Overview

Navigating Kentucky state taxes can feel overwhelming, and we understand that many residents share this concern. This article offers essential tips to make the process easier, particularly through the use of AI technology. By embracing AI, you can streamline your tax experience, reduce errors, and alleviate the stress that often accompanies tax season.

Imagine a world where tasks are automated, accuracy is enhanced, and the burden of tax season is lifted. AI technology can transform your experience, allowing you to focus on what truly matters. You are not alone in this journey; many Kentuckians are discovering how AI can be a supportive ally.

We encourage you to explore these solutions that can simplify your tax obligations. Remember, seeking help is a sign of strength, and with the right tools, you can approach tax season with confidence. Together, we can navigate these challenges and find peace of mind.

Introduction

Navigating the intricacies of paying Kentucky state taxes can feel overwhelming for many residents, often accompanied by confusion and anxiety. We understand that this process can be daunting. However, with the right strategies and tools, you can transform this challenging task into a manageable one. This article offers essential tips and insights, from utilizing AI technology for streamlined payments to grasping self-employment tax rates and maximizing deductions.

As tax laws evolve and deadlines approach, it’s common to wonder: how can you effectively navigate your tax obligations without the stress? Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Turnout: Streamline Your Kentucky State Tax Payments with AI Assistance

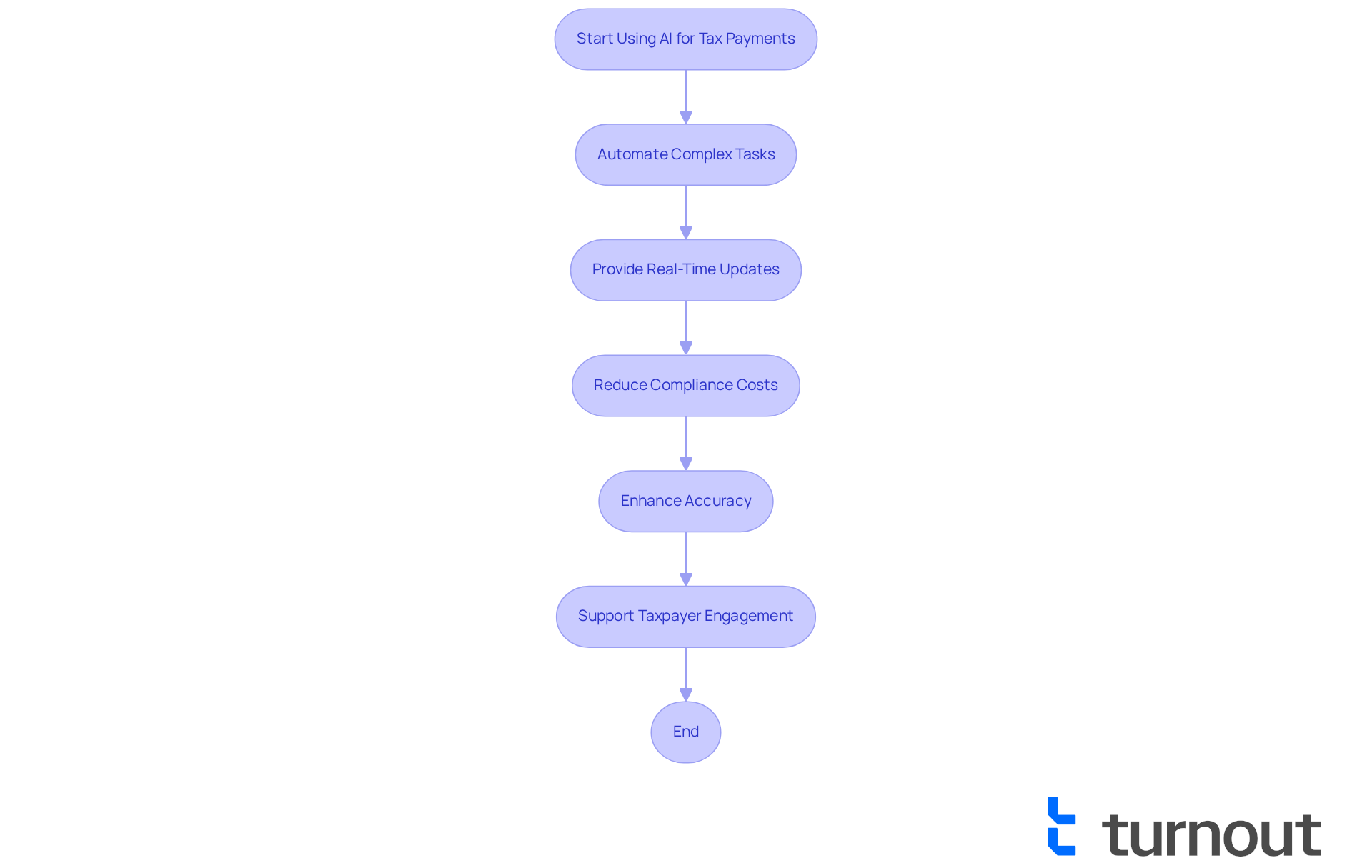

We understand that paying Kentucky state taxes can feel overwhelming for residents. Turnout is here to help, utilizing advanced AI technology to streamline this process with exceptional efficiency. By automating complex tasks and providing real-time updates, Turnout empowers taxpayers to navigate their obligations effortlessly. This forward-thinking strategy not only conserves valuable time but also alleviates the anxiety often associated with tax season, allowing you to focus on what truly matters.

It's common to feel stressed during tax season, but the integration of AI in tax compliance is revolutionizing the landscape. Studies show that businesses using AI tools can reduce compliance costs by up to 40% while enhancing accuracy in tax calculations. This means fewer errors and less worry about penalties. Companies that adopt AI solutions report an average error reduction of 90%, significantly improving compliance rates.

Turnout exemplifies how consumer advocacy can harness AI for effective tax management and assistance with Social Security Disability (SSD) claims. By streamlining the process of paying Kentucky state taxes, Turnout not only supports individuals in meeting their obligations but also fosters a more transparent and efficient tax environment. The IRS-licensed enrolled agents that Turnout collaborates with are qualified professionals who provide essential support without the complexities of legal representation. As AI continues to reshape the tax landscape, you can look forward to a more manageable and less stressful tax experience. Remember, you are not alone in this journey; we're here to help.

