Overview

Navigating the complexities of own occupation disability insurance can be overwhelming, especially when considering how it provides tailored financial protection for those unable to perform their specific job duties due to disability. We understand that this journey can feel daunting, but it's essential to grasp the critical aspects of these policies.

This article sheds light on important elements such as policy definitions and coverage features. Understanding the differences between own occupation and any occupation policies is vital. These distinctions can significantly influence your claim outcomes and financial security during challenging times.

Remember, you are not alone in this journey. We're here to help you make informed decisions that best suit your needs. By familiarizing yourself with these insights, you can take proactive steps towards securing your financial future.

Introduction

Navigating the complexities of disability insurance can feel overwhelming. We understand that grasping the nuances of "own occupation" coverage is no easy task. This specialized insurance provides vital financial protection for those who, due to disability, find themselves unable to perform the essential duties of their specific profession. As the landscape of disability claims evolves, especially with the rise of AI technologies, understanding these policies is more important than ever.

What challenges do you face in securing the right coverage? It’s common to feel uncertain about how to ensure your financial stability in times of need. Remember, you are not alone in this journey. We're here to help you navigate these complexities and find the support you deserve.

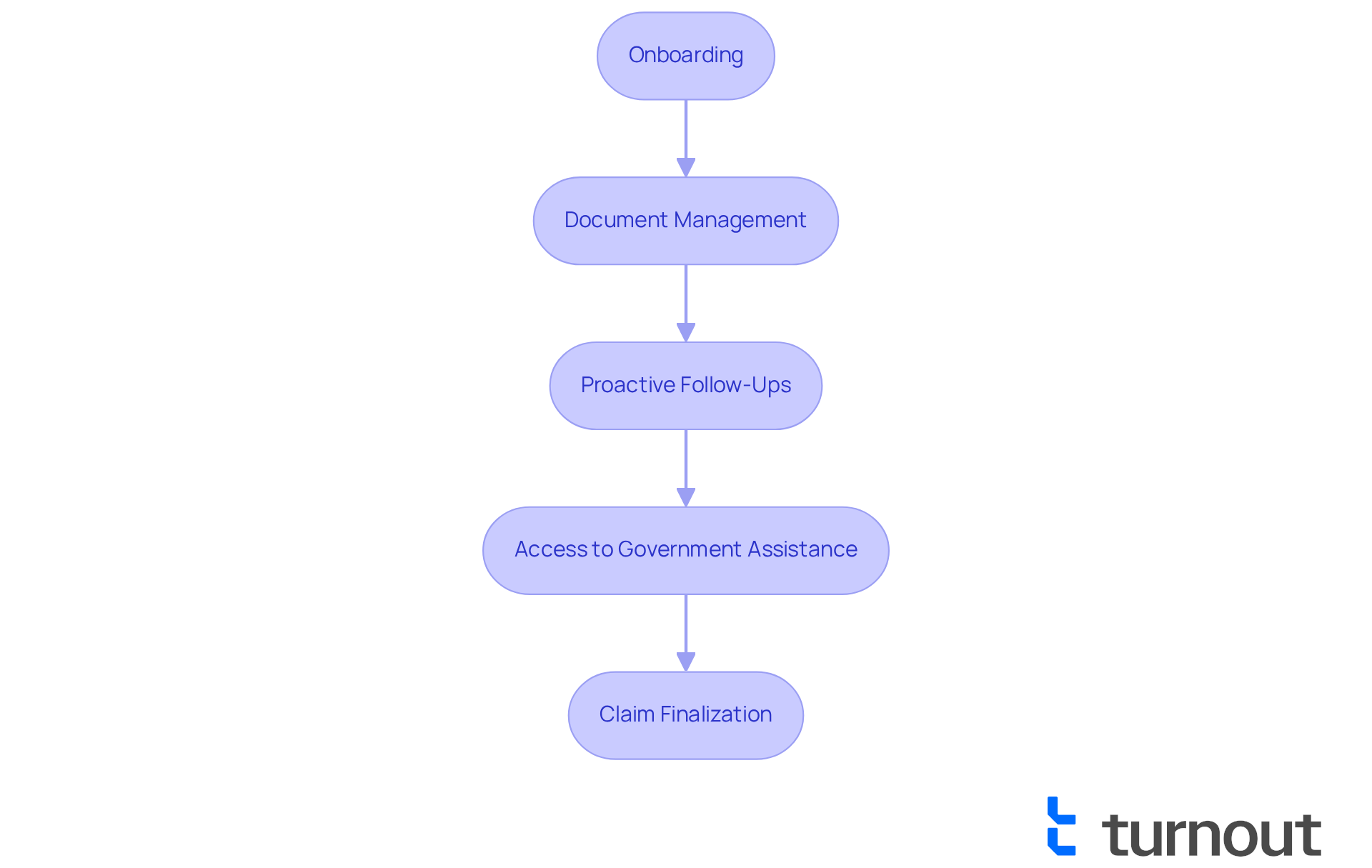

Turnout: AI-Powered Advocacy for Disability Claims

We understand that navigating the landscape of claims related to impairments and tax relief can be overwhelming. Turnout is here to change that with its AI-driven platform, designed to simplify the process of applying for assistance. At the heart of this innovation is Jake, the AI case quarterback, who oversees essential tasks like onboarding, document management, and proactive follow-ups. This ensures that you stay informed and engaged throughout your claims journey.

Turnout's approach streamlines access to government assistance, particularly for those managing Social Security Disability (SSD) claims. With trained non-legal advocates offering crucial support, you can receive help without the complexities of a client-advocate relationship. The incorporation of AI not only speeds up the claims process but also greatly enhances your experience when seeking support for impairment claims and tax matters.

Recent advancements in AI have shown promising results. Studies indicate that automated systems can significantly reduce processing times and improve accuracy. For example, the Social Security Administration is incorporating AI to modernize its decision-making processes, aiming to alleviate the current backlog of 1.4 million claims, which often takes an average of eight months for initial decisions.

