Overview

Navigating Schedule R IRS forms can feel overwhelming, especially for seniors and disabled individuals seeking to understand their eligibility and potential financial benefits. We understand that this process may seem daunting, but we’re here to help you every step of the way.

This article offers essential tips to empower you in maximizing your benefits. It outlines the necessary documentation, highlights common mistakes to avoid, and discusses how Schedule R can impact your tax liabilities. By being informed, you can streamline your filing process and ensure you receive the benefits you deserve.

Remember, you are not alone in this journey. Many taxpayers share similar concerns, and with the right guidance, you can navigate this process successfully. Take a deep breath, and let’s explore how to make this experience as smooth as possible.

Introduction

Navigating the complexities of tax forms can feel overwhelming, especially when dealing with the Schedule R IRS form, which provides essential financial relief for the elderly and disabled. We understand that this process can be daunting, and we’re here to help. This article offers key tips to empower eligible taxpayers to understand their rights, maximize their benefits, and steer clear of common pitfalls during the filing process.

But what happens when the very system designed to support you becomes a source of confusion and stress? It’s common to feel lost in the details. Exploring the intricacies of Schedule R not only reveals the opportunities for financial assistance but also highlights the challenges many face in accessing these benefits. Remember, you are not alone in this journey.

Turnout: Your Advocate for Navigating Schedule R IRS Forms

At Turnout, we are deeply committed to empowering consumers like you by simplifying the navigation of government and financial systems. We understand that tax season can be overwhelming, especially when it comes to the Schedule R IRS, which pertains to the Credit for the Elderly or Disabled. That’s why we offer vital resources and guidance to help you understand your eligibility and maximize your benefits. Our AI-driven platform, guided by Jake, ensures you receive timely updates and assistance throughout the submission process, making this time of year a little easier.

The incorporation of AI in tax support is truly transforming how individuals manage their tax responsibilities. With the advancements in technology, you can now access tailored support that simplifies complex processes. For disabled individuals, this means having a dedicated advocate who understands your unique challenges and can provide personalized assistance.

Experts emphasize the importance of consumer advocacy in tax preparation, particularly for at-risk groups. By leveraging AI, Turnout not only enhances the efficiency of the filing process but also ensures that you are informed and empowered every step of the way. This innovative approach is crucial in making tax compliance less intimidating and more accessible for everyone. Remember, you are not alone in this journey; we’re here to help.