Kentucky Self-Employment Tax Rates: Know What You Owe

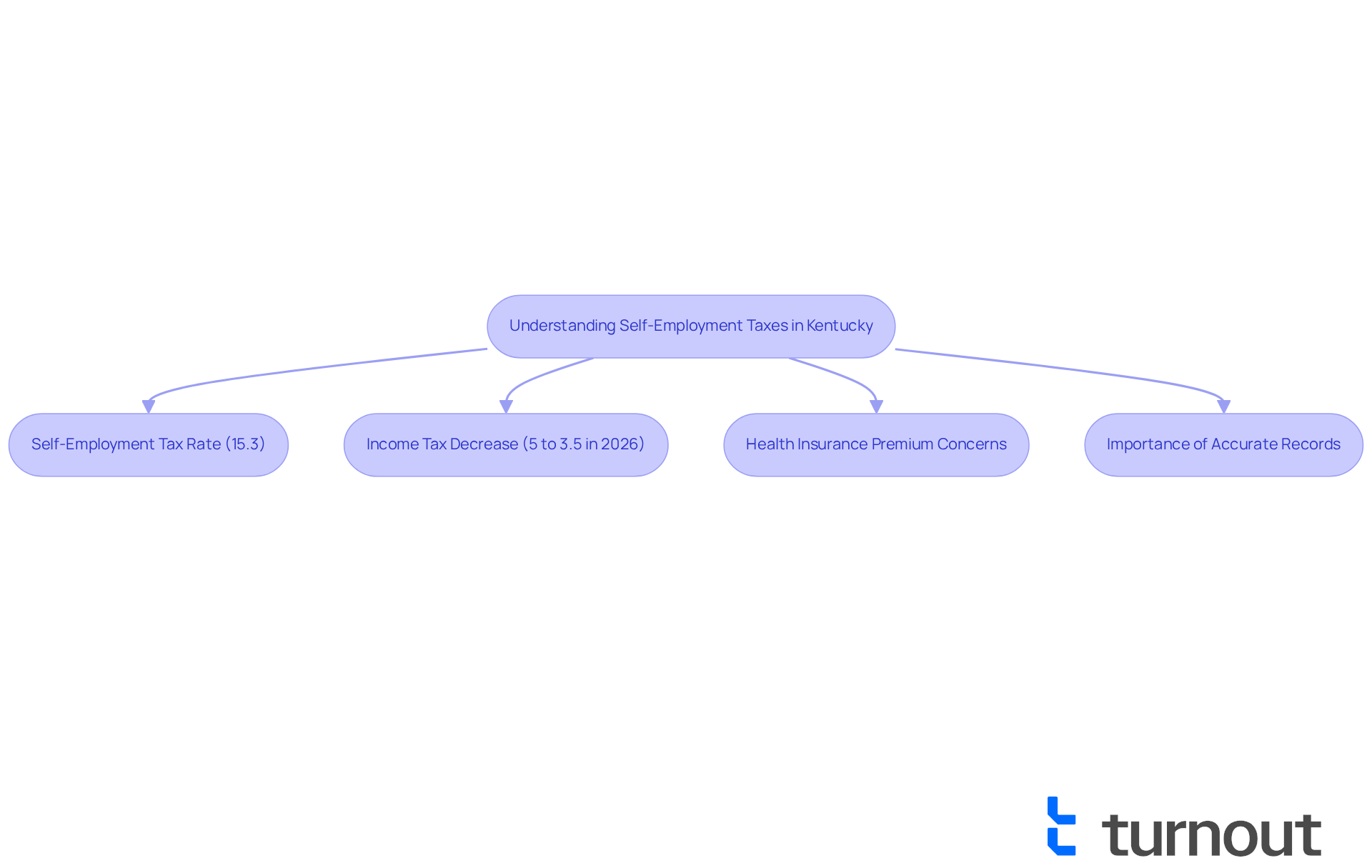

Self-employed individuals in Kentucky understand that paying Kentucky state taxes and navigating tax rates can be daunting. It's essential to be aware of the state’s self-employment tax rates, which are typically based on net earnings. For 2025, the self-employment levy rate is approximately 15.3%, covering both Social Security and Medicare contributions. Accurately calculating these taxes is crucial to ensure compliance and avoid penalties. Keeping detailed records of your income and expenses will greatly assist in this process.

The financial landscape for self-employed individuals can feel overwhelming, especially with the rising health insurance premiums. Ann Pipes, a self-employed real estate appraiser, shared her concerns about the possibility of her monthly premiums reaching $900 if tax credits expire. This situation underscores the importance of understanding your tax obligations, particularly paying Kentucky state taxes, and planning accordingly, as financial pressures can significantly impact your overall stability.

Tax professionals emphasize the importance of staying informed about paying Kentucky state taxes as part of your overall tax responsibilities. With the state’s income tax revenue decreasing by $490 million compared to the last fiscal year, it’s vital to remain vigilant regarding changes in tax rates and available credits. Notably, the income tax rate is set to decrease from 5% to 3.5% starting January 1, 2026. This reduction may provide some relief for self-employed individuals, allowing for better financial planning and potentially easing your overall tax burden.

In summary, we encourage self-employed individuals in Kentucky to prioritize understanding their self-employment tax rates. Maintaining accurate financial records and staying informed about legislative changes that may affect your tax obligations is key. Remember, you are not alone in this journey, and we’re here to help.