Furthermore, successful implementations of AI in consumer advocacy demonstrate that these technologies can effectively manage large caseloads while maintaining high standards of care. As industry leaders highlight the importance of technology in consumer advocacy, Turnout leads the way, enhancing the accessibility and efficiency of benefits and tax relief processes for everyone. Remember, you are not alone in this journey; we are here to help.

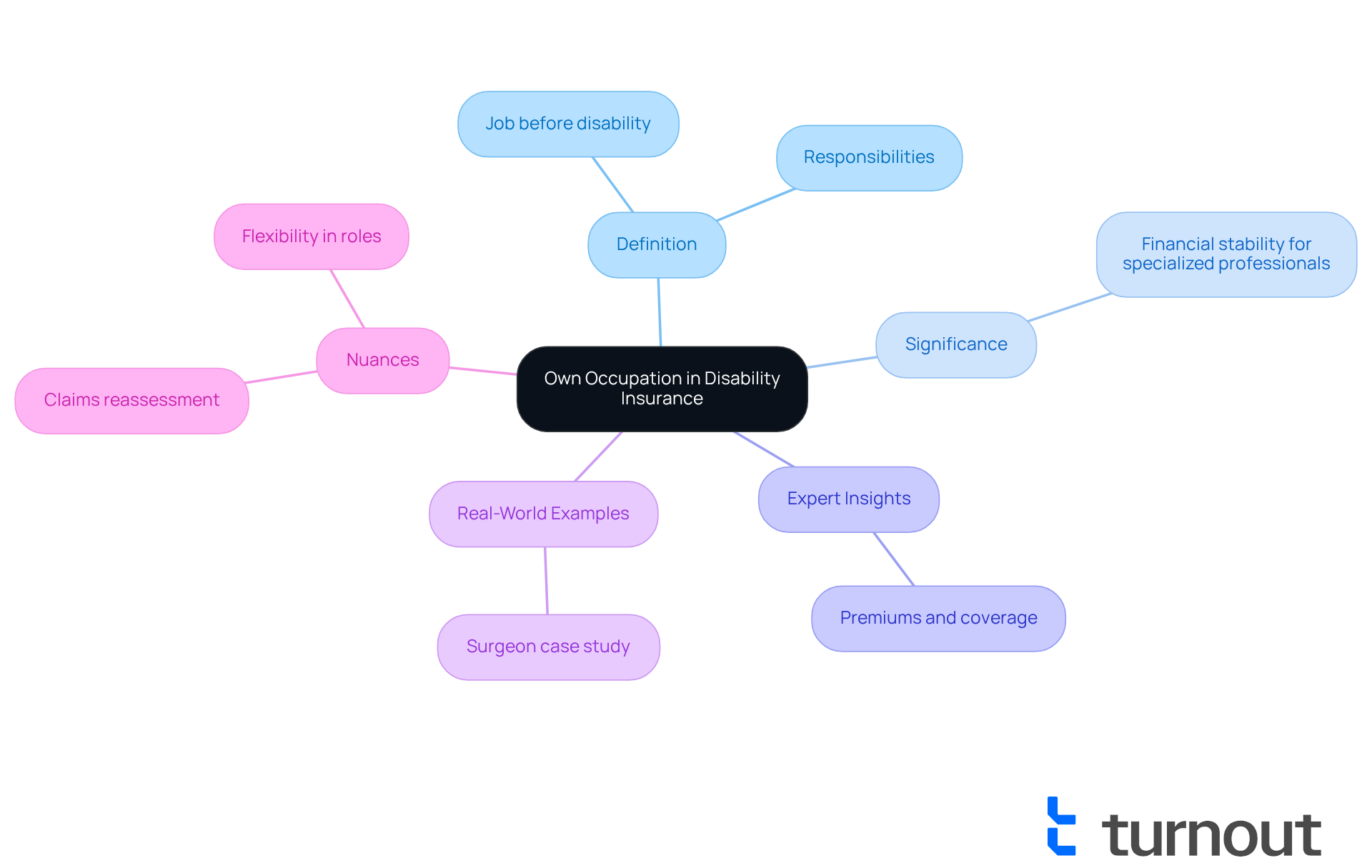

Definition of Own Occupation in Disability Insurance

In the realm of disability insurance, the term 'own profession' holds significant meaning. It specifically refers to the job or career an individual had before becoming disabled. Under this definition, a policyholder is considered disabled due to their own occupation disability if they cannot fulfill the essential responsibilities of their own job, regardless of their ability to work in a different position. This distinction is crucial for professionals, especially those in specialized fields, as it ensures they receive benefits that truly reflect their own occupation disability and unique responsibilities.

Insights from insurance experts shed light on the importance of 'own profession' coverage. Many guidelines that utilize this definition provide increased financial stability for individuals with advanced education and training, such as surgeons or specialized physicians, in case they experience an own occupation disability. It's worth noting that premiums for 'specific profession' plans tend to be higher, which indicates the tailored coverage they offer. In fact, a considerable percentage of disability insurance agreements today incorporate the 'own occupation disability' definition, highlighting its growing recognition as a vital aspect of income protection.

Real-world examples further illustrate the impact of this definition. Consider a surgeon who faces a condition affecting their fine motor skills. They may still qualify for assistance under an 'own occupation disability' agreement, even if they are capable of performing less specialized tasks. Certain regulations even allow claimants to work in an alternative position while still receiving full benefits. This flexibility is essential, especially in 2025, as more professionals seek customized coverage that acknowledges their unique career needs and potential limitations.

Understanding the nuances of 'own occupation disability' compared to 'any role' definitions can significantly influence the outcomes of disability claims. It’s crucial for individuals to carefully review their agreements and seek assistance when needed. Additionally, it's important to recognize that some regulations may reassess claims after a specific period, which could impact the benefits received. This understanding is vital for grasping the long-term implications of 'own role' coverage. Remember, you're not alone in this journey; we're here to help you navigate these complexities.

