Overview

Navigating tax obligations can feel overwhelming, and you're not alone in this journey. Many individuals struggle with debt relief, and it’s common to feel anxious about finding the right support. That’s why we want to introduce you to nine tax settlement companies that can help simplify your path to financial stability.

These companies offer tailored solutions designed to meet your unique needs. They provide compassionate support and innovative approaches to effectively manage your tax obligations. Imagine regaining your financial stability and peace of mind with the right guidance.

Here’s what you can expect from these services:

- Personalized strategies that fit your situation.

- Ongoing support throughout your debt relief journey.

- Empowerment to take control of your finances.

We understand that seeking help can be daunting, but remember, you are not alone. Many have walked this path and found success with the right assistance. If you’re ready to take the next step, reach out to one of these companies today. They’re here to help you regain control and find peace of mind.

Introduction

Navigating the complexities of tax debt can feel overwhelming, especially for individuals and small business owners facing significant financial obligations. We understand that as these pressures mount, finding effective solutions becomes crucial. Many people turn to specialized tax settlement companies for help, seeking guidance to ease their burdens.

This article explores nine leading firms that not only simplify the debt relief journey but also offer tailored strategies to meet your unique financial situation. With so many options available, it’s common to wonder: how can you determine which company will provide the most effective support in reclaiming your financial stability?

You are not alone in this journey. We’re here to help you find the right path forward.

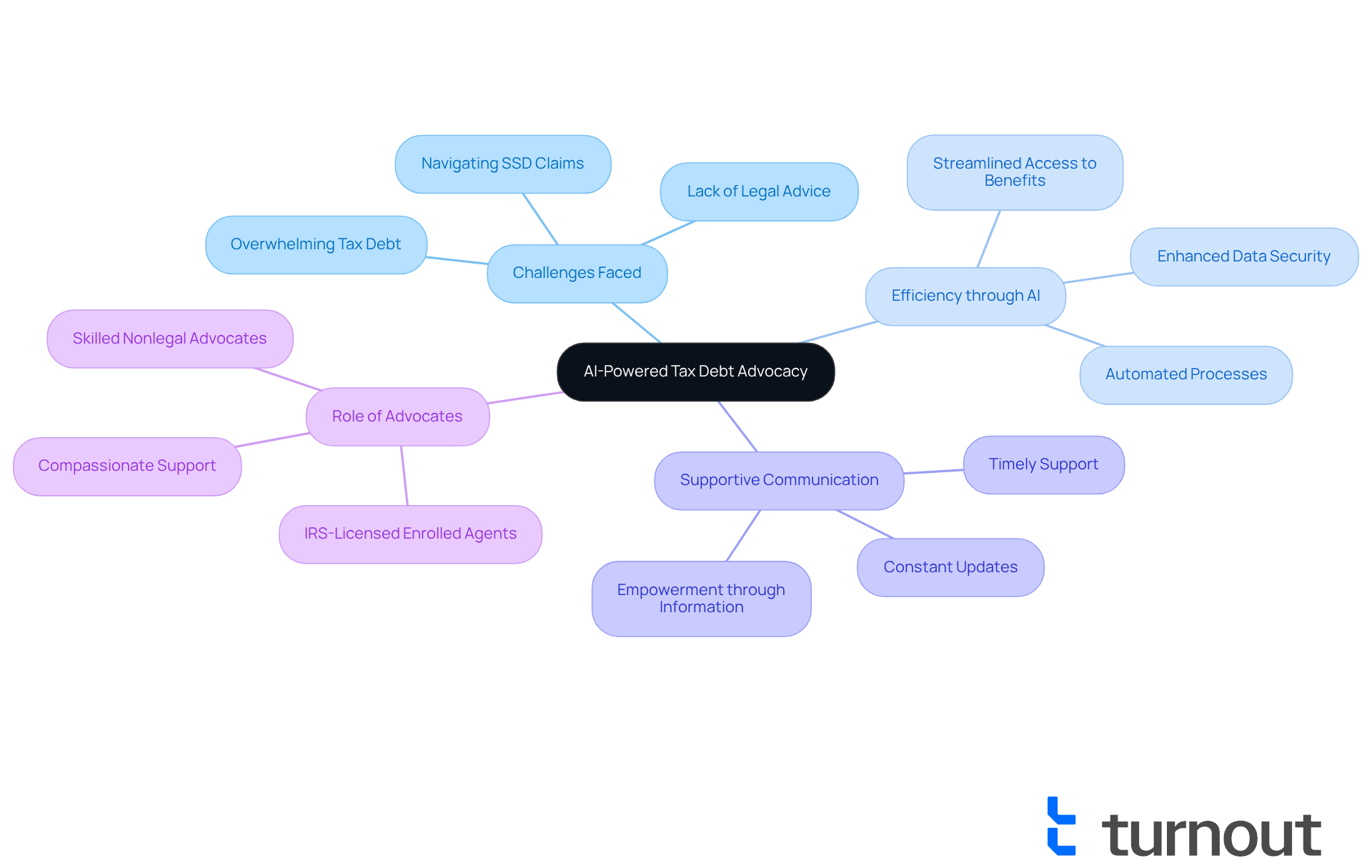

Turnout: AI-Powered Tax Debt Advocacy for Streamlined Relief

Navigating tax debt can be overwhelming, especially when you're also dealing with Social Security Disability (SSD) claims. At Turnout, we understand the challenges you face. That’s why we utilize cutting-edge AI technology to provide an efficient method for tax debt advocacy tailored just for you.

It’s important to note that Turnout is not a law firm and does not offer legal advice. Instead, we focus on automating processes and maintaining constant communication, ensuring you receive timely updates and support throughout your journey.

This innovative approach not only enhances efficiency but also empowers you to take charge of your financial situation with confidence. With our skilled nonlegal advocates and IRS-licensed enrolled agents, we streamline access to government benefits and monetary assistance.

You are not alone in this journey. Turnout stands out as a compassionate choice in the tax support arena, ready to help you every step of the way. Let us support you in reclaiming your financial peace.