Essential Forms for Kentucky State Tax Filing: What You Need to Prepare

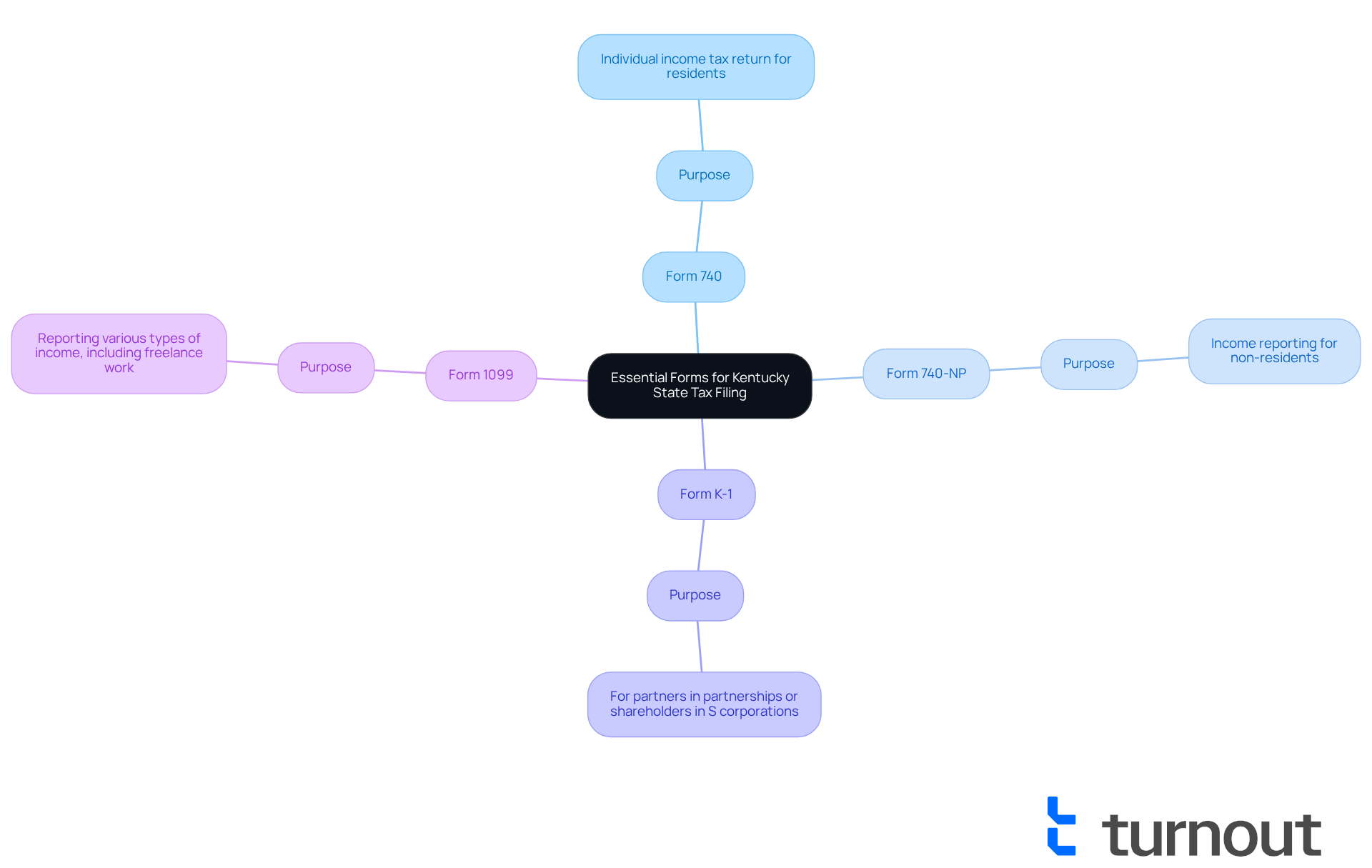

While paying Kentucky state taxes can feel overwhelming, we're here to guide you through the process. It's essential to prepare the following forms:

- Form 740: This is the individual income tax return form that residents must complete.

- Form 740-NP: Non-residents should use this form to report their income.

- Form K-1: If you are a partner in a partnership or a shareholder in an S corporation, this form is necessary.

- Form 1099: This form is used for reporting various types of income, including freelance work and interest earned.

We understand that precise filling of these forms is crucial. Data show that almost 20% of tax returns in Kentucky contain mistakes, which can lead to delays and penalties. To help you avoid common pitfalls, experts recommend double-checking all entries and ensuring that all required documentation is attached.

It's common to feel anxious about deadlines, but submitting your filings early can alleviate some of that stress. The state's Department of Revenue will start accepting individual income return submissions on January 27, 2025. Remember, paying Kentucky state taxes involves submitting your forms accurately and on time to avoid penalties and ensure a smooth tax filing experience. As Tom Miller, DOR commissioner, stated, "We encourage Kentuckians who anticipate a refund to file their taxes early." You're not alone in this journey; we're here to help you every step of the way.

Pay Estimated Taxes: A Guide for Kentucky Residents

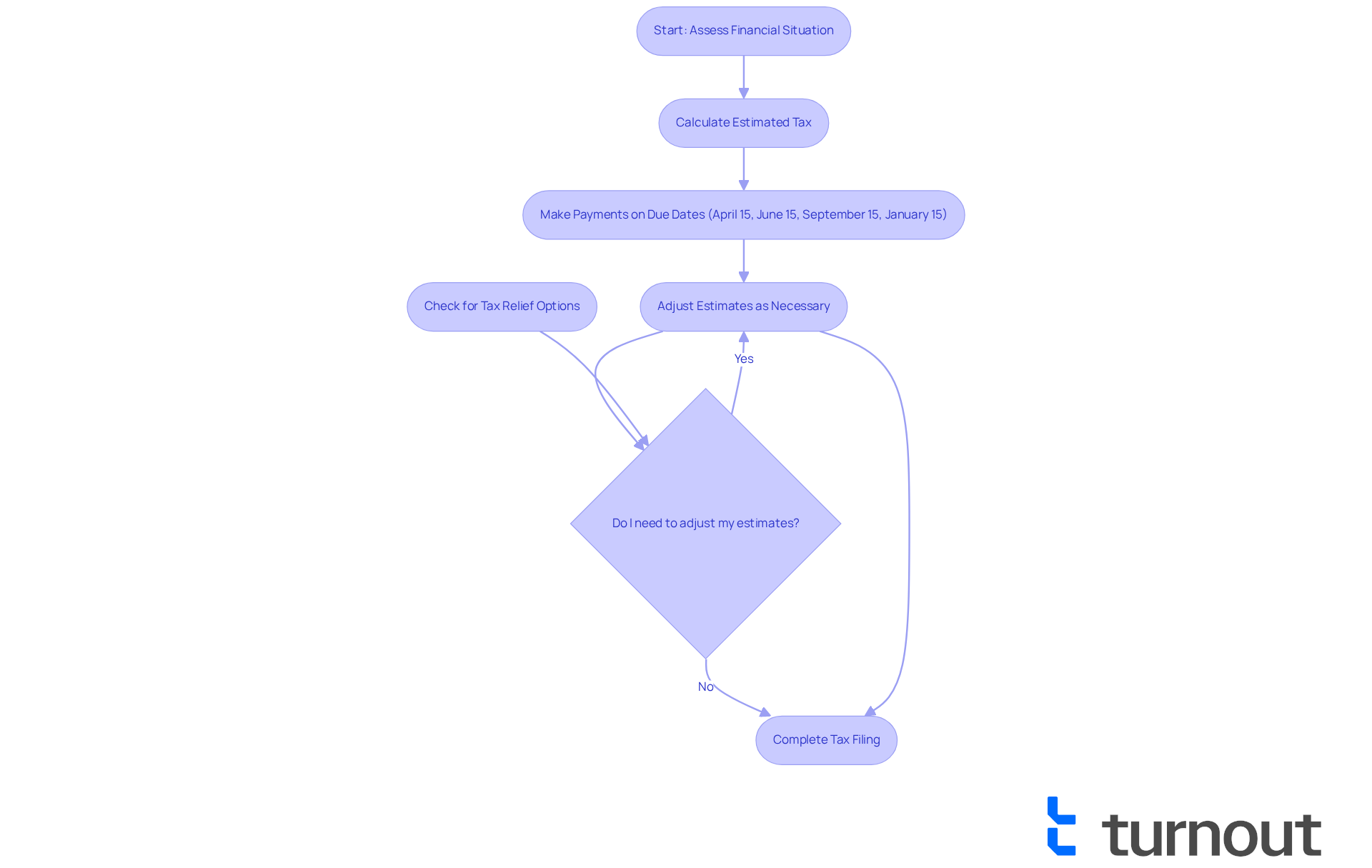

In Kentucky, we understand that paying Kentucky state taxes can feel overwhelming, especially when the amount exceeds $500. To help you navigate this, it's important to make estimated tax contributions throughout the year, especially when paying Kentucky state taxes. These payments are due on April 15, June 15, September 15, and January 15 of the following year. A practical way to calculate your estimated tax is by assessing your expected income, deductions, and credits. Using the previous year's tax return as a reference point can provide a solid foundation for your estimates.

Many taxpayers find it beneficial to regularly track their income and expenses. This proactive approach allows you to adjust your estimates as needed, helping you stay compliant and avoid underpayment penalties. While projected tax contributions can vary greatly depending on personal situations, understanding your financial condition will assist you in deciding a suitable amount to reserve.