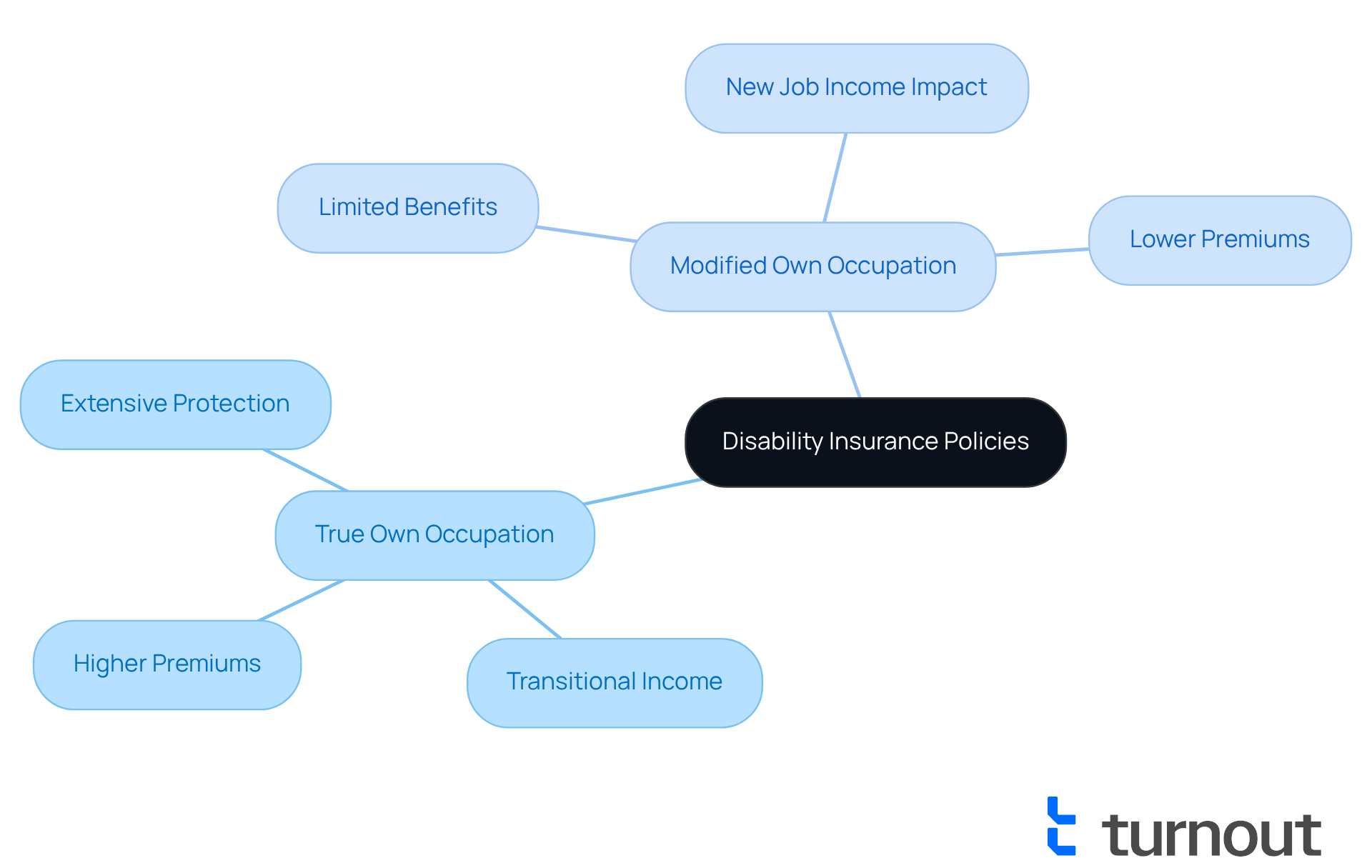

True vs. Modified Own Occupation Policies

We understand that navigating employment challenges can be overwhelming. Genuine plans for own occupation disability offer extensive protection, allowing you to seek assistance if you cannot fulfill your specific responsibilities, regardless of your ability to work in another role. On the other hand, adjusted employment regulations may limit benefits if you take on another position, even if you are still unable to perform your original job.

It's common to feel concerned about the costs associated with long-term disability coverage. Premiums for 'own occupation disability' terms are generally higher, reflecting the comprehensive protection they provide. Additionally, transitional 'Own Occupation Disability' Insurance allows you to earn income from a new job while receiving support, as long as your total earnings do not exceed your previous income before the disability.

Understanding these differences is essential for choosing the right policy that aligns with your professional and financial needs. We encourage you to consider consulting with a professional insurance adviser to navigate these options effectively. Remember, you are not alone in this journey; we're here to help you find the best solutions for your circumstances.