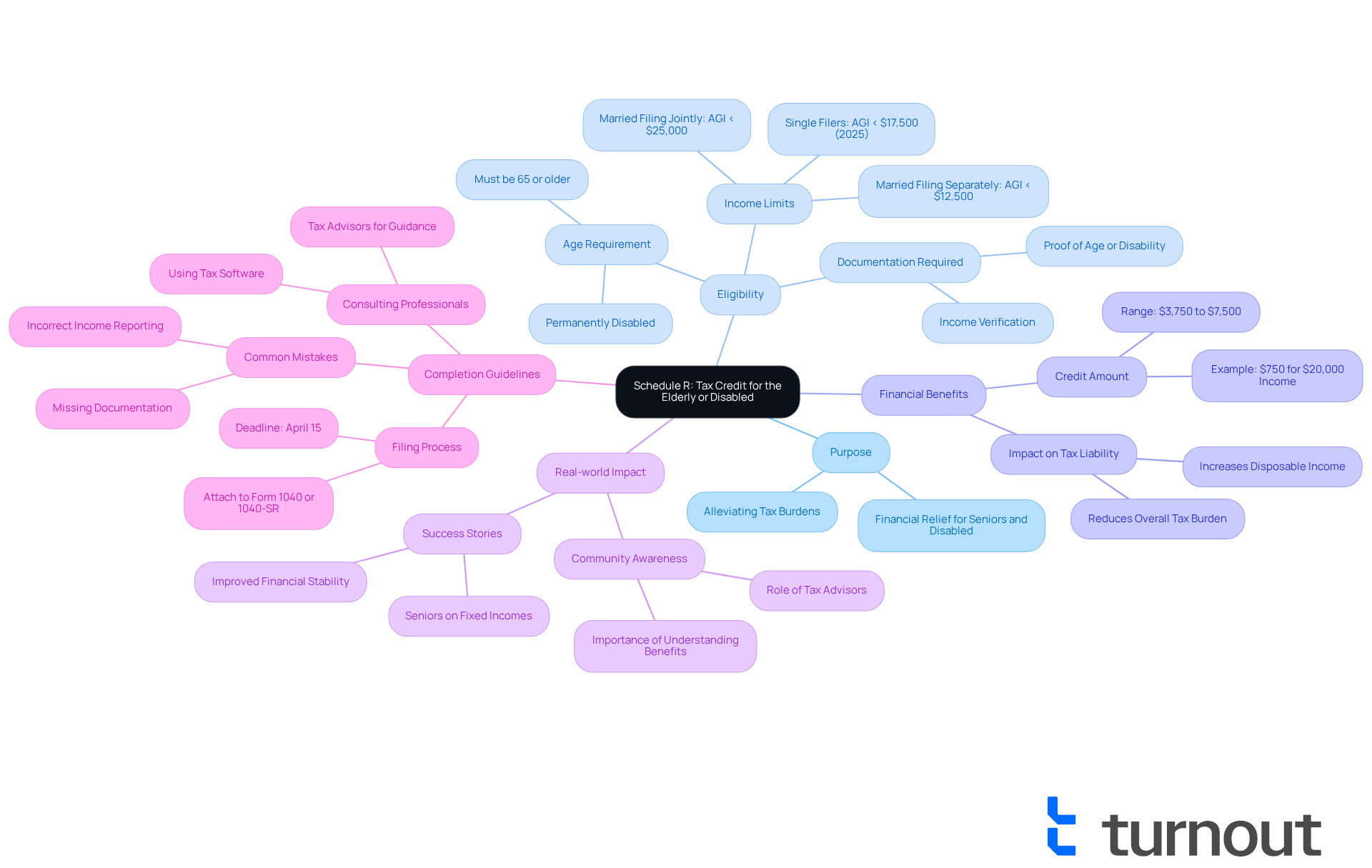

Purpose of Schedule R: Understanding the Tax Credit for the Elderly or Disabled

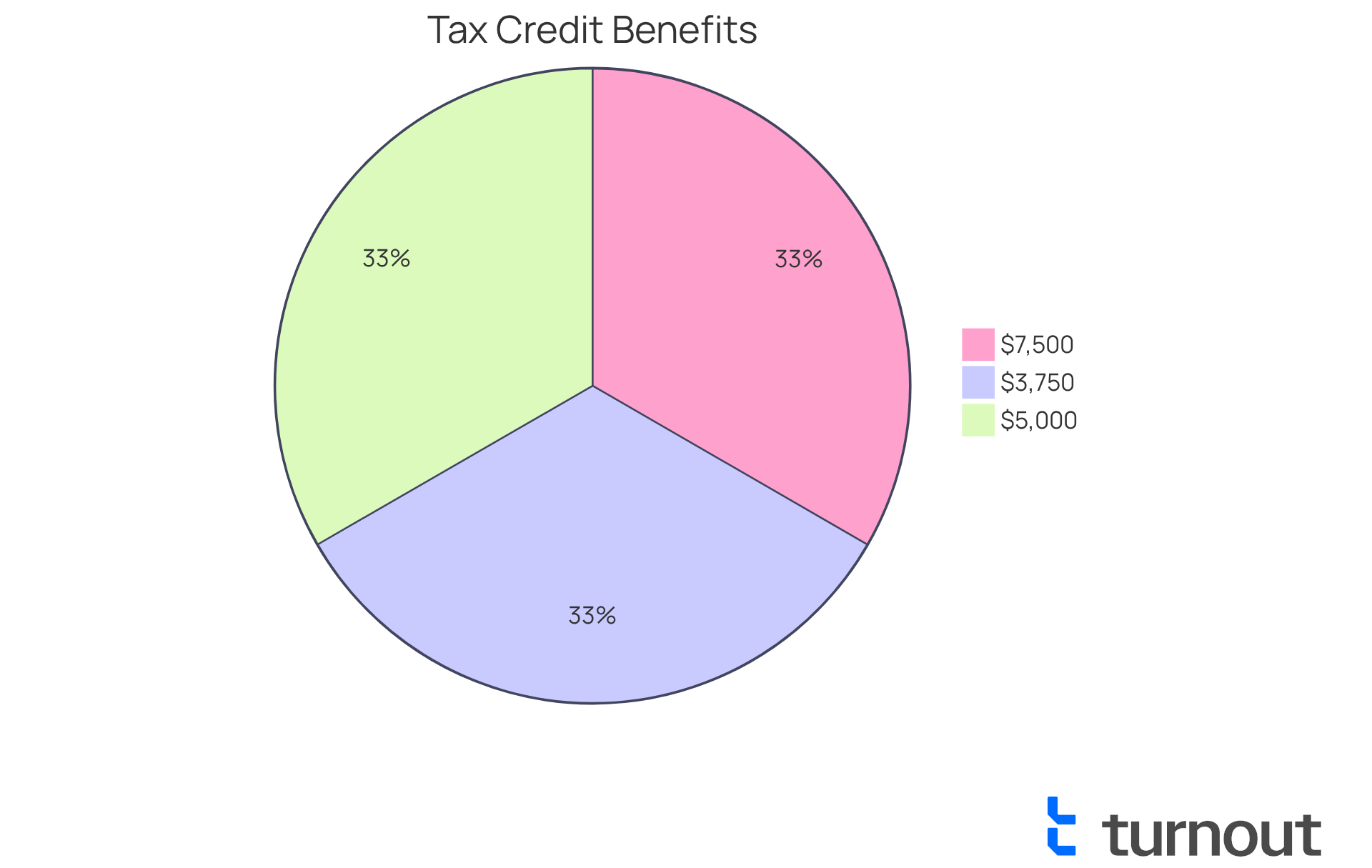

Schedule R serves as a vital resource for qualifying taxpayers, allowing them to claim a nonrefundable tax benefit designed to alleviate financial pressures for individuals aged 65 or older, or those who are permanently and completely disabled. This financial support can range from $3,750 to $7,500, significantly reducing the tax obligation for eligible individuals. For instance, a single filer earning $20,000 annually with $5,000 in Social Security benefits could receive a benefit of up to $750, showcasing the tangible advantages of this support.

Understanding the purpose of Schedule R IRS is essential for ensuring that eligible taxpayers can access this financial aid. With nearly 5 million Americans potentially qualifying for this benefit, it’s important for seniors and disabled individuals to grasp their eligibility. Tax advisors emphasize that this benefit not only provides immediate financial assistance but also helps individuals manage their overall tax responsibilities, allowing them to allocate more resources toward crucial needs like healthcare and housing.

Real-world stories highlight the significance of this program. Many seniors on fixed incomes have successfully utilized this credit to alleviate their financial burdens, underscoring its role in fostering economic stability among vulnerable populations. By carefully completing Form R and adhering to the Schedule R IRS guidelines, qualified taxpayers can maximize their benefits and receive the financial support they deserve.