It's also crucial to note that if you settle your dues by November 3, 2025, late submission and fee penalties will be waived. This offers a clear motivation for prompt settlements. Governor Andy Beshear has emphasized the state's commitment to providing tax relief for Kentucky families and businesses affected by recent severe storms, straight-line winds, flooding, and landslides. This assistance includes extended deadlines for impacted taxpayers, allowing them to submit various federal tax returns and fulfill their obligations, such as paying Kentucky state taxes, until November 3, 2025.

To ensure a more seamless tax filing experience, consider these practical suggestions:

- Regularly examine your financial documents

- Adjust your estimated contributions based on any fluctuations in income or expenses

- Stay informed about any tax relief options that may apply to your situation

Remember, timely payments not only help you avoid penalties but also contribute to a more manageable tax process. You're not alone in this journey; we're here to help.

Maximize Your Refund: Common Deductions for Kentucky Taxpayers

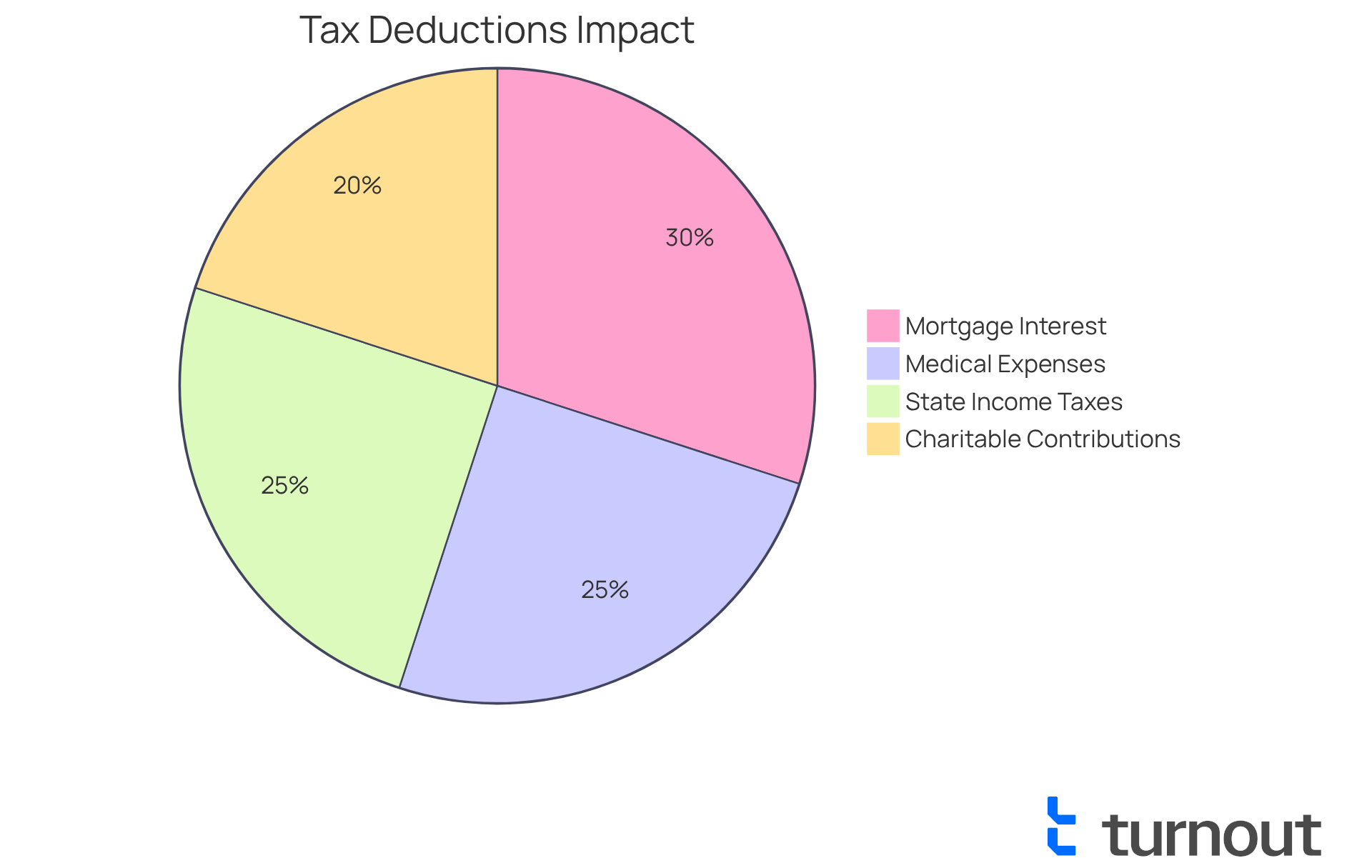

Kentucky taxpayers, we understand that navigating tax season can be overwhelming, but you have the opportunity to significantly enhance your refunds by leveraging several common deductions:

- Medical Expenses: If your medical expenses exceed 7.5% of your adjusted gross income, you can deduct these costs. This means you can recoup some of your healthcare expenses, which can be a relief when it comes to paying Kentucky state taxes.

- Mortgage Interest: Homeowners can deduct the interest paid on home loans. This deduction not only provides financial relief but can also potentially increase your refund.

- Charitable Contributions: When you donate to qualified organizations, those contributions are deductible. This encourages philanthropy and also offers financial benefits to you as a contributor.

Don’t forget that you can deduct the state income taxes you’ve paid, including those from paying Kentucky state taxes. This can lead to a more favorable outcome for you when paying Kentucky state taxes.

In light of the recent disaster relief measures announced by the IRS for Kentucky residents affected by severe storms, it’s crucial to thoroughly review these deductions. We know that many of you are filing your taxes proactively; currently, 97.8% of returns received have been submitted electronically, with over 1,112,947 refunds already processed.

The IRS has extended the deadline for impacted individuals, allowing you until November 3, 2025, to submit various federal tax returns and make payments. By carefully reviewing and claiming these deductions, you can ensure that you receive the maximum refund possible. Remember, you are not alone in this journey, and we’re here to help you make the most of your financial situation.