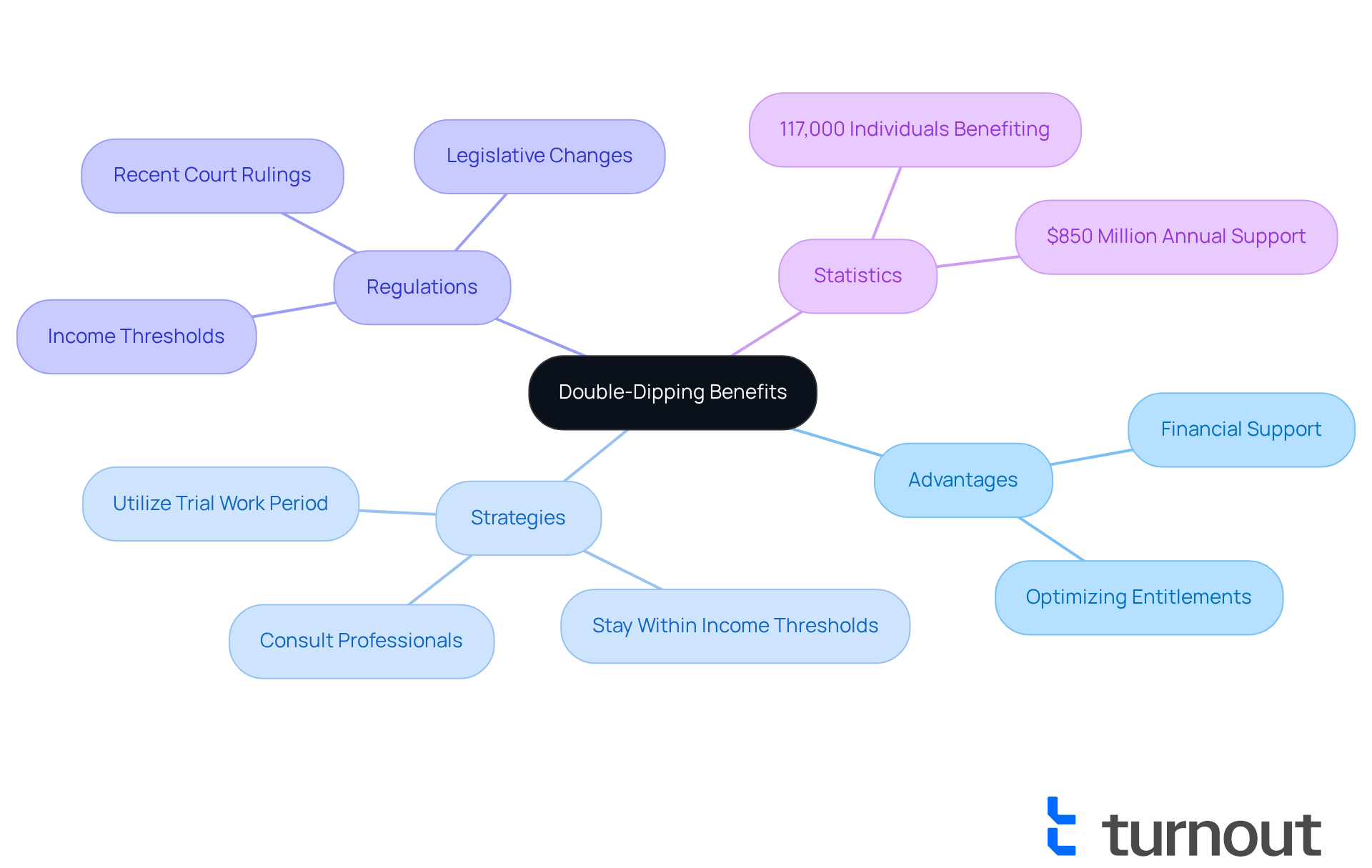

Double-Dipping Benefits During Disability Claims

Double-dipping refers to the practice of obtaining assistance from various sources at the same time, such as merging private insurance for incapacitation with Social Security Insurance for incapacitation. While it is possible to gain advantages from both, comprehending the regulations overseeing these interactions is crucial to prevent penalties or decreases in support. Many individuals successfully obtain both SSDI and private assistance, illustrating that with the right strategies, optimizing entitlements is possible.

We understand that navigating these complexities can be overwhelming. That's why it's important to consult with knowledgeable professionals. Their trained non-legal representatives can assist you in maximizing your advantages without encountering penalties by following specific guidelines. For instance, SSDI recipients can frequently obtain a portion of their private assistance funds without endangering their SSDI payments, as long as they remain within the income thresholds established by the Social Security Administration.

In fiscal year 2010, at least 117,000 individuals received both unemployment insurance and disability assistance, totaling approximately $850 million each year. This illustrates the potential for double-dipping strategies to provide substantial financial support. Additionally, the Trial Work Period enables SSDI recipients to assess their capacity to work for 9 months without forfeiting support, providing further opportunities for financial stability.

However, it's essential to stay updated on the changing regulations, including recent federal court decisions that have affected SSDI and unemployment assistance. We encourage you to seek advice from Turnout to ensure compliance and optimize your support effectively. Remember, you are not alone in this journey; we’re here to help you navigate the path ahead.