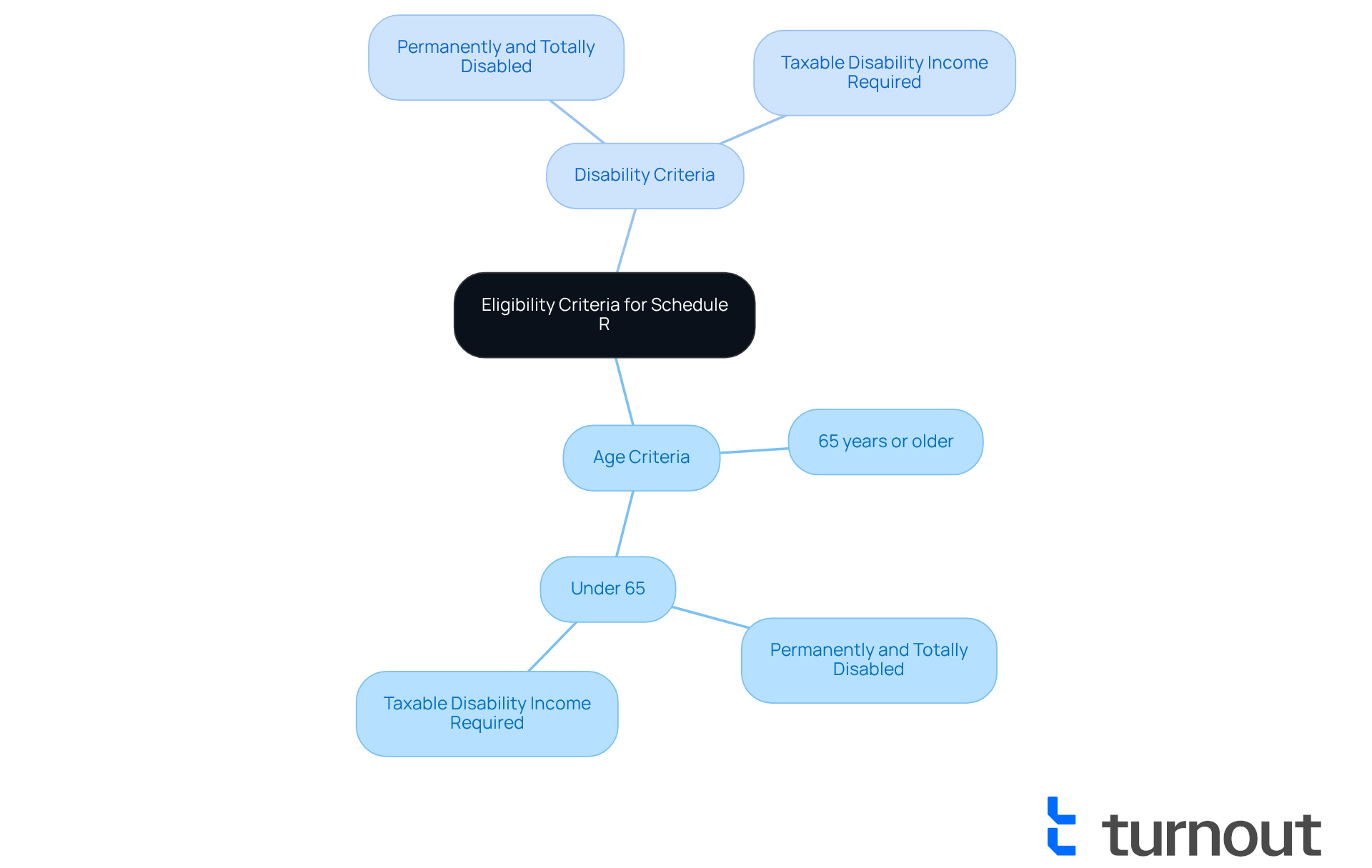

Eligibility Criteria: Who Can File Schedule R?

Navigating the complexities of tax forms can be challenging, especially when it comes to understanding eligibility for benefits. To submit Form R, taxpayers must meet specific criteria that can feel overwhelming. Individuals must be either 65 years or older by the end of the tax year or under 65 and permanently and totally disabled. Additionally, receiving taxable disability income during the year is crucial.

For example, Jesse, a 58-year-old who retired due to permanent disability, successfully obtained a benefit of $51 on Form R by fulfilling these criteria. This illustrates that qualifying is possible, but it’s essential to ensure that you have received taxable disability income during the tax year. We understand that this can be a lot to take in, but knowing these details is vital for determining eligibility and maximizing potential benefits.

Moreover, it is important to note that individuals must not have reached the required retirement age on January 1 of the prior year to be eligible for the benefit. Remember, you are not alone in this journey. Turnout is here to assist you, providing support through trained nonlawyer advocates who can help you navigate these processes. They ensure that you are well-informed and supported in your claims, making the path to securing benefits a little easier.