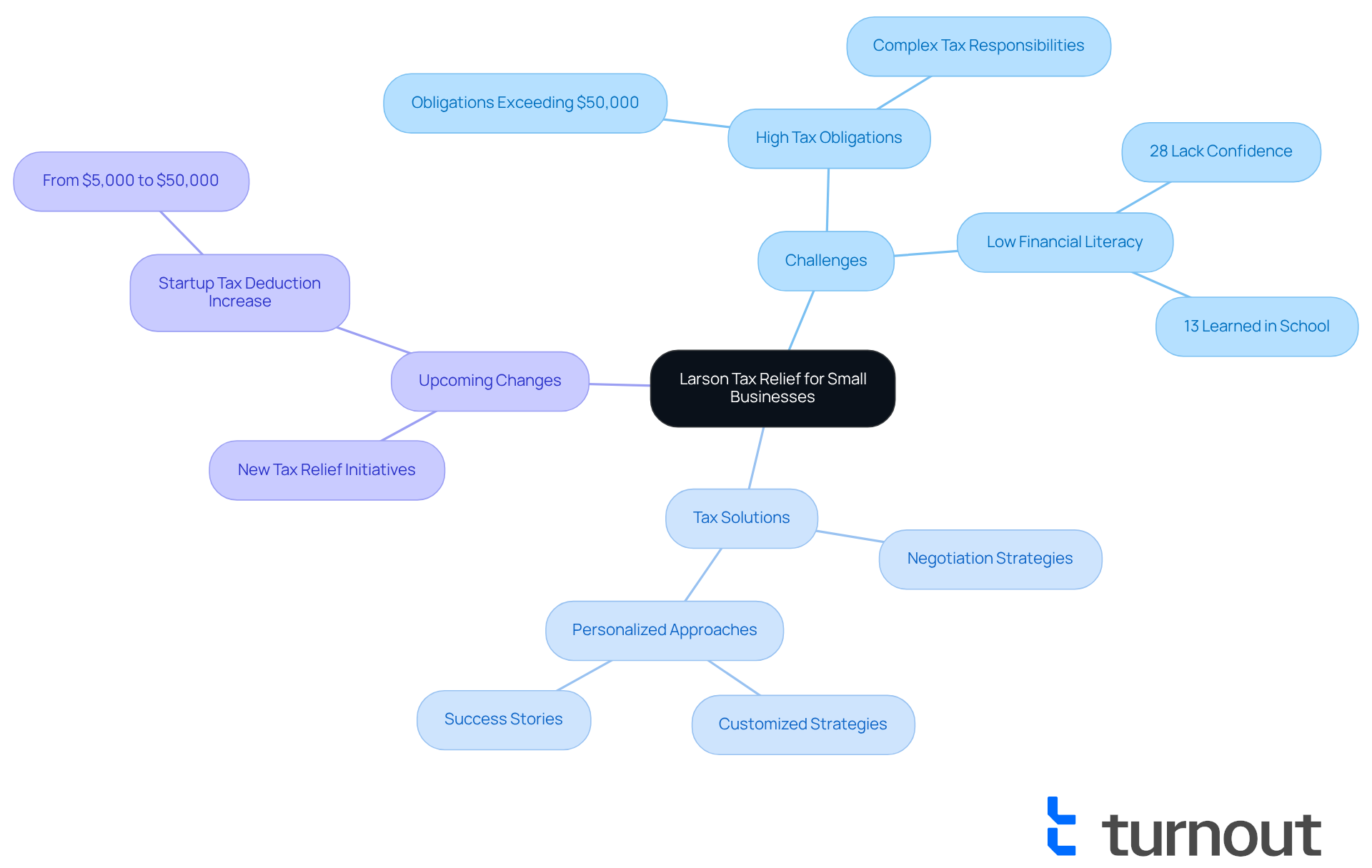

Larson Tax Relief: Best for Small Business Owners Seeking Tax Solutions

At Larson Tax Relief, we understand the unique challenges small business owners face when it comes to tax obligations. Our specialized tax solutions, offered by tax settlement companies, are designed with you in mind, providing negotiation and settlement strategies that cater to your specific financial situation. We’re here to help you navigate the complexities of tax responsibilities while working to reduce your liabilities. If you’re an entrepreneur seeking efficient tax solutions, you’ve come to the right place.

Many small business owners have shared their success stories, expressing how Larson’s services have significantly eased their tax burdens. It’s common to feel overwhelmed, especially when tax obligations can exceed $50,000 for many small businesses in the U.S., making the services of tax settlement companies essential for effective negotiation tactics. Our tax professionals emphasize personalized approaches, as customized strategies can lead to more favorable outcomes.

As we approach 2025, new tax relief initiatives are on the horizon, including an increase in the startup tax deduction from $5,000 to $50,000. This change aims to alleviate the economic strain on small businesses like yours. Larson Tax Relief is well-equipped to guide you through these changes, ensuring you maximize the benefits available to you while collaborating with tax settlement companies to manage your tax responsibilities effectively.

Remember, you are not alone in this journey. We’re here to support you every step of the way.