Unlock Savings: Available Tax Credits for Kentucky Residents

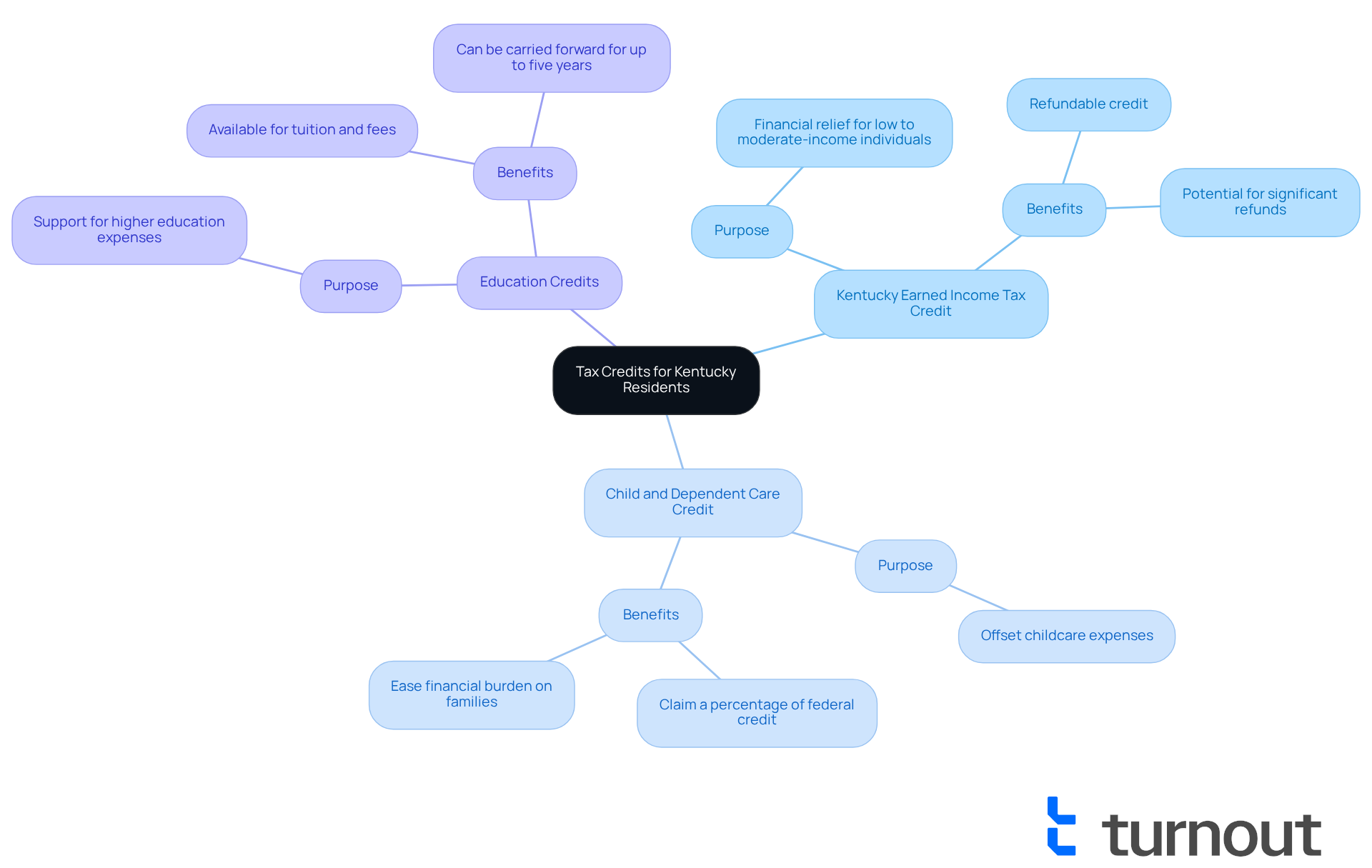

Residents of Kentucky have the opportunity to benefit from several tax credits that can significantly lighten their financial burdens.

-

Kentucky Earned Income Tax Credit: This refundable credit is designed specifically for low to moderate-income working individuals and families, providing essential financial relief during challenging times.

-

Child and Dependent Care Credit: This credit helps offset the expenses incurred while caring for children or dependents, making it easier for families to manage childcare costs, which can often feel overwhelming.

-

Education Credits: Available for tuition and fees paid for higher education, these credits support individuals pursuing academic opportunities, opening doors to a brighter future.

We understand that researching and applying for these credits can seem daunting, but doing so can lead to substantial savings on your tax bill. For instance, individuals who qualify for the Earned Income Tax Credit may receive a considerable refund, which can be transformative for low-income families. Additionally, the Child and Dependent Care Credit allows taxpayers to claim a percentage of their federal credit, further enhancing their financial situation.

With the right information and guidance, you can navigate these credits effectively. Remember, we’re here to help you ensure that you receive the benefits you deserve. You are not alone in this journey.

Effective Record Keeping: Tips for Kentucky Tax Filers

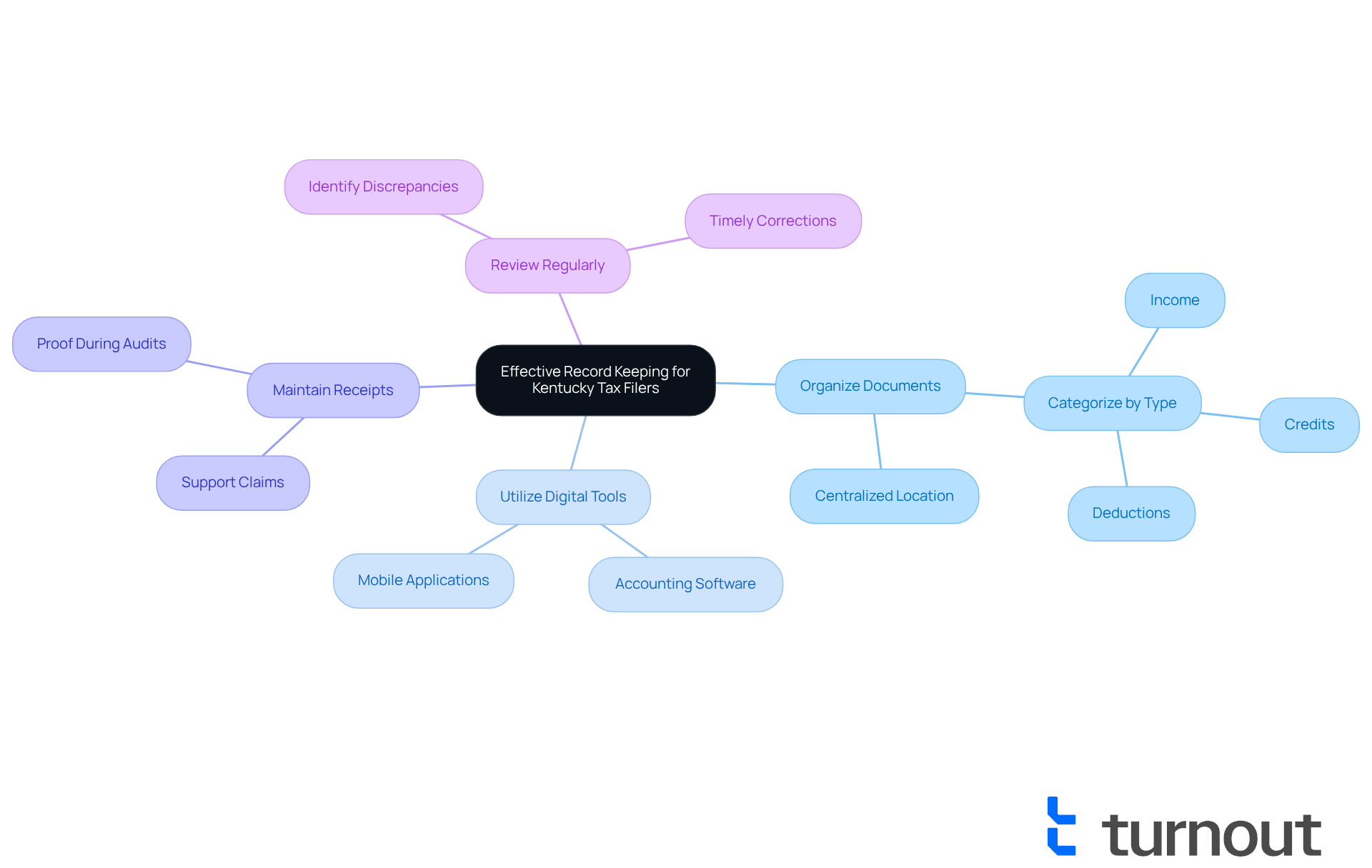

For those paying Kentucky state taxes, effective record keeping is crucial. We understand that navigating tax preparation can feel overwhelming. Here are some essential tips to help you streamline the process and ease your concerns:

- Organize Documents: Keeping all tax-related documents in one centralized location can make a significant difference. Categorize them by type—such as income, deductions, and credits—to facilitate easy access during filing.