Benefits of Schedule R: Financial Relief for Eligible Taxpayers

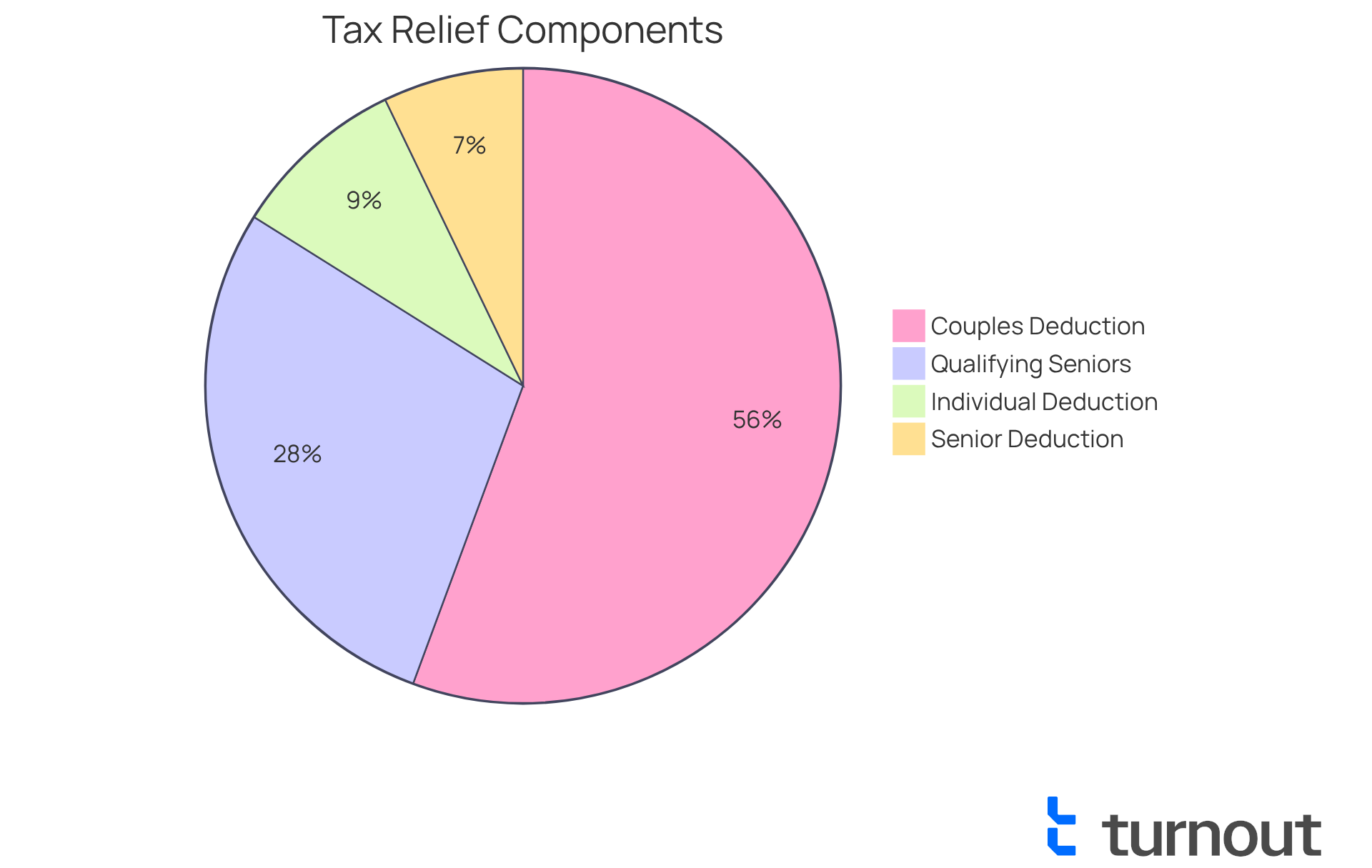

We understand that navigating tax obligations can be overwhelming, especially for seniors and individuals with disabilities who face higher medical and living expenses. Submitting Schedule R IRS can provide substantial financial assistance for qualifying taxpayers, potentially lowering tax obligations by as much as $7,500 based on income and submission status. This credit is particularly beneficial for those who often encounter elevated costs.

Starting in tax year 2025, seniors will have the opportunity to claim an additional $6,000 deduction, further enhancing their tax savings. Imagine qualifying seniors being able to subtract up to $23,750, while couples submitting jointly may deduct as much as $46,700. By utilizing the advantages of Plan R, you can take proactive steps to improve your financial situation.

We encourage you to consult with tax experts or use reliable tax software to ensure precise submissions and maximize your potential savings. Remember, you are not alone in this journey; we're here to help you navigate these opportunities.

Step-by-Step Instructions: Completing Schedule R Accurately

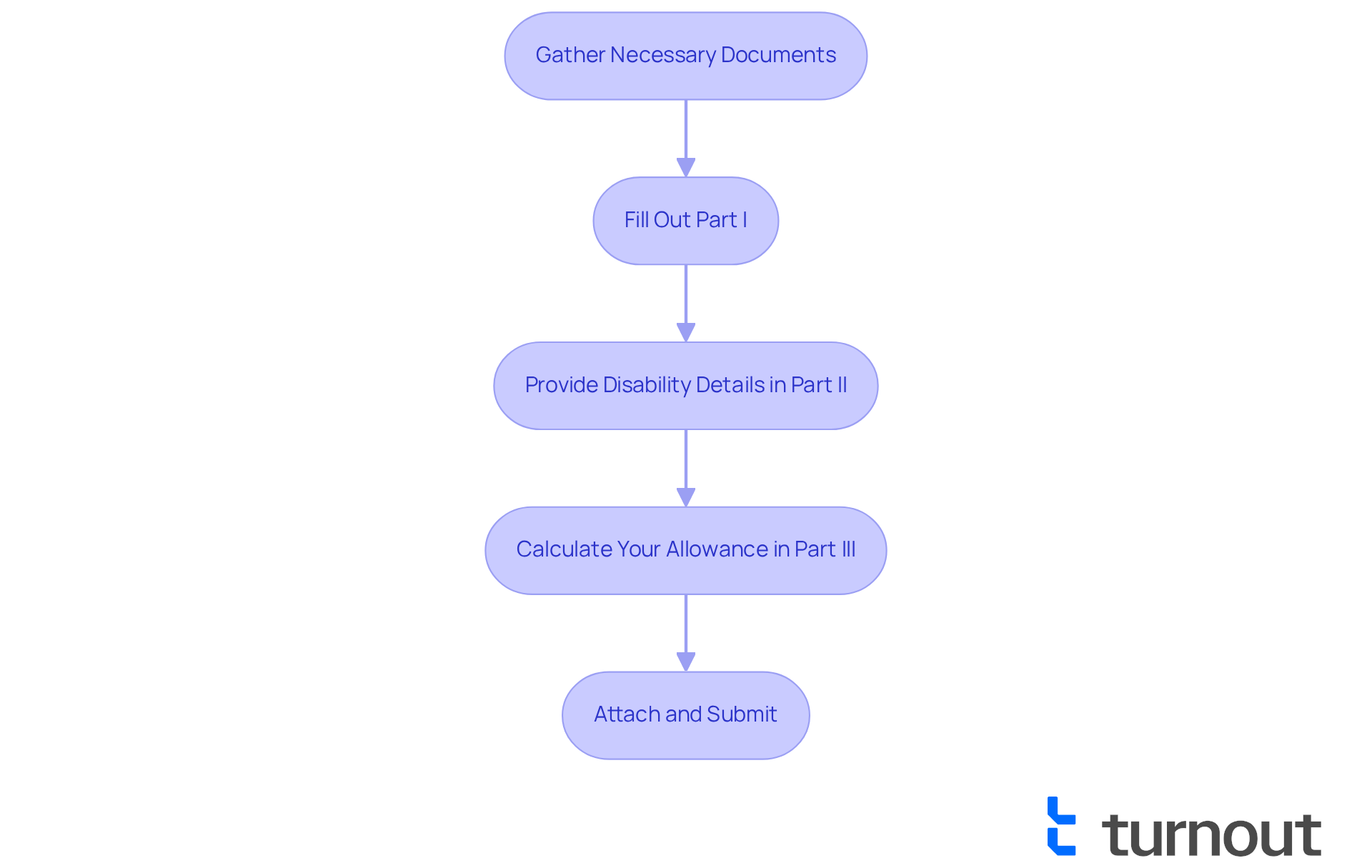

Completing Schedule R IRS can feel overwhelming, but we're here to help you navigate this process with confidence. Understanding the essential steps is crucial for ensuring accuracy and compliance:

- Gather Necessary Documents: Start by collecting proof of age or disability and income statements to support your claim. This foundational step is vital.

- Fill Out Part I: Check the boxes that reflect your filing status and age. This is essential for assessing your qualification for financing.

- Provide Disability Details in Part II: Clearly outline your disability status. This information is vital for the IRS to assess your claim accurately.