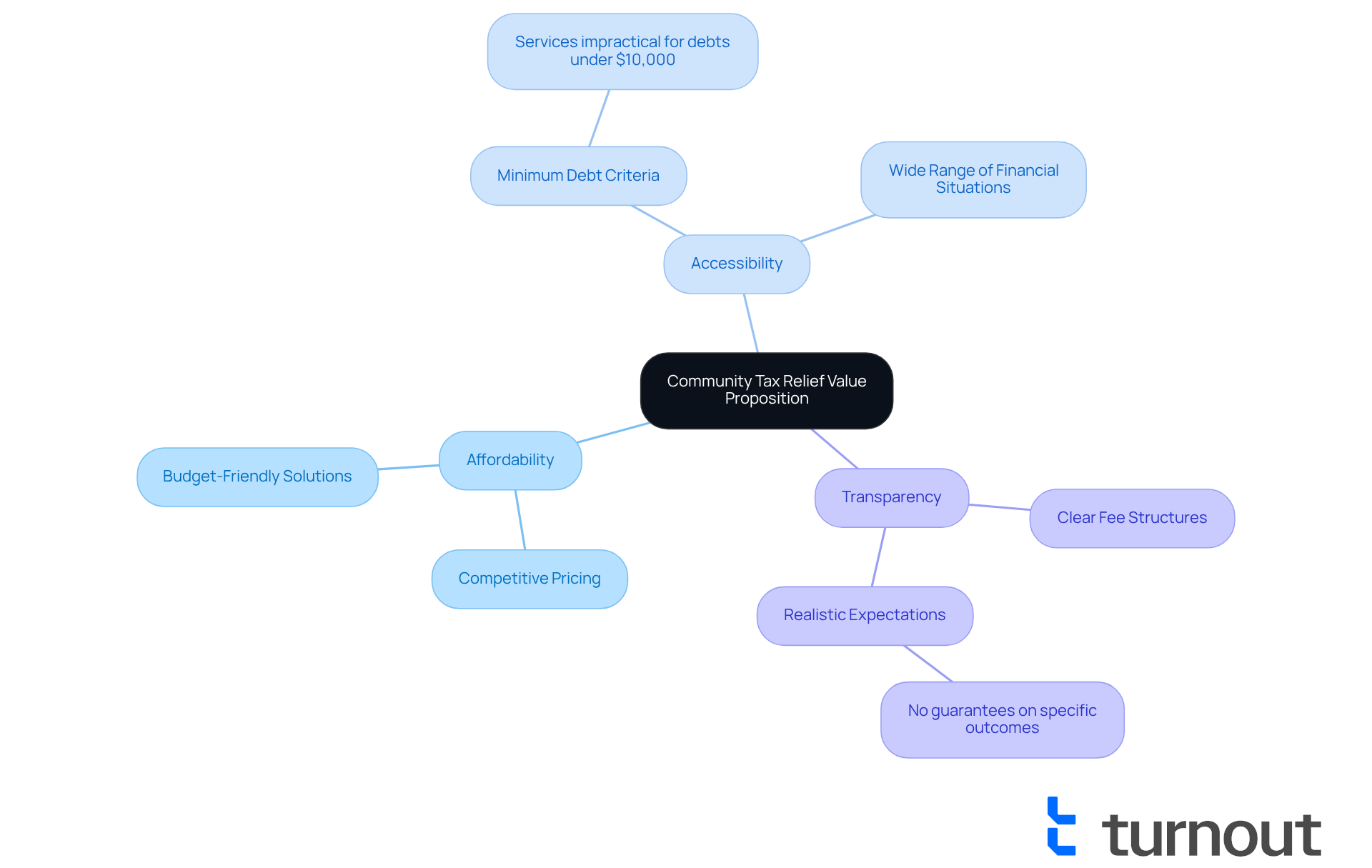

Community Tax Relief: Best Value Proposition for Tax Settlement

Community Tax Relief understands the challenges you face when dealing with tax debt. They’re recognized for their strong value proposition in the tax settlement companies arena, offering competitive pricing and a variety of services tailored to meet your needs. By prioritizing affordability without sacrificing quality, Community Tax Relief helps you regain financial stability with effective solutions.

In 2025, many respected tax assistance firms, including Community Tax Assistance, acknowledge the importance of making their services accessible to everyone. Statistics show that reputable tax assistance companies often set minimum debt criteria, which can make their services unfeasible for smaller amounts, especially those below $10,000. Community Tax Relief aims to accommodate a wider range of financial situations, ensuring that more individuals can access the help they truly need.

Successful tax reduction programs emphasize transparency in pricing and realistic expectations. Community Tax Relief exemplifies this by clearly communicating their fee structures, allowing you to make informed decisions without the burden of high upfront costs. As Matt Richardson wisely points out, "Legitimate tax assistance companies cannot guarantee specific results since only the IRS decides final settlement amounts." This insight highlights the importance of transparency and realistic expectations in the tax assistance process.

As you explore your options, Community Tax Relief stands out as a top choice among tax settlement companies for those seeking effective and budget-friendly solutions to their tax challenges. You can expect to submit necessary documentation, such as federal returns and bank statements, as part of the application process. This ensures that you are well-informed and prepared to engage with the services offered. Remember, you are not alone in this journey; Community Tax Relief is here to help.

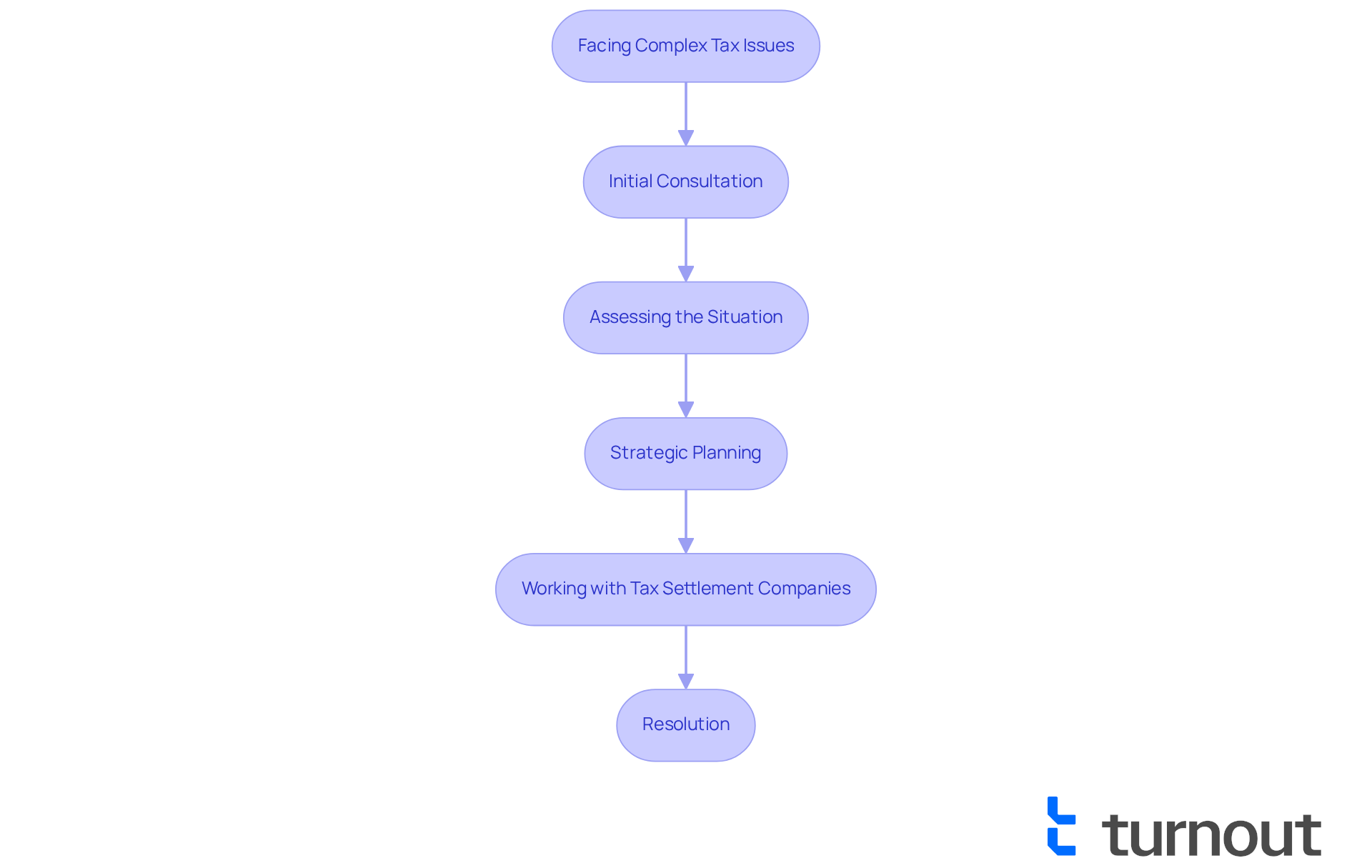

Victory Tax Lawyers: Best for Complex Tax Cases and Legal Support

At Victory Tax Lawyers, we understand that facing complex tax situations can be overwhelming. You’re not alone in this journey. Our caring team excels in providing the support you need, helping individuals navigate intricate tax issues like audits and disputes with tax authorities by working with tax settlement companies.

We’re here to empower you to tackle these challenges effectively. With our experienced professionals by your side, you can find tailored strategies that many clients have used to resolve complicated tax disputes with the help of tax settlement companies. Their success stories inspire hope and demonstrate that with the right guidance, resolution is possible.

On average, clients can expect a resolution time of several months for intricate tax issues. This highlights the importance of having a dedicated team focused on strategic planning. In 2025, legal support for tax disputes remains crucial, and we, as one of the tax settlement companies, stand out as a reliable partner in this journey.

