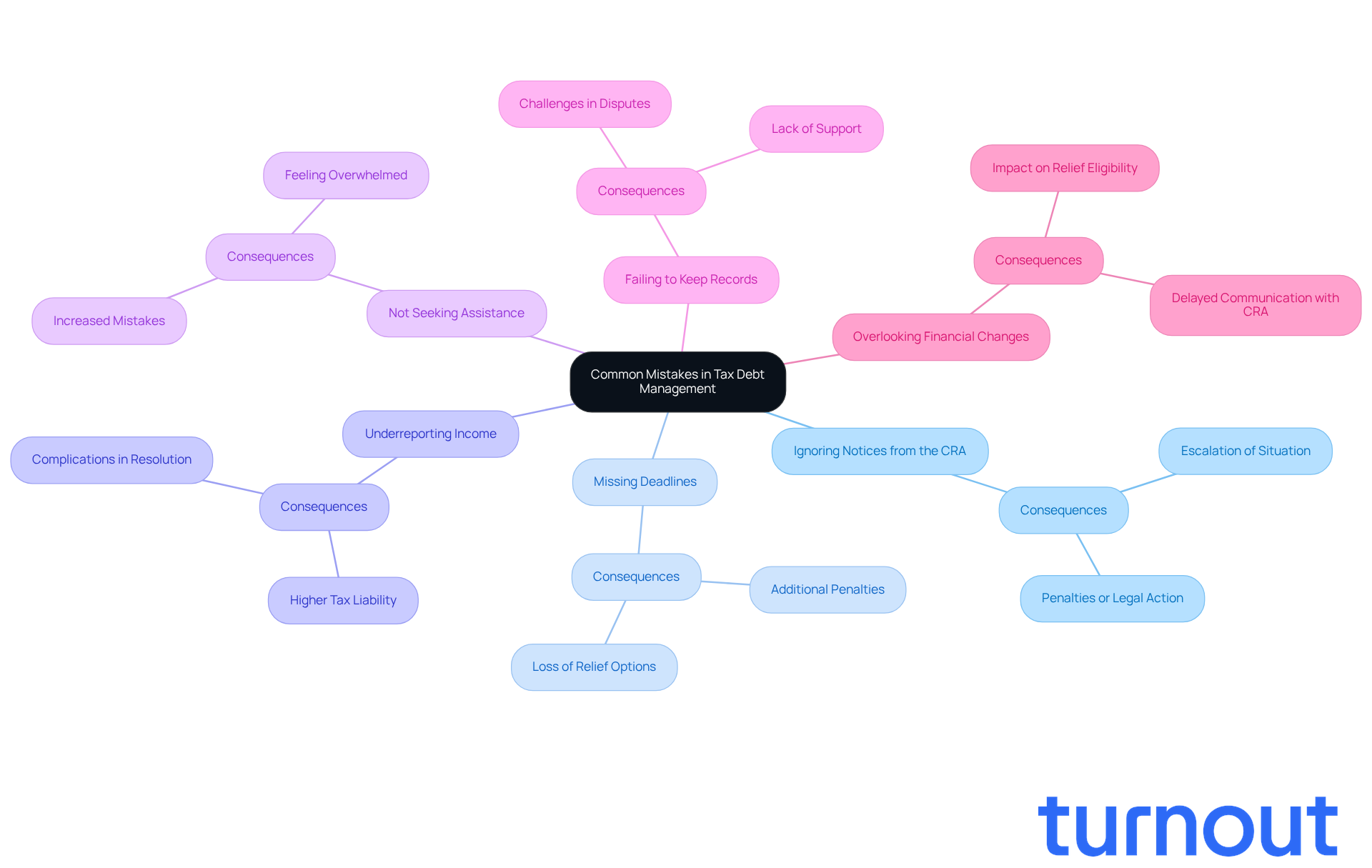

Avoid Common Mistakes in Tax Debt Management

Managing tax debt can feel overwhelming, and it’s important to avoid some common pitfalls that many face. Here are a few mistakes to steer clear of:

-

Ignoring Notices from the CRA: We understand that receiving notices from the CRA can be daunting. However, failing to respond can escalate your situation, leading to penalties or even legal action. Always address correspondence promptly to keep things manageable.

-

Missing Deadlines: It’s common to feel stressed about deadlines for filing applications or making payments. Missing these can result in additional penalties or even loss of eligibility for relief options. Stay organized and mark those dates on your calendar.

-

Underreporting Income: Ensure that all income is accurately reported on your tax returns. Underreporting can lead to higher tax liability and complications in resolving your financial obligations. Remember, honesty is key in these situations.

-

Not Seeking Assistance: Many individuals try to handle tax obligations alone, which can lead to mistakes. Don’t hesitate to seek professional assistance if you feel overwhelmed. You’re not alone in this journey.

-

Failing to Keep Records: Keeping thorough records of all communications and documents related to your tax debt is essential. This will be invaluable if disputes arise, providing you with the support you need.

-

Overlooking Financial Changes: If your financial situation changes - like a job loss or medical emergency - inform the CRA immediately. This can significantly affect your eligibility for relief options.

Remember, we’re here to help you navigate these challenges. Taking proactive steps can make a world of difference in securing free tax debt relief.

Conclusion

Navigating tax debt in Canada can feel overwhelming, and we understand how challenging this situation can be. However, knowing the options available for relief can truly lighten this burden. It’s essential to recognize the different forms of tax debt, the potential consequences of ignoring these obligations, and the proactive steps you can take to regain your financial footing. By familiarizing yourself with these relief options and taking action, you can find a path toward alleviating your tax burdens.

Key insights include various relief strategies like:

- Payment plans

- Offers in compromise

- Taxpayer assistance provisions

Each option offers a unique way for you to manage your obligations effectively. Remember, gathering documentation, understanding eligibility criteria, and avoiding common pitfalls - like ignoring CRA notices or underreporting income - are crucial steps. With the right knowledge and support, you can navigate your tax situation more effectively.

Ultimately, taking action is vital. Seeking help from a licensed insolvency trustee or tax professional can provide invaluable guidance throughout this process. By embracing the strategies outlined, you can not only tackle your current tax debt but also cultivate better financial habits moving forward. Remember, empowerment through knowledge and action is key to achieving tax debt relief and securing a more stable financial future. You are not alone in this journey, and we’re here to help.

Frequently Asked Questions

What are common reasons for tax debt in Canada?

Common reasons for tax debt in Canada include underreporting income, failing to file tax returns, and not paying taxes owed.

What are the potential consequences of unresolved tax issues?

Unresolved tax issues can lead to penalties, interest charges, and even legal action.

Does owing taxes impact my credit score?

Tax obligations themselves do not directly impact your credit score, as the CRA does not report these obligations to credit bureaus. However, actions like wage garnishments or tax liens may appear on public records and could affect your credit score.

What types of financial obligations should I be aware of regarding tax debt?

Types of financial obligations related to tax debt include income levies, GST, and corporate charges.

How many individual income tax returns did the CRA receive in 2025, and what was the total balance owing?

In 2025, the CRA received over 33 million individual income tax returns, with a total balance owing of approximately $75,774,977,000.

What is the average balance of tax debt for individuals who filed returns in 2025?

In 2025, 8.25 million returns had an average balance of around $9,000.

What should I do if I can't pay my taxes immediately?

If you can't pay your taxes immediately, the CRA encourages you to reach out to them. They are willing to work with you to find solutions.

What can happen if I neglect to communicate with the CRA about my tax debt?

Neglecting to communicate with the CRA can worsen your situation and may lead to involvement from collection agencies.