- Calculate Your Allowance in Part III: Use your income and the provided guidelines to determine the allowance amount you qualify for. This step is crucial to maximize your potential benefits.

- Attach and Submit: Finally, attach Schedule R to your Form 1040 or 1040-SR and submit it to the IRS.

By following these steps meticulously, you can significantly enhance your chances of a successful submission. It's common to feel unsure about the process, but remember that statistics suggest that taxpayers who organize their paperwork and adhere to IRS regulations achieve greater success rates in obtaining benefits. Consulting with tax professionals can also provide valuable insights into common pitfalls, ensuring that all eligible credits are claimed. You're not alone in this journey, and taking these steps can help minimize the risk of errors and delays.

Common Mistakes: What to Avoid When Filing Schedule R

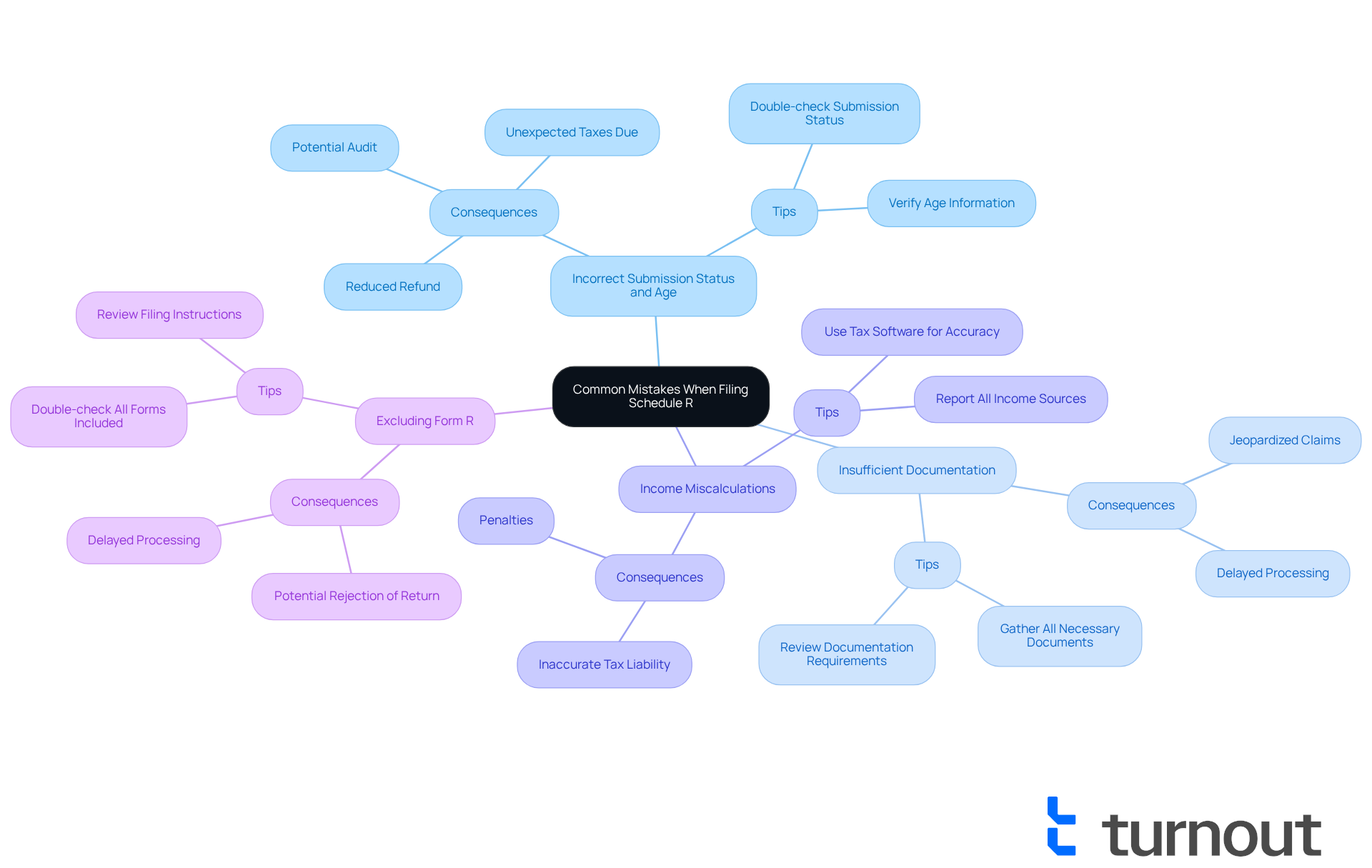

When completing Schedule R IRS, it's crucial for taxpayers to be aware of common mistakes that can complicate submissions. We understand that navigating tax forms can be overwhelming, but avoiding these key errors can make a significant difference:

-

Incorrect Submission Status and Age: It’s easy to overlook the correct boxes for submission status and age. This small oversight can lead to major issues, such as a reduced refund or unexpected amounts due. As tax specialist Tayne wisely notes, "Selecting the incorrect status can lead to a reduced tax refund, extra taxes due, or even an audit."

-

Insufficient Documentation: Not providing adequate documentation to support claims of disability can jeopardize the entire claim process. We encourage you to gather all necessary documents before submission to safeguard your claim.

-

Income Miscalculations: Miscalculating income or forgetting to include all sources of income is a frequent mistake. It’s essential to report all income accurately to avoid penalties.

-

Excluding Form R: Neglecting to include Form R with your primary tax return may delay processing. Always double-check that all forms are included before you submit.

Statistics reveal that seniors are particularly vulnerable to tax submission errors, with over 9 million mathematical mistakes found on last year's returns, many stemming from basic miscalculations. Tax experts emphasize the importance of reviewing returns carefully to catch these mistakes. As one advisor reminds us, "Before submitting your tax return, review it carefully to ensure you're not missing last-minute deductions or contribution opportunities that could lower your tax bill."

Additionally, keeping detailed records of estimated tax payments can help ensure accurate reporting. By being mindful of these potential errors, you can significantly improve your chances of a successful claim. Remember, you are not alone in this journey; we’re here to help you navigate the complexities of tax submissions.