- Utilize Digital Tools: Consider leveraging accounting software or mobile applications to efficiently track your expenses and income. These digital tools can enhance accuracy and reduce the likelihood of errors in your filings, allowing you to feel more confident.

- Maintain Receipts: Retaining receipts for all deductible expenses is vital. They serve as proof during audits, supporting your claims and simplifying the verification process. You deserve peace of mind knowing your records are in order.

- Review Regularly: Conducting periodic reviews of your records ensures everything is current and accurate. Regular checks can help identify any discrepancies early, allowing for timely corrections and reducing stress.

Tax professionals emphasize that organized records can significantly ease the tax filing process. Individuals who consistently keep organized records often experience smoother interactions with tax authorities and fewer issues during audits. Additionally, if you are involved in apprenticeship programs, it’s important to maintain records verifying your participation in registered programs, as this is crucial for compliance with tax regulations.

It's also essential to be aware that due to recent disaster assistance, the deadlines for paying Kentucky state taxes and filing have been postponed to November 3, 2025. This change may affect your record-keeping and filing approaches. By adopting these practices, you are taking proactive steps to navigate the tax landscape of the state, including paying Kentucky state taxes, with greater confidence and efficiency. Remember, you are not alone in this journey, and we’re here to help.

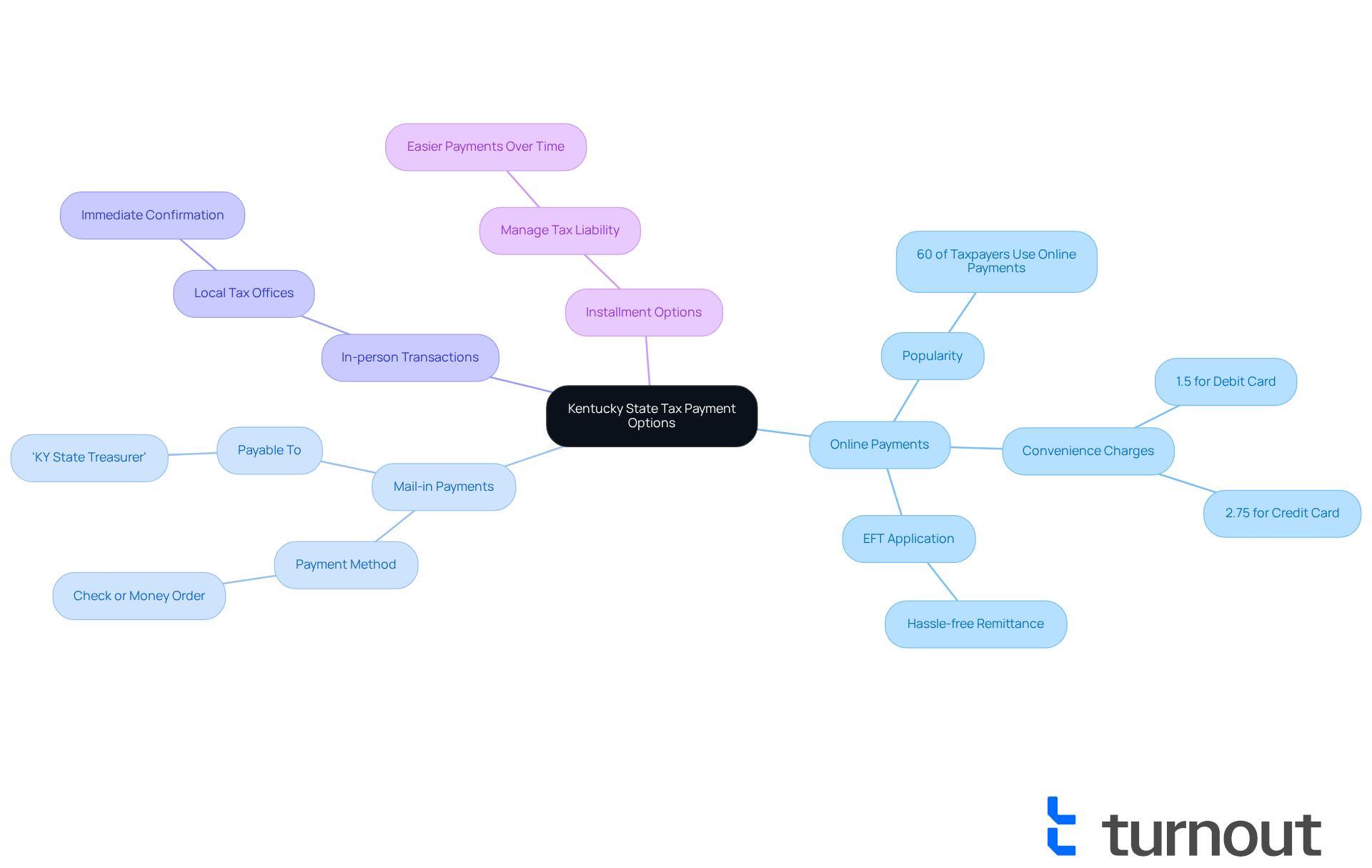

Kentucky State Tax Payment Options: Choose What Works for You

Kentucky provides a variety of options for paying Kentucky state taxes, ensuring flexibility and convenience for you, the taxpayer. We understand that paying Kentucky state taxes can be overwhelming, and we’re here to help you navigate through managing them.

- Online Payments: The Kentucky Department of Revenue website provides a quick and easy way to make online payments. This method is increasingly popular, with about 60% of Kentucky taxpayers choosing electronic transactions for its efficiency. You can also use the Electronic Funds Transfer (EFT) application for a hassle-free remittance of funds.

- Mail-in Payments: If you prefer traditional methods, you can send a check or money order along with your tax return. Just ensure that your payment is made out to 'KY State Treasurer' and sent to the correct address.

- In-person Transactions: For those who value face-to-face interactions, local tax offices welcome direct contributions, giving you immediate confirmation of your transaction.

- Installment Options: If your tax bill is substantial, consider setting up an installment plan. This option helps you manage your tax liability over time, making it easier to meet your obligations, including paying Kentucky state taxes, without financial strain.