Remember, you are not alone. Let us help you navigate your tax challenges with compassion and expertise.

Optima Tax Relief: Best User-Friendly Technology for Tax Management

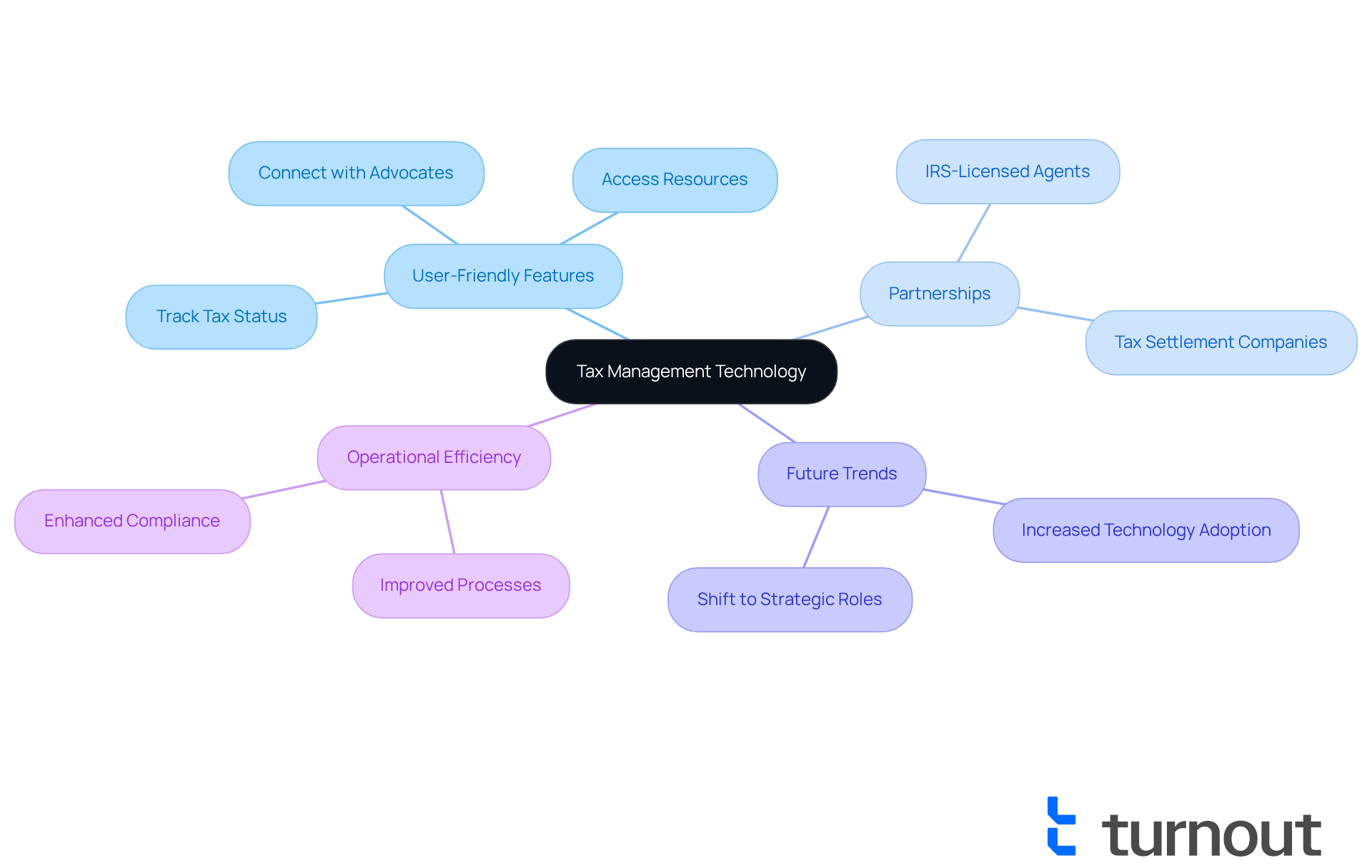

We understand that navigating tax management can be overwhelming, which is why tax settlement companies are here to assist. Turnout excels in leveraging user-friendly technology to make this process easier for you. Our innovative platform allows you to effortlessly track your tax status, connect with trained nonlawyer advocates, and access valuable resources that clarify your tax obligations.

It's important to note that Turnout is not a law firm and has no affiliation with any law firm or government agency. For tax debt assistance, we partner with IRS-licensed enrolled agents and tax settlement companies that are qualified to support you through your unique situation. This technological emphasis not only enhances your experience but also simplifies the often complex process of tax assistance.

Did you know that over 80% of tax administrations are using advanced techniques to manage data? As we approach 2025, the role of technology in tax management is expected to grow even more. Many professionals are anticipating a shift towards strategic roles that focus on data analysis and forecasting.

Successful implementations of technology in tax settlement companies are already showing significant improvements in operational efficiency. This means you can navigate your tax challenges with greater ease and confidence. As tax laws become increasingly complex, the focus will shift from simple preparation to more strategic work. This underscores the importance of technological advancements and the expert guidance we provide at Turnout.

Remember, you are not alone in this journey. We're here to help you every step of the way.

Precision Tax Relief: Best Customer Support in Tax Relief Services

Precision Tax Assistance stands out in the tax assistance sector by offering exceptional customer support. We understand that navigating tax issues can be overwhelming, and our goal is to ensure you feel valued and understood throughout your journey. Our dedicated team is here to provide timely responses and personalized assistance, which is vital for anyone facing the complexities of tax situations.