Required Documentation: Supporting Your Schedule R Claim

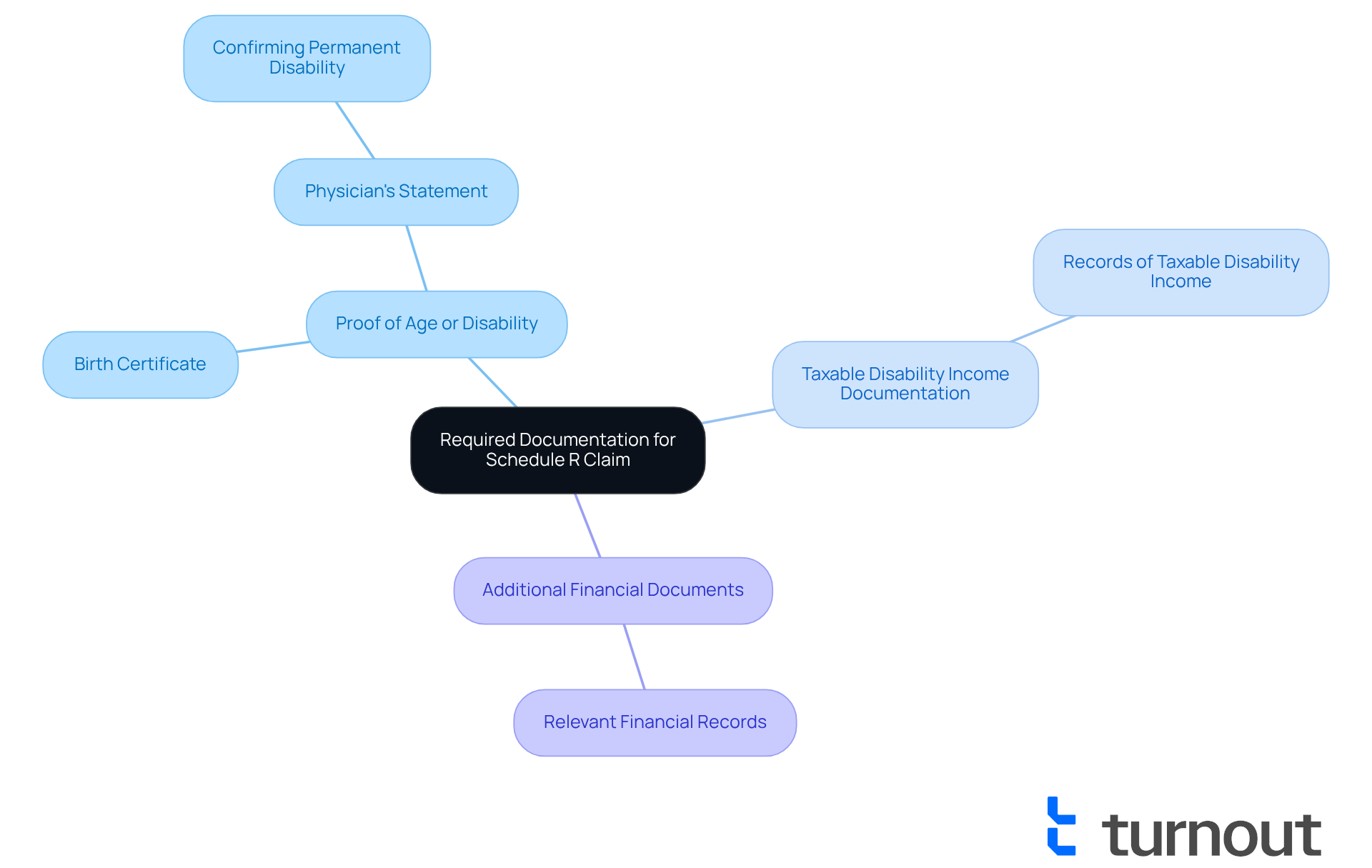

To successfully support a Schedule R IRS claim, it is essential for taxpayers to gather specific documentation. We understand that this process can feel overwhelming, but we’re here to help. Here’s what you need to collect:

- Proof of Age or Disability: This can be a birth certificate or a physician's statement confirming permanent and total disability.

- Taxable Disability Income Documentation: Records of any taxable disability income received during the year are essential.

- Additional Financial Documents: Any other relevant financial documents that may affect eligibility should also be included.

Having these documents organized and readily available can significantly streamline the filing process and strengthen your claims. It’s common to feel unsure about what’s needed; in fact, approximately 30% of taxpayers often overlook the necessity of adequate documentation, which can lead to delays or denials of claims.

Tax experts stress that thorough preparation and attention to detail in documentation can greatly impact the outcome of a claim related to the Schedule R IRS. Successful claims frequently depend on accurate supporting evidence, such as income statements and disability certifications, which confirm your qualification for the benefit. Remember, Form R must be attached to Form 1040 or Form 1040-SR to ensure proper processing.

To effectively organize your documentation, consider creating a checklist of required documents. You are not alone in this journey; consulting resources like the Tax Hardship Center can provide valuable assistance.