When making online transactions, please be aware that convenience charges apply: 1.5% for debit card transactions and 2.75% for credit card transactions. Additionally, certain tax categories require a NOTICE NUMBER for transactions, which is crucial for ensuring that your submissions are processed accurately. Many individuals have successfully used these methods, particularly digital options, which simplify the process and reduce the chance of mistakes. For instance, the Department of Revenue's EFT application allows you to submit funds easily, enhancing your overall transaction experience.

Moreover, due to recent disaster relief measures, extended deadlines for tax payments originally due between February 14, 2025, and November 3, 2025, are now in effect. This provides additional support for taxpayers like you, ensuring that you are not alone in this journey.

Tax Debt Relief: Strategies for Kentucky Residents Facing Financial Challenges

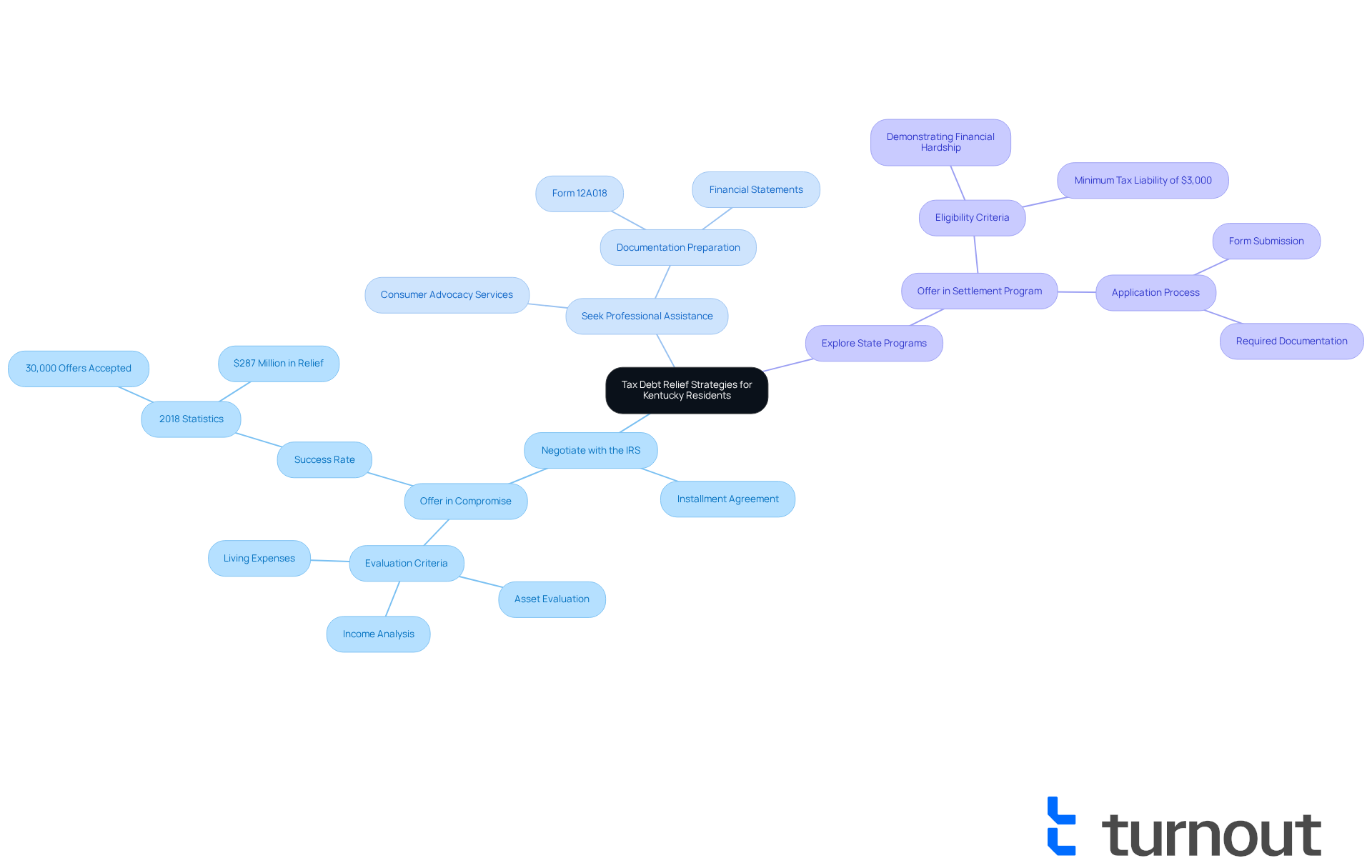

For Kentucky residents grappling with tax debt, it’s important to know that you are not alone in this journey. Several effective strategies can help alleviate financial burdens:

-

Negotiate with the IRS: Setting up an installment agreement or pursuing an Offer in Compromise can provide significant relief. The IRS evaluates offers based on reasonable collection potential, which includes an analysis of income, assets, and living expenses. In 2018, nearly 30,000 offers were accepted, resulting in approximately $287 million in tax relief. This showcases the potential success of this approach.

-

Seek Professional Assistance: Engaging with consumer advocacy services that specialize in tax debt relief can be invaluable. These organizations help navigate the complexities of tax negotiations. They ensure that all necessary documentation, such as Form 12A018 and financial statements, is accurately prepared to avoid common pitfalls that lead to application rejections.

-

Explore State Programs: The state provides specific initiatives aimed at assisting residents in managing tax debt, such as the Offer in Settlement program. This program allows taxpayers to settle their debts for less than the total owed, provided they meet certain eligibility criteria. This includes having a minimum tax liability of over $3,000 and demonstrating financial hardship.

Taking proactive steps can lead to more manageable tax obligations and significantly reduce stress. As one consumer advocate noted, 'Owing the IRS money is stressful, but it doesn't have to wreck your finances or your peace of mind.' By understanding available options and seeking help, individuals can regain control over their financial situations. Additionally, it’s advisable to gather all relevant tax documents before contacting the IRS to streamline the negotiation process.

Stay Updated: Key Changes in Kentucky Tax Laws You Should Know

Tax regulations in our state can change frequently, and we understand that this can create uncertainty for residents when it comes to filing and paying taxes. Here are some important updates to keep in mind for 2025:

-

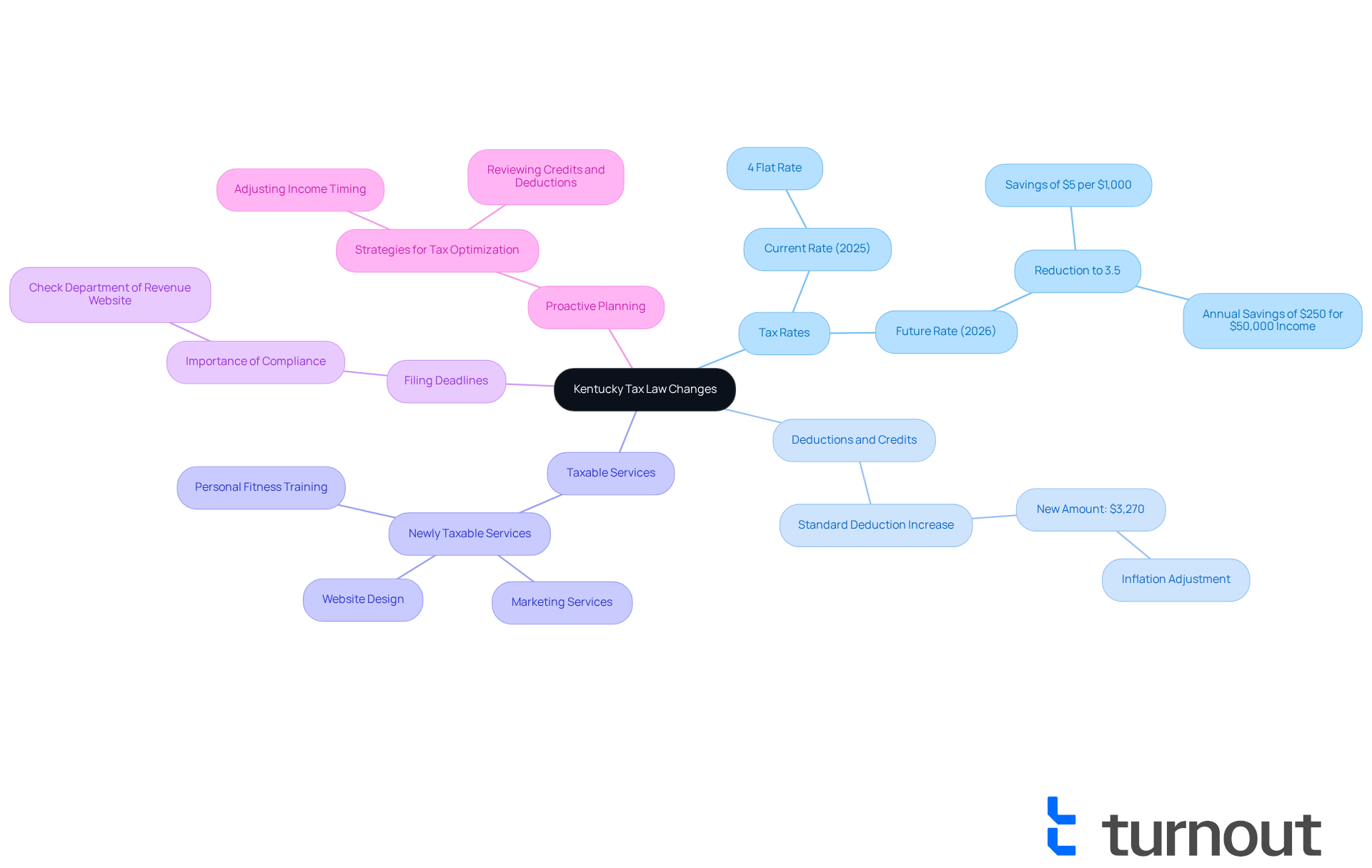

Adjustments to Tax Rates: For 2025, the individual income tax rate in Kentucky will remain at 4%. However, it is set to decrease to 3.5% starting January 1, 2026, as established by House Bill 1. This reduction depends on specific fiscal triggers outlined in the 2022 tax reform law. What does this mean for you? Individuals will save $5 for every $1,000 of taxable income, translating to an annual savings of $250 for someone with a taxable income of $50,000.

-

New Deductions and Credits: The standard deduction for 2025 has increased to $3,270, reflecting adjustments for inflation. This increase offers additional relief for taxpayers, especially those in lower and middle-income brackets. Staying informed about any new tax benefits is essential, as they may provide further support.

-

Newly Taxable Services: Kentucky has introduced new taxable services, including personal fitness training and website design. If you provide these services, it's important to comply with the new regulations, as they may impact your pricing and operational strategies.

-

Filing Deadlines: Changes in filing deadlines can affect when you need to submit your taxes. We encourage you to regularly check the Department of Revenue website to ensure you meet all deadlines and avoid any penalties.

-

Proactive Planning: With the state's tax code in transition, proactive planning is more crucial than ever. As Baldwin CPAs notes, consider strategies to optimize your tax situation, such as adjusting income timing and reviewing available credits and deductions.

Staying updated on these changes is vital for effective tax management. Remember, consulting with tax professionals can provide valuable insights and help you navigate the complexities of Kentucky's evolving tax landscape. You're not alone in this journey; we're here to help you every step of the way.

Conclusion

Navigating the complexities of paying Kentucky state taxes can feel overwhelming. We understand that many residents may find this process daunting. However, it doesn’t have to be that way. By leveraging advanced technologies like AI, understanding self-employment obligations, and staying informed about essential forms and potential deductions, you can significantly simplify your tax experience.

Consider utilizing AI tools to enhance accuracy and efficiency. Keeping organized records can streamline your filing process, and taking advantage of available tax credits and deductions can make a substantial difference. It’s also crucial to stay updated on changing tax laws and deadlines, as these factors directly impact your financial planning and compliance.

Ultimately, the message is clear: proactive engagement with the tax process can alleviate stress and foster a more manageable experience. By embracing available resources, including professional assistance and digital tools, you can navigate your obligations with confidence and ease. Remember, you are not alone in this journey. Taking these steps not only ensures compliance but also maximizes potential refunds and savings. We’re here to help you feel informed and prepared.

Frequently Asked Questions

What is Turnout and how does it assist with Kentucky state tax payments?

Turnout is a service that uses advanced AI technology to streamline Kentucky state tax payments, automating complex tasks and providing real-time updates to help taxpayers navigate their obligations efficiently.

How does AI integration benefit tax compliance in Kentucky?

AI integration can reduce compliance costs by up to 40% and enhance accuracy in tax calculations, leading to fewer errors and a 90% reduction in compliance errors for companies that adopt AI solutions.

What support does Turnout provide beyond tax payments?

Turnout also assists with Social Security Disability (SSD) claims and collaborates with IRS-licensed enrolled agents to provide essential support without the complexities of legal representation.

What are the self-employment tax rates in Kentucky for 2025?

The self-employment tax rate in Kentucky for 2025 is approximately 15.3%, which covers both Social Security and Medicare contributions.

Why is it important for self-employed individuals to keep detailed records?

Keeping detailed records of income and expenses is crucial for accurately calculating self-employment taxes and ensuring compliance to avoid penalties.

What changes are expected in Kentucky's income tax rate?

The income tax rate in Kentucky is set to decrease from 5% to 3.5% starting January 1, 2026, which may provide relief for self-employed individuals.

What essential forms are required for Kentucky state tax filing?

The essential forms include: - Form 740: Individual income tax return for residents. - Form 740-NP: Non-resident income reporting form. - Form K-1: For partners in a partnership or shareholders in an S corporation. - Form 1099: For reporting various types of income, such as freelance work.

What should taxpayers be aware of regarding common mistakes in tax returns?

Almost 20% of tax returns in Kentucky contain mistakes, which can lead to delays and penalties. It's important to double-check all entries and ensure that all required documentation is attached.

When does the Kentucky Department of Revenue start accepting individual income return submissions?

The Kentucky Department of Revenue will start accepting individual income return submissions on January 27, 2025.

How can filing taxes early benefit taxpayers?

Filing taxes early can alleviate stress related to deadlines and may expedite the process for those anticipating a refund, as encouraged by the Department of Revenue.