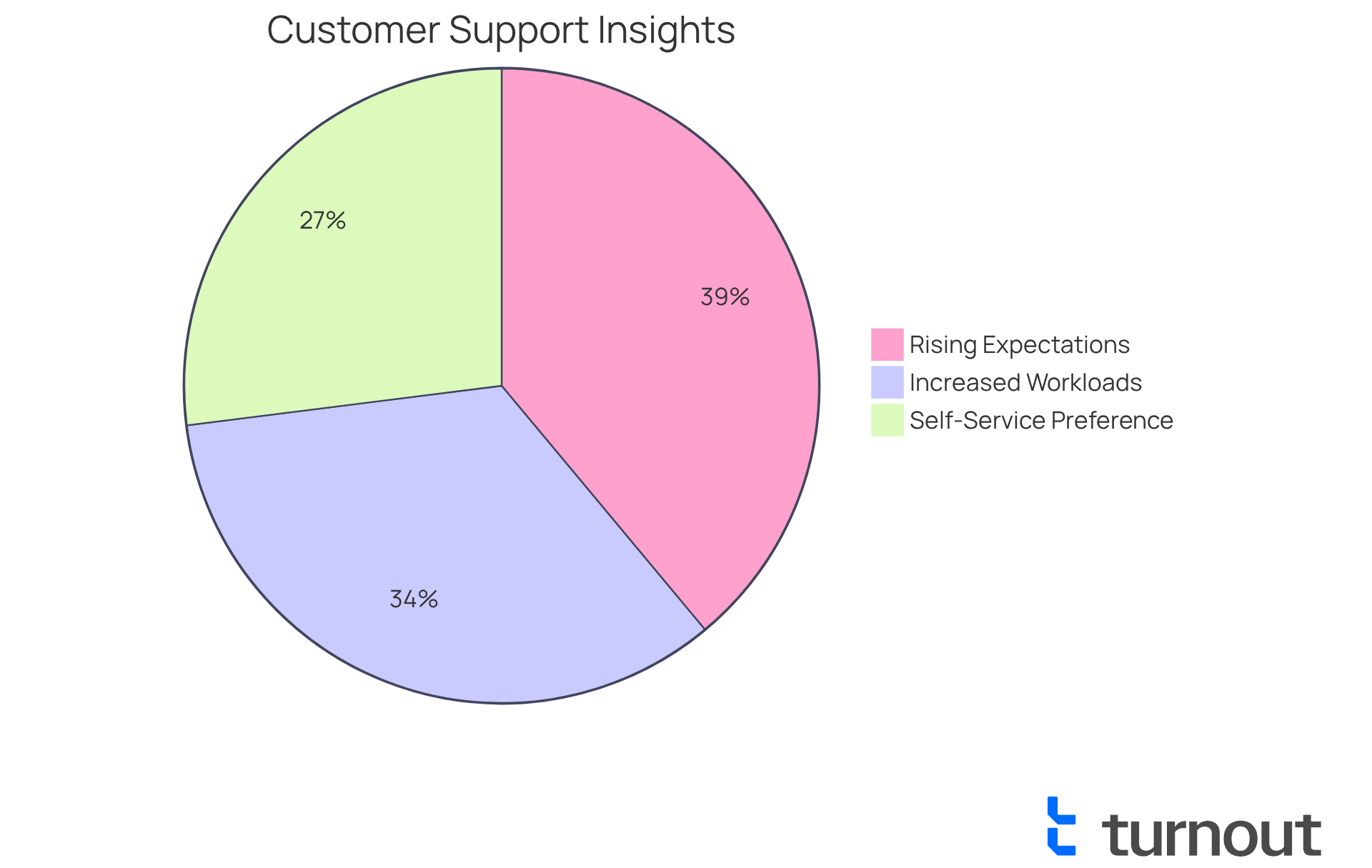

Research shows that 88% of service professionals report rising customer expectations. This highlights the importance of prioritizing client care. At Precision Tax Relief, we are committed to outstanding customer service, which not only alleviates the stress associated with tax situations but also fosters trust and satisfaction among our clients.

Many clients have shared their success stories, praising the personalized attention they receive. This significantly enhances their overall experience. In fact, with 61% of clients preferring self-service for straightforward problems, we balance this trend by offering customized assistance that meets your unique needs. We believe in the significance of human interaction in resolving tax obligations.

Moreover, with 77% of representatives reporting increased and more complex workloads compared to just one year ago, the need for effective assistance has never been more critical. As industry specialists emphasize, prioritizing customer support is essential for addressing the challenges faced by tax settlement companies. Remember, you are not alone in this journey; we’re here to help.

IRS Programs: Direct Options for Tax Debt Relief

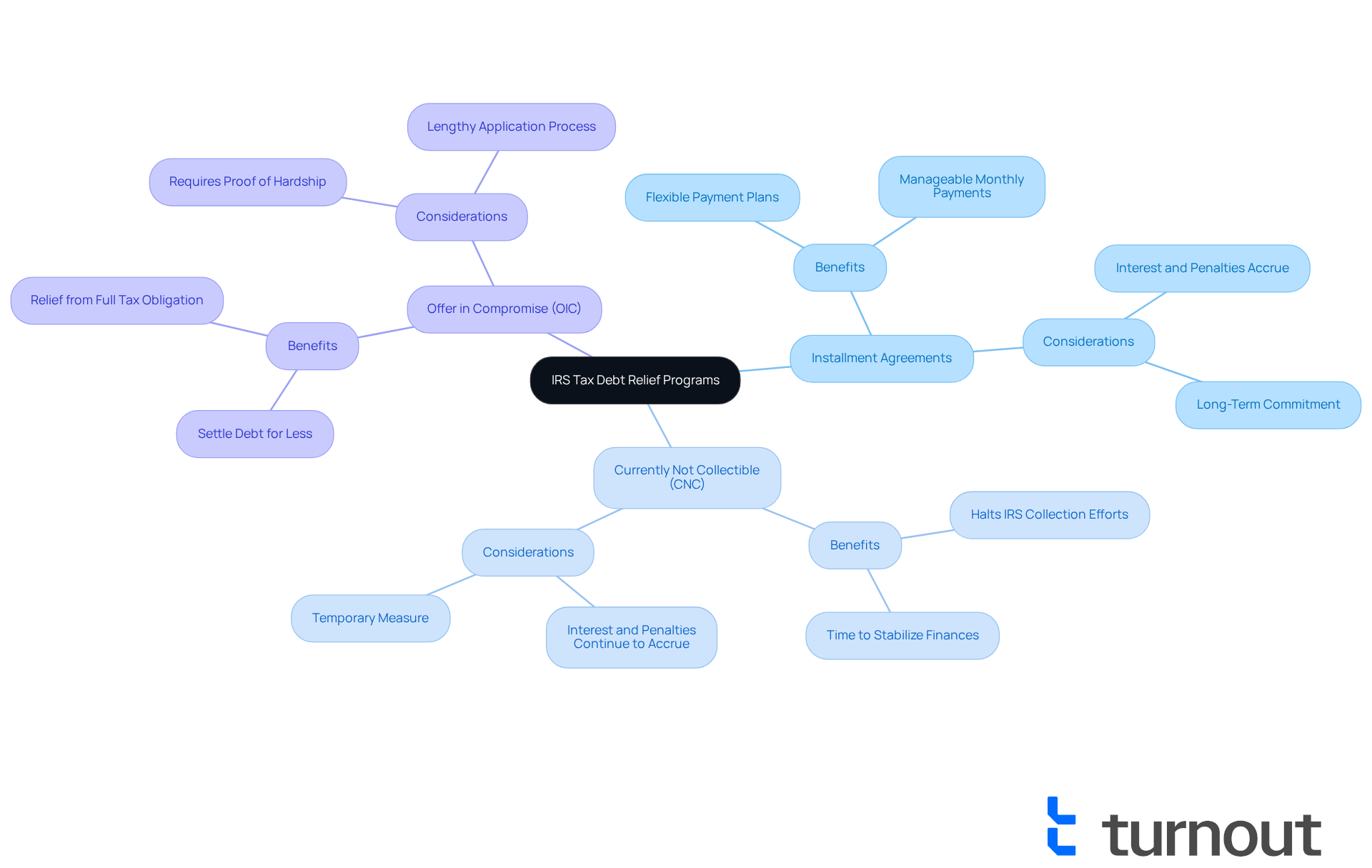

Facing tax obligations can be overwhelming, and we understand that many individuals struggle with this burden. The IRS offers various programs designed to help you navigate these challenges. Options like Installment Agreements and Currently Not Collectible (CNC) status can provide you with the relief you need, allowing you to manage your obligations without added stress. In fact, by 2025, millions are expected to benefit from these IRS financial assistance programs, reflecting a growing awareness of these supportive alternatives.