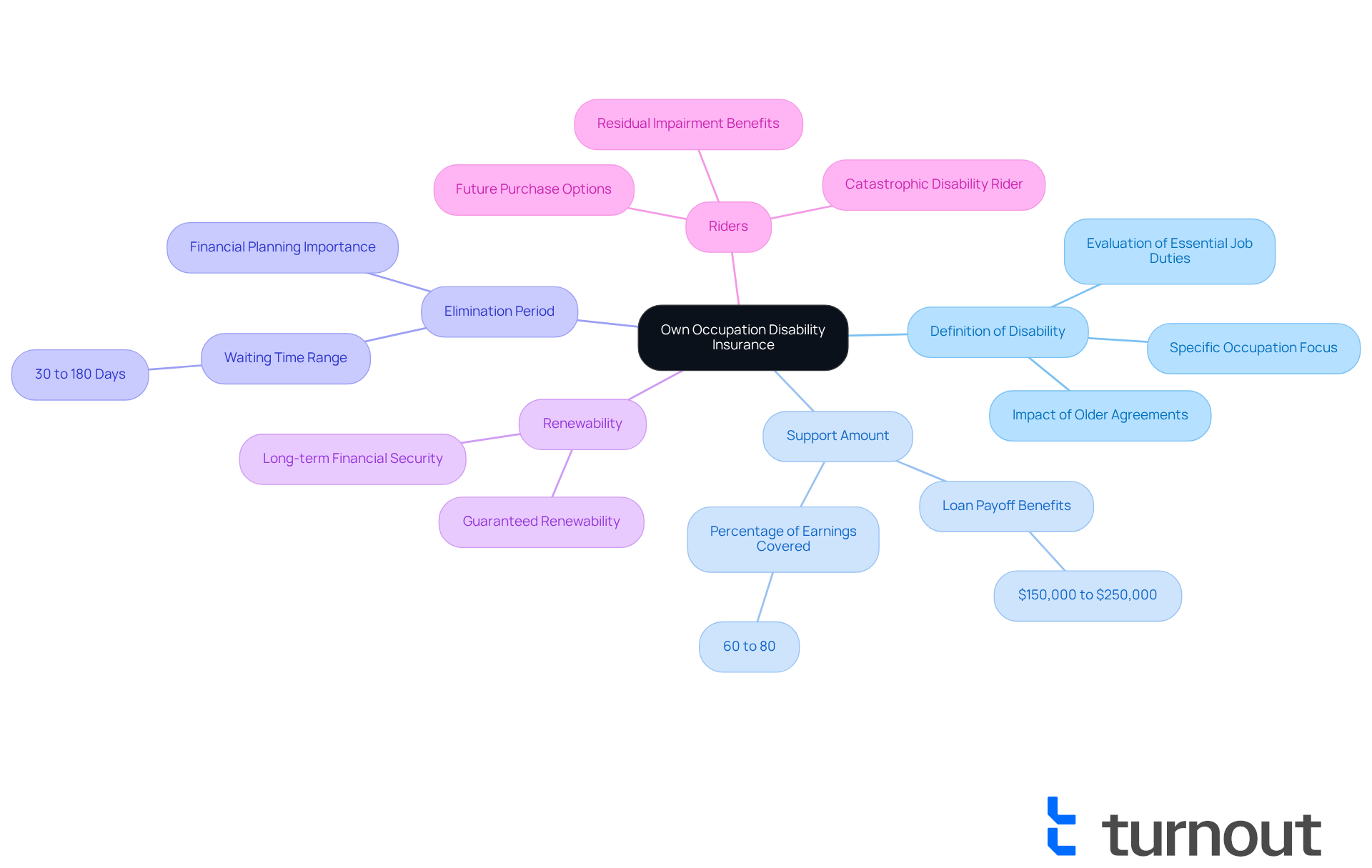

Key Features of Own Occupation Disability Insurance

When considering own occupation disability, it’s essential to understand the key features of the insurance, as they can significantly impact your financial security during challenging times.

-

Definition of Disability: It's important to know how policies define disability, especially in relation to your specific occupation. This definition ensures that claims are evaluated based on your ability to perform essential job duties. If you find yourself unable to carry out significant responsibilities and are not employed at all, payments will be made to support you.

-

Support Amount: These plans typically provide a substantial share of your earnings, usually between 60% and 80%. This financial assistance can be crucial during times of disability, helping to ease your worries.

-

Elimination Period: The waiting time before benefits begin can vary widely among plans, ranging from 30 to 180 days. Understanding this timeframe is vital for planning your financial needs during recovery. It’s common to feel anxious about how to manage during this period, but knowing your options can help you feel more secure.

-

Renewability: Many policies offer guaranteed renewability, ensuring that your coverage remains intact as long as premiums are paid. This feature is essential for your long-term financial security, providing peace of mind as you navigate your journey.

-

Riders: Additional features, like residual impairment benefits, can offer partial benefits if you can still work but at a reduced capacity. This flexibility is important for those returning to work after an injury. Furthermore, regulations may allow for future purchase options, enabling you to enhance your coverage beyond the initial limits of your agreement.

Recent insights emphasize the importance of regulations that provide clear definitions of disability, particularly regarding own occupation disability. Individuals with older agreements that include future purchase options might find opportunities to improve their coverage. Understanding the effects of elimination periods is also crucial, as many plans enforce waiting durations that can impact your financial stability during recovery.

As the landscape of impairment insurance evolves, staying informed about these key features empowers you to make better choices regarding your income protection. Remember, you're not alone in this journey. Quotes from insurance professionals underscore the significance of understanding these features to ensure adequate financial support when you need it most.

Own Occupation vs. Any Occupation Policies

Understanding the difference between personal employment and all employment plans is crucial, especially when it comes to assessing disability. We recognize that this can be a challenging topic. Specific job coverage defines a person as disabled if they cannot fulfill their particular work responsibilities. In contrast, broad job coverage requires that the individual be unable to work in any role for which they are qualified based on their education, training, and experience. This distinction can greatly influence the protection you receive.

For instance, consider a surgeon who cannot perform operations due to an injury. Under a specific job arrangement, they might still qualify for assistance, even if they can work in another capacity, such as a general practice physician. However, under any employment approach, if that same surgeon is deemed capable of performing any suitable role, they could be denied benefits. It’s common to feel overwhelmed by these complexities, but understanding them is vital for ensuring your financial security in case of an impairment.

Statistics show that claims approved under own occupation disability agreements are often higher. This is because they offer tailored protection for specialized professionals facing own occupation disability. Insurance analysts emphasize that the definitions used in these agreements can significantly impact claim outcomes. Therefore, it’s essential for consumers to carefully evaluate their options.

We’re here to help you navigate these choices. Comprehending these differences can empower you to make informed decisions that safeguard your future. Remember, you are not alone in this journey. If you have any questions or need further assistance, please reach out—we’re here for you.

High-Income Replacement in Disability Insurance

Individuals with high earnings often encounter unique challenges when it comes to insurance for disabilities. We understand that typical plans frequently fall short in providing adequate income replacement. For instance, employer-sponsored long-term incapacity (LTD) plans may only replace about 60% of an individual's income, capped at $10,000 monthly. This limitation can create a significant gap for those with higher earnings.

To safeguard their financial security, it’s crucial for these individuals to consider specialized high-limit insurance policies that cover own occupation disability. These customized plans are designed to replace a greater portion of earnings, often exceeding standard thresholds. This ensures that high-income individuals can maintain their lifestyle and meet financial obligations during times of incapacity.

Imagine a corporate executive earning $500,000 annually. They might find that their group income protection plan covers less than half of their earnings, potentially forcing them to dip into savings or sell assets. This scenario underscores the necessity of securing a high-limit insurance plan that adequately compensates for lost earnings in the event of own occupation disability, allowing individuals to focus on recovery rather than financial stress.

Financial advisors emphasize the importance of proactively addressing the income protection gap. Many high-income professionals may not realize the limitations of their group plans, which often lack sufficient coverage. As Steve Heney notes, "Many highly compensated employees face the potential of an income protection gap within their employer’s group long-term coverage." By seeking guidance from experts in income protection, individuals can uncover options tailored to their specific financial situations and lifestyle risks, ensuring comprehensive coverage against revenue loss due to unexpected disabilities, particularly their own occupation disability.