Income Limits: Understanding Financial Thresholds for Schedule R

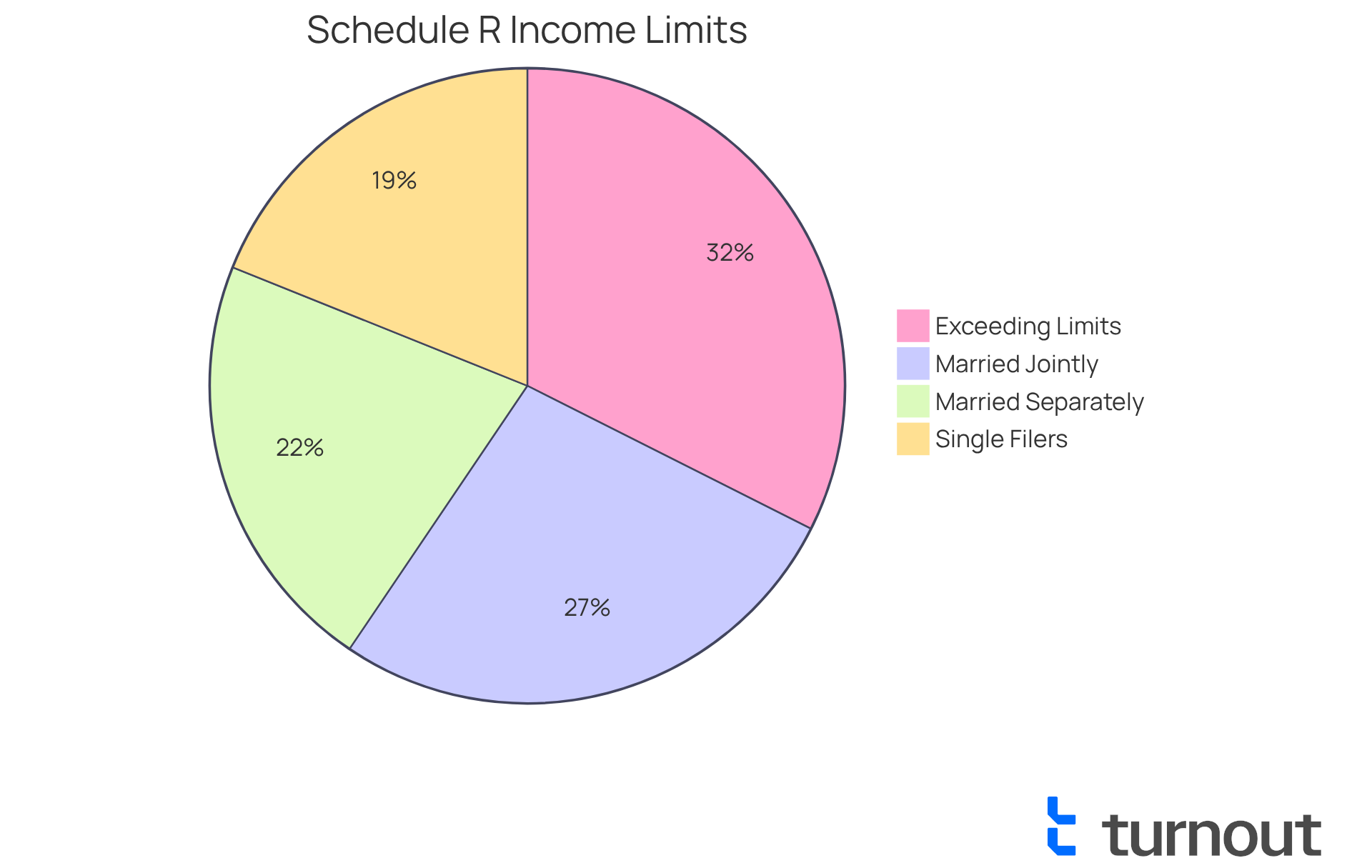

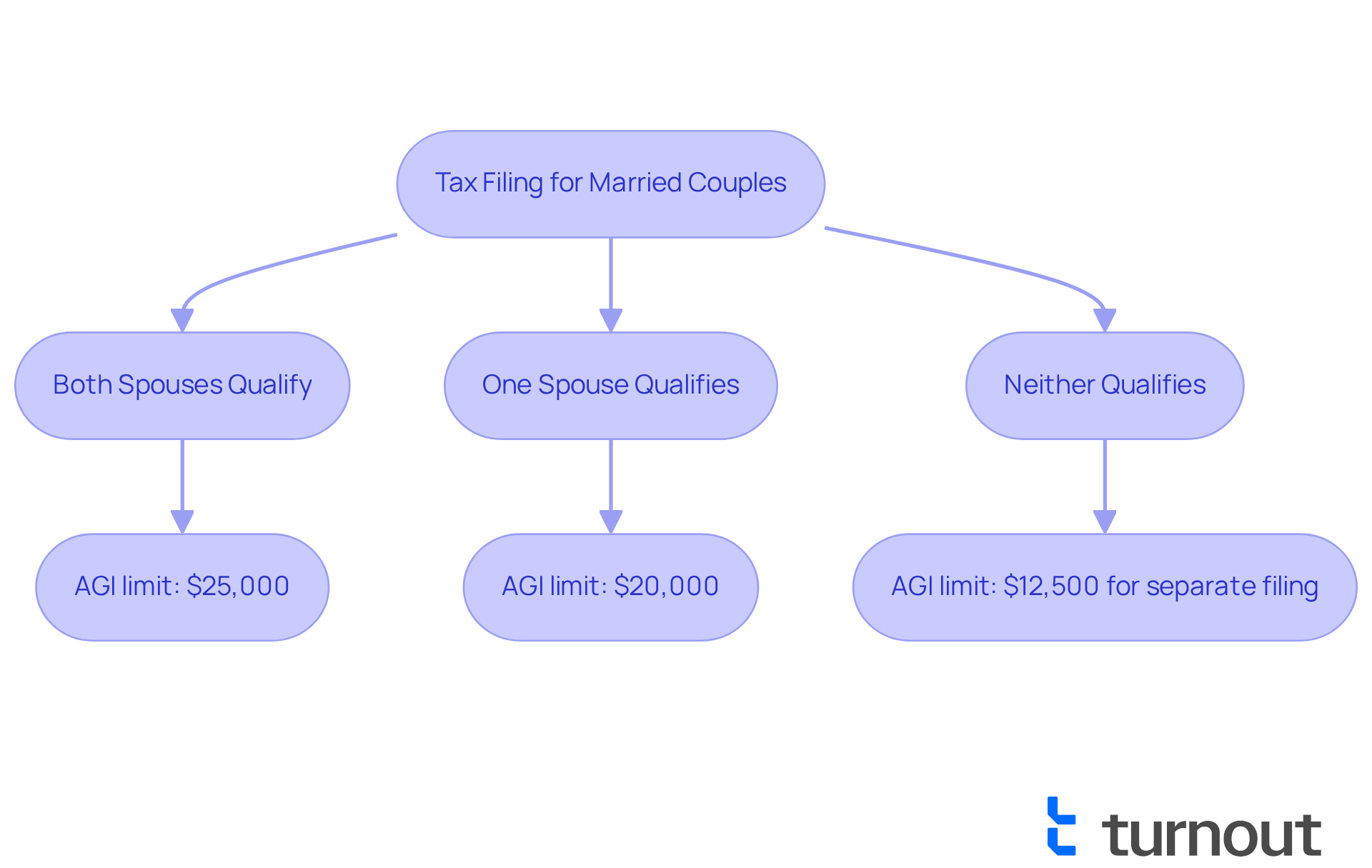

To qualify for the Schedule R IRS benefit, understanding specific income limits that can impact your eligibility is important. For single filers, the adjusted gross income (AGI) must be below $17,500. If you are married and filing jointly, your AGI should be under $25,000. If only one spouse qualifies, the limit is set at $20,000. We understand that navigating these limits can be challenging, and exceeding them may mean missing out on valuable tax incentives.