Installment Agreements can be particularly helpful. They allow you to set up a payment plan that fits your budget, giving you the flexibility to pay over time. However, it’s important to remember that interest and penalties may still accrue on any outstanding balance.

Many success stories highlight how individuals have found comfort through these IRS programs. For instance, those who qualify for CNC status have experienced a pause in IRS collection efforts, giving them the necessary time to stabilize their finances. It’s common to feel relief knowing that you can avoid harsh collection measures while gradually settling your obligations. Just keep in mind that while in CNC status, interest and penalties continue to accumulate on your tax debt.

Expert opinions stress the importance of understanding these programs. Qualified professionals from tax settlement companies can guide you through the complexities of applying for CNC status, which involves submitting IRS Form 433-F to demonstrate your inability to pay taxes owed, or setting up an Installment Agreement. By taking advantage of these IRS options, you can take proactive steps toward addressing your tax issues through tax settlement companies and restoring your financial well-being.

Additionally, the Offer in Compromise (OIC) is another viable option for those unable to pay their full tax obligation. This program allows you to resolve your tax debts for less than the total amount due, provided you can show significant economic hardship. Remember, you are not alone in this journey; we’re here to help you find the best path forward.

Offer in Compromise: Settle Your Tax Debt for Less

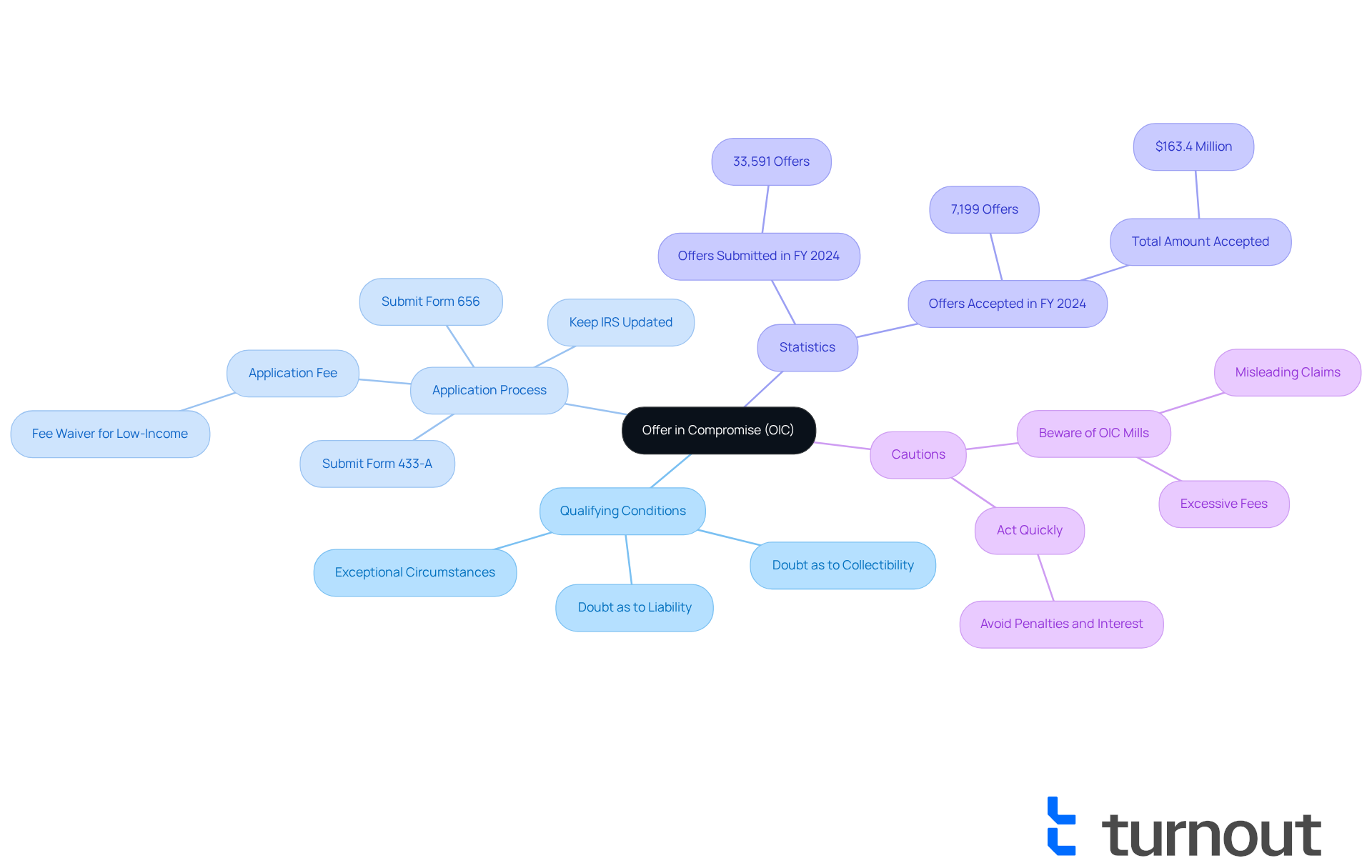

Are you feeling overwhelmed by your tax obligations? An Offer in Compromise (OIC) might just be the solution you need. This program allows you to settle your tax debts for less than what you owe, providing a lifeline for those facing economic hardships. It’s designed to ease the burden of full repayment, offering a more manageable way to resolve your tax liabilities.

To qualify for an OIC in 2025, you’ll need to meet one of three conditions:

- Doubt as to collectibility

- Doubt as to liability

- Exceptional circumstances that justify a reduced payment

The IRS has made strides to simplify the application process, adopting flexible evaluation standards that take into account your unique financial situation—like your income, expenses, and asset equity.

It’s important to keep the IRS updated about your circumstances, as this can greatly influence the outcome of your application. On average, those who successfully navigate the OIC process can save a significant amount. In fiscal year 2024, taxpayers submitted 33,591 offers, with the IRS accepting 7,199 of them, totaling an impressive $163.4 million. This shows the potential for substantial reductions in tax obligations.

Many individuals have found relief through tax settlement companies, settling their tax debts for less than they owed and gaining a fresh start. If you’re facing excessive difficulty, consider proposing a reduced sum. This can empower you to take control of your financial future. However, be cautious of tax settlement companies like OIC mills that may mislead you about your qualifications, leading to unnecessary financial loss.

Remember, it’s crucial to act quickly when you realize you have tax obligations. Delays can lead to increased liabilities due to penalties and interest. By taking proactive steps and utilizing the OIC program, you can find a viable solution to your tax challenges. You are not alone in this journey; we’re here to help.