Remember, you are not alone in this journey. We’re here to help you navigate these challenges and find the right solutions for your needs.

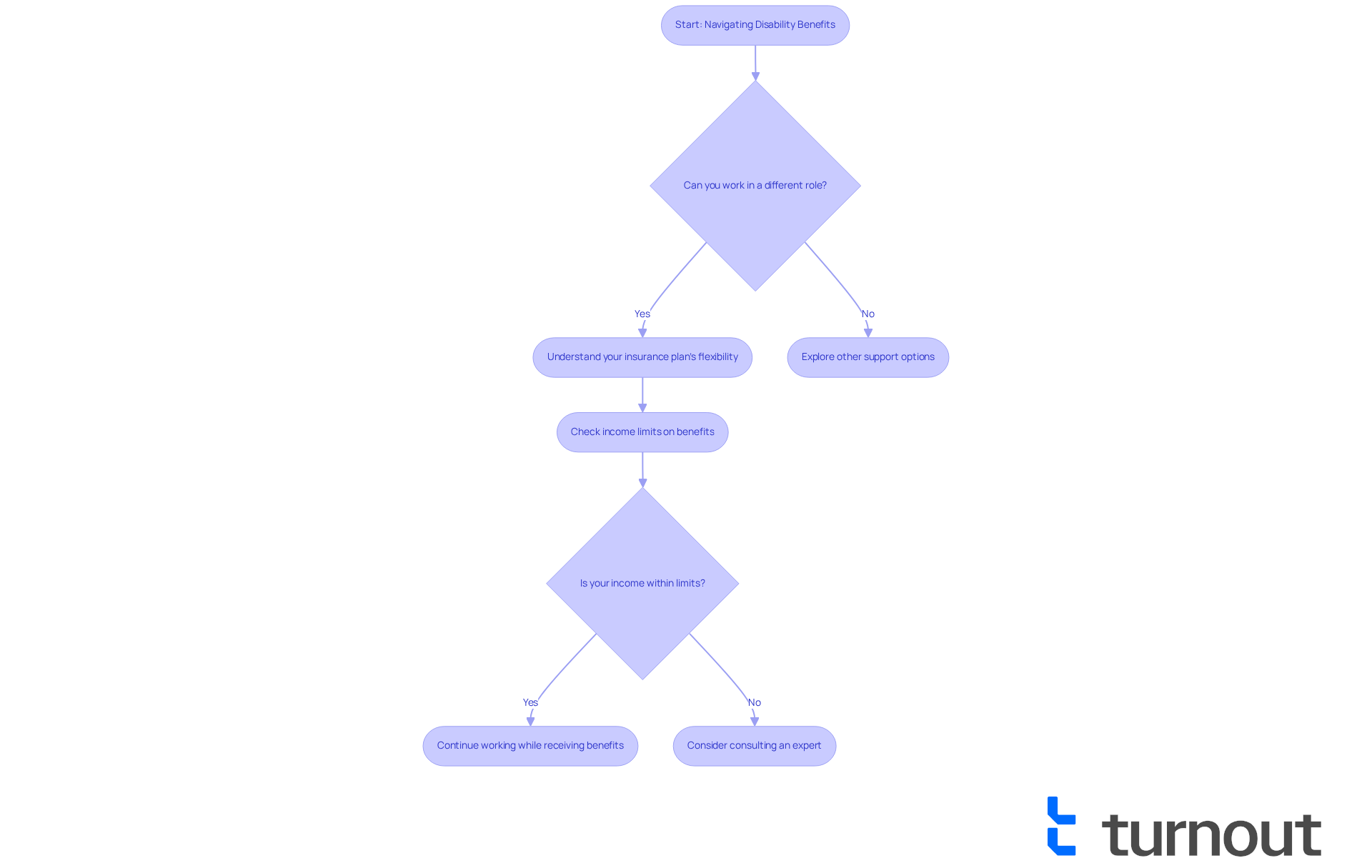

Flexibility to Work While Receiving Disability Benefits

We understand that navigating your profession insurance options can be overwhelming, especially during challenging times. Many insurance plans offer the flexibility to work in a different role while still receiving support for own occupation disability, as long as you are unable to perform your initial job. This feature can be incredibly valuable for those looking to supplement their income during their own occupation disability.

However, it’s essential to thoroughly comprehend the specific conditions of each agreement. Some plans may impose limits on the amount of income you can earn while receiving benefits. For instance, while regulations may allow part-time work, the proportion of income that can be earned varies significantly.

Discussing your options with a representative from Turnout can help clarify these terms and ensure you meet the requirements. This guidance is crucial for maximizing your financial support during difficult times. Turnout offers tools and services designed to assist clients in navigating SSD claims and financial assistance without legal representation.

Understanding these policy terms is vital for maintaining your financial stability. Remember, you are not alone in this journey; we’re here to help you every step of the way.