Additionally, don’t forget to consider non-taxable income, such as Social Security or disability benefits, when determining your eligibility. Recent updates show that approximately 30% of eligible taxpayers exceed these income limits. This statistic underscores the importance of careful financial planning.

Financial advisors emphasize that staying informed about AGI thresholds is essential for maximizing your potential benefits. Remember, the Schedule R IRS benefit is non-refundable; it can only reduce your tax liability but cannot lead to a refund. You are not alone in this journey, and we’re here to help you navigate these complexities.

Special Rules for Married Couples: Filing Schedule R Together

If you’re a married couple submitting schedule R IRS, it’s essential to understand the specific rules that affect your eligibility for tax benefits. We know that navigating these regulations can be challenging, but both partners must qualify to share the recognition. If only one meets the requirements, the combined adjusted gross income (AGI) must be below $20,000. However, if both spouses qualify, the AGI limit increases to $25,000. It’s also important to note that partners living together but choosing to file separately may lose their eligibility, with the AGI threshold for married individuals filing separately while living apart set at $12,500. This highlights the importance of thoughtful planning in your filing choices.

Consider the case of Riley and Parker. They filed jointly with an AGI of $29,350, which included nontaxable social security and taxable pensions. Riley earned $21,250 from a job, while Parker received a taxable disability pension of $1,700. Despite their joint submission, they found themselves disqualified for the benefit because their earnings exceeded the established thresholds. This example serves as a reminder of the necessity for couples to carefully assess their financial situations before deciding on their filing status.

Tax experts often advise couples to explore the advantages of filing jointly, as it can lead to more favorable outcomes regarding tax credits. By understanding the nuances of schedule R IRS and how their tax status impacts their benefits, couples can make informed decisions that maximize their potential advantages. We encourage couples to consult with a tax professional to evaluate their unique circumstances and determine the best filing strategy. Remember, you are not alone in this journey; we’re here to help you navigate these complexities.

Impact on Tax Liability: How Schedule R Affects Your Taxes

Submitting Form R can significantly influence your total tax obligation. This benefit effectively decreases the amount of tax you owe, potentially leading to a larger refund or a lower tax bill. For eligible individuals, especially seniors and those with disabilities, this financial relief can greatly alleviate the burden of living expenses.

We understand that navigating tax incentives can be overwhelming. Fortunately, accessing government assistance and financial aid becomes easier, helping disabled individuals manage the intricacies of tax incentives like schedule R IRS. Financial advisors emphasize that understanding how schedule R IRS affects your tax obligations is essential for optimizing your benefits.

For example, the highest financial amounts available for the elderly and disabled tax benefit can vary from $3,750 to $7,500, depending on personal situations. Moreover, many states offer their own tax incentives or deductions for seniors and disabled individuals, further enhancing the financial assistance available.

As noted by Naveed Lodhi, a Tax Analyst, "Understanding these requirements is crucial to determining whether you qualify for the credit and can receive the financial relief it offers." Utilizing the schedule R IRS not only helps in securing refunds but also plays a vital role in improving overall financial stability for those who qualify. Remember, you are not alone in this journey; we’re here to help you navigate these opportunities.

Conclusion

Navigating the complexities of Schedule R IRS forms can feel overwhelming, particularly for seniors and individuals with disabilities. We understand that this process may seem daunting. However, it’s crucial to recognize the importance of this vital tax credit, which offers essential financial relief to eligible taxpayers. By leveraging available resources and support, you can approach your tax obligations with confidence and maximize your benefits.

Key insights covered include:

- The eligibility criteria for filing Schedule R

- The significant financial advantages it offers

- Step-by-step instructions for accurate completion

- Common mistakes to avoid

- The required documentation for a successful claim

- The impact of income limits on eligibility

These elements empower you to take proactive steps in securing your rightful tax benefits.

Ultimately, the significance of Schedule R goes beyond just financial relief; it plays a crucial role in enhancing the overall quality of life for vulnerable populations. By staying informed and utilizing available resources, you can navigate this process more effectively. Remember, you are not alone in this journey. Consulting with tax professionals or advocacy organizations can ensure proper filing and help you maximize potential savings.

You deserve support every step of the way. Together, we can navigate these tax responsibilities.

Frequently Asked Questions

What is the purpose of Schedule R IRS forms?

Schedule R allows qualifying taxpayers, specifically individuals aged 65 or older or those who are permanently and completely disabled, to claim a nonrefundable tax credit designed to alleviate financial pressures. This benefit can range from $3,750 to $7,500, significantly reducing tax obligations.

Who is eligible to file Schedule R?

To file Schedule R, individuals must be either 65 years or older by the end of the tax year or under 65 and permanently and totally disabled. Additionally, they must have received taxable disability income during the year.

How can Turnout assist with navigating Schedule R IRS forms?

Turnout provides resources and guidance to help consumers understand their eligibility for Schedule R and maximize their benefits. Their AI-driven platform offers timely updates and personalized assistance throughout the submission process.

What kind of financial support can individuals expect from Schedule R?

Eligible individuals can receive a nonrefundable tax credit that can significantly reduce their tax obligations, with potential benefits ranging from $3,750 to $7,500, depending on their specific circumstances.

How does Turnout utilize AI in tax support?

Turnout leverages AI to enhance the efficiency of the filing process, offering tailored support that simplifies complex tax responsibilities, particularly for disabled individuals and seniors.

Why is consumer advocacy important in tax preparation?

Consumer advocacy is crucial for at-risk groups as it helps ensure they are informed and empowered during the tax preparation process, making compliance less intimidating and more accessible.

Can you provide an example of someone who benefited from Schedule R?

An example is Jesse, a 58-year-old who retired due to permanent disability and successfully obtained a benefit of $51 on Form R by meeting the eligibility criteria, showing that qualifying for the benefit is possible.

What should individuals know about reaching retirement age in relation to Schedule R eligibility?

Individuals must not have reached the required retirement age on January 1 of the prior year to be eligible for the benefit, which is an important consideration when determining eligibility.