Bankruptcy Considerations: Managing Tax Debt During Financial Hardship

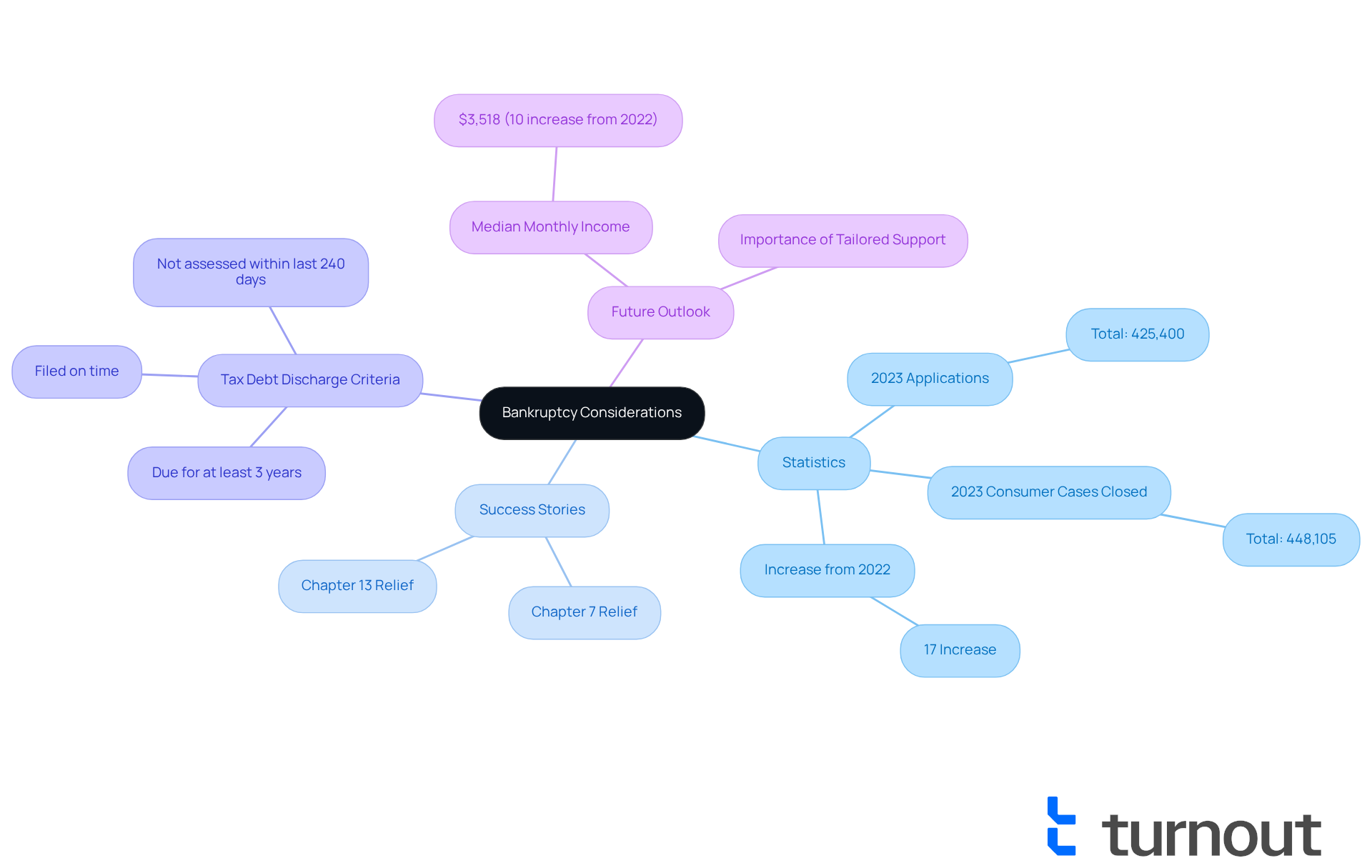

If you're facing significant financial challenges, bankruptcy might be a viable option for managing your tax obligations. While certain tax debts can be eliminated through bankruptcy, the rules can be quite complex. It's essential to understand how bankruptcy affects your tax situation, especially since over 425,400 bankruptcy applications were filed in 2023 alone, with many linked to tax issues. This marks a 17% increase from the previous year, highlighting the growing need for effective financial support.

Many success stories illustrate how individuals have successfully navigated their tax obligations through bankruptcy. For example, numerous people have found relief by filing under Chapter 7 or Chapter 13, allowing them to start anew. In 2023, around 448,105 consumer cases were closed, with 55% under Chapter 7, showcasing how this path has worked for many.

However, it's important to note that not all tax debts qualify for discharge. Generally, income taxes can be discharged if they meet specific criteria:

- They must be due for at least three years

- Filed on time

- Not assessed within the last 240 days

Understanding these nuances is crucial for anyone considering bankruptcy as a solution.

As we look ahead to 2025, the impact of bankruptcy on tax obligations remains significant. The median monthly income reported by debtors has risen to $3,518, reflecting a 10% increase from 2022. This shift suggests a potential improvement in financial stability for many. In this changing landscape, making informed decisions and seeking tailored support from tax settlement companies is vital, ensuring that you can effectively navigate your options for tax assistance. Remember, you are not alone in this journey, and we're here to help.