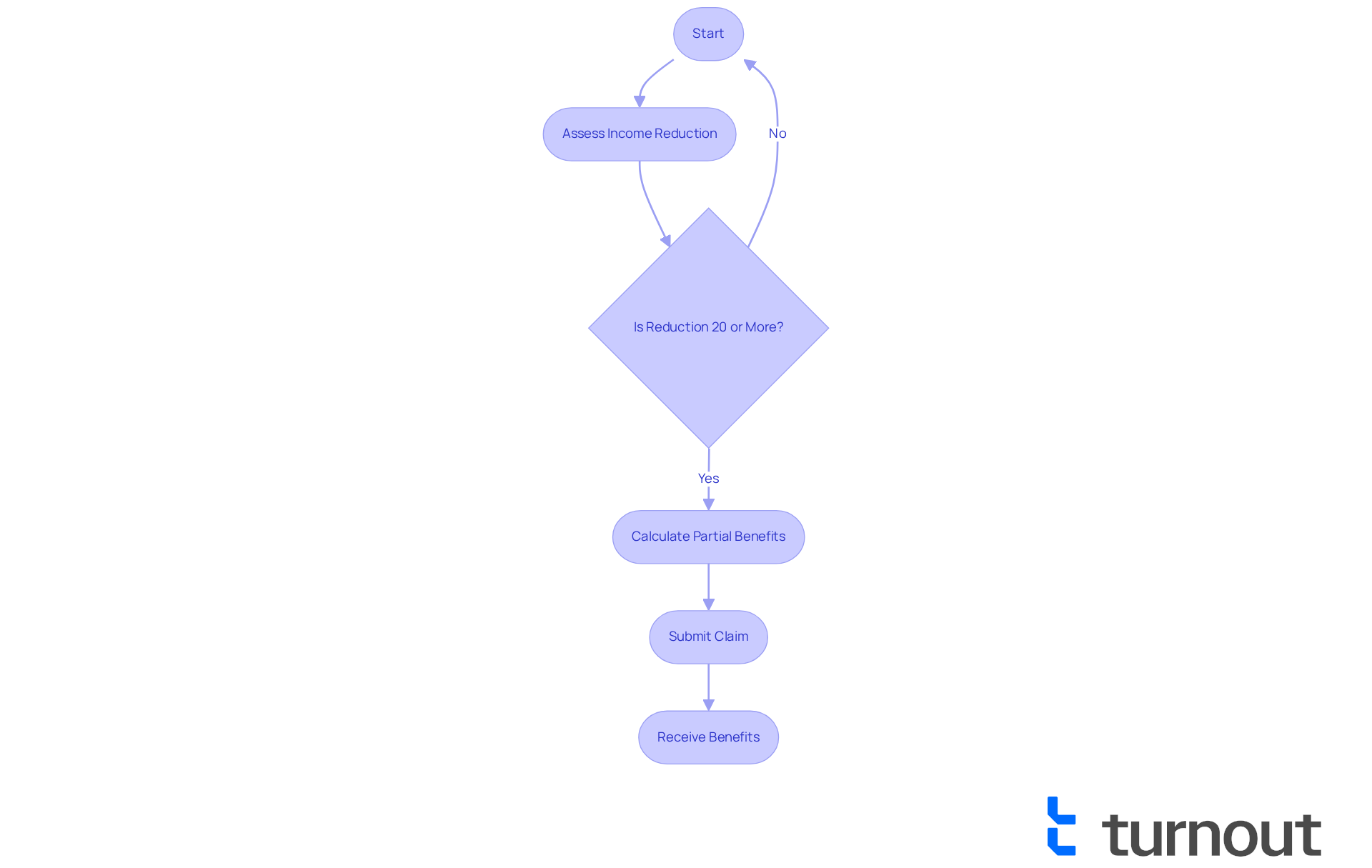

Understanding Residual Disability Benefits

Residual support offers vital financial assistance for individuals who may be partially impaired yet still able to work in a limited capacity. These benefits are typically based on the percentage of income lost due to the impairment, allowing policyholders to receive partial support that aligns with their specific income reduction. For instance, if someone experiences a 40% decrease in income because of their condition, they could receive approximately 40% of their total compensation.

Importantly, residual benefits can begin after a 20% reduction of pre-disability income, which is a key eligibility requirement. This aspect is particularly significant for those who may not qualify for full assistance but still face considerable financial challenges due to their situation. We understand that navigating these options can be overwhelming.

As one insurance expert noted, optimizing the payout of residual benefits requires a strategic approach that encompasses both financial planning and a clear understanding of policy terms. Moreover, residual disability payments are often among the most contested types of claims, highlighting the obstacles individuals face when seeking these payments.

By grasping how residual benefits function and maintaining thorough records while adhering to policy guidelines, you can navigate your insurance options more effectively. This ensures you have the necessary coverage to support you during tough times. Additionally, these benefits may continue until the full retirement age, making them a crucial factor in long-term financial planning. Remember, you are not alone in this journey; we’re here to help you through it.

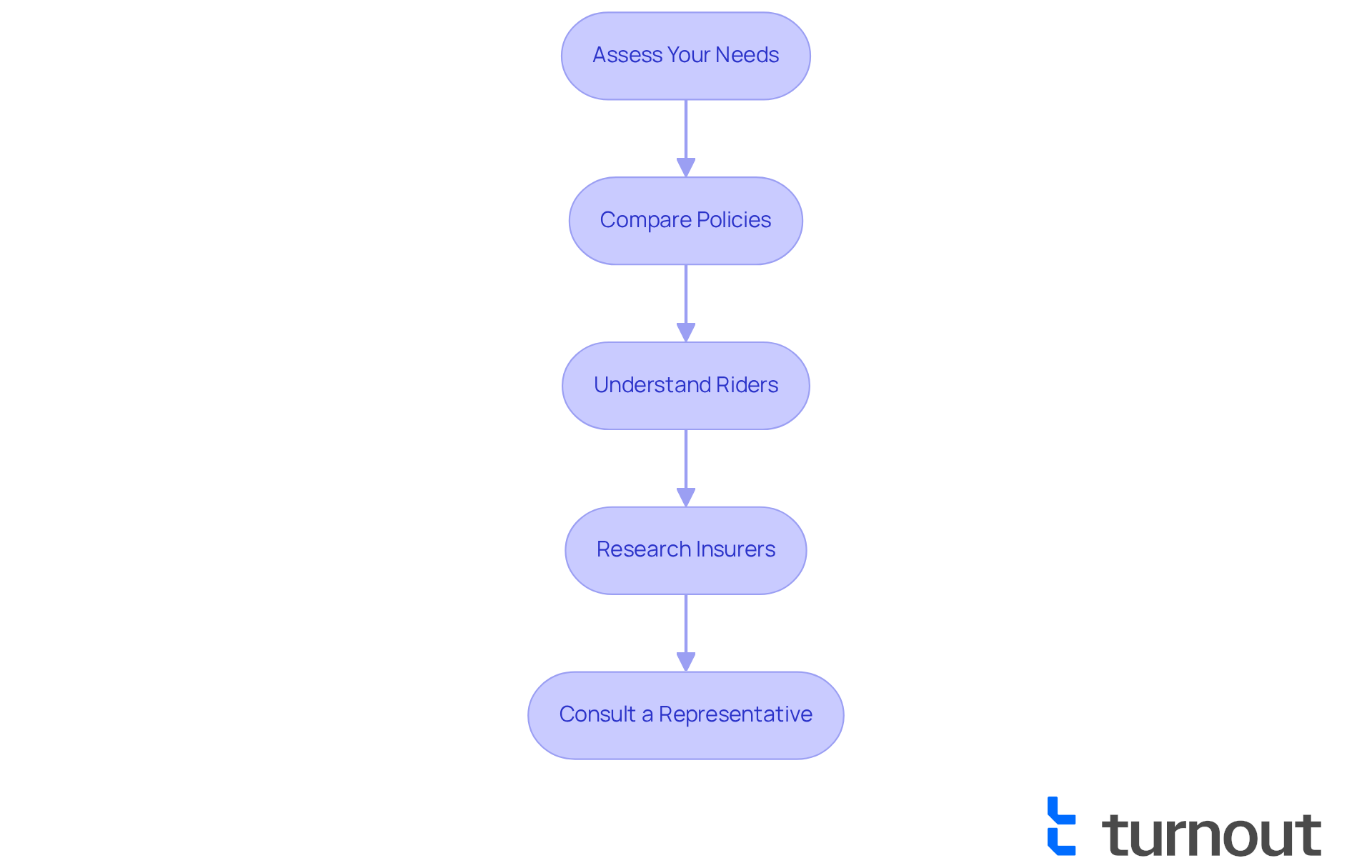

How to Choose the Best Own Occupation Disability Insurance

Choosing the best own occupation disability insurance can seem overwhelming, but we're here to assist you in navigating this important decision. Begin by assessing your needs—evaluate your income, expenses, and financial obligations to determine the level of coverage required. This foundational step ensures you choose a plan that adequately safeguards your financial future.

Next, compare policies. Look for those that offer true own occupation disability definitions, which provide advantages if you cannot perform the specific duties of your profession, even if you can work in another capacity. Additionally, seek high advantage limits and favorable terms that align with your financial objectives.

It’s also important to understand riders. Consider additional features such as residual disability provisions, which can offer extra financial support if you can only work part-time due to your condition. Riders can enhance your policy's value and provide tailored protection.

Researching insurers is crucial. Investigate the reputation and financial stability of insurance providers. A company with strong financial ratings is more likely to fulfill its obligations, ensuring you receive the benefits you need when you need them.

Finally, consult a representative. Seek guidance from a knowledgeable representative who can help you navigate the complexities of insurance for disabilities. Supporters can offer perspectives on options and help you choose the most suitable coverage for your individual circumstances.

Statistics indicate that approximately 70% of individuals consult advocates when selecting disability insurance, highlighting the value of expert guidance in making informed decisions. Real-world examples illustrate how individuals have effectively navigated the insurance environment with the assistance of advocates, ensuring they obtain the most appropriate coverage for their needs. Financial advisors emphasize the significance of evaluating insurance requirements comprehensively, suggesting that you take into account your unique situation and future earning potential when selecting a plan. By following these best practices, you can confidently choose an own occupation disability insurance policy that offers the protection you deserve. Remember, you are not alone in this journey.

Conclusion

Understanding the intricacies of own occupation disability insurance is essential for anyone looking to protect their income and ensure financial stability in the face of unforeseen challenges. This type of insurance not only recognizes the specific responsibilities tied to your profession but also provides tailored coverage that aligns with your unique needs. By grasping the nuances of this insurance, you can make informed decisions that safeguard your future.

We understand that navigating the world of disability insurance can be overwhelming. Throughout this article, we shared key insights regarding:

- The definition of own occupation

- The differences between true and modified policies

- The potential for double-dipping benefits

- The importance of high-income replacement coverage

Each point emphasizes the significance of selecting the right policy and understanding its features, such as residual benefits and the flexibility to work while receiving support. These insights serve as your guide for navigating this often complex landscape.

Ultimately, the journey towards securing adequate disability insurance requires careful consideration and proactive planning. Engaging with knowledgeable representatives and utilizing AI-driven tools can enhance your experience, making the process smoother and more supportive. As the landscape of disability insurance evolves, staying informed and seeking assistance ensures that you are well-equipped to face any challenges that may arise. Embrace the opportunity to protect your income and future by exploring the best options available, because the right coverage can make all the difference when it matters most.

Frequently Asked Questions

What is Turnout and how does it assist with disability claims?

Turnout is an AI-driven platform designed to simplify the process of applying for assistance related to impairment and tax relief, particularly for Social Security Disability (SSD) claims. It features an AI case quarterback named Jake, who manages onboarding, document management, and proactive follow-ups to keep users informed throughout their claims journey.

How does AI improve the claims process for disability assistance?

AI enhances the claims process by speeding up processing times and improving accuracy. For instance, the Social Security Administration is using AI to modernize decision-making and reduce a backlog of claims, which can take an average of eight months for initial decisions.

What does the term 'own occupation' mean in disability insurance?

'Own occupation' refers to the job or career an individual held before becoming disabled. A policyholder is considered disabled under this definition if they cannot perform the essential responsibilities of their specific job, regardless of their ability to work in a different position.

Why is 'own occupation' coverage important for professionals?

'Own occupation' coverage provides increased financial stability for professionals, such as surgeons and specialized physicians, by ensuring they receive benefits tailored to their unique responsibilities and disabilities. Policies that use this definition are becoming more common, reflecting its importance in income protection.

How do true own occupation policies differ from modified own occupation policies?

True own occupation policies provide extensive protection, allowing individuals to claim benefits if they cannot perform their specific job, regardless of their ability to work in another role. Modified policies may limit benefits if the individual takes on another job, even if they are still unable to perform their original job.

What should individuals consider when choosing a disability insurance policy?

Individuals should carefully review their agreements to understand the nuances of 'own occupation' versus 'any role' definitions, as well as the implications of premiums and benefits. Consulting with a professional insurance adviser can help navigate these options effectively.