Future Tax Planning: Avoiding Future Tax Debt After Relief

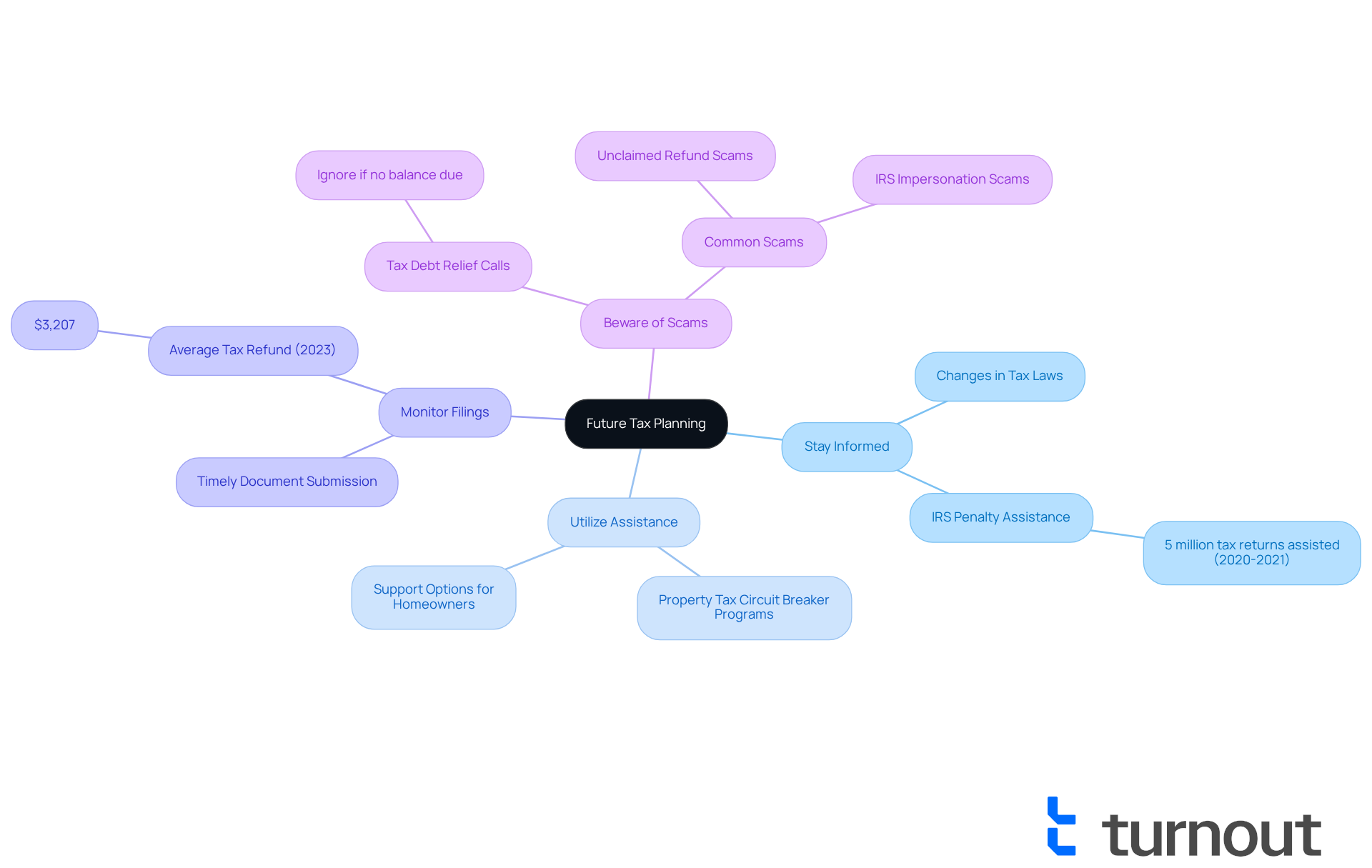

To prevent falling back into tax debt after achieving relief, engaging in effective tax planning is crucial. We understand that navigating tax responsibilities can feel overwhelming. That's why having a clear understanding of your obligations and maintaining precise records is so important. By consistently assessing your financial situation and seeking advice from professionals, you can gain valuable insights into compliance and strategic planning. Adopting these proactive strategies can help protect your economic well-being and significantly reduce the likelihood of future tax problems.

Here are some successful strategies for avoiding future tax debt:

- Stay informed about changes in tax laws and regulations that could impact your financial responsibilities. Did you know the IRS offered tax penalty assistance for nearly 5 million tax returns between 2020 and 2021? This highlights the importance of understanding the support options available to you.

- Utilize available tax assistance options, like property tax circuit breaker programs, which can help homeowners facing rising property taxes. You're not alone in this; many are in similar situations.

- Monitor your tax filings and ensure all necessary documents are submitted on time to avoid penalties. For instance, the typical tax refund for the 2023 tax year was $3,207, which can help set your financial expectations.

- Be wary of tax scams, especially unsolicited calls about tax relief. If you don’t have a balance due with the IRS or your state tax authority, these calls are likely scams that you should ignore. Protecting yourself from these scams is essential for your peace of mind.

The significance of tax planning cannot be overstated; it acts as a cornerstone for sustaining economic stability. As U.S. income tax revenue is projected to grow from about $2.18 trillion in 2023 to about $3.03 trillion in 2027, understanding how to navigate these changes will be essential. By prioritizing tax planning and employing effective strategies, you can enhance your financial resilience and avoid the pitfalls of future tax debt. Remember, we're here to help you through this journey.

Conclusion

Navigating tax debt can feel overwhelming, and we understand that. But remember, you’re not alone in this journey. The right support can truly make a difference. This article highlights nine tax settlement companies dedicated to providing tailored solutions that ease financial burdens for individuals and small business owners alike. From Turnout’s innovative use of AI technology for efficient advocacy to Victory Tax Lawyers’ specialized support for complex cases, these companies are here to guide you through your unique challenges.

Key insights from the article emphasize the importance of personalized approaches and transparency in pricing. Technological advancements play a crucial role in enhancing customer experience. Community Tax Relief stands out with its commitment to affordability and accessibility, ensuring that help is within reach for a broader audience. Meanwhile, Larson Tax Relief focuses specifically on the needs of small business owners. Additionally, understanding IRS programs like the Offer in Compromise and bankruptcy considerations can provide essential relief options for those facing financial distress.

Taking proactive steps in tax planning is vital for preventing future tax debt. By staying informed about tax laws and utilizing available resources, you can maintain financial stability and avoid the pitfalls of tax obligations. Engaging with these tax settlement companies not only offers immediate assistance but also fosters a sense of empowerment in managing your financial future.

The journey toward financial peace is achievable, and support is readily available to help you navigate the path forward. Remember, we’re here to help you every step of the way.

Frequently Asked Questions

What is Turnout and how does it assist with tax debt?

Turnout is a service that utilizes AI technology to provide efficient tax debt advocacy, particularly for individuals dealing with Social Security Disability claims. It automates processes and maintains constant communication, ensuring timely updates and support.

Is Turnout a law firm?

No, Turnout is not a law firm and does not offer legal advice. It focuses on nonlegal advocacy and support for managing tax debt.

Who provides support at Turnout?

Support at Turnout is provided by skilled nonlegal advocates and IRS-licensed enrolled agents who help streamline access to government benefits and monetary assistance.

What services does Larson Tax Relief offer for small business owners?

Larson Tax Relief offers specialized tax solutions for small business owners, including negotiation and settlement strategies tailored to their specific financial situations, helping them navigate tax obligations and reduce liabilities.

Why are tax settlement companies important for small business owners?

Tax settlement companies are essential for small business owners as they provide effective negotiation tactics, especially when tax obligations can exceed $50,000, helping to alleviate financial burdens.

What upcoming tax relief initiatives are mentioned for small businesses?

Starting in 2025, there will be an increase in the startup tax deduction from $5,000 to $50,000, aimed at reducing the economic strain on small businesses.

What is Community Tax Relief known for?

Community Tax Relief is recognized for its strong value proposition among tax settlement companies, offering competitive pricing and a variety of services tailored to meet individual needs without sacrificing quality.

How does Community Tax Relief ensure accessibility for clients?

Community Tax Relief aims to accommodate a wider range of financial situations, making their services accessible even for those with tax debts below $10,000, which many firms may not serve.

What should clients expect regarding pricing and expectations with Community Tax Relief?

Community Tax Relief emphasizes transparency in pricing and realistic expectations, clearly communicating their fee structures and highlighting that no legitimate tax assistance company can guarantee specific settlement results.

What documentation is required when engaging with Community Tax Relief?

Clients can expect to submit necessary documentation such as federal returns and bank statements as part of the application process to engage with the services offered.